Drumbeat: February 23, 2011

Posted by Leanan on February 23, 2011 - 9:00am

Jeff Rubin: Why Saudi Arabia can no longer temper oil prices

What’s easy to lose sight of in the chaos sweeping through the Middle East is where oil prices were trading before it began. The Brent futures contract, the world’s new benchmark oil price, had already broken $100 (U.S.) a barrel before protesters in Cairo started sweeping into Tahrir Square and demanding Hosni Mubarak’s head. And the price of West Texas Intermediate CL-FT, laden as it is with record inventories of Bakken oil and Canadian oil sands crude piling up in Cushing, Okla., was trading just shy of $90 per barrel.These are the kind of prices that one might expect to encounter at the end of an economic cycle, not at the beginning of one. But world oil demand once again grew at lot faster than the oil experts at the International Energy Agency were expecting – almost twice as fast, to be precise.

David Strahan: Saudi denial not what it seems

Sadad al-Husseini’s statement distancing himself from the Wikileaked cable written by US diplomats in Riyadh is most interesting for what it leaves out. While robustly denying claims that were not actually made in the original message – always a good tactic when you’re on the back foot – the former VP Exploration & Production for Saudi Aramco pointedly fails to deny the most important passage.

Steve LeVine: Why Saudi is now in play

We keep hearing that al-Saud rule is safe (and the al-Sabahs of Kuwait, along with the al-Thanis in Qatar). But retaining power is only one metric for oil price stability. The chink in the Saudi armor is its oil-saturated, Shia-dominated Eastern Province. Here is Dharan, the headquarters of Saudi Aramco; the humongous 5-million-barrel-a-day Ghawar oilfield; the 800,000-barrel-a-day Qatif and Abu Safa oilfields; the gigantic Ras Tanura oil port; and the Abqiaq processing center. Because of all this, the king has nailed down every movable part in the province with overlapping protection -- private Aramco security, Interior Ministry forces, the National Guard, and the military, all of them manned largely by Sunni personnel and loyal to the royal family.Even so, if the Shia population does start protesting, we will see the oil market's version of pandemonium.

Steve LeVine: If the world calls, will Saudi be there?

So now we come to where the rubber hits the road with the turmoil in the Middle East: Just what is the risk of the entire global economy going south, which is what would happen if the Saudis couldn't compensate for a global oil deficit as they have done in the past?

The Peak Oil Crisis: Inflection Point

It has taken two months for the contagion that began with the immolation of a fruit seller in Tunisia to reach the first significant oil producing nation.As oil production in Libya grinds to a halt and Muammar Gadhafi clings to power amidst increasing turmoil, it is beginning to look as if it may be sometime before Tripoli resumes its normal oil exports. While the 1.6 million barrels a day (b/d) that the Libyans pumped in January may not appear significant in a world that produces some 88 million barrels each day, we should remember that those barrels are being consumed somewhere in a world where they are consumed just as fast as they are produced. If there is anything that we have learned in the last 40 years, it is that relatively small disruptions in oil production can lead to relatively large increases in oil prices.

Revolutions could rob Opec of its ability to manipulate supply

For the moment, the cartel can only wait and watch what happens to production figures. But according to Fateh Al-Khayat, the former director of planning at the Iraqi oil ministry, the outlook is even worse in the long term. He has told an audience at the International Petroleum week in London:Libya might go out of the market for a while. Algeria is a potential trouble spot. If we add Yemen and Egypt, troubled countries produce about 4m b/d. If that supply is disrupted, the other Opec countries cannot in my opinion compensate for that.

Agency sees emergency stockpiles as last resort

RIYADH: The International Energy Agency will rely first of all on OPEC to meet any loss of Libyan oil and would save its emergency stockpiles as a last resort, its executive director said. "We can produce 2 million barrels per day (bpd) for two years but these are stocks and once we use them, they will run out, unlike spare capacity," Nobuo Tanaka said. "That's why the stocks are for great emergencies.

Oil briefly hits $100 - highest since 2008

NEW YORK (CNNMoney) -- U.S. oil prices briefly hit the $100-a-barrel for the first time in over two years Wednesday, as reports of Libyan oil production shutdowns swirled.

NEW YORK (CNNMoney) -- Airlines are hiking their fares at the fastest pace in two years, driven by high fuel prices and enticed by strong consumer appetite.And travelers should brace themselves for more hikes, because there's no reason for airlines to stop now, according to industry experts.

Gasoline shortage feared as Lebanese importers halt supplies

BEIRUT: The Energy and Water Ministry failed to release the weekly update of gasoline prices scheduled Wednesday, sparking speculation over fuel availability in the upcoming days.Oil importing companies announced they would stop the supply of fuel to distributors until the Energy and Water Ministry releases the weekly price updates.

Libya asked oil firms to fund terror suits

Libya's ruling family tried to coerce billions of dollars from Libyan and foreign oil companies, and its leader Muammar Gaddafi exhorted the United States to sow division in Saudi Arabia, leaked American diplomatic cables reveal.

Libya oil production grinding to a halt

NEW YORK (CNNMoney) -- Oil production in Libya is shutting down as companies operating there begin to close facilities due to the ongoing violence.

SINGAPORE: Saudi Aramco's move to set up a trading subsidiary for refined products is aimed at optimising its massive production system, focusing on the fuel oil and gas oil markets, traders said yesterday.The main objective of Saudi Aramco Product Trading Company, expected to be operational by the end of the year, is to maximise profits by selling surpluses from its plants when prices are high and buying external cargoes for its requirement when they are low, they added. Unlike regular trading houses, it is unlikely to take positions in the market.

Does Peak Oil Equal Cyclical Recession?

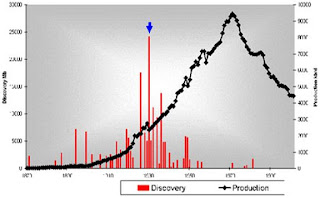

"Peak oil is the point at which you reach your maximum production level, after which you will never produce as much again," said Alan Stagg, an economic geologist based in Charleston. Stagg read Hubbert's writings when they were first published.We won't know it has happened, Stagg pointed out, except in retrospect.

But the fact that oil's vastly unprecedented high of $147/barrel in the summer of 2008 didn't draw forth an outpouring of new production, some say, is a strong indication of a peak.

Middle East uprisings might mean the end of free-flowing oil: U.S. must find new energy sources

So what's the problem? Oil markets don't like unpredictability. So an oil price spike is possible, even if we have oil stocks as protection. In addition, if chaos spreads to Saudi Arabia and Iran, causing more disruptions, prices will go through the roof.But an even bigger problem looms: We're overusing oil. The International Energy Agency has radically changed its forecast on when that habit will have to end, whether we like it or not. Until recently, it dismissed notions that oil supplies might peak or reach a point where production slows and then decreases.

Richard Heinberg - How Markets May Respond to Resource Scarcity: The Goldilocks Syndrome

Before examining limits to non-energy resources, it might be helpful to consider how markets respond to resource scarcity, with petroleum as a highly relevant case in point.

Greg Palast: We're Not Running Out of Oil, Just Cheap Oil

In this eighth video in the series “Peak Oil and a Changing Climate” from The Nation and On The Earth Productions, investigative journalist and author Greg Palast says the era of cheap fuel is over. Now energy companies are scouring the globe for oil, often extracting resources in more expensive and more environmentally sensitive conditions.The problem, according to Palast, isn't really that we're running out of oil entirely. We've become addicted to cheap oil, Palast says, and we now accept the oil companies digging in sensitive areas, even though “there is a safer way to drill for oil."

President Obama and the Democrats should take their cues from world leaders who are taking on Big Oil in their own countries, Palast says. Ecuadorean President Rafael Correa has refused to go along with “the usual methods of oil companies.” He kicked Occidental Petroleum out of Ecuador and has agreed to support tens of thousands of Amazonian settlers in Ecuador as they sue Chevron for damages to their lives and their land. Only with these kind of bold moves can we hope to take back our environment from the major polluters.

North African Turmoil Could Rocket Crude to $220

If the turmoil paralyzing parts of the Middle East and North Africa brings oil production in Libya and Algeria to a standstill, it could cause crude oil to explode to $220 a barrel, derailing the global economic recovery.According to a new report from Tokyo-based Nomura, a simultaneous production halt from embattled Libya and neighboring Algeria would reduce OPEC spare capacity to 2.1 million barrels a day and may cause crude to spike from about $97 a barrel today to $220 a barrel.

Nomura’s $220-a-barrel crisis oil call

Talk about an oil shock.Nomura’s commodity analysts, led by Michael Lo, are calling for oil at $220 a barrel, if both Libya and Algeria were to stop oil production. Oil’s currently around $108.

If Libya revolts, Saudi Arabia could be next

It is a very dangerous game to try and predict what will happen next in the Middle East and North Africa at the moment, so I report this with all the usual caveats. But John Roberts, an energy security specialist at Platts, has been watching the region for a long time, and he thinks that the possible removal of Muammar Gaddafi blows apart a lot of long-held assumptions about the region.

Saudi king back home, orders $37-B in handouts

RIYADH, Saudi Arabia - Saudi King Abdullah returned home on Wednesday after a three-month medical absence and unveiled benefits for Saudis worth some $37 billion in an apparent bid to insulate the world's top oil exporter from an Arab protest wave.

Muammar's Oil - Libya's Contribution to the World's Oil Picture

Recent unrest in Libya has led to unrest in the world's oil markets. In this posting, I'll take a brief look at Libya's contribution to the world's oil picture.

UK oil workers 'desperate' for Libya exit

A Scottish oil worker stranded with 300 people in a Libyan desert camp has told how the group has just one day's supply of food and water left.

Half of Libya’s oil production shut down

At least half of Libya’s oil production has been shut down in the wake of the violence wracking the country, industry executives estimate.

Big Oil's $50 billion bet on Libya at stake

FORTUNE -- The instability in the Arab world claimed its first oil-rich victim over the weekend with the uprising in Libya. That's bad news for the bevy of international oil firms that have set up shop in the cloistered North African nation over the years, most notably Eni, the Italian oil giant. Libya has become a hot bed of energy investment since the lifting of trade sanctions seven years ago. Major oil companies from BP to ExxonMobil could now stand to lose millions, and in some cases, billions of dollars in investments and expected future revenue if the current regime falls.

At least 3 oil cargoes sail from Libya - sources

Reuters) - At least three oil cargoes have left Libyan ports in the past 24 hours despite a revolt against Muammar Gaddafi's four-decade rule, trade and shipping sources said on Wednesday.

Why you really can’t swap Libyan oil for Saudi

Much discussion on Wednesday of whether Opec could pump more oil from the Arabian peninsula to make up for Libya going offline — so we thought these pointers from Barclays Capital’s Amrita Sen might help:

Last Thursday, February 17th, was a very big day – and perhaps a very good day – for the offshore drilling and energy industries as two separate but related developments could help ensure the near-term viability of deepwater oil drilling in the Gulf of Mexico.

Rising alarm over global scarcities

While the unrest spreading through the region has developed from unique combinations of political, economic and social factors in each affected country, anger over rising food costs is a unifying force. Rising domestic energy prices caused by shrinking state subsidies have also stoked popular dissatisfaction, while regional water shortages loom as never before.Several Arab governments, alerted to the security threats posed by resource scarcity, have recently moved to enhance their buffer of key commodities in a region that imports more than half its food, including staples such as wheat, rice and maize.Last month, Jordan cut taxes on food and fuel. Saudi Arabia announced plans to double the kingdom's wheat reserves to 1.4 million tonnes, or enough to satisfy demand for a year.

This month, the director general of the UAE's National Crisis and Emergency Management Authority said a proposal to build emergency reserves of food, water and medicine would be submitted to the Cabinet in April. Abu Dhabi started building a strategic water reserve last year.

Oil Rises to 28-Month High on Libya, Middle East Supply Concern

Oil rose to its highest in more than two years as Libya’s violent uprising threatened to disrupt exports from Africa’s third-biggest supplier and spread to other crude-producing nations in the Middle East.

Jeff Rubin: Soaring oil prices a double-edged sword in the Middle East

Why is the Arab world convulsing with social and political unrest when triple digit oil prices should be bringing enormous wealth to the region? The answer may be that the link between energy inputs and food prices suddenly makes soaring oil prices a double-edged sword in the world’s largest food importing region.

Oil Soars as Furor Shakes Markets

HOUSTON — The political turmoil sweeping the Arab world drove oil prices sharply higher and stocks much lower on Tuesday despite efforts by Saudi Arabia to calm turbulent markets.The unrest that has spread from Tunisia to Libya pushed oil prices to a two-year high and has spurred an increase in gasoline prices. The specter of rising energy costs and accelerating inflation in turn unsettled investors.

Oil is now at a price not seen since the recession began, and it is more than $20 above goals set in recent months by Saudi officials as strong enough to satisfy the top producers but not so strong they might suffocate the global economic recovery.

Opec holds back extra supplies

RIYADH // Opec held back from releasing extra oil to cover disruptions in Libya as world prices hit their highest level in two years.Oil producer and consumer nations meeting in Riyadh agreed there was no immediate shortage of oil on world markets, and Saudi Arabia and the UAE said they stood ready to compensate for any future supply gap.

Saudi minister: OPEC nations has capacity to produce surplus oil

(CNN) -- Seeking to alleviate concern about rising oil prices, Saudi Arabia's oil minister said his country and other OPEC members have the capacity to produce surplus oil, Saudi Press Agency reported.Saudi Arabia alone has a surplus of about 4 million barrels per day, the agency quoted Minister Ali al-Naimi as saying.

Gasoline, Heating Oil Surge as Violence Escalates in Libya

Gasoline and heating oil surged to the highest levels in more than 28 months as heightened violence in Libya stirred concern that unrest in North Africa and the Middle East will disrupt fuel production and shipments.

The Stealth Return of $100 Oil

The days of $100 oil are back—and not just in Europe, where the Brent crude benchmark vaulted past $108 a barrel on Monday.

Gasoline Gains on Refinery Shutdowns, Crude Slips: Oil Products

Gasoline extended its 28-month high, breaking with declines in Brent crude and West Texas Intermediate oils as refineries slowed production for maintenance. Crude oil traded on the New York Mercantile Exchange dropped for the first time in three days. Heating oil fell. Ethanol was little changed.

U.S. Oil Supply Rose a Sixth Week, Bloomberg Survey Shows

U.S. crude stockpiles probably rose for a sixth week, the longest series of gains since May, as a glut forms at Cushing, Oklahoma, the country’s biggest oil- trading hub, a Bloomberg News survey showed.

Gaddafi's Next Move: Sabotage Oil and Sow Chaos?

There's been virtually no reliable information coming out of Tripoli, but a source close to the Gaddafi regime I did manage to get hold of told me the already terrible situation in Libya will get much worse. Among other things, Gaddafi has ordered security services to start sabotaging oil facilities. They will start by blowing up several oil pipelines, cutting off flow to Mediterranean ports. The sabotage, according to the insider, is meant to serve as a message to Libya's rebellious tribes: It's either me or chaos.

Gazprom takes a hit from regional unrest

The Russian gas giant Gazprom is emerging as one of the biggest potential losers from the continuing unrest in the Middle East.The company has interests in Libya, Bahrain and Iran, all of which are experiencing some level of civil disturbance. Gazprom shares, listed in Russia, declined by almost 9 per cent in the past week.

Italian Energy Company Suspends Gas Pipeline to Libya

ROME — Concerns rose about Italy’s natural gas supplies on Tuesday, after the country’s main energy company, ENI, said it had suspended supplies through its Greenstream pipeline, which runs from Libya to Sicily and supplies 10 percent of Italy’s natural gas.

Libyan revolt likely to leave deep scars on oil sector

(Reuters) - Regardless of what comes next in Libya's lethal political standoff, the OPEC country's oil sector is nearly certain to suffer, bringing long-lasting supply disruptions or even permanent damage.None of several potential outcomes is benign for Libya's oil industry -- the lifeblood of its economy -- or for oil prices. The scenarios run the gamut from all-out civil war and attacks on energy infrastructure to low-level neglect and reservoir damage, as foreign expertise flees the country.

Can the Saudis really ride to the rescue?

The fate of the global economy may hinge on surging oil production from the world's biggest exporter. But it's not clear that the Saudis have the juice.

Spare Capacity Theory and the Libyan Disruption

In truth, the spare capacity that the world cares about—that the oil futures market cares about—is not the inventory level. But rather, actual production capacity that can be brought on immediately. You can see the problem, from a price standpoint. If the world loses Libya’s 1.5 mbpd production for 90-120 days, and starts drawing down above-ground inventories, this only makes the inventory cushion that much thinner for any new supply disruptions. The question on the mind of the oil market therefore is not Mr. Fyfe’s 1.6 billion barrels of crude, but whether countries like Kuwait, the U.A.E. and especially Saudi Arabia or even Russia can lift supply. Immediately.

Saudi Arabia stands by oil forecasts

RIYADH // Yousef al Furaidan, the production manager for one of Saudi Aramco's biggest oil projects, is unsure what more could be done to convince the world Saudi Arabia has the oil reserves, output capacity and spare capacity it claims.The issue of Saudi oil data transparency resurfaced this month with the release by WikiLeaks of confidential cables from the US embassy in Riyadh urging Washington to heed a former Aramco executive's warning that the kingdom's reserves may have been overstated. The rekindled controversy has intensified as political tensions have erupted in parts of the Mena region, with anti-government protests now endangering oil exports from some Opec states including Libya.

Saudi Arabia, the biggest Opec oil producer, has felt only minor repercussions from the furore. However, to many New York oil traders, the kingdom's ability to compensate for supply disruptions elsewhere is again an open question.

Indonesia says may delay limiting fuel subsidies due to high oil prices

(Reuters) - Indonesia's chief economics minister Hatta Rajasa said on Wednesday the government might further delay a plan to limit fuel subsidies for private cars from end-March due to high oil prices and inadequate government preparation.

Frontline Back in Black on Chinese Oil Demand

Frontline Ltd., the world’s biggest supertanker operator, may return to profit this quarter after its biggest loss since 2002 as oil demand from China curbs a glut of vessels that sent freight costs to a 13-month low.

Mexico oil output seen up in 2011, natgas to plunge

(Reuters) - Mexican oil output will rise 2 percent to 2.627 million barrels per day by December from the rate expected to be produced in January while natural gas output will fall sharply, according to the industry's operational plan that the government released on Tuesday.

Fog Halts Houston Ship Pilots’ Inbound, Outbound Boarding

Houston Ship Channel pilots stopped boarding inbound and outbound vessels today as fog limited visibility on the approach to the largest U.S. petroleum port, according to the Coast Guard Vessel Traffic Service.

Chevron Halts Work at Gorgon LNG Site, Apache Shuts Gas Plant on Cyclone

Apache Corp. halted gas production from Varanus Island and Chevron Corp. suspended construction at the A$43 billion ($43 billion) Gorgon project in Western Australia because of Tropical Cyclone Carlos.

BHP to Buy Chesapeake Shale Gas Assets for $4.75 Billion

BHP Billiton Ltd., the world’s biggest mining company, agreed to buy Chesapeake Energy Corp.’s Arkansas shale gas assets for $4.75 billion in cash, more than doubling its U.S. oil and gas reserves.

TNK-BP to sell crude, diesel delivered via Geneva arm

(Reuters) - Russian oil company TNK-BP will start selling crude and distillates on a delivered basis through a new Geneva trading office to open later this year, its head of downstream said on Tuesday.

Iraq rushes to address food-security problems as price of flour trebles

The price of flour in Baghdad has tripled in the past two months, forcing the new Iraqi government to scramble to address its potential food security problems.

Pakistan Case Tests Laws on Diplomatic Immunity

For Pakistanis, many of whom are angry at the apparent impunity with which the C.I.A.’s drone missiles regularly kill terrorism suspects — and, at times, innocent bystanders — Mr. Davis’s case has proved galvanizing. Protesters have called for Mr. Davis to be hanged.But for Obama administration officials, the legal case is clear-cut. They insist Mr. Davis has full diplomatic immunity that protects him against prosecution in Pakistan. Pakistan can expel Mr. Davis, the administration says, but it has no right to imprison him and move forward with a murder case.

Iran says ready to export gasoline

Iranian Deputy Oil Minister Alireza Zeighami said the country had begun marketing plans for the imminent exports of its gasoline, local satellite Press TV reported on Wednesday.

The oil services and equipment sector is the best place to invest over the next few years because these guys have order-backlogs all the way to Mars…The oil services industry is now in a full-blown revenue-based bull market as high oil prices justify expensive exploration by the majors; that’s a trend that will be in place for years to come as Peak Oil is perhaps jettisoned by political instability in the Middle East, and possibly, in the Persian Gulf’s Strait of Hormuz. If Iran goes, then it’s $150 to $200/barrel oil fast.

How to Position Your Portfolio for the Impending Global Energy Crisis

For the past month or two I have been researching and organizing my thoughts on what I believe is an impending global energy crisis. Until recently, I had been unable to fully convince myself that this was likely to happen. However, the recent events in the Middle East and Northern Africa have helped to embolden my concerns. As a disclaimer, I am not an expert and I am limited in my access to information. Having said that, though, I believe this is a very rational concern and is supported by widely available data.My belief that a global energy crisis is impeding centers on the concept of peak oil. This is a topic that has been debated for decades but has recently gained credibility because of the IEA’s acknowledgement of peak oil as a reality.

What 'Peak Oil' Really Means for the Energy Sector

Peak oil is here. Even the International Energy Agency (IEA) has admitted that production of conventional petroleum has peaked, although they forecast continued conventional production at 2011's reduced levels (down 2 million barrels per day from 2006) many years into the future.The attainment of even this plateau, however, depends on rapid increases in Saudi production, for which there are no guarantees and indeed very serious doubts. If Saudi production cannot be raised, global production of conventional crude oil will necessarily begin a precipitous decline.

For sale: refineries producing millions of barrels

2.5 millionThat's how much global oil-refining capacity in barrels per day is up for sale, says IHS Herold's John Parry. It's enough to process the entire crude output of Nigeria or Norway.

Baby dolphin deaths rise along Gulf Coast

The alarmingly high number of dead young dolphins are being looked at as possible casualties of oil that fouled the Gulf of Mexico after a BP drilling platform exploded in April 2010, killing 11 workers and rupturing a wellhead on the sea floor.

The House's decision to rescind about $2 billion in Recovery Act funds and loan authority has jeopardized some $40 billion of private industry investment in clean energy.

Green projects run amok with little oversight. What are we getting for our $130M?

As much as $130 million of one-time money has either been dumped down the drain or committed to fund ex-mayor David Miller’s Climate Change Agenda in the last four years — money which could have been used to offset Toronto’s humongous debt, it was revealed at audit committee Monday.

Britain sign nuclear, oil deals during Cameron's visit

Oil-rich Kuwait and its close ally Britain on Tuesday signed several deals on nuclear and oil cooperation during British Prime Minister David Cameron's visit to the emirate.The official KUNA news agency said Kuwait's Prime Minister Sheikh Nasser Al-Mohammad Al-Jaber Al-Sabah and Cameron discussed the latest developments in the region and issues of common concern.

Nuclear Malaysia: Red flag in a greening global economy

Before the Malaysian government takes the country down the path towards nuclear energy, every citizen must decide if nuclear power is the right choice for the nation.For some, the threat of climate change and peak oil has produced a false choice between either going nuclear or suffering unabated global warming.

But Malaysia, and indeed, the rest of the world, has an increasing number of truly clean and renewable energy options to choose from, such as solar, wind, tidal and wave.

Battery-electric cars will struggle after normal buyers replace early adopters

Some say electric cars will save the planet from man-made climate change. Others see a need to clean up the exhausts of an increasing number of cars clogging up city centers across the globe. Most agree that oil will run out one day, and some manufacturers have bet the farm that battery-only electric cars will be able to rise to the occasion and provide us with viable personal mobility.The evidence is mounting that this won't happen.

WSJ Bigotry, Lies and Abuse of Power or a “Range Fiasco”?

Mr. Khosla comes out swinging at the Wall Street Journal’s take on Range Fuels and biofuels.

Along the Columbia, Concerns for Salmon and Energy Production

STARBUCK, Wash. — The governor of Montana invited himself to Washington State not long ago to explain to people who live along the Columbia River why they should help Montana export its coal across the Pacific Ocean to China.Last month, the governor of Idaho turned up near the Columbia’s principal tributary, the Snake River, to tell Idahoans that it was good policy to barge enormous oil-production equipment up both rivers and then truck it farther inland in triple-wide loads across a scenic highway.

AGL Energy Holds Off on $2 Billion of Wind Farm Plans on Australian Prices

AGL Energy Ltd., the Australian utility building the southern hemisphere’s largest wind farm, said it will likely hold back $2 billion of additional projects until prices for renewable-energy credits increase.

Memo To The EPA: Don’t Mess With Texas!

The Lone Star State is truly going it alone in refusing to comply with the EPA’s latest attempt to apply industry greenhouse gas (GHG) restrictions under the aegis of its Clean Air Act endangerment finding that has declared CO2 to be a “pollutant.” Although at least a dozen other states have joined along in legal challenges to the ruling, all of them are pursuing compliance accommodations until such time that federal courts or Congress reign in the agency’s runaway regulatory rampage.

Unpredictable Oil Prices are Hurting Everyone

Why is the World on this Terrible Rollercoaster?Why… because oil is a particularly inelastic kind of commodity. Oil is not like doughnuts or most other things that are quite easily substituted or done without if prices rise too much. People NEED oil and it is very hard to do without or to substitute with something else — you cannot put coal into your tank.

A Climate Skeptic With a Bully Pulpit in Virginia Finds an Ear in Congress

Yet as the Republican leadership puts the brakes on a climate science confrontation, Mr. Cuccinelli has forged ahead.In the process, his critics say, he has not only made mistakes, but also twisted facts to bolster his case against the climatologist, Michael E. Mann, now a professor at Pennsylvania State University.

Sherwood L. Boehlert, a retired Republican congressman from New York and a former chairman of the House Science Committee, is among those who have sharply criticized Mr. Cuccinelli’s tactics.

“I find no logical explanation for spending taxpayer dollars on this politically designed, headline-grabbing pursuit of his,” said Mr. Boehlert, whose panel in 2006 investigated nearly identical charges by climate skeptics that Dr. Mann had falsified results but found no evidence of wrongdoing.

Arab uprisings foreshadow climate havoc, says British diplomat

LONDON: A string of Arab uprisings are giving a foretaste of the likely havoc that climate change will cause without greater effort to curb greenhouse gas emissions, a British Foreign Ministry official warned.Soaring food prices, stoked by Russia’s drought last year and subsequent ban on wheat exports, were an additional trigger in the popular revolts across North Africa and the Middle East mostly blamed on public frustration with autocratic rule.

“Treat this as a ‘prequel,’ because if we can’t remove some of those upward pressures on resource stresses then crises that are difficult to deal with when they happen will become more likely,” said John Ashton, special representative for climate change at Britain’s Foreign Ministry.

50m ‘environmental refugees’ seen by 2020

WASHINGTON: Fifty million “environmental refugees” will flood into the global north by 2020, fleeing food shortages sparked by climate change, experts warned at a major science conference that ended here on Monday.“In 2020, the UN has projected that we will have 50 million environmental refugees,” University of California, Los Angeles professor Cristina Tirado said at the annual meeting of the American Association for the Advancement of Science (AAAS).

If inflows are exceeding outflows at Cushing, at what point do they start slowing in inflows? I'm wondering how that decision is made. There's only so much storage, it has to get tapped out at some point.

You have to remember that there are different kinds of crude oil. We don't know for sure, but there is a strong suspicion that a disproportionate share of the surplus crude is very heavy sour crude from Canada, because new pipelines from Canada have added more capacity for such crude. There is only a small percentage of refineries in PADD2 that can handle this crude, and they are operating at capacity. If this crude could make it all the way down to the Gulf coast, it could be refined, but as it is, it just accumulates in Cushing and other places, because there are not pipelines past Cushing to take it farther south to the Gulf.

Somehow, the excess crude needs to be moved to somewhere where it can be refined. This may mean putting it on trains to the Gulf coast. The problem is not lack of demand for oil products, it seems to be lack of capacity to handle some of the particular types of crude that are being sent to PADD2.

PADD2 gets oil from both the South (by pipeline from the Gulf area) and the North (Canada and Bakken). If the oil were interchangeable, it seems like the oil from the Gulf would stop or slow down pretty quickly, because of the lower prices now being offered. My post on the WTI-Brent spread and the comments discuss some of these issues.

I suspect Kingfish was referring to the fact that if there continues to be more oil flowing into cushing than flowing out then at some point there just won't be any storage left. Once it's all full then what do they do with the oil? It would seem they'd have to reduce inputs...or just start dumping it out on the ground with the tanks overflowing everywhere. Or start filling up a whole bunch of trains real fast.

Which of those happens depends in large part on price signals. I suspect a combination of all of the above, as well as horse-trading deals between Conoco (with a pipeline asset) and other major companies.

Thanks, that's exactly what I was getting at. Big pipe in, small pipe out, storage fills up, then what? There's only one option -- slow down the incoming flow. Question is, how much spare storage capacity exists at this point? I know they've been building storage like crazy, but as long as oil's coming in faster than it's going out, the storage has to fill up at some point.

Well, oil is backing up all through the system. You have to realize that not only are the storage tanks at Cushing full, but the storage tanks back in Canada and North Dakota are also full.

The problem with the storage tanks is nothing compared to the problems with pipeline capacity. The TransMountain pipeline from Alberta to Vancouver has nominations for twice as much oil as it can possibly move, and all the other export pipelines out of Western Canada are similarly backed up. The North Dakota oil is going into the same pipelines, so it has the same problems. However, there is new pipeline capacity to move oil to Cushing, so that is where it is going. Unfortunately there's no new pipeline capacity to take it past Cushing.

Meanwhile, in the rest of the world, demand from India and China has increased dramatically, but Saudi Arabian exports are down, Mexican exports are down, Venezuelan exports are down, etc. etc. - So there is not much oil available. And now North Africa is blowing up in a major way and Libya is going off production.

This means we have two different oil markets - mid-continental North America, where there is lots of oil available; and the rest of the world where things are tight. Oil marketers are trying to figure how to get oil from the first market to the second, but so far they haven't had a lot of success.

I think the amount of oil piling up at Cushing is due to the lack of pipeline capacity to move it from there to the Gulf Coast, where half the US refining capacity is located. It's not just Canadian oil piling up in Cushing - North Dakota sweet light Bakken oil is filling up the tanks as well. The Gulf Coast refineries can process just about any kind of oil you can ship to them because a lot of Mexican and Venezuelan oil is heavy and sour as well.

However, I think that at this point in time the oil traders are getting skittish and are just buying oil to hold in storage. They don't care where it is as long as they have oil in storage tanks somewhere, anywhere.

If things in North Africa and the Middle East get worse (which they very well might), and the oil prices at the Gulf Coast spike to over $150 (which they very well might), they'll figure out some way to get their $90 oil to the coast.

It may involve large fleets of brand-new tanker trucks running bumper-to-bumper down the highways in Texas. If that's what it takes, that's what you'll see.

Yesterday gas prices went down 4 cents down per litre. I get gas here solely from Alberta.

Yeehah! Westexas quoted in Fortune:

Link

Regarding Saudi Arabia, it's really a story of two countries: (1) Saudi Arabia through 2005 and (2) the post-2005 Saudi Arabia. Let's look at 2002 to 2010 Saudi net oil exports versus US annual spot crude oil prices (EIA):

From 2002 to 2005, the Saudis responded to rising oil prices with sharp increases in net oil exports:

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

But then we have post-2005 Saudi Arabia, when the Saudis responded to generally rising oil prices with declining net oil exports:

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

2009: 7.3 mbpd & $62

2010: 7.4* mbpd & $79

*Estimated

Post-2005 Saudi Arabia has of course shown the same pattern as Texas after 1972, i.e., declining production, relative to a prior peak, in response to rising oil prices.

In my opinion, what passes for excess capacity worldwide, including Saudi Arabia, largely consists of what Matt Simmons called "Oil stained brine."

By increasing their output of "Oil stained brine" and by depleting inventories, I suspect that the Saudis could show some kind of short term boost in delivered oil, but I think that the time has passed when they could bring global prices down via a steady increase in net oil exports in excess of their 2005 annual rate. The Saudis to have some new production coming on line, but that was true of other post-peak regions too.

For example, Sam Foucher looked at new oil fields in the North Sea whose first full year of production was 1999 or later, and these new oil fields had a peak of about one mbpd in 2005 (versus the overall peak of six mbpd in 1999). These new fields, equivalent, at peak, to one-sixth of 1999 production only served to slow the overall decline to about 5%/year.

BTW, there were certainly have two stock markets in Saudi Arabia: (1) Through 2005 and (2) Post-2005:

http://www.tradingeconomics.com/Economics/Stock-Market.aspx?symbol=SAR

Interesting coincidence.

Yet the "Dream Machine" grinds inexorably onward. CNBC last night (Kudlow Report) featured an oil "update" by Brian Shachtman where the usual old saw about Saudi Arabia's 5mbpd surplus capacity was reliably trotted out for the umpteenth time. Later on, I heard a report that the surplus capacity was 8mbpd!

Personally, I'm in the "Darwinian Camp". I doubt that the Saudi's have even 1mbpb surplus capacity at this point.

One wonders when we'll get the tectonic reaction from the markets after they finally stop drinking the Kool Aid. These guys are smart enough that eventually (like probably pretty soon) they're gonna have to wake up and smell the coffee.

It's interesting how Saudi insiders responded to the Saudis' decision, in early 2006, to start "voluntarily" reducing their net oil exports in the face of rising oil prices. It would seem that lots of Saudi princelings decided that they didn't want to keep their money in the Saudi stock market (see chart above).

Yup. Another tidbit worthy of bookmarking.

Also, it's interesting that over the past few years, after dumping their shares in Saudi stocks (basically Aramco + SABIC), they seem to be more interested in buying gold (along with the Indians and Chinese).

J/wt - Here's another take on the situation and a question that might be put to the cornucopians: What's the effective difference between a KSA that doesn't have excess capacity and a KSA that has excess capacity but won't produce it so the can max their profits?

I suppose the only theoretical difference would be that someone could threaten the KSA if they didn't increase production. Of course that would only work if they really did have excess capacity AND took the threat seriously. But given what's going on in Libya and elsewhere would it be wise to do anything that could threaten the stability of the KSA. It would be one thing to force them to increase production yet another to stir up the locals and have all of the KSA off the market. Imagine the world if the KSA production were shut down for just a few weeks.

I can only imagine that certain "Islamic radicals" - UBL/OBL comes to mind - are licking their chops to stir the pot in SA.

This http://www.zerohedge.com/article/if-mountain-will-not-come-muhammad-revo... posted on ZeroHedge and I only reference it here as FYI - not that it is or that I consider it fact. Who knows?

As we all know the USA has significant (military) assets in SA for obvious reasons and I believe an "accord of some sort" to defend the Kingdom.

You can't make this stuff up, but what if the masses do get overly riled up regardless of whether it is influenced from the outside or not? Imagine the USA engaging the locals?! I wonder if it would be limited to protecting the oil pumping/delivery infrastructure, but even that....

Anyone else stomach kind of knotted up?

Pete

I'm not so sure we have very much in Saudi Arabia, certainly not lots of personnel; perhaps forwardly positioned supplies, I'd believe that.

If you remember, one of the reasons for the invasion of Iraq was the loss of being able to station personnel in country within the borders of SA; the presence of infidels in the "Holy Land" being destabilizing to the House of Saud and all that. That pretty much shut down our ability to enforce the "no-fly zones" against Saddam's military in the south and to the north over "Kurdistan" (except at great expense using carrier based aircraft).

I think there is a world of difference. In the later case, if the price spikes high enough they can determine to sell more now "while the price is right". This would mean there is a cap to the potential price. In the former case, we know supply is completely inelastic, (its not about will but way), and the only thing elastic is demand.

EOS - But that was my point: regardless of price what if the KSA won't meet the demand of those willing to pay the freight? Granted it's difficlt to believe they won't sell at $200/bbl. But if oil reaches that level and the KSA puts more out on the market and it drops the price to $130/bbl would they do that...as long as no one points a gun at the king's head?

Just a very hypothetical question.

Rock,

Past performance has shown them to be pretty conservative about raising prices. I think they fear demand destruction and world economic recession. The former is partly recession caused, and partly due to the market response on both the consumption and production side. The later wouldn't only hurt them because of the demand destruction link, but because their soveign wealth fund is widely diversified. So they cautiously allow the price to rise a bit, then wait to see how the world reacts. Once they become comfortable at a given price point, then $10 more doesn't seem so scary to them. So I think they want the price to rise in a slow and sustainable fashion.

Most likely they won't be able to increase production enough to matter IMHO. But the latest headline claimed oil infrastructure damage in Libya may be overestimated, so perhaps we won't get all that much of a shortterm shortfall.

"they're gonna have to wake up and smell the coffee" which is shipped in using foreign oil.

Coffee is setting new highs also.

"Spare capacity theory" is a term being used by Seeking Alpha in a referenced article posted by Leanan at the beginning of this Drumbeat. First time I've seen that term, and it seems appropriate given the uncertainty and doubt by many knowledgeable people with respect to SA's spare capacity. Kudos to the regulars here for trying to pry out the truth from "secret" data.

(I also think of "Peak Oil Theory" as not being about the reality of limits to finite resources, but rather about the details and timing of conventional oil maximum production rate.)

Dave

KSA doling out 37 billion to the regular Joes should up domestic consumption a fair bit, although probably not overnight. The Midnight Flight of cash and gold to Switzerland must be immense right now!

Rising alarm over global scarcities, up top. Nothing new here for TODers. The process of the 'haves', those with ample food supplies, converting body fuel to machine fuel, has been ongoing and increasing in the US in particular. That this results in an increase in the number of 'havenots' shouldn't come as a surprize.

2030?? Sir John seems to be a bit late to the party.

Ghung - Yeah...I suppose Sir John doesn't travel much outside of Britain. Been going on for quit a while in some of the world's worse corners of hell. Maybe he just meant he saw a perfect storm coming for a lot of white people. Yep...that has to be it: now it was going to start impacting the folks that really count.

Just wondering how millions of people will be able to flee from anywhere, when they can't afford food and oil will be in short supply. How far will people generally be able to travel?

I have pondered this very question many times.

How hungry must people get before they move.

How long can they go unfed, or underfed, before they must stop moving?

Craig

There is a line from a song by Rage Against The Machine that has always haunted me: "Hungry people don't stay hungry for long" (New Millenium Homes).

When you think that many famines only last for a year or two, and that you can expect people will eventually riot for food as it becomes sufficiently scarce, the whole time-line can be frighteningly short.

I have done some reading on police riot control techniques and, to their credit, they are getting very good at 'crowd management'.

I wouldn't be surprised, in the event of TSHTF, if things are held together for longer than we might expect and then just completely unravel very quickly.

I saw a photo that was taken of a military training exercise on

crowd control. A guy that was part of the "crowd" was holding

a sign that said: FOOD NOW! So I guess someone has an idea

of what to expect.

I would perfer a cook-off abut how to make swine feed and beef protein feed raw materials as good tasting as possible as a backup plan.

You jest of course, but a wink or a joke is as good as a word to the wise..

Take notice , folks, it is not inconcievable that your very life might hinge on laying in an emergency supply of relatively non perishable, easily stored food on very short notice.

In the event of a real emergency, your best bet might actually be a local farm supply.More than likely you would be able to load your car or truck there easily while people are fighting with clubs and guns over oatmeal and dogfood in your nieghborhood supermarket. The bagged stuff fed to calves,pigs, horses, chickens, and so forth may or may not contain some unsavory ingredients, such as waste animal fat, but a ton of it will keep you alive and healthy for a rather long time,a year or more perhaps, especially if supplemented with vitamins and any fruit and veggies available.

I would steer clear of dog and cat food except as the very last resort.

Funny enough, I just bought a chunky 50lb bag of feed-corn, and it's sitting in our hallway.. and I pass it wondering what the cornflour would be like were I to grind that up for my bread. Anything making it particularly suitable or unsuitable for emergency Purina People Chow?

Bob

Hi Bob,

Isn't feed-corn usually GMO? And not really what you want humans to eat directly?

I believe Airdale posted at length about this - back when.

Hi Aniya;

Good question.. I don't know it's source. I'm generally against GMO as an ag practise, but I don't know whether it's got health implications in human consumption.. my worries over GMOs has generally been what it can do to spread into the gene pools in the fields and connected ecosystems.. and the shift in economic power against farmers when they get hooked into annual purchases of terminator crops (non-reproducing)

Best, Bob

Agreed. To that I would add that it can be surprisingly cheap to do if you just add 20% to your weekly shop and buy non-perishable stuff on special over time - white rice - canned food - etc - this stuff lasts for years.

And you can ramp up as/if/when needed. It just makes sense to have at least a couple of months of food at hand in the event of any kind of disaster that might cut off food and basic supplies. And you don't have to buy awful food. Buy the stuff you will like and if you reach a level of reserve that you are comfortable with for the time being you can just cycle through it (use it) and replace it so that you always have the 'freshest' food in reserve.

You certainly do not want to be forced to be in a large crowd competing for food and it hits a tipping point and turns into a riot; that bag of rice you were lucky to get may cost you your life. At least if you have some food at home you have the option of deciding that maybe it would be safer to try again later and leave the crowd. If you have no food at home you are more likely to take risks in a dicey situation.

I have a question, regarding rice storage. I take a look at the supermarket and rice comes in packages of 1kg and I notice they have an expiry date only a few months away. Is this normal? Can't rice be stored for longer? If I buy several kilos and wrap each one in 1 or 2 plastic bags and then stack them inside a non-transparent plastic box (with lid), can I hold on to them for a couple of years? For white rice, does the grain length affect the time it can be stored?

Here in the US, expiration dates on food really don't mean anything.

I can't imagine why rice would go bad. It can get infested with bugs. (IME, brown rice is especially prone to this.) For this reason, some people put brown rice in the freezer for a few days to kill any critters, then store in it in airtight container.

I've never had much of a problem with white rice. In Hawaii, with its large Asian cultural influence, many people buy 100 lb (45 kg) bags of rice, and just keep them in a spare bedroom. They'll fill up a smaller container from it to keep in the kitchen, and just leave the rest in the bag with the top folded over.

White rice doesn't generally go bad - there's nothing but starch there. Brown rice, with the germ and bran and all, can and does get rancid if not stored very carefully. Very disagreeable.

I don't know about rice specifically, but for any dry foods your storage life enemies are oxygen, water, and temperature. To keep out moisture you could add packets of silica gel (available at craft stores for flower drying). To keep out oxygen, I have taken to filling a small sock with fine gauge steel wool sprinkled with a bit of table salt. The purpose of the salt is to encourage rusting of the iron which acts as a sacrificial metal to adsorb oxygen. These little packets work like a champ for keeping dried foodstuffs fresh.

Thank you everyone for the info. Absitively, thanks for the tips on silica gels and steel wool. Until now I thought wrapping the products in several plastic bags would be enough, I guess I need to be trying harder.

Our own government recommended this. In case of pandemic. They recommended at least two weeks of food that doesn't require cooking. (This hit the news as "keep peanut butter and tunafish under the bed.")

Though I gotta say...I don't think the average American is in any danger of starving in two weeks, maybe even two months. ;-)

Personally, I don't care for the kind of food that stores well. So rather than eating it, I donate it to the local food pantry before it expires, and replace it.

A viable rotation plan is important, especially since you don't necessarily want to donate expired but perfectly edible food.

The rotation is what we struggle with most, and managing inventory. That's my resolve for this year -- plus creating more storage space.

I'm pretty good about rotation. I worked my way through school at a deli, where it was drilled into me.

Still bugs me at the grocery store, when I see they put the new milk in front of the old milk. Even though it makes it easier for me to grab the newer stuff. ;-)

For those who may not know, in the event of a disaster where you might lose power it doesn't mean that you cannot cook food or treat water.

For cookers you have 'solar ovens' that are very effective and simple to make. I have seen a cardboard box with a reflective surface like alfoil on the box's flaps to reflect and concentrate the light into the box:

http://en.wikipedia.org/wiki/Solar_cooker

A project I have lined up for March to make a portable parabolic cooker from an umbrella:

http://solarcooking.org/plans/barbeque.htm

http://solarcooking.org/images/gallery-para.htm

You can also disinfect water with a plastic bottle and sunlight (SODIS):

http://en.wikipedia.org/wiki/Solar_water_disinfection

In my food reserve I have also added plenty of treats - not only because they generally have lots of carbs - but also because I think it will be good for mental health to simply have at least one moment each day in a bad situation where you can just chill and take a time-out of 'disaster mode'.

I look forward to seeing how much extra oil can "really" be pumped by OPEC.

This is simplistic, I know; but the first thought I had after "getting" Peak Oil was that once peak was acknowledged, the world would effectively have no spare capacity -- even in times of reduced demand as we saw in the recent economic downturn. Apart from the collapse in investment and the effect that might have on exploration and development, we would see a tendency to withhold oil and gas by producers as they came to understand that oil and gas would only become more valuable with time. I understand that cash flow considerations may compel producers to pump oil and gas even though they know that future prices can only rise. But my gut says that the oil exporting countries have absorbed the lesson of North Sea oil and have determined that it makes little sense to sell an irreplacable commodity at fire sale prices.

The other problem is that people have to have the income to afford high oil prices. If the people are laid off from work, their demand is pretty low, even relative to oil prices that are not very high. If they are working for low wages, oil prices will become an increasingly large share of their expenditures.

So we pretty much have to expect rising oil prices, followed by a crash as people cannot afford those prices, and cut back on discretionary spending (and some default on debts). Besides oil prices dropping, a credit contraction can be expected. What may happen is a glut of oil, because oil is offered at prices higher than people can afford. Recession is likely.

People don't expect that crashing oil prices and a glut of supply is a likely outcome of peak oil, but to me, it is. It basically is related to declining Energy Return on Energy Invested (EROI). People are not getting the benefit back to justify the high price that they are being asked to pay for oil. The economic system cannot support the high oil prices, because of this lack of benefit. Eventually, the prices must crash. It is really EROI (or something very close to EROI) that determines the upper bound for what can be extracted, not the amount of low quality resources available around the world. Many of these low-quality resources cannot be extracted at an adequate EROI, so will be permanently be left in the ground.

One of the interesting corollaries of high-quality but limited energy is a predilection for lethargy. Large carnivores don't run and eat all day long. They run a little, eat once, and sleep a lot for days.

Shrimp and ants eat and work without stop. They have an abundance of low-quality input to deal with.

As the availability of high-quality energy drops, I figure humans will become more "lethargic" as well -- less travel, less HVAC, less waste, etc. If everybody stays fed then the system can meander along. It's only when the lions get hungry that things get really nasty fast.

Exactly. 40 million people or more on food stamps in the U.S. This is a staggering number, yet barely gets mentioned in the mainstream media.

It means income can't buy food anymore! These people are on a plantation, managed by the banks.

This also explains why suburbia is declining. What was once one of the best ways to live - your own plot of land and house, drive anywhere, access to the country and the city - immediately turns into one of the worst when you become atomized and stuck in your home with nowhere to go and nothing to do.

Everyone will just sit around doing things like posting on TOD. The horror.

Being there, doing that...

E. Swanson

Your statement is only true for high per capita consumption countries; it is not true for low per capita consumption countries. When per capita consumption is low, people can afford much higher price. Expensive oil may trigger a recession in OECD countries, but it will barely slow down growth in Chindia. As a matter of fact that is exactly what happened in 2008-2009. What a recession will do is kill frivolous consumption and that will shift overall consumption from OECD countries to fast growing developing countries like Chindia.

Example 1: An affluent American middle class family lives in a large single family home with a big mortgage, property taxes and utility bills. They barely have any equity in their house. They drive a couple of large gas guzzling vehicles on which they owe money. Both husband and wife have a round trip commute of 40 miles each. Their combined income is $200,000.

Example 2: A young Indian programmer couple live with the husband's parents in a small apartment that was bought for cash 40 years ago and drive a small fuel efficient car to work. They work in the same office park and their round trip commute is 15 miles. Their combined annual income is $40,000.

When oil goes to $150/barrel who will be forced to cut consumption?

With similar thinking to yours, I have wondered if the US is/will be the 'canary in coal mine'.

For now this is going relatively well, except for the people who lost their jobs. When oilproduction goes down, the elasticity disappears and the system will break.

Certainly they don't want to cut food consumption, so more money is spend on food. Left is less money for growing the economy.

You're still "well-supplied" at current prices. Oops, did I say prices?

From up top...

Let's see, it's Ok for governments to prep for scarcities but those of us who do it here on our own are seen as nutcases by lots of people. I save by buying in bulk and in quantity when things are on sale. I'm ahead even if things never get scarce. As I mentioned to some people in an email this week, it's nice to go out to one of the freezers to get some meat that now costs twice as much or a few pounds of wheat berries for the bread I make.

Todd

Todd - So you admit you're a hoarder. I suppose confession is good for the soul. LOL.

Seriously though it wil be interesting to see how some country's effort to "buffer" themselves will be portrayed as hoarding etc. For instance the U.S. is hoarding over 700 miilions bbls of oil in our SPR. So when times get bad you might think we'll share with the less fortunate around the globe. Like China, maybe. Yeah...maybe start paying interest in oil on all that debt we owe them. Or maybe we start pulling some of our grain exports off the world market and trade them directly to the KSA for payment for oil.

Certainly seems like interesting times ahead.

Rock be careful what you say or I'll go on some DHS No-Buy list!

hoarding, surely not!

I prepare prudently

You stock up

He/she hoards criminally

Yet another S. I. Hayakawa (Language in Thought and Action) irregular verb... (scroll down a bit at link)

Rock, "just-in-time" says that hoarding is not only unnecessary but that it creates inefficiencies as it withholds from the market commodities that might return a higher value in some other application. Problem is that the world is not the well-oiled machine that Neo-liberal economists picture it being. Hoarding is an instinctual behavior for a reason. It is the concept of "just in time" that is an abberation. Survival depends upon being conservative with one's resources -- and in times of uncertainty, that means "hoarding." Always did; always will.

Tarzan - Your comment reminds of what was discovered long after the late 70's oil embargo and how U.S. gasoline inventory dried up almost overnight. No, it wasn't Exxon hiding billions of bbls of fuel in hidden underground bunkers. No, it was tankers steaming in circles off the coast of CA as Rivera supposedly filmed. After surveying folks and determining how they reacted to the impending shortage they discovered where all that missing fuel was: it was in everyone's gas tanks. Instead of waiting until they were down under a 1/4 tank (or less) to fill up folks started filling up when they got to half full...or even a little sooner. When they estimated how much this would add up to it almost perfectly matched the "missing" gasoline. So the fuel didn't disappeared...it was now partially stored in some 100 million very small storage facilities (cars).

Here's a question that can't be answered: since matters started going to hell in a hand basket in Libya et al how many folks have been letting their gas gauge get down to an 1/8th or less? With fuel escalating almost daily are folks hedging by filling up more often? Again in the eye of the beholder: hoarding and just good planning? A model: if 100 million vehicles are carrying an extra 3 gallons of gasoline more than they averaged 4 months ago....300 million gal off the market....that's 7.1 million bbls.....gasoline yield/bbl of oil is around 25%...so that's the equivalent of around 28 million bo. Not a huge number but that's just for U.S. vehicle storage. I also wonder how many gas stations are keeping their underground storage topped off? How many U.S. refineries are making any extra runs they can and keeping their storage topped off? How about the rest of the world? Are folks with various fuel storage systems suddenly keeping their inventories higher than usual? I've read Italy gets 80% of their imported crude form Libya. Makes me wonder how many Italians are filling up every extra container they can find with fuel? If you lived in Rome right now wouldn't you? If you had an empty tanker would you fill it with gasoline/diesel and park it in some Italian harbor and wait to see what happens? A gamble for sure...but their are a lot of gamblers in the world.

Sorry but most crude yields 50% or more gas and diesel yields closer to 25%. Remember 321

dip -It varies but I'm sure you're right. I must have been remembering diesel yield.

Yeah, Matt Simmons often brought up this artifact of our 'just-in-time' system. Specifically, the gas supplies can run out fast if everyone fills up their tanks.

I'm wondering if this will soon happen in Italy. Because if I were in Italy, I'd be filling up my tank right now. And a few spare gas cans.

Yes. He said gas stations would go dry overnight if the average half empty tank in each car was filled.

We kind of saw that after the hurricanes in the southeast.

Just try to get John Q Public to believe that, versus some wild conspiracy theory!

Ob viously you are right. Especially all the oil or product going into containers, and gas stations topping off, that could amount to quite a bit. But you gotta be at least somewhat numerate to realize that milions of small hoarders could have a big effect collectively.

EOS - And the more I thought about it the impact could be very major. The combination of 100's of millions (or billions???) of small "hoarders" combined with a very small number of huge hoaders (folks with empty tankers and storsge tanks) might be a real shock.

Yes. And the bigger the impact, the more John G will cling to his conspiracy theories.

Had to chuckle Rockman, topped off my fuel store today. 45 gals treated gasoline, 5 "grill" size propane tanks and 5 gals of lamp oil pretty much always on hand. Guilty as charged I guess.

Don in Maine

Don - For some bizarre reason your post brought back to mind a very old story from another lifetime I had not thought about in decades. It concerns "sharing" limited resources in tense times. A buddy of mine was a Navy SEAL. They had a training exercise: exit from a sub escape chamber. He and 4 others crammed their way in. There were 5 rebreathing devices. No problem: just grab your rebre, open hatch and exit. What the training instructor didn't tell them was that 2 of the rebre's wouldn't work. The objective was simple: monitor their reactions. They did well. But my buddy admitted the thought did cross his mind for a second: what if had to take out one of cohorts to survive. Later, over more than a few beers, all 5 admitted to each other the same thought had flashed across their minds.

Easier to share when you have plenty. Not so easy when you just have enough. And when you don't have enough for you and yours???

Exactly Rockman, the old drill about what to do when the air masks drop on the plane. Get yours on first, then help those who need it. Can't help anyone if you're gasping for air.

Don in Maine

Reminds me of the old joke in bear country: "Remember...you don't need to run faster than the bear...you only need to run faster than your buddy!"

Certainly seems like interesting times ahead

That is a rephrase of a Chinese curse, isn't it?

CC: I believe the curse is: "May you live in interesting times and attract the interest of important persons"

Thanks!

Not a chance. The U.S. would give China the middle finger over its debts before the SPR could feasibly be sent off to China. The public would scream bloody murder.

I wonder what the amount of US or more generally western direct investment there has been in China over say, the last 20 years. I know it's a very large amount.

People who think the US can simply default specifically on China's portion of the debt have to be mindful that under such extreme circumstances the Chinese may simply seize all the physical plant/equipment of US entities in China.

Of course, a net benefit analysis would have to be done, as the Chinese have their foreign direct investments(largely oil related as is so often mentioned in these pages) overseas also, and in many different nations. The political dependability or not of many of these places is likely to be the hinge upon which WWIII starts, as these events unfold. Leastwise, that's my guess...

The U.S. would give China the middle finger over its debts before the SPR could feasibly be sent off to China. The public would scream bloody murder.

Now wait a minute. Before you give China the middle finger and start screaming bloody murder, keep a couple of things in mind.

1) The Chinese could buy the SPR and give it away as a door prize. 700 million bbl * $100/bbl = $70 billion, while the Chinese are holding roughly $2.5 trillion in foreign exchange reserves,

2) A lot of the oil being shipped to the US at the moment belongs to the Chinese, unbeknownst to most Americans. However the Chinese don't have any way to ship it to China, so they sell it to Americans. Enjoy it while it lasts.

3) Buying Canadian oil is a lot cheaper than buying American oil, and the Canadian government is less paranoid about foreign investment, so the Chinese already have bought billions of barrels of Canadian oil reserves through joint ventures and other vehicles. They'll probably buy even more billions of barrels in the future.

1) You are assuming the markets will stay open, instead of people slamming down capital controls. The free market, global market, or whatever you might call what is happening to day has not really faced such a stress as "Oil supply goes to hell".

2) If they don't have physical access to their own capital, they I'm not sure you can really say you have control over it. Paper ownership only matters when people respect those bits of paper.

3) Certainly, but I'd wager good money that the U.S. would lean very heavily on Canada first, or quietly fund environmental groups opposed to infrastructure projects that could give the oil sands access to Chinese markets.

In sum, I don't think people will play fair/nice when the chips are down.

In sum, I don't think people will play fair/nice when the chips are down.

Yes, but you have to remember, if you don't play nice, none of the other kids will play nice, either.

You will realize that everybody has stopped playing nice when they stop accepting payment in dollars, and start demanding payment in gold. For your oil imports, I mean.

I'll be too old to care when Canada stops exporting oil, unless I'm seriously mistaken on the reserve amounts. Or do you think I'm an American just because I have a gloomy outlook, and expect the U.S. to not play nice with all their weapons and money?

Not so sure of the efficacy of weapons. The BBC showed burned out armoured personal carriers from Libya, taken over by unarmed youth. That should give people who think they can bully people by giving fancy toys to toughs. I was pretty impressed!

No - And if China refuses to buy U.S. debt will the rest of the world? Last I think I heard our about 50% of the fed budget is being paid with borrowed money. So if China and the rest of the world stops buying our debt the feds will cut their budget in half? And how many tens of millions would then be unemployed? I guess the politicians would have to decide what bad situation the would want to be yelled at for.

Nope, but if/when the U.S. repudiates its debt, it's going to be a big old party of debt repudiation. I honestly don't think the U.S. will go first, they'd probably be near the end of the line for that party. I'd bet countries in the EU-zone would be the first to go, maybe Italy if the situation in Libya doesn't let up. Italy will have a neat scapegoat, at the very least.

I mean, it wouldn't be the first time in history a government repudiated its debts. Heck, I'd wager that the politicians would find somebody to scapegoat, it is one of America's grand traditions, it seems to work fantastically on people there. I mean, why bother with the truth when a lie will suit? Isn't that the credo of politicians everywhere.

*edited, sorry about earlier language.

Theere is no reason whatsoever the U.S. would need to repudiate its debt. And it doesn't matter if China and other countries no longer buy U.S. debt and/or sell what U.S. debt they own.

The reason is that the Federal Reserve will buy up all this debt--in other words printing money and causing massive inflation.

Printing money that is vanishing. Like the several billions of home equity that has vanished, won't cause inflation. You have to look at both the sources and sinks. If wealth is vanishing you could in principle print the same amount as vanished and keep the supply constant.

p - A simple question: if the fed printing all that money instead of U.S. sending $billions in interest payments over seas is a viable solution then why aren't we doing it now?

Well, first off, we have to still pay the interest, only using printed money, which is worth less and less over time (as is their principal).

Second, we are pretty much doing that, with Bernanke having the Fed buy up a pretty good fraction of the newly issued bonds.

The downside is that every mortgage, savings account, and $20 bill in circulation becomes worth less and less over time. A little bit of inflation is desirable -- it sucks down savers (small fry individuals) and transfers wealth to banks (any body charging interest will factor in the inflation factor). Wages go up over time, so you feel good about yourself while grumbling about the rising cost of food.

If you're on a fixed income or pension, it sucks to be you. But hey, the organization paying it is happy -- they're making money by loaning the basis paid in, while discounting the payouts. Past debt tends to shrink in the rear-view, so you can always borrow more later.

What's not to love? As long as you're part of the gov't or moneyed elite, anyway.

Good explanation.

The real question is not that if the debt will be repudiated, but how. I'd bet it will be defaults for the EUzone, and printing dollars for the U.S., but I suppose that isn't exactly a controversial statement.

I suppose the interesting question is whether or not the Euro as a unit of money will survive, or will countries go back to national currencies?

If you have rising population and rising production, then to keep the net value of the currency in circulation the same, you do gotta print more. So a sustainable printing rate as a percentage of the money supply per year should be: the inflation rate, plus the rate of increase in production. In normal times those numbers are something line 2-3% each, so you can print from 4-6% of monetary base each year sustainably. [Of course we just give it to the banking system rather than use it for the people, so its just "tapeworm food" to use my new prefered term for bankster.]

In addition, it is the US bond market more than anything else that has made allowed the dollar to retain its positons as the world currency, and all the benefits (if you see them as such) that follow from that status.So, we still sell bonds.

But as enemy of the state explains, the money supply must expand so printing is nescessary. It is the Congress that prints, not the Fed, when it authorizes spending in excess of tax receipts.

But, isn't it the Fed that controls the money supply. Feeding or starving the tapeworms to try to keep it within prescribed bounds? Obviously, its the net money creation/destruction that matters, but the Fed is the designated "swing producer".

Last I think I heard our about 50% of the fed budget is being paid with borrowed money.

You're not even borrowing it now, Bernanke's printing it on demand.

+10

Of course when we have millions of unemployed, then the Chinese will also have millions of unemployed as we stop buying their products and people main use their money for food & rent.

And the Chinese really don't want millions of unemployed since it will be quite destabilizing for them.

Ugh . . . it is impossible to know how this stuff will play out. But I think I can sum it up in one word: badly.

I'd guess the U.S. will look more like Cuba (local farming, more repairing rather than buying new, generally crappy with a rich minority and what have you) and China will look like a war zone.

US like Cuba.

We wish.

The US pop by and large have no ethic of communal mutual aid.

We will mostly not come to each others' aid.

We will try to f our neighbor, not help our neighbor.

The sub-atomic small mindedness of me-first, me-always, me, me, me, me of the dominant homo-economic, neo-conservative nit has dominated all levels of society and will doom us to annihilation once things going remotely in a southerly direction.

Meanwhile, in the land of the freaks and the home of the depraved:

http://www.desdemonadespair.net/

Badly? Badly!!??

When this all began to spread to Egypt, I asked if this was what the "beginning of the end" looks like?

The Jury is out, Speculawyer... Did you do any voir dire? Sure wish I had.

Craig

Yes. Saudi Arabia, Jordan, etc. try to keep the peace by giving their people money, fuel, food. China's strategy is to give their people double-digit economic growth, and the jobs that go with that. As you say, this probably won't end well.

If China stops buying our debt, IMO, the Fed will pick up the slack with QE3, 4, 5, ... n. That would really give the old bird to China (and everyone else, for that matter).

Can you say, "Hyperinflation?"

Craig

Craig - And that was my point. I lived through the days of 10%+ inflation and 16% prime. And this is the solution? I recall the feds clealry depicting this as THE problem and struggling to find a solution. I easily recall Ford's "WIN" buttons (Whip Inflation Now). Heck of a solution...buttons. Rates right up there with "WTF" IMHO.

If the money printing gets out of control > inflation takes off > the value of the dollar crashes > the price of oil rises, for US consumers > the US can't afford it > the US enters depression > everyone else takes a breath and can use the US consumption to aid their transition away from oil.

Net result, the US is destroyed and everyone else lives.

As such, the money helicopter has about been used up. No more scope for action should, say, another crash be around the corner. The next turn takes someone way down, methinks.