Tech Talk - California Oil and Hubbert Linearization

Posted by Heading Out on July 3, 2011 - 11:23am

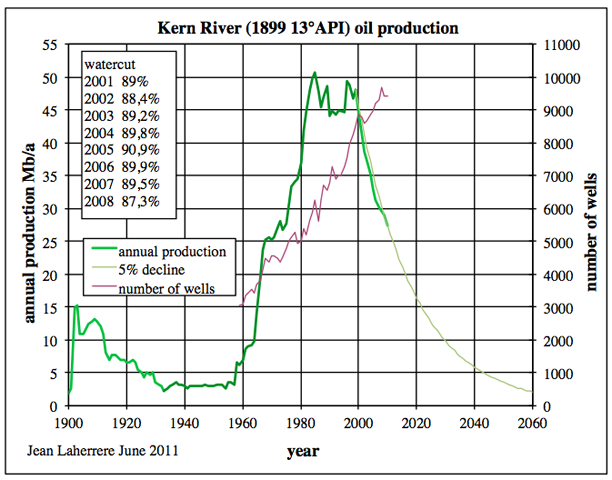

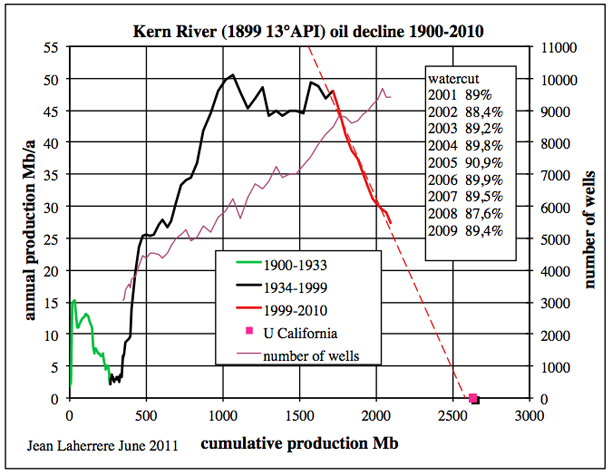

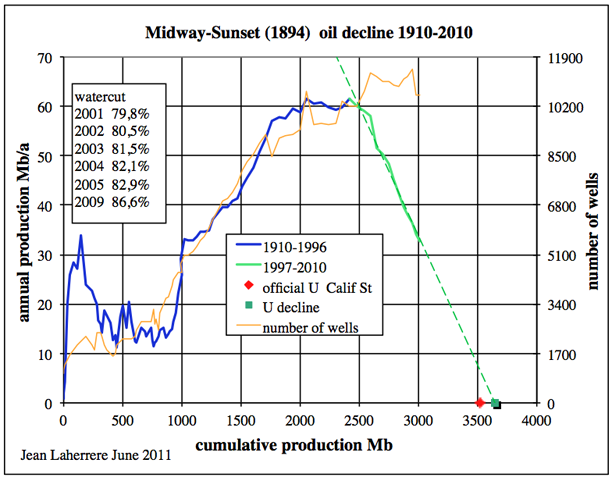

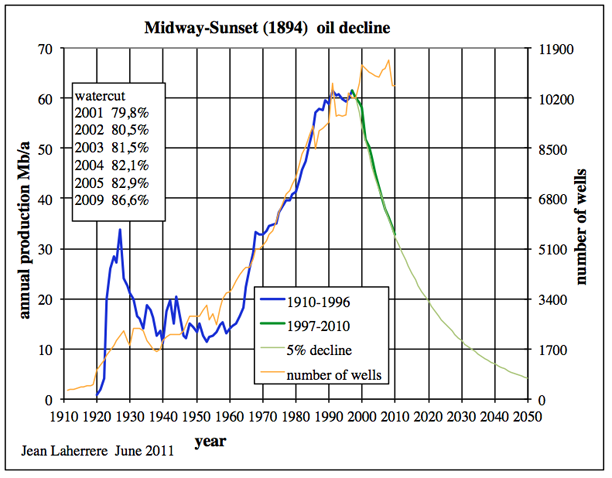

Last week, when I was writing about the heavy oil fields of California, I used a plot from Jean Laherrère to illustrate the potential ultimate production from the Kern River oilfield as a way to illustrate its potential future. Jean has written, via Luis de Sousa, to point out that the curves that I used are out of date, and was kind enough to send along the more up-to-date curves, not only for the Kern River, but also for the Midway-Sunset field, which, as I noted, is the largest remaining field. It seems to be too good an opportunity to miss to also briefly discuss the basis on which these projections are made, since they allow an estimate of the ultimate oil recovery from a field and a projection, as the following figures show, of when the field will effectively run out of oil. Let me start by putting up his figures for Kern River to facilitate the discussion, and then I will explain, and add the Midway-Sunset plots at the end. Jean has (since the initial post went up) written to point out that it is important to note that despite oil price increases and more wells, the field has steadily declined in production, at a rate of about 5% pa, since 1998.

This projection of field decline involves an estimate of ultimate recovery from the field which is derived from this curve.

So how are these plots derived?

This is a topic that has been covered almost since the time that The Oil Drum was founded (back in March 2005), since it was in May of that year that Jean published a paper describing how to “Forecast Production from Discovery.” (His pioneering work, internationally recognized in this field, did not start with this. For example, he co-authored with Colin Campbell the Scientific American article on “The End of Cheap Oil” in 1998.)

Within the pages of TOD Stuart Staniford had briefly explained it while comparing different methods of estimating future production back in September 2005, with a follow-on post looking at specific examples where it might be applied.

The technique derives from a process known as Hubbert Linearization (after King Hubbert, who is largely remembered for predicting the date of peak oil production in the US before it happened). Examining the data from oil production over time, Dr Hubbert postulated that it followed a logistic curve, which as Stuart pointed out, is an accepted model of how exponential growth occurs in a system that is of a certain finite size. It has been used since its original discovery in 1838.

The mathematics of the equation are fairly straightforward, and for consistency I am going to quote Stuart’s explanation:

In terms of oil production, the differential equation looks like this:

dQ/dt = kQ(1-Q)

Here, Q is the cumulative production as a proportion of the ultimately recovered resource, t is time, and k is a constant that sets the width of the peak.

The solution Q(t) to this equation is a sigmoid function, and the derivative is the famous Hubbert peak. The idea behind the equation is that early on, the oil industry grows exponentially - the annual increase in production is proportional to the total amount of knowledge of resources, oil field equipment, and skilled personnel, all of which are proportional to the size of the industry. Thus dQ/dt is proportional to Q.

Later, however, the system begins to run into the finiteness of the resource - it gets harder and harder to get the last oil from the bottom of the depressurized fields, two miles down in the ocean, etc, etc. The Hubbert model assumes that all of this complexity just comes down to that annual production gets an extra proportionality term of (1-Q) - the amount still to produce.

Now, there's a nice trick which I learned about from Deffeye's book "Beyond Oil", but I don't know if he thought of it or got it from somewhere else. The idea is that if we plot dQ/dt / Q versus Q, the above equation says that it should be a straight line, since

dQ/dt / Q = k(1-Q)

So we plot the ratio of annual production to cumulative production to that date, versus cumulative production. In his book, Deffeyes does this on p37 for US oil production. In the beginning, the data are crazy, but after about 1958, they settle down into pretty much a linear regime (with a little noise) that has held good ever since. The nice thing about this method is that you do not need to input an estimate for the URR. Instead, you extrapolate the straight line, and it tells you the URR.

You will note that Figure 2 shows this for the Kern River field, with the extrapolated out to an Ultimate Resource Recovery (URR) of around 2700 Mb of crude. One can then project out the decline in current production (Jean notes that it remains at around 5%) with an estimate of how long the field will last. (Figure 1).

The technique has some limitations in fields that are produced under political control, or due to other external forces where production can be shut off for significant periods (one thinks of Saudi Arabia, Iraq and now Libya as examples) however when political constraints are removed (such as for example in Texas) then the decline does assume a linear trend.

It does not, however, always apply, and Robert Rapier has explained, in two posts (here, and here) why he has concerns about using the technique. But in terms of giving a ballpark for production (and recognizing that there are always new discoveries and inventions that can be, as they say, game changers) the technique has considerable support. And the consistency with which the Californian fields are following the predictions provide evidence for such an opinion.

I am deeply indebted to Jean for making this updated information available, as well as his indefatigable work in examining the remaining oil reserves in the oilfields of the world.

P.S Jean has also discussed results from this region in other material, such as, for example, here.

On July 4th, let's honor those who fueled U.S. independence by fighting for fuel independence. Support biofuels to reduce our addiction to cheap oil.

Support a fuel tax sufficient to raise U.S. private vehicle mpg average to that of the current Prius or better within 5 years from now.

The concept of designing a gasoline tax that defines a minimal price might be easier to sell. In this approach the tax collapses back to the current value at a predefined high price.

As unintuitive as it seems, decreasing demand appears to be the only way to limit increases in oil price, given a supply limited environment. I mean, other than recession or depression, which seem less desirable.

As in another vast government subsidy to produce a fuel that almost requires as much gasoline to produce it as it supplies? De careful what you wish for, it will cost far more than anyone expected, require massive tax payer support and deliver little of what was promised.

Sorry for the cynicism but ethanol has become the worse possible example of any possible substitute for oil – as for grass or sugar cane or cellulose or algae all we hear is possibilities. So far, no real effect on meeting oil needs.

W/r to ethanol monetary cost, the $0.45/gal payment to fuel blenders is not really a vast government subsidy. Senator Amy Klobuchar - a politician from an ethanol producing state - has stated that the removal of ethanol from the market would increase gasoline retail prices by about $1.50/gallon in the U.S. If that is true, then one way to look at it is to consider where the additional $1.50 would go if there were no ethanol production. If the U.S. imports roughly half of current petroleum consumption, that means $0.75 would go to U.S. oil companies and $0.75 would go to foreign oil companies. But for what? For gasoline? No, no additional gasoline would produced for that $1.50. Instead the increase would be profit.

So really the choice is a) produce ethanol (with or without subsidies - in fact it would be better if we stopped bribing the blenders) and gasoline prices remain somewhat affordable, vs. b) do not produce ethanol and let gasoline prices exceed $5/gallon. Which would you prefer? Which do you think the Congress prefers?

The mind boggling part is w/r to the energy cost to produce food. A few quick back of the envelope calculations show that for corn, the amount of ethanol required to grow and harvest the crop can be derived from approximately one quarter of the corn crop. (This doesn't consider ancillary inputs such as fertilizers, pesticides, etc., only machine fuel.) The ethanol dollar equivalency in corn is very close to the cost of diesel fuel; i.e., approximately one quarter of a typical corn crop’s value is the diesel fuel used to produce it. That equivalency is why farmers don't use ethanol - the entire farm industry is built around diesel fuel, and if there is no dollar advantage to switching to ethanol, why would they?

The U.S. is now consuming close to half of the total annual corn crop to produce 13 billion gallons of ethanol for the retail market. Obviously this demand increases the price of food but the energy equivalency as reflected in the markets is nearly perfect; so in reality, without ethanol, the resulting increases in transportation fuel costs would induce increases in the prices of commodities and services, by a value equivalent to the ethanol not produced.

And start an addiction to scarse biofuels?

Naw, there is a whole PLANET of biologicals to be made into fuel!

Burn Bay-beeee Burn!

(How about some reduction of consumption instead?)

Rather surprising there has been almost no production response to the recent rise in oil prices in these CA fields. Recoverable reserves must be a function of oil price. This brings up a question I have been looking to ask. Is fracking or some version of this technique applicable to traditional fields that are mostly depleted?

Daniel – Frac’ng nearly depleted fields: two part answer. First, Conventional reservoirs would represent almost no potential at all. Such fields deplete via two routes: reservoir energy declines too low or water production increases to uneconomic levels. In either case frac’ng wouldn't likely offer a solution. Second, unconventional reservoirs could have some potential but suffer from the same potential limits as conventional fields. The one big exception would be drilling additional infield wells to tap reserves not drained by the initial wells. Similarly, we can re-frac an existing well. Typically doesn’t recover nearly as much as the first time but since the well already exists it’s done just for the cost of the frac.

You have to remember that frac’ng long horizontal wells is relatively new. But frac’ng vertical wells to increase productivity has been going on strong for over 60 years. The technique has seen improvements over the decades but is still done for the most as it was in the 40’s and 50’s. And the same point can be made about all EOR methods. There is no long list of old fields just waiting for somene to remember EOR. Virtually every field producing in the US today is either undergoing EOR or has been evaluated for an application and was rejected.

Reinvigorating older wells, and cost/benefit analysis to that effect, was a recent topic of a set of articles by Heading Out on stripper wells in the U.S. Here's a link to the article in question.

Tech Talk - Chemical floods to enhance oil recovery

Heading out goes into the techniques commonly used to increase oil product in fields whose water cut is high. Additionally, here's a link to the first article in the series:

Tech Talk - American Stripper Well Production

Thanks both, Yeah, I guess the real question was the number of currently drilled wells that might be fracked or subject to other enhanced recovery techniques. Still, a 4-fold increase in oil price and barely a sign of expanded production. Clearly a sign of peaking.

The Hubbert analysis assumes the growth rate equals the decay rate. As the physical mechanisms are wholly different, assuming them the same is what, hubris? desperation? based on lots of historical observations? A more reasonable global assumption than a local one.

jc - Hubbert made no such assumption. Others might add their decline expection on to his original curve. In fact, if I recall his words correctly, he wasn't willing to offer any speculation about the decline side. Actually I think the only aspect of the decline side of the curve that he was certain about was that it wouldn't be symetrical. In his opinion it wasn't very predictable. Of course, that hasn't stop countless others from offering the rest of the model.

As the physical mechanisms are wholly different, assuming them the same is what, hubris? desperation? based on lots of historical observations? A more reasonable global assumption than a local one.

Occam's razor.

If a one parameter model works, don't turn it into a two parameter one. (2/3 parameters for the integrated form)

The reason it works is that only the decline is of interest. You don't actually care whether it built up at 2% or 20% so you don't need a separate parameter for it. If you do care how it built up, then you will find that you need a very much more complicated model, because development is a much more volatile process than decline.

I would love to see a similar graph side-by-side with the Kern River one showing the same production and oil rig counts for world or OPEC+Russia.

I love how the oil rig count keeps rising rapidly in the face of flatlining, then declining, production.

Can there be any doubt that we are on the flatline right now as a globe?

And by similar I mean on the same sort of timescale of the past 100 years. I hate all the graphs that start at 2000...

My problem with Huppert linearization is that while it often fits a production curve well once it's at or past its peak, you can't use it to reliably estimate the ultimate resource recovery parameter until then. "What's the URR?" is the fundamental question you want an answer to, and you want it *before* you reach peak oil.

This almost always happens. Statistically, URR is very poorly constrained until cumulative production Q is about half of URR. The result is that Huppert analysis is a great tool for understanding processes, but pretty useless for predicting the future.

It's like a fire alarm that triggers once the entire house is ablaze.

g - I think your characterization is fair. OTOH while the past curve profile may not be very helpful in predicting the future profile that doesn't mean it can't be modeled with great accuracy. But it has to be done on a field by field basis and then combined. All it takes is the details of the production history. As you point out once a field has past 25%-50% URR the model isn't too difficult to complete. Just referring to existing producing fields it would take only a modest effort to project URR to within as little as 5% accuracy IMHO. I do this for a living and the methodology has been rather standard for decades. But there's the problem: producing countries, especially OPEC, refuse to make that data available. I have no doubt the KSA has a future production rate model of existing wells that is very accurate. Despite our never ending debate on the URR of existing fields the producers have a very good estimate.

The URR of yet to be discovered fields is another matter. In addition to not knowing what you don't know, estimating the URR and rate profile of an even a newly discovered field can be very inaccurate. But again, many countries refuse to provide any details of their current exploration efforts.

Rockman

You noted: "Virtually every field producing in the US today is either undergoing EOR or has been evaluated for an application and was rejected."

How about CO2-EOR? DOE funded a number of reports by Advanced Resources International that suggest high potential to over 60% recovery of OOIP However adequate CO2 supplies are lacking. the wide-scale implementation of "next generation" CO2-EOR technology advances have the potential to increase domestic oil recovery efficiency from about one-third to over 60 percent, doubling the technically recoverable resources in six domestic oil basins/areas studied to date.

e.g.

CHALLENGES OF IMPLEMENTING LARGE-SCALE CO2 ENHANCED OIL RECOVERY WITH CO2 CAPTURE AND STORAGE, Vello A. Kuuskraa

How are we to interpret these statements compared to your comment?

Well, when you start talking about "affordable CO2" you're talking about a carbon tax to get it.

But we're planning to spend all the carbon tax money on climate adaptation measures.

Your ball, Dave.

A carbon tax isn't enough. You have to allow EOR users an exemption for the CO2 they produce as well. They need to get credit for the CO2 that goes down the injection well and not be charged for the CO2 that comes up the production well. CO2 EOR is about miscibility. You produce oil with CO2 dissolved in it or CO2 with oil dissolved in it. Either way CO2 comes back out again with the produced oil and it wont be economic if you have to pay the carbon tax on it as well as the oil.

A genuine carbon tax without exemptions to subsidise CO2 EOR would result in less of it, not more, because it is actually a net CO2 producer. The currently affordable CO2 comes from CO2 reservoirs and ends up in the atmosphere. CO2 EOR is the opposite of CO2 sequestration. It takes CO2 from underground and releases it to the atmosphere. A properly designed carbon tax will drive CO2 in the opposite direction and kill CO2 EOR.

hot air

Again need to separate out issues and assumptions. See my reply above.

1) CO2 EOR "is actually a net CO2 producer" - assumes mining CO2 and exhausting it to the atmosphere - that is not the only combination.

2) Anthropogenic CO2 can be captured and used for CO2 EOR.

3) You assume "CO2 comes back out again with the produced oil" - Only some CO2 comes out. Part is left or "sequestered".

4) You assume produced CO2 is exhausted. Commercially the CO2 is separated and recycled.

5) On carbon tax - see McKitrick above etc.

6) This discussion presumes:

6.1) climate mitigation is necessary and

6.2) ignores the impact of peaking of light oil on the economy.

For a reality check, see Robert Hirsch, The Impending World Energy Mess.

For CO2 EOR see Advanced Resources' publications for DOE on "next generation" CO2 Enhanced Oil Recovery.

Back to the original questions:

1) Is there is a place for CO2 EOR?

2) At what cost CO2 delivered?

Hot air – Actually for the most part you have it backwards but that’s easy to do if you don’t understand the production process. Produced oil goes thru a separator system that removes water and gases. You’re not allowed to put any oil containing CO2 into the transport system especially pipelines…just way too corrosive. So the CO2 is recovered at the well site. In most cases the CO2 is compressed and injected back into the reservoir. IOW CO2 is valuable byproduct of the production process. A company might be spending a huge chunk of money to buy and transport CO2 many hundreds of miles. They aren’t recycling the CO2 because they suddenly got green…it’s about profits. Of course, compression produces exhaust gases. In some cases, these gases are also injected. Wouldn’t take much of a rule change to make it mandatory...maybe use that CO2 credit. Also, much of the CO2 injected never makes it back to the atmosphere…stays in earth indefinitely.

ormondotvos

We need to distinguish and separately address the issues involved.

1) I heartily agree on adaptation not mitigation as commonsense effective stewardship of resources.

2) Imposing a carbon tax is an entirely different issue with very serious consequences for civil society. See Vaclav Klaus, Green Shackles for a Blue Planet.

3) See Ross McKitrick's T3 tax if you "must."

4) I agree on seeking "affordable CO2".

5) However, logically that does NOT require a carbon tax.

6) What is "Affordable CO2"? The reports I have seen refer to $2/mscf (~$40/ton) of CO2 delivered as being commercially cost effective.

7) Are there any better numbers?

8) Are there large untapped natural sources of CO2?

9) If so what is the cost to deliver them?

10) What is the cost of capturing and delivering anthropogenic CO2? The latest reviews I have seen suggest $50 to $100/ton.

11) DOE's current cost evaluation of both CO2 Capture & Sequestration is about $126/ton. (I'll pass on that).

David – If you pay attention to the phrasing you’ll see the report completely supports my post. “CO2-EOR has been underway for several decades, starting initially in the Permian Basin and expanding today to numerous other regions of the country”. Too be honest I getting very tired of the misuse of the term “potential.” Offering any potential devoid of linkage to a viable implementation process is as best misleading and, at worse, an intentional deceit.

Every reservoir in the US that would benefit from EOR, including a CO2 flood, is undergoing EOR. And any well (and there are possibly thousands) that would benefit from CO2 that doesn’t have access to CO2 won’t ever benefit from the process until a local source is developed. So now we’ll hear about the “potential” development of local sources. Yet with $100+ oil do we see thousands of CO2 sourcing efforts underway today? Obviously not to any significant degree otherwise such articles wouldn’t be talking about “potential” gains but actual gains being realized today.

I have to go back to beating the same dead horse again. The US oil patch is almost hysterically trying to squeeze every drop of oil out of the ground. Tens of $billions are being spent drilling fairly marginal plays. Between the lines such reports seem to imply the oil patch is ignoring this great “potential”. IMHO folks need to stop focusing on “potential” solutions and stick with what’s possible under current economic conditions. The greatest lie that been floating around for years is the “potential” for the “oil (kerogen) shales” to produce countless billions of bbls of oil. Is this a legitimate use of the term potential when no one has yet developed a commercial method of producing even one bbl? It would be useful to notice that many of the folks writing such reports don’t spend a penny chasing any of this potential. There's nothing in the world easier than telling someone else how to do their job if you don’t have skin on the game. Armchair quarterbacks are not going to improve our situation. People that “can” do…people that “can’t” write reports telling us what someone else might do.

Hope I didn’t come off too snotty. Just tired of dealing with cornucopians. And this from a geologist who, for 36 years, made a living by pitching the “potential” of making big bucks developing oil/NG reserves. Trust me: I know very trick in the book as well as some that have never been written about. LOL

Thanks Rockman for the clarification.

As I understand you, oil fields with CO2 available are applying CO2-EOR. Conversely, I understand Advanced Resource Technologies to say that about 97% of oil fields that could use CO2-EOR are NOT using it for lack of CO2.

On "arm-chair" potential, ARI's 2009 preliminary review stated:

CO2 STORAGE IN DEPLETED OILFIELDS: GLOBAL APPLICATION CRITERIA FOR CARBON DIOXIDE ENHANCED OIL RECOVERY

Their 2011 followup abstract of 6 basins states:

CO2 storage in depleted oil fields: The worldwide potential for carbon dioxide enhanced oil recovery

From your comments and ATI's, I infer then that 97% of the "potential" CO2 EOR is NOT being done for lack of CO2, but that delivering CO2 at $40/ton ($2/mscf), preferably at $15/ton (0.75/mscf) would enable such CO2-EOR.

David - Again, at the risk of being a snotty SOB, if a angel came down and gave us all the CO2 we needed for free we can really add a lot of reserves. So what if it looks good on paper at $15 or $40 per ton? If CO2 can be delivered at an economic value to a potential EOR project then it's being done right now. The whole CO2 conversation is turning into one giant "if frogs could fly they wouldn't bump their asses" circular discussion. I couldn't care less how much additional oil could be recovered if CO2 can be delivered $X per ton. The only thing that's important is how much it actually cost. And for some odd reason they never seem to hit that little detail. IOW could someone please point out just one potential EOR project that has affordable CO2 available that isn't being done. Or, IOW, please point out where there's money laying on the ground that no one is picking up.

Rockman

PS Correspondingly, I presume that Hubbert linearization methods assume constant technology. Since 97% of CO2-EOR is NOT being used, that current national/global Hubbert linearization excludes significant CO2-EOR.

David - Something else just popped to mind. Let's say suddenly CO2 can be delivered to an oil field with millions of bbls of potentially recoverable oil. So now we have a nice bump in production, right? Nope. And for a good reason: you need wells to inject the CO2 into and wells to produce the oil out. And guess what? All the wells were plugged and abandoned decades ago. The vast majority of all wells ever produced have been abandond. Those fields only exist on some reservoir engineer's map. What...you mean that report didn't mention that much of this oil production potential is from wells that no longer exist? Surely they included the $trillions needed to redrill those fields and replace all the production equipment. Surely they included that little detail in their economic analysis, didn't they?

Getting down to the detailed level really does pop some day dreams, eh? Right now I know where there are over 2 billion bbls of oil along the Texas coast that would be economical to produce just by pumping the wells...no CO2 required. I've got over $80 million left in my budget this year that I can't find a place to spend. I would be thrilled to go buy those wells and pump the heck out of them. But I can't: these thousand of wells no longer exist. And the cost to redrill them vs. how much oil I could pump out doesn't make it economical to do so. But I can right fully say these reservoirs have the potential to produce many millions of bbls of EOR oil, can't I? And they'll always have that potential becase ain't nobody going to produce it until oil gets north of $400/bbl.

Rockman

Appreciate that important caution.

On

Any guestimates on the average cost of drilling and completing wells suitable for CO2-EOR using conventional technology? (You mentioned that the coiled tubing drilling cost about half of conventional.)

The EIA reports producing wells in the USA were

363,459 in 2009 and

384,394 in 1995.

The Railroad Commission of Texas (2009) reports:

The RRC lists oil wells and gas wells drilled and the number plugged by year. (~ ranging from half to all.)

(I see the RRC is spending its revenues to plug oil uncapped oil wells to protect the water table etc.)

(Any other sources handy on the total number of oil wells drilled?)

In round numbers, could we say that maybe one third to half of all Texas oil wells are still active?

Productive well adjustment:

If drilling is presumed uneconomic, then would we nominally cut the CO2-EOR projections to say 30% to 50% - if affordable CO2 was made available?

ROI:

What returns are needed to drill?

e.g. NETL/DOE's CO2-EOR assumes a 25% hurdle rate

An Assessment of Gate-to-Gate Environmental Life Cycle Performance of Water-Alternating-Gas CO2-Enhanced Oil Recovery in the Permian Basin

(That appears a bit high relative to recent stock market returns etc.)

David – Costs will vary widely with depth from several hundred of thousands to one million+. A CO2 injection well will cost much more than a conventional well…expensive tubulars to deal with corrosion.

The Texas RRC is the definitive data base for our little chunk o the world. Those numbers indicate that around 50% of all wells drilled have been plugged…I would have guessed higher.

“If drilling is presumed uneconomic, then would we nominally cut the CO2-EOR projections to say 30% to 50% - if affordable CO2 was made available?” I don’t want to offer a guess. The original premise was that X% of fields have not had CO2 EOR applied and that if it were to happen Y bbls of oil could be recovered. This ignores a very basic fact: not all reservoirs would benefit from CO2 injection. Most water drive reservoirs containing relative light and high quality crude recover need no EOR to max URR. I’ve seen such fields recover 60-70% of their in place reserves. CO2 EOR is especially efficient in heavy crude reservoirs with poor recovery dynamics. And while such reservoirs represent a large percentage of fields left to deplete, they are not characteristic of the majority of old fields containing all that residual oil. Another important consideration: timing. EOR methods such as CO2 and water floods can greatly improve recovery IF initiated early in a reservoir’s life. But applying such methods late if a field’s life can, at best, be marginal and at worst a complete failure.

A 25% ROR required? In their dreams. LOL. Despite how much profit folks think oil companies make the typical full cycle return is closer to 10% on average. If someone is using a high threshold for ROR they are likely doing so to compensate for failures. Project A might yield a 30% ROR but has to be averaged with Project B that lost $15 million. In fact, as I think back to all the EOR proposals I’ve even seen the all had very modest ROR. Perhaps 10% to 15% on the high side perhaps. But they were considered viable because most EOR projects are also considered relatively low risk. You’ll likely make a profit but not a very large one. When EOR works it doesn’t increase field production rates by 2X or 3 X. More likely a few percent to 10 to 15% if you’re very lucky. Which is another reason you don’t see $billions going into sourcing CO2 for fields where it would be applicable: large capex requirements seldom work with marginal projects. The cash flow stream just doesn’t return the investment fast enough. And that brings us back to my basic problem with such analysis: it matters not if applying CO2 injection to various fields would increase URR significantly. In the entire history of the oil patch not a single company undertaken an EOR project to increase URR. They did so to make an acceptable ROR. No CO2 EOR will happen if it doesn’t make economic sense regardless of how much additional oil is technically recoverable. Another reality check: as you read my post approximately $2 billion/yr is being spent drilling what I consider barely profitable Eagle Ford Shale oil wells in one small portion of Texas. Almost 200 rigs drilling nonstop. Thus there is no lack of capex for projects. And how much is being spent on new CO2 projects today? As some people say: if you want the truth…follow the money.

Thanks Rockman.

Good to hear from the real world.

On CO2 needing “expensive tubulars to deal with corrosion” a number of papers call for drying CO2 to control corrosion. E.g.

A Study to Evaluate the Impact of CO2-EOR on Existing Oil Field Facilities Saadawi et al. 2011 SPE.

Use of CO2 Containing Impurities for Miscible Enhanced Oil Recovery Wilkinson et al. SPE 2010.

ROI:

You noted “the typical full cycle return is closer to 10% on average.” “EOR proposals . . .all had very modest ROR. Perhaps 10% to 15% on the high side perhaps.”

That sounds more realistic.

So an average 15% -20% ROI with full risk weighting might generate serious interest?

Drilling:

“approximately $2 billion/yr is being spent drilling what I consider barely profitable Eagle Ford Shale oil wells in one small portion of Texas. Almost 200 rigs drilling nonstop.”

Thats serious focus.

“The Eagle Ford Shale is located directly below the Austin Chalk Formation and is estimated in some spots to be as deep as 11,300 feet. . . the Eagle Ford Shale extends up toward Dallas County and has an average thickness of 475 feet.”

I was interested in the rate of drilling in how many thousand feet/year.

Any guestimate on how many wells/year/rig? E.g. 25 to 50 wells /year?

Or how many feet / year per rig into that Eagle Ford Shale? E.g. 250,000 to 500,000 ft/year?

David – Very interesting about the CO2 drying. Had not heard of that before. This would certainly decrease the cost of the injectors. Even standard tubulars are getting pricy these days.

A 15% - 20% ROI? They would kill for it IMHO especially when you consider the gain in booked proved reserves. Again, the main reason for the current push in the Eagle Ford is the Wall Street demand for increased reserve base by public companies. It would also provide a very nice bump in borrowing base: banks look at mature producing fields as the most secure collateral.

Eagle Ford drill footage: the oil window in the EFS is between 6,000’ and 11,000’ more or less. Assume 200 rigs running; one well every 5 weeks; 13,000’ per well average (8,000 vertical + 5,000’ horizontal. If I did the math right that’s a little over 27 million feet of hole per year. Or around 135,000 feet per rig per year. Not as high as you were guessing but they’ve reduced the drill time significantly since they began a couple of years ago. The big tech advantage has been the “rotary steering assembly”. Used to drill from vertical to horizontal. Some of these systems are costing as much per day as the rest of the drill rig.

Mr. Rockman, you are spot on regarding Eagle Ford economics and wonder once the real numbers start to come in on EUR's (500K per well BOE and 3:6 to 1 ROR gives me the same skin rash the Chalk use to) and banks start to cut these guys off, how long will it be before rig counts tumble?

You are doing big work today, thanks for setting it straight.

Mikey - I know exactly what you mean by "Chalk rash". But I assume you weren't drilling for a public company. I actually think the rig count will expand some more especially if the service companies start beefing up. Just my WAG but as long as oil stays above $70-80/bbl the public oils have no choice but to keep drilling the EFS as if there's no tomorrow. And for good reason IMHO: there is no tomorrow for the majority of public companies if they had to depend solely on conventional plays. But if prices fall below what ever magic number is required we'll likely see a repeat of the E Texas SG bust.

A cute analogy comes to mind. In S.E.A.L. training they go through a "drown proofing" execise. Tie their hands and feet together and dump them into the deep end of the pool. As long as they don't panic (the real point of the exercise) they can sink to the bottom, push up to the surface for a breath and sink back down and repeat. Keeps you alive until someone arrives to save you. And that's what the public companies are doing IMHO: using the unconventional plays to stay alive. Unfortunately, there's no one coming to the rescue them. Likewise, the S.E.A.L. knows he's going to die also if no one comes for him. And that's the reason they keep them in the pool until they nearly drown: don't panic even if it feels like you're dying. A handy skill in combat as you might imagine.

Hey Rock, I like the analogy. I agree with you to some extent but think the banks will pull the plug on these guys eventually. I might be wrong on that; what does Chesapeake owe, something like 35 billion with the worse debt to asset ratio of any 500 company in the country?

Go to the Clearinghouse website and have a look at the Jackson County package; I am familar with that stuff, its way over operated (the net cash flow should be much higher for 300 BOEPD) and man, talk about behind pipe potential. Take a look anyway.

Mikey - I'm sure you've heard it before: owe the bank a little money and they have you by the short and curleys. Owe the bank a lot of money and you have them in a corner. Just like Mastercard I suppose; as long as you can keep making the interest payments they don't care if you ever pay off the principal.

IBMikey

Thanks for your cautions. Appreciate your comparing what the industry considers healthy - and then what would be healthy for CO2 EOR.

Mr. Hagen if I could contribute in a way that would help, I would. The science is there, thanks for all that. Sometimes its just hard for old farts like Mr. Rockman and I to get past the problems. I think there is such a massive practical component to sourcing CO2, getting it into abondoned fields, injected into depleted reservoirs where high water cuts cause massive corrosion issues in anything less than stainless steel environments, its overwhelming to think of. In depleted fields with hundreds of old wellbores in them plugged but perhaps not with the cement integrity to completely isolate one zone from another I do not know how you could construct effective injection patterns and know where the CO2 was even going. Mr. Rockman has a good handle on it. There is an overwhelming qualified personel side of all this; most of the folks still alive and working that could implement CO2 injection into abandoned fields are off doing bigger and better things, like Marcellus and Bakken, bagging elephants.

The ship has sailed on millions and millions of barrels left behind when hundreds of thousands of wells were abandoned (prematurely?) due to low oil prices and poor economics. I am not even sure if you could start over in a lot of these old fields for reasons I have mentioned. I can tell you this sir, knowing what I know now and getting another chance to develop some of the fields I have plugged over the years, I would develop those field with ultimate CO2 injection in mind. But thats hindsight and if I had been smarter and known the price of oil was going to be 150 dollars someday, I would never have plugged any 2 BOPD wells.

Rockman

You noted: "EOR methods such as CO2 and water floods can greatly improve recovery IF initiated early in a reservoir’s life. But applying such methods late if a field’s life can, at best, be marginal and at worst a complete failure."

Vello A. Kuuskraa, further emphasizes the impact of early vs late on the Net Present Value. e.g. Slide 23

Conventional EOR (million) Early EOR (million)

Gross revenues (NPV @10%) $9,300 vs $19,000

Oil recovered (bbls) 1,060 (56 years) vs 1048 923 years)

Water (bbls) 3,900 vs 1,500.

MAXIMIZING OIL RECOVERY EFFICIENCY AND Future Oil SEQUESTRATION OF CO2 WITH “GAME CHANGER” CO2-EOR TECHNOLOGY Advanced Resources International

Doubling the NPV should be worth some effort.

Also, realize that it is not just number of wells,

it is the cost of the new wells, and cost to operate given the extensive use in enhanced oil recovery methods now used in these fields - that is a well in 1910 does not equal a well in normalized capital cost nor operating costs.

Yeah, thats exactly right. I could pick a number of depleted fields where there is considerable OOIP left behind but to re-drill even the shallowest of wells with CO2 injection in mind is not cheap anymore. Wells that use to cost 20,000.00 to drill and complete in 1960 now cost 200,000.00, plus; add 100,000 more for proper tubulars, x 10 wells and it gets beyond the economic means of typical shallow, stripper well, junk yard dogs like meself, especially knowing that each one of those wells may require 4-5 years to payout at 5 BOPD instead of the pre-abondoned rate of < 2 BOPD. I use to be able to lease acreage in S. Texas, along the Gulf Coast for 50 bucks an acre; you can not touch it anymore for less than 1000 dollars, thanks to those Eagle Ford fellers ruining everything for us little guys.