Does the Hubbert Linearization Ever Work?

Posted by Robert Rapier on March 22, 2007 - 11:15am

Part II: The Titanic, Oilsville, and Saudi Arabia

In Part I, we examined the evolving Hubbert Linearization (HL) of Texas oil production, and found that the predictive precision of the technique was quite poor. The error range was on the order of 3 decades. However, some have suggested that the trends just need to stabilize, and then we can be more confident in the predictions. Others offered rationalizations for why Texas behaved as it did, and suggested that the HL is still a useful predictive tool provided we somehow filter the data. Still others suggested that it is futile to attempt to linearize non-linear data. In this essay, we will push this issue further. I will examine more cases that cast grave doubts in my mind that the HL can accurately predict anything.

But first, does this debate even matter?

The Sinking of the Titanic

A number of people have latched on to the sinking of the Titanic as an appropriate analogy for the debate over the methodology and timing of peak oil forecasts. I see those analogies as missing a number of key points. If you wish to apply an appropriate analogy, try the following.

After the Titanic hit the iceberg, a debate quickly ensued on how fast it would sink. One train of thought was that it didn’t matter, because everyone was doomed anyway after the precious few lifeboats were utilized. Most of these people sat idly by biting their fingernails while others made decisions that would affect them. One train of thought suggested that based on the alignment of the stars – which had correctly forecast prior disasters - sinking in 2 hours was inevitable. These people proceeded to warn everyone to expect the ship to go down in 2 hours. They demonstrated unwavering faith in their forecast.

But another group employed a more scientific approach. First, they challenged the faith-based group to show a case in which their methodology had ever been demonstrated to work. Challenges to their arguments were met with repetitious assertions of the original claims. Yet the scientific group continued to challenge the argument – not because they didn’t think the ship was sinking – but because they saw some inherent dangers in faith-based arguments and they were not satisfied with the integrity of the conclusions. In response to their challenges, the scientific group was accused of mounting frantic, even hysterical attacks on the faith-based arguments. They were accused of having agendas and of being non-believers. The faith-based proponents were praised by their followers for maintaining faith in the face of these challenges.

However, the challenges persisted, and some in the scientific group pointed to data suggesting that the ship would actually sink in 4 hours. (To be fair, some scientifically minded investigators concluded that the ship would sink in 2 hours). But two hours after the iceberg was struck, the faith-based group began to cry “We are all doomed!” A number of people, unable to bear the tension any longer, decided to end it all before they were plunged into the icy water.

But the 2-hour mark came and went, and while it was clear that the ship was sinking, the voices of the faith-based group had been silenced. They had either jumped overboard as the 2-hour mark bore down upon them, or they were ignored because their assertions now rang hollow. They still sought influence, but their previous tactics now undermined the possibility of sounding a warning.

At the 3-hour mark, a few small rescue boats made it to the area. While there were not enough boats to save everyone, some of those who had taken a cautious approach toward the faith-based group were saved. However, there was a very large group of people who did not differentiate between the arguments of the faith-based group and those of the scientific group. They decided to discount both messages. “After all,” they argued, “these sinkers have already shown that they can’t forecast very well.” So this group called into question the credibility of the scientific group based on the missed forecast of the faith-based group. They convinced great numbers that the Titanic wouldn’t sink at all, and that they were safer taking their chances there than by climbing into a rescue boat on the open sea.

Of course we know how the story turned out. The cry of “wolf” at the 2-hour mark resulted in great loss of life when the Titanic actually did go down at the 4-hour mark. Those who survived were the ones who valued the scientific approach of cautiously evaluating and challenging the data. Many doomers were wiped out at the 2-hour mark, and many cornucopians – along with the vast majority of the passengers - were wiped out at the 4-hour mark. So the debate over the timing of the Titanic’s sinking actually had great significance for all 3 groups. And while we don’t know if any rescue boats will actually arrive or just how long we have until the ship sinks, the debate does matter to many people.

Oilsville – The Constant Production Case

Consider the case of a fictional society called Oilsville. Oilsville discovered a great oil reserve in 1955 and began full production on January 1, 1960. The size of the recoverable reserve is at least 5 trillion barrels. Oilsville’s policy makers decided that they would maintain their oil production constant at 10 billion barrels per year. It was estimated that the new find would provide for the needs of Oilsville for at least 500 years, provided they maintained their longstanding policy of keeping their population relatively constant.

Note that we have made no assumptions about how they produce their oil. We don’t know if there is a water-cut, we don’t know if they are using horizontal wells, and we don’t know how hard they are pumping their fields. All we know is that they are keeping production constant. So, let’s do a series of HLs for Oilsville to better understand the HL behaviour under these circumstances. First, fix in your mind what you think the HL for Oilsville will look like after 20 years of steady production. Form your hypothesis. So, what does the HL actually look like?

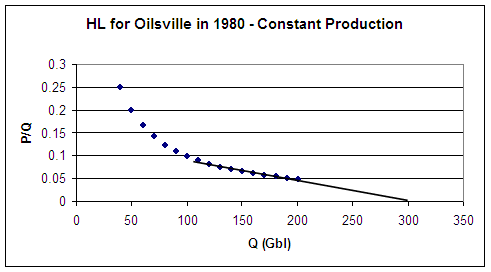

Figure 1. Hubbert Linearization of Flat Production Case after 20 Years.

At the end of 1980, they have produced 200 billion barrels, or 4% of their total URR of 5 trillion barrels. The last 10 points on the graph have stabilized such that we can make an estimate of URR based on the HL. It appears from the HL that the predicted URR is 300 billion barrels. However, this is only 6% of the actual URR. The % Qt indicated by the HL is (200/300) or 66.7%, indicating a fairly advanced stage of depletion and likely well past peak. Yet the actual depletion is 4%. Furthermore, recall that even though the production rate is constant, the slope of the line is negative. This may confuse some into thinking that production is declining.

Maybe that one was a fluke. Let’s look at 1990.

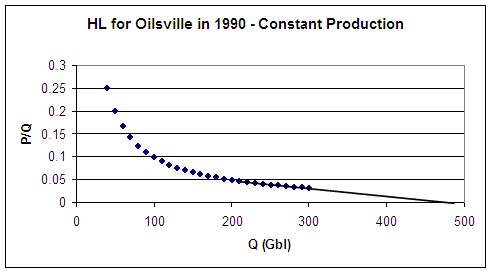

Figure 2. Hubbert Linearization of Flat Production Case after 30 Years.

Hmm. The URR according to the HL prediction has now increased to 460 billion barrels, still only 9.2% of the actual URR. The % Qt implied by the HL is now (300/460), or 65.2%, while the true % Qt is (300/5,000), or 6%. Also, by 1990 they had produced 300 billion barrels, which only 10 years earlier was predicted as the URR by the HL. These HL predictions are not remotely in the ballpark. Let’s jump to 2000.

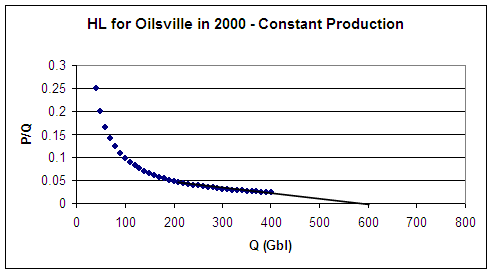

Figure 3. Hubbert Linearization of Flat Production Case after 40 Years.

It’s more of the same. The URR is trending to a higher value. The HL is now predicting that the URR is 580 billion barrels, or 11.6% of the true value. Cumulative production in 2000 is 400 billion barrels, giving an implied Qt of (400/580), or 69%. The actual % Qt at this point is (400/5000), or 8%. But let’s look at one more in 2010:

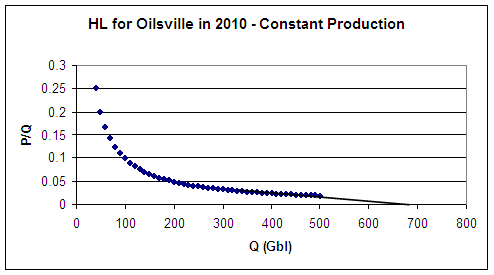

Figure 4. Hubbert Linearization of Flat Production Case after 50 Years.

Again, the pattern is the same. URR as indicated by the HL continues to grow, and now stands at 630 billion barrels, or 12.6% of the true URR. Yet cumulative production is now at 500 billion barrels, giving a predicted (500/630), or 79% of Qt. That’s right; the HL is telling us that they are 79% depleted, when they are actually only (500/5,000), or 10% depleted.

The HL has failed in this case, and furthermore it will show the same tendency for any area having relatively flat production over an extended period of time. I will leave that one for the reader to do as an exercise. But the problem is – as someone mentioned following my previous essay – linearization of non-linear data. That is why we so often see “doglegs” when we stop and plot the graphs. Often, the dogleg is a mere manifestation of the fact that we are drawing a straight line through a curve, and the points at the end don’t fit.

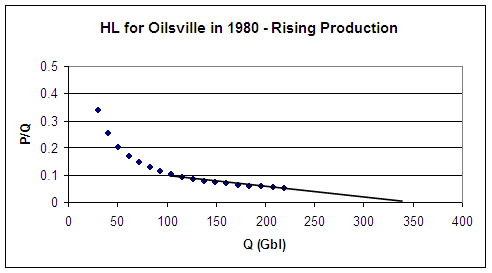

The Rising Production Case

Now, if that doesn’t convince you that there is a problem, perhaps this will. Instead of a constant production rate, let’s assume they increase production each year by 0.1 billion barrels per year. Let’s also say we no longer know anything about reserves. You could assume any number you want. Let’s revisit the HL from 1960 with this new assumption:

Figure 5. Hubbert Linearization of Flat Production Case after 20 Years.

At the end of 1980, they have produced 219 billion barrels. Despite the fact that production has increased each year, and despite the fact that the reserves could for all practical purposes be infinite, the HL predicts a URR of 348 billion barrels. So, 20 years into production, the HL says they are at (219/348), or 62.9% of Qt. Furthermore, the R-squared of the last 10 points is a respectable 0.969, indicating a very good fit for the trend line. To me this is indicative of a major malfunction in the HL, given that all we know is that production has increased every year.

Once again, the HL has failed badly in Oilsville. And while you may dismiss this case as an unrealistic example, consider the implications. This example suggests that it is not possible to forecast a production peak prior to the production actually turning downward. Given this, I conclude that it is highly unlikely that Hubbert actually used this sort of linearization technique in making his forecasts.

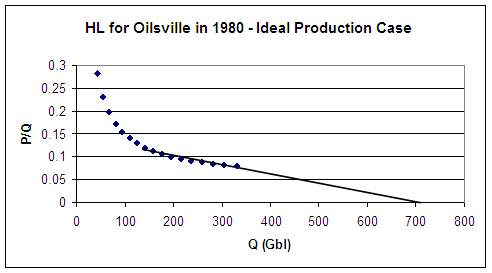

The Ideal Production Case

“No fair,” you say. “You are feeding the HL contrived and unrealistic cases. You can’t expect it to behave in these instances.” So, let’s examine an ideal case. Consider the case in Oilsville where the production rate increases by 5% each year for 20 years, and then starts to decline at 5% a year indefinitely. What we see in this case is an eventual convergence toward a URR of 861.3 Gbl. This should be an ideal case for the HL. Peak production will occur in 1980, and we will cross the 50% depletion mark in 1984. We know all of the important parameters. But can the HL predict the results? Let’s look first at the HL for 1980:

Figure 6. Hubbert Linearization of Ideal Production Case after 20 Years.

Even though production has risen each year to 1980, the HL is still under-predicting the URR. The R-squared is indicating a good fit at 0.945. The trend line is predicting a URR of 702 Gbl, an under-prediction of 159 Gbl. Cumulative production in 1980 is 330.7 Gbl, which means that they are at (330.7/702), or 47% of predicted Qt. But the actual position is (330.7/861.3), or 38% of Qt. Remember, that last point represents the year of peak production.

Let’s jump forward 10 years.

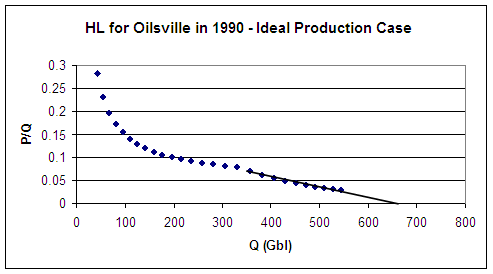

Figure 7. Hubbert Linearization of Ideal Production Case after 30 Years.

The 50% depletion mark was crossed in 1984. The HL is now predicting a Qt of 667 Gbl, which is a greater error than the previous prediction. The R-squared in this case implies a better fit than in the previous graph (0.986 now versus 0.945 for the previous case). Yet the actual URR is being under-predicted by 194 Gbl. Cumulative production in 1990 is 543.6 Gbl, putting the actual % Qt at (543.6/861.3), or 63%. The predicted % Qt is (543.6/667), or 81.5%.

The HL is lying to us even in the ideal case where we have specified all of the important parameters. In none of these cases has the HL come close to providing accurate predictions.

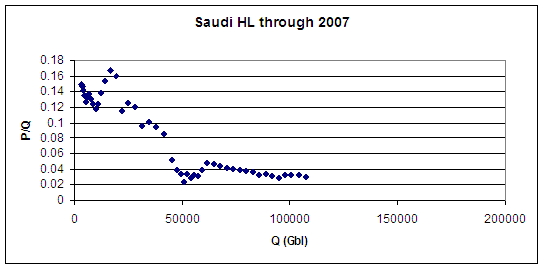

Saudi Arabia

If the HL is not even reliable when all the important parameters are defined, then it is pointless to use it in a case in which we are trying to predict the parameters. The HL has failed all validation tests. As someone accurately said in another thread, my motive here is that I really want to know “what the heck is going on.” Given the enormous errors in the HL predictions where URR is persistently under-predicted, I don’t have any confidence in the ability of this model to do that. We saw this in the case of Texas, where the URR grew by 50% in 20 years.

The HL has failed us in every single test case. But let’s go ahead and look at the case of Saudi Arabia. So, what does the actual HL look like for Saudi? First, we need production statistics from Saudi. After 1960, those numbers are available from the EIA. (1, 2) Prior to that, I had to cobble data together from several sources. According to Matt Simmons’ Twilight in the Desert, (3) the first major oil discovery in Saudi Arabia occurred in 1938. Simmons further indicates that production was slow during World War II, and that at the end of the war Saudi was producing 60,000 barrels per day (bpd). Figure 3.3 in Twilight shows that in 1950, Saudi was producing about 0.5 million bpd, and by 1960, production had risen to just over 1 million bpd.

To calculate cumulative production prior to 1960, I assumed an average of 30,000 bpd from 1938 through 1945, and then an average of 250,000 bpd until 1950, and finally an average of 750,000 bpd from 1950 to 1960. There may be an actual cumulative number available, but I haven’t found it. Regardless, later production rates are high enough that even if we assumed no production prior to 1950, it would have minimal effect on the results. But based on my assumptions, I calculated a total of 3.2 billion barrels produced in Saudi Arabia before 1960. Using those assumptions, the entire HL graph for Saudi Arabia looks like this:

Figure 8. Hubbert Linearization of Saudi Arabia in 2007.

This curve is quite consistent with previous HLs of Saudi Arabia. The HL was very erratic until 1991, at which point the slope became relatively stable. By 2000, there were 10 points that looked to have stabilized:

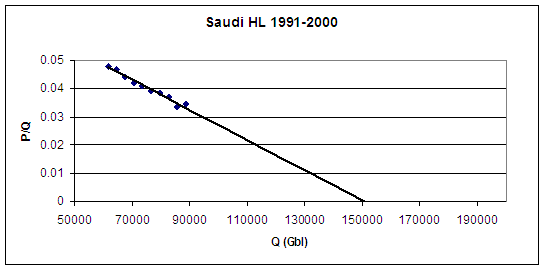

Figure 9. Hubbert Linearization of Saudi Arabia 1991-2000.

The HL performed in 2000 predicted a URR of 151 Gbl. That would put cumulative production through 2000 at (88.7/151), or 58.7% of Qt. The R-squared is 0.969. Now let’s include production numbers through 2006:

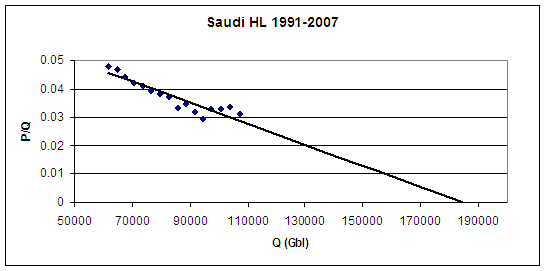

Figure 10. Hubbert Linearization of Saudi Arabia 1991-2007.

The addition of a mere 6 years of production data has shifted the URR prediction to 185 Gbl. Between 2000 and the end of 2006 Saudi Arabia produced 19 Gbl, but the URR prediction increased by 34 Gbl. Because of this, the 2006 HL is at a slightly lower % of Qt than the 2000 HL. In 2000, the graph showed that Saudi was at 58.7% of Qt, but in 2006 the graph indicates that Saudi is at (107.5/185), or 58.1% of Qt. This implies that one could have used the HL to make a stronger case for an imminent Saudi peak in 2000 than in 2007. Furthermore, the R-squared in 2006 – 0.856 - is worse than in 2000, indicating that the stability of the line has degraded. Yet this is the data that is being used by some to forecast the peak of Saudi oil production. Perhaps you can now understand my extreme scepticism that the HL has the ability to accurately make such a prediction.

Conclusion

Based on the case studies I have carried out – both hypothetical and real – I conclude that the Hubbert Linearization technique does not have the capability of predicting a production peak in real time. Furthermore, I believe it is the responsibility of those who are using this technique as a basis of their peak predictions to validate the model. Each case I have investigated showed a failure of the HL technique and an incorrect prediction. This was true for Texas, it was true for the idealized cases, and we are now seeing evolution in the HL for Saudi Arabia. But it is not my responsibility to investigate every possible variation of when the HL “might” work. I could spend the rest of my life evaluating case after case. I think it is a much more reasonable request to ask proponents to provide details on some cases in which it did work - or would have worked – to predict a peak in something resembling real time.

If we are to have any confidence in the HL model, I think it is fair to request the following of HL proponents:

1). Please validate your model. Demonstrate any case – real or hypothetical – in which the HL would have predicted a peak in real time. Details are preferred over assertions.

2). Please define the conditions and parameters of the HL (e.g., % Qt, P/Q intercept) that indicate a production peak.

3). Please identify cases in which the HL would be expected not to work.

4). Please identify any other criteria (filtering, etc.) that need to be fulfilled before the method should be used.

I know that some have a difference of opinion on whether this debate even matters. I am of the belief that it does, and that we should rigorously challenge all of our assumptions. Furthermore, I know that there are some who believe that peak is imminent, but who also agree that continually testing and evaluating conclusions is necessary. I want to make it clear that there is a big difference – especially in the ability to persuade others – in the faith-based approach and the more rigorous approaches. This is true regardless of the ultimate conclusion of the approach.

References

1. World Oil Production 1960-2005, Energy Information Administration, Accessed March 18, 2007.

2. Saudi Production 2006, Energy Information Administration, Accessed March 18, 2007.

3. Simmons, Matthew R., Twilight in the Desert, John Wiley and Sons, Inc., 2005.

Note: There were a lot of calculations involved in this one, and it is quite possible that there may be an error or two. If you spot one, I would be grateful if you would call it to my attention and I will fix it. Thanks.

Robert,

a systematic study done well. This appears to be a fairly damning case for HL predictive ability. What happens when you look at your idealized case at a true 60%

depletion? Can the URR be approximated?

I will run that when I get a chance. My feeling is that it does converge, and the ideal production case will be a good test case.

Robert, a good article that points up some of my own misgivings about the reliance on HL. The wise words "don't use models the way a drunk uses a lamppost - use them for illumination, not support" comes back to me. The moment you rely without thinking and questioning is the moment you make that BIG mistake.

To me the whole thing is very much a case of 'the central limit theorum' - if you know nothing more then you can assume that the combination of independent distributions tends to a normal distribution (eg 'Peak Oil'). However we DO know something more - production is NOT independent and production levels/demand are significantly influenced by politics, prices, technology, social events, etc. Although to a first order it will be OK, we know the model cannot be taken beyond that because of all the influences upon it.

Does that mean peak oil is a joke (hello CERA)? No, the basics are still there. Oil is a finite resource and production will increase with increased usage, and decline with increase problems of production (smaller, harder wells). However to get to a useful prediction of reserves, dates, and most importantly, decline rates, we need a much better model - particularly since we have to make up for hidden data.

Some try to consider fields individually, summing the resultant predictions to arrive at a global production forecast, bottom up. Some also try to capture planned developments (megaprojects) to predict future production. Neither really deal with the key issues the confuse our view of production/reserves and thus forecast - the human dimension.

It seems to me the only way to try and apply a model to the data to make predictions is to 'reverse out' the effect of the human dimension on production figures - constructing an idealised production history from the raw data by removing the human perturbations (from history, which we DO know accurately). From there we can use three more pieces of information; which fields the oil is coming from, the fact that any country/company will produce its 'easiest' oil first, and the fact that companies will produce oil so as to maximise their discounted return on investment.

Putting that together, it should be possible to arrive at an alternative history of production which would then be amenable to improved mathematical modeling to determine what was under the ground. We could then take real production to yield real world predictions of future production capability.

I'd suggest that a fuzzy systems dynamics model is the first approach to performing this 'reversing out' - constructing a model that predicts out history supply record with the known history, and then reversing the effects of the elements to arrive at the inputs. It sounds as if this should work, being based on the data we do know accurately (production totals, history, driving behaviours), rather than the data we don't (URR, etc.)

Your thoughts?

Shouldn't that be "the way a dog uses a lamppost.." :)

I just used the non-dog variation on the Logistic model:

http://mobjectivist.blogspot.com/2007/03/derivation-of-logistic-growth-v...

This is the "drunk looking for his car-keys under the lamp-post" problem. Somebody asks the drunk why he chose to look under the lamp-post. "Of course, that's where the light is".

But the dog variation is actually more funny and perhaps more telling.

WHT

Perhaps you could post an article here describing your Shock Model. In particular I would appreciate your view of recent Saudi production with regard to your model, assuming that they are pumping to the capacity of refiners to accept their crude oil.

The only reason I'm not convinced the shock model is right is I'm not sure we have enough data to support it. I think it is probably a better model but on the same hand given the data a simple analytic model suffices. I think you could drop even drop the

logistic curve and simply use parabolas. It would be nice if you picked a simple model of your choosing that you did like so we could see how the shock model varied against that.

Here you basically do that.

http://mobjectivist.blogspot.com/2007/02/quardratic-linearization.html

And here you compare to a Gaussian. Isn't a Gaussian good enough for our purposes ?

http://mobjectivist.blogspot.com/2007/01/missing-link.html

Next you added in discovery for the US but KSA for example has had many fields that were discovered yet not produced because of technical problems.

Again in general your right and I agree its just hard to see

if your model has to many parameters.

I actually favor a Gaussian because it fits what I know about movement of molecules through a matrix so it scales nicely a sample of the matrix all the way up to the field.

So you don't have to change equations. Because of the noise in the data I did not see that the choice makes a lot of difference.

I'd say the best approach is a Gaussian first approximation then move to something like the shock model for more complex cases. In general the only reason to model is when your within 20% of peak on the front side as say 10% on the backside. So I'm not sure we needs a super good model.

With that said I'd love to see you model Russia.

Thats one that HL basically fails on and probably any other simple analytical model. And if you do what I said and pick a simple model this would be a good way to show when it fails.

The only reason I'm not convinced the shock model is right is I'm not sure we have enough data to support it.

Yet you latched on to the HL and continue to insist that it has value, even as case after case falls upon scrutiny. Now, scanning down the responses I can see that you have been reduced to aspersion casting. You still haven’t produced a case that works, but insist that I have demonstrated nothing. It is like someone who insists there are pink unicorns living in their house. I go from room to room, and I find no pink unicorn. But you insist that the burden of proof is on me to show that the unicorn is not there. Actually, the burden of proof is on you. Show me the unicorn.

Thats one that HL basically fails on…

Show me one that it didn’t basically fail on.

Robert its a model. In this post you already showed it works for KSA in your examples of how it does not work.

The 2000 production data gave a good fit and when you went to 2006 the fit was worse and the URR changed but the model indicated that it had more noise. The good thing about HL is its noise or error term is realistic.

So you already posted a great example of HL working if you understand modeling.

So what is the model hinting at after 2000 ? Its says that a lot of "new" production was brought online but yet KSA did not

find some large new field during this time period.

So what happened ?

They had spare capacity in 2000 by 2006 this was gone either it was rotated out or depletion is catching up since prices are still high depletion is a good possibility.

HL cannot predict when someone changes the extraction pattern abruptly but it does show in the data and the fit as noise. Its also giving us a estimate on how much spare capacity the used to have. And we have confirming statement from KSA that say they where pumping at capacity in 2005.

If you had bothered to read on the noise distribution in HL you would have realized that a increase in the noise itself

means something disrupted the model since the noise goes to zero. And your using the URR estimate without a error term

if you showed the real error in URR you would see that most of what happened through 2006 was simply to increase the error in the estimate the error terms probably still overlap.

I'm comfortable with your KSA plots and believe since KSA was a confirmed swing producer and the model shows that they have brought all their excess capacity online they have already peaked from the HL data.

This post is junk science at its worst.

Its a different metaphor. One is about using the lamp post as a tool to help, rather than trusting it to do all the work - the other is about looking to find answers only where you have the data.

Lots of lamp post metaphors.

Ahh well, looks like nobody is going to come back on the meat of the suggestion. Pity really, I think systems dynamics and working from the data we really do have is a promising approach. Maybe I'll have to do it myself one day.

Whats your rate of production in each case ?

If your assuming the same rate of production then your right

but thats a incorrect you of the model.

If you have such a large urr your production rate should be much higher then in the examples your giving.

I don't yet think you have proved anything. To be honest.

The production rate should depend on the total URR thats

the reason why it should work. The production rate is a non-linear function of remaining URR. Even your simple case of increasing by 5% per year then decreasing by 5% is wrong

although closer too reality and in this case HL is giving results inline with the real answer.

If your going to test the model this way we need the real production non-linear function. A Gaussian should be right. Or you can use a square wave as the first approximation.

So far I don't agree with your production models.

It would be easier if you also posted the production profile you assumptions are making.

I actually think this is a better analysis then what you just presented.

http://mobjectivist.blogspot.com/2005/12/hubbert-linearization.html

And more in line with what I've said.

Lets keep looking at this before we throw HL out.

I don't yet think you have proved anything. To be honest.

I have shown case after case, real and hypothetical based on rising production, flat production, rising and then falling production - and it has never worked. So do you think it would be too much to ask - given that you think the model has some merit - that I ask you to do some plotting and show me a case in which it worked, or would have worked? It's not like I went looking for cases to disprove it. It was wrong in ever case I looked at. So I ask you to show me a case in which it worked.

So far I don't agree with your production models.

Well, see the challenge at the end of my essay. Provide your own. Show a case that works. Stop saying it works if you can't show a case in which it worked.

It would be easier if you also posted the production profile you assumptions are making.

I told you exactly what my assumptions were. You could generate it in 3 minutes in Excel. Otherwise, I am going to post a hundred lines of numbers here.

Robert the function that ties production rate to URR is a unknown non-linear function. HL is a way to guess the answer without knowing this function. Thats why its empirical.

The one example you gave that was even close to reality was giving HL answers that were not too bad.

What you have just wrote says nothing about HL it's basically garbage.

If you come up with something close to right its worth arguing about. Your so hell bent on proving HL wrong your not even trying to understand it.

You can keep being unreasonable or start thinking.

I gave you a hint the shape of the function is not that critical. It can be a Gaussian or a square wave.

And I told you the reason HL works is regardless of the shape of the curve the peak time and total URR are basically constants thats why HL works. The model HL uses is the Logistic curve.

http://mobjectivist.blogspot.com/2005/12/hubbert-linearization.html

He is basically right. We just happen to know the logistic curve seems to give the best fit for a simple analysis.

It seems that these unkown non-linear functions that relate production to URR can be mapped to a logistic curve. Of course the probably map to others. I'm not convinced logistic is the best but I think the error in the data is high enough it does not matter.

So again go back and pick any non-linear function that maps production rate to URR use that to generate your production data then run HL on the results. I'd like to see the graph

of the production profile so I can visualize the function.

The 5% per year one is basically I triangle if I understood

what your saying.

Then and only then can we discuss HL.

If at this point you have some valid arguments I'm interested. I know I'm being a bit harsh but this is bogus

and its public.

One more time.

Its too early to throw out HL.

Memmel,

Robert has an interesting point though. As he accurately describes a situation (Oilsville) with a flat production rate, what happens is that the width of the upside down parabola begins to increase; i.e. the second derivative of the production profile starts shrinking.

This kicks the y-intercept further and further into the future. Which you can mathematically see in that blog post of mine that you referenced.

Actually in the case you mentioned HL still works since the

peak comes down as the curve flattens. So as long as its a parabola your ok.

Generally flat production happens on the backside when production is constrained the case I use is a well that 90% watered out and the rate of production is constrained by how much water you can handle.

HL is not a good method once your constrained by above ground factors. Remember there is still a lot of oil left behind even after a well has watered out so its being produced at a low production rate basically forever for all intents and purposes. But where it fails your way past peak production anyway so whats the point ?

You can also of course come up with a number of contrived cases where a field is not reasonably exploited and these would show a flat production at the beginning. I don't know of a real world case that fits this.

One we have is Russia which collapsed where production collapsed for several years then rebounded slowly. And this one is problematic.

I might add there is a chance here to have a good discussion on HL and it needs to be examined but lets at the minimum start the discussion with the right baseline in place.

I have not varied all the constant volume parabolas to see if you can introduce some numerical instability into the procedure but mathematically all your doing is a trick integration of the parabola so all true parabolas with the same area give the same answer.

The real important piece that gets dropped on the floor it seems like is Hubbert is assuming a parabola or Gaussian shaped distribution the area under the curve is a constant

this makes the "date" of peak a constant just the shape of the curve is changing so what really changes is the amount produced at peak but this is not so important. If you have enough points on the curve then you can get both. I don't understand the choice of the logistic function over others but as I've said a few times I don't think it matters to much given the quality of the data. HL has real issues that should be addressed. They have not so far.

In any case you have to use curves the might is well be parabolas since you taylor expand with constant volume/URR

and linearize those the get the numerical instability.

Other curves i.e Gaussian are interesting but this is secondary. What Robert has shown so far is not that interesting.

Btw I'd be happy to talk with WebHubbleTelescope on the issue.

He at least seems to understands the problem.

He rejected HL and generally I AGREE WITH HIM.

Sorry for the caps but your not listening.

Someone has already done a fantastic job of questioning HL

and he used the correct production profile.

Until you integrate his work I'm not sure what the heck your doing.

http://mobjectivist.blogspot.com/2005/12/hubbert-linearization.html

One more quote from his blog.

So a good well reasoned rebuke of HL already exists.

And I'll say one more time generally I agree with him.

But its not clear that he can come up with a better model given the data we have. Not that he can't create a better model or a better model is possible simply do we have enough

data to support a better model.

So again does HL have problems yes here is the link that points out its flaws.

My answer as to why it works is simple.

Although the function changes that describes the actual production profile HL implicitly assumes that the rate of production is related to the overall URR via the logistic curve. Since we know from theoretical plate models that the time of elution or peak is related to the interaction of the

material with environment with a given geology if you steadily pump a field the time of peak does not change.

This means you can change the shape of the curve but your not actually able to change URR or the date of peak by much

without massive changes in the way the field is pumped.

In the case of chromatography they use Guassians and derive the interaction numbers i.e theoretical plates.

Now using a model that is well understood and tested the Theoretical Plate model and applying it to a oil field its says the following. If I drill a well into a porous geologic formation and a few wells around it. And first I pump some oil down it then start pumping water. The wells in a circle around the pumped well will get the oil in a Gaussian profile. The main body of the oil has a interaction with its it surroundings thats FIXED!

In the case of a field full of oil this block of oil is moving through a system that has immobile oil as part of its

environment but the behavior is no different. As you begin to produce a field the main driving force is oil pushing oil. Later its water pushing oil but the little Gaussian regions can't move till the ones behind them move.

This is my interpretation of what Fractional_Flow says and he

is also correct its the field geology that determines the peak.

http://europe.theoildrum.com/node/2372#comment-170481

Hubbert chose the logistic and uses the rate to guess the URR. The choice of logistic is interesting and its not clear

in the least its the best and again its not clear that a better one exists given the data we have. Given that we are just doing a taylor expansion the exact shape of the curve are not important whats important or interesting is that HL works when the production is assumed to be a curve.

The examples you have given don't even behave correctly to the first taylor expansion term no wonder they blow up.

I'm only saying you need to use a production profile that can be taylor series expanded about its center point i.e it needs to look like a parabola to apply HL otherwise its junk. I don't need to do anything the work is already done and has been done for some time. You simply need to use a production profile thats reasonably close to what HL assumes.

Next since your generating data if you pick parabolas which are simple you can find one that gives a perfect match then vary the parabolas away from the perfect keeping the area under the curve or URR constant. one to see how much HL varies. Actually you can use any series of parameterized curves. The only restriction is they all have to have the same URR.

Your current work is not even close to being the right way to critique HL.

Until you integrate his work I'm not sure what the heck your doing.

What I am doing is showing case after case in which the HL failed. Do you think it might be too much to ask – given that you continue to insist that it works – for you to show me a case in which it would have worked? Thanks.

Your current work is not even close to being the right way to critique HL.

Show me the “right way.” I don’t really think that’s too much to ask. Show some cases. Plot them. Tell me the parameters that would indicate a peak to you. Don’t keep asking me to show you cases and then denigrate what you are given. Produce something yourself.

HL is reasonable if you produce max possible with regards to your URR, right?

Thats the assumption you childischly refuse to mention.

Your oilsville produces 10/5000 per year (was it?). Thats too low. Max would be 4/400 (or maybe 200 like Saudi, sounds familiar?). This is the most simple way I can put it. Change that in your spreadsheet and tell us what happens?

You sound slightly too closed to allowing other comments into your worldview at the moment. Are you always like that? Hard on debating? Do you ever yield a mm?

HL is reasonable if you produce max possible with regards to your URR, right?

Thats the assumption you childischly refuse to mention.

So, this is your response to "Show me"? You can't show me either. All of these insults and cast aspersions, and nobody can show me a case where the HL would have worked. Why is that?

Your oilsville produces 10/5000 per year (was it?). Thats too low.

How do you know what is too low? You are making unwarranted assumptions. Besides that, this wasn't the only case I modeled. What the case shows is that a flat production case - as Saudi has been for many years - will underpredict URR if production is constrained. Or do you believe that Saudi has been producing flat out for all those years?

You sound slightly too closed to allowing other comments into your worldview at the moment. Are you always like that?

Given that nobody is giving me an counter-examples to show when the HL would have worked and how you would have determined that, right now I have no reason to question my worldview. Show me a case and make me question it. I am quite open-minded, as some posters on the board who actually know me can verify.

Even though I make no claim to following the math, what I've been gleaning from this whole series of exchanges is that Hubbert noticed that the way in which oil fields were drilled and developed in an unconstrained market tended to follow a familiar pattern. He didn't know the URR, but he had enough experience to make an educated guess. That pattern has seemed to fit in other unconstrained markets.

As I see it, we don't have the info to have as good a feel for the URR of KSA, so we've seen modelers fitting the curves as if KSA is unconstrained and choosing from a fairly wide range of possible URRs.

It seems to me what Robert is doing is significantly constraining Oilsville production and then saying that because HL doesn't work in unconstrained markets, it doesn't work at all.

I have not been following this closely so forgive me if someone has already beaten this to death, but the only cases where HL should work, conceptually, are where production is only constrained by physical geology. Where the field or province operators are producing as fast as they can, or responding to smoothly rising demand (the curve shape is supposed to model the reservoir dynamics). We know this is not the case for Texas/lower 48, Saudi Arabia and Russia so I do not see why we should expect it to work there. That's why it also should not work for your thought experiments (above). If world demand rose smoothly and no one withheld production to control prices (or for whatever), we might expect it to work in the aggregate. It is not surprising that such a simple model does not work for such a complex system.

The one example you gave that was even close to reality was giving HL answers that were not too bad.

Define “not too bad.” What you will find is that once again, “not too bad” will span a huge error range.

What you have just wrote says nothing about HL it's basically garbage.

Read what WHT wrote below. He actually understood the point that I am making. Cases, hypothetical or otherwise, can show you how the HL would behave. The flat production case – hypothetical or not – shows how the HL will behave in ANY relatively flat production case (like Saudi). The rising production case shows that it can’t call peak. The rate of rise doesn’t matter. If you did some modeling yourself, you would see that. But you are still insisting that the pink unicorn is there somewhere, while saying I have do “basically garbage” in showing that it doesn’t exist.

If at this point you have some valid arguments I'm interested. I know I'm being a bit harsh but this is bogus and its public.

It’s amazing to me, then, that you won’t produce a case in which it worked. Some recognize modeling for what it is. Some know how to test a model. I do. Show me that you know how, instead of doing all the aspersion casting. Support your own argument. Look again at the last section of the essay.

RR, I think HL only works when the producer is always producing flat out. Since this never happens in real life I guess you are correct that HL can't be used to predict when peak production will occur. I think you have already proved your point.

A simluated version of world production with steady growth (exponential) of 1.5% per year since 1982:

The last 25 years looks quite close to linear. and is a close match of Khebab's HL:

This type of discourse is why I keep coming to TOD.

First, I think Flakmeister raises a good question. What happens when looking at 'true' 60% depletion for the idealized case?

Furthermore, I think a problem with both sides in this argument is that there isn't much of a debate on the larger theoretical reasons for using HL type techniques. The 'Oilsville' example above is a good way to demonstrate how under certain circumstances HL does a poor job in making predictions. The problem, as I see it, is that Oilsville is seemingly divorced from a theoretical understanding of oil field geology and production and so based on unrealistic assumptions.

What I'm getting at is that lost in this debate is 'WHY' we should be using HL or some other technique to model oil field production. Does it fit with our understanding of oil field geology? Above ground production constraints? Both? As I understand the debate as presented here, the HL model and its offspring are models that seem to be good fits with the dynamics believed to be underlying discovery and production. As I understand the scientific method, you start with a theory, derive a hypothesis, and then test the hypothesis against the data. Given what WT has repeatedly argued here, this seems to have been done and so the model, despite its faults, is a good one at present because it couples sound theory with empirical justification. From what I can tell, the only mark against the HL method is that there have been too few data to really test the model rigorously.

This suggests that critiques like the ones presented above by RR are, at best, suggesting that the HL technique needs to be further refined. We can't junk it because we have no alternative to the model that explains as much or more than the current technique.

So, for the critics, what alternative model do you suggest using? What refinements to the current method? That, I think, is the hallmark of a constructive research program. Is there common theoretical or methodological ground the two sides can agree on that can be used to build a better model?

As I understand the scientific method, you start with a theory, derive a hypothesis, and then test the hypothesis against the data. Given what WT has repeatedly argued here, this seems to have been done and so the model, despite its faults, is a good one at present because it couples sound theory with empirical justification.

"Demonstrate any case – real or hypothetical – in which the HL would have predicted a peak in real time."

Still waiting for someone to show me. A model that converges 30 years after peake is not what I have in mind, given that Saudi did not peak 30 years ago.

Robert, you posed the question early on in your post as to whether this debate really matters or not. At this point, I don’t think so. I’ve been on the Oil Drum for more than a year now, and in this time, I’ve seen the general consensus for the time of Peak Oil move closer and closer; there seem to be considerably more people who feel that Peak has either already passed or will occur within the next couple of years.

In light of the fact that any meaningful mitigation attempts will take 10-20 years to develop and show results, it doesn’t seem that it makes much difference if May of ‘05 eventually proves to be the Peak, or if there is a brief upturn in production, and the Peak date ends up sometime in 2010-12. In the context of the time-frames we are dealing with, May of ‘05 and some date in 2012 are, essentially, both NOW.

Antoinetta III 3-22-07

But what about West Texas / Lower 48? North Sea? These seem to me at least the initial validity of trying to refine the HL method.

But, again, what alternative model are you proposing? It's one thing to note another's method is imperfect, another altogether to present a better model.

I guess that's what I'm looking for. By now I think you've raised some real issues with the HL method, but to go beyond this critique something more constructive needs to be offered. Where's the better model? Where's the alternative theoretical understanding of oil field discovery and production?

But, again, what alternative model are you proposing?

It is not necessary for me to propose an alternative model. There may be no model that works.

It's one thing to note another's method is imperfect, another altogether to present a better model.

I am not so much saying that the model is imperfect. What I am saying is that it just doesn't work at all.

Winding down for the night. A few more responses, and then I will be offline until tomorrow.

Robert I think you simply need to go read this whole site.

http://mobjectivist.blogspot.com/

He is basically right I just don't see that his models are giving better results given the known noise in the data.

Gosh Robert. I wish we had thirty years to verify your theory. I guess we have no choice but to wait - either for a complete test of the theory or a new theory.

Umm....Just curious -- will we have to also wait thirty years to test any new theories?

I mean, shouldn't we afford any theory that anyone objects to the same consideration you are willing to give the HL linnearization?

Also, one more thing. Is it okay if we go ahead and start edging towards a sustainable world? Do we have to wait for you and the boys to finish this hair-splitting?

I mean, I really don't want to sully the purity of science, cause we all know how important maintaining the form is, but guys, your argument, your sad, silly, egotistical, and prolonged argument is wasting electrons.

The one thing I do know, the one thing that does not need a formula, or a even a brilliant mind, is the simple, plain, undeniable fact that WE LIVE ON A FINITE SPHERE FLOATING IN SPACE.

I'm sorry. Were my words too sarcastic? Too emotional? Did I hurt anyone's self-esteem? Mea culpa. I wish I could assume the bland face of objectivity. I wish I could peer out at you with the calm even stare of a judge ruling against the poor and claim that the law is clear. I wish I could assume the steady countenance of a Bush appointed EPA official and explain with all the gravitas of the powers that be and rule against the planet in favor of continued economic growth. BUT I CANNOT BE THAT EVIL.

I am willing to shame people, point out the crazy thinking behind sanctioned science formalism. I am willing to get emotional, to use ad hominem attacks, to be rather vicious. Unlike the people who raise hell about patriotism, religion and all the other faked up conceptual horse hockey that festers in the zeitgeist, I raise hell about the one thing we all need. THE GODDAMNED PLANET.

I'm going out to feed the chickens. At least they seem to realize that they belong to a planet, not a theory.

Even as a moderate doomer who believes we are at or past peak, I find that your diatribe seems unfair. I think WesTexas is right in that we are about to experience import crises -- likely one after another IMHO. I also think he's right about when peak oil occurred, but as a real novice in all of this I really haven't got a clue as to whether or not HL is a valid tool for modeling peak oil.

But Robert has said many times that we have a problem and need to prepare NOW. He has repeatedly said that the main reason he wants to nail this is to keep from being dismissed as a kook with another false "end of the world" prediction if he blasts "peak oil" to the world and it turns out to be a false alarm. There is probably ego involved in this too, but frankly, anytime someone invests a lot of their time and energy in a project it becomes a part of them and it's hard not to want to be right. That's being human. And all of the regular diarists on TOD have a lot invested in their peak oil analyses.

For those of us already convinced of peak oil's passing, it's unlikely that Robert's quest for HL proof will change our minds. If that is what it takes for him to feel comfortable raising the red flag, then I say "go for it." I would rather he get to the point of comfort and then speak up than to keep his mouth shut forever because he just doesn't feel sure enough about it. Since he works for an oil company, I'm pretty amazed that he is even willing to consider raising the red flag when everyone else involved in big oil and government seems more inclined to say "everything is fine...just go shopping."

Even as a moderate doomer who believes we are at or past peak, I find that your diatribe seems unfair.

There are a few posters that I can always count on for this. One is TrueKaiser. So, I started at the bottom and started working my way up. Bingo. There were TrueKaiser's shrill comments in which he merely complained and added nothing to the discussion. My expectation was that I would shortly see Cherenkov weighing in with similar shrill rhetoric. I can always count on him to 1). Say nothing; 2). Do it in a shrill manner; and 3). Misrepresent my position while doing so.

I'm sorry. Were my words too sarcastic? Too emotional? Did I hurt anyone's self-esteem? Mea culpa.

I think you take the prize for the person on TOD most puffed up with self-importance. Even as I wrote the essay, I knew that I could count on you to show up – and even though you wouldn’t address any of the math or analysis in the essay – you would feel the need to bestow upon us your words of wisdom. Did you hurt my feelings? I would have to care about your opinion before you could hurt my feelings. Given that I have never gotten any value out of your pompous mutterings, it is not possible for you to hurt my feelings.

I'm going out to feed the chickens. At least they seem to realize that they belong to a planet, not a theory.

Of course your chickens do belong to a theory. It is called the Theory of Evolution. Perhaps you heard of it. Scientific types debated it 150 years ago. And throughout the entire debate, I am sure that they endured the same kind of pompous rhetoric coming from the popcorn stands that you continue to bestow upon us.

What happens when you look at your idealized case at a true 60% depletion? Can the URR be approximated?

I just ran it. If you run to the true 60% depletion mark, which is 516.8 Gbl, the last 10 points forecast a URR of 640 Gbl. So the model is saying the depletion is 517/640, (81% depleted) when it is actually 60%. You have to go out to the true 70-80% mark before it starts to converge to the real URR number.

Interesting. How many runs/variations of the simulation have you run? Establishing a point around which HL effectively becomes a good predictor of ultimate recovery would be a very valuable contribution.

Is there anyway to parameterize the model such that an initial estimate of ultimate recovery can be taken into account?

Very good article,

Do you have any method in which you have confidence, since the HL debate is back in WT's court for the time being.

David

Do you have any method in which you have confidence, since the HL debate is back in WT's court for the time being.

There are some other models, but I haven't really looked at them. I think Stuart's work has a better chance of getting to the heart of the matter. That is, I am not sure modeling is actually going to do it. I think we will have to look at available data, see if their actions are consistent with the market (we are about to have that question answered) and try to make interpretations. It isn't easy, but if it was we would already know the answer.

Very good. That explains why the folks at CERA shake their heads and call linearization "pointless curve-fitting" or somesuch. You've now worked with HL quite a bit, so do you think it is just worthless? Do you think there might be a way it could be modified to be useful? Some method to determine a likely peak date based on production would be extremely useful if it's possible.

I can think of two obvious HL modifications. It's intended to be used on a logistic function - does it come any closer on that? Has anyone attempted to linearize the log of P/Q or come up with a rational higher order equation to model the production curve? It seems like I've seen that somewhere.

I think I'll hold onto my deckchair a little longer, while watching for a spot on a rescue boat...

You've now worked with HL quite a bit, so do you think it is just worthless?

In my opinion, it has no value whatsoever as a predictive tool. As someone else wrote, it is really a descriptive tool after the fact.

Well, that certainly explains Deffeyes' failure to predict the decline in world crude oil production, my failure to predict the decline in Saudi crude oil production, Khebab's failure to predict the decline in Mexican oil production and my failure to predict the 2006 decline in oil exports by the top three net oil exporters.

I have another prediction. In the near future, Robert will admit that Saudi Arabia's recent decline in crude oil production was involuntary, but his admission will be accompanied by the following qualification: "But by God, Jeffrey's methodology was wrong."

Ultimately, these predictions are why the model has a degree of empirical validity.

Methodologically, what is the common ground between you two? Can a better model be constructed out of this debate?

In the near future, Robert will admit that Saudi Arabia's recent decline in crude oil production was involuntary, but his admission will be accompanied by the following qualification: "But by God, Jeffrey's methodology was wrong."

Sounds like a faith-based prediction. Anyway, if you use the HL as the basis for making the prediction of a Saudi peak, yes, that is wrong. It doesn't have the precision to do that. I can tell you that. Stuart can. Khebab can. In fact, I think most people familiar with the HL will tell you that. But you have faith in the technique.

I rest my case regarding what is really going on here.

In any case, lots and lots of real world "coincidences."

I rest my case regarding what is really going on here.

What is going on here, Jeffrey? Something other than a critical look at the ability of the HL to make real-time predictions with any sort of precision?

As I predicted, Saudi oil production started declining at about same stage of depletion at which Texas started declining (based on HL data through 2005). A coincidence?

I have addressed several of these claims before. It is not clear to me why you continue to make this claim, when I showed in my previous essay that it is not remotely true. When Texas peaked it was at 73% of Qt. Not only is Saudi not there, but the 2000 prediction for KSA looked much better than the 2007 prediction. The R-squared was higher in 2000, and it was at a higher % Qt. In recent years, URR for Saudi has grown based on the HL, and % Qt is moving backwards as I documented in this essay.

But, you continue to ignore all of this and repeat the claim "Saudi oil production started declining at about same stage of depletion at which Texas started declining." It just isn't true. You may believe it, and you may have convinced yourself that it is true, but anyone here can plot that data, or look at my essay on Texas, and see that the claim is false. Ask someone else who has plotted the HLs if they believe you are correct. Ask Stuart. Ask Khebab.

That's all from me for today.

Robert,

I never claimed that the Texas data could accurately pick the Texas peak. I did--and still do--claim that the total Texas HL plot can give us an idea of what stage of depletion that Texas peaked. That was and is the basis for using Texas a model for Saudi Arabia: http://static.flickr.com/55/145186318_27a012448e_o.png

I think that we can use the total Texas HL plot as a model for Saudi Arabia.

You say we can't.

Fine.

This pissing contest has no bearing on the cold, hard reality that Saudi Arabia appears to be in terminal decline.

In regard to your "analysis" of the HL method, you have focused on the noisiest of the HL case histories and a contrived model that has no relevance to an actual case history, and you have no explanation for why a method that has "no ability to predict declines" is being successfully used to predict production declines.

Why don't you take a detailed look at the Lower 48 and world HL plots?

In regard to your "analysis" of the HL method, you have focused on the noisiest of the HL case histories and a contrived model that has no relevance to an actual case history

I am not sure why you need to wrap the analyses of the actual case histories of Texas and Saudi in scare quotes. I am also not sure why you don't understand that a contrived case history can show how a model would work under particular circumstances.

and you have no explanation for why a method that has "no ability to predict declines" is being successfully used to predict production declines.

I suggest you re-read my analysis of Texas where I showed it predicting a false peak 16 years too early. So I do have an explanation.

Why don't you take a detailed look at the Lower 48 and world HL plots?

I am starting to wonder why you don't. You keep asserting that these histories worked. Show me. Tell me how you would have made the determination in the case of the Lower 48. I think once again, we will see that you are merely using a benefit of hindsight that you don't have with Saudi. I am sure you could predict the winners of the last 20 Superbowls, but I don't think that will help you predict the winner of the next one.

I see arrogance, pigheadedness and perhaps even childishness on both sides of this argument. This is not what I've come to expect from Robert, Jeffrey and The Oil Drum.

I see nothing wrong with encouraging people to prepare now - whatever the impetus.

The only reason I can fathom why people would be dissuading others from preparedness would be *faith* in the growth paradigm.

-----------

Ask Dr. Bartlett what time it is...

I agree. See my final comment below.

Preprinted Version of M. King Hubbert’s 1956 Speech:

Figure (1) Lower 48 HL Through 1970:

http://static.flickr.com/49/108477614_b15aab378c_o.png

Figure (2) Lower 48 Post-1970 Predicted Versus Actual:

http://static.flickr.com/43/108482206_8769d44c1c_o.png

Published on 24 May 2006 by GraphOilogy. Archived on 25 May 2006.

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

http://www.energybulletin.net/16459.html

by Jeffrey J. Brown & "Khebab"

Hubbert predicted, based on quantitative modeling, that the Lower 48 would peak in 1966, if URR were 150 Gb, and in 1971, if URR were 200 Gb. The larger estimate appears to be more accurate.

Khebab generated a predicted Lower 48 production curve, using only the HL data through 1970 (Figure #1). The post-1970 Lower 48 cumulative production was 99% of what the HL model predicted it would be (red curve on Figure #2).

The Texas HL plot is clearly noisy, but I think that the point I made in the Texas/Lower 48 article is valid, to-wit, the overall Texas HL plot can give us an idea of where the peak was.

I did ask Khebab to run some estimates for me regarding Texas:

In other words, the stable linear data prior to the Texas peak, excluding the rapid increase in production provided us with a reasonably accurate estimate of Probable URR. The 1958-1972 estimate, which includes the pre-peak runup in production, was wildly wrong.

Note that Texas is the noisiest of the HL plots that we looked at the Texas/Lower 48 article, but based on the Texas case history, the 150 Gb Qt estimate for Saudi Arabia (excluding the recent runup in production, the infamous "dogleg") is probably more accurate than the 186 Gb Qt estimate.

I would particularly call your attention to the following two HL plots. See any similarities?

Lower 48:

http://static.flickr.com/45/145149304_a4a72211e6_o.png

World:

http://static.flickr.com/54/145149301_b930ef7bc4_o.png

Deffeyes predicted a decline in world crude oil production, using the HL method, and crude oil production is declining.

I predicted a decline in Saudi crude oil production, using the HL method, and crude oil production is declining.

Khebab predicted a decline in Mexican crude oil production, using the HL method, and crude oil production is declining.

The North Sea decline in crude oil production precisely fits the HL model, and the post-1984 cumulative Russian production, through 2004, was 95% of what the HL model predicted it would be, using only data through 1984 to generate the model.

It’s a virtual certainty that 14 out of 14 of the fields that are or were producing one mbpd or more are in decline or crashing.

IMO, we are now entering Phase Two of the bidding wars for declining world oil exports, where we will be bidding against China and the EU, instead of against regions like Africa.

It’s hard for me to imagine a bigger waste of time than arguing over how accurate a mathematical model is for predicting production declines, even as crude oil production in large producing regions and the world is declining as predicted--and more importantly, as net oil exports are declining, as I predicted, faster than overall crude oil production is declining. From the point of view of oil importers, I predict that the gradual decline in world crude oil production will look more like a production crash. IMO, you need to be thinking very hard about how you are going to feed your family.

Way to go, Jeffrey. If you can't provide a reasoned response, at least we can always count on some hysterics.

He's made a reasoned response before, to wit, we'll find out for sure in a couple of months. KSA is obviously declining, but RR and Mearns have taken the stand that it was voluntary. It'll be obvious what's happening in a short period of time.

Analogies, like mathematical models, are helpful tools for understanding complex systems and information, but they are not reality.

If one forces an analogy to far, like this overlong Titanic piece, it begins to fall apart and lurch into the absurd. The analogy slides from being useful and helping understanding, into something so which is clumsy and actually self-defeating when carried to extremes, like this gross Titanic analogy.

An analogy needs to be relatively short and succinct to have maximum effect and meaning, otherwise one might as well drop the analogy altogether and just say what one means!

Often, one can become so enamoured with brilliance of ones spectacular analogy that the thing takes on a life of its own, regardless of how foolish a calm examination of the analogy's content makes one appear.

Hubbert's models are only a model after all. Of course they won't fit reality perfectly especially as they are predictive. I always take all models and statistics with a large grain of salt. One can do all manner of wonderful tricks with numbers that actually tell us very little about "reality".

None the less models can and do help our understanding of complex information.

Was Hubbert a prophet? No, he wasn't. However, in some respects he appears to fit the role of prophet, which would probably have appalled him. He was a man with a mission, a lone voice crying in the wilderness, with a potentially terrible message about the end of the world as we know it.

Given the timescales we are opperating with in relation to Peak Oil and the consequences of not taking mitigating action in time, a decade here or a decade here really doesn't make that much difference in the great scheme of things. We need to reduce our consumption of energy as a priority and we should have started on this years ago, even the Hirsch report is clear about this.

I agree with Simmons that we are going to see a substantial gap developing between supply and demand in the near future, with all that this implies. Anyway the next few years are going to sort things out one way or another in relation to Hubbert's accuracy, though by then the result may only be of academic interest.

Often, one can become so enamoured with brilliance of ones spectacular analogy that the thing takes on a life of its own, regardless of how foolish a calm examination of the analogy's content makes one appear.

Nate, on the other hand, liked it. You know what they say about pleasing all the people all the time.

I agree with Simmons that we are going to see a substantial gap developing between supply and demand in the near future, with all that this implies.

I have stated the same on numerous occasions. This is the basis of my Peak Lite argument.

Anyway, for someone worried about overly long analogies, you sure wrote a lot of words without making much of a point.

Dear RR,

I admire the work you do here. I think you're correct to question many of the assumptions we make here. But you don't really need to get so touchy because I think you went overboard on the Titanic analogy. It wasn't meant to be a personal attack on you. Would it help if I said that I think you're a really clever guy with a lot to offer this site?

Would it help if I said that I think you're a really clever guy with a lot to offer this site?

I am not looking for praise. But I prefer that criticism be constructive.

I think I was being not only constructive but helpful as well in relation to your writing style; one shouldn't overdo a metaphore or an anlalogy. It's best to put the breaks on before one goes too far with these things as they have there limits. One could risk spending hours talking about the Titanic instead of something more relevant, and then suddenly find that the whole discussion fall flat because the historical facts don't actually support many of the details in ones analogy. Analogies have their place, but one does risk reducing complex arguments to absurd levels if one pushes things too far and I'm not sure how far that helps one to communicate and spread the message.

I do admit that an overly wordy criticism about the analogy being overly wordy was brilliant.

"I do admit that an overly wordy criticism about the analogy being overly wordy was brilliant."

Hey, when did any of us ever worry about being overly wordy! :-)

(oh, oh, could we have possibly hit peak wordiness?)

RC

Remember, we are only one cubic mile from freedom

Westexas, you clearly know which tool to use, how to use it and when to use it. You demonstrate an innate ability to see the shape of things, whose form eludes the vision of others not so gifted. I look forward to your columns.

Westexas, you clearly know which tool to use, how to use it and when to use it. You demonstrate an innate ability to see the shape of things, whose form eludes the vision of others not so gifted.

"The faith-based proponents were praised by their followers for maintaining faith in the face of these challenges."

Wow, no kidding. Seems like we've got a nice little cult brewing. Good articles; looks like the emperor has no clothes.

That's right, cornucopians rejoice - oh Peak Oil/Energy Descent is NO LONGER going to occur because the HL method doesn't work, right? Hubbert, WestTexas, you guys are just sooo lucky with your predictions! Look, HL doesn't even have to exist to see the obvious - that resource limits are being hit right now, across the board - and that WestTexas and others will be proven right whether it's in 6 months or 3 years. That's the scary part - the earth is metaphorically pissed, and it's payback time for homo sapien sapien, man the doubly myopic.

I forgot to mention that the faithful will sometimes speak in tongues when unable to generate an actual rebuttal of the data.

RR

Have you been reading NAFTA documents lately? I forgot to mention in my comment about that practice, that besides 'speaking in tongues', reading it also tends to make one denigrate one's opposition and use phrases like 'The faithful'.

By the way exactly what is the time that the 'spaceship life boat' will arrive to save those with the correct 'lottery' timing of this game.?

How about in the meantime we send a few S.O.S.'s with the message, "we are sinking pretty soon don't know exactly when, but bring life rings cause we don't like the water and don't really want to learn how to swim"

Robert again you need to back up and cool down.

First WT is not the HL modeler is is interpreting the models. If you ever really prove HL is wrong then his interpretation is wrong by default. Better if you do a decent analysis we may find parts of WT statements that are unsound or wrong at the moment we know nothing.

At the moment your way way off base.

We know of several cases where HL seems to work well and we also know of one big case where it is probably not working Russia.

Next if you don't like these models fine. I given you a link to another model that models a very similar problem and it works very well.

http://openchemist.net/chemistry/chromatography/node8.php

Your claim of no possible model flies in the face of the ability to create a simple model such is this for a very similar physical problem.

A oil field could be considered overloaded chromatographic column if you wish and there exists studies of this condition. Although its the wrong model since it deals with low concentrations. I'm only pointing out that a simple model for a similar complex process exists so your statement that one might not be possible is probably not true.

And one more time you need to read this.

http://mobjectivist.blogspot.com/

The fact your not even looking at previous work bothers me.

Hello Robert,

Or, to rephrase it (which I'd like to do because I'm interested in what everyone says here...and I think it matters)

re: "And one more time you need to read this."

Could you possibly take the time to look up this reference, think it over and get back to us?

The fact your not even looking at previous work bothers me.

That's the problem with your conclusion-jumping: It leads you to incorrect conclusions. Why would you make that assumption? Of course I read that. In fact, I had read it before.

Now, the fact that you won't attempt to show me a time that the HL ever worked - while continuing to insist that it must - bothers me. I think your particular issues would resolve themselves if you would attempt to do so.

Ok how come you did not do a case where it does work ?

Even the logistic curve itself. Or a Gaussian its pretty much the universal starting point. No one is going to argue about assuming a Gaussian distribution at least initially.

Its not hard to show where HL fails. Russia is obvious.

And you have this post.

http://www.theoildrum.com/story/2006/1/8/25235/83999

It's trivial to show a Gaussian works better than HL.

Now with the error in our data its not clear if the better fit adds any real information same with the shock model.

If anyone of these methods say you may be close to peak and the bottom up approach points to the same conclusion your safe to assume your at peak. For the use cases we have it seems good enough.

You did none of this instead you posted contrived examples.

And you have claimed maybe no model works without even presenting them or offering one shred of proof.

Ok how come you did not do a case where it does work ?

You aren’t listening. I haven’t found a case where it does work! Show me one. How many times must I log this request?

And you have claimed maybe no model works without even presenting them or offering one shred of proof.

What I have said is that you can’t always be sure of having a working model. Sometimes you just don’t have enough information to develop a working model. We don’t have working models for many phenomena. So you need to get it through your head that because Model A doesn’t work, I must present working Model B before we abandon Model A. A non-working model is no better than no model at all. In fact, it is probably worse because it can provide a false sense of confidence in the garbage results it is spitting out.

Robert all you have done is succeeded in completely discrediting yourself. You dug your own hole its up to you to get out of it. The fact you can't even see what you have done makes me doubt you can.

If you ever wake up I'd be happy to talk with you. If some people want to believe you thats fine but its a faith based argument.

I'm sorry to be harsh.

I'm done posting I've said what I have to say.

> Why would you make that assumption? Of course I read that.

Get off your high horse. Of course everyone is making EXACTLY that assumption, because you still can't be bothered to reference the work at Mobjectivist's site. Been around for years now, it has.

Someone had some arguments in your last HL thread explaining why references weren't important or necessary, and they were ridiculous.

However, good job re-inventing the wheel. A little arrogance is fine for the peak oil movement in general, to match up with the likes of Lynch and so on.

Of course everyone is making EXACTLY that assumption, because you still can't be bothered to reference the work at Mobjectivist's site.

Um, hasn't this ground been covered?

http://www.theoildrum.com/node/2357#comment-168349

There is a little back history here, moreso involving Staniford. I think I merged you both together unfairly. I'll post again tonight, to highlight some of the issues I have seen, and I'll be keeping my temper in check.

Overall I was unfair in that I kind of lumped two seperate people in one post, and I'll clarify a bit later tonight.

Perhaps if you continue having problems keeping your temper in check, you might count to 10 before hitting the "Post Comment" button. While I appreciate your concerns that everyone who ever said “HL” is referenced, I don’t think this is practical. I did not use Mobjectivist's work in building my case. I did not rely on his work to plot any of my HLs. It is beyond me why you think I must reference his work. If your complaint was universally addressed, I could probably tack on 50 more references to each of my essays.

And of course here was the "ridiculous explanation" by Pitt the Elder:

There are compelling reasons why peer-reviewed papers have extensive bibliographies, such as attribution of merit for purposes of funding and promotion.

TOD has no such profession-related reasons, and hence RR had no need to cite other posters to attribute professional merit.

Moreover, not all mentions of a topic are cited - to do so would leave no time for doing research. So even in scientific journal papers, one makes judgements about which references to include. One important criterion is whether inclusion of the reference will help the reader, giving insight into the argument you're presenting by showing background work.