Oil Limits, Recession, and Bumping Against the Growth Ceiling

Posted by Gail the Actuary on August 17, 2011 - 10:30am

The issues we are confronted with today seem to be a subset of the issues foretold in the book Limits to Growth back in 1972. At some point, the economy cannot continue to grow as rapidly as it did in the past. It appears to me that the most immediate limit we are hitting today is inadequate low-priced oil, but there are other limits lurking not far away–inadequate fresh water and excessive pollution, for example. When the economy cannot grow as fast, or actually starts declining, recession sets in. Governments start having debt problems. Financial markets start behaving strangely.

This issue is a difficult one to talk about, because there really is no good solution. I have talked to a couple of groups recently (one a church group; one a peak oil group), about this issue. This is a copy of the presentation I used (Bumping up against the Growth Ceiling (PDF) or Bumping up against the Growth Ceiling (PowerPoint). In this post, I will discuss my presentation, omitting the section at the end called, "Where do we go from here?" The full post and discussion can be read at Our Finite World.

The world is finite. We know that, logically, the amount of any resource extracted from the world’s crust cannot continue to increase year-after-year, forever. But most of us have never thought about the idea that economic growth might eventually stop because of limits we hit.

It seems to me that the financial problems we are reaching today reflect a fundamental mismatch. We have a financial system that requires growth. At the same time, world oil supply has stopped rising enough to keep oil prices down. This mismatch threatens to put a cap on economic growth, especially for large users of oil such as the United States and many European countries.

Let me start by describing why our economy needs economic growth.

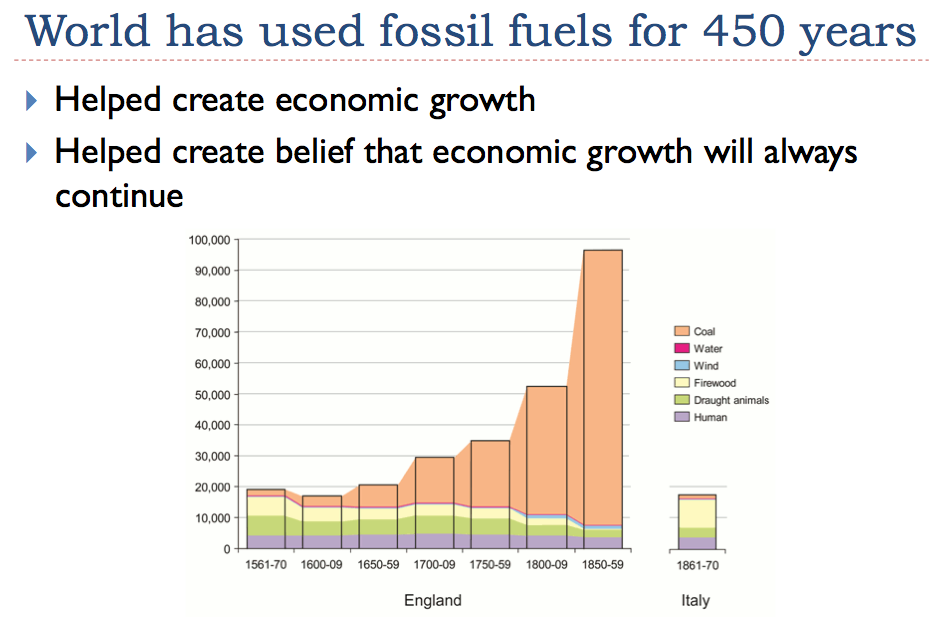

Europe has used coal for about 450 years, according to Tony Wrigley. The use of coal helped reduce the amount of firewood needed (cream-colored area), and thus helped prevent deforestation. The use of coal also led to economic growth, because its energy could be put to many uses. According to Wrigley’s analysis, wind and water never produced a large share of the total energy supply.

In recent years, oil and natural gas have been added to the energy mix. All of these fossil fuels have helped increase the amount of food produced and the quantity of manufacturing done, and thus, economic growth.

The fact that we have had fossil fuel driven economic growth for such a long time–at least 450 years–has helped create the belief that economic growth is the natural state of affairs. It is easy to believe that it will always continue.

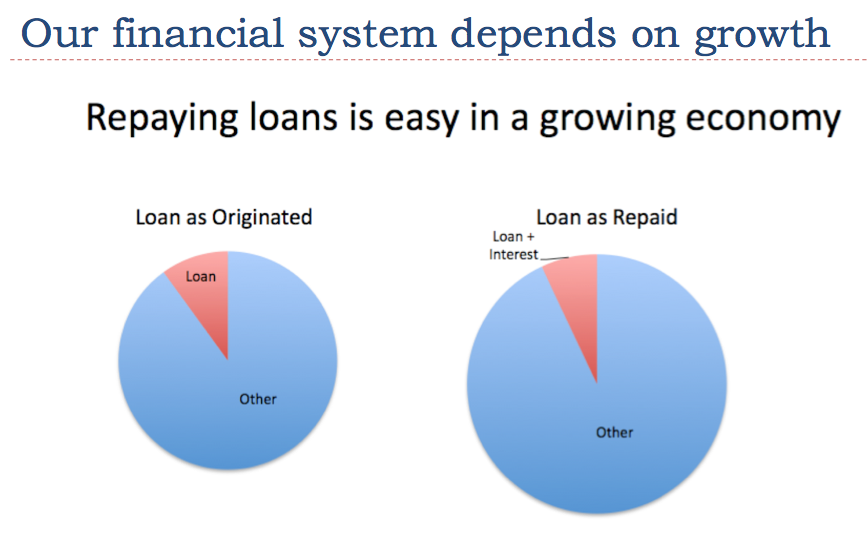

Our financial system today depends on the use of debt, and the repayment of that debt with interest. We don’t usually think of it, but in a growing economy, it is much easier to repay debt with interest than in a declining economy, because, on average, things are getting better over time. This is easiest to see for an organization like the government that funds its borrowing with taxes. These taxes tend to rise when the economy is growing, making it easier to repay debt and the interest on that debt.

The same principle works for other individuals and businesses. If an economy is growing, a person is more likely to be able to keep his job, to get a new job if he is laid off, and to get promotions, so it is easier to repay loans and the interest on those loans.

Of course, the reverse is true in a shrinking economy, or even a level economy. The loan plus interest leaves the borrower with less money left over for other things, so is more difficult to repay.

Reinhart and Rogoff wrote a well-known academic paper, and made the observation quoted in Slide 8, apparently not understanding why this relationship existed. It seems to illustrate the relationship that a person would expect, based on Slides 6 and 7.

Economic growth provides many types of benefits. If the economy is growing, people have jobs, and many are getting raises. People can afford to buy bigger homes, so home prices tend to rise. The stock market tends to rise, because companies are making increasingly large amounts of money, and people believe that they will continue to make more money in the future. The number of people employed tends to rise, because of rising demand for goods and services.

Governments find that taxes rise, even without raising tax rates, because citizens are prospering. Charitable organizations, like churches, see rising contributions.

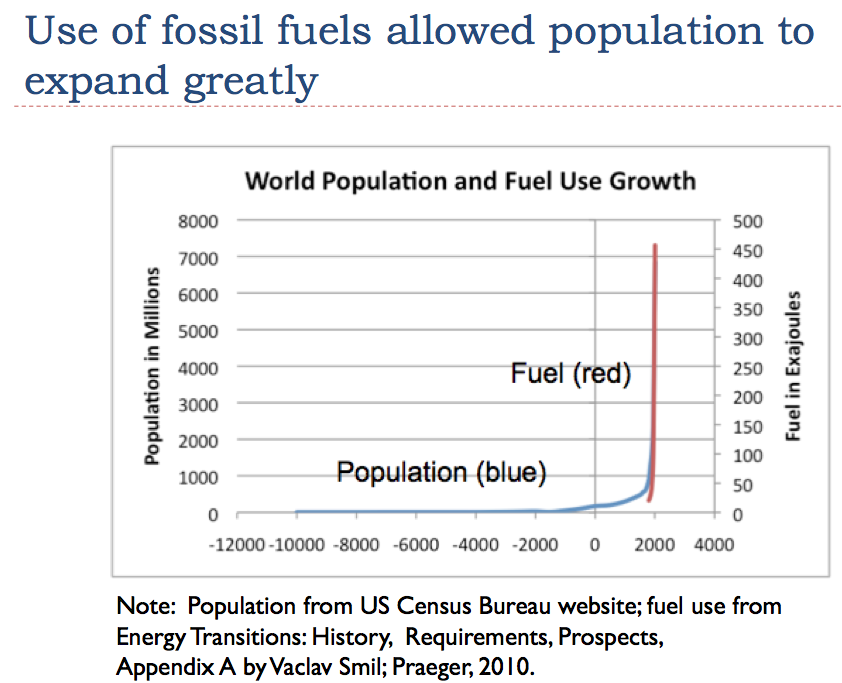

With the use of fossil fuels, it was possible to greatly increase food production. Population grew in the same time period that fuel use grew. World population is now about 7 billion, compared to about 450 million in 1500 . Thus, population is now more than 10 times as high as it was in 1500.

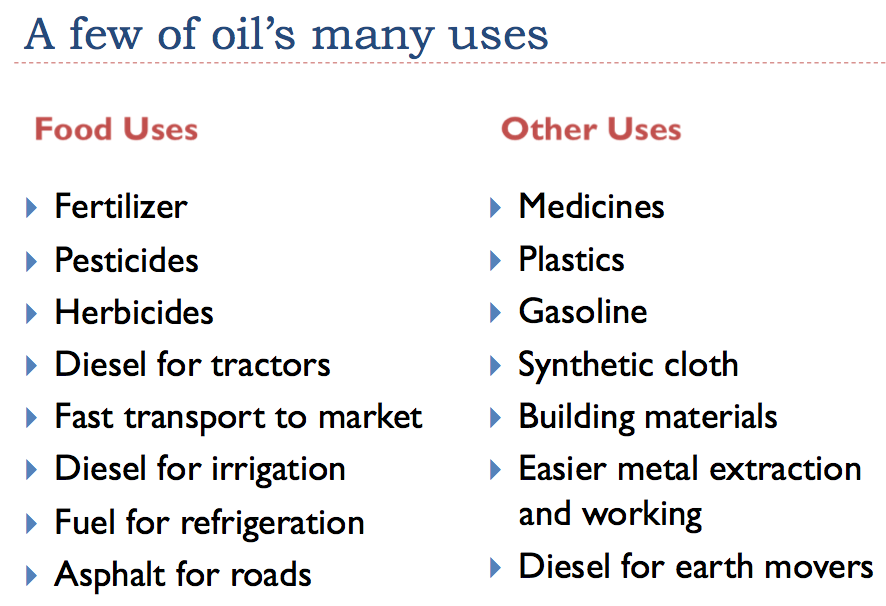

In this slide, I show a few of uses of oil. Oil is especially important for growing and transporting food. Thus, its use helps explain the recent population rise.

The unfavorable outcomes shown on slide 12 are just the reverse of the favorable outcomes mentioned earlier, when there was adequate economic growth. We recognize them as problems we have seen during recent recession.

Next I would like to talk about how limited oil supply is constricting economic growth.

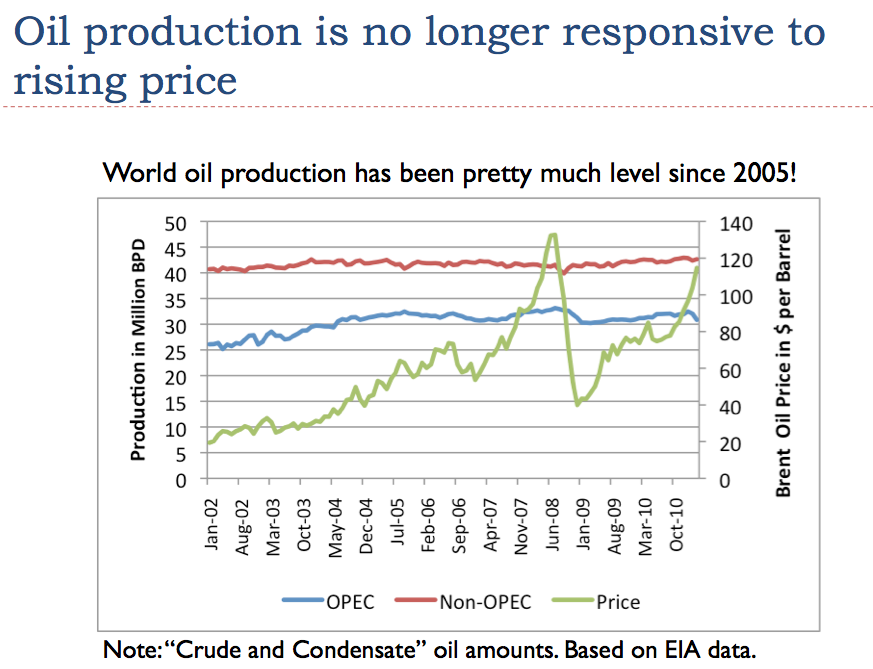

On this slide, I divide world oil production into two parts–oil produced by the Organization of Petroleum Exporting Countries (OPEC) and oil produced by Non-OPEC countries. OPEC countries claim to have plenty of spare capacity, but it is hard to see that such capacity actually exists from their actions. Neither OPEC or Non-OPEC production has increased very much since 2005, even when prices spiked very high in 2008. OPEC cut back production somewhat when oil prices dropped, but that is more or less expected, because at a low price, some extraction may no longer be profitable.

Readers should be aware that statements made by OPEC countries are not audited. When US oil companies were involved in the Middle East prior to 1980, oil reserves were much lower than today. After state-owned oil companies took over, there was competition to raise reported reserves. Some of these increases may be simple exaggerations; others may be correct, if a person includes oil that can be produced at a dribble a year, over many, many years. But we are likely kidding ourselves if we think the high reserves indicate spare capacity, or likely higher production in the future.

Also, statements about OPEC raising oil production aren’t necessarily very truthful. If they do raise production, it may only be to cover rising internal consumption, with virtually no impact on exports.

We often read that there is a huge amount of oil available, in the oil sands in Canada or in the oil shale in Colorado, for example. The problem is that not all oil is equivalent. Some oil is a liquid, and is easy to extract. Other oil is not a liquid, or is in very inconvenient locations. Our problem is that a lot of the easy-to-extract, cheap-to-extract oil from the top of the triangle was extracted first, and is now gone. What is left is mostly oil that is much harder to extract. As an example, some oil is very “heavy” and oil companies may need to use steam to heat the oil, and then collect the dribbles of melted oil.

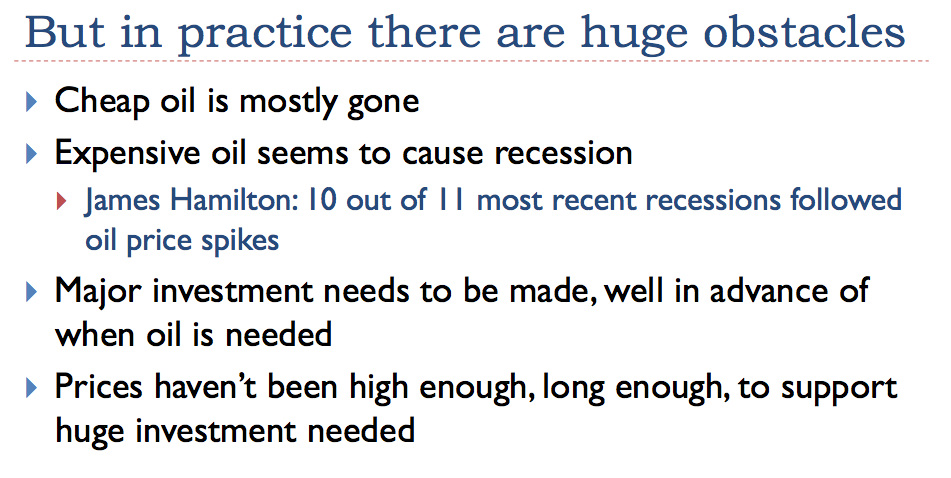

To elaborate a bit further on why we can’t get the oil out, one problem is that quite a bit of the cheap oil has been extracted, and expensive oil (which we have plenty of) seems to cause recession. Economist James Hamilton has shown that 10 out of 11 of the most recent recessions occurred in conjunction with oil price spikes. (We will talk a more later about why high oil prices tend to cause recession.)

In order to justify extracting the very expensive-to-extract oil, companies need very high prices for a long time, so that they have reasonable confidence that prices will be sufficiently high when the oil is extracted and ready to sell. But oil prices don’t seem to stay high long enough–high oil prices seem to lead to recession, and recession brings them back down again.

I might mention, too, that there is a theoretical upper bound for prices. Just as you wouldn’t use more than one barrel of oil to extract a barrel of oil, at some point, the resources that go into extracting the oil become too high, relative to the benefit to be obtained from using that oil. If this happens, there is no point in extracting the oil–it makes more sense to leave it in the ground. For some of the oil resources, we may be approaching the too-expensive-to-extract limit.

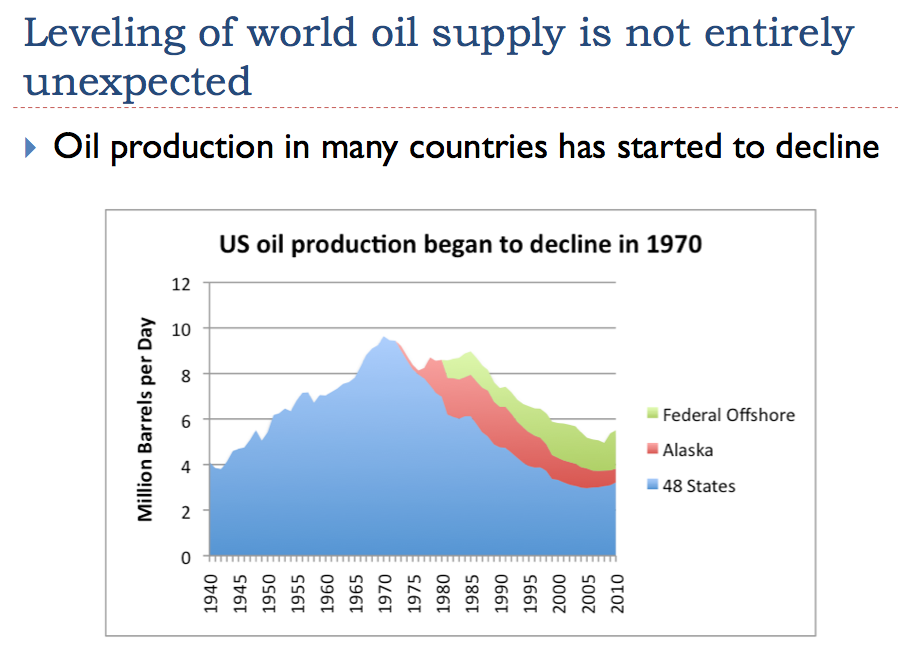

The fact that world oil production is more or less on a plateau is not entirely unexpected. In many countries, oil production has risen, reached a peak or plateau, and then begun declining. If the world is the sum of production of individual countries, the world might also eventually get to a peak or plateau.

For the United States – 48 states (blue on Slide 17), oil production suddenly started declining in 1971, after hitting a peak in 1970. When we realized that there was a problem, we quickly got to work on extracting oil from other areas. We ramped up production in Alaska in the late 1970s (red “layer” on the map), and added a pipeline so that the oil could be transported better. The amount of oil obtained from Alaska has now dropped to less than half of its peak amount.

Eventually, we started drilling in the area designated as “Federal offshore,” mostly in the Gulf of Mexico (light green layer on graph). The oil from the Federal Offshore area is still increasing, but no one expects that it will bring us back up to the 1970 level of peak production. Last year’s oil spill occurred in the Federal offshore area.

The decline in US oil production had been predicted in advance, although oil companies did not believe the forecasts. M. King Hubbert had predicted in 1956 that oil production in the United States would peak between 1965 and 1970. In the same paper, he also predicted that world oil production would reach a peak around the year 2000.

Hyman Rickover, a four star admiral in the US Navy, gave a speech in 1957 in which he explained the importance of oil, and talked about the fact that oil supplies were expected to run short around 2000, and natural gas and coal not too much later. Because of the likely shortfall, he said the nation should conserve its resources and should tell its children about the upcoming problem, so that planning could be made for the difficult transition away from fossil fuels. Needless to say, schools have not taught much about this problem.

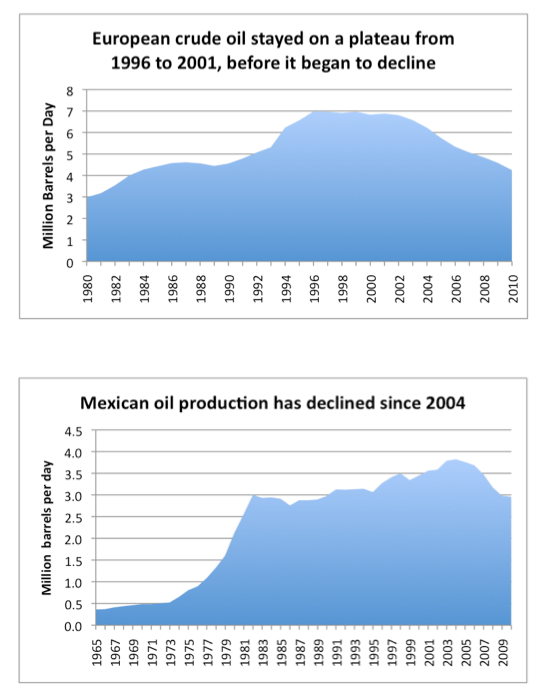

On Slide 18, I show oil production of two areas that were brought on-line after it became clear that US oil production was falling shortly after 1970. The top graph shows European crude oil, which is mostly oil from the North Sea. Its production was on a plateau from 1996 to 2001, but is now declining.

The bottom graph shows Mexican crude oil production. It was ramped up quickly after it became clear that US crude oil production was declining. The graph indicates that since 2004, Mexican oil production has been declining as well.

With all of these areas experiencing declining production, it is not surprising that world oil production has been close to flat. There theoretically is non-liquid oil that could be steamed out, and very deep oil that could be extracted at great cost, but all of this would require huge expense, long lead-times, and assurance that oil prices would be high at the time the oil was finally extracted.

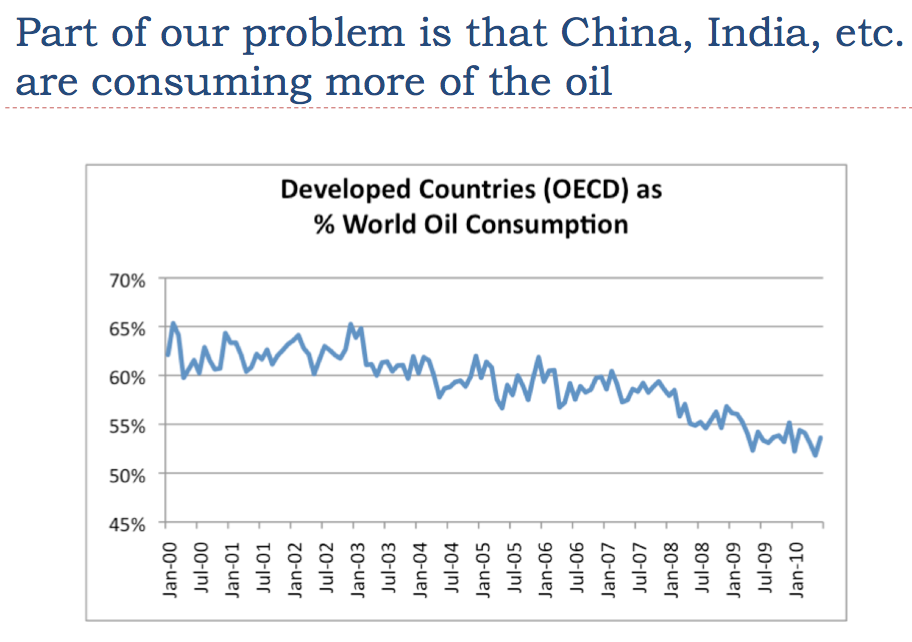

Having flat (or close to flat) world oil production wouldn’t be a major problem, if world demand for oil weren’t rising. But what is happening is that countries like China and India are using a greater percentage of the available oil. Oil exporters are also using more, because their populations are growing rapidly. When these countries use more, this leaves less oil for the United States and other “developed” nations to consume.

I’d like to talk a little now about what happens when an economy doesn’t have enough inexpensive oil.

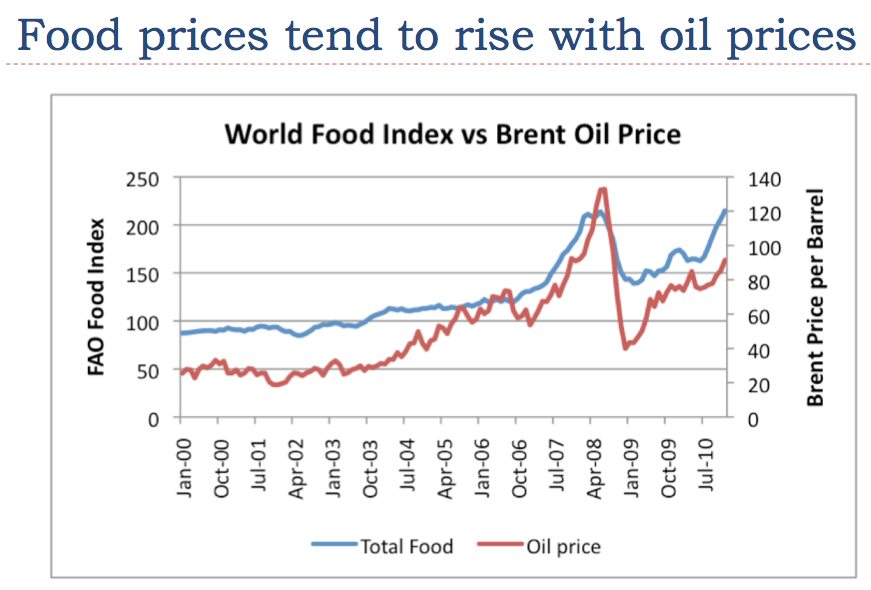

One thing that tends to happen when oil prices rise is that food prices tend to rise as well. This occurs mostly because oil is used in food production and transport. The fact that food and fuel prices rise at the same time causes a double problem for consumers, since food and fuel for commuting are both necessities. As a result, consumers tend to cut back on discretionary expenditures when oil prices rise.

Higher food prices can have other impacts as well. If people’s incomes haven’t risen and the increase in food price is severe, or if many are unemployed, there may be riots, and governments may be overthrown. We have already seen this in the Middle East and North Africa. If governments cut back on programs for the poor, as in London, this may further raise the potential for riots.

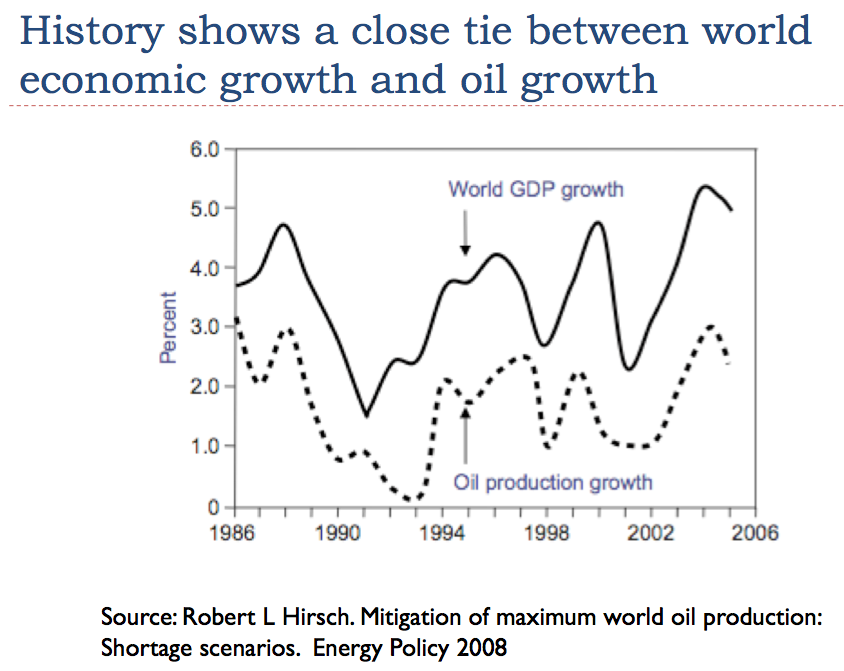

The graph shows that there tends to be a tie between world economic growth and growth in oil use. The tie may be less close after 2005, because of greater coal use in recent years.

Slide 23 shows the steps I see that lead from rising oil prices to recession. I might add that when discretionary spending drops–such as fewer trips to restaurants–employers tend to lay off workers. The fact that these workers have been laid off further adds to the cutback in the purchase of discretionary goods and further adds to debt defaults.

If many people are laid off from work, governments start finding themselves with increasing financial problems for several reasons:

- Lower taxes collected, because fewer people are working

- Higher expenditures, because there are more unemployed people

- Need for stimulus funds, to try to increase employment

- Need for funds to bail out banks and insurance companies

What seems to happen when there is a shortage of cheap oil is that the whole economy tends to shrink. The way I think of it is similar to making a batch of cookies. If a baker finds that he has a recipe that calls for four cups of flour, but he only has three, he needs to make a smaller batch. When he does this, he uses less of his other ingredients as well – sugar, eggs, shortening, and chocolate chips. If he had planned to use a whole bag of chocolate chips, he may only need to use part of a bag.

The economy seems to work in a similar fashion. If oil is too high-priced, the economy shifts to a mode of operation that uses less oil, but also employs fewer workers, uses less steel and copper, and uses less electricity. We call it recession.

Now I’d like to talk a little about what happens after an economy starts hitting the ceiling with respect to economic growth.

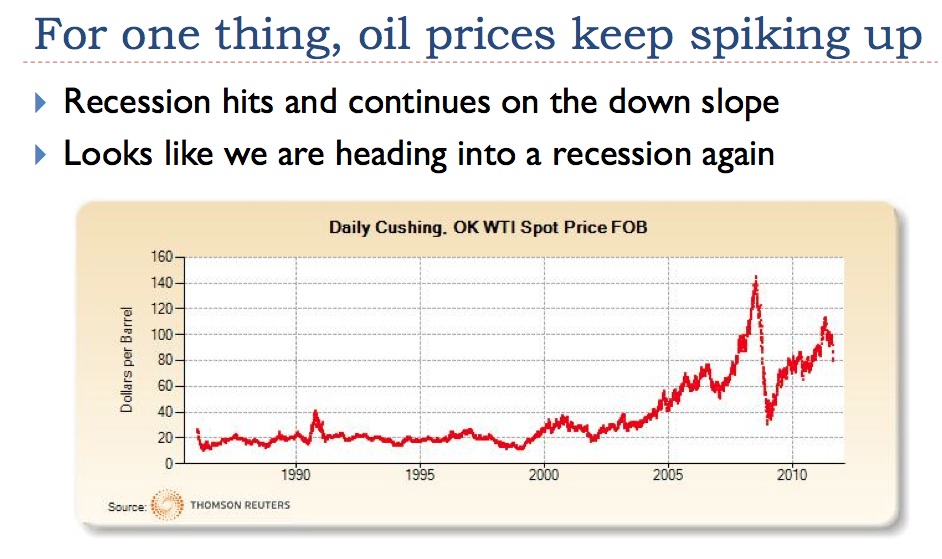

One thing that seems to happen is that oil prices seem to keep spiking.

The last recession ran from December 2007 to June 2009. This period started while oil prices were rising, before they hit a peak in July 2008, and ended after prices had collapsed and were again on the upswing.

We are now in the midst of another oil price (and food price) spike. We don’t know for certain that we are headed into a recession, but evidence is starting to point in that direction. Reported economic growth has been less than 1% in the first half of 2011. Given the past history of recessions being associated with oil price spikes, we shouldn’t be surprised if this spike leads to recession in the not too distant future.

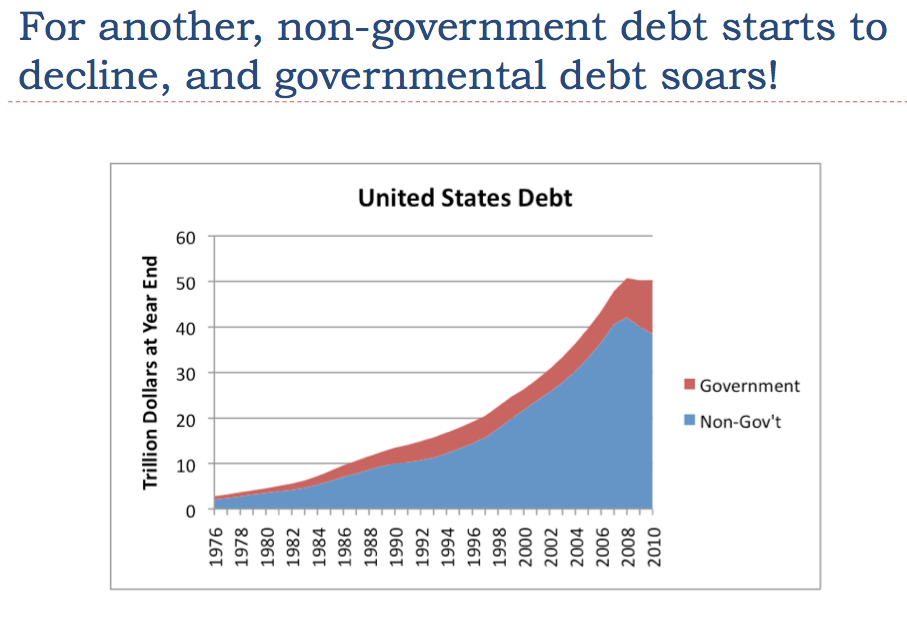

Another thing that seems to happen as we start hitting limits is that private debt (blue on Slide 27) starts to decline. This is related to what I said on Slides 6 and 7 about the need for economic growth in order for debt to work out well. If oil prices are high, and recessionary forces are starting to hit, people don’t want to take out loans to expand their businesses, because it doesn’t look like there will be enough sales to support the expansion. Workers don’t want to move up to new bigger homes, partly because they haven’t gotten raises recently, and partly because future prospects don’t look all that good. Some credit card consumers find their cards cut off, because they have failed to make required payments.

Government debt (in red) tends to increase rapidly, but not rapidly enough to keep total debt rising the way it was prior to hitting growth limits. (Government debt in red is added to the private debt in blue, to produce the total debt.)

Government debt grows for a couple of reasons. First, tax revenues tend not to rise as rapidly, or to actually fall, because of higher unemployment rates. Second, government expenditures are higher, both for programs to help the unemployed, and for stimulus programs. This combination leads to the type of debt limit crisis that we recently experienced. Many European governments are experiencing similar difficulties.

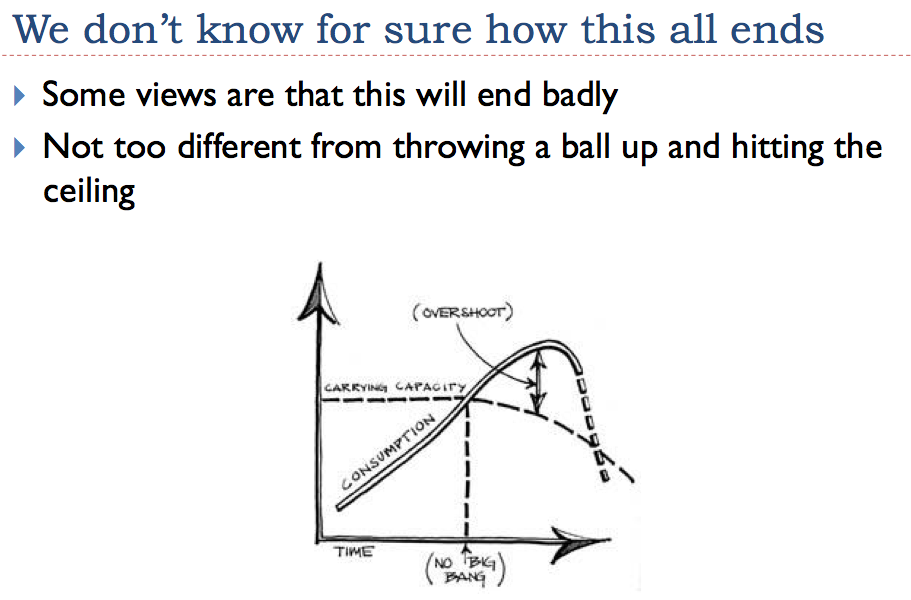

We can’t know precisely how things will turn out, or exactly what the time frame will be. But at least some estimates are that things will turn out very badly. The shape of the graph shown in Slide 28 is sometimes called “Overshoot and Collapse.”

The problem we have is that the world’s population has grown to 7 billion people. If we substantially cut back on oil (or on fossil fuels in general), there is a question as to whether we will have enough food and water to support the 7 billion people alive today. If we had very many fewer people, we would have much less of a problem.

Some of the particular problems we are running into now relate to government debt, and inability to fund government programs for the unemployed at reasonable tax rates. It is not clear how these can be resolved. It is virtually impossible to raise tax rates enough to cover the cost of currently promised benefits, especially if unemployment rates rise even higher in the future. At the same time, cutting benefits can lead to riots–or even the overthrow of governments.

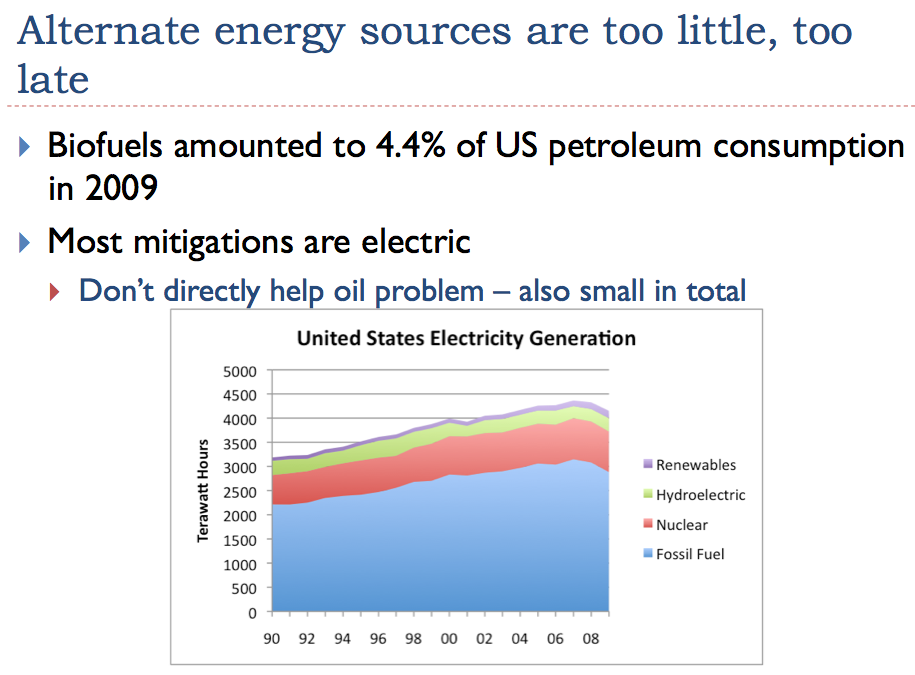

At this point, alternatives look like they will be too little, too late.

The closest substitute for oil is biofuels, but the ethanol we use today tends to use a huge amount of our corn crop, with very little ethanol yield. In 2011, ethanol is expected to use a little more than half of America’s corn crop. The energy content of a tank of ethanol is equivalent to the amount of food needed to feed a small person for a year. And of course, using a large amount of corn for ethanol tends to keep food prices up.

Most of the mitigations we hear about are electric–wind, and solar photovoltaic, and geothermal, and biogas. One problem with electric mitigations is that they don’t directly fix our oil shortage problem. The cars you and I drive today don’t run on electricity; they run on gasoline or diesel fuel.

Another problem with electricity mitigations is that they tend to produce only a small quantity of electricity. The layer I show as renewables includes all of the “new renewables” I listed above, plus wood scraps and sawdust, which are sometimes burned for electricity. The renewables line is getting thicker, but its growth is almost matched by the shrinkage in hydroelectric over the years. So in total, we aren’t getting very far, very quickly.

Also, I should point out that even if an alternate source of energy is called “renewable,” it doesn’t really mean that it could be maintained for very long, without the use of fossil fuels. Our electricity transmission wires are maintained using trucks and helicopters that use oil-based fuels. Wind turbines (and replacement parts for repairing wind turbines) are shipped using oil-based fuels. It requires fossil fuels to make solar panels.

Another issue is that alternative fuels are often expensive. If high-priced oil is leading to recession, it is difficult to see how even higher-priced alternatives will fix the situation.

Based on a longer post, from Our Finite World.

Gail

At this point, alternatives look like they will be too little, too late.......

Most of the mitigations we hear about are electric–wind, and solar photovoltaic, and geothermal, and biogas. One problem with electric mitigations is that they don’t directly fix our oil shortage problem. The cars you and I drive today don’t run on electricity; they run on gasoline or diesel fuel.

The largest use of oil in the US is to transport people in cars and light trucks ( usually one person/vehicle) relatively short distances(40 miles/day) and consuming 1.5 gallons. There is great scope for reducing this dramatically by driving more fuel efficient ICE vehicles, car pooling, replacing ICE with EV or replacing short private vehicle trips by walking, bicycling or using mass transit. This will happen as oil remains expensive but does take time. One hundred years ago almost no one drove ICE vehicles, 20 years ago almost no one drove SUV's. In 20 years time almost no one may drive vehicles that use oil or if they do get less than 50mpg.

Another problem with electricity mitigations is that they tend to produce only a small quantity of electricity.

To replace all oil used in land transport would only need a small amount of electricity( 100GW what is produced today by nuclear).

Also, I should point out that even if an alternate source of energy is called “renewable,” it doesn’t really mean that it could be maintained for very long, without the use of fossil fuels. Our electricity transmission wires are maintained using trucks and helicopters that use oil-based fuels. Wind turbines (and replacement parts for repairing wind turbines) are shipped using oil-based fuels. It requires fossil fuels to make solar panels.

The amount of oil used to maintain transmission lines or transport wind turbines is tiny, that amount of oil will still be available for a long time or could be replaced by bio-fuels or synthetic liquid fuels.

There is actually a great deal more required than this simplistic statement would seem to imply. A few things that are required:

1. A political system in power that is strong enough to put rules into play throughout the country and enforce them.

2. A system to maintain roads, and raise sufficient taxes to pay for the maintenance of roads.

3. Replacement parts for vehicles used for transporting and servicing vehicles must either still be made, or must be imported, or must be stockpiled in large quantities.

4. Workers who work at all of these things must somehow have adequate food, clothing, transportation to work.

5. Computerized systems which maintain electrical transmission systems must also be in service. Replacement parts must be available, even if there is an interruption of international trade. And people who know how to operate and fix them must have adequate food, clothing, and transportation to work.

6. There need to be gasoline stations available for workers to use, to keep their cars and vans filled, and some way of getting gasoline /diesel to the various workers.

7. Someone must figure out in advance exactly what supply chains need to be maintained, and figure out how to maintain them, while at the same time cutting off irrelevant ones. Schools, medical care, police, and many other services need to be considered. In many places, people riot when they are without basic services.

1) Need to mine all the rare earth elements and bring them to the production facility.

2) Produce the turbines, panels and all the supporting electrical infrastructure.

3) Fabs needed to produce all the computer chips to run the systems and all the fuel needed to produce , maintain and get workers to those giant monoliths and back home (unless they sleep there).

High technology societies require massive energy gaps and long supply lines. Without very high EROEI energy systems, you can kiss your cell phones goodbye (other than for the kings and family - nobody to talk to).

As for too little too late:

The rare earth parts are not indispensable. They are very handy, yes, and increase performance, efficiency while reducing weight, size & cost, but wind turbines can be built without them.

In spain, right now (Real Time website) you can check that we are using some 16,2% from big hidraulic & wind (12,2% wind), and 20,6% from other low impact technologies (photovoltaic,thermosolar, cogeneration, microhidro, biomass..). This figure is low, as normally it is higher.

Electric Grid website (spanish, sorry!!):

https://demanda.ree.es/demanda.html

Yes, but is this really sustainable? How much was financed with tax payer funds and how much was manufactured using the last of the cheap fossil fuels?

It is one thing to have renewables up and running, even Abu Dhabi is making a super renewable city (Masdar), but it is another thing to do all that from scratch without the benefit of low cost debt, oil revenues, global supply chains and cheap fossil fuels.

Let us all close our eyes and imagine we are standing in a large field. We have 150 miles in all directions to get our resources. OK, now, make your high tech society.

Let's say that it costed from 0% direct subsidy (hidro) to 84% subsidy (PV), and wind is arround 66%. It is an oversimplification, of course.

As for wind, it was made using oil and natural gas. Why? because most plastics come from these sources, and these behemoths are steel, concrete & composites. The rotors, in order to be efficient & durable, have to be made of composites, and that means either oil or nat gas.

Except that this vision is as far away from reality as expecting a combination of corn ethanol, solar and wind to continue powering the system we currently have.

I don't know about you, but I have my eyes wide open and I'm actually standing among piles and piles of recyclable resources and we have the knowledge and technology right, now off the shelf that can be applied to build a somewhat lower tech, more equitable, and sustainable society from these materials.

We just have to admit that the current system is dead and that we need to stop trying to maintain it and get on with the business of building a new one with what we have.

To be clear we can't support as many people as there are now and we certainly won't be able to support growing populations. There are going to be a lot more people suffering the fate of the Somalis. They will not be building either high or low tech societies they will just die!

Closing ones eyes and imagining impossible cornucopian dreams in empty fields isn't very useful!

Cheers!

Fred

Cornucopia dreams? My point is that there will be limited resources to support high tech infrastructure, not unlimited.

I also agree that in some cases there will be the rotting infrastructure of our past glorious civilization to scavenge from.

I guess we can look forward to going through the garbage or, if you want to be more optimistic, cleaning up the mess.

And I don't need lithium batteries to go 35mph and 40 miles today in my LEV/NEV by myself to work and the grocery store, lead acid

batteries will be just fine.

You can generate Dimethyl ether( DME)

http://en.wikipedia.org/wiki/Dimethyl_ether

with a heat source and a hydro carbon source such a natural gas. You could also using nuclear (and others)energy generate hydrogen and combine it with carbon from the atmosphere to get DME. Burn this in diesel engine much as you would diesel. you do have to change the tank and the fuel pump out. Tank would be similar to propane tank. Not 5000 psi like natural gas tank.

Gail,

I agree that these 7 items (and others too numerous to list) are necessary for a modern society to function. Nothing is simple. You seem to imply that all of these (or maybe just a few) would not function once peak oil has been reached and the output plateau where the world has been since 2005 can no longer be maintained. I am not convinced that the world is quite so fragile. Once the threat is clearly perceived, governments will take action to develop alternatives and to maintain the system while adapting it to a lower energy future. It will not be easy and there will need to be shared sacrifice, but I don't think we will see a Mad Max world.

d coyne

I just do not see any possibility of any real form of shared sacrifice being widely adopted by the American public. Unfunded war for oil with absolutely no call for shared sacrifice being a prime example.

No matter. No American leader today, at least not anyone adequately covered by the mainstream media, has the guts to point out the hard truth and make a call for it.

Isn't it impossible to share sacrifice when we are talking energy. If the US powers down, then China and India consume the left over oil. They applaud it in fact. They are begging for it. There is no solution or policy that works except coordinated ones in oil consuming nations. Good luck with that. Have you seen Climate Change CO2 Treaties work in the past. Nope. Neither will coordinated energy policy. Oil is fungible and it will all be consumed until we cease to exist or we cannot extract it from the ground.

That is the perplexing and vexing problem.

Now what should be done is more public infrastructure to reduce oil dependency -- electric charging, electric rail, electric trucking, trolleys, you name it -- etc. That is not necessarily shared sacrifice as much as investment in the future.

The problem is that the future is not well understood by the majority of Americans. So they see public works as a waste of money. Maybe they are right. Maybe aliens will bring us 100 million more bbls of oil per day in a trans solar system pipeline -- once the state department approves it!

The only paths forward are inflation of core items like energy, food, etc. combined with salary and benefits cuts in the developed world. That is how oil demand is going to be reduced. Shared sacrifice is really code for shell the bottom and climb up gradually through the "Middle Class" stripping wealth and spending power one traunch at a time.

It is up to individuals to decide for themselves if they want to consume tons of energy or they want to consume less and save money. But this will all be for not and the economy will have to crash since no real energy policy is apparent at all in the US or anywhere for that matter.

So no. I do not see any hope for this system. It has to disintegrate. No body in government will try to enlighten the public.

Once I sat down to think about it, I figured out that any substitute for oil is really an "add on" to oil, because the amount of oil we have is pretty much fixed. Thus, biofuels raise world CO2 emissions.

As long as production is maxed out, any oil we don't use is quickly used by someone else. Our conservation efforts help someone else have more. It makes the situation very difficult to fix.

This is not quite true for coal and natural gas, because there the amount used is more variable. But for oil, where we are faced with essentially inelastic supply, there is a strange relationship that makes it very hard to really reduce world oil consumption.

This is a link to a post I wrote on the subject, that has not been on The Oil Drum. The results were more than a little disturbing.

How to Develop a More Rational Energy Policy.

It is WRONG to assume that a majority of Americans are joined at the hip to their autos and will oppose any expansion of Greem public transit.

Here is a study published by Transit4America :

http://t4america.org/blog/2011/06/21/republicans-and-independents-suppor...

Actually increasing numbers of Americans know that endless highway expansion

works or that gas prices will suddenly go back to 50 cents.

We need to trumpet this loud and clear!!

Here's the question I don't think they asked though. "If increased public transportation was avialable in your area, would you or your family use it?"

I/We tend to be for just about anything if it seems helpful as long it does not directly impact me/us. "1 cent sales tax to help widows and orphans?" Sure no problem. "We will have widow Winslow move into your spare room on Monday." What, uh No!

Just try and get a senator to pass a bill that requires people receiving SS or Unemployment benefits to use public transportation for 20% of thier travel. Could have a chance. Now add a rider to that bill that requires any senator who voted for it to use public transport 2 working days a week. You would either get no votes at all or (knowing how things tend to work in washington) It would pass, along with a second bill designating Limo services for senators as public transport.

In case after case Green public transit ridership has EXCEEDED expectations and projections. Here in New Jersey the Midtown Direct train service added to

previous Hoboken-only service doubled and more rail ridership. The Hudson-Bergen Light Rail completed a number of years ago now rivals the Northeast Corridor for ridership. The Riverline Light Rail ridership has exceeded expectations.

After years when it was perfectly obvious that a Rail option was needed to

go to Meadowlands events since they caused major traffic jams on Route 3 going

to the Lincoln Tunnel, the first opening of Meadowlands Event Rail service

had so many thousands of people that NJ Transit was totally overwhelmed.

Salt Lake City is expanding its public transit system due to its great success.

The key to increased ridership for Green transit is frequency, speed and affordability. If, as the Brooking Study says, it takes 90 minutes to

take a bus to another bus to a van to get someplace you can drive in 50 minutes

nobody except the car-excluded will use it.

This is why it is absolutely crucial to RUN THE TRAINS AND BUSES!

If you have service gaps of 2 hours, or even an hour, if it only takes an hour to drive even in traffic people will drive.

The advantage of Light Rail systems is that they are almost always on a more

frequent schedule than Commuter Rail such as every 10 or 15 minutes.

The disadvantage of Light Rail systems is that they are almost always totally

Local rather than Express making every possible stop.

This kills point to point speed over any distance.

So the other essential point to effective Green Transit is a combination of

Local/Express service. I.e. Some trains/lightrail for local stops and other

trains for less frequent but faster for long distances Express service.

The Shinkasen trains in Japan work this way.

The high-speed bullet trains run on the same tracks as normal Rail but have

passings at stations to allow them to bullet past.

Before Trolleys were destroyed in the USA by the GM/Firestone/Chevron conspiracy

every city in the US including Detroit had trolleys which could actually take you from New York to Boston with transfers.

My mother was raised in Washington, DC and took the trolleys everywhere from

the age of 12 before they were destroyed.

There is no reason we cannot restore Green Transit in the USA.

We really have no choice or as James Kunstler says, we will not be going anywhere!

Here we go again with the "polls". Gosh, with 77% support for those bike lanes - far more than the mere 55% often counted as a "landslide" - we should be seeing them all over, not just in artsy or university towns. And huge fusses like the one over the Brooklyn bike lane should be getting laughed aside long before they ever attract national attention.

I picked on the bike lanes because day-to-day staffing is not required; there is little "operating cost". So they should be ridiculously "easy" to put in, as compared to buses or trains, which require staffing at tremendous expense at all hours they are to be used (hence the widespread "never at night or on Sunday" policy, making transit best suited to hermits.)

I can't help but think that the "poll" results demonstrate little more than interest-group self-delusion engendered by the unicorn method of poll construction. The unicorn method, for example, fails to adjust for bias arising from the widespread "this stuff is all wonderful for somebody else to use" mentality. It also fails to adjust for bias arising from failure to confront the vexatious question of whether actual, as opposed to merely hypothetical, willingness-to-pay might ever exceed zero.

Thus, the unicorn method consistently leaves us mystified as to why, with such a huge landslide of "support", the stuff just isn't getting built all that much in the real world. So rather than wallow fatuously in airy hypotheticals, we might ask, say:

When we look around, do we actually see those bike lanes, or do they exist only in a la-la land hallucinated by pollsters and inhabited by unicorns? And even if we do see some, do they connect up, or are they just uselessly isolated bits of urban bling for the mayor to brag about at "conferences"?

When we look around on a Sunday morning, or around midnight, or at other odd times when many of the peons must travel to or from work, do we see any buses, trams, or trains? Do they even run out to where said peons - who cannot conceivably compete in the downtown real-estate market with the offices of $1000/hour lawyers - can actually afford to live? Or, again, are they just urban bling for the mayor to brag about at "conferences"?

And of course, the money question on "operating costs": under straitened economic circumstances, how many more $100,000/yr (wages+fringes) congenitally-tardy transit drivers are we really able to afford on the taxpayer's dime when both ability and willingness to pay (in the real world, not the pollster's unicorn planet) seem to reach new lows with each passing quarter? (Indeed, it seems like we're getting a lot of yammering about transit cuts in the big cities, although politicians do often define "cut" as failure to increase by leaps and bounds.)

I have been using Green public transit since 1996, i.e. for 15 years.

In that time punctuality within 5 minutes has been well over 95%.

In the midst of the blizzard early last Winter when virtually all roads in

New Jersey were closed and people were not driving my neighbor took his

usual train to get to New York City right on time and then returned on

schedule on a 3:30 PM return train when his office was closed due to cars

not being able to drive to work.

For my current Green commute I ride a shuttle van provided by my Company

which is sometimes late due to accidents and traffic but with excellent

service provided by the shuttle drivers who go out of their way to serve

their customers.

I do not understand why you wish to lob personal insults against conscientious

workers who in my experience provide stellar service.

What exactly is wrong with providing good jobs paying $100K including benefits

to Americans desperate for work if those jobs provide a major public benefit in reducing oil usage, greenhouse emissions and land usage?

Is it better to provide $100K including benefits to endlessly repave the miles upon miles of asphalt required for our current auto-addicted Transit?

All towns and the State of New Jersey faced major additional costs for snow removal on top of the existing gargantuan costs of autos as it is.

The trains ran through the snow with 12 times less track to clear than the

football field of asphalt required for 5 cars.

I have no illusions that it will be easy to kick the US auto addiction.

But it is absolutely essential and halfway steps like "cash for clunkers"

Stimulus funding for more highways, or $7500 subsidies for affluent electric car buyers are the totally wrong strategy.

Transit ridership was setting new highs in 2008 when gas first broke $4 per gallon. But then just when people were turning to Green transit, 150 cities

cut their public transit service. Ironically in a number of cases due to

deals with Wall Street for revenues in exchange for derivatives which were then

called in...

I exclusively walk or ride my bicycle - in Wisconsin - as a consequence of losing my license 3 years ago. I put MANY serious miles on my bicycle - and I can tell you that I am almost the ONLY serious rider here. The FEW riders I see - are recreational. Tires and tubes need to be replaced almost every 2-3 months due to use. Serious use. We have a few bicycle lanes and trails here- most are used for recreation - walking dogs, a brief, short walk, or recreational bicycling. Further, bicycling is growing increasingly dangerous. Inattentive drivers, those on cell phones, those distracted with food/children. I am lucky to be alive - and have had some words with inattentive drivers. No one wants to give up their cars - and most can't live without them - perhaps to the benefit to those of us who can.

enicar - it is certainly going to be a lot more difficult to reduce auto addiction and provide Green Transit options in more rural areas.

I am presuming that you do not live in the Milwaukee or Madison Metro areas so there is probably zilch Green transit outside of biking and walking available.

Here is Milwaukee's rating by Brookings:

http://www.brookings.edu/~/media/Files/Programs/Metro/jobs_transit/jobs_...

It is not impossible to support reasonably safe bicycling in rural areas-

look at Ireland for 100 years before the boom!

But the easiest progress will be in Metro areas.

Wisconsin DID have trolleys outside of Milwaukee or Madison before

the auto addiction took over, see:

http://www.trainweb.org/twerhs/wisctrolleys.html

All bike-riders and Green Transit advocates might be interested in the

BetterWorldClub which is modeled after the AAA but primarily to support

bicyclists and Green Transit. They provide pickups and support for bike

breakdowns, bicycle maps and other services, including even (ahem)

auto towing. But their basic purpose is to get away from auto addiction.

http://www.betterworldclub.com/

I think this is going to be a real issue, in the long run. It isn't just the new bikes we need, but the replacement parts for them, because they wear out fairly quickly. As our roads get worse, this will be even more of a problem.

If we can't make bicycle tires with local materials, then we have a major problem. We would almost be better off, figuring out early on that bicycles are not sustainable with local materials, and move on to something that is--horse drawn cart with wooden wheels, for example. But this will be an expensive alternative, because you have to feed the horse, and keep replacing wheels that break, so few will be able to afford it. Most will walk, and perhaps pull a little wooden wagon behind them.

Gail,

I really can't imagine why long distance transportation will have problems. Rail is efficient and can be electrified, and can also be electrified when necessary. Local can go by plug-in hybrid truck1. Wwater transport is even more efficient, and can find substitutes for oil.

Substitutes for oil for water shipping? Pshaw, you say.

No, really. Substitutes include greater efficiency, wind, solar, battery power and renewably generated hydrogen.

Efficiency: Fuel consumption per mile is roughly the square of speed, so slowing down saves fuel: in 2008, with high fuel costs, most container shipping slowed down 20%, and reduced fuel consumption by roughly a third. For example, Kennebec Captain's ship carries 5,000 cars from Japan to Europe (12,000 miles) and burns 8.5 miles/ton of fuel at 18.5knots, for a total of about 1,400 tons of fuel. At a 10% lower speed of 16.6 kts, the ship burns 21% less fuel (about 300 tons).

Size brings efficiency: the Emma Maersk uses about 320 tons of fuel per day to carry 220,0002, tons of cargo, while Kennebec Captain's ship uses about 60 tons to carry about 23,000 tons (see here ), so the Emma Maersk uses roughly 60% as much fuel per ton.

Other substantial sources of savings include better hull (I've seen mention of "axe cleaver" designs - anyone seen details?) and engine design (very large (3 story!)marine diesels can get up to 50% thermodynamic efficiency), and low friction hull coatings (the Emma Mærsk saves about 1.3% with special paint, and bubbles work too).

Container shipping fuel efficiency rose 75% from 1976 to 2007, in an era of very low fuel costs.

Finally, reduction of oil consumption brings a kind of reverse-Jevons efficiency. Currently, some 34% of shipping tonnage worldwide is devoted to transporting oil [source http://www.unctad.org/en/docs/rmt2006_en.pdf , p.16]. If we reduce oil consumption, we reduce the need for shipping. Similarly, world coal trade was about 718Mt in 2003 [source http://www.worldcoal.org/bin/pdf/original_pdf_file/global_coal_market_price(01_06_2009).pdf , p2], at the same time as total world trade was 6,500Mt, so that coal was 11% of world seaborne trade by weight.

Continued at http://energyfaq.blogspot.com/2008/09/can-shipping-survive-peak-oil.html

Very good comment. Btw, world coal trade at 718 Mt could be replaced by 7180 tonnes of reactor grade uranium. A single ship (nuclear powered would be feasible) could service the entire world's sea transportation needs for uranium.

I think this sums up in a nutshell what your problem is--a lack of imagination (and underlying understanding) of how the various systems fit together. The financial system and the political systems are very important, and somehow everything must fit together.

The saying goes, "If you only have hammer, then you tend to see every problem is a nail."

As long as you assume some magical way of making what limited supply we have fill all of society's needs, without causing any disruption in other systems, then everything works together. We are already having riots in London. Things just don't work the way you think they do in real life.

Ecosystems are typically quite robust due to diversity, complexity and the adaptability of the species within it. Whenever a species fail, other species fill the vacant niches. The global economy may have its weaknesses, but the problem is absolutely not in diversity and complexity. The problems lie where we have mono-cultures and constructs that is "too big to fail".

Nick's views are valuable, as he is the best here at pointing out the diversity of ways things can be changed to adapt to problems. Skeptics need to counter his diversity arguments by quantitative analyses on whether the alternatives suffice. Then we may reach a good synthesis. However, your dismissal does nothing to contribute to the discussion.

Don't forget - I see no reason not to include nuclear in that diverse set of solutions. It's not what I would personally prioritize, but it will be used, I'm sure.

I think this sums up in a nutshell what your problem is

I understand your frustration - I disagree with a lot of your arguments. On the other hand, getting personal doesn't help.

--a lack of imagination (and underlying understanding) of how the various systems fit together.

That's amusing - that's exactly what I would say about you. I think you're failing to think outside the "oil box".

Here's an example of this kind of thinking: "The interface between finance and energy will prove to be the most important determinant of the way the Greater Depression we are rapidly moving toward will play out in practice. For those here who may be unaware of peak oil, the point is that global oil production appears to have reached a production peak that it will not be physically possible to exceed. ...Energy is the master resource without which no activity, economic or otherwise, is possible."

http://theautomaticearth.blogspot.com/2008/12/debt-rattle-december-7-200...

This kind of deeply unrealistic oversimplification is a remarkably good example of "everything is a nail"!

I agree that the financial systems are important - I just don't agree on the impact of PO on financial systems. The fact that The Automatic Earth has been spectacularly inaccurate with their economic predictions is good evidence of that.

In November 08, they were advising people to short the stock market: "Sell equities, real estate, most bonds, commodities, collectibles (or short if you can afford to gamble)". This strategy would have lost a lot of money in the last 2 years.

Similarly, in 2009 she said the Dow would crash that year, and reach 1,000 in 2010: instead, the US stock market was up up for the year. She predicted sharp, dramatic price deflation - as of December 2010 all measures of prices showed growth.

For the year of 2010 the Dow gained 11%, on top of an 18.8% gain in 2009. The S&P 500 was up 12.8% for the year, with its best December performance since 1991. In 2009, the index gained 23.5%. The Nasdaq finished 2010 with a 16.9% gain after soaring 43.4% in 2009.

Here's a prediction from November 2008: "We appear to be beginning a market rally at the moment, which should lead to precisely this set of trend reversals. Such a rally is only temporary relief however. It may last for a couple of months, but then the decline should resume with a vengeance." http://theautomaticearth.blogspot.com/2008/11/debt-rattle-november-29-20... . Now, we're in the middle of a medium sized correction - I'm sure she's pointing to that as evidence of TEOTWAWKI.

The saying goes, "If you only have hammer, then you tend to see every problem is a nail."

Exactly - everying is not energy related, and especially not oil related!!

As long as you assume some magical way of making what limited supply we have fill all of society's needs, without causing any disruption in other systems, then everything works together.

I'm not suggesting that a transition away from PO will be absolutely smooth.

We are already having riots in London. Things just don't work the way you think they do in real life.

That's completely unrealistic. Western society has weathered much, much larger disruptions than PO.

If the US were to take a WWII mobilization in answer to PO we could address almost any imaginable shortage in weeks - literally, and convert away from an oil based economy far more quickly than oil production will drop.

How about you make a prediction Nick. You are full of a million "we can's" so lets read what you expect. Monday morning quarterback for someone else predictions is easy. You would not have the gonads though, that is not what a shill is all about.

What world do you live in. Appears to be the average world...the average vehicle, the average person, the average price. Which of your "we can", "we could" etc have come to fruition. WWII mobilization, get real, who is paying you to continue that garbage. You've been at it for years and the economy is still deteriorating, FF burning is continuing to rise along with unemployment and atmospheric CO2.

I occasionally say what I expect: gradual adaptation to PO, very slow economic growth in the OECD/US, and growing CO2 emissions. It's worth knowing that TEOTWAWKI is very unlikely (except, of course, if the worst runaway positive feedbacks of climate change happen...).

It's also worth knowing that the technical means are in our grasp to solve our problems - they're scalable, affordable, etc. Will we as a society choose to override the minority that is blocking beneficial change in the way we should? Probably not..

OTOH, coal consumption in the US is falling, and windpower and EVs are growing reasonably strongly. All is not lost, quite yet.

Is that the best you have Nick?

The economy is tanking, energy consumption is falling. Coal exports are the highest since 1992 and expected to continue rising.

http://online.wsj.com/mdc/public/page/2_3022-autosales.html

Read that.....midsize SUV sales up nearly 50%. Ev's pffftt

To claim windpower and EV's caused coal consumption to fall is just the tactic of a paid shill.

http://205.254.135.24/coal/

Above is the first link I Googled. Tell me if the EIA don't think the future is rosy for coal.

The USA produced over a billion tonnes of coal 2010, what is going to reduce that by an appreciable amount in meaningful time period? You deny the numbers and an economy that depends on it.

The economy is tanking

Not really. The stock market is falling, but the overall economy is at worst roughly "stagnant". Of course, stock markets don't like stagnant...

Coal exports are the highest since 1992 and expected to continue rising.

They're still not very high. OTOH, I agree - I'd prefer coal stayed in the ground.

midsize SUV sales up nearly 50%.

Midsize SUVs are what station wagons used to be.

Look at the other data: large cars down 7% YTD. Large SUVs down 8%.Small cars up 17%. Could be better, of course, but that's not too bad.

Ev's pffftt

uhmm...that doesn't seem very specific...

As someone likes to say, people tend not to understand the exponential function. That applies to new things like EVs: they appear to start slow, and pick up speed later surprisingly fast.

To claim windpower and EV's caused coal consumption to fall is just the tactic of a paid shill.

A shill for what???? I don't think coal companies would be very happy with what I have to say. Further...it's the truth: windpower displaced coal.

Tell me if the EIA don't think the future is rosy for coal.

This is what that link says: "First-quarter 2011 coal share of power generation lowest in over 30 years ".

You deny the numbers

Ah...which numbers?

and an economy that depends on it.

Yes, I disagree that in the medium term we need coal: we don't.

And so on, and so on. I have a hard time understanding why TOD people are so US-centric. The US isn't the world. PO should be a global phenomenon, right? And the global economy is improving, overall, and energy consumption is going up.

Of course, carbon emissions will keep rising for the forseeable future, also mostly due to non-US consumption.

Are you joking? Or, do you just not know any better? The European economy is in toilet and it does not seem to be getting any better.

Imports of all OECD importing nations in Thousands of barrels per day. Does not include exporting nations of Norway, Denmark, Mexico and Canada, but does include all OECD importing nations. Per the EIA.

Also in the second quarter of 2011 even the imports of the rest of the world have dropped considerably. The Chinese bubble is about to burst.

Behind a pay wall but available via Google.

The Great Property Bubble of China May Be Popping

The world economy is not improving. The world economy is on the verge of collapse.

Ron P.

Global growth is projected at some 3% this year. The Chinese will obviously have their recessions and bubble-bursts eventually, just as everybody else has had since time immemorial. So what? Europe isn't "in toilet" - some European countries just have too large a national debt and/or deficit. That's going to clear up one way or the other.

The world in still in a deep recession, global growth will come nowhere near 3 percent this year regardless of what is expected. Real growth is now non-existent in OECD nations. The only increases are happening in oil exporting nations and China and India. Don't expect India to increase any this year and China's increase is artificial, based on building houses, malls and office space that will never be occupied.

You are hilarious. The economies of the world cannot grow unless the oil supply grows. We have been on a plateau for six years. The next trip is down.

The point is Jeppen, that all the world, particular Europe, is in the exact position as the US. And several European countries are much worse off. To pretend that the US is worse off than Europe is absurd and anyone who follows world events is well aware of that fact.

Ron P.

"The world in still in a deep recession, global growth will come nowhere near 3 percent this year regardless of what is expected."

You know, more than half the year, and most of the 3% growth, is already in. What you say is tantamount to forecasting an extreme drop in output in the last four months of the year. Three days ago, Citigroup cut their global growth forecast from 3.4% to 3.1% for 2011, and from 3.7% to 3.2% for 2012. That may have to be adjusted down further a few points, but you've gone completely ballistic. What deep recession!?

"Don't expect India to increase any this year"

Why not? Their growth was recently estimated, by themselves, to 8.2% for the year.

"China's increase is artificial, based on building houses, malls and office space that will never be occupied"

Do you really believe China's 9% growth is artificial? For real? Despite increasing real wages, soaring auto sales, good infrastructure and energy projects and so on? I think you draw way, way, WAY too big conclusions from the bad news articles you read.

"You are hilarious. The economies of the world cannot grow unless the oil supply grows. We have been on a plateau for six years."

Here is the real global growth data for the last six years: 2005: 3.4% 2006: 4.0% 2007: 3.7% 2008: 1.7% 2009: -2.1% 2010: 3.7%. So, during this oil plateau and financial turmoil, real global growth has been some 15%. Now, again, tell me how the economies of the world cannot grow unless the oil supply grows. You obviously have NO contact with global economic statistics whatsoever!

"The point is Jeppen, that all the world, particular Europe, is in the exact position as the US."

No. Large parts of Europe are perfectly fine. OTOH, some parts of Europe are worse off than the US. True, developed markets will post a lack-lustre 1.5% growth this year, but emerging markets, comprising half of global GDP, are NOT in the same position. While they are also expected to drop, from 7.8% in 2010 to 6.4% in 2011, that will be 80% of global GDP growth this year. Emerging Asia is quite a bit less dependent on exports to the West now than in 2008. That is one good consequence of the crisis. The US is swiftly losing its role as the world economic engine.

Nonsense! The world sits on the brink of disaster. Did you see the August 22 cover of Time?

This Week In TIME: The Decline and Fall of Europe (And Maybe The West)

And Germany knows it: German minister advocates austerity, warns of 7-year global recession

We are all in this together. If the countries in trouble go down then Germany and France go down with them, followed shortly by America. But Europe is far closer to the cliff than America. That is not to say that we are not close to the cliff also, because we are, but not nearly as close as Europe.

Ron P.

"We are all in this together. If the countries in trouble go down then Germany and France go down with them"

How do you define "go down"? A GDP drop? Bancruptcy? By what mechanism would Germany "go down" if, for instance, Greece and Italy does?

And no, we're still not all in this together. I showed you, with hard numbers, how much nonsense you were talking. You ignore all that and keep saying I'm talking nonsense, supported only by your interpretation of news items and your deeply held belief in PO. Tiresome.

I supported everything with my original posting of data from the EIA. Oil is the lifeblood of the world's economy. The crash started in 2008, paused for about a year and now is set for the second leg down. It is all because the availability of oil is declining and the price of what is left is increasing. Read this. This will be the most important article you read in your life.

Energy and Human Evolution

Ron P.

"I supported everything with my original posting of data from the EIA."

Actually, that supported nothing at all.

"Oil is the lifeblood of the world's economy."

So, you refuse to acknowledge the great decoupling that is ongoing, with 15% cumulative global economic growth (and rising) at an oil plateau? Instead you prefer to make an arbitrary link between oil decline and the financial stress put on a few economies by housing bubbles and undisciplined national budgets.

And then you throw in this 15 year old nonsense article for good measure, an article whose author doesn't know the first thing about demographics. Btw, global population growth has since shrunk to 1.1% and keeps shrinking, and this is not due to resource scarcity as those with the most resources at hand have the lowest fertility rates.

The economy is becoming decoupled from the energy that drives it? Yes, I definitely refuse to believe that is possible. There can be temporary spurts of growth but basically we have an energy driven economy. The industrial revolution was made possible by extrasomatic energy, energy from coal, oil and gas. If you think the economy can be decoupled from the energy that drives it then you are beyond hope.

The age of the article is not important. The point is that there was nothing in the article that required any data from current events. The article was all about the connection between evolution and energy. If you think that connection requires input from current events then you are sadly mistaken.

Overshoot was written over 30 years ago and it is just as relevant today as in 1980.

But the very fact that you call Dr. Price's article nonsense just goes to show how far you are removed from reality. Tell me what is nonsense about this quoted paragraph? And how might it be worded differently if it had been written yesterday rather than in 1995?

Ron P.

You're sticking your head in the sand, Ron. I didn't show that energy was decoupled from the economy, but that OIL is decoupling from the economy as we speak. I did it with hard numbers, but you refuse to acknowledge this. Actually, you avoid the core of the argument like the plague and go on about side issues and try to confuse the issue instead. It gets tiresome. Tell me if you want to get serious about this, otherwise you can have the last reply.

This would be funny if it wasn't so sad. The idea that oil can be decoupled from the economy is unbelievably absurd. Virtually all transportation is powered by oil. Planes, trains, trucks, ships and automobiles are all powered by oil. And you are going to decouple the economy from transportation? Give me a break!

If you had bothered to read "Energy and Human Evolution" you would see the absurdity in your "decoupling" remarks.

Ron P.

The statistics is in. This isn't about "can", it is about what is. And the fact is that economic growth has decoupled from oil consumption growth. You argue about this as if it wasn't history.

Perhaps flight will always need liquid fuels, but that little proportion can be covered by what oil remains, CTL, NGL, biofuels or synthesized fuels. And if not, the world economy can keep improving without flight. All other transportation is becoming increasingly more efficient, powered by alternatives and replaced with more local sourcing of goods and so on.

You are a fairly intelligent person. So I am at a loss to understand why you are quoting theautomaticearth to Gail. Clearly you understand that Gail doesn't write that blog.

If you have a beef with what Gail writes why not quote her?

But if you want to quote people lets look at your stellar technical analysis.

http://energyfaq.blogspot.com/2009/05/do-electric-vehicles-cost-less-to....

Yes, ladies and gentlemen. Nick thinks EVS will cost less than ICEs because they contain no points or carburetors. And somehow catalytic converters are a maintenance issue. It's 1986 all over again.

You are a fairly intelligent person.

Well, thanks!

I am at a loss to understand why you are quoting theautomaticearth to Gail.

1) It illustrated my point well. I find theoretical arguments without examples boring and uninformative.

2) I can't find any other intellectual underpinnings for the idea that oil has some remarkable value that can't be replaced by other forms of energy.

3) I think Gail agrees with it. Actually, I think she can speak for herself: Gail - do you?

they contain no points or carburetors.

I forget what this logical fallacy is called - it consists of finding a small error, and suggesting that it invalidates the larger argument. Actually, I'd remind you that there a surprising number of carburetors still on the road....

So exactly what you just did with the Automatic Earth?

Except the errors by the Automatic Earth are minor timing errors.

And your technical errors demonstrate a severe lack of understanding of anything that has to do with car maintenance or repair.

The latter exposes your lack of expertise to an embarrassing degree.

Which by the way still has nothing to do with Gail or Gail's writings.

Just saying.

http://www.edmunds.com/nissan/leaf/2011/tco.html?style=101301094

http://www.edmunds.com/toyota/corolla/2011/tco.html?style=101372440&zip=...

:edit

http://en.wikipedia.org/wiki/Carburetor

Oh please do tell me how many carburated cars are still on the road. It really does add to your credibility...

Please counter an argument without personal attacks.

All the best,

K.

the errors by the Automatic Earth are minor timing errors.

They're enormous errors: timing is of the essence when it comes to forecasts, and these aren't minor differences. TAE continually predicts disaster, and continually is proved wrong. They reveal that TAE is detached from reality.

tell me how many carburated cars are still on the road

As for carbureted cars (note the spelling), my point was that there are still a lot of old cars on the road, including a lot of 20 year old cars. There are a lot of old Crown Vics on the road. The larger point: who cares? It's quite clear that EVs will have much lower maintenance costs.

Thank you for the comparison of Total Cost of Ownership, where we see that Edmunds agrees that a Nissan Leaf EV is $1,700 cheaper to own over 5 years compared to a Toyota Corolla.

Try again.

Leaf True Cost To Own* $36,645

Corolla True Cost To Own*$34,363

And that's including the $7.5k rebate.

Try again.

Leaf Maintenance 5 year total $2,316

Corolla Maintenance 5 year total $2,882

A $500 dollar difference after 5 years.

But that's probably only because the Corolla is fuel injected.

Leaf True Cost To Own* $36,645

I'm puzzled: the link you provided gives $32,668 for the Leaf. http://www.edmunds.com/nissan/leaf/2011/tco.html?style=101301094

It's true: Edmunds estimates Leaf maintenance costs significantly higher than I would. Any idea what the $1,339 for year 5 includes??

What zip code is it calculating? That changes the TCO.

I dunno. Tires? Not a new battery cause the Corolla shows the same jump as well.

I would think tires wouldn't be more than $600 at the very most.

Very puzzling. How would we find out Edmund's methodology?

Cars.com does a TCO that utilizes a national average.

http://www.cars.com/nissan/leaf/2011/pricing/

http://www.cars.com/toyota/corolla/2011/pricing/

Leaf 5 year total cost of ownership $34,851

Corolla 5 year total cost of ownership $31,547

That too includes the $7,500 rebate.

Maintenance costs

Leaf $1,605

Corolla $1,671

I also looked up a 20 year old Crown Vic. Seems even with the carburetor the Leaf is still more expensive.

And another one

http://db.theautochannel.com/db/newcarbuyersguide/toc_results.php

State New York New York

Year 2011 2011

Make Nissan Toyota

Model Leaf Corolla

Series SL Base

Trim 4D Hatchback 4D Sedan at

Segment Eco Compact, Sedan

Market Price $34,525 $16,521

Rating NA Average

Depreciation $23,465 $10,407

Fees & Taxes $-3,919 $832

Finance $4,599 $2,146

Fuel $4,468 $11,098

Insurance $7,883 $7,736

Opportunity Cost $416 $533

Maintenance $1,885 $1,917

Repairs $1,834 $1,834

TOTAL $40,630 $36,503

Not looking good for the Leaf. Hate to see one of these that calculates the cost of a new battery pack every 7 years.

Well, I think we have several takeaways here.

First, these companies don't really know what to make of EVs, and they aren't trying very hard to learn about them. We see that the maintenance costs are almost identical on Edmunds, and the repair costs are in fact precisely identical on the "autochannel": $1,834 for both. That's obviously a default cost, which hasn't been customized for a new tech.

2nd, they're assuming very high rates of depreciation: in 5 years the Autochannel assumes about 65% depreciation for both. Further, they're depreciating the sticker price, not the net price, when the net price is the true market price. The true lifecycle cost, over a much longer period, will improve the Leaf's picture.

3rd, even with these imperfections, we see that the 5 year cost is really very close: Edmunds is $2k less or more depending on zip code (and in most zip codes the Leaf is less): at worst that's only $33 per month per more : that won't make anybody lose their job because they can't afford to commute.

I agree the TCO estimates need to refined for EVS. You missed another big error. They are assuming you are paying for gas using the empg numbers from the EPA.

That said, without the tax rebate and including the costs for a new battery pack every 7 years or so a Leaf is no where near cost competitive. Carburetor or no Carburetor.

Well, the savings from fuel are likely to be about $1,800 per year: that's $12,600 every 7 years. That will pay for a very nice battery, with a fair amount of change left over.

Even without the savings from eliminating all those other components (including the carburetor...!).

-------------------------------------------

Seriously, any idea where we can get good, detailed data on the real costs of car ownership?

Hi dcoyne78

Thanks for your comment.

re: "Once the threat is clearly perceived, governments will take action to develop alternatives and to maintain the system while adapting it to a lower energy future."

I am curious: Do you have any evidence that suggests this is or will be the case?

The evidence I have gathered suggests entirely the opposite. Both the current and previous administrations know full well about "peak," and are not only not telling the truth, they are actively suppressing much-needed research and planning, particularly in the areas of ways to organize to meet basic needs.

Here's the evidence I draw upon:

re: A. Robert Hirsch is a member of the NAS, and lead author of the first DOE report on peak oil in 2005.

http://www.energybulletin.net/stories/2010-09-16/exclusive-interview-rob...

Peak oil : A conspiracy to keep it quiet in Washington, says Robert Hirsch

Interview with Robert L. Hirsch (2/2) - LINK to full text of original

B. David Fridley.

http://www.energybulletin.net/node/50545

(Steven Chu, US Secretary of Energy) was my boss. He knows all about peak oil, but he can't talk about it. If the government announced that peak oil was threatening our economy, Wall Street would crash. He just can't say anything about it.

-- David Fridley, scientist at Lawrence Berkeley National Laboratory, quoted in an article by Lionel Badal (see Peak Oil News, 10/28, item #23)

http://www.energybulletin.net/node/50055

Hi Aniya,

I have no evidence, simply hope. I was not very clear however and can see how my statement about the threat being clearly perceived was misinterpreted. I agree that governments are aware of the problem, but are not making the public aware (maybe they are concerned with panic or hoarding). What I meant is that once the gravity of peak oil is clearly perceived by the public then they will demand that governments take action. If not right away then as things deteriorate. My hope is that action will be taken soon which is why I applaud the work that Gail is doing. Where I differ with Gail is that I do not think investment in renewables, trains, energy efficiency, and a more efficient power grid is a mistake. It seems that her position is that it will all fall apart quite rapidly and that 50 or maybe 100 years from now there will be no international trade (or much less), that food and water will be severely constrained, that we will be unable to manufacture or maintain modern machinery, electronics, communications and so forth.

I think that people in general will start to realize that there are limits to growth and my hope is that they will start to act more rationally when this becomes apparent. Imagine that a majority of people agreed that peak oil was imminent and that peak fossil fuels was 5 to 10 years from now, what would happen? Some think we would descend into anarchy or a police state. I hope that society moves to a World War 2 type of urgency (without the actual war and other bonehead decisions such as internment of citizens .) The perceived threat might cause society to pull together and do what it takes to solve the problem, humans can be creative and there is much that could be done to create a more sustainable society.

d coyne

The evidence is there that leaders are aware, on some level, that society is behind the peak oil curve, though I think they're also aware that any possible response will be inadequate, too little, too late. There's a major move on in Georgia to add a penny sales tax to address these issues, expanding light rail regionally, etc. The proposals, unfortunatly, also plan to direct funds to highway expansion and improvement. Many of those involved have expressed an awareness of the situation, and a sense of urgency, though they also seem to indicate that they are a bit late (30 years?) addressing this issue. Voters will decide next year.

On the Federal level, while I don't expect elected officials nor their partisan appointees to scare the public into accepting action on these issues, the Military has been the most obvious conduit of awareness and action, much the way it was the incentive for building the Interstate system, at least in the area of alternatives to fossil fuels. Perhaps this is the Govt's stealth method of breaking the news and testing/funding the means to mitigate our energy/climate change disfunctionalities.

I expect that many elected officials are more aware of how poorly positioned the US is to deal with our looming energy conundrum than many think, and when the polls indicate that awareness and acceptance among the electorate is at high levels we'll see many more politicians adopting these issues as their own, but certainly not before the next election cycle winds down. Of course, by then it will likely be glaringly obvious that we're in deep sh@t. They will then be in the uncomfortable position of explaining away their failure to see this coming. Ring the bell on another round of blaming the other guys. So it goes...

If the Tea Party and their like make major gains in 2012, it's game over, IMO.

To be frank, there are existing examples of decoupling (growth without using more resources)

http://www.unep.org/resourcepanel/decoupling/files/pdf/Decoupling_Report...

P113."A more remarkable trend can be observed in freshwater (Figure 8.5). For most of the last 10 years, China achieved absolute decoupling between freshwater consumption and economic growth. During 1998–2007, total freshwater consumption varied within a small range between 290.1 and 306.2 billion m3."

That is the good side. But there are some bad sides about it. First, this is achieved mainly because absolute resource limitation. I understand the importance of water conservation because I was raised up in a city with only 4 hours of tap water supply each day. There just simply not enough water, you goanna to conserve it or you will not have drinking water for the remaining day. Now the situation bettered, but memories don’t easily fade away. Older generations still adopt an resource efficient way of living.

Nowadays, government use a lot effort to promote water conservation. (On the street of Beijing, you can see pictures of an old grandpa or a per-school girl standing near water tap, because she and he are two of winners of “water saving citizen” contest and designed some best ways to preserve water. Such commercials cost a lot, but the bus company is gov-owned, so they just reduce their profit to promote water conservation). However, the lifestyle of newer generations is significantly more resource intensive. They just don’t have the experience of resource limitation.

Second, because more and more Chinese have chance to visit advanced OECD countries, they start to question the rational of resource conservation. I read one post on Chinese forum by a Chinese student in the states. “The Americans are f**king electricity, yes they are f**king it.” (Translate: Americans are wasting electricity just like they can get high from it). Many Chinese lose faith in resource conservation after exposed to western life style. “Why should we conserve oil to power westerner’s big car?” was a common expression during time of Climate talks in Denmark. (In China, Climate change is often discussed together with energy conservation) Chinese government try to reduce the impact of FF limitation by strongly promote hydro-electricity, building nuclear reactors, using electrical high speed railways. And government companies are up-regulating gas and diesel prices to reduce usage. However, the new so-called “citizen’s voice” (not many, but backed with related businessmen, have a lot means to express their ideas) are against it. They want to remove hydro-power plant to restore original sight, get rid nuclear power plant away from their home and take airplane instead of HSR. And they want opening of import of “cheap oils” from smugglers and other sources (once from Iraq, now might be Iran or somewhere else). This is greatly hindering the effort of resource conversation in China. With stronger-than-ever resource shortage, it is very hard to predict what will happen to Chinese resource management policies.

[citation needed]

I think that something similar to the above quote is actually true. The catch is that you need to keep the electrical system operating, and it is almost as likely to fail if we have oil supply problems (or financial problems that affect several systems at once) as the oil supply system itself.