Peak Oil and the Financial Markets: A Forecast for 2008--July 31 Update

Posted by Gail the Actuary on August 1, 2008 - 10:23am

Back in January, I made a financial forecast for 2008. In this post, I will update my analysis, looking both at what has happened thus far in 2008, and refining what is likely ahead.

Most forecasts are made with an overriding assumption of infinite growth, but the analysis made in January and updated now maintains an underlying assumption of resource limitations, such as will likely accompany the advent of peak oil. Under resource limitations, debtors are likely to find it difficult to pay back loans, as resources become more and more scarce. As a result, default rates are likely to continue to rise.

One of the issues I consider important in my forecast is systemic risk. This relates to the interconnectedness of the system, and predicts that if one part fails, other parts are also likely to fail. Many other articles mention this issue, but rarely address its full ramifications.

I also consider the impact of systematic bias, which is different from systemic risk. Systematic bias is more closely related to the issue of resource depletion, and the fact that the infinite growth is ultimately not possible.

Lenders, and those who write insurance against loan defaults, assume that the future will be much like the past. If there is problem with loan defaults, the assumption is made that higher defaults are likely to be temporary. Models based on this assumption are faulty, because resource shortages are likely to raise the price of all types of energy products and food, year after year. This will tend to cause progressively more loan defaults, because people will have less and less money available to repay loans, after buying basic necessities.

This situation of progressively more defaults can be expected when the world is at peak oil; it can also be expected before peak oil, if energy prices rise over an extended period because the quantity of oil available is not sufficient to meet demand at a lower price. This seems to be the position we have been in recently.

Failure of financial markets to recognize the increasing risk of defaults due to resource depletion can be expected to result in a consistent underpricing of risk. Individuals and institutions owning debt-based financial products are likely to suffer huge losses, year after year, as more and more defaults occur. Insurance companies writing this risk are likely to be among the first to have problems, since their financial results are closely tied to the proper pricing of the risk charge underlying loans. Ultimately, the large number of loans which never can be paid back is likely to bring a crash to the already unstable financial system.

Background

My January forecast provides a more detailed explanation of systematic bias and systemic risk. I explain that as we approach peak oil, events that financial modelers would like to think are independent, such as defaults on loans, become much less independent. I also explain why, with systematic bias and systemic risk becoming more relevant because of resource depletion, the predictive value of financial models such as of the Capital Asset Pricing Model and the Black and Scholes Option Pricing Model is likely to decline. I also elaborate on the reasons for my forecasts.

Forecast for 2008

Let's first look at the forecast I made at the beginning of the year. Here is a point-by-point review:

1. Many monoline bond insurers will be downgraded in 2008, and some may fail.

As I noted in the introduction, insurers writing the risk of debt default are likely to be among the first with bad results. Not surprisingly, there have been many downgrades of companies writing this risk. As the year goes on, I expect to see further downgrades and financial failures. I also expect to see a ripple effect through to other financial institutions (including banks, hedge fund, pension funds, and multi-line insurance companies) because they will have to take over the risk that the monoline insurers were supposedly insuring.

Part of the impact of the failed insurers can be expected to be sudden, as banks, insurers, and other institutions fail regulatory ratios, and find themselves in need of greater capital, or need to divest themselves of certain securities which no longer meet investment standards. Part of the impact will be more gradual, as formerly insured bonds enter into default, and the lack of insurance affects the owners of the bonds. The number of defaults is likely to be much higher than in the past, because previously "safe" bonds, such as municipal bonds, will be affected by affected by falling home prices and declining tax revenues.

There have already been several bond insurer downgrades, including MBIA Insurance Corporation, Ambac Assurance Corporation, and Financial Guaranty Insurance Corporation. Among mortgage insurers, PMI Mortgage Group and MGIC have also had their ratings reduced.

Mike Stathis, in the Market Oracle indicates that he considers Fannie Mae and Freddie Mac to be similar to bond insurers.

. . . much of the debt sold to institutions is guaranteed by Fannie and Freddie, making them similar to the monolines like MBIA and Ambac. Combined, they hold around $1.4 trillion in their retained portfolios and they've guaranteed over $3 trillion of what could end up being junk bonds. So you can think of Fannie and Freddie as a hybrid of bond insurers like MBIA and AMBAC, along with Washington Mutual and Countrywide.

The insurance guarantee component of Fannie and Freddie makes the situation for these companies much worse than if they were simply holders of mortgage bonds.

2. More and more people influential in financial markets will begin to recognize peak oil.

Nearly everyone is now aware that there is some kind of problem with the oil supply, and that old assumptions may not hold. For example, Business Week recently had an article in which it questioned whether Saudi Arabia could ramp up production to 12.5 million barrels a day. Even the Economist is beginning to mention peak oil, proffering an interview with Matt Simmons.

At this point, some leaders understand peak oil, but the majority is at the "peak oil lite" stage -- oil supply is short relative to demand, and the situation doesn't look like it will get much better very soon. With even this limited understanding, lenders are likely to be more cautious about granting credit, since with continued high oil prices, consumers are likely to have less money available for debt repayment. If lenders become peak oil "savvy", lending practices are likely to become even more restrictive.

3. Long term loans, including those for energy companies, are likely to become less available as awareness of peak oil rises.

The Bank for International Settlements, in its annual report, describes the world financial markets as being in turmoil, with credit availability greatly reduced.

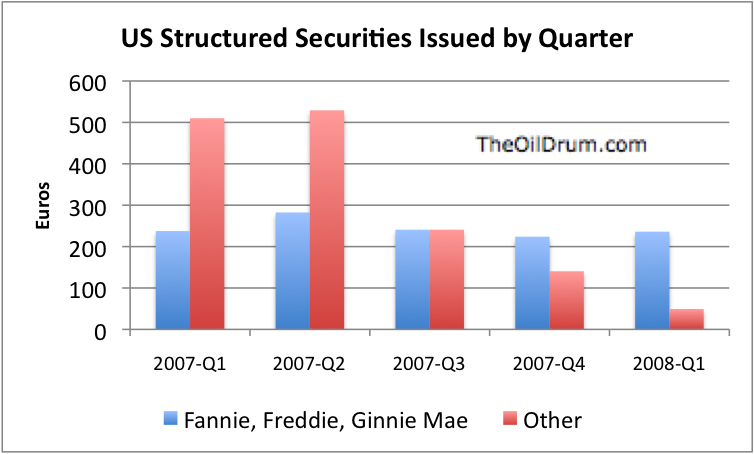

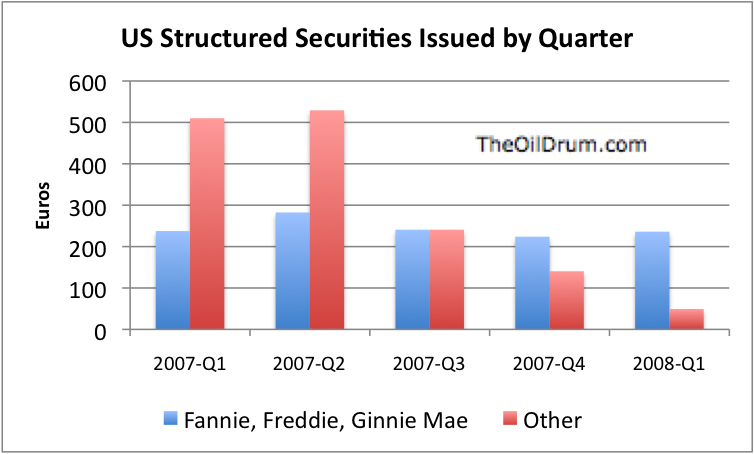

For several years, banks were able to resell loans they initiated to third parties, using structured securities. About a year ago, the US market for structured securities, other than those guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae, started to deteriorate, as illustrated in Figure 2.

Without the structured securities market, banks have become much more cautious about long term loans, such as commercial real estate loans and home mortgages that are larger than those Fannie Mae and Freddie Mac will handle.

Smaller home mortgages have continued to be reasonably available, but only because government agencies have provided a market. In the first three months of 2008, more than two-thirds of new mortgages were bought by Fannie Mae or Freddie Mac, according to the New York Times. If Ginnie Mae (providing FHA and VA loans) were included, the percentage would be even higher.

Regarding energy companies being affected by current financial disruptions, there have been articles about the collapse of SemGroup pinching small oil firms. SemGroup filed for bankruptcy after losing $2.4 billion in the oil futures market. Through its subsidiary SemCrude, it collected 541,000 barrels of oil a day from more than 2,000 independent operators in Oklahoma, Kansas, and Texas. With its failure, many of these producers have not been paid for oil already shipped. Some of the more remote producers are now being left without a market for their oil.

This example shows how financial problems can affect energy companies. While I have not seen a long-term debt example, the trend toward reduced credit almost assures that there will be energy companies that will be unable to make desired investments because of unavailability of long-term debt.

4. There is likely to be a serious recession in 2008, deepening as the year goes on.

According to the official arbiter of recession, the National Bureau of Economic Research (NBER), the US is not yet in recession. The reason they do not believe the US is in recession may partly be timing. The NBER's review is based on several measures, and some are not available immediately. Also, according to the President's Council of Economic Advisors (CEA), real GDP is not yet declining. This may reflect a mis-measurement of inflation.

The CEA's analysis uses an estimate of inflation that seem quite low--an annual rate of 2.4% in the fourth quarter of 2007 and of 2.7% in the first quarter of 2008. If the inflation rate is even a little higher than this, the country has been in a recession for some time. The reason the inflation rate is important in this calculation is because the gross domestic product is estimated first in current dollars, and then an inflation adjustment is backed out to calculate "real" gross domestic product. If the inflation adjustment is too low, it will tend to make the country look like it is not in recession, when it really is.

Whether or not the NBER says the United States is in recession, many economists believe that the United States is either in a recession now, or will soon be in a recession. When USA Today surveyed 52 economists in April 2008, it found that two-thirds felt the US is already in a recession, and 79% believed that a recession was likely by the end of the year.

I continue to believe that we are already in a recession, and the recession will get worse and worse, as the year progresses.

5. At least several large banks will fail.

At this point, IndyMac has failed, and is expected to use up as much as 15% of the funds of the FDIC. The investment bank Bear Stearns got into financial difficulty and was sold to JP Morgan Chase at a fire-sale price.

The Wall Street Journal has reported that the FDIC is staffing up for an increased number of bank failures. Estimates of the likely number of bank failures range from 90 to more than 300.

The SEC recently stated, "There now exists a substantial threat of sudden and excessive fluctuations of securities prices generally" that could affect orderly markets. Because of this risk, short sale activity is being restricted on a list of 19 large financial institutions. This list includes many very large banks, including Bank of America, Citigroup, and Deutche Bank. Some people must believe there is a risk of these institutions failing, if the price of their stocks has been dropping rapidly, and investors want to short their shares.

6. The amount of debt available to consumers is likely to decline.

According to a May 6, 2008 article of the Wall Street Journal:

The Federal Reserve's survey of banks' senior loan officers, one of the most closely watched gauges of lending practices, found that the credit crunch is widening. The proportion of domestic banks tightening their standards was at or near historical highs for almost all loan categories, including credit cards and student loans.

According to that article, 55% of banks that participate in the federal student loan program are planning to reduce their lending in the fall of 2008. Banks are increasing credit score requirements and reducing available limits on credit card debt. The survey showed that 70% of banks had increased standards for home equity lines of credit in the previous three months.

7. Fannie Mae and Freddie Mac may need government assistance.

The financial problems of Fannie Mae and Freddie Mac have been in the news recently. Legislation has been passed which would establish a new regulator, and would provide a temporary rescue plan.

8. A new class of homes -- those "never to be sold" -- will emerge.

The Wall Street Journal talks about a glut of unsold homes, because of a weakening housing market. More and more homes are entering foreclosure, as owners find that their homes are no longer affordable, and the market value of the homes is less than the mortgage amount.

Foreclosed homes often sit vacant for long periods of time. Sometimes they are vandalized and stripped of their copper piping and scrap metal. Cleveland now has a grant that will allow it to renovate 50 foreclosed homes and demolish 100 others.

9. Politicians will continue to make attempts to help homeowners, and perhaps other types of borrowers.

Federal legislation under the title American Housing Rescue and Foreclosure Prevention Act of 2008 stagnated in the US congress for months, and was finally passed last week, when Fannie Mae and Freddie Mac problems became apparent, and assistance for them was added to the legislation. Prior to that, about 20 states launched foreclosure intervention or prevention initiatives.

10. The amount of structured (sliced and diced) debt issued is likely to drop to close to zero.

The amount of new structured debt sold in recent quarters, other than that guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae, has declined by more than 90%. Figure 2 is the same graph as shown above.

Structured securities continue to be used for housing, but almost entirely with agency guaranteed debt. A proposal has been made in the last few days for banks to offer covered bonds as an additional option for writing mortgages. With covered bonds, investors would have recourse to banks' balance sheets, in addition to the underlying assets. It is not clear that these will be much used, because the FDIC currently restricts their use, so as to not deplete assets supporting ordinary depositors.

11. Besides banks, many other players in financial markets are likely to find themselves in financial difficulty in 2008.

One of the big issues for any organization that holds financial securities faces is how to properly value those securities. This is especially an issue for structured securities. On July 28, Merrill Lynch sold $30.6 billion of collateralized debt obligations (CDOs) for only 22 per cent of their face value. Now that this sale has been made, other organizations will have a real value to assign to similar securities, and this is likely to result in many other write-downs.

According to the Timesonline article quoted above, the Egan Jones Ratings Company (EJRC) believes that Fannie Mae and Freddie Mac will be forced into combined write-downs of $100 billion, because of this new valuation. In total, for all financial institutions, Sean Egan of EJRC believes that the write-downs related to this new valuation might total $400 billion.

Prior to the Merrill Lynch sale, American International Group, a large insurer, was in the news for its large investment losses, relating to the valuation of securities. The price of its stock has dropped 64%, and its ratings have been downgraded.

12. The value of the dollar will fall relative to some currencies, causing the relative price of oil to rise.

The value of the dollar has continued to fall relative to a trade weighted basked of currencies, while the Euro and Yen are higher.

13. The stock market probably will decline during 2008.

The general trend of the stock market has been down. The Dow Jones industrial Average is down 13% since the beginning of the year; the S&P 500 index is down 14% beginning of the year. Both indexes have recently been down more than 20% from their 2007 highs, putting them into "bear territory".

14. Prices are likely to rise in 2008 for food and energy products. Prices may decline for homes and non-essential goods and services.

The price of West Texas Intermediate (WTI) crude oil is up 45% since the beginning of the year. The price of gasoline is up 35% from the beginning of the year. Recent CPI data shows US grocery prices up 6.1% relative to a year ago. Food prices around the world have been rising rapidly, and many of the poorer countries are concerned about food security.

15. There is a chance that some type of discontinuity will make financial conditions suddenly take a turn for the worse.

In my earlier article, I wrote:

Will the "wheels come off the economy"? I really don't know.

I then gave a few considerations that might prevent a serious disruption in 2008. These included the underlying momentum of the economy, the ability of regulators to change rules as they go along, the fact the congress is likely to go along with any proposed bailout plan, and the fact that much of the problem is a balance sheet problem, which it may be possible to hide for a while longer.

Since January, the events that have transpired have tended to make me more pessimistic.

One of the issues I see is that Congress is not inclined to do very much, and what it does do seems to work in the direction of increasing the deficit. Congress seems willing to pass legislation that will hand out more dollars to people (as in the stimulus legislation and the housing legislation), or raise the lending amount available to people (as in the new $625,000 cap on Fannie and Freddie loans). It does not seem to be willing to raise tax dollars to go with all of the new commitments. The higher spending coupled with the unwillingness to raise taxes can be expected to make it more difficult to fund government debt, and is likely to lead to an increase in interest rates.

A second issue is the limited nature of the various insurance funds which insure against insolvencies of banks, pension funds, and insurance companies (including FDIC, PBGC, and state insurance funds for insurance companies). These insurance funds generally have a small fund to handle insolvencies, and some mechanism for assessing solvent entities in the group if one of the members fails. In some cases, the additional funding is accomplished by increasing the insurance premiums payable in the upcoming year for the remaining solvent entities.

This funding approach works if there is only an occasional small insolvency, but not if there is an avalanche of insolvencies, all arising from the same root cause (higher oil prices, feeding through to cause higher energy and food prices, causing defaults in many areas). This means that if there is a large number of insolvencies, there will need to be some governmental approach for propping up all of these organizations, rather than just the insurance funds.

A third issue is the apparent inflexibility of our refined petroleum product pipeline distribution system. As I understand it, we need to have a certain amount of refined petroleum products in the pipelines to keep the pipelines filled. If we have too little, pipelines drop below the "minimum operating level," and we have trouble getting petroleum products to the ends of the pipelines. This is not really a remote possibility--we have already run into this problem in various parts of North America in recent years, including North Dakota, Colorado, and Canada.

It seems to me that as the amount of oil we are using decreases, our vulnerability to disruption caused by available oil dropping below the minimum operating level increases. Some possible sources of disruption include a major hurricane; the US not being able to purchase enough oil because of a drop in the value of the dollar; and OPEC refusing to sell us oil. It would seem as though such a disruption could have cascading effects--parts of the country might be left without any petroleum products (gasoline, diesel, or jet fuel) for an extended period, because all refined products are shipped in the same pipeline, with spacers in between. I don't believe that we have adequate truck and barge backup to prevent disruptions from occurring.

Looking ahead

As we go forward, I expect that there will be more and more individuals, businesses and governments that will be unable to repay their debt, because of indirect impacts of higher oil prices flowing through the economy. Eventually, the US government will have to make a decision as to what to do about all these defaults. The most obvious options would seem to be:

(1) Prop up as many as possible

(2) Let the chips fall where they may

Either of these would seem to have the potential to lead to serious disruption. If the "prop up as many as possible" approach is used, it theoretically could lead to a high inflation rate, high interest rates, and a severe drop in the dollar. I would expect imports of all kinds to drop, including petroleum imports. This could lead to parts of the country losing liquid fuels because the pipeline structure cannot easily distribute a much smaller fuel supply. The decline in imports other than oil could also be a major problem because we manufacture so little ourselves.

If a "let the chips fall where they may approach" is followed, it is possible that bankruptcies will cascade through the system. If there are inadequate funds in the FDIC, and banks are simply allowed to fail, this would have very negative consequences. One can think of a lot of other organizations that might need propping up--states with a lot of debt, like California; Fannie Mae and Freddie Mac; auto manufacturers; airlines; LNG terminals; independent oil refineries; and pension funds, to name a few.

Letting any of the major organizations fail would likely cause more homeowners to default on their mortgages and trigger yet more bankruptcies. In this scenario, our imports would likely also drop, because people and businesses will not have the funds to purchase them. This could get us back to the problem of pipelines below minimum operating level.

How much of this will happen in the next two quarters? I don't know. It is likely that Ben Bernanke and Henry Paulson have some ideas I haven't thought of, and there is a way out of this predicament. I don't have all of the answers. It is likely to be an interesting rest of 2008.

Brill article Gail.

After the recent upbeat posts and optimistic comments, it's good to have some PDP ( Proper Doomer Porn ).

What would be the effect of US States becoming effectively, or practically, bankrupt? or USGOV unable to service international debt? How would this effect the UK?

I am sure there would be international repercussions. London with all of its financial industry would be especially hard hit.

There is a lot more that could be written about the subject. I want to think through the ramifications carefully before making any firm projections.

Excellent article. Thanks for sharing your insight. I have a related question that hopefully someone in the oil drilling industry can answer. I saw a recent article in which the EIA stated that even if offshore drilling was allowed, there would be no production from those areas until 2017. That seems like an extremely long time frame. Does it really take that long?

I regularly participate in bloggers calls with the American Petroleum Institute, and this has been discussed. I think the problems is that there are a lot of delays built into the system. As I understand it, the company first bids on the new property. It then has to try to explore the new property, to see if there is any oil. This takes several years--lining up people and equipment, and if things look promising, drilling one or more test wells. Drilling rigs are in very short supply, and there can be very long (1 year +) waits for these. Permits of various types are required and this adds to the process.

If it looks like there is oil and or gas there, someone has to design a plan for extracting this resource. Once the plan is drawn up, the equipment must be obtained, and workers must be located. If oil is in a challenging area, there may need to be new specialized equipment designed and specially built for the purpose. If an oil platform is required, this may need to be built.

Pipeline for transporting the oil and associated gas will typically be needed. If the well is 200 miles out in the ocean, typically both oil and gas pipelines will be needed to extend to the new location. There may be a need to extend land pipelines as well, to connect with the new pipelines into the ocean.

If we were dealing with a standardized process with off the shelf products and without government permits required, the process would take a lot less time.

The length of time I remember hearing is seven to ten years, but I expect that ten is probably pretty typical.

Gail,

It's hard to imagine you get anything else done with all the effort you put in on TOD. Much appreciated. I suspect you're familiar with Chaos Theory and Complex Adaptive Systems. I'm just a novice on the subject but it's easy to the possibilities you describe fitting into such a format. Given the proximaty and uniqueness of PO even stochastic,or "look back" modeling, might offer not offer a very clear vision of the future.

As much as I appreciate your efforts it is a little overwhelming to see all the weak points of our economy stacked up in one spot.

More approach is more to look at what I see as links, and try to see what happens in some sample cases.

I am concerned that there is a fairly close link between electrical availability and petroleum products availability. For example, if we can't get coal because of a lack of petroleum products, then there is likely to be a drop in electricity available. If electricity is lacking in certain parts of the country, this could be a major problem.

Gail, congrats on a truly remarkable article. You really separated out what is important and made it all to easily understood <--That is NOT easy to do. BRAVO!

Your concern of electricity is one that I share. IF we have a hard time getting oil, delivering oil, etc. then people will switch to electric heat, electric cars (doing this already), and our grid does not have extra capacity to replace the lost value of oil based energy. This is clearly overlooked by the MSM. I think you are dead on that this will be another crisis mixed in with the others that will hit.

You also hit on "never to be sold homes". yeegads!

I think you have done a masterful job of outlining the coming collapse with plenty of real "signals" that will be obvious if you care to look.

A job well done.

D

It's also clearly overlooked by many promoting techno fixes on this site.

Thanks!

I keep thinking that the differences in types of mortgages might mean that the US is more likely to follow an hyperinflationary bail-out program than the UK. Although I still think the UK will inflate the money supply in propping some organisations up, and will face a rapidly weakening currency, making most of the goods we purchase as imports much more expensive. Sadly this now includes the most important things, like food and energy.

As I understand it, negative equity is less financially disruptive in the UK, as mortgagers can't so easily just hand back their house keys and walk away, free of debt (as they can in the US).

Another influencing factor though is that defaulting is much more complicated politically, and technically than monetizing debt to pay obligations. Defaults trigger events in credit derivatives markets, which may cascade out of control. Inflating/bailing is easier in the short term and the impact takes longer to be felt, so it's harder for people to know who to blame. Not sure this makes it inevitable, but seems more likely to me - in debtor nations anyway.

It seems like countries will try to inflate their problems away, as long as they can. Once they run into to many barriers, they may have no option but let nature take its course.

What kind of barriers do you foresee? Do you think they will be forced to stop by foreign creditors withdrawing funding? This might be the case, but I can easily imagine hyperinflation first, what do you think?

I think that the amount of debt defaulting will just become overwhelming. There will be bank defaults that cannot be covered by FDIC and FSLIC assets. There will be the big auto makers and the airlines. At some point, the State of California may default on its debt.

Before it comes to this point, there may very well be problems with creditors withdrawing funding, interest rates rising, and the exercise of balancing the budget becoming totally impossible. There may even be the problems with oil availability that I mentioned, and keeping the pipelines running. If folks at the ends of the pipelines were to get left out, this could be a very bad situation.

I suppose hyperinflation is a possibility, but with all of the defaulting debt, it seems like it would be difficult to maintain for very long.

"I suppose hyperinflation is a possibility, but with all of the defaulting debt, it seems like it would be difficult to maintain for very long."

This situation has me totally perplexed. We are going to do bailouts- that we can foresee, but is that money going to evaporate somehow? I just can't get my head wrapped around this one. It seems like a transfer of increasingly worthless money to the wealthy but they too will be dragged down. Like killing the goose who lays the golden eggs.

Comments?

D

Money is created when people / businesses / government obtain loans and spend the proceeds. The amount of these loans looks like it will be dropping precipitously, as the various borrowers default on loans and lenders become increasingly wary of making new loans.

The government may try to bail out lenders, but even with all of this new money, it will be difficult to replace what has recently been available.

DelusionaL,

I have read that using the Case-Schiller numbers so far, about 1.3 trillion dollars of 'hallucinated wealth' (hat tip to JHK) in the form of US residential housing equity have evaporated already. Mish Shedlock, Enrico Orlandini, and other respected analysts believe that the deflationary cascade will overwhelm the capacity of the US gov't credit rating to bail out.

We shall see.

Errol in Miami

It is difficult to understand how and when the inflation will change over to deflation. For one thing, it happens simultaneously. (Food and energy prices have been rising while suburban real estate equity has been vanishing.)

The thing to keep in mind is that most of our assets only have full value if we're not all trying to sell them at the same time.

Another key point is that as state budgets go into deficits, they will likely choose to defund pension plans and sell off assets at bargain basement prices.

For starters, everyone should check out Chris Martenson's Crash Course. Just google:

end of money crash course

"What would be the effect of US States becoming effectively, or practically, bankrupt? or USGOV unable to service international debt? How would this effect the UK?"

If the US goes into catastrophic bankruptcy and continues bailout/intervention + an inability to honor international debt, you can expect more strain on banks worldwide (first Europe then spreading around the world), the increased likelihood of hyperinflation worldwide through all dollar based currencies (read export markets to US) as the treasury prints money to prop up banks and service debt, and a trainwreck of export goods to the US as the dollar falls.

I don't know if things will likely move rapidly to this kind of scenario. Right now, it looks like a slow burn.

If US goes into a fast decline wont they free up oil for the rest of the world?

I would think so. This is one reason I think that others would be happy to squeeze us out. Who needs an oil buyer who takes 24% of the world's oil for 4% of the world's population, and can't pay for it?

This reminds me of an interview with Chris Skrebowski on global public media back in June, where he says that the US hasn't been in control of demand due to it's stagnant economy for months versus Asia/China.

We appear to be at a unique point in history. The US isn't driving demand for once, therefore it can't set the price with its current stagnation from the international market to lower prices significantly. It would have to take a drastic usage drop to lower prices.

So let's say for every 2% oil usage drop the slack is taken up elsewhere. The price therefore remains the same or rises. As long as there is oil around needed for growth, price won't go down. There would have to be an excessive decline in that 24%. I'm sure it's possible, but wouldn't that mean deep recession/depression levels? What is a depression level usage of oil in the US?

However this plays, excess will just go to growing economies, and those who can afford it, re: not Europe or N.A. Therefore China et al are setting prices, and our analysis would seem to require a shift to a worldwide view as well if we wish to remain kept in the loop.

I am sure you have read about the collapse of the World Trade Organization talks at Doha. I am sure a big piece of this is the new power of the countries with growing oil usage, as discussed in this WSJ article. The US has been able to dictate how trade would operate for many years, but this power is going away.

Before getting too carried away, it's important to note that this is (for all practical purposes) impossible. As a sovereign issuer of currency, the U.S. Gov. can always pay it's debts, since it doesn't have to obtain dollars from any external source (note that this doesn't apply to countries like Argentina that owed large debts denominated in other currencies). The only way the U.S. could cease to honer its obligations is if the U.S. congress decided not to cash U.S. treasury checks - not inconceivable, but highly unlikely.

And what would be the value of said currency?

If our dollars aren't worth very much, our lenders won't be very happy when paid back in inflated money. Also, we have a lot of debt to roll over, and new interest rates won't be very favorable, in this scenario.

You still are not understanding the world from the point of view of an issuer of currency. The U.S. gov. (or any other sovereign issuer of currency) does not have "lenders" in the proper sense. As a matter of operational reality, the U.S. government must first spend money into existence in order for it to be available to be "borrowed". In reality, the only reason for the U.S. to exchange interest bearing instruments for non-interest-bearing currency is to support a non-zero interest rate. Japan ran deficits over 9% of GDP for years during the 90's, ended up with a debt-to-GDP ratio of over 150%, and still had interest rates of roughly 0%. Again, this is not magic - it is the operational reality of a currency issuer in a non-fixed rate regime.

I'm not saying there aren't real problems with the real economy. But to float words like "bankruptcy" that simply don't apply is to fog the real issues.

Ah the dreaded Japan analogies that will not die. Japan has always run strong trade surpluses, unlike the USA. If you think the USA can just print paper indefinitely and foreign suppliers will be content to accept such paper in return for valuable goods (even though the USA does not have comparable dollar value goods to sell in exchange) you are probably surprised that the housing bubble "that never was" blew up. It is fun though-just print up magic paper, provide nothing and get everything.

taking the analogy of paying for energy with 'paper' further, the US has WAY more energy than does Japan, and this disparity largens on a per capita per square mile basis. So in the end, we have endogenous fossil energy sources (though not as much as we 'need') and Japan does not. They have just been more thrifty in how they spend their energy (i.e. no military to speak of)

Japan definitely has energy issues, but my point is that, as you state, Japan is not the USA. The USA has been borrowing from foreigners for many years now as a means of propping up the consumption economy, which is just another artificial bubble. The question is what is the longer term actual value of the US dollar, i.e. the value at which the country no longer needs to run trade deficits. This value appears to be very low-probably the strongest offset would be dramatically higher food prices. This is one part of the ethanol (corn and otherwise) story that is seldom quantified.

BrianT & Jimbo,

I agree that the statement "bankrupt" is extreme, but as BrianT says it is not just as easy as printing money.

States most certainly do have lenders Jimbo and it is called the international bond market.

There are many debt markets for every country. First, is the domestic private debt market--the rate that banks charge each other for overnight loans known as the Fed Funds rate in the United States. This market was not backed by the Treasury until Paulson crossed the Rubicon and the final nationalization of the United States banking system by Bush signing the housing bill. Second, is the domestic governmental debt market known as state and municipal bonds in the United States--these are backed by the state or local government--usually the federal governmental will try to intervene rather than one of these fail.

Third, and most importantly, is the actual international bond market.

Japan was a "good" country that the international finance system supported (for a price) during its housing bubble burst in 1990. In that case, the government propped up banks with government funds because otherwise they would have collapsed as they could not have maintained reserves upon writing down assets and the entire thing would have went down. In effect, the private banking system became public as public money provided the financing for the private banking system. Thus, when the government took all this private debt onto its balance sheet in the 1990's we saw governmental debt rates rise, while the Bank Of Japan rates drop to zero or lower. Look at the growth in JGB and the rates paid from 1990 onward:

https://www.mof.go.jp/english/bonds/saimukanri/2004/saimu02b_04_e.pdf

The international bond market provided funds to Japan in JGBs (at higher rates) so that the national banking sector could keep giving loans to consumers for almost nothing so the economy did not completely shut down. But they had a lost decade because the expense of paying those rates weighed on the real ecomony, foreign capital did not want to invest in such a slow economy and capital fled the Nikkei, and the Yen strengthened as the rates on JGB increased similar to when Volker raised rates in the early 1980's to high levels and this hurt their exporting business as their cars, electronics, etc. were not as "cheap" as before reducing their trade surplus further slowing the economy.

Now what happens if you are not a "good" country and the international bond market abandons you? Zimbabwe had public debt that their trading partners required be paid or they would cease trade. Zimbabwe was viewed as a "bad" country, I have no opinion on good or bad here I'm simply trying to visualize structure, and the international bond market stopped providing financing. Therefore, to continue to receive goods from trading partners they needed to pay their debts and the only way to do so was to print currency and the hyperinflationary spiral began.

The same thing happened in Argentina, and since capital fled, there was no money in the banks and access to the banks had to be restricted.

As to America, I am of the opinion that it is considered a good country even if not well liked right now in the world and will get financing. In addition, like it or not, America is the police of the world and I don't think any country really wants to see America collapse into nothing. Also, the exit tax is designed to prevent the wealthy from renoucing citizenship and fleeing with their capital without paying large amounts of taxes on their wealth hindering capital flight. And the U.S. has the muscle to back such a law. I could be wrong.

The increased activity between the European Central Bank and the Federal Reserve, such as accepting covered bonds as collateral and currency swaps, leads me to believe they have joined ranks and therefore the value of the dollar will be a function of the differential between the Federal Funds Rate, the ECB bank rate, and the strength of the Yuan. The ECB can issue currency and swap for dollars and put them on the shelf reducing supply to support the value along with the Chinese. I think they want the dollar weak--but just not too weak--cheap to buy our assets, increases our exports, and increases the cost of oil curbing consumption.

As to future speculation, the following is extrodinarily rampant, totally imaginary and perhaps connecting dots where there is absolutely no basis for doing so, but its my current flight of fancy:

Everyone knows that London and Zurich are absolute centers of finance and Sterling and the Swiss Franc did not join under the Euro. Everyone knows the housing situation in Britian is worse than here and the bad thing for many British banks is that they hold the bloated mortgages on their books--they can't dump them to private equity like covered bonds or CDOs. This could require more Northern Rocks and eventually the Bank of England could be sunk as its not clear how the international bond market would treat Britian.

The Fed will have a derivative clearing house created by December 31 as security in the event a major market maker fails:

http://www.bloomberg.com/apps/news?pid=20601087&sid=a.66zDrlc08c&refer=home

Market maker as in a primary dealer? Or market maker as the Bank of England? Perhaps the Old Lady of Threadneedle has become too old. The top banks are leaving the square mile of London:

http://www.marketwatch.com/news/story/jpmorgan-chase-eyes-londons-canary...

Perhaps the sun does set on the British Empire?

Again, all crazy speculation but I quite enjoy trying to figure out the events of the day and the possible interconnections between them. This discussion makes me think of one of my favorite movie lines:

Godfather 3:

Vincent Mancini: Don Lucchesi, you are a man of finance and politics. These things I don't understand.

Don Lucchesi: You understand guns?

Vincent Mancini: Yes.

Don Lucchesi: Finance is a gun. Politics is knowing when to pull the trigger.

Ben Bernanke, you have studied the Great Depression your entire career. Please take the stage.

Let the games begin!

And if the Bank of England were to fail, what might the consequences of that be?

The world would have to learn a new way to finance it's business activities.

Remember this is massive speculation on the order of Bob Shaw. The reality of these words actually occuring are about as much as a Huber-Lynch oil field where I can raise Unicorns. I am simply taking a flight of fancy.

The Bank of England has always been very powerful, in fact, in my opinion it is the most powerful central bank even more than the Federal Reserve because of the LIBOR:

http://www.bba.org.uk/bba/jsp/polopoly.jsp?d=225&a=1416&view=print

As the Fed influences the Federal Funds rate, the Bank of England influences the London Interbank Offered Rate (LIBOR).

http://en.mimi.hu/business/libor.html

In the past, the Federal Funds Rate and the LIBOR were almost always identical and one could say connected to other. The connection is that they are both dollar rates--the LIBOR determines the amount of Eurodollars on deposit for foreign central banks in the major banking houses in London and is the primary currency used to settle international transactions. Fed Funds are for domestic dollars.

http://en.wikipedia.org/wiki/Eurodollar

We all know the dollar is the world reserve currency, and Eurodollar simply means the reserves held outside the US. As Uncle Sam runs a trade deficit, the world is flooded with Eurodollars:

http://beginnersinvest.about.com/od/banking/a/aa071105a.htm

The deficit next year is expected to explode. The LIBOR rises as Fed Funds stay the same since massive amount of dollars are moving out of country. A rising LIBOR (London Interbank Rate) damages London Banks as the cost of their financing increase (at the very same time they want to lower rates since their housing market is collapsing).

The Bank of England has taken direct measures to try and influence LIBOR down by pumping Sterling into the market but it hasn't been too successful:

http://news.bbc.co.uk/1/hi/business/7002628.stm

http://business.timesonline.co.uk/tol/business/economics/article3705920.ece

http://www.marketoracle.co.uk/Article4437.html

In addition, the Bank of England now wants to cut rates to save its housing market.

On the other side, to dampen inflation from Eurodollars, the ECB raises rates and performs currency swaps increasing its float to prevent complete collapse of the dollar, along with the Yuan buying up dollars. In addition, the ECB raises rates--England is at 5%, ECB is at 4%, and Fed at 2%. If ECB is equal or higher than England then capital will flee from the Bank of England into the ECB. And the housing bust will be getting worse as the LIBOR rises.

At that point, England will likely have more Northern Rocks. And like where the US is now, will need the international bond market to fund their banks or they collapse subjecting them to the world marketplace for both finance and oil--a position they have never been in before. Will someone save them? And if so, on what terms?

The result would be the death of the LIBOR, perhaps the pound Sterling, and a major shift of power in finance away from the Bank of England.

These are scary times. I am certainly frightened. Power is shifting in a major way. I'm not sure what actions might be taken. People get violent. I don't know how long or when but things are certainly changing. The nationalization of the US banking industry is absolutely historical.

What does this have to do with oil, you ask?

Everything. Once the North Sea collapsed London was vulnerable--they would soon become an importer. Also, the international oil companies such as BP, Shell, Exxon were losing production meaning a loss in leverage concerning OPEC as Non-OPEC started to peak except Russia who is not exactly buddy-buddy with the West. The Middle East was the prize. France & Germany (members of the ECB) had contracts with Saddam Hussien for oil lined up prior to the invasion and if you remember were the countries attempting to block London and the US in the UN prior to the invasion.

London & the US went alone over the objection of the UN. Perhaps they could break OPEC open up new markets and keep financial power. But the war was not successful (maybe the amount of oil found wasn't so much) but the Pentagon needed a secure supply that was obtained in Iraq and I'm sure nobody really wanted to see Saddam stay in power. Cheney pushed to attack Iran and expand the theatre but was stopped by the Pentagon and the intelligence community. Cheney talked to Saudi king maybe pushing to attack Iran and Saudi rejected.

Not that Iran is a good state by any means, but the UN prefers crippling sanctions to war.

In my opinion, we are seeing gigantic shifts in power right now. My sincere hope is that war and violence is not used by those attempting to cling to power.

You are mistaken. Should China and OPEC cease buying US debt, or conversely start unloading US debt, the dollar would collapse. Nouriel Roubini has been speculating that the end of Bretton Woods II may be near. In that case, the US would have no option but default. It is anything but unlikely. The world's central banks are getting tired of propping up the US by recycling its increasingly worthless dollars that are now causing hyperinflation in their nations.

That is why it helps to be the World's (capital W) reserve currency. What are you going to replace it with, the Euro, a recognized failed currency (links available)?

How is the Euro supposedly failed?

a good video you might like is Robert Newman's A brief history of oil...

He muses about Euros becoming the new reserve currency. All OPEC has to do is stop using US Dollars and use Euros instead. All those dollars would go back to the US and the US would have to exchange Dollars to Euros, flushing the market and devaluing the Dollar.. Thus the Dollar currency would crash, even more so. That all oil transactions occur in USD is probably the only thing keeping it up?

Agree with energyblog. Another thing propping up the dollar, in spite of the shambled US financial situation, is the huge amount of dollars and US investments held by Japan and Middle Eastern countries. None of these countries want to see a catastrophic decline in the dollar and probably do not dare demand other currency to replace the same because of the triggering effect this would have on further decline of the dollar. It is a catch 22 situation for those countries.

disagree with energyblog.

the US has major problems but the Eurozone has worse. As credit crisis continues (and we are not even half way IMO, though it may SEEM that we are - definitionally 5 standard deviation events go 2 standard deviations further than anyone expects before the fact), there will be several countries in Euro that can't pay bills without cash infusions and central banks will be forced to act - however they will have to act in unison according to charter, and in times of stress old enmities will surface - I think short term dollar is strong, intermediate term dollar is weak (vs euro) and long term dollar is strong (vs euro). Really long term there are likely no currencies except local ones. But lots of wood to chop (literally) before we get to that point. And there are outs (some)

Barter.

I'll sell you 100,000 barrels of oil for the corresponding value of wheat. This is the one that is easy to understands and seems like it has a reasonable chance of working.

It's not getting carried away at all. Technically being able to pay your debts is fine. The bankrupt part comes when no one wants to buy your debt at which point you are bankrupt.

E.g. You are unable to issue enough paper to willing buyers to buy say

manufactured goods and pay for oil imports.

E.g. You go overseas and people do not want to accept US dollars due to hyper inflation.

So yes a Mugabe type can always pay interest on his sovereign issued paper. (Technically NEVER EVER bankrupt) There is a point where effectively you are bankrupt, in the sense of people wanting to accept your currency falls dramatically.

The pipeline problem: are you saying that the oil infrastructure has developed in such a way that it requires a lot of oil to function properly? So that if the US doesn't have a lot of oil, the oil infrastructure will break in various ways?

Peter.

Pipelines are sized for the amount of oil that they are to carry through them. It is my understanding that they don't work for a whole lot less. Or perhaps, the oil won't get to the end of the line, with a whole lot less. I want to more fully understand how precisely this works, and write a longer post specifically on this subject.

My fear is that if we have too little oil for the pipelines, the allocation of what oil that is available will be based on whatever is expedient -- say, piping the oil only as far as it will go. That could leave fairly large areas without petroleum products. This method could be a problem. For example, areas that need petroleum for coal mining might not be able to get the petroleum products; some of the farming areas might be left without petroleum products to run their equipment. I need to investigate this further. Perhaps some readers have insights on the real workings of the system.

I dunno about that.

They can just slow down the pump speed or just throttle the flow(choke down a valve) reducing the velocity of the flow.

The design velocity is 10 feet per second with a maximum of 15 fps and a minimum of 3 feet per second, so running at 3 fps would reduce capacity by 70% of design and we're not going to reduce crude oil THAT much anytime soon.

I know in some pipelines there is water present so maybe water could be added to make minimum volumetric flow, though it makes little economic sense to move oil and water in a oil pipeline. Is this really a problem?

Do they not try to minimise water content so as to avoid corrosion? I thought I read that somewhere... may be wrong though.

Yes it is.

Water and oil products separate readily. At too low a flow rate there isn't enough turbulence to keep the water suspended. Corrosion happens.

And since most pipelines do not physically separate product batches, lower flow rates causes greater amounts of transmix, which reduces the net salable quantity piped.

Does anyone have good references to read more about the pipeline issues? Some of my thinking may not be correct.

You are correct it was in the Alaskan Pipeline. Slow flows lead to corrosion by a bacteria I thought it was.

Gail...this site seems like it might be a good starting point:

AOPL - Association of Oil Pipelines

http://www.aopl.org/go/site/888/

Thanks!

I don't know about oil pipelines. But here in Germany we have this problem in depopulated areas with water and wastewater pipelines. When population decreases and water consumption decreases the water becomes increasingly stagnant, so that bacteria may grow and the wastewater lines become "smelly". In these cases the operator has to flush the pipelines regularly, causing additional costs. Some even encouraged people not to save water (which is spoiled by the flushing anyway, but to be paid by the operator).

I think it's simply logical to point out that the problem Gail refers to would occur, and not be avioded as majorian hopes, when a single large-diameter pipeline is used as common now, to ship multiple products in fairly small individual quantities for long diatances. I believe common practice now is if eg. 36" pipeline (7 cu ft. / ft of length) going 1000 miles exists, and the pipeline company needs to ship say 5 products in it (gasoline, diesel, crude, lubricants, jet fuel etc.) then they will just sequentially inject each of the products, separated by a 36" diameter sealing plug between them, and the product between it's plugs travels the pipe to the destination(s) where it is selectively extracted to various storages, and the seal plugs are recovered once all of a division is extracted.

So say the pipeline company is accustomed to shipping "250 miles of diesel (6.2 x 7 x 5280 x 250 = 57.28 million gallons)", then 400 miles of gasoline, 150 miles of a third product, and 200 miles of a fourth product each week, in that order, and diesel storage facilities at the destinations are set up to supply local demand for the five days out of seven when other products are coming out of the pipe, but not much more. If shipping volumes drop dramatically unexpectedly, then there may be times when the pipeline operator has no product available to "push into" their end of the pipe, meaning that the delivery point which was expecting to get it's 2 days of delivery of diesel on Monday and Tuesday might continue to see only slow flows of other products for an additional week. Their local storage won;t be large enough to bridge the gap, so the local market goes without diesel for the week.

We could suggest "well, just push in some other product to make the diesel come out the other end". But first, the pipeline may not be designed to handle the corrosion of unusual products, and second, that'll be a huge volume of contaminated water (if that's what's suggested) coming out the other end at some point which must be properly dealt with. And no doubt there would be a certain rate of leakage across the moving seal plugs. Contaminating the first mile of diesel following a load of gasoline with a few percent of gasoline is not a huge issue, the engines wouldn't even notice. A few percent of brakish water though, may be a more serious issue.

Obviously, the issues "should" be manageable by reducing the size of individual injection volumes so that delivery-point timings are unaffected by slower travel rates, but means much more precise sales volume predictions at each of the many delivery points, with a greater liklihood of error.

Disclaimer: This is all based on just my speculation, and I have no actual inside knowledge of the problems involved. I may be way off.

I calculate 70 million gallons.

V = πr²h

So V = pi * 1.5 feet * 1.5 feet * 5280 feet * 250

V = 9.33 million cubic feet.

1 cubic foot = 7.48051948 US gallons

9.33 million * 7.48051948 = 69.8 million gallons

A 250 mile pipeline with a 32.6" inner diameter would contain 57.28 million gallons.

I think it already happened. There were fuel shortages in the Dakotas last year, and they complained it was because they were at the end of the pipeline, and were left with the crumbs. It was especially a problem during harvest, when the farmers needed diesel.

I know that there have also been problems in Colorado and in Canada, blamed on being at the end of pipelines. Also, when supplies of gasoline were low last year (?), it seems like Matt Simmons was concerned about the possibility of East Coast pipeline shortages.

So the situation is similar to the Colorado river, where water districts divert their water allotment via pipelines of their own and eventually nothing reaches the other end? The Colorado river used to reach the sea.

Not for many years now.

I'm trying to use an analogy I can understand.

G

I think you have basically hit on the problem. If there is not enough to go around, the ones at the end of the line are the most likely to get left out.

We need to take a close look at what happened with the Colonial Pipeline after Katrina. Supplies were extremely tight on the East Coast. Loss of electrical power was reported to be a factor...

I talked to a fellow who worked on getting the Colonial Pipeline going again. He said that power outages along the coast after Katrina hit caused the pipeline to stop moving oil. He was with one group of people who moved a diesel generator up to the pipeline, and used it to generate electricity to get the pipeline going again. Oil from the pipeline was used to power the generator. It sounded like state troopers watched over the operation. There may have been several places where this type of operation was needed, to get the oil moving again.

Your statement that some mining operations could be put at risk because of a shortage of energy inputs

is worrisome. This of course has already occurred in South Africa. My state of Wyoming supplies 38% of the steam coal used to generate electricity in the US but our biggest regional power plant, the Jim Bridger plant in SW Wyoming mines it's own coal with a huge electrical umbilical power cable powering the massive coal shovel. The coal mined in other areas of the state such as the Powder River basin depend on diesel to mine and the railroads to transport coal out of state. Our state does have refineries which produce the distillate fuels making the state theoretically less vulnerable to fuel shortages. The pipeline issue you raised is disturbing if true. But the complexity of all these interconnected networks poses great risks, not all of whom are readily apparent to an incompetent government, a media lacking scrutiny and an uneducated and inattentive citizenry. Thank you Gail for your continued superb and independent work.

I visited the BP installation in Wamsutter in May and could see that natural gas production there depended on having oil. If nothing else, workers need food, and this generally requires shipping food to Wyoming, often by truck. I don't understand the electric situation as well, but there are so many interconnections, it seems like there is a lot of risk for failure. If anyone tries to do rationing, I am sure they will miss some of the critical needs to keep everything working.

Gail;

I think this dependency of one fuel type on another is worrying, the very heart of complexity, and to put it in the context of one of my little soapboxes, I have been asking those who join into Nuke/Anti Nuke conversations to say if they have heard of any studies that have been done on the complex (or maybe not so complex?) string of continuous dependencies that a Nuclear reactor has in order to maintain steady and safe operation. Whether it's the ability of the workforce to get to the site, the consistency of the roadways and trucking companies that provide parts and regular supplies, or the suppliers of the specialized and energy-intensive parts themselves, that these plants require.

Probably part of a different (and more difficult) conversation, but I felt it applied to the general issue of how much and what kind of energy any given energy source requires to keep the power flowing.

Bob

Excellent analysis and forecasts. Thanks for doing all this work, Gail.

Regarding 8. The 2.1 million vacant homes in the U.S. is an astounding number. Kunstler's doomsday profit rating has been significantly upgraded.

An investment banker friend tell me cash is the most secure investment right now, with the caveat that cash is not a very secure investment right now.

As long as it isn't US cash.

Even cash is not safe. Money created by bankers out of thin

air. The thing with all this financial mumbo/jumbo is "the amount

of money is limitless". All this run into the brick wall of finite

resource. In the end, it's the resource that matter. We'll all be fighting for it -- whether it's oil, land for crop, etc... Of course, a lot of us are betting that "things won't get that bad in our lifetime" -- our grand-children will have to put up with it.

I think the point that it is the resources that matter is a point that a lot of people don't understand.

When looking at the future, most people seem to follow the approach of taking today, and projecting forward, using compound interest. This is the financial planner approach.

I personally have not worked on Social Security funding, but I discovered when reading about it that one approach was to look at what resources were likely to be available, and divide those resources between workers and retirees. With declining resources, I think that this is the only way one can look at things. I use a little of this approach in my post/talk The Expected Economic Impact of an Energy Downturn.

Exactly, it's all about the resources, and how we are going to pay for them.

When looking at things from a global perspective, it's just striking how much money is tied up in otherwise worthless real estate.

Why worthless?

Well, consider we are bidding for oil in the international arena.

India offers cheap yet well educated labour in return.

China offers cheap and reasonable quality consumer goods, 'must have' gadgets.

Other countries might offer minerals, or agriproducts in return for oil.

What does the US have to offer? Residential buildings? Who would sell oil in return for houses which are loosing value?

Ok, since Bretton Woods, it was the US$, everyone trading on a global scale had to have. So for the US it was really that easy: just print enough Dollar notes. And as long as more and more countries needed to pay for their imported commodities and later oil in US currency, retaining its value against other currencies was guaranteed.

But it's coming down.

There is a marked trend since the start of the new millennium, in the number of countries dropping the traditional reserve currency denomination in favour of the Euro. The outlook for the Dollar simply wasn't/isn't seen as promising as the Euro's in an expanding (eastward) market.

So, in order to successfully bid for the world's oil, the US will have to find something new to throw into the deal.

How about human rejuvenation, techniques for reversing the ageing process?

There are two things that have kept the dollar and our economy from complete implosion...the flow of petrodollars in US currency and the US military to maintain that flow. This is why the Fed Gov says that if the US fails, so does the world.

Another thing--I think that having a lot of refineries in the United States has tended to steer a lot of oil our direction. Once it is here, we keep it.

Yep, the ol' petrodollar cycle...

In pre-euro times, this cycle closed itself almost exclusivlely in the US.

If we still were under these old conditions, the US just would rake it in at currently sky high oil prices (via their OPEC friends).

But the re-development of infrastructure in oil producing middle eastern countries has drawn other players to the table. Members from euro-land so to speak have won numerous lucrative contracts. And these new kids on the block are not getting paid in riyal. No, they take the greenback instead which they can use to buy other commodities and oil which they smartly convert into goods and services their desert dweller friends desire....

And because the petrodollar cycle has gotten a new brother called petroeuro cycle things are being shared more evenly.

It has been said so often, too much money on the market chasing too few goods, but now it's too little money chasing too few goods - stagflation....

If I understand this right.

And I strongly believe the US has some smartness up its head to devise a plan of adaptation rather than throwing the whole planet away.

Gail,

As always I appreciate your thoroughness. I just thought that I would mention that is the US is unable to procure sufficient credit to continue to purchase imports (or to "ration" which they do procure), there are a LOT of imports that the US could do WITHOUT (e.g. toys from China, etc., etc.). Also there is LOT of energy consumption that is not so critical (driving to movies, driving to the corner store, driving to work when telecommuting would work as well, etc., etc.).

I also believe that China especially, but also many other countries would be very willing to keep financing the US for political reasons. For example, China will want to be able to exert pressure on Taiwan and the US Navy could be a significant "thorn" in the side of any invasion force sent by China to Taiwan. Also, the Chinese balance of payments is not SO large with other countries that they could readily afford to see the US cut back on non-essential imports.

There are plenty of good reasons for many countries to keep financing the US debt monster apart from strict short-term profit reasons.

Finally, I thought I would mention a key question: What would happen to the massive US export surplus in Agricultural products if the US was not able to continue to purchase oil?? Wouldn't that mean that many countries would go hungry, en masse?? At some level, the US farm sector may "save" the US because so many people depend on the US to sell them food. Also, if the US were to reduce its meat consumption, there would be more export surplus in grain to help with the balance of payments problem.

In Summary, I think that there are SOME factors that would help mitigate the WORST of what you suggesting (although I strongly suspect that you are correct in your overall thinking).

Ian

We are fortunate to have as much good farmland as we do in this country. The farmland, plus energy resources, plus a favorable climate, put us way ahead of a lot of other countries.

We should theoretically be able to do quite a bit with what we have. There is just a big gap between where we are and what is sustainable.

Dinh: Swiss francs are fairly safe. The US dollar is in very serious trouble long term.

Is "doomsday profit" a Freudian slip?

it's very good... will have to use it!

I would guess that there are actually more than 2.1 million vacant homes. Some people are waiting to put them up for sale until "the market gets better".

My mother owns a townhouse but lives in an assisted living center. The townhouse is only used for occasional visiting out-of-town relatives. The house is not really needed, but it is paid for, and my mother doesn't need the money. There isn't much of a market for it, so it hasn't been put up for sale.

Probably the same with a lot of "vacation homes" too. A lot of these would be on the market if the market were better.

I'd say 'reverse-mortgage' it which a lot of seniors do, but is this another form of mortgage securitization 'fraud'?

I wonder how big the 'reverse-mortgage system is?

Can people still get reverse mortgages?

I know a number of people who are sitting on multiple houses.

How long can they do that?

The housing legislation which was recently passed raised the limits available on reverse mortgages to $417,000 in most areas and $615,000 in high cost areas (same limits as Fannie and Freddie).

It looks like these reverse mortgages are guaranteed by FHA and Fannie Mae, so I presume they continue to be available. The minimum age is 62.

So Gail, are you actively pursuading your mother to sell the townhouse? From your post, it seems like you'd be most concerned that your mother might have an empty house in a crashing credit market and bank-failure era.

I stay out of this one. She doesn't need the money and other investments aren't particularly safe. The townhouse is in a reasonable location, near farm land. It might be in a reasonable location for my family or one of my siblings to live post-peak.

I linked to the source of your statement that Indymac wills use 15% of FDIC, but didn't see that figure. Can you please clarify?

Preliminary estimates are that the IndyMac bankruptcy will cost $4 to $8 billion. The FDIC Has $53 billion dollars in assets (to insure $4 trillion plus of bank deposits). The 15% number comes from dividing $8 billion by $53 billion.

This is a link to a WSJ article on the subject. I changed the link above to this one as well.

Thanks for the article Gail... follows much of my thinking, and adds things I haven't thought about. Do you/does anyone, know anything about the UKs FSCS (equivalent of FDIC I think)? I'm not sure what assets it has, maybe none!, maybe any use is just added to the government deficit?

I looked at the FSCS web site. It looks like they started the year with £103.4 million, and are planning to collect levies of £28.3 million, to bring their total fund balance to £131.7 million (from here). This is not enough to cover any reasonable size default.

There is a new plan, effective April 1, 2008, that permits levies of up to about £4 billion each year from insured institutions, if there is a need for this much. The US bankruptcy of IndyMac is estimated to cost from $4 to $8 billion dollars, so this is the equivalent of covering a maximum of one IndyMax loss per year. The plan seems to apply to pensions, general insurance, life insurance, bank deposits, brokers, and a few other categories. Any loss from one of these would go against the £4 billion total available annually.

It looks to me as if the fund won't go very far if it needs to cover multiple large claims. UK seems to be in as bad shape as the US in this regard (or worse).

Thanks. I didn't manage to find that page when I looked previously, or didn't quite understand it. I watched a couple of recent Treasury Committee hearings on banking reform, partly relating to the FSCS. It seems that there are different provisions for deposit protection depending upon whether the bank is a UK bank, a European Economic Area bank(EEA), or a non-EEA bank. The whole thing seems quite confusing, and quite obfuscated, but you're right it looks like there's not enough to meet the bankruptcies I'd expect.

The media has portrayed deposit protection (of up to £32,000) as a certainty though, so I guess the government would have to step in if/when the FSCS fund is exhausted.

Incidentally, they are apparently attempting to introduce new banking legislation in the autumn, to clarify responsibility for financial stability... but will it help, or even come in time?

The FSCS can cover one big claim or a handful of small claims. The government can step in and handle a few more -- say five times what the FSCS covered. The problem is that with huge numbers of people unable to pay their mortgages, the number of failures can be bigger than even the government can handle. What does one do then?

If you're right that the government won't be able to inflate to provide the required deposit protection, it seems likely that at some point there will be total chaos, and imposed limits on daily cash withdrawals etc.

I still don't fully understand what prevents them from nationalising the banking system, in the style of Northern Rock, and now what seems to be happening with Fannie May and Freddie Mac though - what prevents them from increasing the deficit? I know that doing so will destroy the currency and create massive inflation, but find it hard to see a better choice for them.

It has to be said that in the UK there is an very noticable increasing police presence. This will be needed if they start limiting withdrawals!

If a country inflates the currency, it will still work for transactions within the country, but currency loses value for buying overseas imports. The UK would do very poorly without overseas imports.

The amount of US external debt is $5 trillion. Adding the liabilities of Fannie Mae and Freddie Mac would add $5.3 trillion, so would more than double the US external liabilities. The amounts are so huge that no one dares suggest actually putting the amounts on the US balance sheet.

http://www.fscs.org.uk/industry/funding/

Ouch, It's nice to see someone who presents their past predictions for review versus the predominant pattern of forcasters to try to hide any poor predictions under the nearest carpet.

One of todays scary factoids that I heard on Bloomberg this am discussing the huge GM losses just posted is that large SUV's going to auto auctions are not getting any bids whatsoever.

Sure the decline in house prices is painful but many owners will not move and keep making the payments, but imagine what happens when folks realize the SUV they paid $40,000 for last year is now worth not $30,000( expected; drive-it- off- the- lot onetime depreciation) but 10,000 or 15,000? This is a more direct impact to folks perception of wealth or predilection to spend than possibly the housing crisis.... GM's estimate is each SUV coming off a closed end lease is $11,000 under their forcast residual value. How many smaller dealers can afford to accept $10,000 losses on trade-ins already sitting in their lots for 4-8 weeks?

Systemic- no but serious condition in a bellweather consumer segment

I agree SUVs will be a big problem. If people have an SUV plus a smaller car, I can imagine some of them just stopping making payments on the SUV. The lender can have it back, for whatever it is worth.

I expect the consumer segment will be showing more and more anguish as the year goes on. I think the ones that are hurt hardest right now are those living on close to minimum wages.

It's not just the SUV --- it's our lifestyle. When I saw my sister's closet with hundred of shoes, I can see why we are in the situation we're in. When we have super-sized meals and wonder why we're fat and where are our resource goes -- it showed situation we're in. Capitalism pushes people toward consumerism -- it seemed that you can't have a good economy unless people spend money on junks. That's why the President gave everyone $300 to buy more stuffs to stimulate the economy. Time to stop and think and get ourselves out of this slavery mode. I am all for making money but "at what cost to us and our future generations". Somehow, not too many are concerned with the "future cost".

Are there any data on what % of the recent stimulus handout in US was actually spent vs. paying down debt?

There is really a three way split: spent, saved, and paying down debt. There seem to be a number of small surveys, with differing results. The surveys show 25% to 45% of stimulus handouts used for debt pay-down. These are a few links:

National Retail Federation:

thanks for this update Gail. glad tod has u onboard as finances is the main peak oil [US] casualty these days & having a bit of an ira still in the fray i am all eyes & ears to steer as best as i can for me & my family.

i learned of peak oil 3 yrs. ago & didn't know a bid from an ask yet took control of 3 relatively small iras' to try & keep what little financial security we could from the peak oil tsunami & maybe turn a buck as i don't expect my SS to be of much help.

i am somewhat amazed that u tie abrupt defaults with the US moving below minimum operating levels in the oil "pipeline". i have a hard time seeing the connection as that 'immediate' that the cause & effect would be clear & apparent. couldn't we use the SPR too? or, are u thinking about a 6 mo. time lag or so - financial to spot shortages.

one of my biggest concerns is deflation vs. inflation. it makes a lot/fair amount on how i place our bets!

my impression is the inflation route is already chosen & cannot readily be changed. but could we get obama & volker maybe? & a turn around after the elections.

& a no. believe the fed will be overwhelmed by the rate of defaults & deflation will over take us. certainly the gov can deposit $ in our accounts overnite & we are trained to spend [as long as our bank is still functioning].

i gather a semi-controlled default rate- as we are having ,will allow the inflation scenario to work. u'r thoughts?

thanks again!

I think we will aim for inflation, but will end up with a lot of failures that simply cannot be rescued. This may sound strange, but I am concerned that electrical outages will become such a problem that we will simply lose track of a lot of electronic assets. If this happens, is the result deflation?