World Oil Production Forecast - Update May 2009

Posted by ace on May 19, 2009 - 9:59am

[Please refer also to my more recent forecast: World Oil Production Forecast - Update November 2009. ]

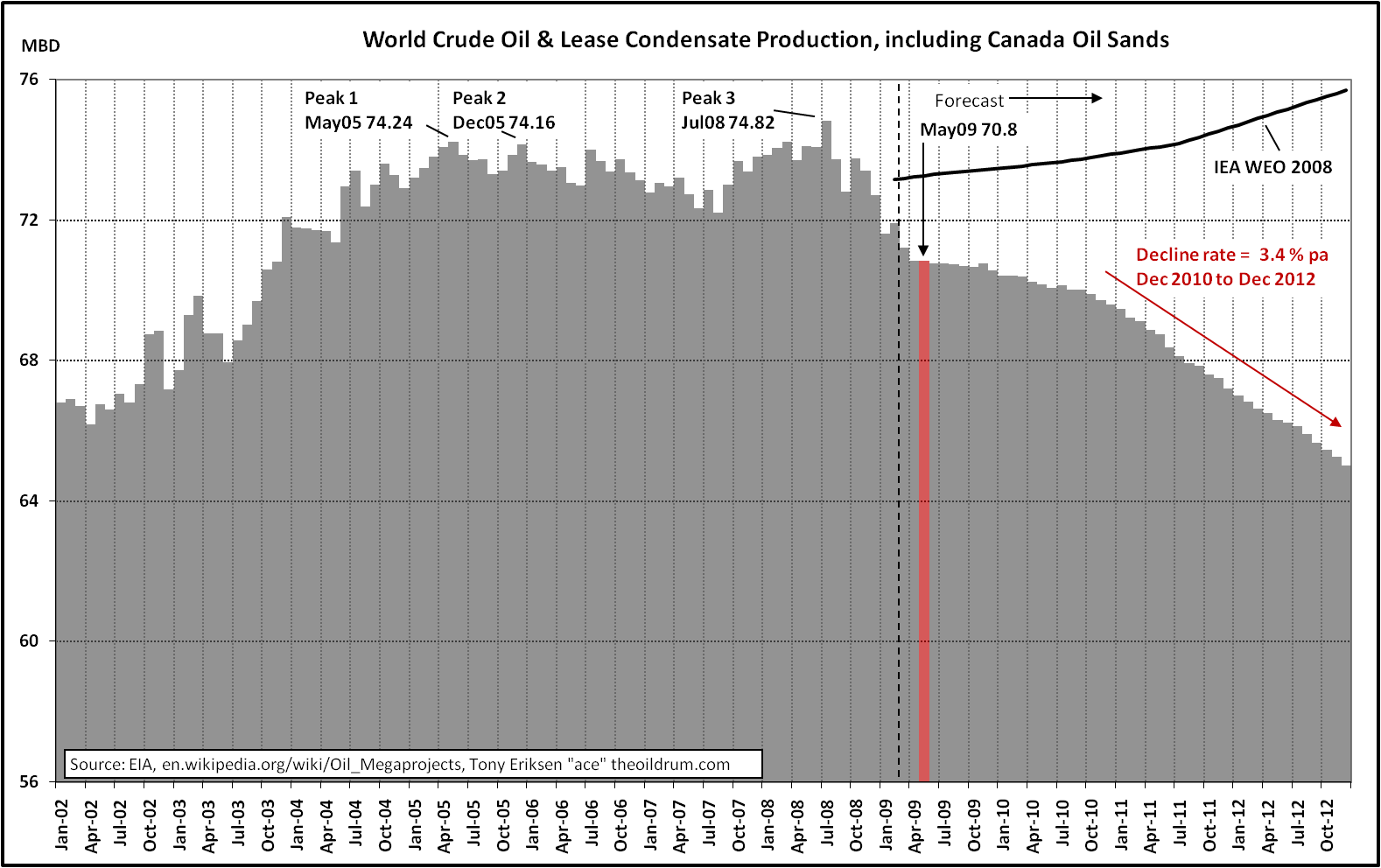

World oil production peaked in July 2008 at 74.82 million barrels/day (mbd) and now has fallen to about 71 mbd. It is expected that oil production will decline slowly to about December 2010 as OPEC production increases while non-OPEC production decreases. After 2010 the resulting annual production decline rate increases to 3.4% as OPEC production is unable to offset cumulative non-OPEC declines. The forecast from the IEA WEO 2008 is also shown for comparison.

The US Energy Information Administration (EIA) and the International Energy Agency (IEA) should make official statements about declining world oil production now to renew the focus on oil conservation and alternative renewable energy sources.

World Oil Production

World crude oil, condensate and oil sands production peaked in 2008 at an average of 73.78 million barrels per day (mbd) which just exceeded the previous peak of 73.74 mbd in 2005, according to recent EIA production data. Production is expected to decline further as non OPEC oil production peaked in 2004 and is forecast to decline at a faster rate in 2009 and beyond due mainly to big declines from Russia, Norway, the UK and Mexico. Saudi Arabia's crude oil production peaked in 2005. By 2011, OPEC will not have the ability to offset cumulative non OPEC declines and world oil production is forecast to stay below its 2008 peak.

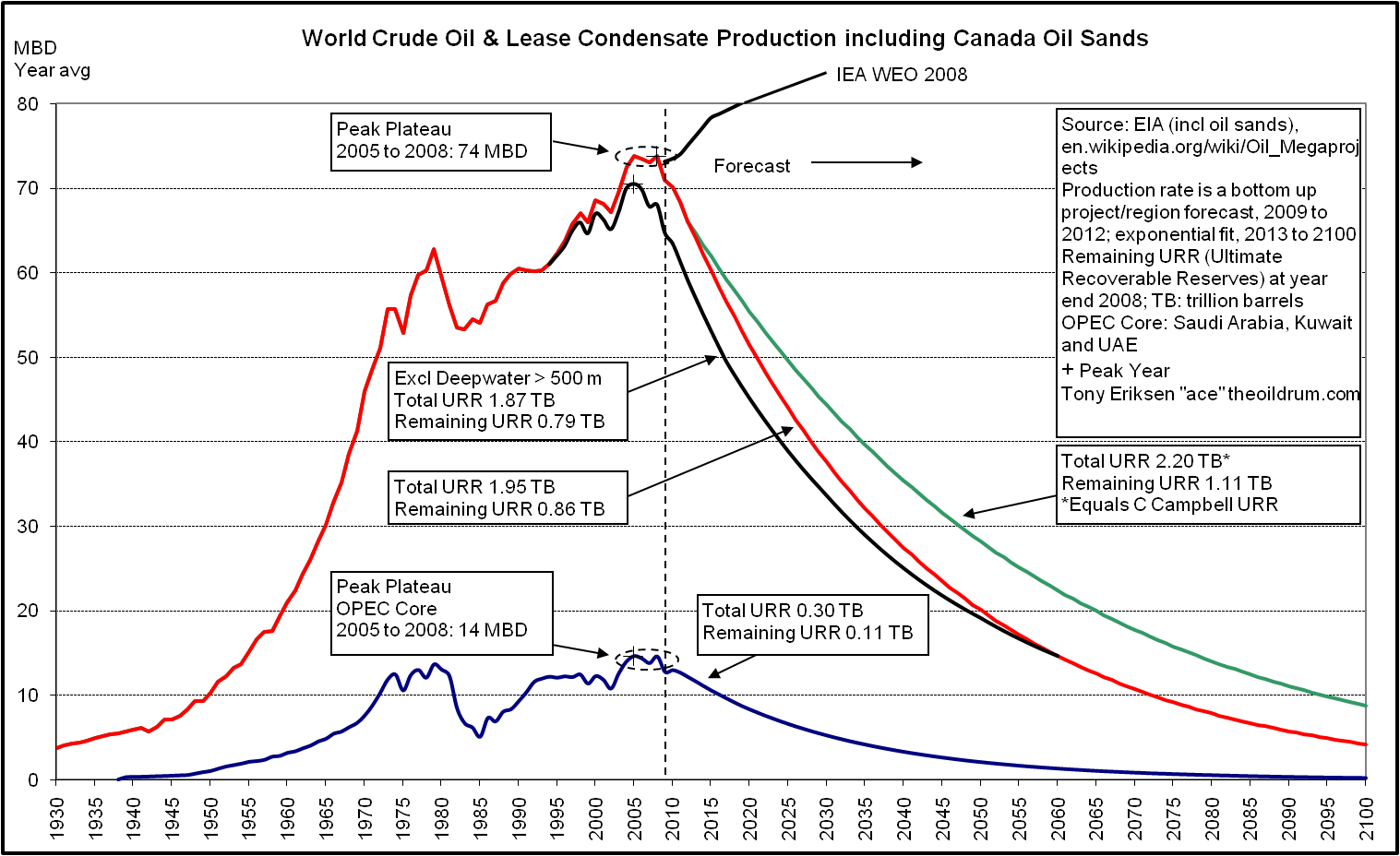

My estimate of 1.95 trillion barrels (TB) of total Ultimate Recoverable Reserves (URR) of oil is used to generate the forecast shown by the red line below. If Colin Campbell's estimate of 2.20 TB is used, which is 250 billion barrels (Gb) greater than my estimate due mainly to more optimistic assumptions about OPEC reserves, the peak production date remains at 2008. This shows that an additional 250 Gb of recoverable oil reserves does not change the peak oil date and instead increased production rates occur later as indicated by the green line below. Additional reserves and the related production from prospective areas such as the arctic, Iraq, and Brazil's Santos basin are highly unlikely to produce another peak but should decrease the production decline rate after 2012.

![]()

World Liquids Production

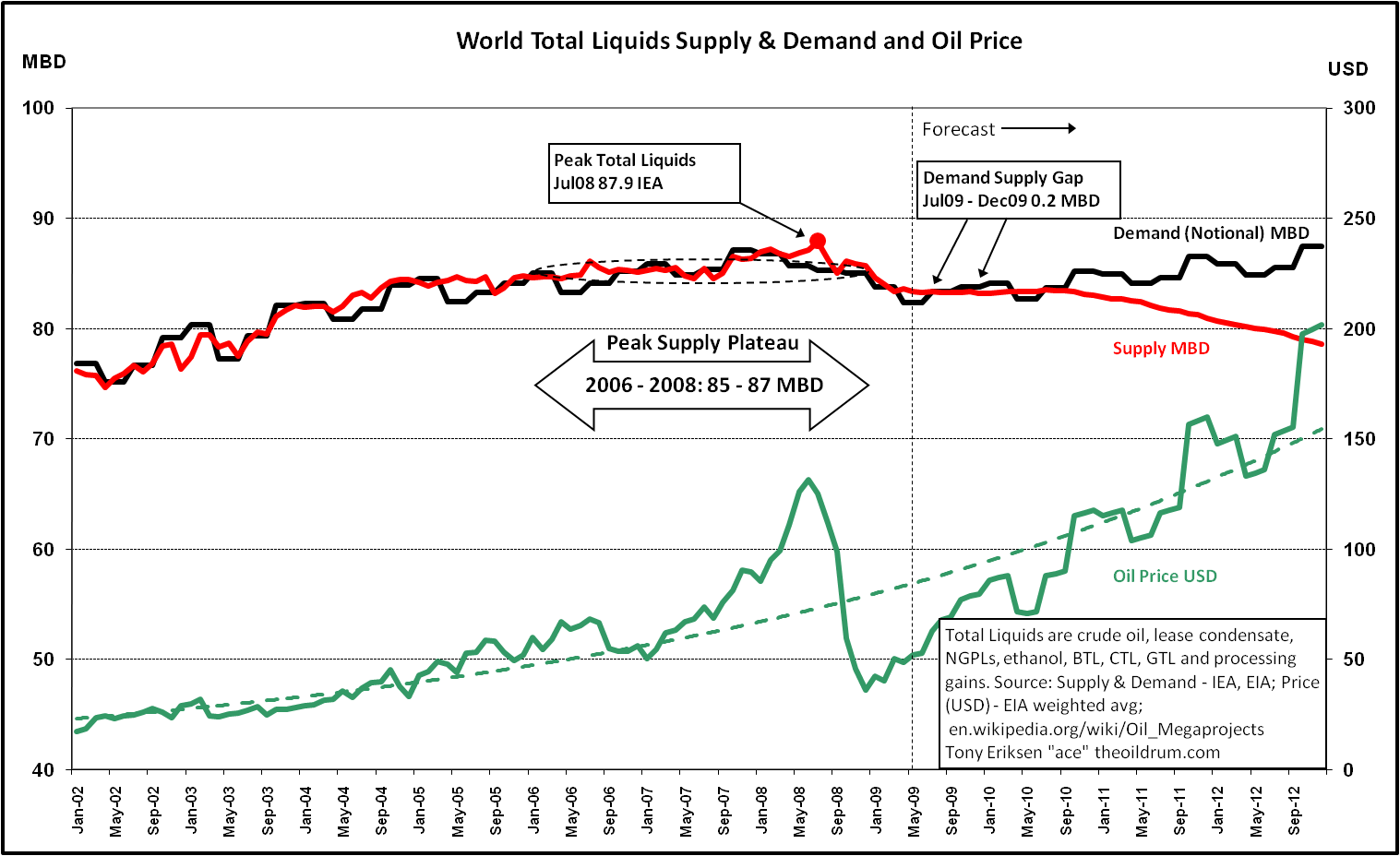

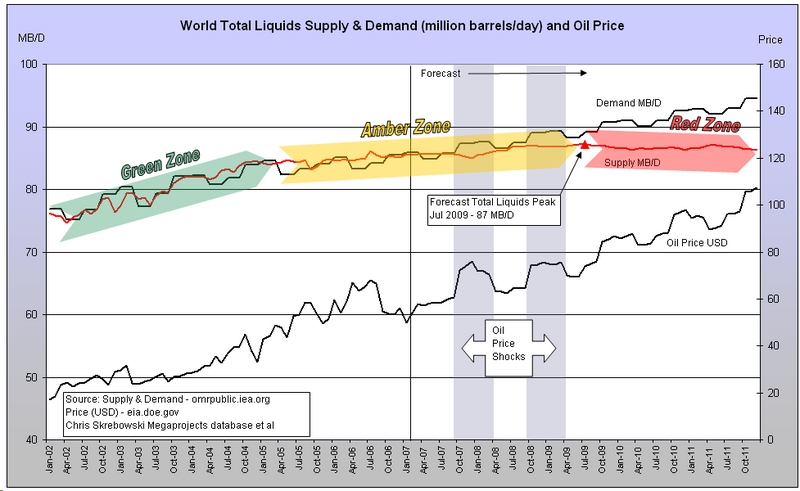

The definition of oil used by the International Energy Agency (IEA) also includes natural gas liquids (NGL), bio-fuels, processing gains and other liquids derived from natural gas and coal. OPEC NGLs were supposed to cause a significant net increase in world NGLs but this has not happened yet as NGL production is struggling to exceed 8 mbd. According to the EIA NGL data, 2007 production was 7.96 mbd, 2008 was 7.94 mbd and 2009 year to date was lower again at 7.80 mbd. Although bio-fuels production has been growing exponentially, world liquids production has probably passed peak in July 2008 at 87.9 mbd as shown below. In 2008, US ethanol production was 0.6 mbd, Brazilian ethanol production was 0.4 mbd, and bio-fuels production outside the US and Brazil was 0.5 mbd.

The average oil price should stay below $US 80/barrel for the remainder of the year as average demand is forecast to be only slightly greater than supply from July 2009 to December 2009. Furthermore, OPEC is unlikely to cut supply further which reduces the upward pressure on oil prices. Some recent evidence of increased demand is shown by US crude oil stocks dropping from a recent peak of 26.2 days at the end of April down to 25.5 days in early May. However, oil prices could exceed $100 in late 2010 as world liquids production drops further. High volatility of future oil prices is also expected due partly to delays in investment causing future oil capacity additions to decline sharply to 2012.

![]()

Sources of Future Liquids Production

There are many sources of future liquids production but it is highly unlikely that production from these sources will cause liquids production to increase above its July 2008 peak because the cumulative declines from existing crude oil production sources are too great. Key sources of future production are future discoveries. The chart below, from Colin Campbell's newsletter, shows that annual discoveries have been decreasing since the mid 1960s. It also shows that production has exceeded discoveries since 1984 which is clearly unsustainable. Campbell also forecasts future discoveries to be 110 billion barrels (Gb) which is also the number assumed for the forecasts in Fig 2 above.

Jean Laherrere also produced a discovery and production chart below from his 2008 presentation. Future discoveries, represented by the area under the dashed green line, are about 120 Gb being slightly higher than Campbell's estimate. Laherrere's discovery curve includes deepwater discoveries and also indicates that production peaked in 2008. Many of these future discoveries are likely to be either deepwater or in arctic regions. These discoveries may be significant but the time between discovery and first oil can easily be ten years which will probably not change the peak production year of 2008 but should lessen the future production decline rate.

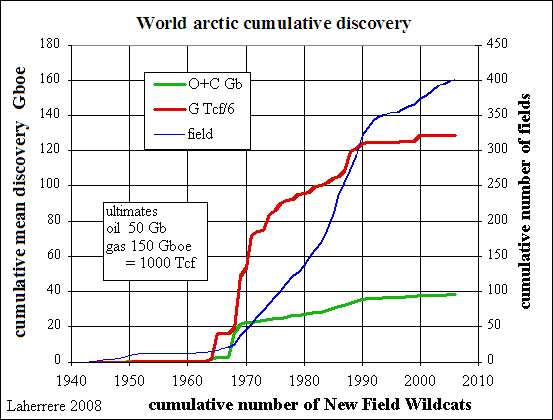

The arctic region is prospective for both oil and gas but quantities need to be estimated. Jean Laherrere estimated that the ultimate recoverable oil reserves are about 40 Gb while Colin Campbell estimates 52 Gb. There was a panel presentation at the 2009 Offshore Technology Conference (OTC.09) which discussed arctic energy challenges. One of the speakers was from Wood Mackenzie who confirmed that the arctic was prospective but mainly for gas not for oil. A report by Wood Mackenzie and Fugro Robertson estimated that the arctic will produce only about 3 percent of the world's oil and that arctic oil production, at best, would peak at 3 mbd several decades from now. Future production from the arctic region should help decrease future oil production decline rates but will probably not change the peak oil production year from 2008.

Other regions considered prospective are the US outer continental shelf (OCS) and Alaska's Arctic National Wildlife Refuge (ANWR). (Please note that the oil production potential of ANWR has also been included in the discussion above of the arctic). At this OTC.09 panel presentation on energy challenges, there was much discussion about allowing further drilling on the OCS and the ANWR. The American Petroleum Institute (API) was represented by its CEO at the panel and the API recently released this ICF report detailing potential reserves and future production from currently restricted areas in the OCS and the ANWR. This report concluded that an additional 1.1 (middle case) to 2.0 mbd (alternative case) of oil production, the majority from ANWR, might be possible by 2030 if drilling was allowed in these restricted areas. This additional production would benefit the US but would not change the peak oil date of 2008.

Canada often states that its oil reserves are almost 180 Gb. However, it is critical that 173 Gb of these reserves relate to oil sands which are not easy to produce. The chart below is from a recent presentation by the Canadian Association of Petroleum Producers and indicates the potential of Canada's total oil production to reach over 4 mbd by 2020. The forecast indicated by the red line in Figure 2 assumes that Canada oil sands production will reach a maximum of 2 mbd. Oil sands production was 1.2 mbd in 2007 and the International Energy Agency (IEA) is forecasting 2009 oil sands production to be slightly greater at 1.34 mbd. David Hughes, a Canadian geologist estimates that oil sands production will stay below 2.5 mbd due to constraints on natural gas, water and diluents. Oil sands production may reach 2.5 mbd but will not change the peak oil year.

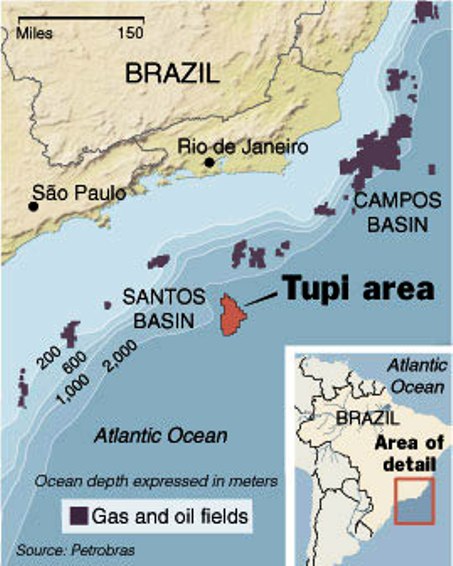

A promising area of future liquids production is the Santos basin, offshore Brazil. There are technical challenges, explained during a Petrobras OTC.09 presentation, with the pre-salt discoveries such as very high pressures and temperatures but Petrobras is optimistic about the Santos basin, stating that this basin may almost double Petrobras' oil reserves. This implies that the Santos basin could hold as much as 15 billion barrels of recoverable oil. However, it is always important to focus on the potential future production rates in addition to the size of the reserves.

The Tupi field was discovered in November 2007 in the Santos basin and an extended well test (EWT) started in early May at a rate of 15 thousand barrels per day (kbd), to be increased to 30 kbd by the end of 2009. The Tupi EWT will run for about 16 months to better understand the flow characteristics of the pre-salt reservoir. If this EWT performs well, then a pilot test of 100 kbd should start in late 2010. If the pilot test is satisfactory then plans for full scale commercial production would be implemented. However Petrobras CFO expects a long ramp up period with Tupi peaking at over 200 kbd at the earliest in 2017. A Wood MacKenzie analyst predicted that Tupi could peak at around 1 mbd in 2022 which appears significant but Petrobras will need this increased production from the Santos basin to maintain total production at 2 mbd. The reason is that declines from existing offshore fields are about 10% or 0.2 mbd per year as confirmed by the Petrobras CFO. Future production from the Santos basin will benefit Brazil but will probably have only a negligible impact on the world production past 2012 (see Fig 2 above).

Iraq is perhaps the most promising country in the world for future potential oil production. However, it has not been an attractive country for investment not just because of terrorism but also the lack of petroleum legislation which includes national revenue sharing from the oil fields of the semi-autononous region of Kurdistan. The chart below shows that Iraq's production might reach 8 mbd by 2020 if sufficient investment was available, peace prevailed and satisfactory petroleum legislation was passed. The ultimate recoverable reserves of oil of 130 Gb is based upon Laherrere's 2003 analysis. Colin Campbell had originally forecast 4.5 mbd being reached by 2014 but now has revised that lower to 2.65 mbd in his June 2008 newsletter. In mid May 2009, the former Iraq oil minister said that Iraq's output could reach 4 mbd by 2014 and 7 mbd by 2019 if satisfactory petroleum legislation is passed in 2010. My forecast, shown by the red line in Fig 2, assumes that Iraq will produce 2.7 mbd in 2012. If the former Iraq oil minister's predictions become true then future production may be closer to the green line in Fig 2 rather than the red line. The peak oil year of 2008 would be unchanged.

The application of advanced technology on existing discoveries is often thought to have potential for increasing production rates and recovery factors. The first production wells developed were vertical then horizontal wells became common practice. Next maximum reservoir contact wells were used for some reservoirs. Finally extreme reservoir contact wells, graphically illustrated below, are being researched by Saudi Aramco in an effort to boost recovery efficiencies. Generally, more horizontal laterals in a production well allows faster extraction of the oil but at the expense of higher production decline rates later. This recent Uppsala University report on decline rates of giant oil fields stated the following:

The important conclusion is that higher decline rates must be applied to giant fields that enter decline in the future. Prolonged plateau levels and increased depletion made possible by new and improved technology result in a generally higher decline rates. Detailed case studies of giant oilfields suggest that technology can extend the plateau phase, but at the expense of more pronounced declines in later years.

In conclusion, this analysis shows that the average decline rate of the giant oil fields have been increasing with time, reflecting the fact that more and more fields enter the decline phase and fewer and fewer new giant fields are being found. The increase is in part due to new technologies that have been able to temporarily maintain production at the expense of subsequent more rapid decline. Growing average decline rates have also been noted by IEA (2008). The difference between using a constant decline in existing production and an increasing decline rate is significant and could mean as much of a difference of 7 Mb/d by 2030.

There are other technologies such as injection to increase pressure in the reservoir. Natural gas, water, nitrogen and carbon dioxide injection can all help to maintain reservoir pressure and production rates. In 2008, Saudi Aramco injected a massive 13.7 mbd of water to maintain reservoir pressure so that 8.9 mbd oil could be produced. Fracing or fracturing the reservoir formation is another technology which can help increase production rates. The fracing can be done by forcing fluid into the formation causing fractures which are held open by special frac sand. Acid can also be used for fracing as the acid can dissolve some of the rock and increase permeability.

New technologies can extract the oil faster but can the recovery factor be increased? Schlumberger has stated that the average recovery factor for all reservoirs is about 35%. This BP study stated that the average global recovery factor is about 30-35% based on 9,000 fields from the IHS Energy database. Conversely, Saudi Aramco stated in its 2008 Annual Review that they are targeting recovery factors of 70 percent partly through the use of reservoir nano-bots known as Resbots. These Resbots would be deployed with the fluids injected into a reservoir to record pressure, temperature and fluid type which could be retrieved later in an effort to increase recovery rates. The OTC.09 Panel Presentation on Technology discussed the importance of technology and one of the presenters believed that technology will allow companies to recover over 3 trillion barrels of oil. It appears that recovery factors can be increased by using new technology but the magnitude of the increase is not clear yet. However, it is unlikely that the improved recovery factors will cause oil production to exceed its 2008 peak.

Mexico's Cantarell field is an excellent example of the use of advanced technology to stimulate the production rate, followed later by a steep decline rate. This field once produced over two million barrels per day (mbd) in 2004 and now production is less than one mbd with an annual production decline rate of over 30%. The chart below, from Matt Simmons' OTC.09 peak oil presentation, shows the steep production decline continuing into 2009. In early 2000, Pemex started using the technology of nitrogen gas injection to keep up pressure to increase production rates which was successful. However, production began to decline after 2004 and Pemex drilled horizontal wells in 2006 in an effort to extract more oil. These horizontal wells probably helped to slow the production decline rate. These technologies of nitrogen injection and horizontal wells have helped to keep production rates high. As the impact of these technologies weakens, the annual production decline rate has increased to over 30%. The expanding gas cap in the Cantarell dome continues to intersect more production wells which decreases the production rate leading to an expectation that Cantarell could become uneconomic as early as 2014.

![]()

Implications

The future sources of liquids production discussed above will help decrease the future rate of decline but it is highly unlikely that the 2008 peak will be exceeded because there are not enough countries with increasing oil production able to offset those countries with decreasing oil production. IEA oil supply warnings have been made in late 2008 when chief economist Birol said that the world needs the equivalent of four new Saudi Arabias just to maintain existing production to 2030. In April 2009, IEA's executive director Tanaka said that the world may face a crude oil shortage by 2013. As world oil production declines, consumption must also decline. Consequently, action must be taken now to reduce oil consumption and switch to alternative renewable energy sources. These sources include electricity generation from wind turbines, photovoltaic panels and geothermal sources. Other sources might be ocean energy which includes tidal energy, wave energy, thermal energy and ocean algae biofuels. Ocean thermal energy conversion was the subject of an OTC.09 panel discussion.

The IEA has recently published some recommendations to improve energy efficiency which apply not just to individuals but also to industry. For example, in the transport sector, the IEA is encouraging the use of fuel efficient tires and introducing mandatory fuel efficiency standards for light duty vehicles. In addition, this IEA document, called Energy Efficiency Policy, also encourages energy efficiency by providing links to almost 30 documents containing energy efficiency policies. One of these documents called Saving Oil in a Hurry suggests many conservation actions including increased use of public transit, car-pooling, telecommuting and speed limit restrictions. For further information, the IEA has its own energy efficiency web page. This recent Oil Drum story proposes many oil conservation ideas for individuals such as moving to a walkable neighbourhood and trading in your car for one with better mileage.

There is no simple solution to the problem of declining world oil production. A simultaneous multipronged approach will emerge which not only addresses oil conservation but also the development of alternative renewable energy sources. As oil production declines, a possible solution is to secure long term oil supply contracts ahead of the next oil price shock. China has been securing long term oil supplies from Russia, Venezuela and Iran. As oil remains critical for economic activity there is a high probability that some countries will act more aggressively in securing oil supplies, even to the extent of oil resource wars. In mid May 2009, Russia raised the prospect of war to enforce its claims on Arctic oil and gas riches.

Additional Information Sources

World Oil Production Peaked in 2008, March 17, 2009

Saudi Arabia's Crude Oil Production Peaked in 2005, March 3, 2009

Non OPEC-12 Oil Production Peaked in 2004, February 23, 2009

USA Gulf of Mexico Oil Production Forecast Update, February 9, 2009

Disclosure: The author, Tony Eriksen, has investments in the oil and gas sector. The American Petroleum Institute (API) sponsored the author's attendance to the Offshore Technology Conference (OTC.09) in Houston, Texas on May 4-7, 2009 of which the presentations reaffirmed the author's views on declining world oil production.

Good report. That looks pretty convincing to me. It seems that it would take a very large concerted effort to beat the July 08 peak.

I do not want to split hairs about a July 2008 Peak. Actually the peak was the entire period from late 2004 to 2008. The data is not accurate enough to determine a precise monthly peak.

Indeed more to the point is that there has been negligible deviation from flat the past four years (remember that graph's not zerobased). And that the crucial date is in 2004-5 at which growth ceased, and that in the face of rising prices. That's the date of breakdown of supply growth leading in due course to breakdown of everything that hangs on it.

Tony,

This is the most complete and thorough iteration of your report that I can ever recall. Excellent.

Thanks much.

Would it be a problem for me to mirror this on my blog? (If Ican figure out how...)

Cheers

Great analysis. How much will gas prices in the United States increase if oil production decreases from 70 to 65 billion barrels from now to Oct 12, or 3 and a half years. Would it be 10 percent, since it's about a ten percent decrease in production? Or would it be more like 30 percent?

I don't think reasoning like that works for oil products. People "need" a certain amount regardless of price. I bet we'll see $4 gas in 2010.

If by NEED you are insinuating a need anywhere close to current consumption, this is patently false. Just because I'd rather cut back on trips out than ride a bike to work doesn't mean I NEED that oil.

Gasoline is one oil product, there are many others. People will be more willing to give up some than others. I doubt people will cut back that far on driving anyway.

No, but Gas and diesel are the main oil products and the easiest area to cut first b/c they represent the most waste.

Many of the other uses are wasteful and polluting too and should be banned anyway. For example, disposable plastics that are clogging our oceans.

Needed plastic can be made from biofuels/matter. These kinds biodegrade more easily. Also, coal can be used for this.

We are at peak oil. We will not run out of all EROI+ oil for a while, so transition doesn't have to be at the switch of a flip. Even once all remotely easy oil for energy runs out, we can still extract EROIneg oil if we are going to use it for feedstock, not primary energy.

I can 100% GUARANTEE you people will cut back on driving if they can't afford it or, better yet, the gasoline isn't there. We could speed this up (maybe with less economic damage) by instituting a ration so the price can't hit the roof and people can't spend so much on it. If I only have 2 gals of gas and a billion dollars I can't spend on gas, I'm gonna buy a bike, not a Hummer.

I agree with the other posters on price - it is almost impossible to tell. With a vertical supply curve and a nearly vertical demand curve (within a broad price band) prices can move a long way on virtually no change in the fundamentals as we saw last year.

Actually I do not believe prices will rise to last years levels again in real terms, except slowly as oil is pushed further up the value chain; and as it becomes less and less affordable to burn in private motoring (all within the context of contracting economies). The price will not matter much to most people anyway, because whatever the price, it is unaffordable if you are unemployed or underemployed in comparison with your earnings in a cheap energy economy. Prices will be high enough to stunt economies, but the trend line will not rise beyond that level except slowly, because the demand will not be there. Bailouts and handouts will cause price to see-saw around the trend line.

I was laying in my bed last when the following thought accurred: what if investors, as a price setting mechanism for oil(-products) interpret the past peak supply crunch as a DEMAND crunch? Waht wold that do to oil prices?

Actually I think this is exactly how its going to be played in the MSM.

See oil prices are rising the economy is improving !

I have a long winded article about this. But effectively boils down to rising oil prices will cause people to spend more which will increase the velocity of money which will make the economy look better.

You can bubble a economy by going to war.

You can bubble it by building houses which don't create new wealth.

You can bubble it by having people spend more on commodities that are consumed.

The economy does not care what causes the velocity to increase and initially the fact that in all these cases the reason is a dead end does not prevent and initial surge in economic activity. Its just when it can't grow because its really a malivestment that the good times halt.

Underlying all of these anything that causes demand for money to increase for conversion to something is good for the economy. Hell having bonfires using pallets of dollars is good for the economy since it increases the demand for dollars.

Eventually in a fiat currency world this demand is met with new loans. If the price of gasoline goes up and companies spend more for shipping then they will try to get larger loans to cover costs "until things get better" same of course for the consumer he will hit his credit lines to float the cost. The economy does not give a hoot about what caused the velocity increase just that it resulted in higher demands for loans.

For houses it worked for a long time because asset values where increasing covering the loss. For oil since its consumed and the real economic activity is actually declining in the end only the bankers are making money until their loans default its a fail fast bubble.

Now in todays warped world the bankers cannot fail since the defaulting loans are written off so they make big money in the form of bonus payments. By this I mean the individual bankers not he bank the bank itself losses its ass.

Here you can see how peak oil will cause the financial system to fail before the real economy actually crumbles from high oil prices. Since our economic system allows people to commit financial suicide by taking out loans based on future earnings that will never happen all thats going to happen is more and more defaulted loans will pile up with ever higher interest rates. This of course is technically inflationary to say the least as long as the defaulted loans are hidden.

This is the game we are playing now and as long as demand for loans is being driven from actions that don't create real wealth and the world allows us to play hide the loan albeit at higher interest rates it will continue until it blows up.

Oil prices will increase to the point that 10% of global users stop using. How that equates to gas prices in the US is anyone's guess. 2008 could be a good example, though.

ccpo,

Please go ahead and mirror my article on your blog, just acknowledge The Oil Drum as the source.

I am just guessing that gas will be above 3 dollars a gallon is the United States by 2012 if these estimates are correct. What do you think?

Did OPEC REALLY curtail production? Demand has dropped, OPEC cut production and stockpiles worldwide are increasing to record levels. Exports have not decreased significantly from OPEC. If you look at the numbers OPEC consumption has fallen a lot. This is highly unlikely in my view - this is just a way to mask their inability to cut production. OPEC talked about production cuts, but they are producing way above their quotas.

I do not really believe the numbers anymore and I think there is not much spare capacity.

OPEC nations does not release production numbers themselves. All we have to go on is what those who monitor their production say. And there is general agreement that OPEC has cut production by about 3 mb/d since last July. Since January however they are down less than one mb/d. They were up slightly from March to April.

Platts OPEC Guide

Ron P.

Well, what caused that huge spike in OPEC demand just when the oil prices were going up.

Looking at the numbers for Saudi for instance, Saudi domestic demand went up exactly the same amount as the Saudi reported production increase around the first half of last year. This left nothing extra to export. Exports actually went down....Supply constraint. Price just kept on going up until the demand busted.

Production numbers for July 2008 are FICTICIOUS.

Kiwi, again, OPEC gives no production numbers. The numbers came from the EIA, the IEA, from Platts, from MEES, from Petroconsultants and from various other reporting agencies. Now one might make a case for the EIA or the IEA fudging the numbers. But their numbers did not differ greatly from those of Platts, or from MEES, or from Petroconsulants or anyone else. So it would behoove you Kiwi to explain why would all these people lie?

Remember all reporting agencies except the EIA and the IEA are paid for their services. They must be as correct as possible. If they are caught lying or fudging the numbers just a tiny amount, they will lose all their customers and be forced into bankruptcy.

They may be wrong but they are not deliberately lying. That defies all logic and common sense.

Ron P.

No, I'm not saying the above agencies are lying. I never did. But numbers are only as good as their source. These agencies collate information from their sources. They aren't the source for the raw data.

What defies logic for me is when the Saudi King says 'we will pump more oil' and none of that oil being exported because it's all consumed domestically.

Well yes, in most cases the are. As I stated twice above, and as stated by OPEC themselves, OPEC never gives out production data. OPEC officials are never the source of the data. Petroconsultants, for instance, are the tanker counters. They count tankers leaving OPEC ports, take into consideration the size of each tanker and how high they are floating in the water, (are they full or half empty), and then sell their data for about $35,000 per year to their subscribers. Platts and MEES use spies and other sources to try to gleam the data from OPEC.

The EIA and the IEA on the other hand rely on secondary sources such as Platts, MEES, Petroconsulants and I suppose other sources. They also use import data from other importing nations. But they never get their data from OPEC nations themselves. Even OPEC's Monthly Oil Market Report states that their published production numbers are from secondary sources. And who are those secondary sources? Why they are Petroconsulants, Platts, MEES and likely several others. From page 35 of their May report. (Page 37 as your computer may count.)

Ron P.

Tankers leaving are exports, not internal consumption.

Exports went down, not up through 2008.

Well at the end of the day they are counting tankers unless they have people on the ground inside these companies feeding them real overall production information.

Exports with some error are fairly well known. Its just the error term seems to be on the order of 1mbd.

I don't know of any reliable third party source for overall production and internal demand levels.

In anycase as far as tanker traffic itself goes differences in the api of the oil and loading levels of the tanker are more than sufficient to add plenty of play in the amount of oil actually exported. A tanker load of high sulfur tar is not the same as one of Arab Super Light.

And last but not least there is simply not much Petroconsultants can do if Saudi Arabia which owns its own fleet wants to run a few tankers with ballast and partial loads to confuse the tanker counters. Probably more likely is changing quality of the oil loads.

If you think that they might be lying about there overall production and you wonder if they can play games with the tanker trackers the answer is yes.

Do they have they I've got no idea but nothing prevents it. If production numbers are suspect and price alone makes them suspect then the amount they can vary from real production levels esp including willful attempts to hide issue is pretty big.

They problem becomes if you think that the numbers are being fudged its difficult to determine by how much.

I use the rule of thumb that global production number are probably only reliable by +/- 2mbd and I see no intrinsic reason why world export may not have similar variation. If anyone is actively trying to hide some production issues then this could be as high as +/- 4mbd.

I'd suggest that if it approached -3mbd from claims and stayed for any length of time then we would see oil price spike to high levels thats enough to definitely put serious strain on world oil supply within six months thats a steady 4% draw down if you assume you started with 74mbd and reasonably full storage globally. Roughly the world has about 2-3 billion barrels of oil or so thats been removed from the ground and is some where in the distribution network. A 540 million barrel draw down would eventually leave a mark.

Put it this way Saudi Arabia tried to cut by 4mbd or so back in the past to support oil prices and failed miserably. Whatever sent oil prices to 150 a barrel was not some variation in the system it has to be big. Next our economy was crashed to the edge of a depression yet less than nine months later oil prices have rebounded back to touch 60 a barrel.

Take the various estimates of how much demand has declined from the economic crash assume 74mbd of production say 3%,6%, 10% decline in demand thats 2.2mbd 4.43 and 7mbd.

Taking the middle case of 4.43 and the time it took for OPEC to ramp down production and the world would be swimming in six months in about 700 million barrels of oil.

OPEC would have to cut by 4mbd for 4-5 months to even put a dent in this oversupply.

By any reasonable guess the price of oil would be in the toilet the entire time.

And thats just to work down the oversupply it does not even address actually tightening the oil market. At 70mbd we should see a large surplus of oil and daily supply just barely down to a level inline with demand. The price of oil should be going nowhere.

Of course you can reverse it and claim that speculators are driving the price and this is the real situation but I find it hard to believe a few speculators can really influence the global oil markets to the point people pay double or more what oil should cost esp given the claimed storage levels.

At least as far as I'm concerned its fairly obvious that some big events have happened and its also fairly obvious that some of the key players in the worlds oil industry really don't want to tell the truth. This just makes the game all the more interesting since it involves guessing who is lying and by how much. How big a lie can Saudi Arabia tell before they have to change their story ? By how much do they change ? How often ?

Eventually the lies begin to tell the truth by the nature of the lie and the truth is not pretty. I'm more interested in what stories will be told when oil hits 200 and the economy is still in the toilet. Either I'm 100% wrong or people are going to have to swallow some serious whoppers if they want to believe what they are told.

Lets just watch the price of oil over the next several months if oil crosses 100 a barrel and OPEC does not raise production or claims to and the price continues to increase strongly then I'd suggest this time around everyone should at least become a bit skeptical about the claims being made about production storage etc.

I too find it hard to buy into the speculation argument. However I do feel there is an influence from a perception of where prices are heading. Generally supply and demand will provide a basis for oil price, but it is not precise. At the end of the day the price is the mid-point at which people are willing to buy and sell it for. If there is a perception that demand is increasing strongly and supply is running out, then it is quite easy to see how people would be willing to pay a premium compared to underlying supply and demand on the basis that it will increase further in the future. Ditto for falling demand and increasing supply.

To a point yes and at least for oil one can assume that excessive sentiment is kept to a minimum. The end user of raw crude is a refiner. Refinery margins have been in pretty bad shape for sometime if you think for one minute that a refiner working on razor thin margins is going to overpay for crude then your mistaken. This goes up the entire end product chain. Gasoline stations often sell at cost and the competition is cut throat measured in pennies a gallon.

http://omrpublic.iea.org/refinerysp.asp

Take a look at these spreadsheets its been tough sledding for refiners for sometime.

Regardless of the reason total oil volumes have certainly declined thus we have spare refining capacity making a bad situation worse.

Given the situation with refiners one can assume that speculation can't move the oil price higher by that much or for that long.

To some extent they are limited by how low they can run their refineries without shutting down but refiners can and will pull back as needed if refinery margins drop to low for to long.

The demand for the lowest priced oil has been very robust for some time. Certainly this can be handled by spot prices and discounts for various grades vs the futures market but you will readily see discounts widen significantly if the oil price is to speculative.

A quick look here does not show spot prices diverging in recent history.

http://tonto.eia.doe.gov/oog/info/twip/twip_crude.html

And you have divergence between Brent and WTI etc.

And last but not least your link shows no correlation between speculative positions and oil price.

Now as far as I know the price of oil is reasonably tied to the relative strength or weaknesses of the dollar we have had posts considering this in the past on the oil drum it does not explain the entire price change but given that the dollar is a temporary currency for the exchange of oil for most transactions and 75% of the worlds oil is sold outside the US it makes sense for oil to at least be somewhat sensitive to the relative strength of the dollar. But 25% of the world oil is consumed by a nation that uses the dollar as its internal currency so this correlation can only go so far.

And last but not least only a fraction of the real oil bought and sold is actually taken for delivery on the futures market although we don't know how many futures settled for cash are used to cover real oil transaction one can assume its probably significant. And serious divergence from what real buyers and seller are willing to pay simply cannot last long.

And back to the top real buyers of oil are because of the nature of their business very unwilling to pay to much for oil.

Now with all that said this is one speculator that can really change the price of oil.

Anyone willing to throw 10-20 million real barrels on the market for delivery to buy up more oil at a cheaper price can speculate for quite some time. Any market is sensitive to someone dumping oil on the market.

If you have a futures market then what you will see is steep contango on the front month and overall prices driven downwards buy a significant amount.

So if you happen to come into possession of a known short term glut in crude and decide to dump some of it on the market to force prices down and take positions further out the depressed futures curve then you will win big.

Maybe if you convinced the Saudi's to empty their storage but it never showed up as deliveries anywhere but yet they told you their production was crashing and they would not be able to do it again. And of course later on you get rumors of lots of oil stored offshore.

Off hand I'm not aware of this happening in the oil market :)

I agree with Memmel, paricularly on price which has rebounded in just 9 months to 60 dollars! As an investor you learn that people investing in a particular stock or commodity have a pretty good handle on its value. They don't toss their hard earned cash in the pot without a sense of where the price is going. You have to ask yourself why would oil be going for 60 dollars in this economic climate, if investors aren't fairly certain it was a good bet, for definite reasons?

I too think the projections in this article are too conservative. I see price continuing to edge up towards 80 by July, 90 by Oct. and 110 by Jan-Feb of 2010. The price of 147 was not the result of speculation, but rather high demand for a dwindling resource. Once the economy starts to charge ahead again, demand for oil will rise and with it the price will jump way up. I don't think it will be long before we're paying 4-6 bucks at the pump.

Whew!

Talk about getting hijacked!

In answer to your question IMO we'll see $3 gas by July, in SE Mi gas at the cheaper stations is now $2.49

Oil and gas prices are also dependent on how much money people have to spend. Peak income/money is driving down prices. Deflation of housing prices is bringing down the whole system. Real incomes are declining. There has to be added value and more income to drive up prices. Where will the income come from? Not stocks, not houses, not cars, not commodities, imagine that we may have to go back to real manual work like manufacturing and farming. Imagine what would happen to prices if the average income in America fell from $30,000 per year down to $15,000 per year???

Where does OPEC spare capacity factor into this analysis? OPEC has curtailed production significantly since the middle of 2008 and can just as quickly bring this back online to breach the old peak.

At the decline rate of 3.4% cited (for 2010, 7 mo. from now), we lose, say 4.6MB/d over two years. By the start of 2012 we lose almost 7MB/d and by the end over 9.

Add in lack of investments and follow-on effects...

There really doesn't seem to be any mathematical way we could not be post-peak unless you could ramp everyone up to full production magically sometime in the next 12 - 24 months. But it wouldn't last long. A year? Two? With the mini-depression/recession on? Fuhgeduhbowdit.

Cheers

(But I'm sure Tony can answer better.)

Opec production is limited by low demand for heavy sour oil which makes up much of excess capacity. The global recession has cut the use of diesel and jet fuel far more than gasoline. Heavy oil when refined, produces larger quantities of diesel and jet fuel, so it is much less marketable now. If the economy suddenly heated up, OPEC could possible produce and sell all of its heavy oil, but the longer we wait for economic recovery, the less likely it is to see a new production peak. As existing light sweet production declines due to the age of the fields, the price of gasoline will likely rise well above diesel, putting further pressure on the consumer, slowing economic growth.

I am of the opinion that demand, is going to shape the peak/plateau of oil production. As we saw in 2008, when excess capacity grows too thin, the price and the economy become too unstable to maintain demand. We may never see the theoretical peak production with zero excess capacity, because it would be self destructive for the economy, especially the banks to allow demand to get too high.

Instead of calling 2008 a peak due to physical/geological supply, would a more accurate description be that we faced an temporary economic peak rather than an all time physical peak in supply in 2008?

OPEC spare capacity (albeit heavy) is ready to come back to help breach the physical 2008 peak if the price is right?

I thought the heavy sour crude was just an investment issue for Aramco - add refinery features needed to upgrade the long chain hydrocarbons and suddenly life is good. I've not yet had a chance to read Downey's Oil 101 but I feel the need every time I peek in here - so much to understand, so little time.

It's already $2.75 in Chicago. It will probably top $3.00 a gallon this summer.

Kevin Walsh

Chicago Peak Oil

Eyeballing Tony's chart, it looks like he's calling for ~$90/bbl of crude in 2010, or $2.15/gal. The gasoline contract typically trades at a $0.15/gal premium over the course of a year, throw in $0.40/gal in federal taxes and you are at $2.70/gal at the wholesale level. Add in state taxes and the price to moved from wholesale to retail and I would guess that would clear $3.00/gal for 2010 at retail.

I think of the 88 million bbls/day of crude + liquids as the world's 'electric fence', touched on in 2008. Tony's estimated price gaps up above $100/bbl at right about this level. A pessimistic but highly plausible scenario has the rapid decline in crude offsetting potential growth in liquids to the degree that we hit the electric fence earlier than 88 million. A more rosy scenario says we hit the fence and the price goes to a tolerable number (like $85-90/bbl) that the physical market can accommodate, and price and demand can grow from there.

The rosy scenario seems too rosy to me right now. The hope for cheap oil is going to keep breaking our hearts and trying our souls.

EDIT: Looking back at the chart, Tony has prices at $150/bbl when demand touches 2008 levels again sometime in 2011. The market's next big test will some at global demand levels well below the 2008 peak (potential for $100+/bbl oil).

Please read my response below to Sam about OPEC spare capacity.

http://www.theoildrum.com/node/5395/503139

...And will continue to decline.

Remember, the Indo- European root for the word CERA means wax.

Kevin Walsh

Chicago Peak Oil

Speaking of wax- I saw a presentation on converting woody biomass to diesel this weekend; apparently there's a plant in Canada already doing this, and northern Wisconsin has another one in the works. The plan here is to use the heat/steam thrown off the plant as input to an adjacent paper mill. The diesel conceivably fuels the logging trucks that feed wood to the operation. The component that makes the whole thing economically feasible is the sale of the wax byproduct, which is anticipated to generate more revenue than the diesel. Wax. Who knew?

Actually wax is a big product for oil refiners. I'm guessing those plants will use a Fischer-Tropsch process to make hydrocarbons. Sasol sells tons of FT waxes, and has for a while.

The integration of Fischer-Tropsch to the kraft pulping process is relatively recent technology. While it may turn out to be a nice byproduct for the pulp and paper industry, I haven't seen anything to make me think it will have a significant impact on the world market. However, one source below thinks that P&P F-T can produce 10% of the diesel used in the USA.

For those who are more interested, here are a few links, in no particular order of significance:

http://www.eri.ucr.edu/ISAFXVCD/ISAFXVAF/HEMPPBB.pdf

http://findarticles.com/p/articles/mi_hb5731/is_200512/ai_n23763984/

http://www.pulpandpaper-technology.com/news/news_archives.asp?NewsID=35

This process seems to have merit, but until we have more industry experience it is too soon to know how successful it will be. Like all alternative technologies, higher oil prices make the returns more attractive. The gassified black liquor used as the raw material is presently used as fuel as part of the chemical recovery process, so it will displace some other fuel, typically natural gas. For a mill that has excess wood burning capacity or a coal fired boiler, this seems like an economic process.

To ask the next question; will biofuel demand eventually muscle out the paper industry? While the paperless office never really happened there are signs that printed newspapers are on the way out. Paper mills represent a huge sunk cost and are ready made transport and processing hubs for biomass. A follow-on question is whether they can provide enough fuel for trucks and harvesting machinery Post Oil and still have a surplus. Otherwise no point. Yet another is since tree pulp will no longer be needed for paper whether grass, hemp and even woody weeds could be used as feedstock.

I did some rough calculations on this years ago and found that if we used 100% of the annual forest harvest it would supply only a fraction of our energy needs; however, there would be no paper, corrugated boxes, disposable diapers, feminine hygiene products, lumber and turpentine, just to name a few items.

These products would have to be replaced with something else, probably requiring even more energy. A significant portion of the energy required for pulp and paper manufacture is derived from burning bark, sawdust (both are directly burned in special boilers) and the dissolved lignin (black liquor), which is the binder of the cellulose fibers in wood.

As for hemp, it has very long fibers which give much higher strength to things made from it than short fibers from wood. Hemp is used in tea bags, for example. We are making a costly mistake by not using domestically grown hemp.

Ace -- Very nice consolidation of a very log story. All I might add is a minor note regarding the KSA's expectation of a 70% recovery factor. That might seem overly optimistic given the average world recovery rates you mention. But such recoveries are physically possible in water drive reservoirs such as Ghawar. I once documented a case where Shell Oil probably recovered more then 80% of the in-place reserves from a field in S. La. But much of that was recovered at a loss. It’s a long story why Shell continued producing after the field became uneconomic but they did have a specific reason.

As you point out, the KSA is already injecting a huge volume of water into their fields. There’s no physical reason for them not to increase this efforts as time goes by: just inject more water and build bigger oil/water separation systems. A 70% recovery is certainly possible though that last 20% to 30% might take 15 to 20 bbls of injected water for each bbl of oil produced. But the question remains: at what price level might they be able to continue such an effort? One can speculate upon much higher oil prices in the distant future to support such an effort. Add to that the relative lack of any other industries in the KSA to pick up any slack in their GDP when oil declines. Producing the last 25% of their reserve base might not be of great net economic value but it may be all they have at the time.

One last qualification of their high recovery rate claim: Not withstanding the magic of nano-robots roaming through Ghawar, that last 30% to 40% of recovery will probably come out very slowly. When the percentage of oil to water drops to less then 15% it will obviously take a huge volume of gross production to net any significant volume of oil. I’ve documented fields that took over 30 years to produce a volume equivalent to what they produced the first 5 or 6 years. I suspect Ghawar et al to have a similar profile. Based on analysis offered by various folks at TOD I might expect Ghawar to slip into rather high water-cut phase within the next 5 years. Just a guess though.

Is there any information available on the distances that volume of water is being pumped? What's the source of the electricity doing the job? I'd like to know the EROI when they're moving 20bbl of water inland for every barrel of oil they get out.

I don't know the details cowtipper but I think most of the injected water is salt water pumped in from the Gulf. The good news is they can recycle the produced water and reinject it. But the seperation process is time consumming and often utilize rather expensive chemicals to help break the emulsification. Just a WAG but the most expensive hurdle might be laying additional pipelines to bring in more water.

As Simmons has mentioned in his presentation the new peak in production in 2008 never translated into and expansion of import. I was receiving Oil Movements at the time and all the tanker traffic indicated that 2008 production was inline we 2006 and 2007. As far as I know there is no compelling evidence to support and significant increase in production in 2008 vs 2007 or 2006.

The data is highly suspect and this has its own implications.

Next as near as I can tell we should end 2009 with production closer to 68 mbd.

I'm really expecting that OPEC will announce another 2mbd cut soon. We shall see.

So for your graph I don't see evidence of a new peak in 2008 and I don't see any reason for the long production plateau you have in 2009 as far as I can tell it looks like that if you remove the 2008 peak and your 2009 production forecast and simply start what your projecting for 2010 but starting in 2008 you probably have something very close to the right answer.

Whats interesting is a sharper decline rate in 2008 would explain the strong price increase.

One would expect if decline rate is increasing that you would have a good chance that the economic collapse at the end of 2008 would not keep oil prices down for long and evidence is increasing that prices are rebounding. Certainly its a bit early to know for sure but given the production profile I described one would expect us to quickly return to the same price situation as happened in 2008 then exceed it.

And last but not least the central limit theorem makes it very very unlikely that oil production declined for two years against rising prices then miraculously increased to a new high even as price reached new highs.

Its sad but it looks like we will have to deal with increasingly obfuscated data as the world moves well past peak production. The real implication of the supposed peak in 2008 is that our global data sources are new very unreliable. I think our models however are good enough that price data can be used to eliminate spurious and even intentionally incorrect data to determine the truth fairly accurately.

Having more faith in the models ignoring the 2008 puported peak and assuming the acclerated decline rate began in 2008 fits very well with the basic model of the system based on the central limit theorem. If increasing depletion rates have manage to cause production to be asymmetric then this implies that the decline rate will accelerate stronger than projected.

Giving the world +/- 4mbd of capacity and looking at production back into the 1990's indicates a gently increasing plateau in capacity that was slowly eroded this is indicative of and asymmetric production profile as you get the classic shark fin production curve with a good bit of the production occuring over the long top.

It seems to me that the evidence points towards decline rates probably being higher than anticipated with symmetric production models.

And last but not least looking at oil production over the last 10 months. The current price of oil is closely tied to the financial problems coupled with what looks like a fairly large amount of oil that fell into the hands of physical speculators taking advantage of the contango in the market. In my opinion asking someone who has taken a large speculative position in physical oil how much oil they have is highly unlikely to result in the truth.

We have every reason to believe that speculators now control 50-100 million barrels of oil. The combination of the financial collapse, Hurricanes and indications that the Saudi's did offload about 30 million barrels from storage that never was landed indicates that this is highly probable. On the high side it could be as large as 200 million barrels however this is unlikely. A more reasonable high estimate is 150 million barrels.

Its not a large amount of oil vs daily production however its enough to make the speculators a significant source of oil that could be rapidly moved to market.

However again we can use the market itself as a sort of lie detector test for this new source of uncertainty.

We would expect them to exaggerate their holdings as long as the market was showing steep contango and they where adding to their positions. This contango has finally been broken going forward if you have speculated on physical storage you will now have to depend on absolute price increases to profit from storage. I estimate that you would want to see at least a five dollar a month increase to make a nice profit storing oil for delivery three months out. As long as oil prices are increasing you can use market variation and buying forward for delivery at a later date on the futures market to maintain your position.

However now you don't want to exaggerate your holdings and you don't want to announce to sharp of a decline and panic the market since you have a very good game going holding physical oil for 3 months or so then selling it. Its literally free money and it does eliminate storage in fact its traditional hoarding behavior.

But you do need to ensure that the market is now driven steadily higher so it time to reverse the lie and record steady market moving draw downs. In fact overtime these claims could pass through your real storage levels and you will actually under report how much oil you have on hand. At no point is the truth obvious.

However once this hoard is no longer expanding rapidly in a steep contango market its absolute size is not critical since the hoarder is buying as much oil as he is selling more or less sometimes more sometimes less as the market moves his ability to dramatically influence how the market moves to his own advantage drops off rapidly. All such a hoard does is put a strong floor on how low prices can go as long as the hoarder increases his hoard when prices fall off.

The overall result of the crazy events of 2008 and first few months of 2009 is that the market is now finally moving to determine the real price of oil in the post peak/ post bubble economy world with a potentially steep underlying production decline rate.

Thus the markets have just now reached the point that short term one time events are no longer having a huge influence and the real supply and demand equation is going to be determined.

Given that some large players in the oil markets have made some very large bets involving storage of millions of barrels of oil one would think that one segment of the the oil industry has really doubled down on expectations that the price of oil will rise strongly.

I happen to be in full agreement with this position. Especially given the relationship between the government and the speculators who have taken these positions. Its highly probable that they have access to information thats far more credible then what we are seeing. Thats not a tinfoil hat statement its the simple truth that American companies often profit handsomely from information or actions of our Government. I hate to some extent to bring up this factor but its important since the problem with the current speculative hoard is it could be easily blown out of the water if OPEC cranks production back up. I find it difficult to believe that speculators would take such a large position without some very good information about the real situation in oil production.

So bottom line I don't agree with your graph from 2008-2009 :)

I suggest that all the interesting things that have happened to date are more in agreement with your 2010 project already happening.

An accelerated decline rate in 2008 coincident with the price rise does not fit with the data because the production of crude oil generally increased from August 2007 through July 2008. Discarding the peak in July 2008 does not change that. The peak in July 2008 was transient and could be explained by oil producers drawing down their storage as the price collapsed during the last three weeks of the month. According to reports Saudi Arabia also brought oil to market from the Abu Hadriya, Fadhili, and Khursaniyah phase 1 (AFK phase 1) project beginning in May 2008. However, mid May through July is less than 3 months which is not enough time to establish whether they achieved a sustained increase in production.

An accelerated decline rate in 2008 coincident with the price rise does not fit with the data because the production of crude oil generally increased from August 2007 through July 2008.

Actually you don't know this is true. There is no intrinsic reason to believe it was true.

US VMT stats showed a accelerated decline in mileage driven starting in 2007 through the end of 2008. The economy slowed and then finally entered and official recession. And the price went through the roof. My opinion give that I do believe the VMT stats and I do believe the market is that production data become increasingly less credible as we entered 2007.

Purported production numbers increasingly diverged from two credible sources which had had close agreement with reported supply up to 2007 only in 2007 did using VMT as a direct measurement of demand and price as a measure of supply increasingly diverge from reported supply.

Reported supply numbers have bee practically useless ever since and today I rely almost exclusively on VMT and other economic data and price to deduce the real supply levels.

I don't look at them except to try and determine the amount they are distorted since the actual amount of "lying" is useful in and of itself. At the moment my opinion is global production of oil is probably closer to 69mbd. So far I've been quite pleased with my results. The impact of the financial crisis and formation of a oil bank where novel but in retrospect not unexpected just the form that post peak hoarding took could not have been predicted. The formation of a hoard when supply is constrained is completely logical.

I do find the politics and implications of who controls the hoard far more important than its creation. GS and MS have significant political leverage over the US by controlling 100 or more million barrels of oil. I actually find it interesting that few people have realized that this is effectively blackmail conditions.

As for the rising production of crude oil between August 2007 and July 2008, I did not make myself clear that I was referring to world crude oil consumption as shown in Figure 1 at the top of this thread and in Oilwatch Monthly. The graphs for U.S. crude oil consumption in the Oilwatch Monthly show it declining in the U.S. over that time frame but other graphs show China's demand remaining strong. Since the U.S. is heavily dependent on imported oil and the price is determined by the marginal barrel in the international market, world demand must be considered.

I remember back in early 2008 that you thought the decline in U.S. fuel consumption was primarily in the construction industry due to fewer new houses being built due to the credit crunch. I think your observation was spot on, but I do not hear it mentioned anymore. If true, the reduction in VMT would have been principally caused by the financial crisis and not the high price of fuel. The VMT data is too vague to indicate which type of travel was being reduced. A reduction in long distance VMT could be interpreted as less building materials being delivered or fewer road trips by families. Notice the VMT reduced much more in the spring and summer than in the winter suggesting the demand destruction affected seasonal travel the greatest. $100 / barrel did not significantly slow winter travel in the U.S.

I interpret this as meaning you believe the OPEC production cuts are actually a cover story for OPEC hoarding crude oil. The problem with this theory is the con must be widespread in both oil exporting and importing countries because in August 2008 about 1.5 Mb/d of crude oil was removed from world production by a (purported) fire in the BTC pipeline in Turkey and Russia's invasion of Georgia while the price of crude continued downward. By the end of the month and into September 2008 approximately 1 Mb/d was shut-in in the Gulf of Mexico by hurricanes Gustov and Ike. Crude oil prices continued their decline in the face of another huge disruption. A scam must have been coincidently formed around world and natural events or demand destruction kicked in to at least 1.5 Mb/d by August 2008. I choose demand destruction.

Hello Tony [Ace],

As usual, I appreciate greatly your top-notch keyposts. My thxs for mentioning acid: I hope TODers will click on your embedded link to see the video, or they can view it here:

http://www.enermaxinc.com/acidizing/

I have posted on acid-fracing before, because I believe if it becomes widely applied to extract more crude and natgas==>it may have important effects on sulfur flowrates, availability, and therefore pricing. Just how much is hard to determine, and I also cannot afford the very high-priced, proprietary market analyses.

As most already know from my NPK postings: [S]ulfur and sulfuric acid is vital to the chem-process of superphosphating for high analysis I-NPK finished ag-products, and is the key input Element for most other industrial chem-processes, too.

Most S used worldwide is consumed for I-NPK manufacturing, and because world pop is constantly increasing: the UN FAO Fertilizer Forecast 2008-2012 suggests a continuing upramp of new I-NPK factories to support this nutritional need.

Currently, recovered S is marginally cheap, but my longtime readers will recall how the price jumped SEVENTEEN FOLD in less than a year. This is a breath-taking level of extreme volatility that can cause extreme pricing variation for downstream products as S is rooted at the very base of the [P]hosphorus enrichment process and much industrial chem-processing.

Thus, this possible, inter-locking cascading blowback effect between the desire to eat and the desire for FFs will be very interesting to track as we go postPeak IMO. Thxs again for your attention to sulphur, and I encourage readers to remember that from Isaac Asimov's Bio-Elemental Intensity Factor list: P is #1 at 5.8, S is #2 at 2.0, with the other Elements far below.

Have you hugged your bag of NPK today?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob, for what is worth, most if not all of the acid used in acidizing oil wells is HCl not H2SO4.

Hello RWReactionary,

Thxs for the reply, but I had to leave immediately after first posting--thus the late response from me.

I am not a chemist, but I think it probably takes 1/2 to 1 ton of sulfur to make 1 ton of HCL, thus IMO, you need to ask yourself how is HCL made [look below for ***]:

http://chemicalland21.com/industrialchem/inorganic/SULFURIC%20ACID.htm

--------------------

The uses of sulfuric acid are so varied that the volume of its production provides an approximate index of general industrial activity. Its main use is in phosphate fertilizer production, both superphosphate of lime and ammonium sulfate.

It is widely also used to manufacture chemicals, e.g., in making ***hydrochloric acid***, nitric acid, sulfate salts, synthetic detergents, dyes and pigments, explosives, drugs, other acids, parchment paper, glue and wood preservatives. It is used in the purification of petroleum to wash impurities out of gasoline and other refinery products.Sulfuric acid is used in processing metals, e.g., in pickling (cleaning) of metal, electroplating baths, nonferrous metallurgy. Rayon is made with sulfuric acid. In one of its most familiar applications, it serves as the electrolyte in the lead-acid storage battery commonly used in motor vehicles (acid for this use, containing about 33% H2SO4 and with specific gravity about 1.25, is often called battery acid).

---------------------------

http://en.wikipedia.org/wiki/Hydrochloric_acid

----------------------

..About 20 million metric tonnes of hydrochloric acid are produced annually.

.. In this Leblanc process, common salt is converted to soda ash, using ***sulfuric acid***, limestone, and coal, releasing hydrogen chloride as a by-product. Until the British Alkali Act 1863 and similar legislation in other countries, the excess HCl was vented to air. After the passage of the act, soda ash producers were obliged to absorb the waste gas in water, producing hydrochloric acid on an industrial scale.[1][3][4]

In the twentieth century, the Leblanc process was effectively replaced by the Solvay process without a hydrochloric acid by-product. Since hydrochloric acid was already fully settled as an important chemical in numerous applications, the commercial interest initiated other production methods, some of which are still used today. After 2000, hydrochloric acid is mostly made by absorbing by-product hydrogen chloride from industrial organic compounds production.[3][4][5]

-----------------------

Many, if not most, industrial organic compound production has sulfur or sulfuric acid as a major starting chemical in the process.

http://en.wikipedia.org/wiki/Sulfuric_acid

-------------------

Sulfuric acid has many applications, and is one of the top products of the chemical industry. World production in 2001 was 165 million tonnes, with an approximate value of US$8 billion.

..It is used for making hydrochloric acid from salt via the Mannheim process.

---------------

http://en.wikipedia.org/wiki/Mannheim_process

------------------

The Mannheim process is an important method for the manufacture of hydrogen chloride and sodium sulfate from sodium chloride (table salt) and ***sulfuric acid*** in which case the Na2SO4 is known as salt cake.

------------------

The link below is using ***sulfur*** for EOR:

http://www.apachecorp.com/explore/Browse_Archives/View_Article.aspx?Arti...

---------------------------

FROM THE WINDOW of a crew plane, the mountainous, bright-yellow structure can be seen from miles away. Closing in on Apache’s Zama field in northwestern Alberta, Canada, the golden stockpile comes into focus.

The immense mound, a byproduct of years of oil and gas production, is made up of elemental sulfur derived from the hydrogen sulfide (H2S) stripped from the field’s sour hydrocarbons (to sweeten it) and then formed into layers of blocks at the Zama Production Office and Gas Processing Facility.

Thanks to Apache’s Zama Acid Gas Enhanced Oil Recovery (EOR) Project, the growth of that sulfur mound – as well as air emissions of carbon dioxide (CO2, a greenhouse gas) and sulfur dioxide (SO2) from flaring (a contributor to acid rain) released during the sweetening process – soon will come to a halt. By late September, Zama’s sulfur plant will be shut down.

But that is just the beginning. In what is believed to be the first such project in the world, Apache is aiming to ***wring another 10-15 percent of the oil out of the ground*** by injecting both H2S and CO2 into Zama’s depleted pinnacle reefs.

---------------------

http://www.greencarcongress.com/2008/09/modified-seawat.html

-----------------------

Modified Seawater as EOR Fluid Could Boost Oil Recovery From Limestone Reservoirs Up to 60%

Researchers at the University of Stavanger in Norway report that injecting a modified seawater fluid—“smart water”—into limestone oil reservoirs for enhanced oil recovery (EOR) could help boost oil extraction from those reservoirs by as much as 60%. Their findings are scheduled for the 10 September issue of the ACS journal Energy & Fuels.

In the study, Tor Austad and colleagues note that more than 50% of the world’s oil reserves are trapped in oil reservoirs composed of calcium carbonate, rocks that include chalk and limestone. The average oil recovery from carbonates is generally lower than for sandstone reservoirs. The reason, they note, is that the carbonate rock is neutral to preferentially oil-wet and often highly fractured.

..The researchers collected core samples from Middle East oil reservoirs composed of limestone and soaked them in crude oil for several weeks. They then prepared batches of “smart water,”—seawater formulated with ***sulfate*** and other substances to improve seawater’s ability to penetrate limestone..

---------------------

It this is truly viable: A hell of a lot of sulfur [in various formulations could be used for EOR.

Thanks Ace for this post.

Question: what's your estimate for reserve capacity?

Looking at the drop since last July 2008, it seems to me that there is at least 5 mbpd of reserve capacity, how does it affect your forecast? is the drop in supply from May 2009 to December 2010 caused by lower demand? do you think that an eventual economic recovery in late 2009 could push oil supplied up again given the large reserve capacity?

Hi Sam,

Excellent question! Reserve capacity statements made by OPEC are accepted without question by the EIA and IEA.

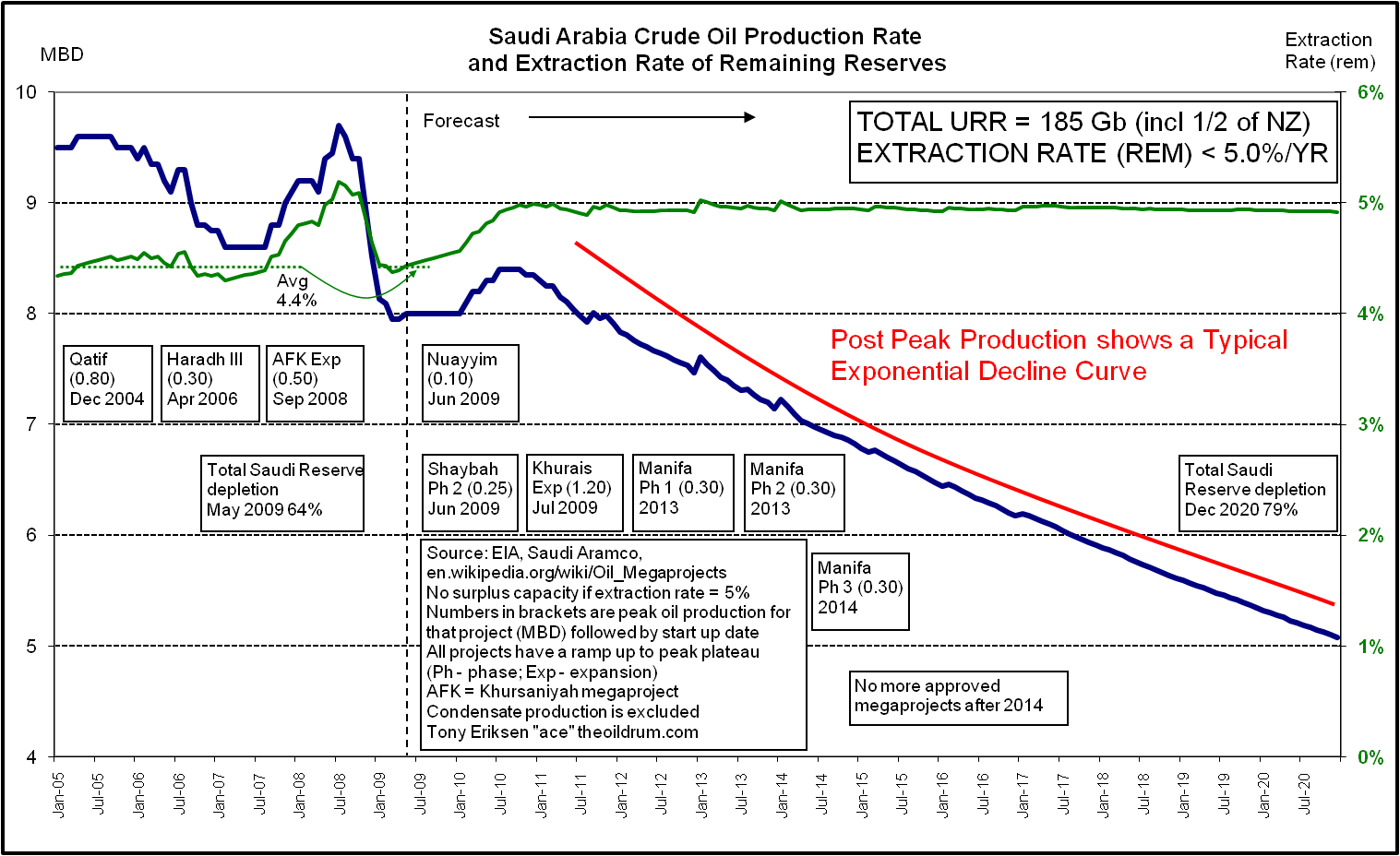

I will use Saudi Arabia as an example as it has the world's largest claimed surplus capacity.

First, a little history about what Saudi Arabia claims and what has happened. The chart below shows Saudi Arabia's production history. Oil prices tripled from 2005 to mid 2008. Surely Saudi Arabia's production would have increased given its huge capacity. Instead Saudi Arabia's crude production decreased from 2005 to 2008.

For further information about the forecast below please read

http://www.theoildrum.com/node/5154

Saudi Arabia Crude Oil Production to 2080 - click to enlarge

Saudi Arabia has also been ramping up natural gas liquids and condensate production from Khursaniyah and Hawiyah to add a claimed total of 600 kbd. This production is not subject to quotas.

http://en.wikipedia.org/wiki/Oil_megaprojects

According to the EIA, Saudi Arabia's NGL and condensate production has been decreasing instead of increasing as Saudi Arabia's claims would support. In 2007, production was 1.440 mbd, 2008 was 1.434 mbd and 2009 year to date was 1.308 mbd.

http://www.eia.doe.gov/ipm/supply.html

Perhaps there are some large decline rates that Saudi Arabia is not willing to disclose.

The message here is that Saudi Arabia's claims about everything need to be questioned. This includes not only claims about remaining reserves but also claims about additional production capacity. We don't know if Khurais will add 1.2 mbd maybe it will add only 0.6 mbd.

Here is the latest surplus capacity estimates from the IEA's Oil Market Report.

http://omrpublic.iea.org/

Saudi Arabia's spare capacity is estimated to be 3.05 mbd. The IEA calculates this by accepting Saudi Arabia's claims of sustainable production capacity, new capacity additions of 0.5 mbd from Khursaniyah and remaining reserves of 260 Gb which justifies very low decline rates. Note however that the IEA qualifies the capacity levels in the first footnote to the table below by saying the capacity can be sustained for only 90 days.

The table below shows Saudi Arabia's sustainable capacity at 11 mbd. Amin Nasser of Saudi Aramco is now saying that sustainable capacity is 12 mbd, before additions of 1.2 mbd from Khurais, 0.25 mbd from Shaybah expansion and 0.1 mbd from Nuayyim. After these addition, claimed capacity will be about 13.55 mbd. However, Nasser does say that some additions will merely offset declines elsewhere but he doesn't quantify the size of the declines.

http://uk.reuters.com/article/governmentFilingsNews/idUKN055172122009050...

OPEC Crude Production and Spare Capacity - click to enlarge

I attempt to estimate surplus capacity by using extraction rates, recovery factors and remaining reserve estimates for Saudi Arabia using this chart http://www.theoildrum.com/files/Saudi%20OIIP_0.gif and further explained in this story about Saudi Arabia.

http://www.theoildrum.com/node/5154

My forecast in Fig 2 above assumes that Saudi crude production will follow the blue line below. The chart below assumes Saudi Arabia's ultimate recoverable crude oil reserves to be 185 Gb. Note that in July 2008, the extraction rate of remaining reserves (ie if reserves remaining are 100 mb then an annual extraction rate of 5% means that 5 mb would have been produced in a year) was slightly greater than 5% which is appropriate for Saudi's large fields. If the extraction rate is too high then irreversible damage could occur to the fields. So my assumption here is that Saudi Arabia's surplus capacity is determined by the maximum extraction rate and true remaining reserves. For my forecast, Saudi Arabia's production will increase, as prices increase, to about 8.5 mbd in mid 2010 followed by decline so that the extraction rate does not exceed 5% per year.

My estimate of annual sustainable surplus capacity for Saudi Arabia this year is about 1 mbd. Late 2010, annual surplus capacity of Saudi Arabia is assumed to be zero. Until Saudi Arabia's fields are independently audited there is no certainty in any of the claims made by Saudi Arabia about project capacity additions, sustainable production capacity or remaining reserves.

Saudi Arabia Crude Oil Production to 2020 - click to enlarge

The drop in supply from May 2009 to Dec 2010 is caused by large non OPEC supply falls mainly from Russia, the North Sea and Mexico.

Now THAT's one of the best responses to a question on TOD ever. Excellent analysis. We now know why you're called Ace.

yeah,I have to second that sentiment. Ace make me feel like a complete and fulfilled moron ...

That said and admitted, I do feel (just my feeling) that "that" Saudidrop since midsummer 08 is still quite finanscal-crissis prone. It's too steep for me to be understood otherwise, also they (SA) have announced some "new stuff" onstream lately/soon.

Anyway, if Ace is on/at the mark, things just start to get interesting ... again.

Thanks for your efforts Ace - Good, deep and interesting update

I agree that Saudi published data is not exhaustive and that it is difficult to draw conclusions from it. I would suggest that there is another equally valid explanation for observed Saudi production which is that it is a direct result of their attempts to keep world oil supply in balance. Saudi makes no secret of the fact that they want to maintain the price of oil high. The last thing they want to see is a return to the 1980s where there was a massive glut of unused capacity which kept prices depressed.

The data do indeed show that Saudi production decreased from 2005 to 2008. They also show that it increased from 2007 to 2008 from 8.7 mmbopd to 9.2 mmbopd. Over the period 2005 to 2008 OPEC spare capacity increased from 0.5 mmbopd to 2.5 mmbopd (most of which is associated with Saudi Arabia). This suggests to me that whilst actual production is going up and down as dictated by Saudi Arabia's interpretation of what the world market needs, this is against a backdrop of increasing production capacity. It is very difficult to increase production capacity if your fields are in terminal decline.

Unless you're determined to read too much into the data, it should be fairly clear that any drops in Saudi production from 2008 to 2009 are mainly due to the impact of a drop in global demand. Saudi production capacity has not vanished (although any further increases are almost certainly now delayed as they scale back investment). I can't help but conclude that your forecast seems excessively pessimistic given that you predict production won't even surpass 9 mmbopd again.

I agree that my forecast seems pessimistic but that's the forecast based upon a maximum of 5% extraction rate and URR of 185 Gb. If the URR is higher say at 210 Gb then the production rates might be closer to 9 mbd in 2010.

Below is an excerpt from my previous Saudi Arabia story.

http://www.theoildrum.com/node/5154