Michael C. Lynch and the 'False Threat of Disappearing Oil'

Posted by nate hagens on August 27, 2009 - 10:02am

This is a guest post by Kevin Rietmann, aka The Dude, on The Oil Drum. The post is a response to Tuesdays NYTimes Op-ed by energy analyst Michael Lynch, showing some historical track records between some 'peak oilers', Mr. Lynch and others.

Michael C. Lynch and “the false threat of disappearing oil.”

Energy analyst Michael C. Lynch's op-ed piece “‘Peak Oil’ Is a Waste of Energy, published in the August 24th edition of the New York Times, has naturally garnered much attention from those in the peak oil community itself. Lynch's dim estimate of predictions of declining supplies of energy is evident from the title of his piece, and those familiar with views espoused by him in the past weren't surprised by this new batch of commentary:

A careful examination of the facts shows that most arguments about peak oil are based on anecdotal information, vague references and ignorance of how the oil industry goes about finding fields and extracting petroleum. And this has been demonstrated over and over again: the founder of the Association for the Study of Peak Oil first claimed in 1989 that the peak had already been reached, and Mr. Schlesinger argued a decade earlier that production was unlikely to ever go much higher.

Indeed forecasts of the demise of oil in the past have often been far wide of the mark, as documented in Lynch's own 1998 piece CRYING WOLF: Warnings about oil supply. In this paper he shows how prominent peak oil advocate Colin Campbell's forecasts from 1989 and 1991 were inaccurate, which they were:

One bit of data which would have been of value to include in this paper would have been who Campbell was being compared to in the first place. Likely guesses are that “CERI” is the Canadian Energy Research Institute, “EMF 11 Avg” is the Energy Modeling Forum, and “IEW” is the International Energy Workshop. As the graph shows, Campbell's forecasts were the most inaccurate of this sampling, although whether other forecasters were even further off the mark for predicting production – or price, which wasn't included in this broader comparison – isn't remarked upon; but then this was a short piece, whose contents were intended to dismiss the then-current warnings of impending irreversible decline in oil supply coming from both Campbell and Jean Laherrère, who were recent collaborators on the March 1998 Scientific American article The End of Cheap Oil, the notoriety of which had undoubtedly reached Lynch's ear; many look to this publication as marking the onset of the modern era of discussion of peak oil, including the coining of the term “peak oil” itself a few years later.

Having dismissed Campbell's credibility with his article – or so one would imagine, anyway – Lynch then rounds things up with Colin's current batch of forecasts for the early 21st century, contrasted with a handful of others, making sure the reader will be left with the impression that Campbell's projections are in no way to be taken seriously:

Lynch (1996) argued that the Hubbert method fails because it takes recoverable (not total) resources as fixed, and assumes that to be the area under the curve of total production. When the estimate of the area under the curve (resources) is increased, the entire increase must be applied to future production. This is exactly what is happening with Campbell, as Figure 15 shows. The errors in his 1991 forecast and the adjustments he has made in his latest work are thus predicted by Lynch (1996). Campbell has not provided an alternative explanation, merely ignored them. And as Figure 18 shows, his forecast is well outside the mainstream.

Short-term prices will certainly fluctuate, and we will surely have more oil crises, since they are short-term events. Unfortunately, there is little doubt that the certain failure of the current Cassandras will be forgotten within a few years and a new round of alarms will be sounded. Hopefully, it will not receive the attention that the current (and previous) ones did, and even more hopefully, most governments and companies have already learned their lesson from the tens of billions of dollars wasted when others cried wolf during the 1970s.

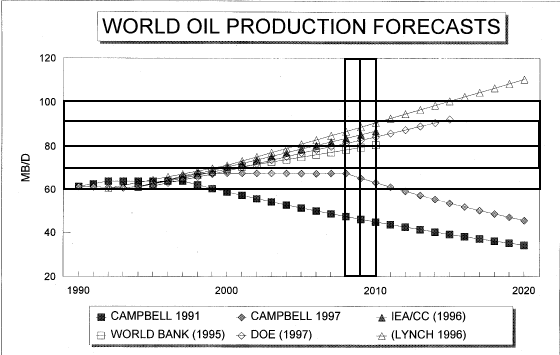

As in his current NYT Op Ed Lynch implores the reader to pay no mind to those predicting a limit to liquid fuels production in any time frame worth considering; as with other sections of the article he includes an easy to digest graph, this of another camp of forecasts, including his own:

So, how have things turned out in the intervening years? No doubt Campbell and his ilk have once again shot far and wide of the mark; of course they will never learn their lesson, but people have been insisting that world oil production will soon irrevocably decline for practically as long as the industry has been around.

Well, let's see: here is a version of Lynch's graph, with bars added by me to delineate increments of 10 mb/d (horizontally) and 2008/2009 (vertically), which weren't in the original:

This is of crude + condensate (C+C); 1998 average production was 66.96 kb/d according to the EIA's International Energy Statistics. As we can see Lynch, perhaps in a burst of confidence, was foreseeing the highest level of any on this graph, which, besides Campbell, included quite sizable government institutions: the EIA, IEA, and World Bank. One might class these as optimistic by nature; thus Lynch would trump even them in a burst of glory.

The trouble is, of course, that it was Lynch that aimed wildly off course here, and it is his nemesis Campbell that appears to have hit the bullseye. Time constraints prevent me from digging up the original documents that these forecasts are derived from, but we can tell enough by simply eyeballing the chart. The plateau of supply Campbell was predicting hasn't come to pass, but if it had it would yield 2008 production of ca. 69 mb/d; actual C+C levels for 2008 were, on average, 73.79 mb/d according to the EIA; a difference of 4.79 mb/d. The World Bank's call looks to be about 79 mb/d, which would equate to 5.21 mb/d diff. No doubt we could settle the niceties of who gets the blue ribbon here with the actual numbers used; but what is incontestable is that Lynch was very far off the mark; his 2008 levels are at least 86 mb/d, more comparable to the actual level of 85.47 mb/d for all liquids – perhaps this was even his intent, to forecast increased use of oil sands and the like, compared with Campbell's pessimistic focus on C+C and little else. But if so the presentation, lacking any kind of elaboration on this point, was misleading, to say the least.

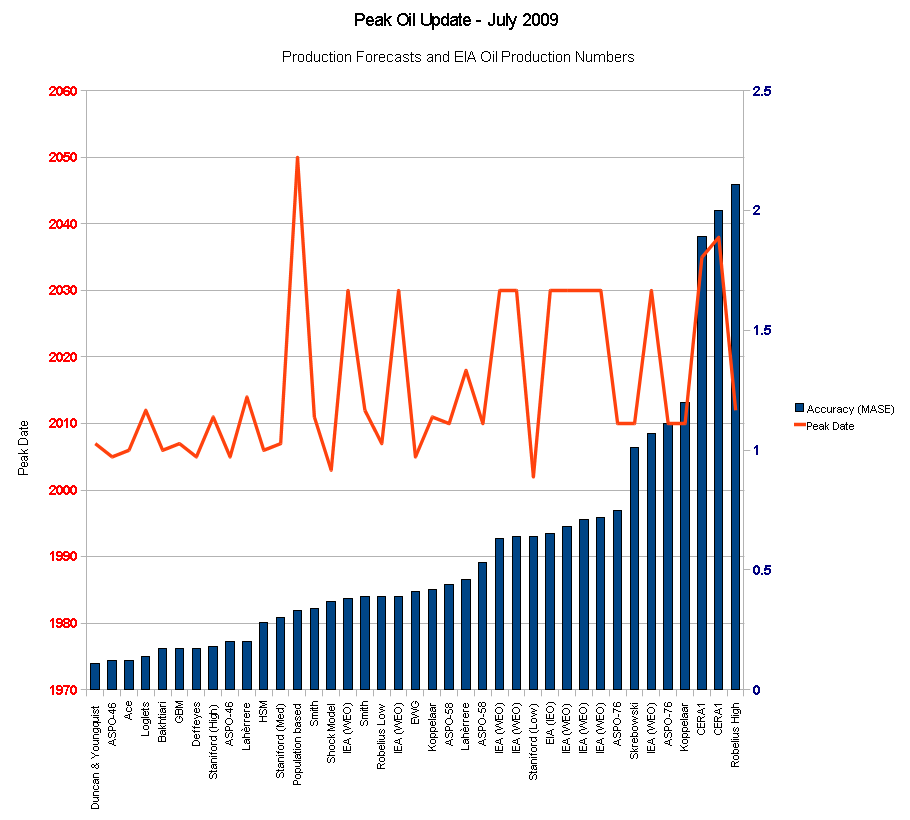

What is more, in the intervening years it appears to have been the peak oilers who have made the accurate production forecasts, not cornucopians or massive government agencies such as the EIA and IEA. This is a chart I prepared from data included in the Oil Drum's Peak Oil Update - July 2009: Production Forecasts and EIA Oil Production Numbers, prepared by Sam Foucher :

The columns show the accuracy of the forecasts at present; the line delineates the year of global peak predicted in the forecasts. As can be seen, calls for near term peaks have overall proven more accurate over the years than those foreseeing peaks decades in the future; amusingly enough, a peak based on the simple stability in historic per capita oil consumption (“Population based”) has proven more accurate than that of any of the government agencies. A remarkable aspect of these results is that, while the median date of publication of these documents is 2006, the most accurate call for 2008 was from the 1998 paper of peak oilers Duncan and Youngquist.

Some obvious caveats suggest themselves immediately; for instance, perhaps more optimistic researchers than those documented here made even more accurate calls, possibly from even earlier dates. For this we can turn to a Canadian commentator on energy issues, Freddy Hutter, who is quite optimistic as regards to the future supply of hydrocarbons. He has a “Prediction Scoreboard” on his page of Peak Oil Depletion Scenarios, which includes forecasts from a broad spectrum of researchers; perhaps one of Lynch's colleagues is way out in front? Or perhaps not?

Using projections made 9-14 years ago, Jean Laherrère earns bragging rights for the most accurate forecast for 2008 with a calculation that was within 1-mbd of the final tally. Looking ahead using Year-to-date figures for 2009 and short term projections, the USA's EIA is poised to garner the long term prediction crown for 2009 & may share 2010 with Duncan & Youngquist.

It would behoove the editors of the Times to inform their readers of these fundamental flaws in Lynch's analysis; in the forecasting department he has stumbled more than a bit badly, and those he has denigrated in the past – and present – have made long term predictions of conditions in the energy markets that leave Lynch's past work – and thus, we surmise, his present work as well – throughly in the shade: indeed, perhaps little better than that “based on anecdotal information, vague references and ignorance of how the oil industry goes about finding fields and extracting petroleum.”

“CERI” is the Canadian Energy Research Institute"

i thought it was cambridge energy research institute.

That's CERA

http://www.cera.com/aspx/cda/public1/home/home.aspx

I think it is important to make sure we are comparing apples to apples in the forecasts. From previous reads of Lynch's comments in the press it seemed to me he was refering to total liquids including spare capacity and not just actual production (I may be wrong so please correct if so). The market collapse and attendant collapse in demand of course had it's predictable impact and spare capacity has indeed increased. Of course when you talk about supply it is hard to take long term demand out of the equation as certainly back when there was lots to find demand drove how quickly supply could come on. Campbell and others were definitely referring to how much could ultimately be supplied and hence would have to include spare capcity in the equation. We will of course circle back to the question of what is current spare capacity and whether it is believable until you see it but hence the problem in this sort of "he's right and he's wrong" analysis. Certainly Lynch is crazed if he thinks it is a limitless resource but he does make some good points about reserve growth. Reserve numbers are tricky beasts and trying to interpret what is reported versus what it's category should be is a bit of a mugs game, fraught with potential large error. That being said reserves can't grow indefintely and Campbell tried to take account of the growth phenomena by backdating, which of course also requires some assumptions. Campbell and others who have said we are already peaked make excellent points as we all know but they are also incorrect in assuming that economics, technology, markets etc don't come into play in some manner. A clear example of that is the affect shale gas has had on the dynamics of the natural gas industry in North America. Over the years I've come to see this as a pretty complex system that goes beyond the notion of a simple two dimensional view of Resource versus Production.

Perhaps it is simpler to say that everyone has been wrong most of the time, some have been right occassionally almost certainly a result of luck (which is required in a complex system I think). What is important, I believe, is understanding the dynamics that influence available hydrocarbons and demand at any given time and how potential future impacts on economics/people dynamics etc will be influenced.

Just my tupence worth.

I agree. This thing is a very complex animal.

I can't help but be struck by the maps at this location (CEPA) http://www.cepa.com/index.aspx?site_guid=20B417BE-EDD6-497C-AFCA-B0D26BF... What is noticable to me is the relatively huge areas of "sedimentary basin" in northern Canada, compared to eg. US. Agreed, much of it is explored already at some level, and found empty or already depleted. But there's still a LOT of it. I mean, has anyone stuck a drill into Hudson's Bay yet?

I also note that the electrical heating technology pointed out by Gail on her trip to the oil sands, as sort of a side note, if effective, opens up for recovery a LOT more of the 2 trillion bbl of oil sands than the ? 178 billion ? bbl now booked. The same technology also has the potential to exploit the "too heavy to pump" bitumen bottoms of many presently exhausted oil formations the world over.

This is a complex game we play.

Over 600 oil/ng exploratory wells have been drilled in Washington state: Oil and Gas Resources. Nothing to show for it beyond the meagre output of a shallow gas field in the SE part of the state in the 1920s.

Now, much of the early work done was of course hit-and-miss; I have an edition of the Oregon Historical Society's journal that documents wildcatting in Harney Co 100+ years ago, and these drillers were completely out of their element; even when geologists kept explaining to them in copious detail that the flares they were encountering were nothing but bursts of shallow marsh gas they kept on raising funds for the next hole; and this went on for something like 20 years, too. But plenty of the exploration was conducted in modern times; a WA coastal well did yield no less than 12 kb of oil in the late 50s. That's 12 kb, not kb/d, too. But if there are fields down there somewhere they're not proving simple to find, and sections of both states are ostensibly suitable for formation of source rocks and traps.

The sedimentary basins of Northern Canada have been rather well explored. I worked for a company that ran a fleet of 26 ships drilling up there, and we found a lot of interesting things, but we didn't find much oil. The Arctic region, in fact, is gas prone rather than oil prone, and it would help if the USGS would wake up and accept that fact.

It takes a lot of things other than sedimentary rock to come together to make an oil field, and just because you have a sedimentary basin doesn't mean there's oil there. Most of the world's conventional oil is in the Middle East because everything came together there to create the big oil fields.

There are not a lot of places left in the world where a supergiant oil field could hide. If it hasn't been drilled yet, it's probably because the geologists think it's not worthwhile putting a drill bit into it.

There's a lot of non-conventional oil in the world, but we know where that is, too. The economics of non-conventional oil are such that it won't be put on production until most of the conventional oil has been produced, it won't be cheap to produce, and it won't be fast.

In other words, it won't change the timing of peak oil much, it will just stretch the decline out longer.

Thanks for the information. Appreciate your patience.

I debated Lynch in the late 90s on the internet and for whatever reasons, he did not want to understand the logic behind peak oil (or net energy). He either was incapable or unwilling to view the situation from a biophysical perspective. Many economists have same mindset...

>Michael, do you agree with L. F. Ivanhoe's statement: "The question is not

>WHETHER, but WHEN, world crude oil production will start to decline, ushering

>in the permanent oil shock era.", found at http://hubbert.mines.edu/ #97/1?

Yes and no. Why does the peak come? High prices/costs drive demand down or

make alternatives preferable? Carbon taxes do same? Or some other energy

(solar, nuclear, hydrates GTL) becomes really cheap/clean/convenient and wipes

out the oil business?

Think it can't happen? There are numerous such cases of peaks resembling

Hubbert curves, such as Pennsylvania anthracite or UK coal, where there are

enormous amounts left in the ground but customers switched to gas or imported

coal (respectively). (See Peter McCabe's AAPG article)

We have huge amounts of petroleum resources left and there is no constraint on

the ability to deliver oil products (gasoline, etc., which is what counts) for

an extremely long time, easily more than 100 years. So, I guess you could say

I partly believe that it's a matter of when, because I think the date is so

long in the future as to be meaningless for any decision-maker.

Michael Lynch, Center for International Studies, M.I.T. sci.geo.petroleum

MCLynch

View profile

More options Nov 15 1999, 1:00 am

Newsgroups: sci.geo.petroleum

From: mcly...@aol.com (MCLynch)

Date: 1999/11/15

Subject: Re: When will Oil be depleted?

Reply to author | Forward | Print | View thread | Show original | Report this message | Find messages by this author

>I noticed that you evaded my question. Do you have an answer for

>"---When, world crude oil production will start to decline"---In article

><19991110073954.01657.00003...@ng-bh1.aol.com>,

>We have huge amounts of petroleum resources left and there is no

>constraint on

>> the ability to deliver oil products (gasoline, etc., which is what

>counts) for

>> an extremely long time, easily more than 100 years.

I'm not sure how to access that article, but if "more than 100 years from now,

based on supply availability (not greenhouse gas policies) doesn't satisfy you,

I don't know what will. I could say 2124 or something, but that would be

meaningless.

Michael Lynch, Center for International Studies, M.I.T.

Or see thread at

http://groups.google.com/group/sci.geo.petroleum/browse_thread/thread/03...

Well, if there is no peak for a 100 plus years, then I suppose production is growing. If we assume a +2%/year rate of increase in production, 108 years would give us three doublings, from about 75 mbpd of crude production in 2005. So three doublings would put us at about 600 mbpd around 2013, or 219 Gb per year, or a trillion barrels every five years.

Wellllll Lets say that today Germans consume 2.456 mmbpd / 82 million = 0.03 bpd / capita. (CIA World Factbook) I'd suggest it's highly unlikely the average world citizen would WANT to get to a rate beyond today's average German. So

World at 6 billion = 180 mmbpd

World at 9 billion = 270 mmbpd

That's about the max range of where things could go in future. Could earth get there? I don't think so.

Wonder if Mike's really saying 200+ mb/d is plausible; or foreseeing a permanent plateau. His 1998 chart suggests ca. 10 mb/d every 5 years.

Let's not forget Michael Lynch - Disputing Peak Oil, thread started in early 2005, with contributions from the man himself - user name "Spike."

Hmm, opening to page 5 purely by chance I see Khebab/Sam made exactly my objections back when: Post. Went 3 pages further in and still no reply, although here's this on recovery factor:

Guesswork, eh?

So what happens when the whole globe is in a state of being unable to surpass previous peaks, and demand increases nevertheless?

Fire away, WT - I see your truck backing up through the hole in that last paragraph already.

That is just funny! So we are past peak but we aren't declining? Is this guy for real? Mr Lynch, come to the UK and try telling us that the North Sea ain't declining. Weirdo.

It is a curious definition of "Declining." Based on his definition, production could fall by 99% relative to a peak, and then show a one bpd increase in production year over year, and Lynch would presumably assert that the producing region is not declining.

Regarding the UK, Russia and Venezuela, Russia's apparent all time peak was back in the Eighties, while the other two have--so far--showed peaks in the Nineties. Regarding net exports, the UK went from major net exporter status (one mbpd plus) to net importer status in about seven years. Venezuela's net oil exports have been falling for about 10 years, and Russia showed about -2.3%/year net export decline rate in 2008.

Correction: three doublings would put us at about 600 mbpd in 2113.

I think Lynch misses the point that U.K. coal production didn't just resemble a Hubbert Peak, it was a classic Hubbert Peak. U.K. coal production peaked in 1913 at over 250 million tonnes, now it is down to 30 million tonnes, approximately what it was in the early 1800s.

What happened was that companies mined out the cheapest resources first, and what was left was increasingly difficult and expensive to mine. Beyond a certain point more mines started closing than were opening, and production began to fall.

Despite what Lynch thinks, the U.K. doesn't have a lot of economic coal left, so they're not going to reopen many of the old coal mines. They may increase production somewhat, but not a lot. They don't have the coal or the money to do that.

U.K. oil production peaked in 1999, so they are on the same kind of curve as they experienced with coal.

the U.K. doesn't have a lot of economic coal left,

Doesn't that depend on price? Coal prices have never been high for an extended period.

Wouldn't it be more accurate to say that UK coal was somewhat more expensive than both imports and oil, but that if coal prices were to rise sharply that very large amounts of UK coal would become economic?

Isn't it also fair to say that coal miner union-related politics had something to do with the demise of the UK coal industry in the 80's under Thatcher?

In a post yesterday, I suggested that this is more the sort of response that should be made to Lynch's arguments. I was not aware that paekists had been so off the mark in the past but, being wrong in the past does not guarantee that you will be wrong in the present or in the future. Actually, being wrong often presents an opportunity to revisit you models and make adjustments to increase your likelihood of being closer to reality in the future.

If Lynch et al are making projections based on the continuation of BAU and if we are facing some discontinuity ahead, Lynch and his ilk will certainly be proven to be way off the mark. We live in interesting times.

Alan from the islands

I think this post shows that some peakists have been incredibly accurate (e.g Duncan, Youngquist). Also, many TODers were pretty prescient back in 2005-6 time frame on how events would unfold.

Remember also that until 1998, the EIA used their DEMAND forecasts for 2020 to predict supply!! Good strategy!!

Duncan can only be called "incredibly accurate" if you sweep his preposterous failures under the carpet.

For example, on March 5, 2001 Duncan predicted that there would be permanent electrical blackouts worldwide by 2007:

Link

I meant with respect to his and Youngquists oil models using Stella in Encircling the Peak- I suspect the Olduvai prediction stuff is a speculative offshoot of his oil modeling - and yes he was very wrong on that prediction (at least on timing).

Thanks, Alan. I cranked this out in a couple of hours last night and, looking at the results now, am pretty horrified at how lousy the writing is - tautology, typos, etc. - but glad that the message is coming through.

Various peaks have been called in the past; in 1974, Hubbert projected that global oil production would peak in 1995 at 40-GB/yr "if current trends continue."

There was an article with the theory published in National Geographic that year. I recall reading it. There's a few pages from the article here: http://www.hubbertpeak.com/Hubbert/natgeog.htm

This actually looks like a good prediction at the time - obviously Hubbert could not take into account the knowk on effects of the 1973 and 1979 oil crises. Up until 1973ish, we were essentially doing classic unconstrained extraction (cf North Sea).

This is why getting a peak date is hard....

I posted this on the other Lynch thread, but I think it bears repeating here, because I think the engineering and political perspective of most posters ignores the pure financial self-interest of customers of Lynch and Yergin.

I'm certain that Lynch is useful for what I call the "fiduciary conumdrum" facing the big boys in the oil industry. I've discussed this privately with a couple of heavy hitters, and they agree. If you are in senior management of a large publicly-traded oil company, admitting peak oil exists harms your shareholders and makes you subject to huge lawsuits for breach of fiduciary duty. In other words, if you make the stock go down, the lawyers can take all your money away.

If you admit peak oil is here, you immediately signal that you are willing to pay a scarcity premium for things like acquisitions of reserves or other companies, key employees, and specialized service providers. In short, all you do is increase your company's costs, while doing nothing to increase revenues. I seem to remember from school that declining earnings make a stock go down.

Some lawyers and pension fund consultants would have a field day picking apart the management teams that admit this. If you were in their position, and faced possible financial ruin, or at least a severe financial and legal cost for just saying you're not sure, then you bet you'd welcome the help that Michael Lynch and CERA provide in confusing this issue.

Why would peak oil cause financial ruin for oil companies? If anything, the price will spike and oil companies will make more money then ever. What hurts oil companies are alternatives like ethanol and EVs.

Oil companies will have to fade away if peak oil is true. Making expensive new investments that produce fewer barrels means that the cost will keep pace, or outpace, the scarcity-driven prices. So it's a losers bet.

Also consider ExxonMobil, a vertically-integrated multinational. They only source about 30% of the oil they refine from their own production. Price spikes might help their production business a bit, but it crushes their refining business.

The way oil companies work is,

they find oil, sell it and then make money.

The reverse would be make money, sell oil and then find it.

This seems to be the recent industry-market paradigm.

If, despite all their efforts, they are not finding new oil they will be out of business eventually.

Like time travel, running this movie backwards is impossible.

This is an interesting perspective, which raises two questions:

1) If oil flow is or will soon peak, does this imply that corporations, as legal entities, are ill-equipped to deliver beneficial outcomes for society in the energy-limited future?

2) Is it not also true that denial of peak oil when (if) it turned out to be the most accurate characterization of affairs exposes officers of a corporation to shareholder action or criminal inquiry because they did not disclose material facts?

atanoi

I have to disagree with some of what you say. There are a number of oil companies that have all along stated they believe in Peak Oil and some have based their strategy on that basis (i.e. investing in oil exploration back when it was $20/bbl believing it eventually would be $100/bbl). A case in point is Dr. Jim Buckee who is the former CEO of Talisman Energy. He was very vocal for years about his belief in Peak Oil theory and spoke on it in public a number of times. This did nothing to hurt his companies share price and on the contrary it rose precipitously during the period 1998 (low prices) through 2008 (high prices). Scarce oil does mean higher costs but it also means higher cashflow. As long as the metrics that the market see of cashflow/bbl, opex/bbl are not inordinately out of whack with the rest of industry the company is generally not going to be punished. Where it might come into play is when you are dealing with very large companies such as Exxon who have to replace very large reserves. That being said higher acqusition costs are associated with higher commodity prices. If the oil companies were all worried about where they might be in thirty or forty years your theory would be more sound but such is not the case. The projected lifespan of the average CEO and Board member in these companies isn't 40 years, they are more interested in what is going to happen in the next 3 - 5 years which would have direct impact on their own financial status.

Here's the reddit links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/environment/comments/9esxo/michael_c_lynch_and_t...

http://www.reddit.com/r/reddit.com/comments/9esxj/michael_c_lynch_and_th...

http://www.reddit.com/r/collapse/comments/9esxk/michael_c_lynch_and_the_...

http://www.reddit.com/r/energy/comments/9esxm/michael_c_lynch_and_the_fa...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

Lynch is the deluded village idiot convinced that the endless repetition of the one tune he has taught himself will land a lifetime sinecure as a court jester.

Campbell and Lahererre righly anticipated the end of cheap oil eleven plus years ago. This indeed signalled peak oil, but peak oil is a multifaceted event involving quantities, qualities, feedbacks, etc.. It is also well underway. The date of the peak production of this or that hydrocarbon is interesting, but only a part of the unfolding peak oil story. These dates, which will never be more that estimates, may even make historical footnotes.

As anticipated, cheap oil is a retreating memory. This is and will remain true whatever the price, as we must distinguish between cost and price. The unwise hand of the energy market is now driving down the price of natural gas and so we can anticipate that cheap natural gas will also be a retreating memory sooner rather than later. Ditto for coal.

The village idiot and his ilk have always championed the appropriateness of marketplace economics for the hydrocarbons. As the years go on, this is emerging as action lying between the height of folly and the product of criminal insanity.

Paradoxically, that's both a bold and vague statement.

Let's break that into steps:

1) Oversupply = price goes down

Fair enough.

2) Price goes down = Cheap natural gas gone forever

How does that follow? If the price goes down it's because no one is buying it for whatever reason (in this case, recession caused by housing bubble and oil price spike). But as soon as there is a shortage of natural gas, the price will rise to allow for additional production, provided that production is geophysically possible (it seems that it is).

And on coal, I think it is fair to say that at this time lack of growth in coal is more driven by cheap natural gas and an uncertain regulatory future regarding carbon than it is by supply.

The situation is bad enough... no need to conflate it with phantom issues.

Price goes down = monumental waste of remaining efficiently concentrated solar energy available at lowest cost is encouraged to continue, and, hopefully, for the tiny fraction of the human race who own a piece of the action, accelerate.

But screw our progeny: they'll figure something out.

It is like blaming the doctor for diagnosing cancer. Nothing can be done to alter the outcome of the disease without the diagnosis. We have Campbell and others to thank for their warnings. But if the patient lacks health insurance maybe Lynch figures it would be better to convince him that he just needs to eat right and exercise.

Huh??

"Huh"

If we can't/won't change course to avoid the iceberg, then turn up the music. Clearly, Lynch/Yergin and their employers don't want to change course. In a back handed way, they are following Derrick Jensen's prescription.

EIA's IPM dated August 12,2009 shows 2009 five month crude production at 71,847 M/b/d. Colin Campbell is looking better in 2009, and Lynch is looking worse.

Production is down because demand is down. If demand were still for 80 mbd, then the price would be spiking.

86 mbpd of demand was illusory, based on explosion of easy money, credit, leverage, etc. on strictly financial terms**. This is where net energy, biophysical economics comes in. We live near the tail end of a fiat system. Historically systems not backed by natural resources have enjoyed about a 40 year lifespan - we went off gold standard 38 years ago. In the 1970s we started increasing notional currencies, leverage, debt, credit, and eventually derivatives faster than our real economic driver (cheap energy) was keeping up. But since everyone pursued dollars, and believed that when a bank was allowed to loan out up to $100,000 to Peter after receiving a deposit from Paul for only $10,000, that all this was perfectly consistent with the past and would work out since the total natural resource gain per unit time had always been high and increasing. Gradually the amount of currency/claims in economy became far decoupled from the stuff that was actually in the ground that could create economic work (high quality joules).

1)If we had far less debt, credit and derivative claims out there, everyone could feel confident that underlying energy resources would be enough to pay back the debt with interest in the future

or

2)If we had the same mountain of debt/credit etc. that the world does now, but had the ability to get 200+mbpd of cheap energy for decades to come, we could conceivably grow our way to pay back the exponential growth in financial claims circulating the world.

Unfortunately, neither is the case -so consumption is going to plummet, or world governments will continue to subsidize 'consumption' (cash for clunkers, free downpayments for new home buyers, quantitative easing buy buying treasuries, etc.) or there is a debt jubilee. In all cases how energy is denominated will not be based on the same metric ($/per barrel) that it has the last 150 years - we shot our wad and it was far bigger than anyone expected.

I am busy quantifying the relationship between real energy gain (total energy returned to society for energy invested) vs financial 'energy' created (total global M3 plus derivatives, debt etc.) on a timescale since the 1970s. It may only be 1/2 as bad as I fear, but even that would require a jubilee. And Im not sure what % of the 2,000 trillion in notional claims might be 'offsettable' (meaning canceled with little financial impact).

And before you say renewables will provide the energy gain to bridge the gap, they will require MORE energy use borrowed from rest of society in order to be scaled.

Bottom line - you are right - production is down because demand is down. But demand is down because production of large quantities of hominid pixie dust per capita wasn't enough to keep us happy - we had to lever the farm on top of it. Without government intervention, demand is going to be permanently down from last 5 years- with government intervention, more people will realize everyday the difference between OECD nations, (including China) and Zimbabwe, is confidence. A debt repudiation is on the horizon, and that will shake up oil production pretty good I suspect, with 85%+ of worlds oil reserves owned by governments.

** Fractional reserve banking and pen-stroke leverage are constructs of a non-physical regime. One couldn't drill an oil well and decide to apply 20x leverage to it, meaning that for each barrel you found you'd be able to sell 20 barrels. They are still teaching in Corporate Finance classes in our business schools that a certain amount of debt/leverage is NECESSARY on a companies balance sheet for optimal profits, which, in the last 30 years, it was. But without fantastic energy gain per unit time sloshing through the global system, these rules would have never have come about.

Now this IS interesting. I hope you'll consider coming to Syracuse in October and giving a presentation at the Biophysical Econ meeting. I for one am greatly intrigued.

George, I layed out my hypothesis here in Tuesdays thread. Here is my initial plan on how to quantify it.

Got any free time? ;-)

Also, I doubt I can come to Syracuse - but if I don't make it be sure to incorporate the fact that you really have a two headed chimera on your hands - you need to calculate the EROI X scale for each energy source, using biophysical metrics AND you need to figure out how far the fiat system has decouple from that and given misleading signals - they are related, but this means that using Charlies method of dollars per MJ via GDP is more fallacious the more the orgy of paper exists.

Yes, I'd like to see that too Nate, as soon as you can offer something reasonably complete. Power to your arm!

"production is down because demand is down. But demand is down because production of large quantities of hominid pixie dust per capita wasn't enough to keep us happy"

That is circular reasoning and you know it! It's the sort of self-serving logic that can only come out at a time when oil has dropped in price by more than half since doom was supposedly imminent. I am a peak oiler but I am not going to resort to these sorts of logical backflips.

Why don't you and all the other peakers who are obssessed with proving that "peak oil caused the credit crisis" look a little closer at the way ponzi schemes like the ARM timebomb can blow up economies regardless of energy prices.

Your comment is insulting. I have never once claimed that peak oil caused the credit crisis. Large quantities of oil were not enough to make us happy so we 'manufactured' energy gain via abstract capital. This is not circular at all. Do you understand it?

Read any of my comments over the last few years on the topic. The ones linked above from 2007, here in March, this post of Futures position limits, this speech on Umbrella Overview of Resource Depletion and Human Behavior, and this thread earlier this week, this radio interview last year,and another from 2 years ago - off top of my head. There are dozens and probably hundreds of others but apparently it doesn't matter what is said, you will believe something else.

But I'll say it again.

PEAK OIL DID NOT CAUSE THE CREDIT CRISIS. IT WAS ONE OF SEVERAL PRESSURES THAT PRICKED THE BUBBLE OF FIAT DEBT/CREDIT THAT HAD BEEN BUILDING OVER 30+ YEARS. HOWEVER, NOW THAT THE CREDIT CRISIS IS UPON US, PEAK OIL ADDS A CRITICAL CONSTRAINT.

Sorry for lashing out -its kind of embarrassing - but I've been passively lumped into the 'peak oil caused financial crisis' crowd once too often and I'm tired of it.

From August 2006:

< / R> Rant off.

Onwards.

the debt/equity ratio of a company is the result of taxation (think modigliani/miller)

Rgds

WeekendPeak

Lynch predicted "oil production" of 86 mbd for 2008. Meanwhile, the IEA states that "oil production" in 2008 is currently estimated at 86.53 mbd.

Sounds like a bullseye to me. You seem to be making the claim that he is wildly in error, and yet accidentally striking within 0.6% of the actual value. The fact is: the definition of oil has changed over the years.

Question: If Campbell is accurate, where is his prediction of 86.53 mbd?

Answer: He never made such a prediction. Campbell has always been behind the curve on unconventional oil, and that's why he has failed so many times.

Here's Campbell's graph from his 1998 Sci. Am. paper with Laherrere.

The peak value of all liquids (what the IEA today simply calls "oil") is 26 billion barrels/year, roughly around 2003. That turns out to be 71 mbd -- more than 15 mbd short of the actual value in 2008. (It would be interesting to show actual production overlaid on this graph. At 86.5 mbd it would literally go off the chart.)

In his earlier comment, Kevin writes:

Yet again, this is the usual M.O. Trumpet the successes, and sweep the failures under the carpet. Duncan and Campbell have both made huge predictive gaffs. Laherrere has been more accurate, but not immune, as the above graph shows.

The failure to soberly tell both sides of the story a classic sign of advocacy, as opposed to objective analysis.

I think the author points out that all liquids might have been Lynch's intent, but that it was obscured if so:

In any case, my first essay on this site was about the sliding definition of what is oil, which is relevant to your point. As I said above however, (and to you in 2007), the fiat/credit story trumps oils peak by a mile, (though one could argue they are related).

As I said above however, (and to you in 2007), the fiat/credit story trumps oils peak by a mile,

Yes, the current recession is quite serious, particularly for the US. But it seems to be moderating, and time will tell how it works out. Personally, I don't see major financial crises as anything out of the ordinary; we've been going through them chronically for a couple hundred years. Likewise, fiat money and credit are ancient phenomena. So I see the current conditions as a rough spot, not the beginning of a terminal implosion of global civilization etc. Time will tell.

To be clear, I never have equated these events with a terminal implosion of civilization. Globalization maybe. I am still of the opinion that there is some likelihood of a dieoff either before or just after a new socio-economic system occurs. I maintain hope that your children and mine (if I have any running around China), will lead happier more fulfilled lives than those in their 30s, 40s, 50s today.

On fiat I disagree, this is unprecedented on global level. The US recession grabs the news but the pain hasn't really hit the streets yet, here or abroad - folks are living off government fumes and vestiges of severance pay. Loan guarantees from G20 nations governments account for 32% of last years G-20 GDP!~ China is on pace to print $2 trillion renminbi this year, double last years pace - and their system is set up on global exports. World has 2 quadrillion of notional securities on top of 55 trillion of GDP on top of shrinking energy gain. The US is in bed with all other fiat nations - the global decouple is too great - there will either be a new currency (Global) eventually, a debt repudiation/jubilee (possible but social feedback from that would be bad), war, or other. And leverage is not an ancient phenomenon - currency is, but not the clash with reality - if you have links on some historical societies that lived so far above their means based on belief, I'd be interested to learn about them.

JD - think on this. Without the explosion of global derivatives and other fiat markers in last decade giving much inflated price of oil, and thereby incorrect signal of supply keeping pace, how could Japan have been able to import all that energy, in exchange for yen?

I am VERY pessimistic about next 5 years, but optimistic about next 30, if that makes any sense.

Oyasumi

n

Nate, I agree with you that the proverbial has yet to hit the fan, but this bit is surely in contention to win the most understated award of all time!

"Social feedback" would be bad in the event of a debt jubilee! You FLIPPIN BETTER BELIEVE IT!!! All those who patiently paid off their mortgages, or those who are presently renting (like me) would take to the streets and spill blood everywhere if our over-leveraged neighbours suddenly got the title deeds to their McMansion which they were in default on!

For this reason no government will ever enact a debt jubilee. It is one thing an ancient biblical king decreeing that no debt exists; a completely different kettle of cod in modern leveraged economies. Imagine, those who had been totally irresponsible suddenly get rich! Even if it did happen, there would have to be assurances that they didn't all just rush out and remortgage.

There isn't a snow ball's chance in hell of there ever being a debt jubilee without a very bloody revolution of the French/Russian kind. No way.

Hac: You are enraged by the idea of your neighbour getting taxpayer money-I guess it should be reserved for the Wall Street nobility that owns your leaders. You can relax-the schmucks aren't going to get anything but screwed by this political gang or the other one.

Don't get me started on the Banksters. The whole system is corrupt, that we know.

ps: I am in the UK, and our Banksters are just as crooked as the wall street thieves. The scum who bankrupted Royal Bank of Scotland - Fred Goodwin - was fired but allowed to keep his £750,000 per year pension for life!!! He is only 54 years old!! Utterly criminal.

I honestly can't understand why the US hasn't erupted into all-out civil war at the blatant way that goldman sachs et al have raped your country. Perhaps this is one time when your second ammendment rights should be put into action.

My point about fiat and credit is that there's no real escape from either of those things. You can go back to a commodity based currency, like gold and silver coins, and people will scam those too, just like they did in the roman days. The roman currency looked superficially like it was "real money", but in practice it was just as much a fraud as our current system. Moneychangers have been screwing people since 150 B.C.

Leverage and debt are phenomena which arise naturally, for strong rational reasons. You can't effectively outlaw them.

On top of that, we live in a world of instant, global information, and ready access to vast computational power. So it's very natural for an orgy of derivatives to evolve. In fact, short of draconian controls, I can't conceive of any way to stop it. What are we going to outlaw? Contracts? Computers? Loans? Banks? Unbacked currencies? None of those are viable solutions. There is always a loophole, or a way to scam the system -- even communism. You can't eliminate debt, leverage, fiat and derivatives any more than you can kill every parasite, insect and germ in the world.

You can tame the craziness to some degree, but it's pretty much an inexorable process, in my opinion.

Roman coinage became debased over time, but I wasn't aware it was counterfeited - "scammed" as you say. These days that's a magnitude more difficult to pull off now, too, not that people don't have the machinery to do it, as the rewards for success are so great.

Surely a political solution implemented on a wide enough scale would reign in the worst excesses of derivatives trading, to cite just one example. But this would entail some fundamental sea changes in the political system of the US = a move away from the current system of campaign financing. This will very unlikely to come to pass, it's hardly a matter of debate at the moment. A few more election cycles or a prolonged recession will be necessary to raise peoples' interest in this, assuming they won't be distracted by other matters in the meantime.

Books like the 4th Turning suggest we're headed into a GD/WWII era that will leave the up and coming youth hardened against such meddling in politics, with a legacy of stricter laws against such malfeasance; I have to wonder.

I do agree about the inevitability of complex financial mechanisms, even suspected as much in the 80s, seeing what personal computers could do; "I bet you could really rip people off with these TRS 80s!" Just a teenager doing some idle musing, but scenarios like the scam in the movie Office Space (skimming off tiny bits of interest accrued) didn't take much insight. Fiat currency is that much more simpler to envision; an unsettling fact about them is that they tend to inevitably crash and burn - or so I've heard.

Speculation is even more fundamental; JK Galbraith's little book on Financial Euphoria is as accesible as it gets, Devil Take the Hindmost is a more detailed read on our sordid history of speculation, and also an entertaining page turner.

What an economic system can do, however, is prevent linkage between the growth of derivatives and the banking system. Fractional banking is more than enough leverage for the currency system, and the traditional operations of lending. If other financial entities wish to erect trillions in insurance/derivative products that's fine. Just forbid the banking system to buy them.

Instead of seeking risk mitigation through the hedging of exposure via the derivatives market, we should have instead a de-massification of the banking system. That will raise costs, and increase inefficiencies. That would be a good thing. It would be more robust, and then the risk mitigation would propagate via redundancy. For example, I'd like to see Bank of America split into at least 100 different banks, if not more.

What we need is a banking system that is dull, and simple. Let towns and states and federal governments enter into derivative and super-insurance contracts to mitigate obligations and losses.

G

Nate,I agree with you on almost everything...except this. I am pessimistic about the next 5 years but EXTREMLEY pessimistic about the next 30 years. We will see a global meltdown and it will be a hell on earth.

Ron Patterson

I already explained to you that Lynch's graph is C+C, not Liquids. The point for 1998 is very clearly <70 mb/d.

Someone who pays much more attention to the veracity of these forecasts, Freddy Hutter, summarizes thus:

Lynch documented Colin's 1997 study on his graph, not this one, which I assume is liquids this time.

Feel free to contribute data about how valid these forecasts are proving over time, or refine the work others have done, as I have. That would be the objectivity you claim to be interested in, no?

I haven't found Hutter's scoreboard very useful because he doesn't give explicit citations for his figures. What is the exact original source for "Jean Laherrere 1997" or "Colin Campbell 1999" etc.? Where are the citations for all the scenarios Hutter covers? Do you know?

The point I am making regarding objectivity is that you should not claim that a peak oiler like Campbell is credible due to a "spot on call" when in fact he has made a long series of bad calls. It's like saying he drove straight onto the green, when in fact he drove into the rough, the lake, and the ladies restroom, and then onto the green. Frankly, it's deceiptful, and that's why I'm criticizing you.

If you want to make the case that Campbell is an accurate forecaster, and Lynch is not, then put it all out on the table -- good predictions and bad, the entire history of both men -- and then make the judgment. Otherwise, it's just ax grinding, not objectivity.

Nope, although I just occasionally wander around his site, and see how the Scoreboard is evolving. He lists a variety of studies that Sam didn't include in that last peak oil update published here, from whence I made my chart in the OP; would be keen to work some of Freddy's pundits into this work.

I figured you'd show up to comment anyway. ;) I'm not much good with writing past a short paragraph or two; trying to work in what you're talking about crossed my mind, but I figured it was best to wrap it up and leave these matters for the comment section. Such is one of the advantages of blogging. The genesis of this was Nate contacting me saying my first comment with graph on the 1st piece posted here about Lynch's op ed would make a good post of its own, so I obliged.

Anyway it's no secret that Colin's revised many of his forecasts - no doubt Mike has as well, that's what forecasts are, they can evolve. Colin's was closer to what has transpired over the years, though; and Mike is still coming on like the peak oil modelers are just throwing darts, in a strong wind no less; it's this that he should be taken to task for, especially given his high profile, publishing in one the world's leading newspapers. Who else has Op Eded in the meantime, too? Jad Mouawad has: After 150 Years, Whither Oil ? Anybody else? Simmons?

Will do, time permitting. Freddy has some very interesting stuff though, an animated graph of the evolution of his Depletion Scenarios, for instance: http://www.trendlines.ca/TrendLinesPeakOilDepletion2006TimeLapse-TODSamu... Ah, looking at that file name it seems this is most likely the work of our own SamuM though. You'll want to open it in a separate tab. Perhaps Mike's 1998 paper was more accurate in the near term too, I don't know.

Freddy's data could be formed into a spreadsheet easy enough, he has an archive of the scorecard on his site; or his list of sources could make for a post on one of the forums. Unfortunately the site's down at the moment - perhaps getting hammered with traffic? We emailed each other almost simultaneously, too; he OKed my excerpting what he had to say, and here's an interesting aspect of that SA article:

So he raised my point about the content of the graph already. Even using two axises can be misleading; I try and always remember to clearly delineate which line belongs on which side, and not mix up the scales' proportionality, either. But contrasting two very distinct volumes on one axis isn't honest, unless they're clearly labeled.

Ironically we (humans) will spend an enormous effort sussing out who was right 10 years ago as if that gives us some reassurance the same person will be right again in the future! (Elaine Garzarelli comes to mind.) It almost seems binary. At issue here wasn't a condemnation of Mike Lynch as a person or a glorification of all folks of the peak oil cloth, but the fact that his prose should be chosen by one of our nations highest media centers over many others who have a better grasp of the situation. Thats politics, confidence, and preference for authority figures.

The Dude is right -I asked him to expand on his comment from earlier this week - he often provides good insights here so wanted to give him the mic. We've sufficiently covered the topic - lets get back to what is happening and what to do...

At least Elaine had one good call. Bob Prechter also cashed out on the '87 crash; someone posted a list of various channels Bob was looking for waves in, it really made him seem like a raving eccentric. Should dig that post out and bookmark it. The wave theory itself seems to be quite a laughingstock here with the membership; you know, a history of valid theories evolving from utter crackpottery would make for a very interesting article. Michelson-Morey anyone? Plate tectonics? Yeah right, the continents move around. On tracks of green cheese, I assume!

After all, Lynch's post leaves the reader with the impression that peak oil is tantamount to pseudoscience. Michelson-Morey was just the first thing that popped into my head too, actually that's an example of assumed validity (the aether) transforming into a discarded theory, the reverse of what I'm thinking of.

In the final analysis it isn't really the peak in oil production that should worry us. It is the peak in net energy available to do economic work that counts. Production of all liquids could increase out the kazoo but if each increment of BTUs (joules or whatever you prefer) takes marginally more BTUs to accomplish in each time increment you can still fall behind in the ability to do work needed to have a "real" economy.

See Nate's comment above.

George

And it is the failure to see this simple truth that discredits the like of Lynch.

You just have to laugh at anyone who thinks we will ever pump 145mbpd.

I recommend everyone on who visits this site watch the video below.

This is an 18min documentary on the current state of Detroit and I have to say the current decay of the city is shocking. It is almost a glimpse into our future post industrial world. How many other cities in the U.S. will look like this in 20-30 years?

http://www.liveleak.com/view?i=2d1_1213190543

Note: the opening seconds play a rap song but it fades out quickly as the start narrating. Also a higher quality version can be found on Youtube if you search for Detroit, USA - "Industrial Ghosts" but you have to have an account.

Also this website is dedicated to documenting Detroit's urban decay. This photos are also pretty eye opening.

http://www.seedetroit.com/pictures/LateSummer2004/

more appropriate for Drumbeat.

Good point, I wasn't sure if we could we make suggestions for content in the drumbeat posts. I think including those two links with a little synopsis in a future drumbeat post might be worthwhile.

Just drop a note to Leanan.

I've suggested articles several times. She's never directly replied but the next morning the article was right there in the drumbeat.

Leanan at peakoil.com

Just a note on Detroit. Agreed, it's down some but I drove through two weeks ago and was surprised how well it looked given what we've heard.

It's like unemployment in the 1930s - sure it's a Great Depression, but 75% of the workforce still have jobs.

I like the thrust and understand most of the article but to a casual reader the last diagram needs another sentance to explain IMO. It is not immediatly clear to me that smaller values are better or why this is the case, I don't really know what 'MASE' is -in order to 'get it' I have had to take a leap and assume smaller numbers are better therefore those names on the left are somehow more accurate (although again I'm not sure how or why they are).

Nick.

Sorry about that. I linked to the TOD post whence came the graph and figured people would head there of their own accord, or remember the MASE system from it; sloppy, I know.

I did think to correct the original graph, which just had "MASE" in the legend. Will remember to provide better subtitles next time, this was all dashed off in a bit of a hurry too.

I have just been reading about the shortage of rare earth minerals needed to build our current designs of solar panels and windmills. As Heinberg says we are at Peak Everything. Still many from the "technology will save us" meaning keeping the party going for those lucky enough to be born in the first world)crowd keep fantasizing on the pages of the Oil Drum and elsewhere that peak oil doesn't have to mean a radical change of lifestyle. I don't see any difference between them and Michael Lynch except that perhaps there is more data is available on how much oil there is in the world than how much neodymium etc. there is. http://www.treehugger.com/files/2009/06/goodbye-fossil-fuel-dependence-h...

Just that there's a world of ethics between mourning a crash/dieoff and cheering for it.

Have you considered the ethics of continuing to rip off third world countries for their rare earth metals. Have you seen the conditions that copper miners in Chile live and die early in to provide us with copper. Ethics - the first world has precious few of those - and what they bound with their own borders.

I have nursed sick babies in Haiti at Mother Theresa's home in Port-au-Prince and had to face the awful truth that saving their lives means more devastation to the vastly overpopulated island. Ethics is easy to talk about when you stay removed. How will electric cars in the US help starving babies in Haiti - do explain the ethics of that. And Bolivia has a big pile of lithium that I understand is needed for those batteries. Will we make sure the Bolivian miners get electric cars too? Wouldn't that be ethical if we use their natural resources. The first world has NEVER been ethical in its push to keep the party going and growing.

Have you considered that a crash is inevitable and seeking to stave it off by ripping of more of the planet might cause a greater dieoff. If it were possible to keep our over affluent lifestyle going with renewables we would crash when we use up soil fertility and ground water. Only we would probably have more people to die early deaths then than we do now.

Dieoff is something we are all going to do. It means a bunch of folks are going to die earlier than expected, in ways not expected and perhaps without leaving offspring. But everyone now alive is going to die eventually and for the 1 billion who live on $1 a day perhaps an earlier death is not as horrific as an earlier death seems to people who live on an average of $70 a day in the US (The median income per household member (including all working and non-working members above the age of 14) was $26,036 in 2006. per wiki). I figured out once that to average out incomes over the world we should each live on $8 a day. I think that would be much more equitable and ethical.

I for one an tired of those cheering for every scheme that will keep the first world party going without any way to share that party with the rest....

Evo Morales is doing what he can to ensure that, if mining companies exploit his country's resources, the citizenry of Bolivia will get a fair shake. For that he's to be applauded; but it may mean the lithium just stays in the brine; or that greedy nations/corporations will intervene as they've done in Venezuela.

In the strictest sense it's unethical to use a computer, or go online - after all, server farms are powered by electricity generated from coal sourced from mountaintop removal, etc. Depends on where you draw your line. Memmel's posts about the ubiquitous adoption of the cell phone in the third world being replicated in the OECD is one of the most interesting speculations I've read here about our future - imagining a network of phones with transmission towers powered by simple renewable energy is a fascinating scenario to contemplate, very Veridian I suppose, as I understand that term (not in depth, I admit).

Don't see dieoff as an inevitability - why not just have a global repeat of the FSU's experience, with the death rate advancing over births? People will become very distraught over losing baseload power and endless supplies of gadgetry, not to mention seeing their supposedly eternal political structures fall down, manifesting in a lack of interest in sex, not to mention the impact from having to burn off a lifetime of fat walking/cycling/digging; others will carry on with what they did before, out of habit as much as anything; also I've wondered what a call for patriotic service would do in the face of mass unemployment. If your town was out of funding and you worked for the water department, would you just say to hell with it and let the pipes and reservoirs fall apart? It's the town you live in, after all, and your prospects for moving elsewhere are negligible, possibly worse than where you are.

This doesn't mean I'm unaware of the prospects for people living in unsustainable parts of the US SW, to name one example. Many have written of a future full of people living chockablock in slums surrounding cities, which would be one way to siphon off the populations living in cities such as Las Vegas. This could unfold over decades, instead of resolving itself in one mass famine.

Doomsday cults are beyond ethics, it's a psychosis.

We are mortal. To so state that fact is not doomsday but reality, to not realize that every person alive today will one day die is the psychosis. Peak Oil or not, Global Warming or not, every living person, animal dies. Just the facts of life.

Our way of life in the first world and especially in the US brings the world ever closer to doom. We protect our goodies with Nukes - and hold on to enough to destroy the world many times. We pump out more CO2 per capita and use more oil per capita than the rest of the world. We pollute our water, we overfish the oceans, we pump dry the ancient water of underground aquifers. Seems to me that business as usual in the US is the doomsday cult. In fact more than a cult, a doomsday machine. In protecting our assets around the world we have brought doom to millions - Iraq just being the latest.

But I suppose the best way to defend oneself against reality is to label it an illness. Too bad for humans that their brains lie to them so easily.

I have no misconceptions about being a permanent part of a core which maintains itself at the expense of the periphery. Who is allowed to stay in the Pale could change at any moment, indeed has in this latest economic downturn. Having ample dumpsters to dive in if you're a homeless American is little comfort. A severe enough cut into services due to peak oil would magnify this dilemma immensely if appropriate measures weren't taken and successfully implemented.

Did anyone sent a "Letter to the Editor" at the NYT?

The absence of any posting of such letters leads me to think this Op-Ed generated a substantial $$$ deal for the NYT in return of a non-rebuttal posting clause. The piece is obviously a "His Master's Voice" order from well vested interests - from abroad? - an attempt to brainwash anyone who reads it into BAU.

I think, reading the reactions posted on the NYT bloggs - I consider TOD is the choir - that it failed. Also, I think that your efforts at rebutting a Michael Lynch are only worth for what it does best - re-group the thinking and solidify the PO science. But you will never change the man himself: his salary depends on disinformation.

I have been looking at the net energy analysis and discounted energy as a Net Present Energy Value formulation of the value of renewable projects. We are not only facing a decline in easy oil, but we are facing an increase in the energy intensity (EI). As Charlie Hall's et al.excellent work (Energies, 2009, 2, 490-503; doi:10.3390/en20300490) points, the O&G industries EROEI has gone down from 35:1 to 18:1 from 1999 to 2006, thus pushing the O&G EI up.

The real goal of Mr. Lynch's Op-Ed is to block the development of (Harebrained) renewable energy in this country. There is a geopolitical intend to reduce the ability of the U.S. to free itself of its subservience to the Oil producing powers.

Congress is about to tackle the energy bills. The timing of this Op-Ed is connected to this event. There are fabulous technologies in the R&D stage that need a push. Forget about private capital going into these. We will need a Private-Public effort to support this research and that is exactly what the Lynches are paid for to avoid happening.

MDL

I didn't peruse the comments at the NYT blog, it was closed prematurely, wasn't it? So I'm not aware that anyone linked to this article in the NYT blog, although Leanan has posted some rebuttals to it published elsewhere. I don't get worked up about reading random opinions on these newspaper blogs, often the most vocal posters have the shallowest knowledge of the topic at hand. Precisely what the ultimate impact will be I can't say, how influential blogs are in the first place at this stage in history I'd like to know. All we can do is try.

Sometimes I encourage people to present this info in a more accessible/digestible manner - I believe there are better avenues to go than just paragraph after paragraph of data. Provide sources for everything you present, of course, but go heavy on graphs, which I love to make, as you can see. With Flash you can create incredible interactive presentations too; if I knew how to pull that off I would. Think of JoulesBurn's work here, where you mouseover a satellite photo of Saudi fields and see how the infrastructure has evolved over time. That carries much more weight than Matt Simmons's rather dry prose, imo. I can imagine how graphic presentations like these for peak oil could work but don't have the chops to pull it off at the moment. This might require collaboration, really, but would be a vast improvement on our list of second hand primers.

How more countries are past peak, the more accurate becomes predicting PO. That is why now it is clear that PO can't be far away or is allready gone.

More important then PO is when oil-exports are going 'of the cliff'. Because of this I'm not so pessimistic regarding the next 3-5 years, but after this time frame things could turn out bad.

One criticism brought up by Lynch is that the post peak nations cited by peak oilers were negligible contributors in the first place, thus not really worthy of attention. His notion of never ending supply is based on the idea that post peak nations can bring up their output slightly, and the net effect is that of a larger nation being online - I think. Don't know if he's propounded on the ELM phenomenon; JD had a post attacking it for the reason I mention above, that the net effect on world supply wasn't worth mentioning; but this conflates total supply with exports themselves; if a producer consumes more the part consumed may as well not exist as far as the rest of the world is concerned.

I repeatedly asked the POD (Peak Oil Debunked) People to cite an example of an exporting country, that had a production decline, where their net export decline rate did not exceed their production decline. Still waiting.

After looking at 21 case histories, the closest I found is Equatorial Guinea, which has a tiny level of oil consumption, but technically if you carry the calculation out far enough, even their net export decline rate exceeded their production decline rate:

Equatorial Guinea (2005-2008l, EIA)

-1.45%/year (Production) & -1.46%/year (Net Oil Exorts)

Based on the mathematical model and based on actual case histories, net export declines tend to be front end loaded. Indonesia's annual net oil exports in 1996, their apparent final production peak, were 285 mb. Their net exports fell in 1997 to 245 mb, before rebounding somewhat in 1998 to 259 mb, down 9% from their 1996 peak (EIA). However, their total post-1996 Cumulative Net Oil Exports (CNOE) were 1,151 mb, and in 1997 and 1998, they shipped a total of 504 mb, 44% of their total post-1996 CNOE. In this two year period, they were shipping one percent of post-1996 CNOE about every 17 days.

So, relatively high net export rates, close to the final peak, are quite misleading. If we average Sam's middle case and high case for the top five net oil exporters and call this the Most Likely Case, in just three years (2006-2008 inclusive), the top five net oil exporters shipped about one-fifth of their post-2005 CNOE (based on Most Likely Case), which suggests that the top five were shipping one percent of their post-2005 CNOE about every 55 days.

The gulf between Lynch's vision of a virtually infinite rate of increase in oil production, and what I believe is the reality of a long term accelerating rate of decline in net oil exports could not be more stark.

Trying to think of a phrase to describe Lynch's fancy that nations peaking doesn't matter, since their collective minor rises will mitigate declines elsewhere, an amusing paraphrase suggested itself: "Life from a thousand bandaids."

Right on bro, all in line with ASPO centrals recent work on depletion rate forcasting of future flows.

Russia claims 500bn barrels in the arctic.

http://www.telegraph.co.uk/sponsored/russianow/6098600/Escalating-tensio...

Right under the title

'This online supplement is produced and published by Rossiyskaya Gazeta (Russia), which takes sole responsibility for the contents'

So just more Russian propaganda IMHO until flowrates show different.

why is it so important to prove Mr. Lynch wrong?

It will not change what is happening.

Rgds

WeekendPeak

Was it important/relevant to disprove that the world was flat?

Eventually, the truth would have been discovered. The sooner it was discovered the less resources were devoted to the wrong paradigm.

True, but people (at least likely the majority on this site) know that the earth, and therefore anything contained within it is finite.

I suspect that ultimately peak oil, or peak resources in general is an effect, not a cause (of unhappiness).

My guess is that our desire/need to propagate and be more than what we are is what causes us to consume and pollute our enviroment - think of the "are humans smarter than yeast" line of one of the users on this site. It seems that all living creatures engage in this - yeast does not choose to stop growing so it doesn't kill itself with alcohol / consumes all the resources around it. Nor do elephants, trees, weeds, goldfish. They all eat and multiply until they run into an externally imposed constraint.

Rgds

WeekendPeak

There is wisdom in what you say. But acknowledgement of permanent resource limitations by humans is z necessary first step towards culturally evolving beyond 'take all available now' to something more in balance with solar flows instead of stocks. A yeast colony does not have the ability to recognize what will happen to it when the sugar is gone and it's surrounded by alcohol. Neither will we in all likelihood - but there is no analog in nature to humans - we, at least in theory, have the ability to use our intellect to match our demand template (wiring/drive + population + footprint) to our supply template(multi-criteria natural resource flow rate available per unit time, accounting for externalities). The sooner Lynches viewpoints are seen as politics/denial/small thinking, the larger the chance that a few hundred years from now there are happy healthy hominids living lightly on this sphere. The decisions of next decade will dictate the future of our own and many other species more than any decade of the past - and each month that the needs of the present become more pressing, the needs of the future will seem less relevant.

And the majority of people reading this site, are not the majority of people...;-)

Enjoy your Weekend, Peak.

This was too verbose. The people who worship Lynch are too stupid to be able to comprehend this article.