#9 - Shale Oil: The Latest Insights

Posted by Rembrandt on December 25, 2012 - 1:00am

The Oil Drum staff wishes a Merry Christmas to all in our readership community. We are on a brief hiatus in this period, and will be back with our regular publications early in the new year. In the meantime, we present the top ten of best read Oil Drum posts in 2012. The second in this series is a summary by Rembrandt on shale oil developments and production expectations.

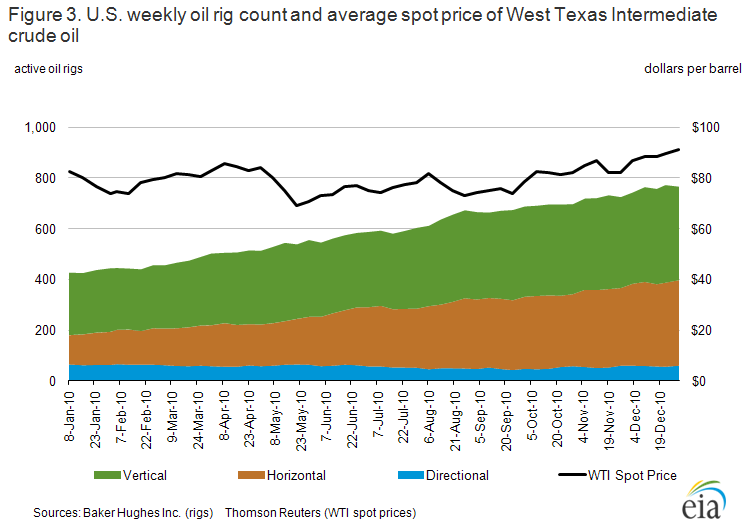

The impact of unconventional fuels like shale oil on the global energy system is still an issue of great uncertainty. Not so much because of the size of the tank (the resource base), but due to the large physical effort necessary to obtain a sizeable supply of this type of fossil fuel. For instance, to exploit tight shale oil formations we need large capital expenditures to obtain relatively low flow rates from many horizontally drilled wells.

The developments of all things shale oil were discussed at a seminar organized by Allen & Overy and their Future Energy Strategies Group in London on 16 October, of which a summary and key take-away points can be found below the fold. With many thanks to both Allen & Overy and the speakers at this event for sharing their knowledge on these important developments in a public setting.

Key take-away points from speakers at Allen & Overy meeting:

- There is a large existing shale oil (and shale gas) resource base but whether the resources can be developed economically at sufficient scale in many countries is still an issue of uncertainty.

- Two promising shale oil plays outside of the US are the Vaca Muerta in Argentina and Bazhenov Shale which both have double digit figures of potentially recoverable resources, with large players like Chevron, Statoil etc. engaging in their development.

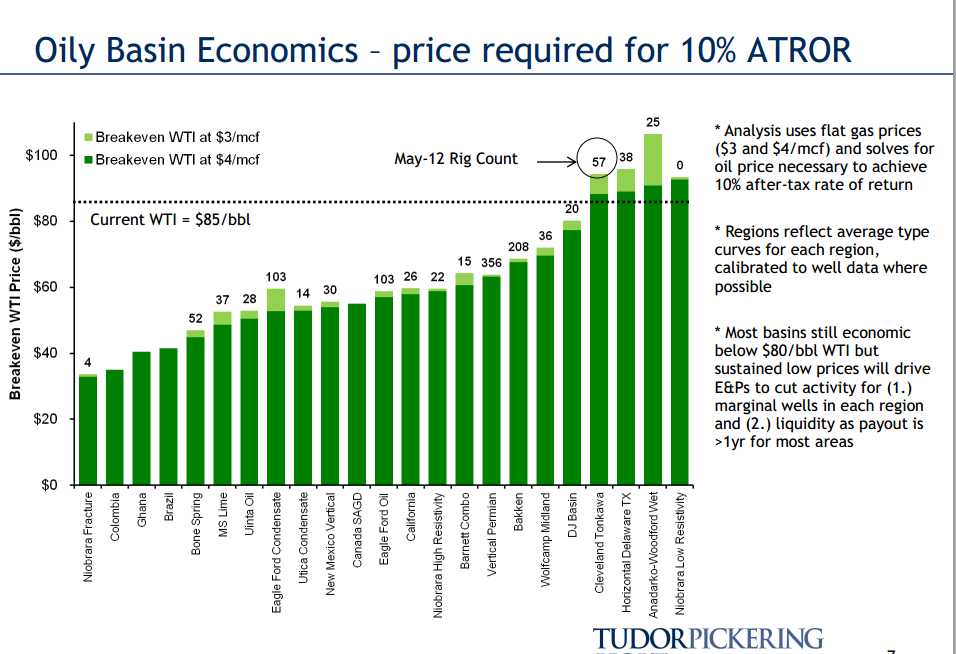

- The marginal cost to develop shale oil in the US is around 90 USD per barrel with average cost of most plays around 60 USD per barrel.

- The effects of the abundance of shale gas in the US, which sent natural gas prices plunging, is unlikely to be replicated in the oil market because of its different market structure (globally connected oil market versus fairly closed domestic gas market).

- The US may not produce as much natural gas as currently anticipated in the future, because the industry will be more motivated to drill for shale oil then shale gas, given the availability of drilling rigs, because it is more profitable.

- We already see a shift today from dry shale gas basins being drilled to shale oil basins being drilled, including those with associated gas.

- In the UK, a report is about to be released by the British Geological Survey on shale gas resources and reserves. Of the studied basins, the most promising one is expected to be the Lancashire shale basin because geological studies indicate the reservoir to be more than 1000 feet thick, as opposed to US-based shale plays, which are in exceptional cases up to a hundred feet in thickness.

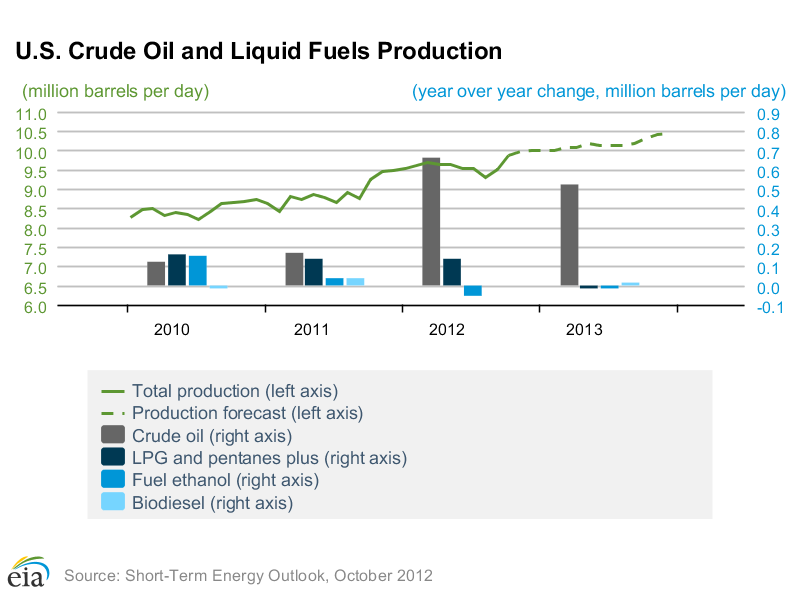

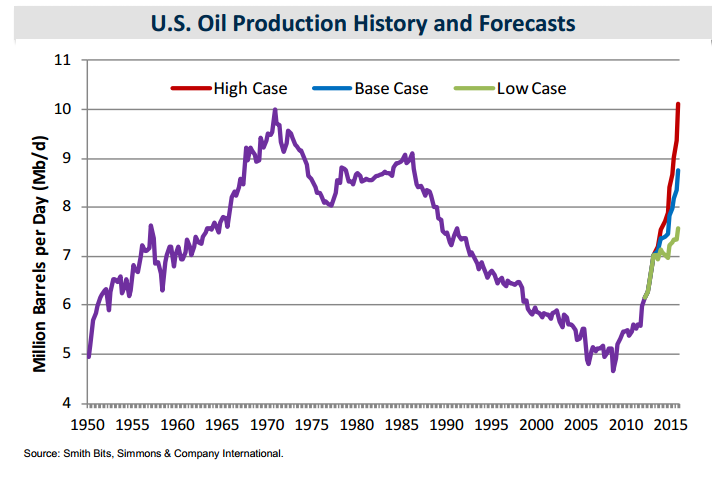

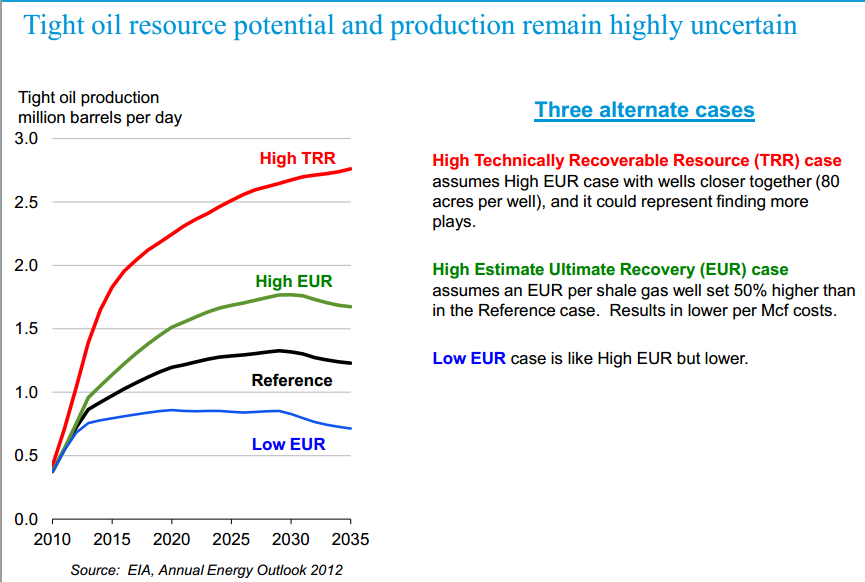

- There is a wide spectrum of views on the potential for shale oil production in the United States, with the pessimistic end being a maximum of 1.8 million b/d (of which 0.9 million is already in production) from Corelabs, and the optimistic spectrum expecting 3 to 4 million b/d from shale oil in the longer run (2020s).

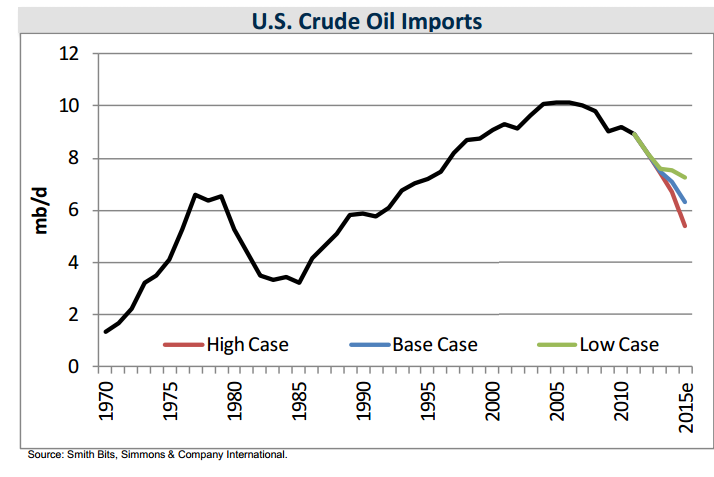

- If the more optimistic scenarios become reality, the consequence would be a substantial decline in US oil imports, falling from 10 million b/d to 6 or 7 million b/d from 2008 to 2015.

Presentation (1) Justin Jacobs, Journalist or the Petroleum Economist

The first presentation about the big picture on shale oil was given by Justin Jacobs, journalist at the Petroleum Economist. He highlighted the importance of the US Eagle Ford and Bakken plays (approx. 27% and 63% of total shale oil supply), and emphasized large production expectations in the short term, with the EIA forecasting 1.5 million b/d shale oil production in 2013.

The Petroleum Economist recently made a first map of oil & gas unconventional resources across the world, to be found here, which Jacobs used to demonstrate the large number of unconventional resource plays in the world. He picked two of the most important shale oil plays to keep an eye on for the future:

- Vaca Muerta in Argentina, one of the largest discovered outside of the US. Its development cost is 250 billion USD over 10 years (with production potentially amounting to 200,000 b/d by 2020). The Repsol YPF section of the basin holds 22 billion barrels of oil equivalent of recoverable resources according to a Repsol YPF initiatied Ryder Scott assessment.

At present development has been slowed by the nationalisation of Repsol YPF by the Argentinian government who took a majority share. Because the investment required is at minimum several billions YPF is trying to find big players who are willing to invest, including Chinese firms and Chevron.

- The Bazhenov Shale in Russia, has drawn interest from ExxonMobil and Statoil who have agreements in place for exploration and geological studies with Rosneft. The first exploratory drilling is to take place in 2013, and the licenses under investigation are expected to contain 15-20 billion barrels of resources. Total resources of the play have been estimated by BofA Merril Lynch at 60 to 140 billion, whereas Jacobs noted that these are wild early stage estimates, but that the shale play’s large size is beyond doubt. He cited Statoil estimating 2014 as an earliest possible production date, however, in his view attractive fiscal terms then currently offered by the Russian government would be necessary for development to take place. The play has also attracted attention from Lukoil, Ruspetro and TNK-BP.

The key issue according to Jacobs is whether the large existing resources can be developed economically at sufficient scale. The development requires thousands of wells due to the steep decline rate, which necessitates the on-going development of a new services sector in the majority of countries with plays. Similar to calculations by Rune Likvern as well as Arthur Berman and Lynn Pittinger published at the Oil Drum, he cited shale oil development to require high oil prices at 80-90+ USD per barrel.

Another relevant point brought forward was that the abundance of shale gas in the US sent natural gas prices plunging. The effect is unlikely to be replicated in the oil market. The reason is the difference in market structure. The oil market is fungible in its imports and exports and requires a high oil price to meet demand. In contrast the US gas market is fairly closed with production being sufficient to meet domestic demand.

Presentation (2) Richard Sarsfield-Hall, Pöyry Management Consulting

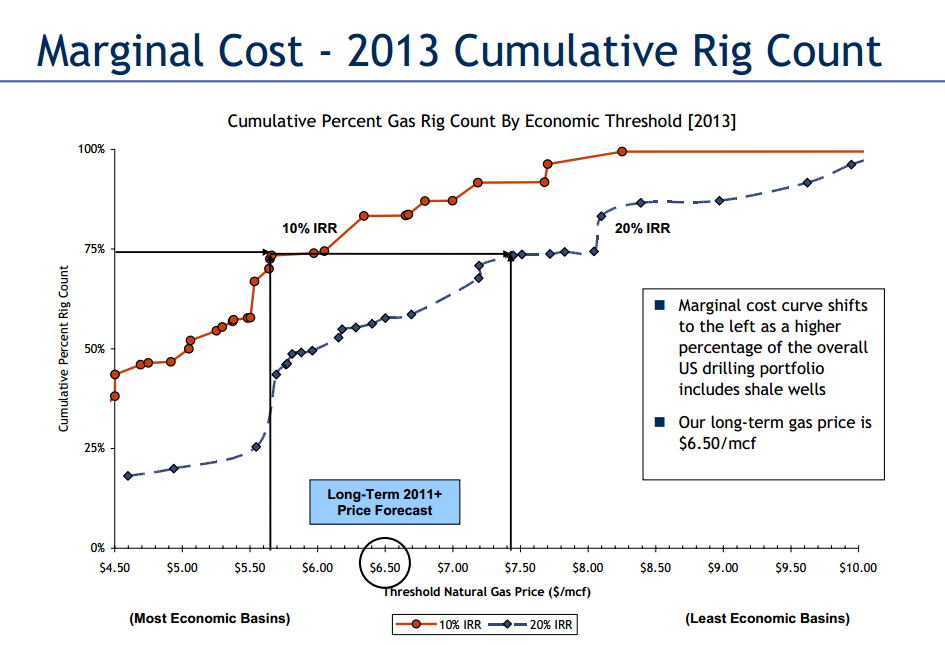

The second presentation was given by Richard Sarsfield-Hall from Pöyry Management Consulting, who posed the question "Is shale oil the brave new hydrocarbon frontier?" He reiterated important common points on the US gas market:

- The current low price level of 3 USD per MMBtu.

- The much higher marginal cost as opposed to current price levels.

- The oversupply of gas caused by a over-drilling given the cost-price imbalance.

- The growth of shale oil and shale gas requires more and more wells to be drilled to maintain and grow production (see Rune Likvern and Arthur Berman’s articles linked to above for more details).

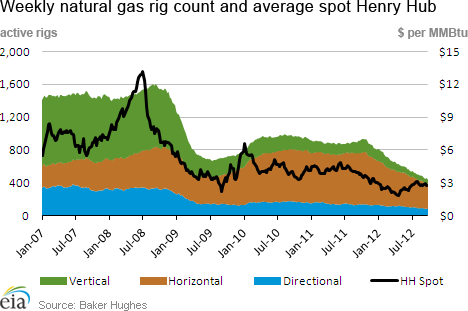

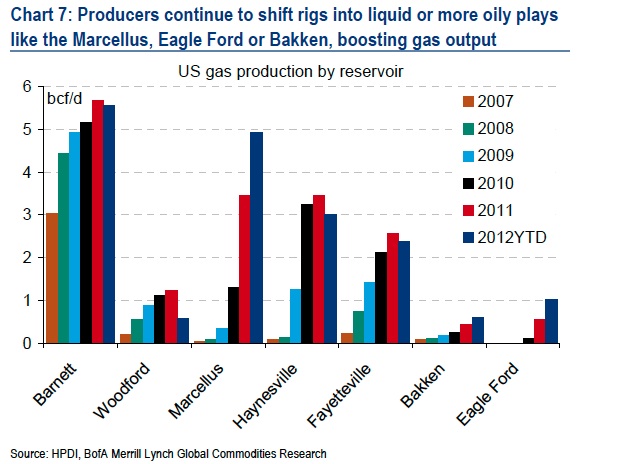

The key issue presented by Sarsfield-Hall was about internal dynamics in the US market, as he sees a drilling competition occurring between the developments of dry shale gas reservoirs (Haynesville, Fayetteville) as opposed to shale oil reservoirs with associated natural gas (Eagle Ford) and shale gas reservoirs with associated liquids (Utica). This occurs because of more favourable economics for one versus the other in today’s market conditions (high oil price, low natural gas price in US). This is also possible because exactly the same type of rig is used for shale gas well drilling and shale oil well drilling. According to Sarsfield-Hall we already see this happening in today’s market, a point quantitatively further emphasised by the third speaker Tim Guiness, Founder Guinness Asset Management. He showed that well drilling has been overtly dropping in dry shale gas plays, while it has been constant or increasing in shale oil and shale oil with associated gas plays.

The implications of this competition are primarily affecting the expectations of institutes and market players, as the US may not produce as much natural gas as currently anticipated in the future, because the industry will be more motivated to drill for shale oil than shale gas. As Sarsfield-Hall puts it “There is a definite move of drilling from dry shale gas into shale oil with associated gas, the rush to shale oil potentially means insufficient shale gas delivered, which may result in higher gas prices and/or insufficient volumes to feed potential US LNG exports”. In addition Sarsfield-Hall showed EIA estimates which are primarily dry gas based increases, with little increase in associated gas from the expansion in shale oil. In terms of shale oil we are talking about a 10%-25% production share of total oil production in the coming decades according to EIA projections.

There were some numbers displayed. One key projection was for dry shale gas production, from a firm called ARC Financial, which showed decline expectation of 0.6 bcf/d up to 2013 from a current level of 23 bcf/d for dry shale gas production. Also some US associated gas production numbers were presented as per table 1, which is gas produced from oil fields (either free gas or dissolved in oil as a solution).

In the last part of his presentation he highlighted work POYPRY has been conducting for Cuadrilla, one of the major players in the EU which is trying to get shale gas production off the ground in multiple countries. The study was conducted to calculate the impact of shale gas development in Lancashire in the United Kingdom, the results of which will be published in a couple of weeks. The Lancashire shale basin is interesting according to Sarsfield-Hall because geological studies indicate the reservoir to be more than a 1000 feet thick, as opposed to US based shale plays which are in exceptional cases up to a hundred feet in thickness. This would in theory make UK shale gas in Lancashire much cheaper to develop. The information provided is preliminary, with full details about to be released by the British Geological Survey (BGS) in a report on UK shale gas resources and reserves.

In using Cuadrilla’s scenario for production POYPRY found that UK natural gas imports could be reduced by 21% by 2020-2025 through shale gas developments. Their conclusions were that this could drive natural gas prices in the UK 4-6% lower which would save consumers 810 million pounds per annum. It would not in his view impact the UK achieving its 2020 renewable targets and alter its power generation at the volumes discussed.

Presentation (3) Tim Guinness, Founder Guinness Asset Management.

The last presentation was from an investors' perspective, with Tim Guinness, chairman and founder of Guiness Asset management, and lead manager of their Global Energy Fund, presenting his views. He began by reiterating the reasons why the US has been able to develop their shale plays as:

- Improvement in ability to steer the drill bit.

- Development of ability to drill horizontally.

- Discovery of how to use hydraulic fracturing.

- US land and mineral rights.

- Relatively low population density.

- Adequate access to water.

- Existence of large successful oil & gas service industry and independent exploration & production sector.

He confirmed the switch from dry gas to shale oil/liquid rich shales with associated gas that is occurring, displaying rig figures per type of shale basin (predominantly shale oil, shale gas, and liquid rich with oil + associated gas). In addition he noted that the growth in gas supply has stopped in the US and is on a plateau, whereas oil production is growing substantially due to shale oil. He cited an onshore production estimate for December 2012 at 4.8 million barrels per day, which has been growing since 2008 after 38 years of decline since the peak in the 1970s, of which about 1.2 million b/d is from shale oil.

In his synthesis he compared three different estimates for shale oil production:

Table 2 – US oil production forecast for 2015 from Simmons & Co. Expectation based on 85 USD per barrel of oil and 3.50 USD per McF of natural gas.

The final point Tim Guinness discussed was marginal cost, which according to Tudor Pickering for the majority of shale oil plays requires 60 USD, with the highest costing ones amounting to 85-90 USD (see figure 9 for details). He also cited Bernstein Energy research which shows cumulative resources of 30 billion barrels of US shale oil to be available at a cost below 150 USD per barrel. Some of the plays have a very low cost range, such as the Eagle Ford, where a figure of 40 USD per barrel was cited (Tudor Pickering shows this play around 60 USD).

Finally in his conclusion, as per recent Bernstein Energy research, Tim Guinness stated that shale oil is not a game changer for these specific reasons:

- Quality drilling locations are finite.

- Shale oil cost structure is high.

- Drilling efficiency gains harder to obtain than in gas shales.

- The industry structure (OPEC) is better for oil.

- Scale of US shale oil find relative to the oil market is small.

In Tim Guinness' words: “It is akin to something like the discovery of the North Sea, Alaska or GOM. A useful addition but not a game changer, as the world needs 5 new North Seas every 20 years to provide enough oil to meet growing demand.”

Previous articles on Shale Oil and Shale Gas at The Oil Drum

- September 25, 2012, Rune Likvern, Is Shale Oil Production from Bakken Headed for a Run with “The Red Queen”?

- August 15, 2012, Ruud Weijermans & Matthew Hulbert, Shale Gas Assets - Overpriced Or a Liquid Turn for Mining Giant BHP?

- January 26, 2012, David Hughes, With Gas So Cheap and Well Drilling Down, Why Is Gas Production So High?.

- August 15, 2011, Arthur Berman, U.S. Shale Gas: Less Abundance, Higher Cost.

- July 24, 2011, Heading Out, Tech Talk: natural gas production, as shale gas arrives.

- April 17, 2011, Heading out, Tech Talk - the new EIA Shale gas report.

- December 19,2011, Heading Out, Tech Talk: When oil isn’t crude and gas isn’t gas, the Eagle Ford Shale play.

- October 28, 2010, Arthur Berman, Shale Gas—Abundance or Mirage? Why The Marcellus Shale Will Disappoint Expectations.

- July 28, 2010, Gail the Actuary, Arthur Berman talks about Shale Gas.

- December 13, 2009, Heading Out, Shale gas and water.

- November 15, 2009, Heading Out, Horizontal wells and gas shales.

- November 8, 2009, Heading Out, Shales and the gas within them.

I am stunned by the tendency to associate the word "pessimism" with doubts about how much oil / gas we can extract, I.e., how quickly humanity can race to the bottom of the barrel.

My pessimism is very different from that.

My bast case scenario is that somehow our frantic efforts to sustain the present obese infrastructure will falter and a tiny bit of oil / gas / coal will be preserved for future generations. My pessimism is that folks like those reading The Oil Drum will never stop to question our mad rush to drain the last of it until it is way too late. Drill drill drill. Burn baby burn.

Optimism to me on this special day is that a few people will stop in the midst of the holiday hubbub to reflect upon our natural endowment and think deeply about what we must do to reframe our debate as we slide down the back side of the Hubbert Peak. Optimism is finding a way to slow down the race to the bottom: to know that over there we can see some viable oil and the best answer we can come up with is to leave it be for our children's children's children. That's a Christmas gift worth giving!

We read here 2574 words including several "conclusions." My conclusion is simple: we need to start asking a new set of questions. Question #1: How do we use what's left to build a society that is not dependent on our kleptomania and pyromania, that instead is based upon the long view ("sustainability") for the success of the human experiment through stewardship of our natural capital.

Merry Christmas!!

If Climate Change is believed to be probable, it would would not be good news to extract tight oil and gas.

This is a site from Artic scientists concerned about what they are seeing, if this doesn't alarm you nothing will!

http://www.ameg.me/

While humans produce approx 4% of CO2 emissions, Earth seems to be finely balanced enough to be sensitive to this.

http://arstechnica.com/science/2012/11/how-sensitive-is-the-climate-to-a...

the best answer we can come up with is to leave it be for our children's children's children.

That assumes that oil has some irreplaceable value. I suspect that unless they are historians, our children's children's children will be very puzzled as to why their ancestors saw much value in fossil fuels in the first place, when other energy sources will be so much cleaner, cheaper and better...

Cleaner, no doubt. But cheaper and better... not a chance. What energy source would that be? Go on, just name one that is cheaper then oil just coming out of the ground. One that for over half a century sold for under $5 barrel. And and name one that is as portable and convenient as liquid fuel. Name one. And name one that can be used any time of the day and no matter what the weather is. Name one that so many units of energy can be contained in such a small space. And name one that can be turned into so many different kinds of products as petroleum.

There is no source of energy that can deliver so much energy for so little as fossil fuel. We can and will find other sources of energy but nothing will ever fully replace fossil energy, nothing.

I agree with Ken Deffeyes who says our grandchildren will exclaim: You mean you just burned it! Burned it?

Ron P.

Well, thanks for bringing that up, Ron. That's a very important, commonly held, unexamined assumption that would be good to deal with.

I think you're right that our descendants will wonder why we burned it. OTOH, I think they'll wonder why we didn't just leave it in the ground. Don't you think they'll ask that question about all FFs?

Yes, oil coming right of the ground has been pretty cheap. On the other hand, both wind and light are free. Yes, there are other expenses to making wind and light useful, but the same applies to oil in spades. We used to think that oil was cheap and easy, but surely a $2 trillion oil war, and a disappearing Arctic has taught us something different.

Beside the real external costs, $5 oil needs to be adjusted for inflation, refining, a scarcity premium,metc.,-, the real cost is now quite high.

An EV can drive for $.02/mile on wind power - what ICE can do that?? The average new ICE would need $.50/gallon gasoline to do that, and that's less than the cost of refining. .

Yes, liquid fuels are pretty dense and portable. But, where they're convenient for niche applications they can be synthesized from electricity, seawater and atmospheric carbon. Yes, that's likely to cost up to $10/gallon with current tech, but the niches where they're really needed are small enough that price is relatively unimportant - maybe 10% of current uses, and the costs will fall at least somewhat. (Of course, ethanol is also likely to be used, for better or worse).

No they are not. It cost a lot to build windmills and solar panels. The break even point only comes after many years. And that is just the energy savings while using the grid for times when the wind is not blowing or the sun is not shining.

But the primary expense with both are storage. Trying to store solar power when the sun is not shining, which is about 65% of the time if you count clouds, is enormously expensive. Ditto for wind when the wind is not blowing. And they both are unreliable. The wind may be calm for days or or weeks. And you may have cloudy weather for many days on end, many weeks on end in the winter. Storing electricity for weeks at a time would make their cost many times over what oil is.

Of course the cost of oil is now a lot higher than it once was. That's the very point. Our economies were built during a time of very cheap oil. Oil only got really expensive in the last ten to twelve years or so. The price of oil is now wrecking the economies of the world. Solar and wind + storage will never be anywhere close to the price of oil today, not to mention during the last century.

You had better do your calculations on wind and solar again. You are way, way off right now.

Ron P.

It cost a lot to build windmills and solar panels.

Sure. That's what I meant by " Yes, there are other expenses to making wind and light useful, but the same applies to oil in spades."

The break even point only comes after many years.

Even Hall agrees that wind's EROEI is around 18 (IOW, break even after less than 2 years), and if you look clearly at his data (which is quite old, and mostly based on very small turbines) you'll see that Vesta's claim of about 50:1 for large mordern turbines is more realistic.

But the primary expense with both are storage.

Ah. So you agree that wind, solar, EVs etc are just fine in other respects: scalable, affordable? Storage seems to you to be the main problem?

Trying to store solar power when the sun is not shining, which is about 65% of the time if you count clouds,

People mostly sleep at night. For obvious reasons, most human activity peaks when the sun is out. A large percentage of night time power consumption is due to very cheap rates at night (smelting, etc) - if rates were cheaper during the day, that demand would move lickety split to the daytime.

is enormously expensive.

Have you looked at "wind-gas"?

Our economies were built during a time of very cheap oil.

No, they really weren't. The era you're thinking of only lasted about 25 years after WWII. Oil wasn't important before WWI (and, of course, our economy wasn't really built during the Depression), and it wasn't cheap after 1973.

Of course, oil was never cheap, it just appeared to be that way.

Solar and wind + storage will never be anywhere close to the price of oil today

It will be much cheaper. Have you looked at the German studies of this?

Well it is daytime here right now and I haven't seen the sun for days. And the forecast is for more of the same for several days. Anyway there is no way you can get around the fact that massive amounts of electricity is used at night. Claiming that if prices were much cheaper in daylight everyone would move lickety split to doing everything during the day time is just silly.

And you did not even address the storage problem. Not a peep from you about that except noting that people usually sleep at night. Really?

And the economy was built on cheap oil. Go here: Historical Crude Oil prices, 1861 to Present and you will see that the only time in this century that prices were high was between 1972 and 1984 and from about 2004 until today. And compared to animal and human power oil is still very cheap, even today. To claim that our economy was not built on cheap oil is truly absurd.

But it is not just oil but fossil fuel, coal, gas and oil. All economies of the world were built with cheap fossil fuel. The population started to explode about the time coal came on the scene. and it really took off when oil came into the picture. The population of the world has tripled since the early 30s.

Energy and Human Evolution

Ron P.

Let's start with the main question, storage: I asked you if you have looked at 1) "wind-gas", and 2) at Germany's planning for a 100% renewable economy.

Have you had a look at them?

--------------------------------------

Now, on to less important details:

it is daytime here right now and I haven't seen the sun for days

Some places have less sun, just as some have less oil. OTOH, you'd be surprised how much energy solar collectors can gather even in places like Seattle and Berlin.

there is no way you can get around the fact that massive amounts of electricity is used at night.

All depends on what you mean by "massive". Night time consumption is perhaps 1/3 as large as peak, and if night time power became expensive and daytime was cheap, night time might be only 1/5 as large.

OTOH, it's silly to suggest we'd only use solar. Wind power is slightly stronger at night and during the winter - it's a natural partner for solar power, especially in temperate and northern climes.

the economy was built on cheap oil

No. Oil may have been cheap from 1880-1973, but it wasn't an important factor in the US economy until post WWI.

compared to animal and human power oil is still very cheap

Of course. And, wind power is even cheaper.

the exhaustion of fossil fuels, which supply three quarters of this energy, is not far off

Now, that's silly. The problem is we have too much, not too little.

no other energy source is abundant and cheap enough to take their place.

What, 100,000 terawatts of solar isn't abundant enough? Solar is now at about 10 cents per kWh - ask the Japanese if that's expensive - they've built a very successful economy on that. And, wind is even cheaper - about 7 cents. That's not dirt cheap, but it's certainly affordable.

So, let's recap.

First, both the US and other developed countries got that way with "moderately expensive" energy, not cheap energy. Oil and electricity have been cheap in the US in the post-WWII period, but energy was rather higher in years before that: coal and electricity cost much more, adjusted for inflation. The US, and other countries, succeeded quite well in growing strongly even when energy was much more expensive, whether it was coal or oil.

Wind power is quite affordable (if perhaps not quite as dirt cheap as US post-WWII oil and electricity prices), scalable, high-E-ROI, etc, etc. So are nuclear, and solar even if they aren't quite as cheap at the moment (coal is also plentiful and cheap, unfortunately), so I see no reason to expect energy to ever be more than "moderately expensive".

The fact that energy pre-WWII was a much higher portion of GDP means that it was a much heavier burden on the economy. If wind and solar are a little more expensive, that means that the wind/solar sector has to be a little larger than otherwise to power the rest of the economy. This analysis suggests that this is not a big deal: that sector would still be a much smaller portion of the economy than pre-WWII.

Second, fossil fuels aren't nearly as cheap as they seem. Pollution is an unrecognized, external cost. So are the military costs we're seeing currently of roughly $500B per year. Those pollution costs aren't sustainable (especially CO2), but unfortunately the military costs probably are (in fact, many corporate interests are quite comfortable with them...). Moving away from oil and other fossil fuels will actually be much cheaper in the long-run than BAU.

Finally, let's assume that Business As Usual involved spending about 5% of our economic activity (perhaps measured by GDP) acquiring energy. If the cost of acquiring energy doubles, then we have to dedicate another 5% to that activity. GDP might go down by 5% quickly, in case we'd have a deep recession. Or, it might happen over time - if it took 10 years, then we'd see a reduction in economic growth of .5% per year, for 10 years. After that transition was complete, economic growth would continue. So, a reduction in "net energy" has a significant impact, but it's not TEOTWAWKI.

So, does unusually strong growth since 1945 show the value of cheap energy in that period?

No, US growth was faster before 1945, using moderately expensive, non-oil energy:

1800-1900: 4.13%

1900-1945: 3.53%

1945-2000: 3.17%

"real GDP" at http://www.measuringworth.com/growth/index.php

Are you saying you know of a car (EV) that runs on wind power? Do you mean it has sails (like the ships of old - for which sails worked pretty well) or do you just mean it runs on electricity which might have been partially generated by wind energy (if it's been windy lately)? In the latter case $.02/mile sounds cheaper than reality.

As for the 50 cent/gal gas being more than the refining cost, back in 1998 (a mere 14 years ago) I purchased gas many times for $0.72/gal and once for $0.69/gal (in GA and SC). The $0.69 was in SC and there the gas tax was (and is) a combined $0.35/gal, so less tax I paid just $0.34/gal - do the math re: refining costs.

You mean "niche" apps like driving and flying, for which liquid hydrocarbons are convenient in 100% of the cases that I know about? And those are very large niches indeed! At present, there is no real alternative to gasoline/kerosene for doing high-volume passenger transport by air (except perhaps for old-style balloons, which would be pretty cool IMHO, given sufficient helium supplies).

do you just mean it runs on electricity which might have been partially generated by wind energy

Yes - wind power in the US costs about $.07 per kWh, and EVs use about .3kWhrs per mile - that's about 2.1 cents per mile. Yes, transmission & distribution add roughly 5 cents per kWh - OTOH, request a Time-Of-Use meter, and you can get 5 cents per kWh night time rates for charging your EV.

less tax I paid just $0.34/gal - do the math re: refining costs.

First, that was 14 years ago - inflation has raised the general price level by 40% since then. 2nd, as you know, a single anecdotal story can be misleading. Refining costs can vary by area and time, and retail costs can misleading. Take a look at how distribution and refining costs vary over time in the following table:

http://energyalmanac.ca.gov/gasoline/margins/index.php

Now, my sense of distribution and refining costs is that the total is now above $.50 cents, but I couldn't find a good source for that quickly - has anyone seen that?

You mean "niche" apps like driving

Driving is pretty easy to electrify. EREVs like the Volt or Prius Plug-in are more convenient than pure ICEs ( a few seconds to plug in every night, and then very few trips to the gas station), and can reduce liquid fuel consumption by 90%, to the scale that ethanol can handle.

and flying

Air transport is the most difficult area in which to eliminate fossil fuels, but on the other hand:

We're going to have fossil fuels for many decades, should we want them, albeit at lower levels than today - we have time to find the cheapest and most convenient way to replace aviation FF consumption.

In the long run, 3x greater efficiency is possible, and synthetic FF-free fuel is unlikely to be more than 3x as expensive per gallon.

> Name one cheaper

Solar (Nothing is free as you point out but all forms require equipment.) Right now 99.99% of all our energy comes from the sun. If we had to replicate ecosystems services provided by the sun, we would be upside down in about 5 minutes.

> Name one as portable.

Sunshine is ubiquitous, even at northern latitudes. I wouldn't be here if my Swedish ancestors had whimpered the way so many TOD folks do about solar and wind.

> Name one any time no matter what the weather.

This is the pot calling the kettle black. We are using solar storage almost exclusively. It's been waiting for us there for 90+ million years. If we are dumber than trees (which manage quite fine 24-7-365) we deserve to go extinct! And the guys whining about the costs will be buying from other countries where they are rolling up their sleeves to solve the problem. If you're worried, go hire a storage engineer (part time -- it's not that hard; I have friends in Silicon Valley getting excellent results).

> Name one ... so many units of energy in small space.

Electricity delivered by wire runs circles around any fuel with this metric. We can engineer solar powered urban transportation with fixed guideways. We haven't figured out air travel yet, but we made do without airplanes for eons ... we can take whatever time we need to fix this issue.

As you point out (from Deffeyes) "just burning it" is Stone-Age mentality.

The US military has realized at least in one context that there are better alternatives than noisily burning stinky liquids. I think this example is instructive:

Solar power lights up Southwest Asia

"With the solar light carts, there is no organic fuel, oil, filters or secondary containment to maintain," he said. "They run completely off stored battery power produced from both the solar panels by day and a wind turbine by night. The electrical power is stored in a battery bank to provide power for the LED lights."

There is very little maintenance required on these units, saving countless man hours, Williams said.

"The only maintenance required on the solar carts is pressure washing the solar panels, which takes about four minutes per unit, and any adjustments to the timing mechanism to ensure operation from dusk to dawn," he said.

Another improvement, one that Airmen and Soldiers can appreciate, is the reduction of noise. Two of these new light carts are located housing areas where quiet hours for service members on crew rest are observed 24 hours a day.

"There is zero noise because there is no engine," Williams said. "These units are completely electric."

The vision of a more eco-and-wallet-friendly future is clear.

There are so many problems with your post I don't know where to start. However... Solar is not cheaper than gasoline for transportation. Solar requires, for starters, very expensive solar panels. Then it requires very expensive batteries to store the power and long times to charge battery powered vehicles.

Of course all energy comes from the sun, except nuclear. But fossil fuel is the subject of discussion here. Saying that it also comes from the sun is just a cop out. Talk sense rather than nonsense. And just who is whining about buying from other countries? You gain nothing in the debate by bringing up things that have nothing to do with what we were discussing.

Battery powered carts have been around for decades. But very few open road cars are powered by battery power. If it were cheaper than gasoline they all would be battery powered. And where are those battery powered long haul trucks. And how about battery powered planes? Where are they?

Anyway, concerning the cost, is solar cheaper than gasoline. Well no, it takes you 8 years of gasoline costs just to pay for the solar panels. Do The Math

And then there are the batteries:

The author of this piece is very much in favor of solar powered cars. But he acknowledges solar is much more expensive. We should convert to solar powered cars, he says, for other reasons. Perhaps but definitely not because it would be cheaper.

Ron P.

Darwinian,

> There are so many problems with your post I don't know where to start.

You could start by reading the link I provided. Tom "Do the Math" Murphy is a smart guy but he limits himself in that post by talking about solar cars. I was not. I have raced solar cars ("brain sport") and that's what led me to another form of solar transportation which has a 2-4 year payback relative to burning one-time only mineral resources. And it doesn't use batteries. You're sure right about batteries!

To call "fossil fuels" cheap is the same as saying it is effortless to throw furniture in the fireplace compared to going outside to chop wood. Expending natural capital for a joy ride is theft, not economics. We have to get our priorities straight here. If you are a peakster, you know we are going to find other ways of getting around or we are going to have a cultural melt-down.

Follow the link I provided this time in order to understand what I was driving at. Then before you automatically dismiss solar as "too expensive," Do the Math. You might be pleasantly surprised.

Of course, solar transportation may be impossible in some places because people are wedded to their cars. In Silicon Valley and Sweden, two sunny (and one windy) places, solar transportation systems are being developed by people who are ready to move on, without exhausting the last barrel before starting down a different path.

By lying around, we can successfully predict a worst case scenario: bedsores if nothing else. We can analyze the data, watch the fireworks from the sidelines and leave it at that. I discovered peak oil in 1966, so I have had time to take in the data, decide that humanity deserves a future and wrack my brain for alternatives. A mountain of batteries to preserve the folly of the "private" automobile (which coincidentally runs on public land), for example, is not what we are building. On fixed guideways, we can deliver energy by wires. If you don"t like my solution, I'm all ears.

Is the automobile the pinnacle of human achievement? Explain that to the friends and relatives of the 3,000+ people who died in traffic accidents yesterday.

Getting away from Stone-burning and inter-generational thievery is a big challenge, and we will burn more stones in the process. if we are resourceful, and we make careful use of our resources, we have a chance. Survival of the fittest, you know!

Solarevolution, I don't doubt that grid electricity generated from solar will become cheaper than electrical energy generated from fossil fuel within the next few years. Not today however.

Solar Energy to be cheaper than fossil fuels in 2017

But this article is only about generating electricity while the sun shines. It assumes that we would convert to fossil fuel generated electricity when the sun goes down. However it is still a worthwhile effort because burning less fossil fuel while the sun shines would make it last a bit longer.

As explained by Josserand in his post below, your statement that "Sunshine is ubiquitous, even at northern latitudes." is palatably untrue.

u·biq·ui·tous adjective - existing or being everywhere, especially at the same time.

In fact the sun is often hidden behind cloud cover for days on end. And it is always hidden at night. You are simply ignoring the problem of storage.

Of course we need to convert to mass transit. But that is just not possible, not in the next 50 years or so in the USA anyway, because we are a nation of suburbia where the car is an absolute requirement for commuting to work or anywhere else. Of course as Kuntsler has pointed out, this is a huge mistake. Nevertheless that's the way it is and it will take half a century for that to change.

Of course we don't have half a century before... well I won't get into that right now.

Woah! Just a cotton picking minute here. You have wracked your to find a "alternatives"? And suppose you do come up with the solution to save the world? What then? How are you going to sell this alternate world to the world? From a soap box in the public square? You are one of seven billion people and your ability to influence the behavior of those seven billion is not very promising to say the least. If you truly believe you can save the world then I believe you have visions of grandeur.

I have studied human behavior for many years. I know a few people can be persuaded to change their behavior by argument, but only a tiny few. The vast majority of humankind cannot be moved to alter their behavior by argument but only by events. People will not be convinced to build mass transport and then to build their homes near this mass transport by argument. Only events, such as collapse of the economy or some other catastrophe will ever convince them to change their behavior.

Bottom line, you cannot change the world. So wrack your brain till the cows come home but all you will ever gain from it will be a wracked brain.

A pretty good article on the subject: Why We Cannot Save the World

Ron P.

Darwinian,

> Not today however... Solar Energy to be cheaper...

I have looked at your suggested references and frankly am confused at what you find there. Am I supposed to fall for someone's rhetoric just because they have a website? Go to "About" at this link and note that the authors don't even identify themselves.

> Why We Cannot Save the World...

Well, I'm afraid I can't help that guy in his suffering...

> Of course we need to convert to mass transit. But that is just not possible, not in the next 50 years or so in the USA anyway...

Guess again.

> You are simply ignoring the problem of storage.

Guess again. There's a difference between ignorance and focus. I will be happy to take you through this subject in depth. I have made strategic investments of time and money in energy storage. My conclusion: There is still hope for humans to become as smart as trees (which survive unscathed through cloudy skies and dark nights). Details are only a phone call away.

> all you will ever gain from it will be a wracked brain...

Guess again. I have contracts and a strong team working with me.

> I have studied human behavior for many years...

No kidding? Are you as smart as this guy?

Keep those cards and letters coming!

Ron S.

Solar is not cheaper than gasoline for transportation.

First, Solarevolution made a mistake by emphasizing solar. Wind is half as expensive, right now.

2nd, solar is indeed cheaper. $.15 per kWh is much cheaper then $3.50 per gallon liquid fuel: $.045/mile vs about $.10 per mile.

Solar requires, for starters, very expensive solar panels.

Not so expensive - less than $1 per Wp. That's 4-5 cents per kWh.

Yes, installation and BOS is also needed, but that's at $2/Wp in Germany, where they've improved methods. It's at $3 for large installations in the US.

Then it requires very expensive batteries to store the power

Well, batteries are certainly much more convenient, though large ones aren't essential. Battery costs add about $.10 per mile (which isn't that expensive) and EVs have lower maintenance costs.

and long times to charge battery powered vehicles.

10 or 15 seconds to plug the car in at night - that's much faster than a gas station!

Yes, gas stations are convenient for long trips - that's where EREVs are a good idea, until batteries get much cheaper (which they will).

As for Tom Murphy....he's very good at analyzing unrealistic, expensive and sub-optimal options, like home batteries and solar powered cars.

Again, grid wind power is much cheaper. If Tom likes generating his own power, that's great, but it's not very relevant to the overall grid.

One definition of 'ubiquitous' is "present everywhere at the same time". Yet, if sunshine were truly ubiquitous in Northern Europe, then I suspect that both you and I would not have white skin, which is believed to be an evolutionary adaptation to life in heavily overcast climates. This is because in such climates darker skin increases vulnerability to certain vitamin deficiencies which are associated with a relatively low exposure to bright sunlight (since dark skin is much more effective than light skin at blocking sunlight exposure).

The straightforward way to reconcile these ideas: humans successfully adapted to northern climes by evolving to use sunlight more efficiently.

Sounds familiar...

http://en.wikipedia.org/wiki/History_of_wind_power

http://www.awea.org/learnabout/industry_stats/index.cfm

Future generations may know WHY we used fossil fuels but may not know why we did not develop alternatives sooner. We could have had synthetic fuels 30 years ago, we could have developed solar and wind long ago but did not.

We go on the economics and not the good. It has to be immensely profitable for any capitalist to take even the slightest interest. It does not seem to matter if it is the right thing to do for the country and the people, but how profitable it is for a few.

It is the false belief that profit always makes it the right thing to do and everything else is irrelevant.

Well, some people are just middle and working class, and the idea of starting over in a new industry is pretty terrifying, and for good reason - it's very hard to do once your career is started. They'll fight change, and it's hard to fault them.

Now, the wealthy investor class - that's another story. I have to admit I don't fully understand how people like the Koch brothers think. They seem to live in a very narrow world of distorted, wishful thinking that supports doing whatever stupidity that looks good at the moment. It's especially odd, given that they have so many information resources available.

Why are the wealthy such bad decision makers? Is it being surrounded by yes-men, and the difficulty of speaking truth to power? Self-selection for being obsessively driven towards money & power regardless of one's real self-interest??

The article says above: "...marginal cost, which according to Tudor Pickering for the majority of shale oil plays requires $60 USD..."

About three years ago Harold Hamm, CEO of Continental Resources (largest driller & producer in the Bakken oil formation), said that marginal cost was $60 per barrel. I would think now the cost is closer to $70 per barrel as costs for everything from drill pipe to labor is going up by 20% or more per year. A friend told me his friend in Williston, ND got a job driving a forklift for oil co. supplier at $32/hour. Two years ago they were paying $15/hour for same work.

Shale oil production increases are ENTIRELY dependant on the WTI oil price increasing, not decreasing as it has been for last three months. The predictions of 3 million barels per day of US shale oil by 2020 will only be fulfilled if WTI can rise to $130 to $150 per barrel in the next 5 to 6 years, IMO. And I doubt the economy's ability to maintain growth with oil prices that high.

Such statements never made any sense to me, except possibly to indicate an upper bound to the EROEI. If your production cost is $90/barrel, and world oil costs $100/barrel, then at most 0.9 barrel is required for production of your 1 barrel, and barring subsidies your well has at least a 10:9 EROEI.

However the price of that $100/barrel oil is based on production from current 20:1 or greater wells. If you had to use your own oil for production you would need to produce 10 barrels for every one that you sell. $90/barrel oil becomes $900/barrel oil.

Nobody is saying that the average cost of an oil shale play in the US is $60 expressed in liquid fuel necessary to obtain a producing well. It does not work anything like that. The $60 reflects labor market conditions, competition between service companies, available drilling equipment etc. which can vary independent of the energetic cost of creating the well.

Thanks for that simplification. You forgot to add that in some places it has been raining all day.

Thanks for that.

Dak - My common thread consists of expenses that are a major part of drilling and can vary quite a lot on a time scale (say of a few months) within which EROEI will vary little if at all. Inferring that our monetary system is directly proportional to our energy budget is grossly unrealistic.

Sorry, my comment was too flip. It was triggered by an irritation I acquired while studying physics and rooming with several graduate students in economics. They were experts in the quantitative analysis of money but strangely qualitative and (seemingly) willfully ignorant about what that money represented at the physical level.

Individuals of most species have to extract the energy required for their existence directly. They may have a good deal of leisure time to dream, play, chew cud, cache nuts, etc. but in general they can not store energy for very long and have to make periodic immersions into their particular entropy stream. But humans have this construct of money, which can be exchanged for the energy gathered by others. Certain people can over-extract and sell the surplus, and thus accumulate money for their retirement or to pass along to their children.

That alters the short-term relation between money and energy, but in the long term it can certainly be argued that they are equivalent, as was done by M. King Hubbart in http://www.technocracy.org/study-guide

dak - Excellent point about long term vs. short term game plans. Short term has always been the focus throughout my career. But I've never seen the intensity witnessed in the last few years. Obsession is not too strong a term. I know pubco managers whose worth has varied by many $millions from one quarter to the next. Not long ago I shared a few Shiner bocks with one for 3 hours and listened to his strategy about reserve booking without one mention of the economics of the wells he was drilling. He knew he was a short timer and couldn't care less what happened to the company a year out.

Seagatherer et al – To build on that point let me go back to the basics. The drilling of any well has never been determined by EROEI…not one. Which isn’t to say there’s no relationship between that theoretical number and drilling economics. First, we’ve discussed many times the difficulty in determining what the ERORI of any given project maybe. One example: it takes a huge amount of energy to build a drilling rig. Not just the construction process but the energy used to mine and process the steel. Logic says one could amortize the EROEI on a per well basis if the total number of wells drilled by that rig could be estimated. Difficult to do over the long life time of the rig but not impossible. OTOH consider that the rig wasn’t built to drill a specific well next week. The energy used to build that rig is a sunk cost. It makes no difference in the decision to drill that next well what the EROEI component of the rig might be. The only component of the drilling infrastructure involved is the day rate. And that number can vary greatly over time. In just several years I’ve seen rates for the same offshore rig range from $250k/day to $700k/day. Though the rate for onshore rigs is much less I’ve seen them vary by 200% to 400%. Whatever the EREOEI component of the rig cost may be attributed to a particular well it doesn’t change over time. But the economics of the drilling decision can vary greatly not only due to drilling cost variations but obviously also with the price of oil/NG.

More specifically the decision to drill a shale well has never been nor ever will be based upon EROEI. But it also isn’t based entirely on the classic economic analysis. I have seen public companies intentionally drill wells with minimal economic value (and on rare occasions at a loss) in an effort to maintain/increase stock valuation. Look at the focus of the vast majority of Wall Street analysts: it’s on the increase in booked reserves and not profit margin. And for good reason: they don’t know what the profit margin might be. But the SEC requires companies to supply reserves numbers (based on a specific set of guidelines) to Wall Street. It’s no accident all the major shale players are public companies. The primary reason an investors buys the stock of a public shale player is the expectation of an increase in stock price. That won’t happen unless Wall Street supports that supposition. And WS won’t do that unless the company delivers reserve growth…the only metric WS has ready access to. I’ve spent a portion of my career pushing those proved reserve numbers to the max. All public companies do the same. Those numbers are audited by “independent” third parties. And I use the term independent loosely. More than once I've had my contract terminated because I wasn't "optimistic" enough to suit management. My favorite memory was when management foolishly asked me, during the annual meeting, to tell the board of directors my opinion of the reserve report. Afterwards I was invited to step in the hallway where I was fired. Why is a long story but one of the more satisfying moments in my career. LOL.

Thus there is a huge “off book” economic value to drilling shale wells with less than impressive profit margins. I’ll point out the most profitable company to ever play the Eagle Ford Shale IMHO: Petrohawk. And virtually all that profit was created via increased stock valuation and not by producing EFS wells: they sold the company’s stock for $12 billion. Most of the assumed value was in their undrilled acreage and not from the relatively small amount of EFS production they had developed. Consider how completely irrelevant EROEI was in that calculus.

Just MHO based on 37 years of working for management of public oils not only is EROEI of no importance but even the effort to estimate some meaningful marginal cost is of little value as far as predicting activity. I have no doubt there are a few companies developing shale acreage for significantly less that $60-70/bbl. Just as I sure there are companies who have spent more than $110/bbl to develop their reserves. But if in the process they increased booked reserves and thus stock value they’ve done what most shareholders demand. The trick for those management teams is the timing of their exit from their equity positions before the bubble pops. In years past I’ve sat in more than one board room and listened to such strategy sessions.

Rockman, EROEI and profit-loss do not move in lockstep but they do move in the same direction. If you have a negative EROEI it will eventually show up as a loss on a companies bottom line. I have complained for years that the term EROEI should be dropped in favor of ROI. That is so simple and everyone can understand it. If a company has a negative ROI, for long, their bottom line will fall into the red and their stock price will collapse.

I don't understand that statement at all. Now I know you are an oil man and I am not, but I was once a stockbroker and have traded equities and commodities for years. That statement is simply not correct. Wall Street has access to another metric, and for stockholders a far more important metric, the profits and losses reported in quarterly and annual reports. Of course a company with losses can promise profits soon, and that will help keep the stock price up... for awhile. But sooner or later those promises must come to fruition or else the company must file for bankruptcy.

The proceeds from the sale of stock can be carried as capital assets, or cash on hand, but they cannot be counted on the profit-loss statement. If a company gains one billion from the sale of new stock, but loses a quarter billion from its operations, only the quarter billion will show up as a loss in the annual report and the stock price will likely fall.

And I must add, if a company has a lot of capital assets, and a lot of cash on hand, but losing money, they are a prime take-over candidate. The reason they can so easily be taken over is that their loses drive the stock price down. Another company, like Bain Capital, will buy them out, keep the cash on hand, sell off all the capital assets, lay off all the workers, and walk away with a handsome profit. It happens far more often than many would believe.

Ron P.

Ron – You’re the WS pro…not me. How many investors did you know that bought stock they expected to go down in price regardless of the profit statement? Second question: how much has been invested in IPO’s the last few years for companies with little or no profit? Actually in some cases with little or no revenue? Remember my experience (and much of the basis for my admittedly biased attitude) spending $18 million drilling hz wells that didn’t increase booked reserves $1 but thanks to increasing income 5 fold the stock shot up 400%. Not only didn’t increase profits but lost $millions in net present value. And all the facts clearly stated in the company’s public reports. You may have sheparded your clients well. The same can’t be said for many IMHO.

You track the numbers better than me so I’ll take your word on it: how many shale playing pubcos would you say have posted profits/revenue that justifies their current stock price? IOW what do you think is a good P/E for a pubco shale player?

Rockman, no one ever buys stock that they expect to go down. I don't recall ever stating anything suggesting otherwise. Many stocks go up in price even though they are "currently" losing money. They buy the stock because they think it is cheap due to the current profit margin and they fully expect the company to be profitable very soon. But someone has the opposite opinion and sell them that stock.

Wall street is all about expectations. If people don't expect a company to be profitable very soon they will dump their stock. All new companies start out in the hole so therefore most IPOs are issued well before a company is profitable... but not always. They do not buy a into a company unless they expect the company to be profitable and they are not willing to wait years for that to happen.

All IPOs are handled by an investment bank. They will not agree to take a company public unless they think the IPO will increase in price. They are sometimes wrong, i.e. Facebook, but they are right far more often than they are wrong.

Wall Street will tolerate early losses but not for very long. Nothing but nothing will send a companies stock higher than profits. All companies are in business to make money, even shale oil companies. Of course oil companies know every well is a gamble but they expect to be right often enough to show an overall profit.

As far as Wall Street investors are concerned, shale oil companies are no different than a baby booty company. Profits or expected profits are really all that counts. If it is expected that a shale oil company will start turning a very good profit next year, or even the year after, they could be losing money today and still demand a very high stock price. It is expectations of profits that drives the price of their stock.

It could very well be that most investors who buy stock in shale oil companies are dead wrong. They could be. Remember the dot com bust. People expected these new companies to start turning huge profits, though most were losing money when their stock was purchased. It didn't happen so the bottom fell out of their stock price. Most went bankrupt. Investors are expecting great things from shale oil companies. They may be disappointed. If so the entire industry could collapse just like the dot com companies did.

Ron P.

Your point about expectations of profit is well taken. Back in the 1990's, I heard young analysts without any real world experience talking about price multiples of projected future net cash flow five years out of various stocks.

No acknowledgement that the best laid plans can go awry. Knew it was time to get out of the market with that sort of idiotic talk going on.

Two of Australia's dozen or so onshore sedimentary basins are being explored for tight oil and gas

http://gastoday.com.au/news/australian_shale_whats_the_next_move/075472/

At Cooper Basin there is one working field next to a conventional gas pipeline and the geology is said to be similar to the US Haynesville shale. However all the gas from that region can be piped to a new export LNG hub under construction at Gladstone Queensland offering much higher prices than the domestic market.

It will be interesting to see if the heat comes out of the LNG market if Japan restarts its nukes. That LNG plant will blend conventional natgas, shale gas and coal seam gas. At the moment piped gas prices in eastern Australia are assuming strong export competition

http://www.theaustralian.com.au/business/mining-energy/origin-energy-sec...

If shale gas disappoints as I expect that will help coal. With a push from carbon tax baseload power stations that were supposed to be replaced by combined cycle gas may keep going another 20 years, nuclear being illegal in Australia despite uranium mining. Some brown coal stations even got a billion dollar downpayment in expectation of being replaced by gas. Apparently they get to keep it. Misgivings about future gas prices seem to entrench coal in green talking places like Germany as well. I guess with shale gas the idea is believe it when you see it.

Russia active drilling rigs. Onshore and offshore.

Hello Balakhany,

Is that rig data available publicly somewhere?

Rembrandt

No. Such information payed. In the public domain there is no such data.

The biggest shale oil and gas prize of all is the Paleozoic of the Arabian Plate, imo.

AAPG Memoir 74 – ‘Petroleum Provinces of the Twenty First Century’ Chapter 24 –‘ Paleozoic Stratigraphy And Hydrocarbon Habitat of the Arabian Plate’, Konert, etal. Page 502

Tony - Good find and goes toward the point I've made before that the shales are not some new discovery. Consider the report is highlighting a huge shale oil potential almost 40 years ago. Which also means that potential was known many years before the report. All it took was the refinement in horizontal drilling (reached about 15 years ago), higher oil prices and a lack of alternative conventional plays for so many of the pubcos to kick the shale plays into gear. We'll have to see how hard the foreign shale deposits are hit and how fast. Might be a lot of oil in them there shales but without the capex, political structure, drilling/production infrastructure and enough international pubcos it might take a while to see much coming out of the ground. But at least we know where much of it is today.

the shales are not some new discovery

Rocky,

If that's the case, then why was the development of the Bakken etc, so unexpected??

Nick - Unexpected by who? Since the Austin Chalk horizontal boom years ago the methodology for getting production from fractured shales was well know. In fact the AC )a fracured carbonate shale) was as hot or hotter in its day than any current shale plays. If you had told anyone that NG would get over $10/mcf or oil would be $100+/bbl many in the oil patch would have been comfortable with today's activity level. Of course, predicting those high prices woould have been the real trick.

Well, that refers to "activity", and sounds like hindsight. Did anyone 5 years ago predict production levels of one million bpd in N Dakota? Or even 250k??