A Debate on the Substance and Timing of the Peak of Oil Production and Consumption, Part II

Posted by Robert Rapier on December 11, 2006 - 11:26am

Jeffrey and I agree on many things. We agree that some sort of revenue-neutral fossil fuel tax is needed to reign in our energy usage and encourage alternatives with low fossil-fuel inputs. We agree that transportation electrification should be a priority. We agree that once Peak Oil does occur, there will be an export crisis. We agree that regardless of whether the date of Peak Oil is today, or 5 years from now, we should have already gotten started on a major effort at moving away from fossil fuels. (Incidentally, even though a peak in the near-term is still a minority view, Global Warming has an overwhelming scientific consensus. So, if we can't make the case to move away from fossil fuels as a result of Peak Oil, there is still the need to do so due to Global Warming.)

That's an end to my digression, and now I will address the issue on which we disagree. First, I want to make it clear that I respect Jeffrey a great deal. I have learned much from his work, and I consider his contributions to be valuable. But I disagree with his interpretation of the export data. Jeffrey did make a prediction that we would see declining exports this year, and he predicted that this was because of a production peak in some of the major exporting countries.

This gets to the heart of my objection. I want the mainstream media, the politicians, and the public to listen to us and to understand the gravity of the situation we face. In order to gain credibility, we have to make very sound scientific arguments. Peer review amongst ourselves should be taken very seriously. If we don't police ourselves, then the media will do it for us. If we haven't done our homework we will lose credibility, the very thing we are trying to gain. When we formulate our arguments we need to put ourselves in the critics' seats, ask what the counterarguments will be, and then make sure we can address them. If we can't, we need to improve our argument.

So, when claims like "the net export crisis is upon us" are made, we need to ask some tough questions. We need to do some peer review. If we don't, and the argument turns out to be wrong, we will lose some credibility as a group. We will have cried wolf. We can't afford to cry wolf, because then we will have more trouble convincing people that the wolf is really coming.

Why Were Imports Down? Or Were Imports Down?

Jeffrey's prediction, made here on January 27th, was that "these factors [one of which was Saudi Arabia on the verge of a permanent and irreversible decline] could interact this year to produce an unprecedented--and probably permanent--net oil export crisis."

As stated here, he is making his case against a "12/30/05 index number of 12.8 mbpd." Imports into the U.S. did indeed start to fall in the first quarter. By March imports had dropped to just under 12 million bpd.

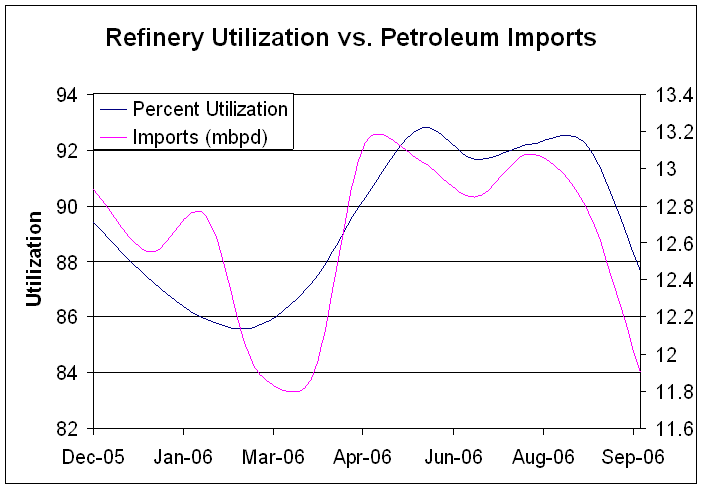

After the first quarter, much was said about this being evidence of the beginning of the permanent export crisis. However, as I pointed out at the time, refinery utilization during this time period was falling. I reiterated this point a week later. In December, refinery utilization averaged 89.4%. In March, refinery utilization was down to 85.7%. Refineries that are down for turnarounds will not be purchasing crude oil. The demand for imports drops. Turnarounds are planned months in advance, so it was well known by the refineries that they would not need oil during this time period. I think in this case a picture is worth well more than a thousand words.

Monthly Average Refinery Utilization vs. U.S. Imports

Note what happened when the refineries came back up from their turnarounds. Utilization started picking back up in April, and reached a peak of 93.2% in June. Throughout the summer, imports were back up - well higher than the December 2005 benchmark - and exceeded 13 million bpd. As you can see, there is a strong correlation between the refinery utilization numbers and imports. In fact, I did a statistical analysis with Excel, and the correlation coefficient for imports and refinery utilization over the past year was 0.72. Therefore, the definitive answer as to why exports were falling in the spring is simply that refiners were in full turnaround mode. The first quarter wasn't about a permanent export crisis, even though at that time falling exports were used as evidence supporting the predictions.

But of course the U.S. is not the world. So, what was happening in other countries as imports started climbing in the U.S.? Were we outbidding other countries for dwindling available exports?

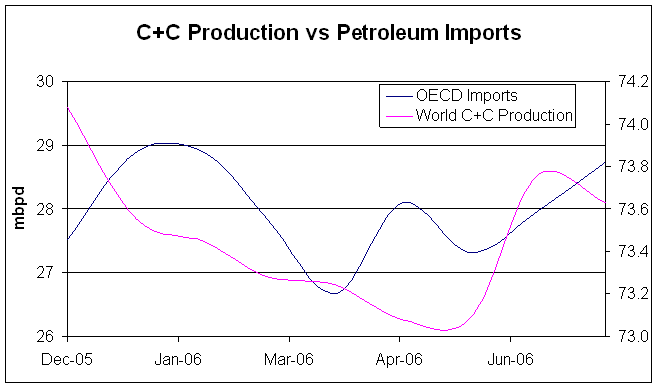

To my knowledge, there are no data on total exports. But we can account for a significant fraction by looking at total OECD net imports. Total OECD net imports in December 2005 averaged 27.52 million bpd. In January, imports did climb to 28.89 million bpd, and then started to fall as refinery turnaround season began. During the high driving season months in the U.S. (May-Aug.), when U.S. imports had climbed back up, total OECD net imports averaged 28.0 million bpd.

Crude Plus Condensate Production vs. OECD Imports

Note that C+C has a decent correlation (although with a time-offset) to OECD imports. That total imports were down slightly from January is not surprising given the high prices over the summer. But summer OECD imports were actually higher than the December baseline for making the import case. I would also add that total OECD stocks went up by almost 100,000 barrels during the same time period, implying that demand was softening and therefore the imports weren't needed.

I would note in addition that Saudi oil production started dropping in January just as OECD imports started to fall. We all know the story that Saudi Arabia's oil minister commented that they were having trouble finding buyers at the higher production volumes: "It's not just heavy oil. Even light oil is having problems." This prompted much speculation that he was lying to cover up the fact that oil production in Saudi had peaked.

Note the graph of crude stocks during this time:

Past 12 Months of U.S. Crude Stocks

As you see, their story is consistent with inventory numbers. From January to April stocks were rising, as exports were falling. Doesn't this mean that the exports weren't needed, if inventories were climbing despite falling exports? This was one of the reasons given for Saudi cutting production: Inventories were full. Well, in the U.S., we can certainly conclude that this is fully consistent with their claims.

Also, as I have noted several times, if they say they have product for sale, and someone needs it, they are going to get phone calls. Just imagine if you claimed to have something for sale that was in demand. Don't you think people who need the item are going to call you? What are you going to tell them when they do if you don't really have the item?

What about Prices?

Again, the OECD is not the world, although it is most of the developed world. So, what of the theory that prices were being bid up, and therefore imports were being taken from 3rd world countries? Without question there has been demand destruction due to high prices. The EIA's World Oil Balance spreadsheet shows that demand in the second quarter dropped off as prices spiked up (again consistent with the Saudi claim). Demand was down by 2 million bpd - at 83.15 million bpd - over the previous 2 quarters in which demand had averaged over 85 million bpd. Of course oil prices had spiked over $10/barrel over this period of time. So, did prices spike because product was scarce? Did prices spike because demand was high? Was it fear and speculation? Or was it a combination of factors?

Those questions are difficult to answer definitively. Hurricane Katrina really shook up the oil markets by exposing just how little excess capacity presently exists in both oil production and refining capacity. A few short years ago, several million barrels of spare capacity were available. But by the time demand reached 85 million bpd, there was little excess capacity. This makes the markets nervous, and so geopolitical events have a disproportionate impact on oil prices.

So, what happened in the first quarter that might have caused oil prices to rise? In January, militants in Nigeria blew up some pipelines taking 220,000 barrels off the import market. At the same time, the Iranian president was making lot of threats which in my opinion were designed to keep oil prices high and help bring money into Iran. Shell decided to evacuate some workers in Nigeria during the turmoil, which prompted the Times Online to report on January 16, 2006:

The withdrawal, combined with Iran's threats to force up prices in response to threatened sanctions over its nuclear programme, prompted a rise in the cost of oil, up 93 cents to $63.18 a barrel this morning.

In February, militants in Nigeria launched their "dark February" campaign designed to make foreign oil interests leave the country. By March, exports from Nigeria were down 300,000 barrels a day over the 4th quarter of 2005. This was significant given Hurricane Katrina had taken hundreds of thousands of barrels of daily production offline. In February 2006, 362,796 bpd were still shut-in. Shell's Mars platform alone produced 140,000 bpd of oil production. This production wouldn't start to come back online until late May 2006.

Those geopolitical events, combined with lingering production upsets from Hurricane Katrina, drove oil prices to record levels. There was a threat from Iran, and actual production gone from Nigeria and the Gulf of Mexico. In a nervous market with little excess oil production capacity, one doesn't have to appeal to an oil production peak in order to explain why oil prices shot up.

Couldn't This still be Peak Oil?

I said I won't try to argue for a specific date on the peak, but I will argue that the import/price data are poor arguments in favor of calling the peak. This is not the case you want to present to the media. They will poke holes in it, and then if/when imports do climb back up, credibility is shot.

Back in the spring, when some others were calling December "the peak", I predicted that as long as demand stayed high we would set new production records in the summer. Well, demand did soften, but the EIA estimates that July 2006 will be higher than December's 84.5 million bpd at 85.2 million bpd. They also project August to be over 85 million bpd. The previous total liquids record was in May 2005 at 85.2 million bpd. (Stuart Staniford also discusses this issue here).

There is a lot of debate about total liquids, and whether it is an appropriate metric. There are two primary problems with total liquids. First, some production is double-counted. If liquid fuels are used in the production of ethanol - and they are - then the production gets counted twice. However, the majority input into ethanol is natural gas. In that case, even though the energy balance might be poor, you have a legitimate addition to total liquids, albeit an addition with a lower energy value. Second, total liquids include items like orimulsion which isn't a replacement for liquid fuels. On the other hand, if orimulsion is used in an application that displaces liquid fuels use, then you again have a legitimate addition to total liquids.

Without question the "purer" metric for predicting peak oil is crude plus condensate (C+C). December in fact remains the highest month on record for C+C at 74.1 million bpd. This summer, we reached an estimated 73.8 million bpd in August. However, a metric somewhere in between - like net total liquids - would be the most appropriate measure. You can't use just C+C because that overlooks the portion of ethanol that is a legitimate net addition to liquid fuels. But you can't use total liquids because it double-counts on the liquid petroleum inputs into ethanol (as an example). What is needed is a net total liquids metric that has subtracted out the double-dips. To my knowledge no such metric exists, and for now we have to live with the imperfect system we have. As it stands, the best we can say is that it is possible that a new record was achieved during the summer for net total liquids.

Conclusions

My intention here is not to "win" a debate. Jeffrey and I are in fact on the same side. My purpose is always to learn, educate, and generate food for thought. As I stated in the opening segment, I believe that credibility is crucial. However, to build credibility we have to build a strong case and be careful with data interpretation. If I argue that there is a problem because imports are down, I need to be prepared to answer the critics. I need to be sure that my case is objective and consistent.

If I use falling exports and rising prices as evidence that my prediction was accurate, then rising exports and falling prices should be evidence that the prediction was inaccurate. If I come up with some new reasoning that explains the latter, I must be willing to apply this reasoning to the former. Otherwise, the reasoning is ad hoc. If I say that A is like B because both are blue, but then I say A is not like C because C is heavy, this is an example of ad hoc reasoning. I can't use one metric in one case and a different metric in another case. When you do this, you make it impossible to falsify your argument. And an argument that is impossible to falsify is not an argument that will withstand scientific scrutiny.

As always, I invite comments, questions, or corrections. If Jeffrey wishes to continue for another round, I would be in favor of that. In that case, I would presume he would have a response up in a week or so.

Question: you say:

"If liquid fuels are used in the production of ethanol - and they are - then the production gets counted twice.

I don't understand why people bring up only ethanol in this example.

What to do with the liquid fuels that are used in the production of liquid fuels?

Don't they count as "double-counted" just as much?

When oil's EROEI drops from 100:1 to 20:1, doesn't that simply mean you use a lot more oil to produce the oil, and you have to discount that 1 barrel in both cases? You use 5 times as much to produce the same.

I started to elaborate on this point, but yes, these liquids are also double-counted. Any liquid fuel inputs that go into producing a liquid fuel product get double-counted.

But I would also again point out that any portion of biofuels that is actually renewable would not get counted if one just looked at C+C. The relevant metric is somewhere between total liquids and C+C.

If 84 mbd is produced, with that 20:1 EROEI, you lose 4.2 mbd every day, so you have net production of 79.8 mbd. That is quite a difference.

And it would be less important if EROEI stayed the same, but it's getting worse all the time, so you lose ever more, and the numbers reflect reality ever less.

I understand that it would be hard to model, but still feel it's too easily neglected.

You biofuel comment is valid. I guess it would be too much of a stretch to look at natural gas use, like in the tar sands?! It may not be C+C (+NGL), but is sure is a waste of energy. Isn't it more appropriate to count these things in some kind of "energy" form, like calories, or joules, or......?

When the debate is about peak oil how can any biofuel be counted towrds production?

Because peak oil is not really the relevant metric. It is peak energy. One could say "Sure, we lost 1 million bpd of oil, but we gained 2 million bpd of ethanol." But an accurate metric has to account for the net of that 2 million bpd of ethanol.

Do you mean to say "peak liquid fuels"?

Peak energy is what we should be focussed on with PO (C+C+NGL) a subset of that broader debate - IMO.

http://www.energybulletin.net/16459.html

Published on 24 May 2006 by GraphOilogy. Archived on 25 May 2006.

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

by Jeffrey J. Brown & "Khebab"

These comments are based on the graphs, prepared by Khebab, in the captioned article.

At the end of 1972, Texas had produced about 35 Gb of crude + condensate (C+C). Khebab's plot showed that Texas had remaining estimated recoverable reserves of about 27 Gb at the end of 1972, with an annual production rate of about 1.25 Gb/year, resulting in a reserve to production ratio of about 22 years at the end of 1972. This implies that production had to fall, and since peaking at 57% of Qt in 1972, Texas has shown a long term decline rate of about 4% per year.

At the end of 2005, Saudi Arabia (KSA) had produced about 108 Gb (I believe C+C). Khebab's plot showed that KSA had remaining recoverable reserves of about 78 Gb at the end of 2005, with an annual production rate of about 3.5 Gb/year, resulting in a reserve to production ratio of about 22 years at the end of 2005. This implies that production had to fall, and since since (IMO) peaking at 58% of Qt in 2005, KSA has shown an estimated 4% decline so far this year (and about a 7% decline from 12/05 to 12/06).

I estimate that Saudi Arabia, in calendar year 2006, will have burned through about 4% of their remaining conventional crude + condensate reserves.

Unless someone has a question for me, I probably won't post any more comments.

I think that the reduced exports are not voluntary. Based on the 2004 to 2005 increase in consumption (about 22% for KSA) and assuming that we see something similar for 2006, and based on the reported production decline, I estimate that KSA's net exports fell by about 13% from 12/05 to 12/06.

I understand that the overwhelming bulk (> 90%) of their production has come from the 5 largest fields and perhaps a dozen or so smaller fields over the past 50 years. This still leaves 80 or 90 oilfields that are supposedly capable of producing oil. The 'rest' of the oilfields in KSA, as I understand and as Matt Simmons outlines in 'Twilight', are not only smaller than the super-giants and giants, but are potentially more problematic in terms of geology and the ability to produce at a high volume.

Nevertheless, if KSA has 80 untapped oil fields, and though 'small' by KSA standards, some are large by oil field standards in the rest of the world, it would seem that there remains potential in KSA that does not exist in Texas. How does one get large production from a slew of slow producing fields? By drilling many wells (look at Russia's 1,000,000+ wells), and, guess what? KSA is apparently in the process of drilling many new wells.

I know that the conventional wisdom is that these leased rigs are being used to upgrade and workover the existing producing fields, but to what extent do we really know this?

It may be true, if KSA's super-giants are in decline, that there is no way to reverse the production curve and that drilling several thousand more wells, whether in new formations or old, will only slow the decline. But, in reading 'Twilight' one keeps seeing the maps with these dozens of untapped fields which are barely even mentioned. Unless they are totally fabrications, they still represent a significant amount of reserves, however slowly their contents may be produced.

Hubbert's curves work because, when a region peaks, it becomes much more expensive to even maintain production, much less expand it, and not because a region has run out of oil. If ksa has in fact produced 58% of urr, we will never again see 9Mb/d, much less 10, 12, or 15.

The PO community, as pointed out, has put itself into the role of Cassandra. But Cassandra does not have any influence. She is a tragic figure, at best, a farce, at worst.

The world has entered the hydro-carbon endgame since the 1970s, when the US peaked. The only thing that matters now is solutions.

I would encourage to stop the bickering about the date of the peak and think ahead of mitigation strategies. The same amount of analysis that gets the peak nailed down to +- 5 years can also predict the economic impact of gas taxes, CAFE standards etc. We have seen enough linearizations. They are a bore. Lets talk solutions.

I don't know why I keep having to point this out, but 1 more time. From the 3rd sentence of the essay:

Some have misunderstood my long-running debate with Jeffrey to be a quibble about the timing of the peak. That is not the case.

If you think this is about nailing down the timing of the peak, you have missed the entire gist of the article.

You can broadcast the words.

But that does not mean that they were received in the sense of being understood or absorbed or believed.

Just to clue others on this insider observation, here is the exchange from the R^2 site:

"Why Were Imports Down? Or Were Imports Down?"

The analysis which follows is quite thorough and I agree with it. One of the arguments made is: "I would note in addition that Saudi oil production started dropping in January just as OECD imports started to fall...." implying that, if a downward trend in production exists, it is driven by demand, not by (geological?) supply. Maybe I was reading too much into this, in which case I apologize.

But in toto what I got from it was an overall attempt to moderate the discussion as in saying "Easy as she goes... Wait! Not, yet!... Not....yet...".

In my opinnion this is not a practical political argument. Well, actually, it is, if one does not talk about PO at all. I believe this is what most politicians do to avoid the Al Gore fiasko. I think we all can agree that this plitical micro strategy achives the goals of political survival of a few but does nothing to help the nation(s).

I liked the crying wolf analogy but also think one should go far beyond that by saying:

"Peak oil is a fact. It does not matter if it will hit us ten years from now or tomorrow. What matters is that we are prepared. The metric can not be to predict PO with absolute precision and start measures the day after or the day before. We have to start WAY BEFORE. And here is how we can prepare ourselves YEARS before the fact... Moreover, to be prepared for an event that will happen and that will happen SOON ENOUGH has the following economic advantages NOW... e.g. lower trade deficit, lower geopolitical risk, lower economic variance in primary energy prices etc."

I might be unrealistic in my expectations to shape the discussion completely like this and I admit that. But I also think that we can learn a lot from modern political campaigning, especially that those who steer the discussion usually win the discussion, even if they have the wrong arguments.

To put peak oil into the category of "it has yet to be mathematically proven before we can afford countermeasures" is a win for the other side (and thus a loss for everyone). And yet, we seem to put ourselves into that corner more than anyone else does. Am I completely wrong about this? Or maybe we really agree about much of it?

No. I believe it is not yet, but not on the basis of this. Saudi's moves could be dictated by the market, and yet they still could be peaking.

To put peak oil into the category of "it has yet to be mathematically proven before we can afford countermeasures" is a win for the other side (and thus a loss for everyone).

It is not about mathematical proof. It is about having the kind of evidence that will withstand scrutiny. If the evidence doesn't withstand scrutiny, then it won't be taken seriously.

Imagine you are Barry Marshall, and you believe ulcers are not caused by stress and spicy foods. You believe they are caused by bacteria. How do you convince people? You make sure your evidence withstands scrutiny, because the whole world and all the pharmaceutical companies are lined up against you. He isolated what he believed to be the bacterium responsible, but he then gave himself an ulcer by taking the bacterium. That's not the entire story, but it ended with him winning the Nobel Prize.

Imagine a different tactic. He believes this bacterium causes ulcers. He never does any actual tests. He argues by analogy. He says "I have an ulcer, and I am not stressed nor do I eat spicy foods. Therefore, it is probably the bacterium." Make that case, and you never convince anyone.

The point is, the case must be able to withstand critics poking holes in it. Even if the case is right, if the evidence is not substantive then nobody is going to give it the time of day.

Aside from this, the fact that SA production declined as prices climbed to a nominal record is IMO proof positive that they were producing at a max. To say that buyers on the NYMEX would pay $70+/b but would not buy from the saudis is absurd, regardless of stocks. And, if further proof of problems in the desert are needed, 3x rigs drilling for oil while output falls is damning evidence. Falling sa production does not prove po is at hand, but the naysayers, eg cera, go first to sa as our saviour, and the probability of this happening is IMO quite low.

You are grossly underestimating the speculative forves in the global markets. Part of the price, a part which can be in both direction is based on irrational factors like fear and greed. Both can lead to temporary fluctuations, but long term the prices seem to settle down at the balancing level (which is what is happening now). There is even the chance of the market going the other extreme and "undershooting" the oil price, but not very likely IMO.

I mean, Westexas does not make the point crucial for the whole debate, he just has a current bad feeling about KSA having peaked already. PO does not need this assumption to be true (enough).

Cheers,

Davidyson

Very true. We are still missing key pieces of the puzzle. Although, I have a feeling that in the end it won't matter. These are finer points on a very strong dynamic which allows only for logarithmic corrections.

I think I understand your argument about needing the evidence. I am a phsysicist/engineer and most of my life I would have argued the same way. However, I find that in "real life" the precision of arguments does not matter as much as their packaging. The sophist can win an argument over the philosopher.

This can be seen in politics as well as in economics. Often a business deal in publically traded companies is not all about absolute economic value but about visibilty to the stockholder. The important part there is to spin a story that is liked by the analysts, even if the fundamentals are not watertight. In the end trust in management's decisions is just as important as the bottom line to assess future outlook. And sometimes the bottom line is bleak, and yet, good managers can earn trust in the market. I am not talking about black sheep here but about CEOs who are struggling to create real businesses with products and real profits. To project a believable image where no data can give any outlook is an important part of the job description.

And in politics the timing and the verocity of an attack can be more of an issue than anything else... see "Swiftboat Veterans". Sad but nonetheless true.

IMHO we do not need to convince the experts any longer. They know the truth already. The management of BP and Aramco are not clueless about how much oil they have left and how much more they can find. How do we know? Because we look at every word of the Saudi's already as if they would be playing poker with us. We want to see their bluff... which implies that we know that they know.

The real problem now is to find language to sell to the public what needs to be done to minimize damage. I think that is much more a problem for ad agencies and campaign managers than experts.

Robert wants PO types to be able to make a strong, 'scientific' argument, and I see a great value in this, because:

In the case of human-induced global climate change (AKA "AGW"), a very strong case has been made, and when that case is put into the hands of CEO's and boards of directors, they have become subject to legal prosecution, jail and fines, if they continue to deny it and act in a way that adds to an event that decreases shareholder value.

Persons in government, or testifying in front of congress, can be prosecuted or fired for lying (unless you're president, I suppose).

Only private think-tank types (Yergin) will be able to glibly lie and not face very real serious consequences IF A STRONG/AIRTIGHT CASE CAN BE MADE.

OSHA is the area where criminal enforcement has been lax.

The fact is that if you are white and median income or above, you walk facing no more than probation if convicted of a non-violent crime.

True, but that awareness will not "suddenly appear" two years, or three years after the peak. That information, whether or not the peak date has passed, will come upon us very gradually. There will be subtle signs that appear from time to time, like Saudi cutting "allocations" to their customers. The point is, we become more and more aware as to whether or not the peak is now, or past, as time goes by.

And right now, most of the world says "no peak until 2030" or some far out date. The majority of "peak oilers" are saying, "peak by 2010 or 2015" or something similar. A very few are saying, "peak is past or right now." By this time next year I predict that the majority of peak oilers will cross over from the former to the latter group.

What an incredibly stupid thing to say! I will guarantee you if we are wrong, WestTexas, myself and the very few others who have the courage to stand by our convictions, will be dragged through the mud if we are proven wrong. You guys will never tire of pointing out how wrong we were if our predictions are premature and what damn fools we were to predict such an early peak. But....but....if we are right, we have the mind of a three year old if we dare try to take credit for our early insight.

God, there is just no damn way we can win is there? No wonder so many peak oilers are going with a more distant peak. It is a kind of "Pascal's wager" for peak oilers. We have nothing to gain but everything to lose by expressing our convictions of an early rather than late peak.

Ron Patterson

That being said....you are still wrong. This is very difficult to put into words and few people will understand. However I will give it a try.

Peak oil will happen, that is an indisputable fact as far as I am concerned. With that in mind, let's look at a few other facts.

- The world's population increases every day, therefore the later the peak, the greater human misery it will cause.

- More of the world's wild animals are going extinct every day, therefore the later the peak, the fewer species that will survive.

- More of the world's forest are being felled every day. More of the world's lakes are drying up and being polluted. More of the world's rivers are drying up, more of the world's land is being blown away, the world is getting warmer and the weather patterns are changing, and I could go on and on. The later the peak, the worse everything gets.

Bottom-line, the later the peak the greater the misery and suffering and the greater the destruction of the world's ecosystem. If we could just hold off peak oil for 50 to 100 years, the earth would be a choking, polluted and barren place.Peak oil? The only thing worse than peak oil would be no peak oil.

Ron Patterson

Youre children and your grandchildrens happiness and well being are by definition your own, as they are part of your life. Suffering by them translates to suffering by you. So unless you have your PO lifeboat and community completely setup, you should be hoping for a later peak, unless of course youre a group selectionist or youre leveraged to the gills in crude futures...;)But the point of my post was be careful what you wish for, you just might get it.

I think this is really a deep and recurring political question... what should we want in the area of PO?

And the answer I come up with is actually "a false peak, leading to a rush to invest in alternatives, followed by a few big discoveries that mitigate the pain while not being so big as to damage the investment program, followed about 10 years later by the actual peak."

And the reason for that is even though we should be investing in alternatives, it will probably take an actual crisis to get things rolling...

We shouldn't want a megacrash...

We shouldn't want a long delayed 20 to 30 year peakoil forced transition away from fossil fuels for all the global warming and environmental reasons outlined above.

Of course what we want has little to do with what we'll get in this case.... But if we imagine the reality that would be most likely to induce intelligent political/technological and economic response this is perhaps it.

We do want reality to shift people's awareness, and what we'd really like is for reality to give a little wake up knock before it smacks us on the head with a 2 x 4.

pdx - i completely agree this would be the best scenario, because it would kick in our evolutionary 'panic' response while still having time to be meaningul.

But this is kind of an unlikely scenario, is it not?

I don't know if y'all can remember the '70s, the panic, the embargos, the "demand destruction", the strangling of the oil market by OPEC.

That was the event and era that let us know that "oils-not-well". Some countries learned a bit from it and raised (and are still raising) taxes on petro-products. And in some areas of the world, society collapsed (Soviet Union/Cuba); besides, it was the shot to the bow which launched a scrambling to invent new technologies.

Wind and Solar have (probably) already come so far only because of the "first" peak.

From a technical trader's perspective, we are in the (possible) middle of a S-H-S (head + shoulders) pattern - late '70s peak was the left shoulder, we are in the middle of the head now, a (relatively) quick contraction will bring us back down to ca. 60 mbd like around 1980 but will then be able to be expanded again.

Maybe using the technical analysis would convince Martin Lynch of the reality of PO???

Hubbert Theory says Peak is Slow Squeeze

I've bookmarked Stuart's Plateau Background, which has a handy index to most of his posts.

So lets assume that the OECD procures energy supplies at the expense of the developing world, we end up with a developing world descending into chaos - their OECD markets may have declined, they will have extreme energy shortages and probably not enough food - cos its been converted to ethanol?

Against this background in the devloping world - I just don't see the OECD financial markets surviving as they are just now with dire consequences for pensioners and everyone else who holds a stake in these markets.

This is one way to look on my local Swedish arguing that we should invest heavily in peak oil preparations that arnt timing specific. Infrastructure that lasts for decades and pilot projects that lasts for manny years. When the peak is obvious market forces will increase the production of what already is being done and fill in the needs as the market prioritizes them.

Sorry sir, but I object to your contention. Single cell 'animals' are just fine, thank you.

BTW, many thanks for all time & effort put forth on this site, and that's even extended to Hothgor.

Byron

Are you referring to politicians?

(I don't know, I relayed your messages. That was his response. Something like that.)

Oh shit, when is that meeting in Nigeria?

FWIW: Declining production of conventional oil and gas is likely to accelerate destruction of the environment as people switch to burning wood and hunting. Rich countries will increase consumption of coal increasing pollution emmissions since businesses will most likely lack capital to build clean coal plants.

Of course this is true. People will hunt the songbirds out of the trees when things really get tough. But what would be worse, 6.5 billion people hunting animals and felling trees or 8 billion people hunting animals and felling trees?

Everything environmental will get worse after peak oil. But it is getting worse everyday anyway. It would be best to start now with fewer people than start much later, after much continued destruction and with many more people.

Ron Patterson

on peak oil much you have learned. the path you predict we will see maybe. but everything set in stone yet is not. else what good are these internets dialogues, hmmm?

p.s. nuclear, wind and reciprocal altruism surprise you they might.

I tell you GWB is our friend :-)

Although I agree with Ron on the early peak, and on this quoted statement, I wonder if he -- and I -- are biased in our cognition of the near-term peak due to our view that a later peak is worse. And I'd also mention the terrible suspense, waiting for the shoe to drop, so to speak. So if only the peak would come, soon, then we could at least break that suspense. (Although I'm sure there would be even worse suspense in that case, e.g., will there be a nuclear world war and when...)

In 'The Empty Tank' Leggett makes the point that if PO is now, renewables lack the credibility (in the eyes of public, politicos, VC-types) of proven coal 'technology' and in our panic we will turn to coal. If given just a few years' more time, many of the non-coal alternatives will have cleared the hurdle of general/public credibility.

I agree with you 100% though that the sooner the consumption/population juggernaut is derailed, the better.

I can change MY lifestyle. And I bet most evryone else who posts on TOD can.

I can't control the reaction of others. I can't contol the reaction of the elected leaders and their attempts to take my prep efforts and call it 'hording' or 'not supporting the war effort' or taxing the property.

How do I defend myself from the increases in robbery as others try to take whatever to pay their expenses? What arguments can be used to make my concerns the conserns of the people who make the laws? What arguemtns don't result in blowblack?

An interesting comparison between the USA and the USSR.

http://energybulletin.net/23259.html

There won't BE wildelife and plantlife to hunt/gather. In addition to the issue of being shot as a tresspasser on a hunt/gather misson.....The 'forage off the land' will end up as a strip the land bear operation.

I can almost certainly guarantee that you will be dragged through the mud, anyway, should your opinnion become a matter of public discussion. That is just part of the game. Look... I agree with you on basically everything. What I am concerned about is that someone needs to take this to the next level. And sometimes, in politics, if you want to achieve A but you can't sell A, you have to sell B which hopefully solves part of problem A. And once people see that the solution to A did not cause an economic collapse, they might even be willing to listen to you about the real solution to A...

Just recently I heard a story from someone who spoke to one of the top managers of NASA's science program. He was young and outspoken scientist at the time and, being asked by this superior what he thought about NASA policy, he let off the usual frustration about the waste on the manned space program vs. the unmanned and much more succesful science program. And the old guy just smiled and said "But young man, you are aware that without the manned program none of us would be here?".

It is the same here... we are hearing politicians talk about oil as a matter of national security. Maybe that is the only way to sell peak oil to the US population. I wouldn't be surprised if that was the case. This does not make anything happening on TOD false... it just puts a spin on it that might have a higher chance of success.

My only serious arguement is that the latest news that KSA is cutting its export allocations in Asia supports his theory And my only real problem with the debate is that the short-term noise obscures the truth-I think we won't be able to decide where the real peak happened until a couple of years have passed after the event. It could be that the Saudi's are avoiding cutting oil supply in the US while cutting Asia in order to prop up the dollar since so many of their assets are in dollars, or it might even be part of their machinations to keep the US in Iraq to protect the Sunni's. We just won't know for a while.

Robert, for clarification, what is condensate and where does it come from?

Is condensate one type of liquid from Produced water?

thanks

oilcan

OK, I am offline for a while. I have to get some actual work done. If a pressing question comes in and doesn't get answered, I will check in later today.

Condensate is easier to pour than oil-higher gravity-and is in essence partially refined by nature. In the Panhandle Field up north of Amarillo, Texas they called these liquids "white gas" and used to steal it off leases to burn directly in old Model A's and trucks. Its worth a premium to light sweet crude.

His argument could be right. The point of this essay was to show that some of the evidence he used to support his argument falls down upon inspection.

The allocation news is certainly interesting. I have surveyed some people this morning and most people think they are just trying to boost prices. But allocating product is a good way to alienate customers. I think the piece of information that would shed some light on this particular question is the inventory level of the Asian market (where they are cutting their shipments). If inventory levels are high, this could be a preemptive move. If inventory levels are low, then allocating product points to something like production problems.

When you have been too long in the House of Mirrors and cannot find the exit.

a) all we have in the absence of data disproving this, and:

b) is probably correct, or fairly nearly so.

The acid test will come when oil is again above $70, or maybe above $75 possibly in about 12 months. If KSA then cannot get production back up to 2005 levels and keep it there, then the argument that they are voluntarily restricting production, or nobody wants the extra light sweet oil at that price, will not be credible. We will then, surely, be on plateau and be on course to drop off it in a couple of years. If by some means they do then WT will have been proved wrong and peak may be around 2010-12.

Which unfortunately does not help us in the short term, but at least is better than the notion that we can only know the timing of the peak and issue credible warnings about it 2-3 years after it passes, which is a sure recipe for disaster.

Stuart, as I have argued recently, unable to, or never called upon to? I have seen no evidence that they were actually called upon to increase production. They said that they would do so if needed, but if I am a refiner I take my chances with the SPR rather than buy from Saudi while prices are shooting upward. I also looked recently, and if I am not mistaken OPEC production during this time was stable.

Prices are not an external force set by Martians. The price of oil arises from the balance of supply offered and demand expressed, and if the price is high despite available spare capacity, it's because some suppliers will withhold oil from the market rather than see the price drop. In response, some demanders have had to curtail plans to take trips they otherwise would have taken (as is very clear in the US VMT statistics).

As to stocks being high - last time I checked on a days-of-supply basis they were not historically anomalous. And the market is probably (and rightly IMO) demanding inventories at the upper end of the range due to increased perception of geopolitical risks to supply.

Days of supply is a completely irrelevant measure when talking about full inventories. If the tanks are full, they are full. It doesn't matter if that's only 1 days worth of supply. If the tanks are full then you aren't taking deliveries if your refinery is down.

Here's the actual data. First is OECD stock levels (from Table 1.5 of the EIA IPM) divided by both global production and OECD demand (through Aug 2006). The upper curve (OECD stocks/OECD demand) is probably more relevant.

As you can see, both the last two summers, when prices have spiked up (from an already very high base) have been associated with higher stocks. However, "higher stocks" is not very much higher at all. If we plot the "days of supply" as the number of standard deviations from the mean over this Jan 01-Aug 06 period, we can see that these are in the upper tail, but not outlandish compared to past behavior.

So to me, this is the fear factor in the market (as I assume you'd agree).

How long does it take an oil company to order and build a new storage tank?

You can't imagine what a low priority item storage tanks are. It drives the guys at the refineries crazy, but the guys doling out the capital don't like spending money on tanks.

Three to five years are needed to get any significant storage capacity on line assuming that you have to start from scratch, that is it is not pre-permited.

- Find and aquire land and right of ways.

- Get necessary zoning changes

- Do design work

- Do environmental assesment

- Finalize permits

- Let bids

- Actual construction

- Testing and acceptance by regulating authority

If any glitches try eight or more yearsInteresting project, though. There's a lot of heavy oil at shallow depths thats never been produced, as well as on several other piercement domes. Its very sour-the biggest onshore sulphur dome was Boling-but its real heavy, around 10-12 gravity. There are a number of domes with oil like that here on the Texas Gulf Coast. Won't be much production compared to US useage, but at $40-50 bbl would probably make a good living. Anybody want to drill some 400ft. wells?

Second, we've got to get some maps, preferably with good well data Tobin Map out of San Antonio makes some, but the old Zingery maps are the best, but they were purchased and put out of business about 25 years ago so they wouldn't compete with BACA Landata. Maybe some can be purchased, I don't know. The Railroad Commission of Texas has excellent field maps, but they are mostly good only after 1940. The county Tax Apraisal maps are good and cheap.

Third, we need to get some professionals interested in the possibilities. I am seriously looking for a geologist with some time to gamble and a good engineer. This is low volume and long lived production. The only two geologists who might know something about this stuff that I know are old-one's 86 and the other about 75. Nobody has messed with shallow salt dome production in years. The last person I know to try to get this stuff developed was Bob Garwick, the 86 year old geologist in the late 1980's at Moss Bluff in Liberty County. I know he drilled a couple of wells there. He also had a prospect at Hockley in Harris County, but its probably under a subdivision by now. The Moss Bluff prospect is I'm sure unleased by now and might have a reentry

The next step is raise some money and take a few leases. I've got some sources for the money, and I'm a good landman I'm getting a nice inheritance this year, and I think shallow oil production is a sure thing money-maker.

Then we need a good engineer to complete and produce the wells. I don't know any, but somebody does. There are also some excellent contract operators. They operate wells for a fee, and I have a couple of contacts there.

The next to last step is write and print a prospectus and raise the money. I've a few contacts for the money, and I plan to do a little gambling myself.

The last step is drill the wells and complete them and sell the oil. I could elaborate for hours, but you get my drift. Its not difficult, just tedious, and a process thats been going on here in Texas since about 1890. And, its in all areas of the state, I just happen to be more familiar with the Gulf Coast than other areas. I'm pretty sure that's what Jeffrey Brown is doing, although in a different area with different types of prospects. My uncle, Charles Passel made a wonderful living for over 50 years in shallow Ft. Worth Basin wells as a geologist, but he's dead.

As an investor, my first question is why hasn't this been done before. Its a function of opportunity costs. Why drill a well for a couple of barrels a day, when with virtiually the same effort you could drill a well making a lot better production. There haven't been many guys interested in shallow prospects in the last 50 years, and much of the areas have been literally forgotten. But I think that crude is going to get so tight in supply in the US that most anything will get drilled and produced. The other main reason is overhead. I office at home, work as contract labor on other people's prospects and am willing to gamble my time and labor. I don't need a fancy office and lots of employees for my ego, so I can make money on small production.

I was squeezed out of the oil patch about 15 years ago, and have just been back for a year and a few months, but I listened to the old guys and have a long memory. I thought after the Club of Rome report that this kind of prospect is worth remembering.And, I've got a dozen ideas worth looking in to, Boling is by no means the best. I keep my best ideas tight, but I'd sure like to hook up with some other professionals with the same interests. At any rate, email or call.

If the oil companies own a huge chunk of the oil inventory, wouldn't they be motivated to keep as low an inventory as possible in order to get as high a price as possible for themselves?

Anecdotal evidence tells me something different as well. I have this friend (working for a supermajor) who was in charge of supplies to the Pacific Islands. According to him, his main objectives were to a)minimise the inventory holding on hand to reduce inventory holding costs while b)ensuring that a stock-out situation does not arise. Due to the lead time in getting a vessel with the appropriate kind of products to the islands, he would normally have to keep 45-60 days of inventory on hand.

RR is the expert on this though

You have touched on a subject that is a great source of interest and mystery to me, and one that I am surprised has not been more heavily discussed here at TOD.

For years, KSA and OPEC generally controlled the flow of oil to keep prices from getting to low, but they seemed almost equally concerned about prices becoming too high. Now, they have totally changed their tune, and think that $60+/bbl is just right. What happened?

I can think of a number of possibilities:

- They just got used to the higher income, got greedy, and can't give up the extra cash even though it is likely to hurt them in the long run; apparently they have forgotten what happened the last time prices spiked.

- They are desperately trying to maintain production without letting the world know how hard they are working to do so. At that point, they want to destroy some demand, in order to rest their fields.

- They have realized that oil has entered the endgame phase, and are going to sell their remaining resources as slowly as possible, in order to maximize both value and timeframe of this income.

- They realize #3, and they are altruistically trying to help the world prepare for peak oil by jacking prices up before the geologic peak hits.

OK, I don't believe #4 either. But beyond that, it's a real mystery to me. Maybe there are specific political factors that have changed the equation. Maybe it's greed.Does any one of you gurus want to take a shot at this? It seems like a subject worth exploring in an article of its own, but I do not have the knowledge to even begin to do so effectively.

2)

And re #3, 'slowly as possible' might be a bit out of their control. 'As slowly as maintains the peace' might be more correct.

Happy days are here again! So, no reason to allow prices to hold under 60, maybe even 70 is ok now. I think they will pick some price but index it for dollar deflation against the euro (price in dollars with a constant euro equivalent.)

So, OPEC is reborn, as tod would like, cutting production and reducing gw. The question is, is this their last hurrah? And, how long will this round of cuts last before demand once again climbs past their ability to produce?

The blue line (right scale) is US ending month stocks of crude oil and petroleum products (exclusive of the SPR) divided by US consumption of crude oil and petroleum products that month. That axis is not zero scaled to better show changes (it runs from 40 to 60 days of supply).

The pink curve (left scale) is spot price.

As you can see, there is nothing anomalous about US stock levels on a days of supply basis. They are higher than in 03 and 04, but not as high as late 01 and early 02. So US commercial stocks are actually less high relative to their historical level than OECD stocks as a whole.

This whole "stocks are much higher than their average band" is, as far as I can see, a complete distortion perpetrated by the EIA because they are failing to divide by the obvious scaling factor in the situation (throughput of oil to the economy has hitherto generally increased year after year, with rare exceptions, and so we would expect, other things being equal, that stock volumes would need to grow in line with that.

- When stocks rose to the present level end 01, and remained there for several months (perhaps on account of the dotcom recession), prices fell maybe 40%. When stocks rose this high in sep, prices ultimately dropped 25% (this would be more visible if chart was log scaled and if prices were extended to today. Also, would have liked to enlarge the chart).

- I am continuously reminded that the market knows more than we do. Your chart is as of Sep, the market reflects refiner buys as of today. Considering that oil continued to fall, and has only reluctantly stabilized on account of opec cuts plus threats of more to come, one might infer that either stocks have statyed high, or perhaps climbed higher. For example, in feb stocks were nearly as high, drawing price down to the bottom of the band, but stocks immediately fell, encouraging price to resume its climb.

- From end 03 stocks climbed fairly continuously, possibly on account of high futures.

- It may be, as you suggest, that the days coverage is just keeping pace with increased use. BUt, have refiners increased storage capacity in line with the incrase in processing capacity? And, even if they have, perhaps 56 days is the point at which every tank is full, in which case refiners would have to refuse delivery and stop buying, regardless of how much higher futures have gone. Consider... if this is so, they would be enthusiastic buyers as long as futures are higher, but suddenly coming to a full stop when the last tank is full, increasing volatility. In this case, climbing stocks will not result in lower price, as was true in the past, until the tank is full, explaining the concordant rise of both price and stocks from end 03 to sep.

- Regardless of future prices, stocks were able to climb only because excess product was available to buy and store. Production and consumption are fairly stable, but the excess liquids had to come from somewhere, imo it is surging ethanol production. Much maligned at tod, the subsidy costs the us around $20/b or maybe $40M/d at current production. BUt, in addition to directly displacing 2Mb/d imports (gross), at maybe $120M/d, there is a case that this production has dropped the world price of oil from 78/b to 62/b, saving the us alone some $200M/d. OPEC's fall in revenue is around twice this and they are hardly amused, furiously meeting to cut production to shore up prices. Even if they are successful they will probably not jack up prices to where they were and, in any event, their revenues look to be down for some time. Accordingly, one might say that ethanol is one of the substitutues that economists predicted the hidden hand (itself visibly helped by farm subsidies) would produce in response to higher prices. How about a thread that looks at ethanol's role in

reducing pricesreducing US energy costs

rducing US BOP deficit

reducing OPEC production

gw

while ignoring, for the moment, eroei, scaleability, peak ng, etc.

6. I wonder if high ethanol production in late summer/early fall is seasonal, resulting from harvesting the corn? It can't be stored for long, right? Maybe supplies will decline until the next crop comes in?

But as I have argued, "days of supply" is pretty meaningless unless sufficient tankage has been installed. If not, days of supply could be down to 10, and yet inventories could still be full. It is not days of supply that anyone buying or selling crude is primarily worried about; they want to know "where can I put it?" And I can promise you tankage is a low priority expenditure.

When investment banks start buying up physical commodities, it's a sure sign of a commodity bubble.

How many barrels could you store in a warehouse? I doubt that it's anything significant.

I haven't been able to get any figures on how much physical oil was/is stored by financial institutions. It would be a very interesting number to track over the last few years.

Yeah, but why would oil companies want to maintain production levels and also incur the expense of storage, instead of simply cutting back production? I think cutting back production is the optimal decision for them, and has the same effect as arbitrage.

Oil companies have different business models to financial institutions, so I would expect them to make different operational decisions.

Building tanks is a pain. You have to do a lot of environmental footwork, get your permits done, etc. It takes a while. It's not that we are unable to expand storage capacity, it is just viewed as a low-priority item. The powers that be just say "Aw, you can get by with what you've got."

You have also not explained why, if storage capacity is the problem, crude prices are not at $22-$28 while storage rents are through the roof.

Stuart, I am just telling you what I know to be fact. Firsthand. I think sometimes you put a bit too much faith in price as an accurate indicator of what's what. Price doesn't tell you everything. Sometimes it lies. Often it is driven by psychology. In the case of oil, excess capacity has shrunk quite a bit. Why wouldn't this cause prices to rise? And how much should the price of oil be?

your graph looks far more volatile than I would have expected looking at how storage levels have changed over the past 3 years. See the link below.

http://www.energyeconomist.com/a6257783p/wpsr/graphs/WTESTUS1.gif

Inventories, short-term, influence price. Inventories, long-term, are a hedge against supply disruptions. In this regard, they matter not at all since 30 to 40 days of supply is nothing. Building up inventories only reflects greater insecurity but does little to alleviate it in any situation we might care about.

Getting to the point, Robert's argument (below) that Saudi Arabia was not "called on" to increase its exports holds no water. This is prima facie evidence that they can not do so, which I thought was common knowledge. They (and OPEC generally) can only cut production to prop up prices.

Having written extensively about the supply, demand & the oil price, I will say that, when history is written about this period, no one will have anything to say about inventories.

I find each and every post here about inventories, even my own, completely irrelevant to the peak oil problem. Some people say if we're at peak, inventories should be low. In fact, high inventories could easily indicate the opposite.

Sorry about the mistake.

Next time I hear one of you people talking about inventories, I shall remember to think about time scales that matter and time scales that don't. I hope you all see what I mean, here.

The first quarter inventory picture, though, supports the point the Saudis were making. Inventories were going up even though they had cut production. That does in fact tell you something.

I said: think about time scales that matter and time scales that don't. This peak oil problem has nothing to do with these ephemeral events in the oil markets, nothing at all.

I meant what I said: these meaningless fluctuations tell us nothing of interest in the bigger picture.

Well, here's what it tells me. When they said they were cutting production due to lack of buyers, they were probably telling the truth. The inventory data back them up, because they told that story as inventories were rising.

Now, if you are not one of those who said that they were lying when they claimed this is why they cut production, then perhaps this information is meaningless to you.

But the peak oil problem has everything to do with the Saudis, so I am very interested in figuring out if they are prone to lying, or if their statements are supported.

What if refineries were down 5% (seasonal maintaince and what no) and SA production was down 2% (PO).

Now in that case wouldn't inventories rise even if SA had peaked?

I'm not saying this happened, but just that you can't draw you conclusion as the only one.

Then imports wouldn't have returned to normal as soon as the refineries came back up. That's what a lot of you are missing. You are looking at one piece of a graph and drawing conclusions. Look at the rest of the graph and tell me how that fits your scenario. I know a number of others have tried to do that - find an explanation for the downslope while completely ignoring the fact that imports interestingly enough returned to normal as refinery utilization did.

/Please accept my apologies if you already explained this and I just missed it.

I distinctly remember it being pointed out in the past that the post Katrina imports were mainly refined products (gasoline etc) and not crude. Therefore you cannot directly link Katrina to the increase in imports in 2005.

I know this because I read the reply to your post where you said the above.

Also imports are down for the same period 05 and 06, this has nothing to do with seasonal cycles.

I can't wait till Prof Goose gets that troll button setup.

That should read

Therefore you cannot directly link Katrina to the increase in crude imports in 2005.

This discussion clearly shows that crude imports are not down, and only refined products are, for the reasons mentioned above. If that is a troll comment then god help all of us. I for one am thankful that Prof. Goose isn't one to act like a child and wouldn't implement a TOD wide popularity contest.

How is that for transparency, Rethin?

I'm not talking about WT. I was commenting on what RR said.

Go back and read the thread.

RR:The first quarter inventory picture, though, supports the point the Saudis were making. Inventories were going up even though they had cut production. That does in fact tell you something.

RR:Well, here's what it tells me. When they said they were cutting production due to lack of buyers, they were probably telling the truth. The inventory data back them up, because they told that story as inventories were rising.

Me:What if refineries were down 5% (seasonal maintaince and what no) and SA production was down 2% (PO). Now in that case wouldn't inventories rise even if SA had peaked?

RR: Then imports wouldn't have returned to normal as soon as the refineries came back up.

ME: But I thought imports were down?

From RR's article:

http://tonto.eia.doe.gov/dnav/pet/hist/wttntus2w.htm

Imports are down Nov 06 vs Nov 05. They are also down compared to Nov 04 (no hurricanes then).

I called you a troll because your comments were

I'm not debating RR, I'm trying to learn. I am asking him questions to increase my understanding of the issues.

RR is incredibly patient and has taken the time to answer me.

Thank You RR

Other people educated you as to why you Katrina import theory is inaccurate, not me.

I don't have to be a genius to see your post is a non-sequitor.

My underlying assumptions were correct, the wording was not.

What if refineries were down 5% (seasonal maintaince and what no) and SA production was down 2% (PO).

And since I was talking about Crude imports and stocks why would you be posting about refined products even after it was pointed out to you?

And even if it included refined products, acording to RR's link you'd still be wrong since Nov 06 imports were down vs Nov 05 (hurricanes) and Nov 04 (no hurricanes).

BTW, telling you something you don't want to hear is not "twisting the facts".

Perhaps its you who doesn't want to be told something aside from the usual doom and gloom.

Imports are down because refinery capacity is down several % from its usual average for this year. As RR stated, when the refineries are down, they aren't going to import oil. If the maintained the same % as before, we wouldn't be down. The entire years data to this point shows that our crude inventory is much higher than normal, and our refinery % is down below normal, leading to lower gasoline inventories but higher crude stocks.

WT on the other hand has stated repeatedly that net refined petroleum products are down, just as his ELM projected, but he fails to take into account Katrina and Rita.

Yes, imports were down because refiner utilization was down. But didn't it rise again to the low 90% in Nov? So why are imports still down? This is my question. Couldn't SA production have been dropping when utilization was low and thus masking the drop?

I am wondering if RR's correct that demand dropped but WT is also correct and that drop in demand is hiding a drop in production.

Down thread someone notes we will find out when demand rises this summer. And RR agrees.

You come charging in to the thread posting crap that has nothing to do with the question I asked RR. What was the point other than to muddy the discussion/spark an argument? Ie trolling.

I'm not comparing apples to oranges. I'm talking about apples, and you bring up oranges.

How can I be twisting facts to support my position when I have no position?

Why do I continue to respond to you?

But its not what RR implied in the post I was responding to.

RR:Then imports wouldn't have returned to normal as soon as the refineries came back up.

I read that as imports have already returned to normal. Hence my question to him

Me: But I thought imports were down?

Which they are in the data he linked to in his article.

Your reply was at best a non sequitor. What was the point in posting it? Especially since other more knowledgeable posters have pointed out it is inaccurate.

Don't you see?

Go re-read what he commented on.

Try thinking outside the box.

If you still don't understand, I'm sure he would be more then willing to point out what your missing.

I am truly humbled.

No, Dave, they have been criticized for not increasing production as promised after the hurricane. What they said was that they would help if needed. If nobody actually asked them for more crude, then you can't turn around and criticize them for not delivering. If we had said "By all means, we need more crude" and they didn't produce more, then there is a legitimate argument. Total OPEC production did in fact come up in the month following the hurricane.

So, you believe that, Robert?

Why would Katrina be different? For the first time we just forgot to ask SA for the oil? For the first time the SPR was more desirable?

RR, it doesn't pass the sniff test.

In other words, you, like everyone else who has brought it up, have no actual evidence that any of their customers asked for more crude and didn't get it? You are just jumping to a conclusion based on your preconceived notions. I don't know if they could or they couldn't. In fact, none of us do unless someone can show that Saudi turned down a request. Simple as that.

Sure its possible the US just forgot to ask SA for Oil this time around. But with the all the other evidence you've seen do you really believe that?

But yeah, its not proof beyond a reasonable doubt. But that's not the point I was making either.

Bingo !

But that's just another way to define demand destruction.

So to determine if we are at peak we need to do only two things.

Show obvious demand destruction at current prices.

Show that their is a good chance that supply will not increased significantly and indeed may have or will peak shortly.

Stuart, I understand how markets work. But the Saudis don't sell on the spot market. They have customers. Unless a customer requests more oil, or the U.S. requests oil from them to refill the SPR, then they aren't going to increase production.

I will point out that nobody has yet demonstrated that more oil was requested from them and that they didn't fulfill the request.

I guess I am not following the point you are trying to make. Could they have gone against the market after Katrina, lowered prices, and sold more oil? Well, sure, but that would have been an insane business move. And they never said they would do anything like that. They want market prices for their product, just like everyone else. But what they said is "If you need it, we've got it."

So unless someone can point to a case where someone had their request for product denied, then there is no case that they couldn't have produced more following the hurricane. That's the key here. Folks are looking at what they did, and saying they couldn't raise production when it was needed. That's an inappropriate conclusion based on the available data.

However, "And they never said they would do anything like that" I disagree with. In the past, they have explicitly said that they are the producer of last resort, that they maintain spare capacity in order to be able to stabilize prices in the event of an emergency. Not only have they said it, but they have done it (in the late 1970s and again during the first Gulf War). So, if they are acting entirely out of "us-first, jack the price as high as it will go" thinking, that is a new thing. Therefore, it is in need of explanation.

Overall, I think there are two possibilities that are hard to distinguish. Either they cannot raise production, or they could, but they haven't because they wanted to let prices rise. The rig counts tend to tip the balance of the evidence towards the "can't" explanation but I agree it's not conclusive at this point - more time will be needed before we can be sure that it isn't just due to delays in new production from all those rigs coming on stream.

I don't think there is any question that they have changed their attitude about pricing. At one time they were content to keep prices at $25. I think what's happened is that prices rose, and the economy was able to absorb the price rise. Hence, $60 became an acceptable floor that wouldn't destroy the economy. I know people personally who have gone through the same evolution of thinking.

But that is not what happened. It was the Saudis who told the Asians that they (the Saudis) can't fulfill their contractual obligation. In my opinion this - coupled with that fact that the price is close to nominal all time high - is clear evidence that the Saudis are unable to increase production.

In other words, they have probably peaked. And if Saudi Arabia has peaked, the world has peaked.

Suyog

I agree that this is the way it should work. But I think the Saudis are trying to tighten up the market to keep supply tight. Look at this article this morning from Iran on the same topic:

The fact that the Saudis can't meet their contractual obligation to Asian refinaries is a clear and unequivocal sign that the production decline is not voluntary.

Suyog

You are jumping to conclusions. First, allocation is written into contracts, so they are meeting their contractual obligations. Second, there are reasons for allocating other than you "can't" meet the demand. I have firsthand experience with some instances of this.

So, while the allocation issue is certainly something to keep an eye on, you can't concluded "can't" where you have chosen to. The vast majority of allocations are temporary, and this one may very well be driven by concerns about oversupply. The statements from other OPEC members tend to indicate that they all think the market is oversupplied.

The point is that if the Saudis had had the light sweet available to make up the shortfalls, they would have sold it on the market. But, they did not.

Could it be (he asked, speculatively) that the European oil/refined product imports here into the U.S. were a more reliable, easily-refined source than what Saudi Arabia could offer at that time and even now -- which was/is basically Spam in a Can?

Robert, it is high-time for you to show some skepticism toward what the Saudis say, on the one hand, and what they do, on the other. While I am not necessarily in the Jeffrey Brown camp about 50% QT and all that stuff, with Ghawar at peak, etc. -- I will say this: the KSA track record over the last year raises many doubts about whether what they say has any proximity to the truth. They put Haradh on-stream (300 mbd) but all I've seen since is production declines. Doesn't this create some doubt in your mind about what is going on there?

-- best (going to bed) -- Dave

It wasn't actually at that time. He made the statements about heavy crude in late spring.

Doesn't this create some doubt in your mind about what is going on there?

Of course it does, and if they were here I would be all over them with questions. My skepticism doesn't just run one-way. But they aren't here for me to question right now. What I can do is take their statements and see if I can find things that actually don't add up. That was my whole purpose of looking into what was going on with inventories when they said they couldn't find buyers. If inventories had been falling when they were saying that, their statements would have been much more questionable.

were loading terminals. Saudi crude would not arrive soon

enough to keep the refineries operating.

"unless something is in our refinery in a week or so, we're starved."

http://www.businessweek.com/bwdaily/dnflash/aug2005/nf20050831_0413.htm

(First post, I'm nervous, great debate folks, and TOD rocks).

Welcome, and thxs for the link to help refresh our memories. Don't be nervous, just realize that top-notch debate is hard work, and TOD ruthlessly works the data very hard and from every perspective. Just imagine what we could do if Simmons's data transparency wish came true.

Yep, TOD rocks: must be the beating on those empty oil drums that is drawing the crowds. So, welcome newbie TODer, grab your steel drum and start banging away with the rest of us. =)

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Now that all is well, the exports are back down to status quo. Y'all are chasing the wrong rabbit...

We are doing fairly Ok at $60 per barrel, at least in western Europe and USA, even if some countries in Africa are struggling. When our economies start to creak under higher prices, there would be strong public pressure for governments to lean on the Saudi's to increase production if they then tried to say they were holding back. Then they would - presumably - either have to up production or come clean on their inability to do so.

The tax income could be invested in a more efficient fleet. I believe the US consumes some 380 million gallons of gas a day. So that makes for $140 billion annual tax income for every $/gallon of tax. That would be enough money to pay for no less than 6 million new Prius per year... and certainly enough to give very substantial tax subsidies for basically all new vehicle purchases. Such a consumption tax would allow Americans to replace their whole fleet within a decade and at the same time collapse the oild market. Not a bad idea, indeed. Certainly one that would almost pay for itself.

Sometimes the analogous case is simply a new iteration of the same case. Or call it a new example of a general case.

I can't make the call for which animal we're looking at here.

On this page the weak analogy is often argued. Then the same poster will put HL plots at the level of Laws.

It's disorienting.

I've personally become tired of the debating as to exactly when a peak in oil production will occur. It is an empty exercise that we all know will have little to no impact on the effectiveness of our response (or lack thereof) to the problem. It does however, seem to serve the needs of many an ego that feels it necessary to confirm their superiority via intellectual sparring over the minutiae of an overwhelmingly large problem.

It has been stated numerous times on this site and elsewhere that energy industry metrics are inherently flawed and opaque. I'm also a subscriber to the idea that such opacity serves the varying agendas of varying segments of human society. I applaud your suggestion for more transparent metric but somehow it reminds me of the represenation of "image enhancement techniques" used in movies. A digital picture is zoomed into a mess of pixels. These mysterious blocks of colour are run through some supergenius' algorithm and reveal perviously unseen pixels within unseen pixels exposing the killer/perpetrator/hero/detail vital to the plot. You can't enhance what isn't there - that's called drawing.

Short of establishing a group to rival Petroleum Intelligence wouldn't reinterpretation of opaque, skewed and inconsistent "Total Liquids" data simply be the statistical equivalent? A very difficult attempt to seperate signal from noise and reinterpret bad data to try and get good data?

I personally think that our metrics were defined before there were any positions on peak oil, and most of the experts didn't even know the questions we would be asking of the data. It would be more useful to use Roberts proposal.

I doubt we could get all of the worlds oil analystist to agree, and,change how the datum were gathered. Inertia is a heavy topic (yes, the pun is intentional, you humorless SOB's).

Thanks.