Peak Oil Booklet: Chapter 3: What's Ahead?

Posted by Gail the Actuary on July 31, 2007 - 10:00am

This is a draft of Chapter 3 of my booklet. Chapter 1 can be found here; Chapter 2 can be found here.

A number of analysts are saying that peak oil is here now (see Chapter 1, Question 8). Suppose they are correct -- what kind of changes can we expect to see in the years ahead?

In this chapter, we will look at the implications of peak oil now -- how we can expect oil production to change between now and 2030, and how this decline in production is likely to affect the economy. While there are many who believe that peak oil is still a few years away (the newsletter of the Association for the Study of Peak Oil and Gas of Ireland predicts a peak in 2011, for example), this analysis will assume that the peak year is 2006, with the decline starting in 2007. If this assumption turns out to be a little early, the worst that will happen is that we will be a little ahead in our planning.

1. If peak is now, how much of a decline in world oil production can be expected in the next few years?

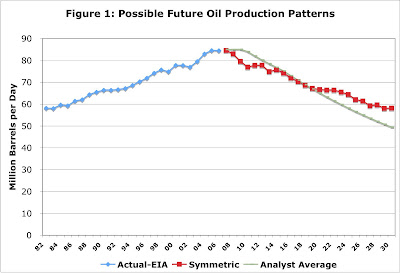

Figure 1 shows historical world oil production, together with two projections of what the future will bring:

The first of the projections we call the "symmetric" projection. It simply assumes that oil production will decrease in the future in a manner similar to the way that it increased in the past. This method assumes that 2006 is the peak year; 2007 production will be equal to 2005 production; 2008 production will be equal to 2004; and so on. Thus, the future is expected to be a mirror image of the past.

The second projection is what we call the "analyst average" method. Here, we average five projections assuming peak in the 2005 to 2007 period - two made by Ace, one made by Bakhtiari, and two made by Robelius. We have adjusted all of the projections to a "total liquids" basis for this comparison (that is, including ethanol and other liquid fuels that are similar to oil), so that they are comparable to each other and to the historical data.

Figure 1 shows that the projection methods produce fairly similar results. Both methods show production declining fairly rapidly:

• At 2010 - Symmetric: Minus 9%; Analysts Average: Minus 1%

• At 2020 - Symmetric: Minus 21%; Analysts Average: Minus 23%

• At 2030 - Symmetric: Minus 31%; Analysts Average; Minus 42%

2. How likely is it that future production will follow a pattern similar to Figure 1?

The forecasts shown are only rough approximations. Actual production could be higher, especially if there is a major technology breakthrough. Such breakthroughs take a long time to widely implement --an average of 16 years, according to a recent report by the National Petroleum Council--so the benefit occurs fairly slowly. Another possibility for increased production is an increase in an alternative fuel, such as coal-to-liquid. Such an increase might make the decline somewhat less steep.

There is also a significant risk that future production will be lower than indicated. Social unrest can be a problem in countries with declining production, leading to pipeline attacks. Oil fields may not be developed because their owners lack the necessary funds for investment or the technology required to develop the fields. Some countries may choose to limit production, so as to save oil for later. Also, there is some evidence that newer technology may keep production in a field high until close to the end, then suddenly drop off. If this phenomenon is not adequately reflected in the projections, the estimates of future production may prove to be too high.

3. It seems like it is really the amount of oil per person that makes a difference. What kind of change in oil production is expected on a per capita basis?

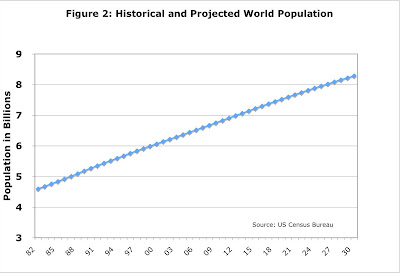

The number of people in the world has been rising at between 1% and 2% per year. A graph of historical and expected future world population based on US Census Department estimates is shown in Figure 2.

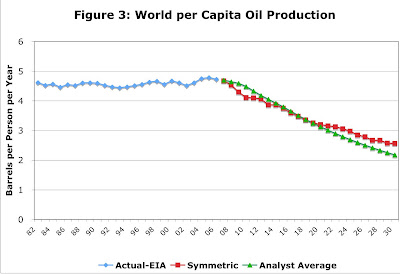

If we use the information in Figures 1 and 2 to calculate oil production per person, the result is as shown in Figure 3.

On a per capita basis, the amount of oil produced has been approximately level, at about 4.6 barrels per person, between 1982 and 2006. The forecasts show that the amount of oil per person is expected to decrease to approximately 2.0 to 2.5 barrels per person, by 2030.

4. Does a decrease in per capita oil production really make much difference? I have heard oil represents only a tiny fraction of world revenue.

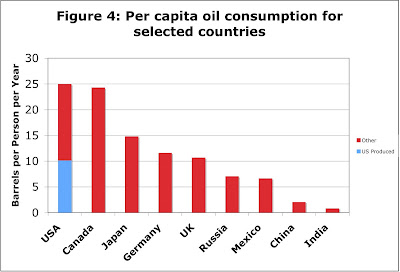

There is a surprisingly close relationship between the amount of oil consumed and a country's standard of living. Figure 4 shows a comparison of current per capita oil consumption, for selected countries.

Of the countries shown, the United States has the highest consumption, at approximately 25 barrels per person per year. (A barrel is 42 gallons, so 25 barrels a year is 1,050 gallons, or 2.9 gallons per day). Canada is close behind, with about 24 barrels. Germany and the United Kingdom are at a level roughly half of that of the United States, partly because they use more public transportation and partly because they drive smaller cars. Mexico and Russia both have per capita consumption of about 7. Note that this is still above the world-wide average per capita consumption of 4.6, from Figure 3. China and India have the lowest per capita consumption of the countries shown - approximately 2 barrels a year for China and 1 barrel a year for India.

Based on this comparison, there is a huge difference among countries in the amount of oil used. Figure 4 also shows a breakdown of US oil between US-produced and imported. If we consider only US-produced oil, oil production of the United States is about 10 barrels per person per year - close to the level currently used by Germany and the United Kingdom.

5. If world oil production decreases as shown in Figures 1 and 3, what impact will this have on the amount of oil the US consumes?

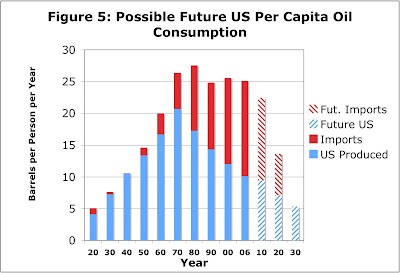

The US currently imports about 60% of its oil supply. The big question with respect to future US oil supply is how much oil we will continue to import in the future, when world supply begins to decline. Figure 5 shows one possible outcome, on a per capita basis.

On Figure 5, we show a a hypothetical situation in which US oil imports drop about 10% by 2010, then drop to about half of the current level by 2020 and disappear all together by 2030. These estimates are not much more than guesses. There are a lot of uncertainties about future imports:

• Will a free market in oil continue the way it does today, when demand is much greater than supply?

• Will oil-producing nations keep a disproportionate share of the oil for themselves and their allies?

• Will the US insist on importing enough oil to fuel its SUVs, when some people are literally starving to death, because their country cannot afford oil for tractors and power plants?

We show a worst case scenario for 2030, with imports disappearing entirely. (If imports continue, oil availability in 2030 is likely to be higher). If imports disappear, a rough estimate is that US oil production will be about 5 barrels per person per year in 2030-- a little lower than the current level of 7 for Mexico and Russia. Efficiency advances and other mitigation efforts will presumably provide some benefit, so that the standard of living might be similar to, or somewhat higher than, the standard of living of Mexico and Russia today. The 5 barrels per person per year in 2030 is approximately equal to the US's oil consumption in 1920 -- a very different world than today.

6. Is the decline in availability of oil the only problem the world is likely to face in the years ahead?

No. With all of the years of growth in population and economies, we are reaching limits in many respects.

• Climate change As the result of man's activities, and in particular the growing use of fossil fuels, the world temperature is rising. Many are now saying that the use of fossil fuel should be limited - particularly coal. In North America, coal is often thought of as a possible substitute for oil, because it is in reasonably good supply and the technology for coal-to-liquids exists. Climate change issues make this substitution more questionable.

• Metal shortages Quite a number of metals are now in increasingly short supply - including copper, platinum, and uranium. Some have suggested that uranium shortages may limit nuclear expansion capabilities, but this is disputed by others.

• North American natural gas A shortage of natural gas in North America starting in a few years appears to be a significant possibility. Natural gas from conventional sources is in increasingly short supply. Gas from shale, which is a major "unconventional" source, is looking increasingly non-economic. Liquified natural gas (LNG) from overseas is sometimes thought to be a substitute, but a lack of investment in overseas facilities to process LNG is likely to limit its availability.

• World food supply and fresh water World food supply is under increasing pressure from competition from biofuels, shortages of fresh water for irrigation, crop failures due to climate change, increasing soil degradation and growing world population. Inadequate fresh water is a serious issue in its own right.

7. What are the immediate impacts of an oil shortage expected to be?

As one might expect, an oil shortage is likely to result in higher prices of goods that contain oil or use oil in their processing. Gasoline, diesel fuel, and residential heating fuel will of course be higher priced. Food will also be higher priced, because a considerable amount of oil is used in growing the food, processing it, and transporting it to market. Other types of energy are likely to rise in cost as well, as people shift to alternative fuels. The inflation rate is likely to rise.

While it is not as obvious, It is also likely that there will be actual "outages" of some oil-related products. Gasoline stations may be without gasoline in some areas, particularly when a nearby refinery is temporarily not available because of a storm or unplanned maintenance. Residential heating oil may be difficult to find in some locations. Asphalt may not be available for paving roads. We are already starting to see a few situations like these, because supplies are stretched tight.

If gasoline or another product is temporarily unavailable, there are likely to be indirect impacts as well. Schools may close because diesel is unavailable for buses, and factories may close for lack of a particular part. Liebig's Law of the Minimum says that a process is limited by its least available resource. If oil is not available, even temporarily, economic activity can be seriously impacted.

Some areas that are likely to first feel the impacts of oil shortages are

• Commercial airline flights - Cost of fuel and higher debt costs will be a problem

• Food imported by air - Demand will decline because of much-higher cost

• SUV manufacturers - Demand for large cars will decline precipitously

• Third world countries - These countries are already being priced out of the oil market

8. What is the impact of oil shortages on the financial markets likely to be?

Strange as it may seem, some of the biggest and most immediate impacts of oil shortages are likely to affect financial markets:

• End of the growth paradigm. Economic markets now expect continued growth and expansion. With declining supplies of oil and other necessary resources, this expectation will need to change to a steady state, or even to a planned decline.

• Declining credit availability. Debt is provided with the expectation that an individual's or organization's income will grow, or at least stay level in the years ahead. If this assumption no longer holds, a shift from the very loose credit standards seen in recent years to extremely tight credit seems likely. A recession or depression is likely to ensue.

• Declining stock prices. The value of stocks reflects the expected future earnings of the company. If these earnings are expected to stop growing, and perhaps shrink, the value of the stock can be expected to decline.

• Deflation and/or Inflation. A reduced supply of oil may lead to inflation, as existing monetary supplies "chase" fewer and fewer goods. Also, countries may adjust monetary policies to encourage inflation, if it becomes too difficult to pay off debt in a declining economy. There may also be huge deflationary pressures, as the value of stocks and other investments decline, debt becomes less available, and the economy shrinks.

• Reduced interest in insurance and other financial products. Volatility in monetary supply, declining values of stocks, and problems with the debt markets will all make insurance and other financial products less attractive.

• Declining globalization Declining living standards in third world countries, declining availability of commercial airline flights, increasing cost of global transportation, and increasing volatility of currencies are all likely to act to reduce globalization.

9. What types of jobs are likely to see growth in the years ahead?

• Small businesses, selling goods close to the customer.

• Recycling of all kinds, including clothing and parts from no-longer-wanted buildings.

• Remodeling homes to make them more energy efficient and to accommodate more people in the same space.

• Food production will require more workers than the few farmers we have today. Some may be more like gardeners.

• Energy related jobs - As energy becomes more and more difficult to obtain, a larger and larger share of workers will need to work in this field.

• Scientist and engineers - Needed to develop more energy-efficient approaches. In agriculture, to develop approaches requiring less energy and less fertilizer, pesticides, and herbicides. In manufacturing, to design factories in this country, to replace factories making goods which can no longer be imported from oversees.

• Manual laborers - As energy becomes more and more expensive, manual labor becomes a more attractive alternative.

10. What are some of the challenges in the years ahead expected to be?

• How do we adapt the transportation system to the new lower supply? Increased fuel efficiency standards for vehicles are unlikely to be enough by themselves. What else can be done without excessive cost-- car pooling? bicycles for short trips? expansion of public transportation programs? more use of distance learning and work-at-home programs? Does it make sense to plan for battery operated vehicles?

• How do we plan for a declining economy? Companies will not want to build a factory, if they know that it will need to be abandoned in ten years for lack of fuel. Oil companies will not want to build pipelines, if they know they can only be used for a short time.

• How do we deal with greatly reduced financial services? If mortgages become unavailable, how do we deal with home ownership? If loans are unavailable, how do businesses plan new factories?

• How do we find adequate resources (both capital and physical resources) to handle all of the investment that is needed in infrastructure? The only resources we have available are those we (1) mine, grow, or otherwise produce; (2) recycle; or (3) import. These resources are needed for other uses as well, including transportation and food.

• How do we find substitutes for the many chemical uses of oil - textiles, building materials, pharmaceuticals? Or do we give priority to oil for these uses?

• How do we protect the food supply? Should farmers be given special access to fuel, through some sort of rationing program? Should people be encouraged to start gardens, to supplement the food supply? How should we train people in low-energy agricultural techniques? Will it be necessary to break up large farms into units that are manageable with less energy?

• How can we avoid future shortages that are likely to have wide-ranging effects? For example, some people are concerned that we may not continue to have enough asphalt to maintain roads. Is this really a problem, and how can this be avoided? How can we circumvent shortages of metals needed to make cars and other consumer goods?

• Resources are unevenly divided. People will want to move to areas with greater resources. How do we deal with the conflict that may ensue? Do we forbid immigration all together? How do we keep countries from fighting over limited resources?

NOTE: Text reflects some edits suggested by the comments below. PDF can be found here.

Links by Question

Introduction -1: Chapter 1, Question 8

http://www.theoildrum.com/node/2743

Introduction -2: July 2007 Newsletter, Association for the Study of Peak Oil and Gas-Ireland

http://www.aspo-ireland.org/contentFiles/newsletterPDFs/newsletter79_200...

Q1-1: Updated World Forecasts, Including Saudi Arabia by Ace, July 19, 2007

http://www.theoildrum.com/node/2716

Q1-2: The World Oil Production Capacity Model by Samsam Bakhtiari, December 10, 2003

http://www.sfu.ca/%7Easamsamb/conference/WOCAP.htm

Q1-3: Giant Oil Fields - The Highway to Oil: Giant Oil Fields and their Importance for Future Oil Production by Frederik Robelius, Uppsala University, March 2007

http://publications.uu.se/abstract.xsql?dbid=7625

Q2: Facing Hard Truths about Energy by National Petroleum Council, July 18, 2007

http://www.npc.org/Facing_Hard_Truths-71807.pdf

Q5: Net Oil Exports and the Iron Triangle by Jeffrey J. Brown, July 13, 2007

http://www.theoildrum.com/node/2767

Q6-1: Intergovernmental Panel on Climate Change - Mitigation of Climate Change, 2007

http://www.mnp.nl/ipcc/pages_media/AR4-chapters.html

Q6-2: Measure of Metal Supply Finds Shortage by David Biello, Scientific American, January 17, 2006

http://www.sciam.com/article.cfm?articleID=000CEA15-3272-13C8-9BFE83414B...

Q6-3: Carmakers gear up for the next shortage - platinum, The Mining News, July 6, 2005

http://www.theminingnews.org/news.cfm?newsID=800

Q6-4: Lack of fuel may limit U.S. nuclear power expansion, Massachusetts institute of Technology News Office, March 21, 2007

http://web.mit.edu/newsoffice/2007/fuel-supply.html

Q6-5: Is Nuclear Power a Viable Option for Our Energy Needs? by Martin Sevior, March 1, 2007

http://www.theoildrum.com/node/2323

Q6-6: A Natural Gas Crisis Coming? by Dave Russum, July 21, 2007

http://languageinstinct.blogspot.com/2007/07/natural-gas-crisis-coming_2...

Q6-7: Facing Hard Truths about Energy by National Petroleum Council, July 18, 2007

http://www.npc.org/Facing_Hard_Truths-71807.pdf

Q6-8: Plank Road fever and the Barnett Shale by Arthur Berman, World Oil Magazine, April 2007

http://worldoil.com/magazine/MAGAZINE_DETAIL.asp?ART_ID=3171&MONTH_YEAR=...

Q6-9: Investing in LNG Projects, Dan Amoss, Whiskey and Gunpowder, July 11, 2007

http://www.whiskeyandgunpowder.com/Archives/2007/20070711.html

Q6-10: Limits to Growth: the 30 Year Update by Donella Meadows, Jorgen Randers, and Dennis Meadows, Chelsea Green (June 1, 2004)

http://www.amazon.com/Limits-Growth-Donella-H-Meadows/dp/193149858X/ref=...

Q6-11: Water Tables Falling and Rivers Running Dry by Lester Brown, July 24, 2007

http://www.earth-policy.org/Books/Seg/PB2ch03_ss2.htm

Q6-12: Australia's epic drought: The situation is grim by Kathy Marks in The Independent, April 20, 2007

http://news.independent.co.uk/world/australasia/article2465960.ece

Q6-13: Soil Degradation: A Threat to Developing-Country Food Security by 2020? by Sara J. Scherr, Food, Agriculture, and the Environment Discussion Paper 27, International Food Policy Research Institute, Washington D. C., February, 1999

http://www.ifpri.org/2020/dp/dp27.pdf

Q7: Liebig's law of the minimum from Wikipedia

http://en.wikipedia.org/wiki/Liebig's_law_of_the_minimum

PDF Click here for PDF of Peak Oil: What's Ahead? Sorry, the links on the PDF do not work by clicking.

unlimited growth on a ball....

what's wrong with that?

Readers may want to try Redditt, Digg, or /.

The icons were removed because we were having problems with being blacklisted with them up. But maybe it will work now.

actually, let readers know here if you have been kind enough to submit this chapter to reddit, etc., and the title that you used.

I would suggest a title of "Projections of Oil Supply: What's Next?" (don't use the words peak oil...it gets automatically downvoted.)

Also, it seems helpful if it is a reader who submits this who has not submitted stuff over at reddit, but is active over there.

why is peak oil automatically downvoted?

--

When no-one around you understands

start your own revolution

and cut out the middle man

Sorry for top posting but it seems we can't get expanded versions of the graphs by clicking. Would this be possible ?

I fixed the first two graphs using a link type of reference. Is this the way you want them? If not, let me know what code I need to use to fix them.

I will fix the others as well, if this method is OK.

Almost right. I think the problem is your have .jpeg instead of .jpg for the file ending and its going to download for me.

I checked some other posts with png's and they open in a new tab on firefox. Also a small thing if your doing graphs I like png's since they scale much better than a lossy codec like jpeg. I think you will see much clearer small versions with png vs jpeg.

Great work and I'm not one to nitpick but I think this will be a important post for future reference.

I am afraid I will need instuction to do png's. I have figured out one way of doing things that sort of works - that all.

Most programs that save have a option to save as png. I'm not sure what software your using.

You can email me my address is in my profile I'm sure I can find the answers to your questions. Google may or may not work questions like this tend to return lots of junk.

Gail, very good work, and obviously took some time and research...of course, some folks will probably nit pick on the details, but overall, no one else in doing any nicer "big picture" work than you are right now.....the whole is much greater than any little arguments about the details of the parts....again, great overall essay...:-)

And I think your point number 9, concerning "What types of jobs are likely to see growth in the years ahead?" is one of the BEST starting places I have seen on that topic to date...the interesting part is we are already seeing some of these areas come alive....although on the "recycling" side, I don't know if we can count "stealing copper" as an acceptable vocational path! :-)

Again, good job all around....

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

I suspect that steadily increasing energy & raw material prices will begin to push small sales volume, low profit margin products out of the market.

Some of these products/services will be trivial ... but others might be indirectly crucial to certain industries.

For example, imagine a small unique company with many years of expertise which produces, say, special measuring tools for other companies which makes special equipment for the nuclear power industry. The owner might simply close the company & retire if raw materials become too expensive & energy costs rose too much.

The demise of this small company might not be noticed for a while ... but at some stage the intermediate companies might suddenly find that they can't calibrate their products destined for use in nuclear reactors. Oops!

Or imagine that a similar supply chain problem leads to, say, engine spark plugs no longer being available due to shortages of a special electrical isolating but thermally tough glue.

This reduction of "biodiversity" repeated across all industry sectors could lead to all sorts of unexpected - and very awkward - production & supply problems.

I think the raw cost of petroleum inputs into those items are small compared to the use of petroleum for energy in transportation.

Suppose we banned the internal combustion engine. How many years of petrochemical use would the remaining oil reserves last? I'd guess centuries.

Why would a specialized nuclear power plant calibration device be a "low profit margin" product?

I'd think that for these kinds of things, the availability of capital would be much more important. High interest rates or low credit availability would do it.

W.r.t to nuclear plant suppliers in particular, I'd venture that GE itself would likely lend money to critical industries in such a situation.

If the owner wanted to close the company why not sell it to the critical buyer?

I see a couple of big problems -

1. There is likely to be a decrease in availability of replacement parts and other manufactured goods from overseas, particularly from third world countries experiencing load sharing and the like.

2. Everyone in the US would like to build new factories and other types of infrastructure, but in total all we have in terms of resources is:

• What we can mine (or otherwise produce)

• What we can recycle

• What we can import from abroad

Lack of capital is just a symptom of lack of resources.

or, HEAVEN FORBID!!

4. What we can grow with the work of our hands and the sweat of our brow, powered by the biggest hydrogen fusion source within 4 light years of us.

Speaking of resources, How much energy do we throw away 'treating' sewage when every human being produces 1500 lbs of fertilizer per year?

Our System of Systems is insane when it comes to resource use and waste.

We take our children off the land and pay for them to go to schools to learn about plants and animals from video screens. Then we send them off to war to get more oil to go to war. The ones that don't get killed on the highways to get to the wars spend their time driving to work to make money to buy cars to drive to work at jobs created by 'incentives' taxed from the landowners who buy oil-based machines to replace the labor which is paid a $40,000 bonus to die in a war to raise the price of oil.

(was that one sentence? ;-o)

"Other than working and paying, what are you good for?"

How much energy do we throw away 'treating' sewage when every human being produces 1500 lbs of fertilizer per year?

A whole lot (motors that move the sewage need to be started and stopped with the power grids knowledge so they can spin up and down the generation for the load) because 'we' are managing the process and shrinking the land used for treatment VS having acres of solar powered treatment or using $15 of electrical power per day to treat 35 tons of human waste a day and letting earthworms do the processing in a worm gin product. (Deployed in South Korea)

The waste treatment plant used to use a Mercury bearing (Yup, floated the aeration arm pivot point on Mercury) till the metal engineering was able to be handle the forces.

And NOT having a connection to the city sewer means you are illegally inhabiting a structure. (Same with a connection to the power grid)

And finally - you'd have to have a change in behavior - all the time with the backdrop of cholera and other disease outbreaks.

You're partially right about this, of course, but really it's a bit more complicated, and not much to do with the direct petroleum cost, which is indeed usually negligible. The truth is that oftentimes, no one is really managing small and obscure supply chains even when they are highly critical. The items may even be highly profitable, but the dollar volume is just too small to get anyone's full attention. The "critical buyer" may not be listening. After all, nearly everything is ultimately run by finance guys, not engineers.

Some years ago, service was disrupted for quite a while on the Washington Metro because, just like that, the manufacturer of certain electromechanical relays no longer felt like making them. Metro had to run some lines at reduced headways in manual mode, making the rush-hour crowding even more awful than usual, until they found somebody else to make relays. There has yet to be any such thing as an economical, reliable, continuing supply of anything electronic.

I would guess that as ever more attention is diverted to the big stuff of energy supply - and complications such as increasing difficulty even getting employees in to work together - failures caused by the neglect of all sorts of little stuff will be on the rise.

Kunstler says that the airlines are the "canary in the coal mine". I have said (years ago) that we will know when we reach The Hole when airplanes start dropping out of the sky.

There was a time when electronic supplies were reliable: When local manufacturers made the parts in house. Philo T. Farnsworth understood this when he invented television. He sent his brother-in-law to apprentice to blow glass for vacuum tubes, he wound every coil himself.

When things are too complex to make it yourself with reasonable skills, you don't need it. Customary comfort and convenience are not 'needs', and we should remember this when looking for ways to ameliorate resource loss. The first question every good inventor learns to ask himself is, "Does anyone need this, or do I have to create a market for it?"

We've let the oil companies and auto industries and energy companies "create the market" which mostly wasn't needed, and now the PTB use "consumption" statistics to tell us how much we will "need" in the future.

What will fit through The Hole?

Are you on crack or perfectly comfortable with the hypocrisy of posting your comment with a computer?

Now, I'm pretty fond of simple tools. For example, I'm really enjoying putting up loose hay for my small flock of sheep with a scythe, rake, hay fork, and wheelbarrow. I'm also a fan of bikes, reel mowers (although sheep are better), and hand tools for woodworking. My leaning is definitely towards depending on tools that can be built or at least serviced by the user. And I'm with you that there are huge lifestyle changes looming in our futures, but specialization will be part of that.

If our population was one tenth of what it is, we might be able to get by, but it will probably suck a lot less if we each choose to focus on areas that would benefit us most (ie. which may include benefiting others most).

When Southwest Airlines quits flying is when there is no more air travel. If Southwest goes under, they will be the last. No other airline in the USA will be flying.

Very good Gail. In general, there will be more ‘jobs’ locally, in communities, from group baby sitting, to repair, to medical, small manufacturing, even transport (assuming a low-key, smoothish decline.) Big Medecine (already very cumbersome, expensive, and lacking stellar outcomes) will be no more except for the very rich, and Big Pharma will de disrupted. Big schools (6-16) will go, that is probably a good thing. In that area, not energy intensive, ppl will naturally adopt a model from the past.

Re: Global Warming. You state as fact that it is a man made. It is at best (worst?) only partially man made and some people would argue that man is not responsible at all.

Coal: May be dirty but is being cleaned up and there is no reason to think that technology won't come up with more answers. CTL which you refer to can already capture CO2.

Global Warming. You state as fact that it is a man made. It is at best (worst?) only partially man made and some people would argue that man is not responsible at all.

Those "Some People" are not in the reality-and-laws-of-physics based community, and everybody ought to ignore them. (Complex reality: there are natural amplifications and suppressions of the inputs put in by humans, but very clearly the human input is the driver and will result in climate far outside the bounds of that seen since the start of civilization). Let's be clear: the physics and scientific evidence for greenhouse-induced global warming caused by humans is certainly more secure than the imminent fact of peak oil. With oil, you have to estimate what is deep inside rocks kilometers from the surface, often in politically vexatious areas with limited data. With climate, we have direct global satellite, aircraft and ground observations over decades with precise calibrated instruments measuring land, ocean, air and Sun in all important ways.

"Coal: May be dirty but is being cleaned up and there is no reason to think that technology won't come up with more answers. CTL which you refer to can already capture CO2."

So far, CO2 sequestration for stationary power plants is an imaginary technology on the large scale. And impossible, obviously for vehicles. CTL won't capture CO2 from the tail pipes of vehicles which burn the liquids.

Technology is still limited by laws of physics and geological reality. After all, everybody thinks that solar power is great with the minimum of downsides. Why, after 40 years or so is it still quantitatively quite marginal as a primary energy source outside agriculture? The answer that there hasn't been technology investment is wrong. There has been quite a bit. The essential problem cannot be worked around: the energy density of solar radiation is orders of magnitude smaller compared to fossil fuels or fissile nuclei. This drives the essential thermodynamics and capital costs.

Since 1970 our microprocessors are enormously better. But do we have a better technology to send people to the moon? No, the "new plan" is but a v1.1 of Apollo and the Saturn V---a capsule on a big stick. Why is that? Because the very smart engineers in the 1950's and 1960's pretty much found close to optimal solutions compatible with the realities of physics and engineering.

Sometimes physical law really does limit possible progress.

And yes there is good reason why technology won't come up with much better answers: laws of physics.

If money and time will be limited, we need to go with what we know we can build now and works within human societies reasonably well. Add to this imperative, avoiding climate disaster. What comes out?

Little makes the cut in any large scale, in my analysis, except:

substantially more nuclear power, electrified railroads, and efficient building construction.

biofuels and wind are an "order of magnitude" down in effectiveness, with solar an order of magnitude further yet.

One big unknown: engineered geothermal power.

Well said, mbkennel!

Many people still think that given a big enough investment, physical laws will go away... which just isn't the case.

I once compiled a list of "solution envelope boundary types":

A solution to GW and Peak Oil

- must obey the applicable physical laws,

- must be engineerable (being subject to the law of diminishing returns),

- must be implementable large-scale within the limits of this planet's resources (both stocks and flows),

- must be able to be implemented fast enough,

- must not cause new deadly environmental or economic consequences,

- must be economic (if only in the broadest sense),

- must be politically and socially acceptable/enforcable.

These are many conditions and I have yet to see any single solution to GW/PO that meets them all when implemented in the required quantities.

Cheers,

Davidyson

Davidyson,

I really like your limiting factors except you left one caveat out. The solution must not encourage population growth or economic growth (which is part and parcel, often, of pop. growth) unless economic growth is redefined as "extending the natural cycle."

What I mean is that all engineering must stop trying to create systems that exist outside of the natural cycles of nature. Now I know that ultimately these do not escape, destroying the planet in the long run will spell the end of these engineering stunts, but why kill all of us off?

Think of the hydrological cycle or the plant cycle. It is like the ouroboros, the snake swallowing its tail. From the molecules of the dead plant come the molecules for the next plant. All parts of the plant figure in the next generation of plants. So it should be for all engineering.

If engineers can bend their prime directives to include this relatively simple concept, then we might be okay. All components of any engineered solution must be recyclable, completely so. All energy inputs must be obtained from the sun, today's sunlight, not fossil. Any byproducts created from the process must fit into other processes. If any engineered item can be replicated by nature, do not engineer that process. Local manufacture trumps non-local.

There is a really important book called "Cradle to Cradle." I highly recommend it to any engineer, physicist or wanna be. It is probably available in your local university library or through interlibrary loan.

Thanks for your reply, Cherenkov, and for the book recommendation.

I thought I had covered the growth aspect by the points about "within this planet's resource limitations" and "not causing any other deadly issues". But maybe it needs to be made more explicit.

Question: Is all growth bad or just resource usage growth? Some people say we need to grow general wealth just enough so that population stabilises and so that there is enough money to pay for the transition to sustainability.

Cheers,

Davidyson

Does nuclear pass the above test?

1. Physics?

The physics are well established. Yes, given a large enough number of power plants, nuclear could be a solution.

2. Engineerable?

There are 435 nuclear plants already running, so in principle, yes. Much less established are breeder plants. Yes, there are some few, mostly small ones (<1 GW) but they are mostly not running commercially, having lots of problems, particularly with the liquid sodium cooling. Because so few plants have been built, there is little experience with them yet.

Outside theoretical speculation, breeder technology is definitely nothing for quick large-scale deployment.

3. Earth's resources

I can't really judge about the uranium supply issue - after looking at both side's arguments I just have that creeping feeling that energy derived from uranium production will peak much earlier than proponents would assume, due to "real" accessibility of reserves and due to EROEI effects.

Also, an emergency nuclear solution would very likely not use fast breeders, thereby limiting the fuel efficiency of the deployed systems.

4. Timing

This is probably the biggest limitation - not many reactors have been built recently. Kicking off a large-scale emergency-type WW2-like program would make production of each individual unit not faster, but slower: nuclear power plants require large upfront investment in capital, energy and raw materials a well as in specialist engineering and technical installation. Historically, it took about 10 years for a nuclear plant to go from drawing board to first MWh flowing.

The new reator in Finland will at least take 5 years. So far, 18 months of delays were apparently being caused by quality problems due to construction workers being unqualified for nuclear power plant construction.

Now think the Finnish plant multiplied by 300+ (Europe) or 1000+ (developed world). Is it realistic that 5, 10, 20 or 50 reactors per year get completed, together with the required scaling up of all the rest of the nuclear industry?

To me, this sounds much less than credible.

5. Financing

Where is the money going to come from? If nuclear would be such a wonderful investment option, why did construction of new plants almost cease? If it is only economic with higher electricity prices, a) the proponent's argument that nuclear is cheap has been struck down and b) we can all look forward to higher energy prices.

With a big number of nuclear power plants being built simultaneously, you can expect costs going up like a firework rocket. Who would invest into such an environment?

There probably comes a point soon when investing in wind energy gives investors a much better return (if it's not already here...)

6. Political and social acceptability/enforcability

Currently, the public opinion in most western countries is very much against nuclear power, justifiably so or not.

Several countries, including Germany, decided to phase out their nuclear plants.

The German fast breeder reactor project had to be given up due to public protest after sinking a couple of billion Euros.

The French Superphénix had to be closed down due to bad economics, technical problems and political pressure.

The tide for nuclear could turn once people feel the crunch of fossil fuel depletion, but it will take time for a pretty vigorous discussion within democratic societies. Time we haven't got.

And then there is another meta-argument: If we go full bore for nuclear and one of plants blows up like Tchernobyl or worse, but in a western country - you can expect huge social and political pressure to immediately close down all plants. Where will we be then?

What do you think?

Davidyson

A few brown-outs will make the Swiss lift their ‘moratorium’ on nuclear in 10 minutes. (Well, it will take a little longer, but at a pinch parliament could just vote it out with some tricks, which would be days or weeks.) Germans will not react differently.

Many ppl are ‘against’ this or that form of energy, this or that legislation or market regulation, this or that principle; and many of them are sincerely Green. But that is in a situation where they lack nothing; cars speed along, public transport runs, operating rooms function night and day, an ambulance arrives with a free phone call, hot water and heat are available at the touch of a button, the turning of the tap. It will take little to ‘feel the crunch’ and the time ‘lost’ can in some measure be compensated for, or even anticipated, planned for. I know the nuclear ‘enthusiasts’, and those involved in that industry, around here, have plans ready to go up their sleeve. Ok, long lead times, but when there is a will there is a way, particularly if organizational skills exist and ppl (the tax payer, the citizen) are willing to pay.

Well, don't you think it might be a double communication problem: first convince people that peak oil is for real and then convince them that we actually need a crash nuclear program while tons of people will assert that it's better to go for heavy conservation and renewables?

(By the way: I am all for running the existing plants for as long as they will safely last - we have already made the huge energy and capital investment, so let's use it to its fullest and buy some time for the climate. At the same time I think a crash renewables program would do much more good than a buildup of hundreds or thousands of new nuclear plants.)

Cheers,

Davidyson

Yes, I agree with what you say - big communcation snarls, etc. But ppl will turn to, and demand, what they know ‘works’ and in switz. (and france, and others) that is hydro and ‘nukulear’...hydro has clear limits, nukulear is a question of investment, building, communal will, etc.

Noizette,

Then, after we have built all these plants, a few brown outs and then earthquakes, a few terrorist attacks, a spill or two and a nuclear war should convince people that they made a really retarded mistake.

The nuclear option is simply not tenable. Uranium and thorium are finite. The last thing we need it more radioactive junk laying around while we try to figure out what to do with it. Why is it that perfectly intelligent people are incapable of thinking beyond a few years? Their solution is always, we'll solve the immediate greedy underlying problem, that is keep the defective paradigm going no matter what, and then, with a vague wave of the hand, they dismiss the future problems. "Oh, we'll figure that out when we get there." NO. You have to figure it out now.

1. What do you do with the waste?

2. What do you do when the fuel runs out?

3. How do we handle the increasing population?

4. Where do we get all the materials to build the plants?

5. How do we ensure no terrorist attacks?

6. How do we protect against natural disaster?

7. How do we build it to be human proof (idiot proof)?

8. Would the nuke companies build it without subsidies? without subsidized insurance, if they were held personally and not corporately responsible, if they and their families had to live inside the fence? if it were non-profit and the corporate people building it were paid civil servant wages, perhaps teacher's salaries?

9. Will they build it if the company must also post, in cash, the decommissioning cost so that the people will not be stuck with the aftermath while the nuke people run off with the profits? (They must also agree to make up any unforeseen costs.)

10. Will they build it if they must also directly fund a cash reserve to pay for any civil suits resulting from nuclear accidents?

In other words, the only reason to build it is to make money, not to actually permanently solve a problem.

Pack it in thickly copper clad steel containers embedded in bentonite clay at 500m depth in bedrock. But first it cools down for a couple of decades in underground water pools. The plant for packaging the waste is not yet built but the final repository shortlist is down to two competing municipialities. The schedule for this is a slow one but the process will start operating while our nuclear powerplants are running. If economical doomers have a point it feels good to have a nuclear powerplant cash flow while the expensive parts for taking care of the waste are built and made operable.

Then we could in theory stop putting the waste away at 500 m depth and either reuse it in already running LWR after reprocessing or reuse it in new breeder reactors. Personally I hope for new reprocessing processes and breeder reactors that are cheaper then the present technology and not suited for extracting pure plutonium. There is French research into this but I am not up to date on it.

By immigration to rich countries that can build sensible infrastructure and have a tradition for integrating immigrants. My country is shaky in the integration but fairly ok regarding infrastructure.

From ores procesed with electricity and oil, coal or even biomass and then component manufacture with electricity. Or from recycled cars, malls, coal powerplants, etc.

By traditional policework, competently running your country to include people in society and taking threats against liberalism, religious freedom(and freedom from religion), freedom of speech, womens rights, etc seriously.

And sometimes a terrorist will anyway blow up something but if we loose our head from that we let them win. Hopefully they will attack sturdy nuclear powerplants and not soft targets that kill a lot ofpeople.

By building well.

With redundancy in systems and inspections and a tradition of openness in the inspection system and plant management.

This has recently partly faild at the Forsmark plant but correction to the tradition is underway and it do so far look good but it will take a couple of years to be sure.

Yes, I honestly believe that.

They should absolutely not be non profit or low paying.

They should make lots of money and invest a large part of them in the grid, in creating new productive uses for electricity and further developing the technology they use.

Building and running nuclear powerplants and buildig systems for them should be high paying prestigeous jobs that are the top of a career. This should reflect down thru the education and teaching chain as a demand for quality.

They already do that.

That is a role filled by the Swedish state that taxes the nuclear powerplants. They would probably prefer other cheaper insurance arrangements but I like having a good state income. ;-) But it would of course be dumb to overtax.

I hope for more nuclear powerplants. It must be good to be swimming in electricity during a peak oil downslope. If we manage to make more then we use locally we can export it to our southern neighbours.

Eh? I've got to question/disagree with the relevance of these statements:

How does immigration help with the global population problem?

Why would terrorists attack "sturdy nuclear plants" if they are indeed that sturdy? What's wrong with just attacking the transport delivering enriched Uranium? Or the mill? Or the transport to a dumping/burial site?

Why bother putting all the waste underground when you can (a) leave the low grade waste at the mining site, (b) leave it at the milling/refining site, (c) have "controlled releases", (d) shoot the highly radioactive stuff at people quibbling over your right to steal their oil? The "bury it" debate has been going on for over 30 years... leakage is a certainty. The nuclear industry puts serious corrosion at 1400 years for the canisters you are talking about. IMO rosey industry estimates will be severely curtailed by real world events.

You admit failures to make the industry idiot proof... and what about corporate greed proof?

You think it would be dumb to overtax the industry? What about making the industry charge the actual cost of producing electicity without subsidy and see if they are/were competitive. That would be a novel idea. Canadians are currently paying for a $38 billion debt run up by their nuclear industry - it appears on their power bill in Ontario as DRC (Debt Retirement Charge). I'll bet that some of those nuclear execs that foistered that bill on the public are now pushing the new wave of nuclear hype.

"You can never solve a problem on the level on which it was created."

Albert Einstein

That the global population size is a problem is to a large degree due to people being poor and desperate and living in areas withouth good sanitation, logistics and recycling. More efficient habits, investments in the utilities etc needed and redistribution of people help to ease the problem with people living poorly. Mysel I live in a rich area, if we could learn how to integrate immigrants into our culture and a million people moved over here it would probably give a net increase in global happiness withouth making my friends unhappy.

I am hoping that terrorists are stupid wich often but not allways is the case. And attacking the transports you mention is also les hurfull in lives liost then attacking a subway or jumbo jet.

Putting the highly radioactive waste underground is a moral decision, it has no immediate economical value, it only shows that you care about future generations.

The idiot and greed profing is a culture whos value lies in the ability to self correct. If it partly fails and corrects itself it is ok. If failure on any level isent acceptable failure will become hidden, silent and never corrected.

Charging the actual cost + decomissioning and waste handling funds + taxes + profit is what the Swedish nuclear powerplant owners already do. There are no subsidies and the industry finances the major upratings and life lenght extensions on their own.

Overtaxing would lead to less electricity being made and our ability to provide goods and services to people with minimal environmental impact and sensitiviness to peak oil would shrink. We and those we trade with would become poorer, the air dirtier and more CO2 released.

It's late here and I'm ready for bed, so I'll only address the first point briefly. I do not consider the population problem to be one of poverty vs wealth, but one of a drain on global resources.

Solution 1) Reduce the population (by a lot)

Solution 2) Stop squandering resources mindlessly and create sustainable living habits

I would not be surprised if (1) forces us to consider (2) realistically, rather than just giving it lip service. I think we might have a different take on the population problem though...

"You can never solve a problem on the level on which it was created."

Albert Einstein

Cherenkov; (BTW love most of your posts, always read them)

9. Will they build it if the company must also post, in cash, the decommissioning cost so that the people will not be stuck with the aftermath while the nuke people run off with the profits? (They must also agree to make up any unforeseen costs.)

This is something I am worried about. With the different Post Peak scenarios out there, in the 2030 timeframe, WHO THE H3LL OUT THERE WILL HAVE THE KNOWLEDGE/TOOLS/MONEY to take down a Nuc plant?

Are we building stuff that will not be "SAFELY" deconstructed? Don't live anywhere near one, who is going to take it apart when the time comes?

Maintaining and building nuclear powerplants keeps the knowledge fresh and running new powerplants provides cash flow for taking care of old outdated plants.

Want to go over the numbers again? Oppose nuclear on security, cost, aesthetics or whatnot, but the notion that its resourse limited is simply being impervious to facts. Reprocessing of spent fuel (of which we have an ample supply over the past fifty years) more than doubles the resource base by itself, coupled with the observation that the lowest quality ores today have an energy return 500 times that of the energy required for mining.

All resources are limited, Dezakin. It appears you are impervious to that fact.

Wow, its fun to watch a strawman burn isn't it.

No one disputes resources are limited; What we're disputing is what the limits are. Over five centuries with growth puts it out of the realm of meaningful speculation. By then we get our power from solar, wind, nuclear fusion, magnetic monopole induced proton decay or magic pixie dust; Or civilization ends because we destroy ourselves in a superwar, making the whole discussion moot.

It's your own strawman, Dezakin. Thanks for burning it, though. I don't have the energy to spare anymore.

What do you think?

The failure modes of our machines need to be taken into consideration. And the failure modes around fission are demonstrated long term problems. It is why they plants are un-insurable in the US of A without the government backing of Price Anderson.

Lets just magically say that all the fission is produced so all of the fossil fuel has the same place in the world market as whale oil does now.

Fine.

How shall the problem of a economic model based on continual growth going to work on a finite planet and how shall limits like the mineable PHosperous be dealt with?

438 nuclear reactors operating in the world now

http://www.uic.com.au/reactors.htm

32 are under construction now.

completing 4-5 per year 2007-2009

going up to 8 per year 2010-2012

http://www.uic.com.au/nip19.htm

by 2013-2017 the completion rate will be up to 15-30 per year. Without a "crash" program.

Historic peak of 24 reactors completed world wide in 1984.

The USA completed 12 reactors all by itself in 1974 from an almost standing start in 1969. Only small reactors before then.

Brown Ferry 1 plant started this year in the USA

Watts Bar 2 is going to get completion approval early 2008

http://advancednano.blogspot.com/2007/07/another-nuclear-plant-for-usa-a...

Plus up-powering of existing US reactors is going to add 1.4-2.8 GW of electrical power 2007-2011.

There are 320 reactors in the world production pipeline.

80 reactors were added to the pipeline since the start of 2007.

The legislation that makes nuclear power plants in the USA attractive already passed in 2005. Further sweateners are going through now. The US will build those 28 reactors by 2025.

Expected completion of those reactors by 2030.

http://www.uic.com.au/nip58.htm#capacity

As of August 2006 over 110 uprates had been approved, totalling 4845 MWe. A further seven uprates totalling about 750 MWe are pending with the Nuclear Regulatory Commission (NRC) and applications for a total of 1690 MWe are expected by 2011.

Most US and other existing plants are getting operating extensions from 40 years to 60 years. Do not be surprised if they get refurbished for 80 years of operation.

Coal plants are completed at about two per week worldwide. Coal plants take 3 years to build and are of comparable size to nuclear plants. If the world shifted from coal plants to nuclear plants, we could add 100+ nuclear plants every year.

I compare nuclear, coal and wind in terms of construction material. Coal and wind use more steel and concrete to generate the same power.

Most of the nuclear plants will be built in China, Russia, Ukraine, India, S korea and Japan. The US, Canada and Europe will build some too and should build more. Germany may end up importing its electricity from France and eastern europe if they do not have their own nukes. The nukes will still be there just elsewhere in europe. Just like Germany now imports French electricity. Some places like Germany will just choose to be hypocrits.

http://advancednano.blogspot.com/2007/07/constructing-lot-of-nuclear-pow...

Russia has restarted its fast breeder development program. Japan is a likely buyer of it. China and India are also working on fast breeder.

There is some social pressure against coal but why not more ? Coal pollution kills more people in a day than nuclear energy ever has (1 million per year, 2000-3000 per day). The coal plants don't always blow up they just keep killing. More people die in the coal mines (5000-10,000 per year). Where is your outrage ? Mountain tops are blown off and 7% of the Appalachian forests are destroyed for coal. all the animals that were then when the mountain tops are destroyed get killed. Then after digging for coal for few decades they push the soil back and stick in some seedlings.

When you get cancer from coal or oil pollution does it hurt more than when you get it from a theoretical radiation leak ? Do you end up more dead or less dead ?

Fossil fuel air pollution hurts children and women and older people more.

Of the 11 new coal plants being built in the USA now, none are sequestering their pollution.

=====

http://advancednano.blogspot.com

As a Ph.D in physics I can tell you with certainty that the issue of Global Warming is far from settled.

So, dougphd, let me ask you a couple of questions.

Do people cause the release of greenhouse gasses above background release levels?

Do greenhouse gasses cause warming or cooling?

Is warming a good thing for humans?

If the planet was warming due to some other cause, would it be considered wise to add to the warming by emitting greenhouse gasses?

Where did you get your degree? Liberty University?

What is your point? Keep running our uncontrolled experiment full steam and collect the data?

As a Ph.D in Atmospheric Physics, I can assure you that for all practical purposes it most certainly is settled. Anyone who denies it now after the most recent IPCC report either has an agenda or doesn't understand the science, or both.

With a BS in BS I can say that this is BS.

Like your "Ph.D in physics" makes your opinion somehow more valuable than scientific consensus, LOL. Who pays you to be here?

What area is your PhD in?

If you never did any research related to climate (including dynamical meteorology) then you are just another spectator who gets their pre-packaged opinion from the media.

Can anyone comment further on the prospects for universal geothermal? My understanding is that there is hot rock at drillable depths pretty much everywhere. Drill two holes, crack a path between them under water pressure, inject water in one, and harvest steam from the other.

What are the main technical problems? Cracking the path?

If the technical issues can be resolved, it seems an incredible resource. Minimal environmental impact (presumably), siting near demand, and renewable (though not quite in the same sense as wind and solar).

If there is even a modest prospect of success, it would seem that this resource deserves substantial research funding.

What the heck, I'd like to request that too, if only to see how it has been debunked as a source which could be expanded. Is there a past TOD article on it, or a good past string?

I'm aware of most of the issues, I think, but it would be great to see what the minds here are aware of, or come up with.

I have a tiny property (unbuilt) on the side of the world's largest active volcano, and it has always been interesting to me that all that heat is down there but not that useful in most parts of the world (IE EROEI<1). Some interesting dry-rock geothermal research in Australia I think, but it requires specific rock formations to work.

It'd be an interesting subject.

I'm not an expert in this area; but I did happen to talk to several people at a geothermal plant several years ago and asked this very question. One of the problems they stated was that the hot steam dissolved elements from the rock and came from the ground under very high temperature, high pressure, and containing theses dissolved minerals. Think extreme sandblasting. This high pressure mixture would corrode and destroy the pipes (even glass lined) every few years; and they were difficult to replace. Something I had never thought of; but I'm sure someone more knowledgeable in this area could give more information.

What you describe is a real issue even with the disposal ofregular oil field brines that occur in water drive reservoirs. As the productive zone waters out, more and more water as a percentage of total fluids is produced.

Generally a very small oil cut [think one percent or so] is enough to lubricate the producing wells, but the salt water disposal wells require special tubing which as noted must be replaced every few years.

For hot rocks geothermal production, a closed cycle would help a lot, but even if a closed cycle could be achieved, the integrity of the cased holes might still be a major issue. I don't have much experience, but I lost a couple of wells to casing collaspes caused by an abnormally corrosive brine. In that instance, both wells collasped after almost exactly the same lifespan as measured from when they were cased.

The risk of limited productive lives of multiple 25,000 foot deep wells whether due to mechanical considerations or due to local cooling as heat is extracted makes this concept a gigantic gamble in my estimation. It may work. It may not work. The bets are dauntingly large.

I bet we have fusion by the time this is viable.

Seriously though drilling deep wells for heat extraction is something that can be done just about anywhere so over coming the technical hurdles is worthwhile. Compared with fusion it seems far more doable. And it has the base load capabilities that no other natural source really has.

My one approach would be to put the heat exchanger at the bottom and not pump the water. This could even be tied to more efficient thermal electric devices.

Great article Gail and I think this work will be very valuable in the months and years immediately ahead.

I think this is happening already. I am sure you will have seen this, but if not, here it is again: http://royaldutchshellplc.com/2006/11/18/the-wall-street-journal-as-fuel...

All of these depressing articles start to blend together. I suspect we will start reading about rising death rates in the not-too-distant future -- or maybe this information will be kept out of US papers.

I wonder whether oil availability per person would decline in the US at strictly the same rate as oil availability for the whole country - since certain sectors, like emergency services and especially the military, would always take their full cut before the rest went out to general distribution.

That's a point I have often made in the past. It is not just the agricultural sector that needs to take a cut off the top, it is also whatever else is considered essential, including military and emergency services.

This could leave very little left for running cars and trucks and for non-transportation uses.

Gail, nice work, I too like the jobs of the future part - makes sense.

My brother told me back in the late 50's early 60's you could buy oil that had been drained from someone elses car and refiltered. The future?

Delusional,

there's already a thriving business in recycling and rerefining oil. It's illegal to dump waste oil in sewers or on the ground, so oil change places give it to a recycler to haul off, at least in Texas.

Here's an interesting true tale. In the early 1960's an oil seep was reported about 40 miles south-east of Austin in Bastrop County. There was oil on a small creek.

General Crude , an oil company, blocked up some leases and drilled a couple of dry holes down dip. On reexamining the oil seep, their field geologist figured out the seep was from the motor pool at Camp Mabry, an old army camp.

Bob Ebersole

Sorry, I left out that this was from service stations. Out of one car into another. :)

The US military is a *huge* consumer, as it is fighting several wars and maintaining multiple bases world wide ..exactly how much is used is not known.

The US is expending energy to control more, and that has been its long term policy, besides the interests of the military industrial complex who make out by skimming off the top or along the side while furnishing what is required to shock and awe.

Investment in arms, in military power are to control resources - fossil fuels, transport routes, pipelines, processing and so on, but also water and agriculture, and naturally the control of the humans on the ground who can be counted on to rule and keep their populations in check.

Recently, several setbacks have been experienced, Iraq the prime ex.

Gamblers throw good money after bad.

Congratulations Noizette, you have just described current U.S. foreign policy in 200 words or less.

How much energy does the U.S. military consume? A lot. How many bases do we have? I lost count. You try.

http://benefits.military.com/misc/installations/Browse_Alphabet.jsp

... and don't forget the massed bands of the civil servants with their VITAL jobs.

During the fuel strike in the UK I accidentally drove into a "secure" filling station reserved for key users only.

Whilst trying to work out what was going on, I noticed a young lad fill up HIS car ... but his nurse girl friend flashed HER staff ID card to authorise the purchase.

That REALLY annoyed me ... and I expect that this sort of thing will allow all sorts of riff raff to jump the queue ...either for social reasons ... or for blackmarket purposes.

I suppose it happens anywhere when there are shortages.

Gasoline will be the first product to be cut - to the extent that refineres can balance their output.

I would be interested to know if the per capita consumption figure for Canada includes petroleum used to produce petroleum. As an exporter, this amount should really be added to the consumption figures for the USA, it's primary if not sole customer.

I know we've been around this before, but as the percentage of fuel used to produce fuel inexorably rises, the question becomes more moot. Canada's carbon emissions from the oilsands production should rightly be figured as a US responsibility as they would not be occurring without the export market.

Realistically, the US and Canada might as well be considered as a unit. Mexico could be added in under this line of thinking, but their much lower per capita usage would make us look better than we are. Also realistically, we could consider the reduction of capitas but ....... how do you capit? Would the public capitulate rather than copulate?

It is my understanding that Canada's big consumption in producing the oil sands is natural gas, not oil.

With respect to oil, I don't think that there would be a big difference between the relative amount the US uses in producing its oil, and the amount Canada uses in producing its oil. These amounts are not subtracted out.

I expect that Canada will want less and less to be viewed as one unit with the United States in the years ahead. We all remember seeing many Canadian comments about "freezing in the dark". This is a link to one of the articles about Canadian energy security.

I disagree, to put it plainly. First, Canada produces far more oil per capita than the US; US production is perhaps double - more likely 1.5 times - that of the Canada but the population is ten times as great. The per barrel amounts may be similar, but per capita is a different thing.

Canada has the burden of having a resource extraction business equivalent to its physical size but with a far smaller population. The energy intensive nature of its businesses is often balmed upon its inhabitants rather unfairly. What other OECD nation exports something over 70% of its GDP?

Trying to unravel this conundrum is made easier by just amalgamating the two for the purposes of analysis and getting on with the reality of the situation. Whether or not Canadians wish to be viewed as a unit with the US is irrelevant.

I used to say that the US gets the lumber and the profits and Canadians get to drive the truck. It seems as though they also get blamed for the emissions from the truck.

Another factor is the use of coal to generate steam to extract heavy oil. Coal to liquids the other way! Imperial Oil [Exxon subsidiary] does this in the Cold lake area as a cogeneration facility. How do you factor the oil extraction component out of that?

My point is that this factor - energy to produce energy for export - will become greater as time passes and could propel Canadians, who don't personally use any more or less than Americans per capita as far as I can see, to appear as big time carbon pariahs and energy gluttons. The same goes for the consumers of American farm products, such as Canadians, who get the oranges but not the fuel bills on the way to the border.

I rest my case.

The US really uses a lot more energy resources than it is charged with. Think of all the goods we import from China. A lot of what we export are things like computer programs and financial products - also IOUs to pay sometime in the future.

I don't know an easy way to get at all of this.

Gail,

very nice, please check section 4, I think you meant barrel per year for China and India (you say per day)

Thanks! I fixed it.

Another one up to your usual high quality standards, Gail - Well done!

A few comments/suggestions:

It is difficult for the average person to relate to a barrel of oil. If you were to add a pie chart explaining how an average barrel of oil is used (gasoline & diesel, heating oil, etc.) that might help readers to grasp the impact a little better. (Perhaps you covered this in one of the earlier sections, but a reminder would be useful here.)

I don't want to launch another firestorm of argument as to when exactly the peak is/was/will be. However, I think it would enhance the credibility of your piece if you had a more explicit acknowledgement that there is in fact still a debate as to the date of the peak.

I understand that your graphs are more readable by using a time period starting in 1982. However, by doing so you miss the impact of the 1970s energy crisis. Might it not be encouraging to point out that we have done with fewer barrels of oil per person before, and we could do so again?

Furthermore, current projections have global population leveling off by mid-to-late 21st century. Your chart gives the mis-impression that there will be steady linear growth. I think that for the sake of the credibility of your piece, you should provide a little more clarity about this.

With figure 5, I think you are trying to introduce WT's ELM concept, which is good. However, you only hint at this in the form of a question. It would be helpful to provide a little more explanation as to why you are assuming for this illustration that imports will decline.

You mention increases in prices of oil derivative products as one of the impacts, but it is actually likely that all energy prices will be impacted. As oil prices increase, part of the "demand destruction" will take the form of substitution of other forms of energy. The consequent increase in demand for those other energy resources will raise their prices as well. It is important that people not get the idea that if fuel oil prices go up, for example, they can just switch to an electric heat pump and thereby be insulated from further price increases.

Somewhere you might want to mention that longer-term, patterns of habitation are likely to change. People will want to live closer to work, shopping, and other services. There will likely be more demand for rail transport, and people will want to live closer to it. This means that the value of housing that is close to these things may increase, while the value of housing in low-density suburbs remote from city centers may decrease.

A very big challenge to include in your list at the end: Where are we going to come up with the investment capital needed? We will need to be making massive investments in energy conservation and efficiency strategies like electrified rail transport. We will need to be making massive investments in renewable energy resources like solar, wind, geothermal, tidal, and even more hydro. We will need to be making massive investments in advanced recovery methods for conventional fossil fuel fields, and for exploration and development of new fields in difficult environments and for unconventional resources. We also have a continuing need for massive investments for renewing our existing civic infrastructure. Where will the money come from?

I added a sentence in question 4 explaining that 25 barrels is equivalent to 2.9 gallons per day. I am leaving this other "stuff" for a background article in the appendix.

I will think about that. I tried to discuss that in Chapter 1.

Many readers cannot comprehend complex graphs. It would be better to use a separate graph, and talk about it there. I think equally applicable is the reduction in oil and other energy usage during the depression. I had thought about writing about what the impact of the current credit crunch on oil production might be, but didn't get that far. I was also trying to keep the word count down.

In this projection, the percentage growth keeps declining, so the growth is approximately linear - not exponential like it has been in the past. I do not want to get into the business of second-guessing official agencies like the US Census Bureau (whose data is used in this graph.)

I will think about this. Exports will decline, even with level consumption. They may also decline if exporters sell to their allies, rather than to the world market. I think oil consumption may continue to grow in exporting countries, but I am not certain enough of this to make this central to my argument. My argument holds, with or without the growth in use by exporting countries.

I probably should have mentioned that. Will think about a short way to add that.

I plan to discuss this in my next piece - "What should we do now?"

I think the equivalent question is where do we come up with all of the resources. As I indicated above, the only resources we will have are

• What we can mine or otherwise produce ourselves

• What we can recycle

• What we can import from other

We will need to split these resources between what we burn as fuel, and what goes into making new infrastructure. I want to add a bullet on this in the last section, but didn't get it in yet.

Even if there was no Peak Oil at all, there are demographic trends underway that will drive that shift in market demand just as you describe. Arthur Nelson forecasts that "Rising energy prices and declining demand for suburban homes on large lots may reduce the value of these homes, yielding important implications for the future." Nelson concludes that, by 2025, nearly half of new growth in metropolitan areas could be transit oriented development, within walking distance of rail stations.

In Tomorrow's Cities, Tomorrow's Suburbs, Lucy and Phillips found that a value decline in aging suburbs is already underway. Compared to historic neighborhoods and brand new developments, aging suburbs built in the late 1940s, 1950s and 1960s are losing value because of outdated homes and inconvenient location.

Already, there are more people living in poverty in U.S. suburbs than in U.S. cities.

There's more discussion of these topics at:

Connectivity Part 6: Vehicle Miles and Traffic

Suburban Poverty

The Market for Mixed Use & Walkability

The above demographic growth is a long term linear projection, while the forces that affect population are short-term and nonlinear. It has only appeared to be long term and linear because of being supported by increasing energy production and consumption.

Changes in biological populations are a nonlinear function of:

* available food and resources (in turn affected by competitors)

* predators

* waste (bodily wastes and decay)

* fecundity (propensity to reproduce, in turn also affected by the above)

But there is one thread that connects this system as it applies to humans, and that is the thread of cheap exosomatic energy.

We expend relatively huge amounts of cheap energy to:

* grow, harvest, and distribute food

* exterminate food competitors with cheap-energy-derived pesticides, miticides, and herbicides

* fence off our resources from other competitors with cheaply-processed ore and wood

* prevent predators through hygiene with pumped and heated water

* combat predators with petroleum-derived antibiotics and electrically-powered medical technology

* pump away our wastes, inter the deceased (most notably, not into the fields from where we get our food, thus depleting necessary nutrients from the fields, thus requiring yet more cheap energy for food production)