The Marginal BTU - The Return of the Red Queen?

Posted by nate hagens on September 27, 2008 - 10:33am

Note: This is an updated version of a post from earlier this week. Some more recent quotes have been added at the end of this post.

Despite recent optimistic news on new shale gas reserves, the totality of North American natural gas production remains on a treadmill, as the EROI reaper has relentlessly raised the marginal cost of producing- to currently above the price of natural gas futures. While shutting in production is not easy to do once wells are drilled, low prices with rising cost structures can put the crimp on future expansion. Chesapeake (CHK), the largest US natural gas producer and operator of land rigs, announced last evening they will be curtailing production, cutting their rig count and reducing capital expenditures. (Of course, it is possible that this is the first example of an energy production casualty due to the credit crisis if the reason for this capex drop is lack of easy funds...)

In recent years, each time Chesapeake Chairman Aubrey McClendon announces some production or capex decreases, it has marked a bottom in the commodity (see graphic below fold). As this will surely be followed with similar announcements by other E&Ps in the near future (I expect Sanridge Energy and Petrohawk Energy soon), there will soon be a drop in monthly gas production--perhaps as much as 5%.

(Note: Most of TOD:USA is still at ASPO - sincere apologies to everyone I missed at that conference- I will be unable to add comments to this post as I am taking a 7 day hiatus from technology)

Here are some of the historical oildrum posts on net energy, increasing costs of North American Natural Gas, and the related issues:

An Update on the Energy Return on Canadian Natural Gas

At $100 Oil, What Can the Scientist Say to the Investor?

The Energy Return on Time

Peak Oil - Why Smart Folks Disagree - Part II

Ten Fundamental Truths about Net Energy

The North American Red Queen - Our Natural Gas Treadmill

Energy From Wind - A Discussion of the EROI Research

A Net Energy Parable - Why is EROI Important?

Natural Gas and Complacency

Here are some details from Chesapeakes announcement last night:

It will temporarily cut production by a net 100 million cubic feet per day in the Mid-Continent, where wellhead prices of $3 to $5 per thousand cubic feet were "substantially below" break-even. That is 4 percent of its total capacity.

"Chesapeake will monitor market conditions and bring curtailed natural gas production volumes back on stream as prices improve," Chief Executive Aubrey McClendon said.

The number of its operated drilling rigs will fall to about 140 rigs by the end of this year from 157 now, and that will stay steady for the next two years, the company said.

Here is a price chart of Chesapeake above a price chart of natural gas, showing the last 2 times CHK reigned in production:

CHK and NG price charts. Red dots indicate capex reductions (Thanks Chris Meeks - Johnson Rice)

Marginal Cost for North American Nat Gas Production (Johnathan Wolff, Credit Suisse Equity Research)

From the Credit Suisse Report (9/8/2008)

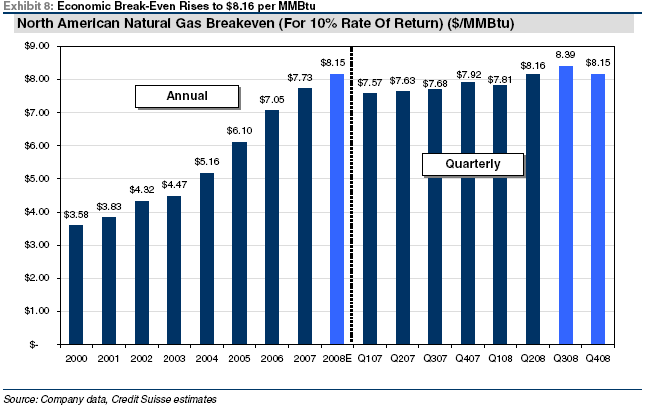

Economic Breakeven Gas Price Rises to $8.16 per MMBtu: We now estimate that the economic breakeven (for a 10% return) NYMEX natural gas price to be in the $8.16 per MMBtu, up from a Q108 estimate of $7.81 per MMBtu (see Exhibit 8). The components of our break even analysis include $3.47 for direct cash costs (lease, operating, production taxes, G&A and interest), a 35% tax rate and $3.00 per Mcfe for D,D&A (versus the industry average $2.49 per Mcfe rate in Q2) reflecting a more "current" cost of adding fully developed reserves. We also "gross up" the NYMEX price needed to get a 10% return by adding a typical industry average basis differential of $0.60 per MMBtu. We then compute the price needed to achieve a 10% after-tax return.

As shown in Exhibit 4, the price needed to get returns has risen dramatically in recent years from about $4.47 in 2003 to $7.05 by 2006 and $8.16 today (and should rise to $8.27 in 2009). Cost inflation has been much more secular than cyclical in our opinion amid an industry shift to poorer reservoirs (i.e. tight gas, shales) that require deeper drilling and complex and long horizontal completions. Likewise, we see a continuation of secular cost inflation (albeit at a slower rate) amid a continued shift to lower quality, deeper reservoirs in the U.S.

Similar proclamations, about costs rising faster than the underlying commodity have been voiced regarding oil as well:

9/12 SAME IRR’s AT $100 AS WE USED TO HAVE AT $40-$50 PER BBL

Wood Mackenzie Richard Lines, head of petroleum economics, “Companies are making the same internal rate of return on big, capital intensive projects at $100 a barrel as they were four to five years ago at $40 because costs had risen so dramatically and fiscal terms deteriorated.”

9/16 OIL PRICE FALL PUTS PROJECTS AT RISK

CEO of TOTAL "Few projects have been given final investment decisions over the last two to three years because their economics have been so marginal and the overall risks have gone up," adding this would impact the amount of oil supply in the market.

9/17 OIL FIRMS PRODUCING AT A LOSS DUE TO LOW CRUDE PRICES

"For the first time in the history of the Russian oil industry, a remarkable threshold has been achieved — Russian oil producers are transferring everything they get from customers for crude oil exports to the budget,“ (Moscow Times –UBS Analyst)

In 100 years, we will still have hundreds of billions of barrels of oil underground. The question comes down to cost, which is a function of the merging of technology and depletion. As energy costs rise, dollar costs accelerate until we reach a point where marginal projects (especially in a fragile credit environment) are scrapped. This in turn puts a cap on production, which (assuming demand remains constant) raises price. Aubrey Mclendon's recent strategy is thus consistent with Hotelling Theory, which predicts that as acknowledgement spreads about intermediate and long term scarcity of a commodity, some of it will be saved in situ, to maximize total future rent (e.g. sell 10% less gas, but at 20% higher prices or some such). A critical analysis would be to see how much of total oil and gas is 'fixed' vs 'marginal'. In other words, low EROI reserves that were still being pulled out of small wells in the Gulf of Mexico due to very low marginal costs, became energy sinks after Hurricane Ike necessitated repair/rebuild. The cost from this point forward was too high. How much of the oil and gas circulating in the world system was discovered and is being extracted on infrastructure built long ago.....?

What does this all imply for natural gas (and oil) production and prices going forward? What % of production will be rise to 'the marginal BTU' in coming years? What happens as EROI of conventional hydrocarbons approaches unity? For the oil and gas cornucopians out there - how much will it cost to maintain current production for the next decade, let alone increase it?

The Red Queen wants to know.

(UPDATE 9/26: Here are some thoughts from Johnson Rice natural gas analyst Chris Meeks, where Nate got the above CHK/NG charts)

THE THESIS:

Nat gas is going to rally .... I will tell you how.

THE LOGIC:

Today on my screen the NG/1 price of natural gas is $7.83/mcf. Many people think this is the price E&P companies get for their natural gas. Nothing could be farther from the truth. The table below shows what different Hubs are paying for natural gas this morning. Note that all but the Hubs in the East are well below the NG/1 contract…many are well below. Most notable are the Hubs in the West (Opal, Blanco, and Cheyenne) with an average price of $4.47/mcfe and in Canada where nat gas is currently $6.09/mcf.

Now here is where the rubber meets the road. The prices below are the prices paid to E&P companies for gas delivered to the Hub. E&P companies have to process and transport the natural gas to the Hub in order to realize this posted price. A guesstimate of processing and transportation costs is about $0.50/mcf, or $0.50 below prices quoted at the Hub. Add royalties to the land owner (on average 20%) and production taxes (another 5%) and an operator in the West is probably netting back something like $2.97/mcf for their gas ($4.47 less $0.50 less 20% less 5%). Simply put, with nat gas at current prices they are losing money, and you don’t drill new wells if you are losing money. Economics are not much better for operators delivering into other Hubs. Few E&P companies can make money at current nat gas prices with all-in costs (F&D, LOE, G&A, taxes, royalties).

Because nat gas prices are extremely dynamic, many of the larger E&P companies hedge out future production to negate price risk. But, here is the problem: over 40% of the 1,853 rigs currently drilling for nat gas in the US are operated by privately owned, much smaller companies that as a general rule do not hedge out future production. That’s 800 rigs. CHK recently announced it is cutting its rig count by 10%; CHK will still operate 140 rigs. They can do this because they have extensive hedges in place above $8 for 2008 and 2009 that make it possible. Other E&P companies both private and public have not hedged and cannot drill through this low price environment. You can take it to the bank: other public companies will cut their rig counts very soon. Private companies do not make announcements that they are cutting rigs, they just do it. With the nat gas prices below I can assure you the private companies will be laying down rigs. THEY SIMPLY WON'T DRILL WELLS TO LOSE MONEY. They will cut capex and curtail production. If these low natural gas prices last much longer, Aubrey's statement that the rig count could go down as many as 400 rigs will come true.

The production response to a lower rig count is pretty quick. A lower rig count means lower production, which means higher prices. I am a dumb geologist, but I know that. Add to the mix: we have had two hurricanes (which caused more damage than people think in the Gulf) that will take an additional 300 bcf out of the nat gas supply; oil is $100 per barrel (have you seen the storage levels of crude oil, gasoline, and heating oil?); winter is just around the corner, and you have the perfect recipe for a strong rally in nat gas. It is coming…stock market meltdown or not.

Let’s get real here. These low [non-Hub] prices are not sustainable. Under the current price scenario the Barnett, Haynesville and a few other smaller trends would be the only economic plays in the US. The US consumes on average about 70 Bcf of nat gas a day. If the Barnett and Haynesville were in full throttle they might produce 15 Bcfpd at peak. That is 5 years out at the earliest. We still need to supply 55 Bcf a day of demand. That gas has to be imported or produced somewhere else in North America. The only way that happens is if gas is priced where E&P companies can make money, and that, my friends, is well above the current price. Nat gas prices are going up. Nat gas prices have to go up.

Update by Gail the Actuary

I talked to Nate and am adding a few perspectives from recent business magazine articles:

One of Chesapeake's problems comes from its hedging activity. According to Business Week:

Producers' attempts to hedge against falling prices are falling victim to the oil market's volatility

Trying to guess whether oil prices, which jumped by as much as 25%, to $130, on Sept. 22, will surge or slump? Don't look to the commodity producers for answers. Even companies pumping oil out of the ground don't have a clue where prices are headed. In this volatile market, several industry players have made ill-timed bets that have wiped out their profits. . .

That's essentially what happened to Chesapeake Energy (CHK), Newfield Exploration (NFX), Noble Energy (NBL), Range Resources (RRC), and others in the latest quarter. As energy prices reached new heights, the companies' core businesses pumped out healthy profits. But those earnings evaporated as a result of their trading operations. "A lot of people got creamed," says industry analyst Stephen Schork.

Another part of its problem comes from its leverage. According to WSJ:

Cash-Rich Oil Firms Snap Up Assets

The turmoil on Wall Street is reshaping the U.S. oil industry, forcing debt-laden smaller producers to sell assets and creating opportunities for larger, cash-rich companies that until recently had been criticized by investors for spending too conservatively. . .

Oil prices, though still high by historical standards, have declined more than 25% from their July peak. Natural-gas prices have fallen even more sharply as rising production has led to fears of a looming glut. And many energy companies have seen their share prices plummet 40% or more from their highs in June or July.

The shift has led to a scramble for cash just when the global financial crisis has made it hardest to come by.

Chesapeake, the U.S.'s largest producer of natural gas by output, Monday said it would cut capital spending by $3 billion, or 17%, through 2010. To help fund its drilling program, the company said it will sell $13 billion of assets during that same period.

According to Oil & Gas Journal, part of the problem is current oversupply of gas, and resulting low price:

Chesapeake Energy slashes drilling budget

HOUSTON, Sept. 25 -- Chesapeake Energy Corp., the second-largest independent and third-largest overall producer of natural gas in the US, is slashing its drilling capital expenditure budget by $3.2 billion, or 17%, for the second half of 2008 through 2010.

Company officials blamed a 50% drop in gas prices since June and the possibility of an emerging gas surplus in advance of increased demand from the US transportation sector.

"Expect other firms to follow Chesapeake's lead and lay down rigs as well," said analysts in the Houston office of Raymond James & Associates Inc. "We continue to see reduced drilling activity (lower rig count) as necessary to balance the natural gas market. Still, this may lead to the decline in activity about a quarter earlier than we anticipated."

The above article goes on to say that production is expected to continue to rise, even with the reduced rig count:

Moreover, Raymond James noted, "This does not seem to be a fundamental savior for gas prices since Chesapeake still plans to increase its production by 16% year-over-year despite 11% less rigs."

Forbes' view is similar. Chesapeake is cutting production because of the current oversupply and resulting low price:

Analysts praise company's decision to cut drilling

Analysts on Tuesday praised Chesapeake Energy Corp.'s decision to reduce drilling for natural gas amid concerns of a gas surplus.

Oklahoma City-based Chesapeake Energy (nyse: CHK - news - people ), the largest producer of natural gas in the U.S., said Monday that it is cutting its capital budget by $3.2 billion, or 17 percent, from the second half of 2008 through 2010. The company said the move is in response to an approximately 50 percent decrease in natural gas prices since June 30 and concerns about the possibility of a gas surplus in advance of increased demand from the U.S. transportation sector.

At the ASPO conference, Matt Simmons expressed some doubt about the net energy output of the Barnett Shale play, when all energy inputs are factored in. In any case, the cost number per MMBTU graph is pretty shocking.

But WT we're back to the same point we've covered before: the UNG plays are not being drilled because they have good net energy output. They are being drilled because they make the operators a profit. Do you think the Chesapeake announcement indicates that they have reached a point where they can't recover their drilling investments in the UNG plays? That would be a shocking admission of a failed biz plan. But I've also heard rumors the Chesapeake was having trouble on the credit side for some unexplained reason. I consult for a company that would buy ever acre C has if it can be drilled economically: $'s in vs. $'s out and not based on net energy gain. I'm not disputing the validity of the MMBTU graph. But I don't see it being used in any of the decision making process regarding drilling UNG today.

If C is pulling the plug on UNG they better have something in the wings to replace their rapidly declining reserve base. Otherwise they've just announced to the world that their stock is worthless except for its breakup value.

I suspect the stock is worthless. The decline rates have always made me wonder if these shale plays make sense. I like that Simmons has also publicly questioned them. I don't have much else to say but if EROEI is close then we can expect the financial gains to be very marginal.

Although not identical profitability and EROEI are very closely linked in my opinion with low EROEI being at best marginally profitable.

You would export profitability to be lost well before the EROEI drops to 1:1. I'd hazard that any thing with a EROEI of less than 10:1 probably has profitability issues.

The stock is worthless? Hardly. Chesapeake is one of the lowest cost producers in the business. Now their MARGINAL property might not be worth it to develop. But if natural gas goes to $20 per mcf - more in line with international LNG, Chesapeakes stock will triple (or more). Natural gas is less price elastic than oil so demand destruction will hurt low cost producing nat gas stocks less than it will oil stocks (and most US oil producers now have very high costs). What portion of our 21 trillion cubic feet of production is near the upper quartile of cost structure is an interesting question indeed....

Your assuming they don't suffer the receding horizons problem. It seem fairly clear that we are past peak net energy as energy declines everything including energy extraction becomes increasingly more expensive. From what I've seen costs seem to be increasing inline with price with no net increase in profits. If they are not profitable now they won't be at any price.

From now on out price increases simply will not change the net profitability of unconventional natural gas extraction or extreme oil plays for that matter.

Also because of the short lifetime of shale plays and the need for ever more rigs they basically have to pay current energy prices esp for things like pipelines to service the newer shale plays. They cannot depend on long lasting older conventional plays to create large profits.

The current high profits for oil and gas companies can readily be attributed to older fields and infrastructure put into production when oil and gas was cheap.

In fact the shale plays are probably our canary in the coal mine for detecting the EROEI cliff and will be the first ones over it as exploding costs make them unprofitable at any price. If you think that some magic price point suddenly makes things better then you don't understand the EROEI cliff.

If you think that some magic price point suddenly makes things better then you don't understand the EROEI cliff.

I'm not sure I understand. By EROEI cliff do you mean that below some figure greater than one, profit disappears because expense of production rises so high that no price can be had that will make it profitable? If you mean that, then it's almost a tautology. It is true that ultimately oil and NG will, at some point, remain in the ground because there will no longer be an economy or society that can afford to lift it. But are we there yet?

If the EROI is less than one and you use natural gas to produce natural gas you have to buy more gas than you sell.

Re "EROEI cliff", see http://www.theoildrum.com/node/3800#comment-326341

Quick question on the use of "UNG." I do alot of investment and research in the NG area, and I have not been able to figure this out. Can't even figure it out in context. So, I give up: what is "UNG"?

Thanks,

Gregor

Unconventional Natural Gas?

are folks just using the ETF symbol as a representation for the commodity?

Thank you for this timely article! If world demand turns out to be fairly inelastic in the short run (as I would argue), the price for fossil fuels will continue its upward path, despite volatility, and marginal projects come online until near 'unity' when production no longer makes sense and the resource stays in the ground. 'Near unity' is probably 2:1 at best given overhead, hidden costs, etc.

What I find interesting about this line of research is that it informs us about the bottom line of production; further, we can see the difficulty producers face when market volatility is so wild, no effective planning for marginal production is possible without a proverbial 'risk analysis' appendix.

Volatility, in this sense, is a form of inefficiency...

I wouldn't be surprised by talk of further 'controls' over price, markets, etc. as this problem becomes more chaotic.

The world waits with bated breath for USA to nationalize the oil and gas industry. The state owns your mortgage, they are in the process of adding Wall Street to the taxpayers bill. Just add several hundred trillion and the state can own every E&P play. I'm sure Palin knows what to do with a duster.

BOP - I would have to wonder what Mrs. Palin (or her hubby) would do with the hundreds of "marginal" wells throughout the oil and gas producing regions. And, if you do not nationalize everything, how can you nationalize anything? I was pretty much shouted down for even broaching the subject of nationalization some months back. I do think at some price, the idiots in Washington will do just that, but it may take in excess of $ 500 (five hundred) / barrel. Also, if nationalized, what happens to that production when economic activity then slows to a crawl and we have $8.00 oil again?

Hello Nate,

As posted before: IMO, legislation to enhance future national food security by increasing I-NPK stockpiles plus grain stockpiles above JIT levels should be considered. In short, IMO, the Red Queen needs to eat to maintain the ever faster pace, and our increasing import reliance on external sources of I-NPK does not bode well [currently a 44% import reliance for N products].

See previous postings on I-NPK, UN FAO Fertilizer Forecast, Federal Reserve Banks of I-NPK, Control of crucial Elements for Geo-Strategic Control amd Optimal Overshoot Decline, USGS Minerals, links to Bill Doyle's POT, etc.

[PDF Warning]:

http://www.ers.usda.gov/publications/WRS0702/wrs0702.pdf

------------------

Impact of Rising Natural Gas Prices on U.S. Ammonia Supply

..Natural gas is the main input used to produce ammonia. Additional increases in U.S. natural gas prices could lead to a further decline in domestic ammonia production and an even greater rise in ammonia imports.

...Natural gas is the primary raw material used to produce ammonia. Approximately 33 million British thermal units (mm Btu) of natural gas are needed to produce 1 ton of ammonia. Natural gas accounts for 72-85 percent of the ammonia production cost, depending on the size of the ammonia plant and the price of ammonia (TFI(a)). Ammonia prices were weakly correlated with natural gas prices before 2000, but became strongly correlated after 2000.

----------------------------------

Turn this on its head: would the buildup of I-NPK stockpiles result in a higher pricing floor for natgas, plus a further impetus for less volatile extraction flowrates?

Sorry, but I don't have the expertise to fully extrapolate the ramifications, but from my feeble two cent viewpoint: it seems to have great potential for our postPeak future. I will leave it up to the TopTODers and regular TODers to put this speculative proposal through our exclusive TOD-MeatGrinder. :)

EDIT: The Red Queen will be a real nasty bitch is she is desperately hungry. :(

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

This is a clear indication of the growing cost, $ & energy!

"AT $US100 or more a barrel -- actually, even at $US80 or $US90 -- your immediate instinct would be that companies finding and producing oil would be well on the way to making some good returns for shareholders.

But no, says Austock Securities. In fact, its research shows that the oil sector is likely to underperform the market over the next few years. In general terms, writes analyst Simon Oaten, Australian company costs of finding new reserves are between 200 per cent and 300 per cent higher than they were five years ago.

Take his analysis of three-year average finding and acquisition costs per barrel of oil equivalent (that means all the oil and gas values thrown in together). For Australian Worldwide Exploration (AWE), the three-year average cost is $69.70 for each boe found, largely due to the big 2007 exploration program in New Zealand. For Roc Oil (ROC) the three-year average is $94.70/boe, the Angola work being the main driver of that cost.

These are the higher-end ones. Copper Energy (COE) costs came in at $32.40/boe and Oil Search (OSH) at $14.50. Petsec Energy (PSA) was in the middle at $31/boe found.

Those of you who accept that oil is going to get harder and harder to find will not be surprised by Austock's findings. Discovery size per well has fallen by about 65 per cent over the past five years and the average number of wells drilled by companies has increased by 25 per cent over that period.

We think that means fewer bangs for your buck per well. These trends have significant implications for profitability in the years ahead, the report states.

Is there no good news -- anywhere?"

from http://www.theaustralian.news.com.au/story/0,25197,24380399-18261,00.html

Price has plenty of room to go up. Everyone has a prejudice that it should be cheap because it USED to be coming out of the ground at an EROEI of 100:1. But the question isn't what 'seems' expensive in terms of EROEI, but rather, it will ultimately be valued in terms of human labor. Indeed, there may come a day when asphalt roads are processed (partly) by hand for their oil content. Remember, if we look at this matter in terms of the energy contained in a barrel of oil vs. the energy of human labor, one barrel is approximately worth 25,000 hours of human labor. So is $500/barrel expensive? Well, yes and no. Not in the long run. It's still very cheap. Try rounding up 10 people to work for you for a year and promise them room and board and all the rice they can eat. Even slave labor makes oil look like a steal at $500/barrel.

The definition of 'marginal' will continue to change as the price continues to rise. EROEI of 2:1 may never leave the ground. Look at price for the short term analysis, but EROEI for the long run.

That question is pure sillyness.

It ignores any difference in quality of energy; human labour gives you flexibillity and intelligence unavailable to even the best of machines and robots.

If all you care about are BTUs then hydropower, wind turbines, solar power and lignocellulose is always going to be cheaper BTUs than human food(protein, starch, fat...); no matter what you think of the longer term prospects for natural gas, coal, fission, geothermal, wave or fusion.

I don't think the comparison between the price of oil and the price of human labor is 'silly' at all, although my initial formulation was unfortunate. In any case, I believe this comparison of relative thermodynamic values (labor as energy v. oil as energy) will become the central debate about the value of oil; that is, this comparison gains its notion of value by virtue of what oil can do INSTEAD of using humans, horses, etc. Electricity, (its various sources), is competitive for many, but not all, of the uses of oil as well. And like electricity, human labor is by no means a replacement for oil. Those facts make oil even more dear, harder to replace, and ultimately more expensive--the most expensive form of energy precisely because of its density. Consider airplane transportation, for example: impossible without oil-derived kerosene. I'm not ignoring variations in the quality or density of various forms of energy! But it is critical to understand that comparisons CAN be made, have been made, and indeed, that is why we can speak about the different 'density' of energy forms. I'm not making up the number of 25,000 hours of human labor equivalency for a barrel of oil--as most people know on this forum.

So what I'm trying to explain to other readers is that this rough equivalency is the 'bottom line' valuation for oil at the high end. Does that make more sense? I've raised this issue before and had readers react with confusing statements that represent a misunderstanding of what I'm claiming and what I'm not.

Here's a little question for you--At what price will a gallon of gas cost, in your opinion, before weed-wacking is done by hand? Or before 'leaf-blowing' returns to leaf raking? At some price, no one is blowing leaves using gasoline! It's too stupid and wasteful when the leaves can be raked.

Here is a good article to review: The Freezing Point of Industrial Society--

http://anz.theoildrum.com/node/3228#more

Leaves should be composted, not "blown," raked or bagged.

I know it is fashionable to harp Armageddon around here but don't start counting your apocalypses just yet. Plant breeders are quietly providing farmers with ever more efficient strains of the crops they grow. When I farmed sugar cane (I'm retired now.) it was not uncommon for the best farmers to use 160 lbs. to 180 lbs. or more of N per acre to achieve the best yields. Today with newer more efficient varieties they get better yields with 100 lbs. of N. Most try to double crop now, planting a crop of soybeans that does not need comerical N and leaves residual N in the ground thereby reducing the amount of N needed as well as increasing the income per acre. In short, farmers like any other business, tend to adapt to increase costs.

I would like to also point out that natural gas is not the only source of N, as in anhydrous ammonia. It is, at the moment, still the cheapest most practical source.

Hello Nate,

THX for a very interesting post.

From the figure of development of marginal costs for North American NG production it looks like presently the doubling time is approximately 6 years which translates into an average price increase of approximately 12 % annually for North American nat gas.

For oil production from (Norwegian) North Sea fields OPEX is presently far above forecasts given a few years back (according to quarterly reports from some of the operators).

An analysis of the collective decline rate from NCS fields starting to flow prior to 2002 reveals that the decline rate lately has been (temporarily?) slowed down after the strong price increases in oil, suggesting that this may have encouraged increased OPEX for the marginal barrel by the use of infill drilling etc..

The diagram above shows the development in the collective year over year decline rate for NCS oil fields starting to flow prior to 2002. The diagram also shows a 12 month moving average (to smoothen the wild swings) red dots connected with a red line.

Note how the relative decline rate initially accelerated reaching a collective annual decline rate of approximately 15 % in 2005 and 2006 (ref Cantarell), and also how this has been slowed down during the strong price increases of oil.

It now remains to be seen if the decline rate again will reach 12 - 15 % annually as some of the effects from the extra OPEX starts to wear out.

How much of global oil production would be shut in if oil prices should drop to say US$50/bbl?

And how long would it then take before demand again surpassed supplies, thus feeding new growth in oil prices?

Did anyone mention volatility?

It appears to me that Chesapeake's announcement is little more than PR to try to get the price up. The previous two announcements occurred at about the this time of the year in 06 and 07. So now it is three in a row.

Summer demand for natural gas is slack so the price drops. This is an attempt to goose the price as we head into the heating season. It evidently worked so well the last couple of times they tried it, they are going for a triple.

I don't believe it has anything to do with net energy. We've been though this shortage of natural gas talk so many times, I'm totally cynical.

The crowing rooster thinks he makes the sun come up too.

Well, given that the gas has got a big boost this year, it's only natural that the price plunged. It's also natural that the gas companies didn't like it. And it's also only natural that they are trying to put pressure on the market so that the price goes up.

It's simple economics.

Regarding the Hotel economics, well, the problem with Hotel economics is that it's only possible with a cartel. And if there is a Cartel going on, then there will be protests and government institutions or independents must look at it and take conclusions out. It's simply illegal.

It's also a shot in the foot in the industry, ask the iranians and saudis of the 70s about it.

Hello Luisdias,

Carefully constructed cartels can be quite effective over time: the P & K cartels legally allowed by the 1918 Webb-Pomerene Act, the Canadian Competition Act, and similar acts in other countries. Googling Canpotex Belaruskali, Phosphate Chemical Assoc., North-African phosphate cartel, can reveal more on this topic.

Here is a short brief [4-page PDF]:

http://morningbull.blog.tdg.ch/media/00/00/1111013717.pdf

-----------------------------

...Farmers say too much market power is concentrated in the hands of a small group of companies in the U.S., Canada and Russia that dominate global production of potash and phosphate. [I would add Morocco too-BS].

...Major fertilizer producers deny any allegations of gouging. They say they are simply raising prices to reflect tight supplies and growing demand after years of relatively low prices.

But there's an unusual piece in the pricing puzzle: In several countries, obscure laws shield makers of potash and phosphate from certain antitrust rules. In the U.S., for example, phosphate makers are among a handful of industries empowered by the 1918 Webb-Pomerene Act to talk with competitors about pricing and other issues.

-------------------------------

As discussed in prior postings: effective Element geo-strategic controls can help preserve and extend depleting I-NPK & sulfur flowrates while at the same time fostering a faster and more optimal Paradigm Shift to ramping the natural feedback loop of O-NPK recycling.

Recall the even former Pres. Clinton is now calling for the elimination of landfills to foster this change, minimize waste, and enhance ecosystem vitality.

The sweet deal with industrial or inorganic N products depleting with FFs is that proper crop rotation is the natural solution for N soil fixation.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

US natural gas production has been on a treadmill, or plateau, for almost four decades.

Recently, production has been increasing.

CHK's announcement of a reduction of 100 mmcf/d is only 0.18% of daily US production. CHK is hoping that more gas producers will voluntarily reduce production to be a significant force to increase gas prices, in turn increasing CHK's share price which has fallen from $69 in Jul 2008 to $41 today.

http://finance.yahoo.com/echarts?s=CHK#chart2:symbol=chk;range=6m;indica...

UPDATE 1-Chesapeake sees other companies cutting gas spending

http://www.reuters.com/article/marketsNews/idINN2338126120080923?rpc=44

It's interesting that US proved gas reserves have been recently increasing.

What I take away from these charts is how elastic natural gas seems to be in the U.S. still. Eyeballing the recent production chart, we've had a 5ish% growth in supply in approximately the past year, with what looks to be an acceleration as the price of gas was high recently. I'm ignoring the possibility of big Gulf projects (if any, is Thunder Horse still on the receding horizon? I forgot.) Anyway, my opinion is that between the rapid depletion rates of existing wells, the rising importance of marginal EROI wells in the national supply, and the apparently still fairly elastic supply response, we're gonna see boom/bust cycles of increasing magnitude and frequency in NG supply and prices. At least until the price domestically is regularly at or above the cost of imported LNG, anyway.

For elaboration, a frequently mentioned (and subsequently debunked or belittled) statement that US supply has a 4% spread between a glut and shortage. If right now, we are keeping up with the Red Queen, a decrease in new E&P domestically of 50% from what is required for flat production and a 30% depletion rate of the existing base, you have a decrease in supply of 15% or so within a year, or about 1% a month, or a shortage within about 2-4 months from being undersupplied. If CHK's move is matched on average by the industry, about a 10% drop in E&P, assuming the market is currently oversupplied (about 2% over what is needed by the market) we're about a year from being undersupplied. Take issue with whatever issue with the numbers you may, but thanks to rapid depletion rates (and maybe a stray hurricane or bad cold front), we're never far from being undersupplied again. And with plenty of marginal plays that can now be exploited, we may subsequently never be far from being oversupplied again.

So my guess is not too long from now, rig cos. and natural gas cos. will go into another shortlived run-up.

Pretty much the same conclusion I have however your missing the fact that we now have a lot of shale wells in decline these must be replaced by drilling the same number of new wells before you can actually increase production. You end up we some pretty insane numbers like one drilling rig for say 5-15 wells depending on how fast they are drilled.

Basically every 5-15 wells or so you have to build a new drill rig and keep the rest going to keep from declining.

The boost in production from shale plays was pretty much a one shot deal during the first five years of expansion after that you simply can't keep up. Given the low ratio of rigs to wells you actually have to basically include the total cost of the rigs and the energy used by them in the well cost.

The full hurricane damage to rigs and platforms in the GOM has not been published not in yet. Reports of damaged natural gas pipelines have surfaced.

http://www.rigzone.com/news/article.asp?a_id=67028

EIA has finally updated their Ike reports: September 22, 2008 Report

The DOE Emergency Situation Reports give all the specifics.

just a little ignorant here in New Jersey-- viewing the wide worldwide price disparity and seeing all the prognostications and statements that we have a temporary oversupply of Natgas- excuse me but could this be exported? ie Do the the US LNG terminals have the ability to run backwards ie compress it and load it into LNG tankers for export or not?

No, but I think that there are barge mounted LNG facilities. If the price of US NG stays low relative to the world spot price for LNG, we could see US NG being exported overseas.

given the amount of energy it takes to liquefy NG, it would seem that one would need a pretty big price differential for the US to load tankers.

There is no evidence from either the press release or the conference call today that the gas wells Chesapeake is shutting in are from their shale plays. In fact, they indicated that the temporary shut-ins are in Oklahoma and the rig laydowns would impact mostly their plays in Oklahoma and East Texas.

Both the temporary shut-ins and the cutback in drilling make perfect sense; they have gotten big enough that their production at the margin is helping to set the market price. Why would they want to sell now at below cost when NG is, in the long run, a scarce and extremely valuable resource? In addition, the new wells they're bringing on-line in the Haynesville are so productive and profitable -- and cannot be delayed because of their partnership agreement with PXP -- that they are focused on drilling their half million acres of leases there over the next few years to hold those leases through production.

Chesapeake is expected to slow its drilling in the Barnett Shale

The issue of EROEI for oil shale was addressed and put to bed in the early 1970s. Is this a new generation who have failed to study history and are doomed to repeat? How many times do we have to experiment with oil shale?

"1967-71 Starting with analysis of agricultural systems for the President's Science Advisory Council, and then in a best-selling book "Environment, Power and Society," embodied energy analysis methods were introduced for understanding and deriving public policy for systems of humanity and nature generally. Limitations were shown to many proposed alternative energy sources including oil shale and solar technologies. The tabular equivalence of network representation of the counter current of money and forward current of materials in ecosystems was shown which was the basis for the later development of input-output energy analysis. By showing the relationships of energy and money a new field of ecological economics was defined. Caused the net energy concept to become a national concern (News Week magazine) and introduced as a congressional law to prevent waste through Senator Mark Hatfield. Testimony before congress showed a net embodied energy loss to the billion dollar plans for oil shale synfuels, but this was ignored and the projects failed.

http://www.eoearth.org/article/Annotated_contributions_of_Howard_T._Odum

Funny you should bring up kerogen: Oil shale production ban likely to end

Firstly, I'm a big fan of Odum's work (though emergy never really hit home with me). The above article however is about natural gas from tight shale deposits, not oil shale. Secondly, I should point out that oil shale probably is an energy dead end, but quoting its energy properties from 35 years ago dispenses with the possibility that some technology may have been developed in the interrim to better access/harvest the energy embodied in shale (not true to my knowledge, but possible)

The reason for the cutback in production may indeed be credit related, or at least partly credit related, as Nate indicates in his first paragraph.

Those who don't have such heavy credit commitments have some flexibility as to when they cut back. For this reason, the big oil companies doing this on the side may have an advantage. The current NG price is extremely low compared to oil. Over the long term, it will almost certainly rise.

Gail et al,

There are some important facts which need to be considered in analyzing CHK’s press release.

Above all else EROEI has no bearing at all on drilling decisions. This isn’t to say that EROEI isn’t as low or worse then some calculate. Drilling decisions are based on economic return and not net energy return. But this doesn’t mean EROEI is not related to drilling costs on some level. Drilling/completing costs have almost doubled since the UNG play took off. Productivity has also jumped in many trends. But the process is still utilizing the same materials as it did when it started. Thus the same energy utilization. In fact, given the increased productivity in many trends as a result of improved technology EROEI should have improved over the last 2 to 3 years.

With regards to falling NG prices being behind this move that statement is 100% BS. Go back up and look again at the chart of CHK stock price vs. NG prices. Big run up in stock value when NG spiked last spring. But look at the NG prices back in 2007. On average, at or slightly below where they are today…at the end of the “low price” season. While CHK stock benefited greatly from the high spring prices, the decisions to drill those wells were made at lower NG prices than exist today. NG prices are not “low” today…they are just lower then the very anomalous spring prices. Today they are still above the “high season” prices of last January. I don’t make a business of predicting NG prices but consider this: this is the time of the year when much NG is shipped to storage for the winter demand peaks. The majority of GOM NG is still shut in. Anyone think CHK is projecting low NG prices this winter?

As I’ve pointed out before, public oil stocks are valued on Wall Street based upon the reserve growth (in volume…not $’s). Profitability does have a role but it’s minor compared to asset growth. Consider this scenario: if CHK eliminated all capex today their profits would shot through the roof. But would you buy the stock? All you would gain would be dividends. But stock value would steadily decrease as reserves depleted. So you’re making 4% or 5% dividends but will never get your principal back if you hang on to it till the bitter end. Any one want to buy CHK on that basis?

As far as the “analysts” expecting other UNG players to power down you should reserve judgment for a while. I consult for one of the major UNG players in the country and 2 months ago they decided to expand their rig count by almost 50% in 2009. These folks are not stupid. And they are rather conservative in their economic analysis. This is just speculation on my part but from various bits and pieces I think the CHK announcement was primarily do to a lack of credit. Notice they say they are going to expand their drilling efforts in the Haynesville Shale. This is one of the most expensive plays in UNG. But it appears to be one of the most profitable. Also note that they are not pulling out of the Marcellus Shale. They are looking for a partner. If the play isn’t profitable for them at 100% of the cost will it be profitable at 75% of the cost? As far as choking back existing production due to low NG prices will see. It’s been my experience over 33 years that when prices drop operators almost universally do everything they can to produce more. Once the well is completed it becomes a strictly cash flow business. I’ve never seen an operator not sell NG or oil because the price is lower than the cost to develop the reserves. In fact, I’ve seen many operators produce wells for short periods on time when net income was less than zero. It was done to maintain the leasehold (most leases expire in 30 days if there is no production) and to avoid plugging costs (at least for a while). The hope was for prices to increase or for someone to come up with a new idea about drilling another well on that leasehold.

Analyze the CHK words as you like. But it doesn’t pass my smell test.

The only way that makes sense is if by expensive you mean upfront capital costs, and by profitable you mean long duration asset. I.e. once the wells are set up, the amount of gas you sell more than offsets initial costs. Or how else could they be both the most expensive and the most profitable at the same time?

I don't think the above post was about Chesapeake, but rather the many reasons that there may be an upcoming floor on both natural gas and crude oil pricing dynamics.

That's correct Cornelius. The expense I refer to is the leasing, drilling and completion costs. Profit is rather straight forward. It's normally viewed as net present value (NPV). This requires an estimate of future NG prices. The value of the return is adjusted by time using a discount factor. The DF is like a negative interest rate on earnings. Most companies use about a 15% DF. Thus if a well produces all it's reserves in one year and the net sale of that NG is 115% of the total cost to drill and complete the NPV would be $0. (the 15% of apparent profit is negated by the DF). It varies quit a bit but NPV of most UNG plays run around 2X to 3X the costs. With respect to expense vs. profitability the Haynesville is one of the deepest UNG plays and also requires some of the most expensive completion techniques. But it has been delivering some of the best wells (with respect to initial flow rates) in the UNG plays. The UNG wells are not great compared to the good old days but they are fairly low risk and, more importantly, there are thousands of potential locations. The big independents can't make a living drilling just a few UNG wells. They each need to drill hundreds.

As far as a floor on NG prices I don't even begin to play that game. I've watched others who did this for a living and saw them fail time and time again. And when they were right I just wrote it off to the blind pig theory. I've seen hundreds of millions of $'s lost by folks who were absolutely sure they knew where NG prices were going and had all sorts of pretty charts proving it. I helped start a small company in the early 90's which lost its first 2 years of profit thanks to such foolish confidence. It took our senior VP 2 minutes to destroy the fruits of 2 years of effort by making a bad futures bet on the price of NG. He "just knew" the prices weren't going to hold up. The thing to remember about futures: for every winning bet there is one loosing bet.

Well this is the heart of the issue. Declining EROI ultimately means significantly higher prices, or huge demand destruction, or both. This time it's different. We'll see.

Higher prices for what Cornelius? NG or drilling costs? I do think demand destruction is THE biggest risk factor in the UNG plays right now. Before the latest economic upheaval it did't seem as though DD was that big a risk. But if the credit market really does tank, we hit a serious recession and companies contract the DD could be far greater than one might have expected from DD due to price increases. Under a worse case scenario (big drop in NG consumption) I can see the economics of UNG shattering almost overnight. That's why I think a NG pricing expectation right now is truly a fool's game: unknown DD, minimal NG storage, unpredictable winter effects. Just too many big constructive/destructive possible swings in the curve IMO.

1) what is UNG? you mean natural gas futures?

2) demand destruction in NG from credit crisis will be much smaller than the supply destruction IMHO. Most of the plastics and fertilizer production has moved offshore or shut down and now we need nat gas for refining, industrial heat, and home heating - a full 25% is used for residential home heating and demand destruction there is pretty slow.

In any case, I think the point of this exercise is to highlight that even with record production we may see higher prices, as costs are keeping pace (or going up faster) with spot pricing.

Sorry Cornelius: UNG = unconventional natural gas. This includes the low porosity sand reservoirs and shale gas plays.

I hope you right about the lack of DD from a down turning economy. I was working in the oil patch in 1986 when the DD from the oil-price induced recession drove NG prices under $1/mcf. Oddly enough, it was during this period that I generated one of the most profitable (from a rate of return basis) in mt career. although the NG was sold for $0.90/mcf it only cost $0.12/mcf to develop it. That lesson is why I don't look at high comodity prices as a certain path to profitability. It still boils down to how much you spend to get it out of the ground and not so much what you sell it for. I see folks drill wells today that won't recover their investment with $13/mcf NG.

The execs at CHK are schyzophrenic.

One day it's "shale to shining shale" and the next day it's "we're curtailing production."

These wild swings of sentiment from feast to famine indicate that all is not well in paradise.

I suspect CHK is producing its wells wide open, but at producing rates that fall short of expectations. Could CHK be announcing it is "voluntarily" cutting back production to disguise the fact that production is not up to snuff.

Like you say, ROCKMAN, none of this passes the smell test.

With the decline in gas production… I think we can expect to see spikes in the gas prices in the up coming months… I find it interesting that Chesapeake decided to do so... based on Nate’s graph of past two times the CHK did this, its obvious that there will be a rally to come. Basic supply and demand rules of economics. The question I have is will this rally set new floor prices, or will it be a quick pop and drop? Like everyone else I’ve become more interested in commodities, and how to value them in a market without fundamentals. I came across a great read at http://www.stockresearchportalblog.com/ outlining methods to value mining companies, apparently it’s a 17 part series, and though I’ve only read the first 3 so far I’ve learned a ton.

Rockman,

When you say NG prices are not "low" today and use this fact to dispute the statement that CHK is shutting in production due to low prices, you miss the fact that the prices you are looking at are national averages, or Henry Hub prices, not the prices that CHK is receiving right now in Oklahoma for the wells that are being shut-in. They were very explicit in saying that the wellhead prices they were receiving for unhedged gas right now in mid-continent were extraordinarily low ($3-5), in part due to temporary factors such as having so many gas processing plants off-line on the Gulf Coast. Pointing out that "on average" NG prices are not terribly low misses the key point.

I didn't miss the point Catman. Read my words again. I didn't say they weren't shutting those Ok wells in because of low NG prices. I said if that was the reason it will be the first time in my 33 year career that I've seen an operator do so. Last winter in some parts of the Rockies, NG prices fell to way under $1 because of insufficient pipeline capacity. Many operators had to shut wells in but not because of the low prices. Those that could sold for the low prices. Since I'm not sitting in the CHK board room I can't say why that decision was made. But remarks were primarily addressing the question of why they are reducing rig activity when every other operator I know of in the UNG plays are picking every rig they can get there hands on. The decision to not drill as many UNG wells this year or next isn't predicated on current prices. It's based upon assumed NG prices. If CHK is predicting NG prices over the next 12 to 24 months to below development costs then thy should shut down drilling operations right now. And I mean all drilling ops. I think a more likely explanation is that they've finally reached the end of viable locations in certain portions of some of there UNG plays. This is to be expected. All the trends, regardless of how well they're working today, will come to an end.

And again, I think the most informative portion of the statement was their desire to sell off 25% of their Marcellus play. Companies have competed fiercely for lease positions in all the UNG plays. And now CHK wants to trade a piece of one of the hottest UNG plays in the country. And the implied reason is low NG price expectations? But they are still willing to fund 75% of the effort. And this isn't because they are having capital problems. A break down in logic, don't you agree?

How precisely has EROEI increased the marginal costs of extraction?

Rockman,

Here is what you say now: "I didn't say they weren't shutting those Ok wells in because of low NG prices."

Here is what you said earlier: "With regards to falling NG prices being behind this move that statement is 100% BS."

Aside from the confusion caused by the double negative in the first sentence, these two statements strike me as being directly contradictory.

On the rig issue, I think it's a bit hard to compare CHK's rig strategy with most of the other shale operators, for several reasons: 1) They have far more rigs drilling than anyone else; 2) they own half of their rigs; 3) because of their size they have far more flexibility to swap rigs around to high-grade their prospects and cash flow than most operators. I don't disagree that they may be reaching the saturation point on some shale plays in terms of optimum number of rigs.

You say the most informative part of the release is the news that they want to sell off 25% of their Marcellus holdings. This is not new news. It was announced months ago, when NG prices were much higher. It has nothing to do with prices, but rather with their desire to place a readily recognizable market value on each of their major plays. They have already sold 25% of their Haynesville and Fayetteville plays and will do so for their Marcellus play next. (By the way, as with the other two, they will probably get more for the 25% that they sell than they paid for their entire interest in these plays at the time they bought them--an advantage of being smart enough to get in early.) So what exactly is not to like here?

I tend to think about NG -or oil, on a somewhat longer timescale. There are at least a few solar projects, that (if they pan out), might be able to create electricity at very low prices. CoolEarthSolar, has one estimate as low as 17cents per peak watt. If something like this is acheivable, it might be possible to create local power, which is very inexpensive, but suffers from severe time variability (none available unless it is sunny, and the wind is low enough for CoolEarthSolar). If this power could be used to replace the major energy costs of NG (or oil) production, then EROEI is no longer an issue. The economic issue then becomes, the value of the NG versus the cost to produce it (including the cost of the stranded solar electric source). Since the NG could be used for the generation of load balancing power, or used as a vehicular fuel, I would think that its market price per BTU could be considerably higher than the cost of time variable stranded solar. This might be a cheaper way to get baseload power out of time variable sources than trying to store the electrical energy, or long distance transmission.

The EIA currently projects that between 2008 and 2011, 34,000 Megawatts of natural gas powered generating capacity will come on line. Assuming a 95% up time and 40% efficiency, this represents an additional 1 trillion cubic feet or 5% increase in natural gas consumption. While coal is still the least expensive fuel per BTU, NG's clean burn will probably make it the de-facto choice for most new power plants (and industrial processes) because NG plants can be built in just 18 months and can be spooled up in under an hour, where as coal plants take much longer. What this means is that many folks will scrabble into the NG lifeboat as oil prices continue to climb, and I would not be surprised to see NT’s price/BTU increase until it’s nearly equal to crude oil. As we learned at the ASPO conference in Sacramento last week (8/21/08), clean coal is still many years away, and the infrastructure to pipe any significant amounts of CO2 to underground storage will take a significant effort to build and be equivalent to the in-place crude oil infrastructure.

See http://www.eia.doe.gov/cneaf/electricity/epa/epaxlfile2_5.xls