An Update on the Energy Return on Canadian Natural Gas

Posted by nate hagens on August 4, 2008 - 9:45am

| This is an updated post on the energy return on energy invested on Canadian natural gas by Jon Freise. Jon's initial draft of this analysis, and related comments, can be found here. |

An intermittent but longstanding theme here on theoildrum is that dollars do not sufficiently inform us of the long term details of energy depletion, and that the inexorable race between technology and depletion can be better understood using biophysical methods. Essentially this post suggests that it is requiring more and more energy to procure the same amount of natural gas in Canada, and this trend will likely continue into the future. This update makes the initial analysis too pessimistic on the rate of EROI NG decline but also too conservative on the absolute level of energy return. It is going to be a very interesting few years as Canada declines, Barnett peaks, and Haynesville and other unconventional plays ramp up. The treadmill spins on.

EROI of Canadian Natural Gas, Revised

Preamble

[Hughes 2007] Interview transcript with David Hughes of the Canadian Geological Survey.

"The assessment of discovered and undiscovered gas is based on statistical methodology. So, we look at what's called pool size distributions - discovered and undiscovered - and we can make an estimate of how many undiscovered pools are left, and the size of those pools. I'm also on the Canadian Gas Potential Committee - a group of senior geoscientists that prepares periodic national assessments of Canada's discovered and undiscovered gas resources - and in our most recent assessment, on the conventional gas side, in the Western Canada Sedimentary Basin, the two-thirds of the gas that we found were contained in 44,000 pools. The one-third of the gas that we haven't discovered, yet, is contained in 500,000 pools. And the last 200,000-300,000 pools on that tail will be far too small to be commercially developed. So, roughly 90% of what's left of the undiscovered resources are contained in probably 250,000 pools. It takes us two wells to find each one - that's 500,000 wells to find the last 30% of Canada's gas. To put that in perspective: we've drilled 300,000 wells to find the first 70%, so we can see that's the treadmill, the law of diminishing returns."

Introduction

This paper uses data collected by the Canadian National Energy Board to estimate the Energy Return on Energy Invested (EROI) of Canadian natural gas production.

EROI is critical because no fossil fuel can remain an energy source with a low EROI. A falling EROI is an indication that technology is losing the race against depleting reserves. (See Ten Fundamental Principals of Net Energy by C. Cleveland)

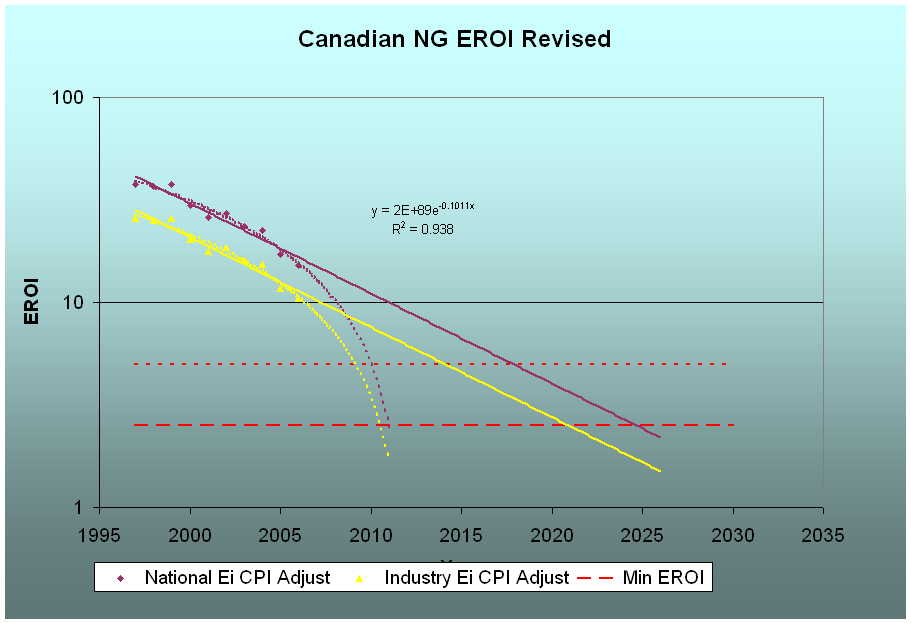

In the prior article on the EROI of Canadian Natural Gas showed that EROI was falling rapidly, and that it could possibly hit unity in less than 10 years. This article refines the prior estimate after helpful suggestions from Nate Hagens, Dr. C. Hall, and Dr. C. Cleveland. Unfortunately, the estimates were revised downward because the natural gas industry is more energy intensive than the national average industry. North American Natural Gas Production and EROI Decline.

This article also focuses in greater detail on the Canadian EROI calculations.

It would be helpful to hear from anyone who has access to drilling and operating cost data so we might form a more complete picture of what is happening with the most recent wells in the United States.

Decline in the WCSB

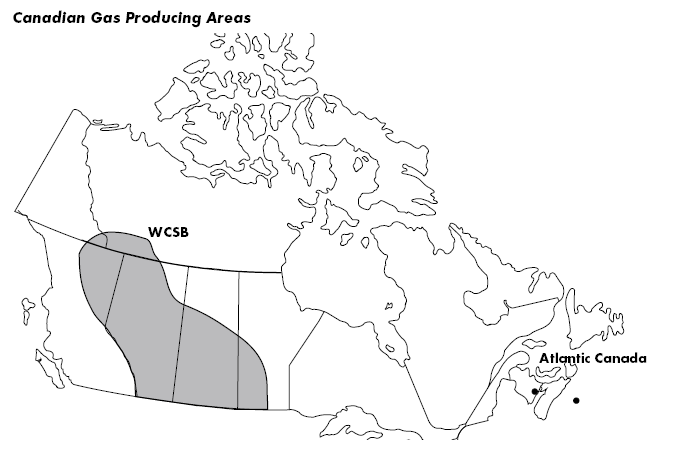

Canada is a major natural gas producer and supplies about 18% of the natural gas used in the United States. Most of Canada’s natural gas is extracted from the Western Canadian Sedimentary Basin, which is located north of Montana and North Dakota.

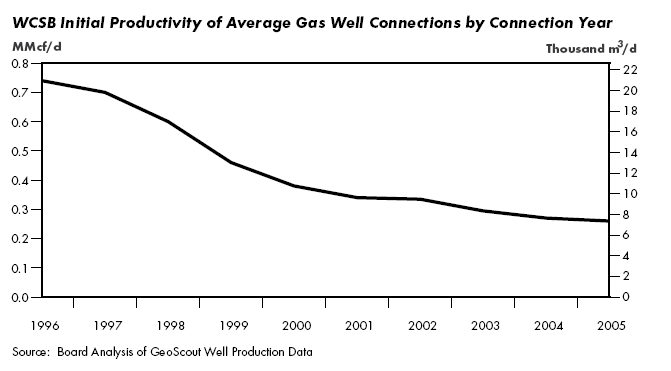

The WCSB is a mature region and well productivity has been slowly falling.

Falling well productivity means that more wells must be drilled each year to produce the same amount of natural gas.

Natural gas drilling and extraction is very energy intensive and more wells means more fuel must be used, more steel pipe, more drilling rigs, and more labor. Eventually the energy required to drill and operate a well will require more energy than the well produces. At that point natural gas extraction will stop being a fuel source and if continued would only be a fuel upgrade

We examine how to calculate EROI and how to forecast EROI trends below.

The Basic Calculation

There are many ways to calculate EROI described in the literature [Hall 1979] (the primary reason there is not ONE way is the lack of available data in parsed energy terms). The method used here is one that could be repeated with the same information needed to calculate the financial ROI.

The basic equation is:

EROI = Eoutput / Einput

The Eoutput is easy to calculate. This is the energy in the sum total of natural gas produced by a well (or group of wells). Natural gas production is often measured in cubic feet and this should be converted to Joules of energy.

The Einput is harder to calculate. Einput includes all fuels used to drill, complete and operate the natural gas well(s). But it must also include all capital equipment, materials, and labor. The energy embodied in these materials often exceeds the energy consumed directly as fuel. (Casing pipe being one major energy cost).

Our society does not track the energy content of every item we use. Instead, our society does accounting using money. This means that we need a mechanism for converting from money into energy.

The equation to do this is simple (in principal):

Einput = Eintensity * (drilling cost + completion cost + operation cost).

Eintensity is the conversion factor from $ to Joules. It is expressed in J per $.

National Energy Intensity

An accurate Eintensity conversion factor is very important. One method is to calculate a national average Eintensity. This is done by taking the GDP of the country and dividing by the total energy used by a country.

Eintensity = Total Energy / GDP

For Canada the GDP was taken from the Statistics Canada and the Total Energy was taken from the BP Statistical review. [Can Stat 2007] [BP 2007]

As an example here is 2006:

9.4e6 j/$ = 1.36e19 j / 1.45e12 $

Now we have an (approximate) method of converting $(Can) into energy. The next step is to get the Eoutput and cost input data.

Canadian National Energy Board Data

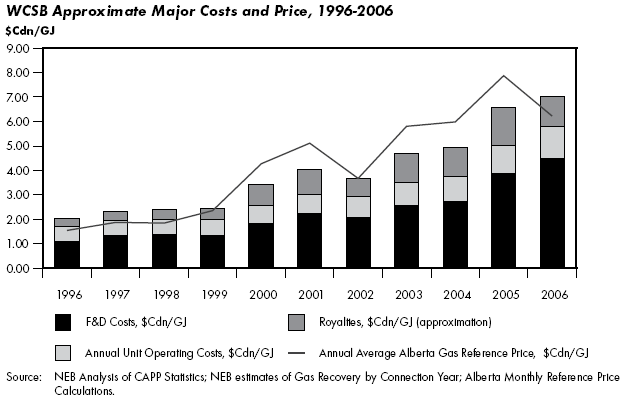

The Canadian National Energy Board calculates the total natural gas production from each year's newly drilled wells. And they calculate the cost of drilling and operating those wells. The data is summarized in the following table. Notice how costs have been rising to produce the same 1 Gj of natural gas.

The equation is:

EROI = Eoutput / Einput

Eoutput = 1Gj (because the NEB data is provided this way)

Einput = Eintensity * $Can/Gj (the NEB data for the chart is also in table form)

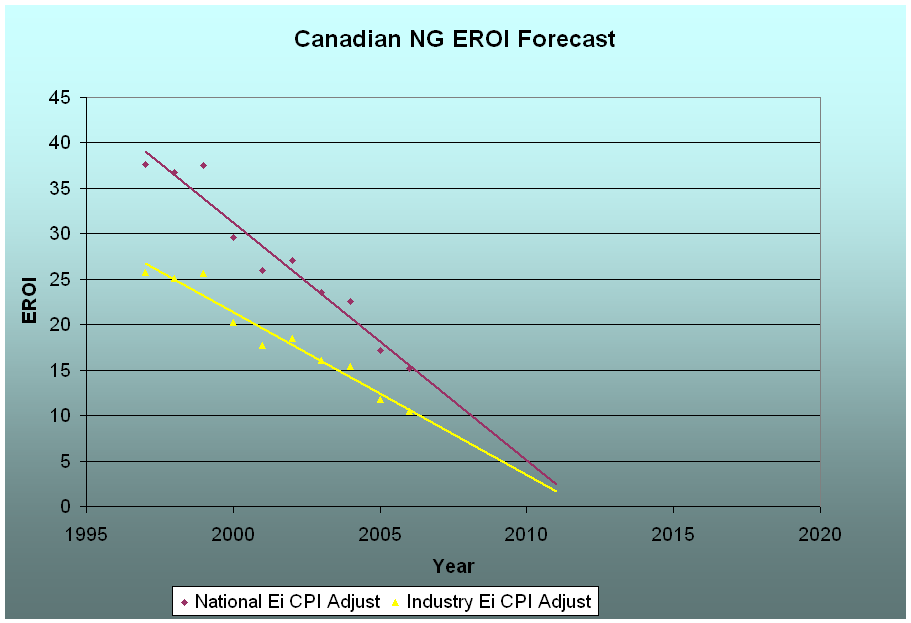

This is done for every year from 1996 to 2006 and is graphed below:

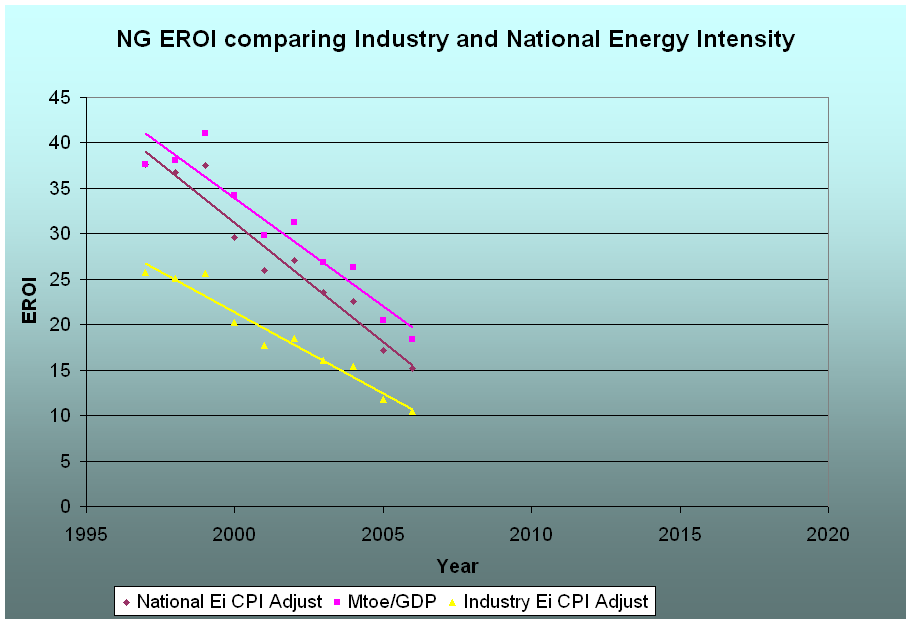

This method yields a 2006 EROI from 15-18.

Inflation Adjustment

One issue with using a conversion from money to energy is that monetary inflation will skew the results. An inflating currency will appear as a dropping EROI. Inflation must be removed from the cost data.

There are two series in the above chart. Each series represents a different technique for removing inflation.

The first method (CPI Adjust) is to adjust all $ values using the Canadian Consumer Price Index. All cost data is inflation corrected to the same base year. Then the Eintensity is calculated for the base year and is applied to all years.

The second method (Mtoe/GDP on the chart) does not use the CPI but instead recalculates the Eintensity every single year. If monetary inflation is happening, that should show up as inflating GDP numbers and should be canceled out. Both methods yield similar results.

The CPI method is used for the rest of this paper because it works better for the technique explained next.

Industry Energy Intensity

The problem with an Eintensity based on the National Average is that some industries are much more energy intensive than other industries. Specifically energy producing industries can use double the energy per $ that other economic sectors use. And this is the case with natural gas.

Dr. Hall provided an updated estimate of Eintensity for the natural gas industry of 20e6 j per $(2005). This is just about double the national average and means that the prior EROI calculations were twice as optimistic as they should have been.

The yellow line in the chart below shows the EROI recalculated using the industry Eintensity.

The yellow line is much lower than the prior estimates. This apparent bad news is offset somewhat by a more moderate rate of decline.

Forecasting EROI

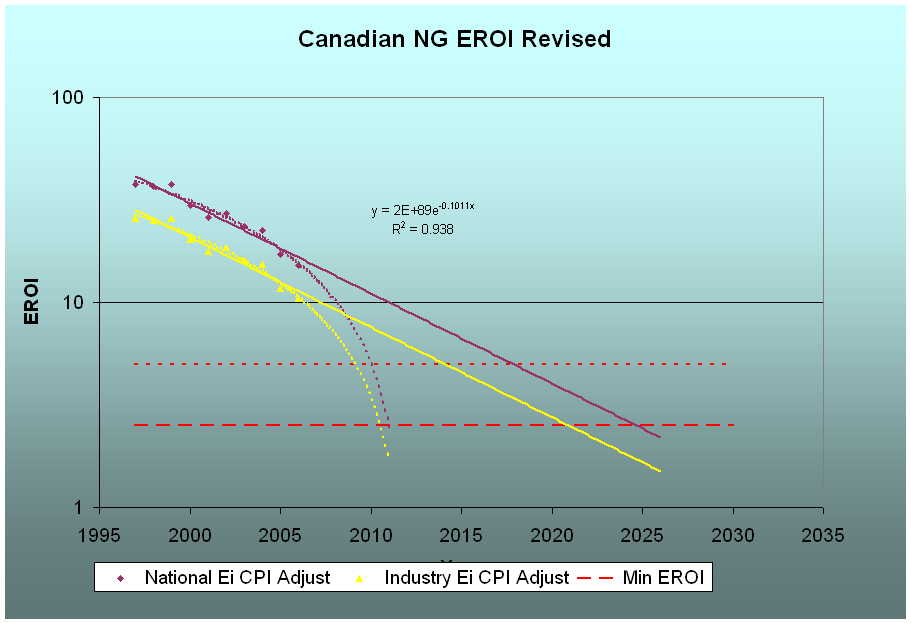

In my prior article, future EROI was calculated using a simple linear regression of the EROI data points and extending that line to unity. This resulted in a forecast of EROI hitting unity in just a few years.

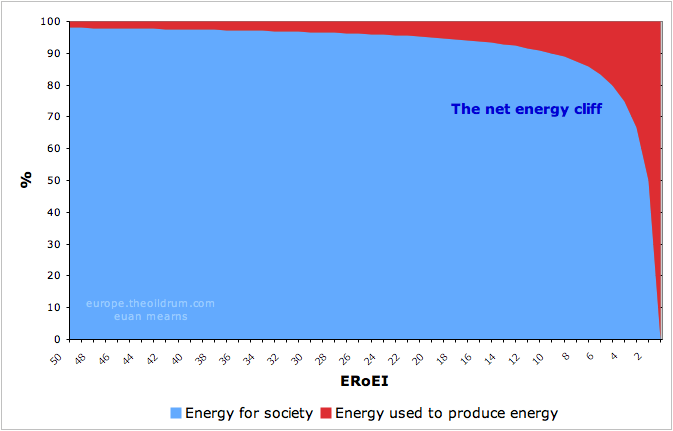

However, EROI does not have a linear behavior at low values. A change in EROI from 100 down to 10 requires only a 10% change in energy input. But a change in EROI from 10 down to 5 takes another 10% increase in energy input. The shift from a slow input change to a fast input change is easiest to see graphically -it resembles a knee or cliff.

This sudden bend in the chart suggests that we cannot use a linear regression to forecast EROI.

Instead we forecast EROI using an exponential function. While the exponential fit is good, it depends on there being a very large number of future wells, each with smaller and smaller URR. There is evidence to support this position [Hughes 2007]

If the graph is changed to a Log Normal plot then the exponential appears as a straight line and the new intercepts can be seen to occur about 2030.

Which brings up the question: How low can EROI drop before we have serious issues with our natural gas supply?

How Low Can EROI Go?

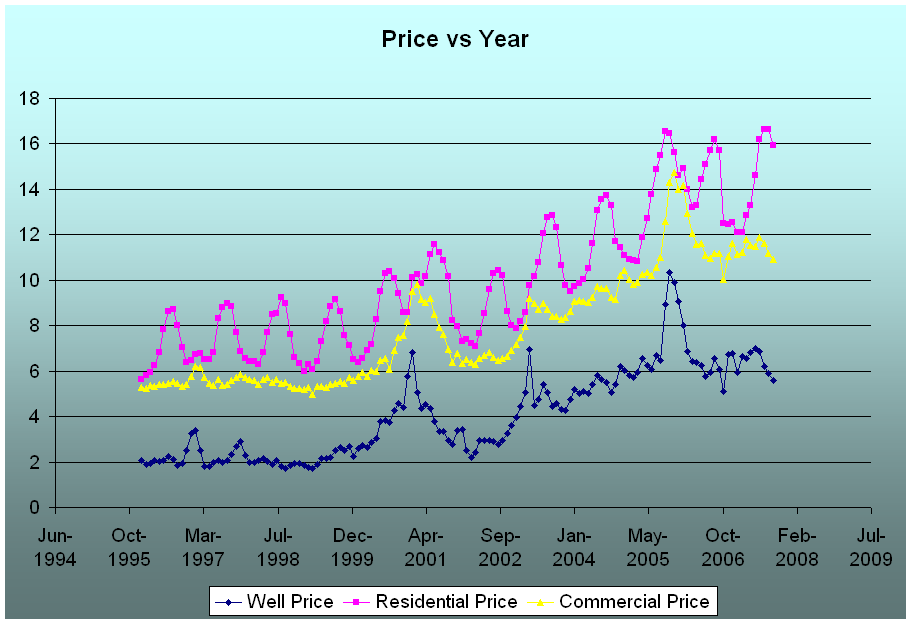

Not down to 1:1. Look at this graph of natural gas prices. The well head price is much lower than the delivered price. Looking at the 1990 numbers, you can see that most of the cost was in distribution. By 2008 that had reversed and the largest cost was at the well head. Natural gas distribution uses significant amounts of natural gas for compression and storage.

Estimating the EROI at the well head is just the first step in calculating the minimum EROI for a fuel source. For a residential consumer the distribution cost would at least double the energy input needed to get the fuel to the customer. This means a well head EROI of 2:1 sounds like it would be energy positive, but actually all the net energy surplus would be consumed in distribution and the residential customer would receive no heat. (Other types of customers have lower distribution costs).

After distribution, the energy cost of the furnaces or heating equipment must be added because it is vital to turn the natural gas into usable heat for the consumer. Again, this ratchets upwards the minimum EROI threshold.

There are many other uncounted energy drains in the natural gas production chain. A truly wide boundary analysis would include more of these indirect costs. Universities and colleges are needed to train the technical staff that oversee the whole production and distribution system. The road and transport system is vital to transport and maintain the natural gas infrastructure. If society stops paying any of these hidden energy costs, it would be impossible to maintain the natural gas production and distribution system. So a holistic analysis must set aside extra energy to account for these necessary expenses.

Thus we can place a very approximate lower bound for EROI somewhere between the absolute minimum of 2.5:1 up to possibly as high as 5:1.

This approximate lower bound leaves us with a serious natural gas net energy issue somewhere between 2013 and 2020.

Results and Discussion

Using this method, the EROI of Canadian natural gas production has dropped by nearly 50% in the last 10 years and is trending strongly downwards. The WCSB is clearly showing signs of depletion. A heroic effort by natural gas producers has held production relatively flat, but at a tremendous energy cost.

Depletion is fast outpacing drilling technology. It is possible that within the next 10 years Canada will no longer be a supplier of energy positive natural gas. (Again, they might still produce natural gas, but only by utilizing abundant lower quality energy inputs, if available.

Forecasts that show flat natural gas prices and flat or rising production are likely in error (Such as the EIA's AEO 2008). Either prices must rise to cover the rising production energy cost, or production must fall. And most probably, prices will rise at the same time production falls.

Appendix A. Estimating Natural Gas Production per Well

This section discusses a few details on how the Gj/$ dollar values were calculated by the NEB. The full details are in [NEB 2007] Appendix A & B.

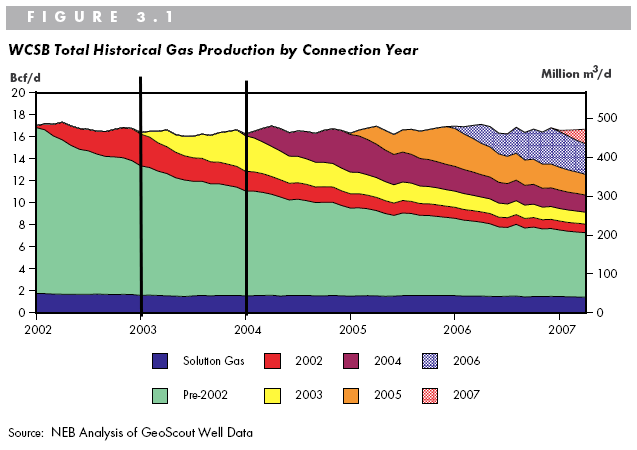

This graph shows the problem with trying to calculate EROI for a given years drilling and producing activity. Take a look at year 2003 (Yellow). You can see that most of the gas production in the year 2003 was actually from prior years drilling (red and green and blue on the bottom). That means that the EROI calculation is going to be skewed by prior years drilling.

There are two ways to deal with this problem. The first is to just accept the error if there is no way to separate out new gas from old gas.

The second method is to separate out the production of each year (as the graph above does) and then estimate the future production of each years wells. Then calculate the EROI for each year using only the gas produced that year. (So take only the production costs for 2006 and only the natural gas produced from year 2006 vintage wells).

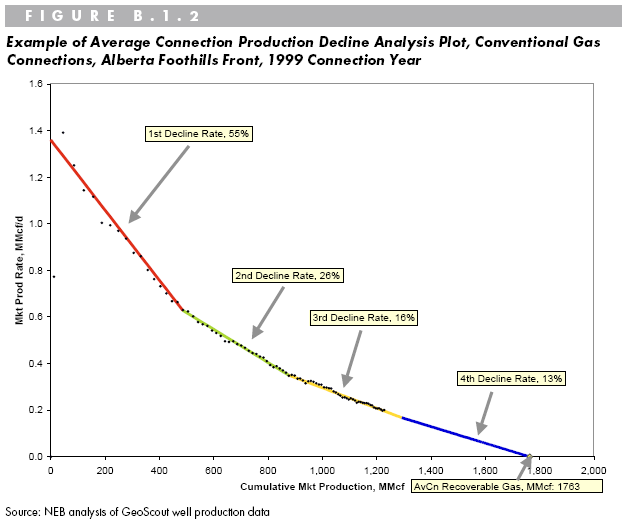

The future estimate of each year's production is done with a decline model. This next graph shows what a decline model looks like.

There are several downward slopes and eventually production hits zero cubic feet of gas per day. The amount of gas produced is totaled up and the energy value of that gas is calculated. Then energy output is divided by the cost to drill the well and you get Gj/$.

Or would if there was data for every single well. In reality, lots of wells are averaged together (read the report for further details).

The NEB uses this decline model strategy to calculate Gj/$. And that is why we can see the EROI decline very quickly. It is not getting "muddied" by prior year's gas production.

Appendix B. Real Demand Inflation

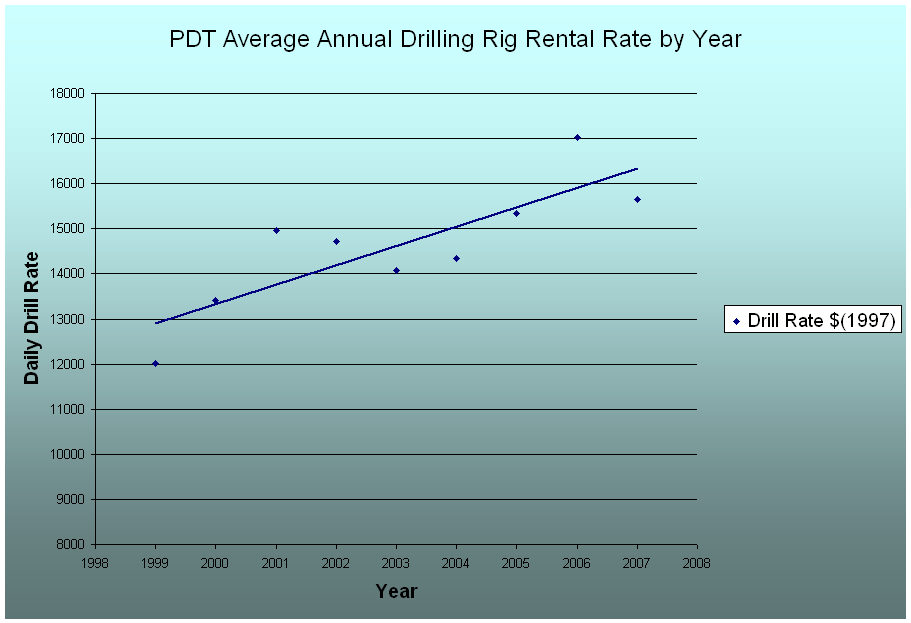

Inflation can cause drilling costs to rise and can look like falling EROI. That was corrected by using the CPI. However, during a period of high demand for drilling rigs, it is possible that companies bidding against each other (real demand) pushes prices up faster than the CPI.

This brings up the question: Is Canadian EROI falling because energy inputs are rising or because demand for rigs and equipment is pushing up prices and it just looks like EROI is falling?

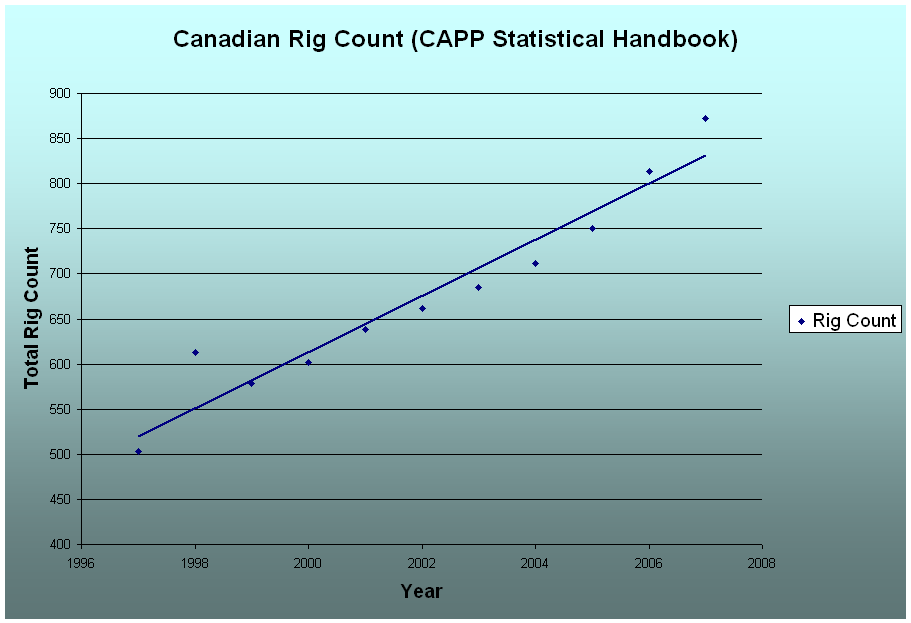

To try to answer this question, the daily rental cost for drilling rigs was taken from the annual reports of the Precision Drilling Trust (PDT). PDT operates a very large number of the rigs in Canada. It is assumed the costs they charge are a good proxy for all rig costs.

Charting the data from multiple annual reports and inflation correcting the prices shows that the cost of renting drilling rigs is trending upwards.

Rig utilization data shows that some years have a high demand and in other years the demand drops quite a bit.

We would expect that on years with high demand we would see much higher prices. And on years with low demand we would get much lower prices. However, this is not what we see. When rig rental rates are plotted against rig utilization, we see no correlation (we expected a line running from lower left to upper right). Instead we get data points scattered all around. Statistical analysis finds no correlation (regression p = 0.51).

If competition is not driving up the cost of rigs, then what might be the cause? One possible answer is that the number of rigs is increasing quickly and the cost of these new rigs must be paid for in drilling rental rates.

Increased capital expenses must be included in the EROI. Increased costs to pay for new drilling rigs are a valid inclusion.

The EROI drop does not appear to be caused by rig demand in Canada. However, further study should examine rig demand in the US. And further study should also examine other major inputs to drilling, such as steel and casing pipe. Another approach might be to look at the profits of major companies that supply drilling services. High profits are more indicative of real demand inflation.

TheOilDrum References

Biophysical analysis is important in a world of finite resources. We write often about net energy and EROI on this site, as it gives insights that might not be immediately seen by conventional dollar analysis.

Here are some selected historical posts on the topic:

Why EROI Matters (Part 1 of 6)

EROI on the Web part 2 of 6, (Provisional Results Summary, Imported Oil, Natural Gas)

At $100 Oil, What Can the Scientist Say to the Investor?

The Energy Return on Time

Peak Oil - Why Smart Folks Disagree - Part II

Ten Fundamental Truths about Net Energy

The North American Red Queen - Our Natural Gas Treadmill

Energy From Wind - A Discussion of the EROI Research

A Net Energy Parable - Why is EROI Important?

Natural Gas and Complacency

Other References

[NRC 2006] Canadian Natural Gas; Review of 2004 & Outlook to 2020”, Natural Resources Canada, January 2006. pg 22.

[Hall 1979] C. Hall, M. Lavine, "Efficiency of Energy Delivery Systems:1. An Economic and Energy Analysis", Environmental Management, vol 3, no 6, pp 493-504, 1979 (First part of a 3 part article).

[Hall 1992] "Energy and Resource Quality: The ecology of the economic process", C. Hall, C Cleveland, R. Kaufmann, 1992, University Press of Colorado, pg 184-188.

[NEB 2006] Short-term Canadian Natural Gas Deliverability 2006-2008 National Energy Board, 2006,

[NEB 2007] Short-term Canadian Natural Gas Deliverability 2007-2009 National Energy Board, 2007, pg 8-9.

[Can Stat 2007] Statistics Canada

[BP 2007] BP Statistical Review of World Energy 2007

[EIA Feet] Energy Information Agency. Feet drilled in natural gas wells.

[EIA Wells] Energy Information Agency. Natural gas wells drilled.

[Capp 2007] Canadian Association of Petroleum Producers. Wells and Meters Drilled in Canada 1981-2006

[Capp Rigs 2007] Canadian Association of Petroleum Producers. Western Canada Rigs Drilling, Available Utilization Rate Annual Average 1977-2007

Author Note

This is a guest post by TOD reader Jon Freise. Jon is a software engineer living in Minneapolis, Minnesota USA and is a volunteer with the Twin Cities Energy Transition working group, seeking a path to a low carbon future. Jon can be reached at gmail [dot] com under the name grandpa [dot] trout.

Editors comment: Thanks very much to Jon for continuing to explore this important aspect of our natural gas situation. (and for the record, he formatted the entire post into HTML and sent me the images with the same file names as in the post, which meant that what would normally have taken me 6-7 hours to prepare took under 1.5...;-)

You are very welcome Nate. Thanks for all the advice. The analysis is much stronger now. And also thanks to reviewers Gail the Actuary and Mikael Höök of Uppsala U. for your kind suggestions.

Another great post on a great site. When I was a student at University of Alberta (Edmonton) in the late 1960s a chemistry professor said to a group of people in an elevator "They shouldn't be burning petroleum and gas for heating, they should save it for synthetic chemicals - it is too precious to use simply for keeping houses overheated". From that day on I became aware of the limits to fossil fuel resources and have been following information on the ultimate depletion of these non-renewable resources. TOD is the best site I have found. The regular writers explain things in a manner understandable by most and are providing an invaluable resource for the general public. Thank you all for the many, many hours you are spending to discover the truth as much as possible when much of the needed data is hidden by industry and government or buried in hard to access resources.

My self, I have started to understand much of the complexity of the problem and am trying to share this with friends and acquaintances. Even a few years ago such conversations would be met with blank looks and a polite (not always) change of subject. There has been no greater challenge to civilization since that faced by man during the last ice age. At least during the ice age people had the option (in theory at least) to try to move to milder climates. There is no such escaping the reality of the evolving energy problem.

I am not convinced, however, that people will rise to the occasion soon enough to avert crisis of catastrophic proportions. Few politicians and governments will be willing to put in place major conservation measures and massive investments in new infrastructure and renewable energy programs in a timely manner. Their rational will be that such measure would put them at an economic disadvantage that would allow other nations to plow ahead with growing economies and gain economic and military advantage. Their mantra is that if they don't use the energy others will. It is this kind of fear that prevents needed measures happening until it is maybe too late to head off complete disaster. Never has there been a greater need for international cooperation. This problem can not be solved on a stand alone basis.

However, I am overall an optimist and feel we must keep spreading the word and hope that enough people become informed soon enough to force through the measures needed.

Please continue the great work and thanks again.

thanks for the kind words

Right now it seems our leadership is in the 'put out the fire of the week' mode, not caring about larger fires in the future. Obama today suggesting we open up the SPR to reduce short term gas prices is a kindergarden suggestion compared to likely political issues of the future. Any long term solution is going to have to address population, among other politcally untenable topics. I wonder what it will take and who will be the first (western) politico to bring up penalties for more than one child, curfews, loss of various freedoms, etc.

if you come up with any optimistic answers to the whole enchilada please speak up!

Nate - of course increasing population will negate any progress made on previously discussed needed changes. Unfortunately population control is a taboo subject in too much of the world. I do not know how to approach that problem. Perhaps, TOD can put together a "think tank" with others on how to approach the political-religious issues - Bio1

Woody says it best:

:o)

Nick.

Thanks for another good analysis Jon. I finally understand Charles Hall his point that EROI around 1:5 or so is necessary for society to function.

Thanks and you are welcome.

I think minimum EROI is important and it would make a good article. EROI determines the rate at which a new energy source can grow. (a society can only reinvest energy profits). But EROI of the fuel source is not enough. All the other energy demands must also be met.

Meaning wind power cannot replace oil unless all the other uses for oil energy are paid (cars, roads, etc). This lowers the rate of growth quite a bit.

So there are two more posts that need to be written!

The claim that EROEI in and of itself determines the possible growth rate of an energy supply is incorrect. Of course if the energy balance is zero then you cannot obtain any useful energy whatsoever. Zero does indeed equal zero. However, the possible growth rate does not bear a simple relation ship to the energy balance.

For example, suppose that you are alone on an island, and you have figured out some way to produce fuel. Further suppose that the source of this fuel is so large that the only limitation on how much fuel you can produce is how many hours you dedicate the fuel extraction process. Suppose that in one hour of work you extract a gross output energy G and you consume an amount of energy I. Then your net energy production per hour is

N = G-I = G(G-I)/G = µG.

Where µ=(G-I)/G is the fraction of the gross output energy which is left over after the input energy has been subtracted (I call this number the energy utilization rate). In this case there is no energy growth issue whatsoever. The amount of energy you can harvest in a given year is simply proportional to fraction of your labor that you dedicate to producing energy. There is an issue of optimization of labor effort: How much time should be spent extracting energy and how much time should be spent using that energy to produce useful output?

Growth issues occur only when time delays come into the picture. If the energy payback on investment in natural gas exploration and drilling were instant, so that as soon as a new field had been found and drilled all of the energy from it was instantly available, then the only thing that would limit how much energy you could obtain in a given year would how much of your economic effort was dedicated to exploring and drilling. This would not be a growth issue but a resource allocation issue. Of course the energy balance would effect the optimum resource allocation via the energy utilization rate µ.

On the other hand, if a substantial period of time is required to recoup up front energy investments, then limits to growth issues arise. These limits cannot be analyzed in a simple way as a function of energy balance. What matters then is the time profile of the energy return relative to the time profile of the energy investment.

Yes, time is important. Construction time. Energy payback time. Total plant life time.

Here is a paper that did a nice study of the EROI to growth rates question:

http://eprint.iitd.ac.in/dspace/bitstream/2074/1323/1/mathurdyn2004.pdf

Rising Natural Gas Prices

There are a few things I would like to add that are related to EROI but have nothing to do with the calculations. The first is that to keep production on plateau prices need to keep rising exponentially.

However, I think the E&P industry should take a look at what is happening to consumers. I took the following data from Minnesota Public Utilities Commission Cold Weather Compliance Questionaire filed by Xcel energy (A large natural gas and electricity distributor) as of June 2008.

Total number of disconnection notices mailed to customers 78,000.

Total disconnections to date 4,030.

Total $ past due on all residential accounts $39,391,766.00

Total $ revenue from sales to residential accounts $79,801,757.00

Perhaps a TOD member who works in distribution can explain what is happening, but it looks like the Natural Gas distributors are getting the same squeeze as the oil refiners.

https://www.edockets.state.mn.us/EFiling/DocumentSearch.do

Search for docket year 8 number 14. Click on the "public" link on the left hand side of each result to view a spreadsheet of the data.

Jon,

I'm involved in two unconventional shale gas plays at the moment and can offer a little insight into the idustry's current view. There are several factors that will continue to drive the unconventional gas E&P effort even if the distribution side of the equation is starting to look a little soft. The industry has 100’s of millions tied up in lease inventory. And the leases have an expiration built in….1 to 5 years. Even just retaining a lease can become expensive as many have yearly rental clauses which can be as much as the original lease bonus. In the last year, thanks much to the Internet, minerals owners became savvier in negotiating lease terms. Where $50/ac was the norm a few years ago prices have jumped to $10,000/ac in some areas. Also, drilling/completion cost have more than doubled in the last year or so. But companies were compelled to continue leasing for some good reasons. The unconventional gas wells all share the same critical character to some degree: a very rapid payout of the initial investment. Usually 12 to 18 months. During the remainder of their life they typically have a very low net present value due to very rapid decline rates. One of the biggest risks in E&P is price forecasting. For wells with longer payouts errors in the forecast can cut both ways. Current operators are receiving much higher oil/gas prices then they forecast a year or two ago. Also, each play has its own learning curve. Once a company has invested in this education it’s not easy to walk away.

But these resources plays also become something of a trap. Most of the big players are public companies that see their asset value rise quickly as 100’s of these wells are drilled. But the rapid decline rates can reverse that trend quickly. They are thus driven to drill even more wells to replace depletion. In a way, you can consider it their own corporate PO/PG. During the oil price spike of the late 70’s Texas public oil (Union Texas) virtually committed suicide by drilling over 600 very commercial oil wells. These wells had a similar high initial flow rate followed by a rapid decline. Their stock rose steadily until they ran out of places to drill. All plays, no matter how good, have physical limits. Their reserve base fell just a quickly as it rose and the stock plummeted. They were eventually sold for scrap. So even if the big players do see a softening in NG prices it would be difficult for them to stop drilling. Wall Street can accept a company’s declining asset vale due to lower prices. But a declining volume of assets is punished severely even though a company may still be generating a health profit. In a way these public companies are adhering to the motto of the French Foreign Legion: “March or Die”

Interesting! By the way, what is PO/PG ?

Peak Oil / Peak Gas

Sorry Gail: Peak oil(PO)& peak gas (PG). Inside the industry we stopped worrying about PO long ago. With the exception of the unconventional oils and the Deep Water few of us even think much in terms of domestic oil anymore. Even my specialty, EOR, isn't on the table much anymore since it's such a very mature area these days. PG has been the issue for the last 15 years or so. Before the unc gas plays picked up steam the emphasis was on reserve acquisition as a vehicle for reserve growth (of individual companies...not global URR). There were much more reserves to be bought then to be drilled. But many of the acquisitions did lead to some new drilling as the typically smaller post acquisition company could better focus on these smaller targets. We proudly referred to ourselves as "bottom feeders".

Rockman:

What is the industry view on potential competition from foreign NG?

If the E&P costs on unc are high then surely folks are looking over their shoulders at lower cost imports when decision time comes. Or are the time horizons so short that foreign supply is not even on the table?

Interesting info on collapse of the distribution system. And it is not even PW (Peak Winter). Suggests that the US consumer is under significant pressure such that they cannot afford energy at current prices. So we have demand destruction in both 3rd world countries and in 3rd world regions of the US.

If you mean are domestic E&P companies worried about imported NG to hurt their business? It's not even part of the equation right now. The unconventional plays pay out much too quickly to be affected by imports. The vast majority of the profit comes out in 3+ years. Imports are very low right now and would take many years to ramp up significantly. Most gas leases are taken on a 5 year term though it does vary. Virtually every current uncon gas lease existing today will be drilled or released long before imported LNG could be a factor.

Another aspect of your question: the companies playing the uncon gas resource plays are not typically players in the LNG import arena. Pretty much two different animals. I get you point about demand destruction in "in 3rd world regions of the US." If we have an exceptionally cold winter a lot of folks in the US will be shocked to realize that they are a part of that world.

The nat gas E&P companies in North America may become a dicey investing area because of the EROI/drilling thing. Some of them may do well because there is so much unconventional gas out there. But many of them are going to have trouble with the drilling treadmill. The gas drillers and service companies (the pick 'n shovel vendors of the shale rush) will probably be the way to invest.

As gas EROI approaches 1, America's NG becomes merely an upgrade of the diesel and other inputs. I haven't looked at any figures, but I have to wonder if this gas drilling treadmill is contributing to the global diesel shortage that is, to a large extent, setting the price of oil.

netfind,

Calling the uncon NG drilling a "treadmill" is an excellent analogy. As I've mentioned elsewhere most of the uncon gas players are public companies and thus they must quickly drill more wells to compensate for their rapid decline curves of individual wells. But the more new wells they put online the more wells they have to drill to make up for the decline of those additional wells. It's not just a treadmill running at a constant speed but is actually accelerating over time. In other words, they just can't maintain a steady drilling rate. The drill rate has to accelerate or they eventually start showing a company wide decline in asset volumes. And that is exactly where ExxonMobil et al are right now. It's almost impossible for the Big Oils to stop their own "corporate PO". No matter how good and how far the uncon gas plays are they will eventually run out. And then these companies "corporate PG" will hit them hard. The same would happen if there were a deep and prolonged drop in NG prices for any reason.

As far as fuel consumption of drill rigs I'll get a number from one of my drillers. After that it's Y gal diesel/well drilled X number of rigs X number of wells drilled per year. It will be a rather crude number but I think it will show a minimal impact of USA diesel demand. The 2400 rigs (US and Canada)running today is a small number compared to the 100's of thousand (if not millions) diesel trucks and millions of fuel oil home heating systems. The biggest rigs only run at 2000 to 3000 horse power. Which I guess would be about the same as 10 big truck rigs running 24 hours a day. Offshore rig consumtion would be a lot more but there are very few of them compared to other fuel burners.

Mix this accelerating treadmill with NG refining requirements for increasingly heavy sour oils plus heat and electricity. And don't forget to add a touch of export land and oil depletion.

Stir bake for two or three years.

WARNING!! wait till economy implodes before opening oven door.

memmel,

As always it depends upon winter demand to some degree but I would guess your 2 -3 year time frame is a good estimate. The industry has been hitting the unconventional NG plays for a good 2 years now. New rigs coming out the yards all the time but not a huge percentage gain even over the course of a year. Thus we've gotten pretty close to peak drilling on uncon NG. Wells completed 2 years ago are starting to head down that steep treadmill. As long as prices stay above $7/mcf I see no slow up in the drilling. In theory, in 2 years or less, we'll barely keep new production additions in sufficient numbers to offset the decline of the previous drill cycle. At that point the industry may still have 50,000 new locations (just a wild guess) but public companies will be able to just maintain reserve volumes with the drill bit. Thus no growth from this source. Toss in some sudden downward pressure on NG prices and you could see a little panic in the eyes of many public oils.

My division focuses on tite gas sand and shale gas. This year’s budget was bumped from $700 million+ to over $900 million. Having the budget is one thing...getting 5 or 6 more rigs and casing is another matter. I would say we're a good poster child for aggressive uncon NG development and we're essentially at peak drilling rate now. Even if NG/oil prices stay high there should be a mad rush at big corporate NG acquisitions in about 2 years…maybe a little sooner.

Any oil and gas company not buying up smaller companies is on the treadmill! The gas version is probably speeding up faster than the oil version.

Above, I said that at EROI=1, gas becomes just an upgrade of oil. Well, you are converting crude to gas, but the EROI of 1 takes the conventionally produced gas EROI from about 10 all the way over and down the net energy cliff (splat). This means that the nat gas recovery becomes a total waste of crude. At this net energy level, you can make a zillion TCF of gas and not displace one pint of crude.

Netfin,

Have that number for rig fuel comsumption. Just a generic number for a 11,000' hole. This doesn't include the fuel requirements to move equipment to the rig as well as the rig move itself. It runs about 50,000 gals per well. Just a guess but add another 15% to cover the transportation factor.

Whats that work out to for btus for the average well ?

In a sense the oil-ng EROI is more important than other EROI issues i.e electric to some extent.

It doesn't feel right that unity is the cut-off point. Leaving aside quality of energy, there are also issues of risk, finance and maybe other externalities that don't get factored into EROI. The more chaotic the environment the higher the EROI would have to be to make a project worthwhile. That might include positive feedback loops, where something as unrelated as society grinding to a halt prevents the exploitation of resources with low EROI. Or not enough volume to fill a pipeline. I wonder if the ratio might not be quite a bit higher, perhaps 1.5 to 1 or even more. There is always loss to friction and I think it will be greater at low EROI - at least on the transaction by transaction level.

cfm in Gray, ME

well again, 'leaving quality aside' is not going to be realistic. For all intents and purposes for the next decade +, light sweet crude roughly 30+ API and natural gas are going to be our highest quality fuel sources - if possible we will produce them even at sub-unity EROIs if we have lower quality precursors. The problem is that in these two cases, we don't. (e.g. we presently need natural gas to produce/refine both crude oil and natural gas)

Bingo.

And if you start looking at sing NG to refine heavy sour crudes you reach the point that the NG is as valuable used directly vs using it in a complex refinery. The value add of complex refining in a world of expensive NG is zero.

Thus you really should discount the value of the heavy sour oils vs increasingly expensive NG.

Only if we had cheap abundant NG would you treat heavy sour oils at the slight discount they now have vs the light sweet oils. The market is not correctly discounting future NG prices in determining the value of these heavy oils. The intrinsic value vs light sweet is in my opinion a more correct assessment. This means the energy value of these oils is a fraction of that obtained from light sweet oils. This is a fraction of the energy value returned from light sweet often around 60%.

This powerful coupling between our remaining heavy sour oil reserves and NG is the reason the western nations are intent on war with Iran. Iran is basically the only source of NG that can be used to provide enough gas to upgrade and use the heavy sour oils without the NG from Iran the value of a lot of the remaining oil reserves is basically half the number of barrels in the ground.

Small wonder the US is willing to risk all out war with Iran and Iran is willing to play the nuclear weapons game without the Iranian NG our current lifestyle declines rapidly.

How many cubic feet of natural gas does it take to upgrade a barrel of heavy sour oil?

On a btu basis I did a rough calculation that the energy required to upgrade the remaining heavy tars was about 2:1 so assuming the heavy sour oil had 50% tar or so then you need about the same amount of btu's as this produces to upgrade the tar.

If you think about it the energy needed to coke tar is about the same as the energy produced from the liquid fuel. Also of course you have energy inputs in removing the sulfur and heating the pipes to move the tar etc.

Overall it seemed that the total energy required to upgrade heavy oils was between 50-100% of the resulting btu content of the fuel.

Also understand that if you use the volatile components to upgrade the rest of the oil then these would have to be substituted with NG or NGLS instead of sold at market value. So its not correct to discount volatiles produced during the refining of heavy oils. Basically you need to look at the total inputs and outputs of a complex refinery for heavy sour oils vs one for light sweet oils.

So lets say you have a barrel of heavy sour oil and 50% of the final product mix is made by complex refining of the residual tar.

1 barrel(42 gallons) of crude oil = 5800000 Btu = 5.7 MMbtu

5800000/2 = 2900000 Btu == 2.85 MMbtu or at 9 dollar a MMbtu == 25 dollars worth of NG.

Assuming you bought it at a discount say 100 dollars a barrel your total cost is 125 a barrel

once NG is included.

So this rough estimate actually matches pretty well with NG costs vs discounts for the heavy sour vs light sweet prices.

Note I had no easy way to really figure this out except that all the complex refining process are energy intensive.

I'll admit that figuring out how much NG is used in complex refining is a difficult problem I found no external data sources for this. But intrinsically the energy costs of thermal depolymerzation are pretty close to the energy content of organic compounds.

http://www.kantor.com/blog/2004/01/thermal-depolymerization/

The have it as 85% efficient i.e 1 BTU in .85 btu out.

So my 1:1 assertion seems reasonable.

Obviously if the cost of NG approaches that of oil on a BTU basis then either we will see very steep discounts for the heavy sour crudes or they simply won't be used since it makes more sense to just burn the NG.

I suspect T Boone Pickens has done a similar calculation and realized that it makes more sense to just switch to NG and skip buying the heavy sour crudes. What he is not telling you is that whats really going on is its simply not worth complex refining of the heavy sour crudes if NG is in short supply.

He likes to picture it as our way off oil but its really not. It just simpler to burn the NG directly and only go through fairly simple refining of heavy sour crudes and use the residuals like we used to.

Complex refining itself seems to me at least to only be reasonable during the time period when NG is a lot cheaper than oil on a per BTU basis like 5:1-3:1.

The lack of cheap NG coupled with declining light sweet crudes is the real problem the heavy sour crudes are worth little in a world of expensive NG. Given that the gasoline yields are half those vs the light sweet crudes in a simple refining schema they practically don't matter unless we have lots of cheap NG. And if we had lots of cheap NG then might as well just burn it. If we have expensive NG might as well burn it.

Small wonder the heavy sour crudes are hard to sell they really don't have any value or at best its 50% or less of the value of light sweet crudes if NG was priced equal on a btu basis to oil.

In my opinion this situation makes a move to light sweet and NG directly as the next big thing. Pickens of course sees this. What he is not saying is overall we get no more energy since we won't extract the heavy sour oils.

Thanks! It would be good if we could figure out a way to use heavy sour crudes, without using natural gas. I'm afraid it would just be asphalt or something equivalent.

Well the coke from a previous batch plus probably some of the asphalt could potentially be mixed and burned.

If you go this route your probably talking about a 25% reduction. Plus of course you can burn all the lighter fractions instead of selling them but the economics of this is of dubious financial gain.

The net loss is probably going to stay at 25% pretty much no matter what you do. This is 25% of the 50% or so residual in a heavy barrel or about 12% less product. Thats a big hit on overall production levels. Say heavy sour crude make up 50% of world production then your talking about a 5% hit on finished diesel and gasoline production from this problem alone once NG reaches parity with heavy sour oil on a price basis. This means basically one or two doublings of NG prices. We have seen repeated doubling of the oil price once it became scarce. A single doubling of the price of NG is pretty much all thats needed to make it uneconomic to refine these heavier grades without a much steeper discount basically about 25-50%.

This situation is on collision course with WT's export land model since a significant amount of the oil remaining for export in the Middle East and other OPEC countries is heavy and sour.

http://www.platts.com/Oil/Resources/News%20Features/crudeanalysis/index.xml

Once you put together the NG situation in North America and Europe where a lot of the refining capacity is and even the situation in Asia which in general lacks NG supplies or pays a premium for LNG. We are rapidly approaching a explosive situation where price doublings of NG make it uneconomic to extensively refine our remaining heavy sour crudes using NG in the upgrade process.

In my opinion we probably won't make it far past peak oil before we see a major crisis from this issue.

And of course you throw in the EROI problems mentioned in this article for recovering natural gas itself much less using it to upgrade low quality oils.

We are facing percentage losses in real oil availability from EROI issues etc.

Here is my best guess.

5-10% loss in overall yield from declining EROI of oil and NG and don't forget its a cliff.

5-10% loss from depletion itself on the higher side if I'm right about depletion.

5-10% loss from export land esp as NG shortfalls cause a price crunch.

5-10% loss from political instability war above ground effects.

So on the minus side we see 20-40% declines from all factors as the reinforce each other.

On the plus side if its a plus economic issues could cut usage by say 5-10%.

But your still down a lot oil and NG will remain expensive.

No way our current lifestyle can survive this sort of stress. This will of course cause the prices of assets such as cars and homes to plunge as people focus on meeting daily living costs and this will ensure that the debt pyramid built on selling cars homes and Chinese junk to put in said cars and homes collapses.

Small wonder the US is willing to risk all out war with Iran to secure its NG reserves to support the non-negotiable American lifestyle.

Even if my estimates are high simply taking low numbers such as 2% for each problem results in a 8% hit.

But a drop in usage of 5-10% is ludicrous since this is like a -20% drop in real GDP on a per barrel basis.

So a real drop of 0.1-0.5% globally in oil usage makes a lot more sense since this matches better with a survivable 1-3% annual decline rate effectively a serious recession or light depression.

Thats still enough to collapse the fiat/debt economic model we have given its current state.

Bottom line is given that we can readily identify four or more factors that result in percentage changes to the net energy available for use outside the oil industry and we probably will see more develop over time no way are we getting out of this one without some serious pain.

A very interesting angle and one I had not considered before. Now you just need an acronym for it. I agree that the interdependencies of all energy supplies are not properly discounted.

Thanks for that, memmel, very useful post.

Two questions: 1) don't some complex refineries use their own residuals as fuel, vs. natural gas? 2) Couldn't Qatar do as well as Iran as a source of nat gas for ME heavy grades?

1.) Yes they can. Some even seem to use the coke back in the refining process. For some reason its really hard to get good information about complex refineries. They don't report NG input for example or the internal process used. But understand anything burned in the refining process is not sold. So a refinery configured to use its own volatile fractions or residuals in refining is not creating products from these fractions. At the end of the day its all about btu's needed for the processing these btu's have to come from somewhere and for heavy sour oil s they are a significant fraction of the total energy content of the oil say 25-50%. These are either supplied by external inputs such as NG or burning a decent fraction of the barrel.

So on a net btu basis heavy source oils have a significant disadvantage vis light sweet in addition to higher fixed refining costs. This is not EROI but Energy of transformation. The classic example is of course the tar sands once the NG is used up its probably no longer economic to upgrade the tar sands. Once you take into account EROI and Etrans the net energy from anything but light sweet oil is significantly lower. This was okay as long as we had cheap NG to supply the needed btu's but the era of cheap NG is coming to a close.

The problem is NG has a number of uses outside of being used to transform oil in refineries. Its a valuable product and critical to our civilization once NG approaches parity with oil on a price per btu basis then its no longer worthwhile to burn it to make liquid fuels since it has its own direct markets. Certainly you can optimize your process and use fractions of the barrel internally but your net liquid btus out drops by precentages say 25%. Its a catch 22 at this point from a economic perspective since end customers are now paying for how they want their btu's as liquid fuels electricity heat fertilizer etc.

Sorry for the long reply but whats happening is btu's are becoming fungible minus discounts for various conversions and the price is driven by the most valuable form right now liquid fuels. And worse in general conversions take out percentages of the total btu's on the order of 10 to even 50% for things like CTL.

For the end consumer the result is that they may see cheaper liquid fuels as NG is sent to complex refineries but then they see higher electric or heating bills. They are now paying for a finite number of btu's and the form they want to use them. Their total cost is constant. So whats really happened is now the EROI is declining across the board for all basic inputs Coal, NG and Oil and absolute production rates of all three have pretty much peaked is that we have probably passed peak BTU. Transforming our energy sources between various outputs depending on our quality desires does not change this.

Electric rail stands out only because its the most efficient use of our remaining btu's and it fits well with renewable sources such as wind and PV that can actually slow our declining btu budget.

Sorry for the long response but I think its important to understand our world is changing to one that is driven by

btu*transformation loss = output form.

As liquid energy gets more and more expensive this equation will make all energy sources fungible and transformable and worse the price will be discounted vs its desirability for use in transformation to liquid fuels. GTL and CTL biofuels etc are just the beginning of this transformation. Given that these transformations result in a net loss of btu's and net btu's are no longer growing because of EROI we pay.

2.) Now you may see why the world is fixated on Iran. Russia controls the other major supply of NG and is nuclear armed. Iran is trying to move into the same position as Russia. By controlling the worlds NG supply they control our ability to transform other energy sources such as heavy sour oils to liquid fuels. In this new era of finite fungible btu transformations Iran NG reserves play a critical role in the availability of liquid fuels.

Excellent series of posts, memmel. One issue I think you may be missing (or ignoring for a good reason I'm not clear on) is using waste carbons from heavy oils at source (petcoke taken out at initial production sites eg. tarsands) in a water-shift reactor to produce H2 which is then used at site to "lighten" crude quite effectively. In fact there is some discussion that this reaction can be managed "in situ" in the tarsands in the THAI process, eliminating even the cost of the vessels for the water-shift reaction. It seems obvious to me that at eg. recent crude prices, this type of process becomes automatic, essentially eliminating any requirement for N Gas in processing tar sands oil.

See an Alberta govt. study. "In addition, the lower cost bitumen derived feedstocks would help sustain Alberta’s worldclass petrochemical industry, which is currently based on higher-priced natural gas feedstocks." -- appears the process has three main pitfalls, 1) an excess generation of amonium sulfate (fertilizer) or hydrogen, 2) an excess generation of electricity and 3) an excess generation of pure CO2 though that is apparently proposed to be sold to EOR / sequestration projects in the older local oil fields. Otherwise even using product costs from before the recent crude spikes, this system is economical and must be simply awaiting proof of stable prices and organization of capital.

http://www.energy.gov.ab.ca/Petrochemical/pdfs/AlbertaIntegrationReport.pdf

Once you have syngas your better off using it as a feedstock into the petro-chemical industry.

Syngas is good stuff and converting it back to hydrocarbon fuel is a bit stupid in a resource constrained world.

Coke is best used for steel manufacturing potentially concrete and as part of the petro chemical synthesis process.

To my knowledge almost all petrochemical process contain syngas equivilent processes to create reactive initial starting materials with actual syngas as a premier starting material.

Your Alberta link is probably talking about this. However the petrochemical industry is the premier buyer since it produces the most valuable products plastics fertilizers etc etc. So it can readily pass on costs to its customers. So in my opinion syngas like solutions are solutions looking for a problem. As the us of fossil fuels decline the petrochemical industry can readily absorb higher feedstock costs. And on the consumer side we have tons of room to reduce the use of plastics if they get more expensive same with fertilizer. On the production side plenty of raw materials exist for use in the production of petro chemicals depending on the price point. I just don't see us having problems in this area outside of fertilizer and its something that can be fixed with better farming practices.

In my opinion what will happen is we will eventually be forced to abandon using fossil fuels for widespread personal cars usage and we then have plenty of NG to meet our petrochemical and electrical generation needs.

Its only a problem until we give up on cars once they are gone we really don't have any problems. And if we move to a more conservative society all our sane petrochemical needs can readily be met from renewable resources. Ammonia from PV for example makes a ton of sense. Cellulose feed stocks for syngas and on to plastics are reasonable and we can certainly increase recycling of plastics. Once society slows down a bit and stops this endless growth we really don't need to exploit the remaining marginal fossil fuel resources. Localized bio/pv solutions are more than sufficient.

Memmel,

Do you think we are close to a bottom here for the price of oil? What do you think caused a decline of nearly $30 in less than 4 weeks?

Thanks,

Suyog

I do get Oil Movements and if you look at tanker traffic over the last 6 months or so exports from the Middle East have been low until just recently. A huge slug of oil is at sea at the moment most of it heading east with but with a good bit heading west. Overall the amount of oil shipping at the moment is slightly above 2007 highs right when demand is beginning to slacken.

In my opinion this is politically motivated by two issues the Olympics in China and the US elections. Sailing out of the ME look to have already begun to drop off.

I bring up the political factor since this does not fully explain the steep drop in NG prices on the NG side I think its a combination of the dropping oil price and market manipulation. NG right now is significantly below its historical norm vs oil on a BTU basis so a combination of effects is probably at play.

Its important to note that the much smaller propane market has not "responded" to the news that things are plentiful and heating oil also is not dropping off near the rate oil is. If propane had dropped of then I'd say this was a real event since it has not it stinks of market manipulation. The US NG market is small enough that for a short time determined parties can push it down potentially at great cost.

I hate to invoke conspiracy theories but the ME has excellent political reason to ensure that oil supplies from the ME does not become a major election issue and overall I think the support is with Mcain in the ME.

On the other side China probably worked with KSA to also ensure plentiful oil supplies during the Olympics.

They don't want to see diesel or gasoline shortages while the Olympics are going on. So you happen to have the two largest oil consuming nations and the second largest producer both interested in cheap oil prices over the next few months. Finally we have had reports surface that Mexico has made some large plays in the futures market selling cheap. The current Mexican government is also very interested in oil imports from Mexico not becoming a political issue and its also supportive of Mcain.

Back in the energy side there was no real reason for us to see some of the largest oil shipments this year right as we enter the next low.

My own models had predicted that the prices should have entered a plateau period a bit earlier then they did.

Price continued to rise for almost a month after I predicted they should have leveled off. Without manipulation we should have entered a consolidation period with the floor probably around 130. I was puzzled why at least a reasonable attempt to meet demand and ship a bit more oil continued to fail to materialize.

We should have gotten this oil much earlier then when it finally arrived. Its now effectively to late to do much good except to cause a short term depression in prices. But in any case we both went to high for my model and have swung too low. But right now from my model price we are only 10 dollars off the bottom. Given the amount of oil that was shipped prices could theoretically go as low as 80 a barrel for a short period of time I would be surprised if they drop below 110.

But are we going to pay a price for this. US storage levels are still scrapping the bottom of the five year average NG is not looking that great in the middle of the five year range but with some fairly large injections into storage etc. We could well see a NG crisis develop later this winter and both probably will snap back quit hard it really depends on where ME exports return too. I'm expecting them to actually be lower then what they where before the slug of oil shipped. Best guess is oil will be past 160 a barrel by Dec with NG back north of 13. No real telling where the market will end up once we get past this manipulation phase.

And again I'm really sorry to have to make these sorts of accusations but all the facts I've been able to gather point towards a concerted effort to lower oil prices via both shipping excess oil and market games.

Whats actually interesting if you agree its a full court press is that the results are really not all that great esp if you use my 130 floor price they have only been able to drive oil 10-20 dollars below my equilibrium price. In effect it when 15 too high and is going about 15 too low.

My model price was asymmetric on plateau 125-140 with a sort of floor price at 130 I call it the equilibrium price but with more room to move upwards. We should have set at this starting in June had a slight decline now then headed steadily through 150 towards the end of the year. Instead it looks like because of the games we will briefly touch some unstable lows with 80 possible but 110 more probable with a floor increasingly forming at 120. If I'm right about this just being a pulse of oil we could well see SPR draws shortly after the election and a price increase that puts this drop to shame. Prices will explode upwards. Right now I can't even predict where they end up. A reversal with us seeing prices rise by $60 in four weeks is not out of the question. Assuming no more market manipulation and this was a one shot deal for political reasons we probably won't see prices line up with fundamentals till next March. Thats how long this stupid game will effect us. I think our sort of equilibrium price next year is 160 -> 200 towards the end of the year. But we could easily blow through 200 the problem is although decent floor prices are fairly easy to figure out its almost impossible to guess the topside prices. Like right at this moment its easy for me to be very confident that the absolute floor is $80 with $110 more realistic but the top is as high is 160 thats almost a 2X range in prices. There is basically no constraint on how high prices can go.

I think the lack of a market top is what makes the prices so volatile as we get into these constrained resource situations. Buyers really start moving as a herd with prices swinging wildly and only briefly testing new lows but any number of potential highs possible with 30% or more price swings. Fairly firm floor prices can be established but markets don't seem to work well when there is no reasonable top its possible for oil prices to move up by insane amounts. Most people I suspect would call this rubbish given the recent large drop but they are completely missing that this is the sign of extreme volatility it can and will go up faster than it dropped.

Thanks, Memmel. Oil that is already at sea is paid for and therefore

should not impact price. Am I correct?

Sailing out of the ME look to have already begun to drop off.

In that case, we are probably close to a bottom. Am I correct?

I think so. Overall it looks like shipments where willingly delayed leading to higher prices and sent when they are not really needed leading to abnormally low prices. Next it looks so far like to achieve this required storing quite a bit of oil over many months to be able to dump it now. If this is true then after about 60-90 days we will return to what ever normal level should be for this year.

If the shipments however continue them I'm completely wrong but the problem is if I'm wrong then they should have been higher during the year and this dumping should have occurred with prices closer to 100 sending oil back to about 60. The fact that they had to send prices high in order to pull of a politically motivated dump before the elections says that this was a pretty desperate attempt.

The problem is the short term price drop has renewed demand and we are just going to burn the oil and worse the next time prices go high people are going to treat it like a "cry wolf" situation expecting that the taps will open any day now.

It will take a few more weeks before we know for sure but I expect shipments from the ME to actually drop quite a bit lower than they where earlier this summer since they can claim concerns about the falling prices and lack of "demand".

Its actually a beautiful way to hide peak oil for almost a year. I have my doubts they can pull it off in 2009 but maybe they do the same trick next year. They have two periods where they can play this game.

Right now and in the spring. However it looks like they can only pump enough oil to do it once a year and its not clear they can even pull it off next year.

Back to your question about the bottom the oil is still coming in and will for the next several weeks the bottom from fundamentals seems to be timed to be in late Sept early Oct i.e we will have plenty of oil on hand and winter demand is still low. However demand is rebounding nicely so I think the price will bottom out a bit earlier. In my opinion the fundamental bottom for price is $80 a barrel but rebounding demand will cause use to hit a floor higher up my guess is $110. But the whole game is and attempt to ensure prices are still felt to be low before the Nov. elections. The target seems to be to reach $80 or so by Oct we will see.

Whats more interesting is NG prices since this one is trickier we have not gotten a flood of NG from imports and the ability to hold down NG prices is probably more market manipulation then fundamentals. I'm fascinated to see if they can manage to keep NG prices low during this time period. We would have to see some serious injections into storage despite the low prices over the coming weeks to keep NG down. I suspect they have it all under control and we will see enough NG injections to push us up towards the top of the average range even as prices fall. The reason I think they will do this is because on the NG side the producers probably hedged like crazy in preparation for this big push while prices where high. They can afford to let the near term contract prices fall off a cliff. This is actually no grand conspiracy the North American NG market has this sort of dynamic. Prices increase the producers play the NG market and then short it before they open the taps. Its naturally a fairly rigged market that is intrinsically a pump and dump. So all I care about is if they can actually pull off the injections while prices are falling if not then NG will firm up and put a hard floor under oil nothing they can do about it.

One hurricane and this master plan is blown however.

Thanks for your insight, memmel. Your above posts have confirmed my suspicions, and I'm selling my Option for Oct Crude, and eating the loss. Get back in next month or when a cyclone hits or something.

I think that if I'd bought Dec or Jan Options, I'd have been on the money, as it were.

Cheers.

Wow I'd not sell I think your loss in Oct if there is one is pretty much priced in now. A hurricane in the Gulf is not out of the question and the US is still bumping around MOL. I'd say the chances of loosing a lot more money are slim and the chances of breaking even or even making a small profit in Oct are non-zero.

Also understand that prices are incredibly unstable right now they could go up 10 dollars or more tomorrow if Israel bombs Iran. At the moment your looking for a event to save your but but on the other hand your probably not going to suffer any greater losses.

Its your call and I don't give investment advice I'm just saying that in this particular case you may just be locking in a loss that could be quickly reversed in this volatile market.

If your option was at 140 or so then yeah your probably have eaten it.

Personally I don't like oil options or futures during this period since they a really volatile and on good hurricane the day after you take your losses makes you feel miserable.

The problem with this time of year is demand is low and refinery maintenance is not happening refiners have quite a bit of discretion in product mix gasoline, heating oil diesel etc. Its a bad time to buy.

But if you consider it a bet on a hurricane then YMMV.

I ate it. :D

But now we see fighting within a stones throw of the pipeline running through Georgia, so up prices go again, I expect.

memmel

"So in my opinion syngas like solutions are solutions looking for a problem." --

That seems (to me) to clearly contradict the overall theme of the article, eg. "The problem is the shortage of natural gas needed to upgrade tar sands bitumen to light sweet crude".

I'll try to clarify once your playing games with partial oxidation and syn gas production your better off sending the syngas off into making petrochemicals its too valuable to be burned. Next your getting the hydrogen from water not from the original hydrogen content so synthesis of liquid fuels from syngas esp when coupled with some NG really reduce the starting material to a carbon source the hydrogen can be managed by the amount of C02 produced. Thus once your reduced to this route then coal and coke from more traditional heavy sour oils become viable your tar sands are effectively reduced to a poor source of coal you just as well do CTL or better combined CTL/GTL. The tar sands cannot compete with coal over the short term. So if partial oxidation become cost effective then the numbers should be better for coal if you have the water. But even with coal if you really need to go this route then it means the petrochemical industry is short NG and its willing to pay more than people trying to make liquid fuels.

I just cannot see us being able to keep demand for liquid fuels high enough to make large scale use of partial oxidation a viable way to meet demand since other more vital markets would have to be displaced to do this. We have to keep making electricity and fertilizer we don't have to keep the SUV's fueled.

That is more or less how I understand the concept behind Odum's emergy. Horse eats hay, produces 1/10 the horsepower of the hay which itself is 1/10 the original insolation (probably less). The quality is vastly improved and concentrated but at a large cost along the way.

Where I posted way above about quality being equal - what I was more interested in was the sort of non-linearities memmel brought up where NG is used to refine heavy oil. Thanks.

cfm in Gray, ME

Memmel

Thanks for that I assume this is what you were alluding to recently. If this is the case (and I have no reason to doubt you) then refining heavy sour crude, like corn ethanol degrades to a gas to liquids process. Another scenario is that you discount the heavy crude based on its tar content and dump the tar (Which doesn't look good for tar sands syncrude)

We are then back in the situation of continued supply of liquid fuel obscures the impending decline of liquid fuel and hence we continue business as usual.

What we then need is data on tar content of crude production and the NG requirement to process Tar

Neven

Have you shot an email to Robert Rapier?

We had a few arguments so I dunno if he will talk with me. I'll try and bring up the subject with him if I get the chance. However someone who works for Valero would be a better choice.

I did not get the impression that Robert worked with complex refining with cokers etc.

I do get the impression that in the US at least these complex refineries are very much custom jobs with each plant being fairly unique. The reason you can't find good data about complex refining is simply that its not a unified concept with a lot of variation plant to plant.

http://www.aspentech.com/publication_files/HydrocarbonEngineeringJan2005...

In this paper on page two Valero puts purchased energy at 17% assuming that this is a mix of electric and NG lets guess that NG purchases make up say 10% ?

They give numbers for a Houston refinery. It processes 135,000 bpd of oil and uses 17.7 MMSCFD of NG and 28.6 MMSCFD of sweet gas ??

So assuming you can add the two together 46.2 MMSCFD

1 MMSCF of natural gas = 172.3 barrels of crude oil equivalent

So the NG inputs seem to be 7960 boe per day however this does not seem to fit with the NG import costs of

$4084/h NG import costs. In any case as you can see we can't seem to easily get the amount actually used in complex refining and its not clear that this refinery is even complex it seems to be a simple one.

Indeed it turns out to be one that handles "medium crudes".

http://www.valero.com/AboutUs/Refineries/Houston.htm

So :)

But this shows you what I run into when I try to figure out NG usage and NG usage for sour heavy crudes the info really does not seem to exist.

Found this really fantastic link on delayed coking

http://www.coking.com/DECOKTUT.pdf

No energy usage is discussed but you can see from the temperatures employed and amount of steam used on a btu basis its pretty high.

Here looks like a good paper looking at then energy usage cant get at it though.

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6V2S-4C835VP-5...

In any case the key result is that about 50% of our oil is of the heavy sour variety. About 50% of that is basically asphalt requiring significant upgrading just like the tar sands in canada. On a btu basis this

upgrading has a low EROI on the order of 1:1 or 2:1. The btu's for delayed cokers are supplied primarily from NG or burning the volatile components of the oil.

Once NG supplies become constrained and NG prices approach parity with oil on a BTU basis we effectively lose this 25% immediately. The EROI cliff thus causes energy intensive transformations to no longer make sense once the feed stocks are price competitive on a btu basis. This holds for the energy intensive refining process in general but processing heavy tars are the worst part of the problem. As long as we had cheap btu's from natural gas this issue is almost completely hidden but the moment we don't have cheap btu's from NG we also effectively lose the btu's from complex refining. You just as well burn the NG directly. The btu's from refining now have to be subtracted from or total energy budget once we are constrained.

Think about it this way you have a finite amount of btu's from NG once we are constrained lets say it 100 btu's.

We can either use 25 btu to create 25 btus of liquid fuel or say use 25 btu's to make rail for a electric rail road the choice becomes one or the other not both. While we could grow NG supplies you did not really have to make this choice since you have the option of increasing supply to 125.

Energy quality suddenly becomes a huge issue as you run into problems with EROI of original energy sources supply and the Energy costs of transformations. Basically overnight decisions on where to use our finite btu's are competitive thus putting them into refining takes them away from other uses such as manufacturing or electricity generation since supply is no longer growing. And prices of energy per btu tend to converge.

Unless I'm wrong its effectively the same problem in transformation as the EROI cliff as we are forced to decide where and how we want to use or btu's with any decision having a negative impact on other parts of our economy. Using energy for frivolous personal transportation starts to have a direct negative impact on our economy. And it seems to be big in the sense that once we are constrained and can no longer grow or btu budget from any source coal, NG, Oil then we have to effectively balance the budget and subtract like 25% of our current energy usage from the economic growth model. Before this since we could always grow one of these sources we did not have to subtract since increased usage generated higher production.

It seems very similar to the case that you no longer have access to credit and have to operate within a balanced budget suddenly your force to actually subtract out expenses. This btu issue seems to be the same sort of problem. Just looking around it seems that since 2006 we seem to have reached this point that we have a lot less energy available for regular economic activity its pretty obvious that even though the total amount of oil supplied today is about the same as in 2006 we are substantially worse of now then we where then. This indicates that free btu's from the economy outside of transportation have dropped quite a bit.

Certainly financial excess of the past are part of the problem but overall costs have risen substantially even if you include the financial issues. For a lot of us cost of living has almost doubled in just two years. I don' drive a lot but my food bill for example has about doubled while my wages have remained flat.

Fuel cost certainly have along with the costs of a wide array of goods and services.

So just looking around we seem to have indeed gone over some sort of EROI type of cliff over the last three years.

memmel,

Interesting numbers: 135,000 bo/46.3 mmcf = 0.35 mcf per bbl. That's if I followed your numbers correctly. Well head gas prices are running around $12/mcf these days. Don't know for sure but lets say the refiners are paying 3X well head price. This would mean they're burning about $12 of NG per bbl refined. As I work at the far end of the refiners I have no idea if this is close to right but it seems like a rather low NG feed stock cost per bbl refined. Does this come close to fitting the picture you're putting together?

Note that that was a "medium oil" refinery not a heavy sour but yeah that seems to be about right for a medium refinery near as I can figure it. Light sweet is probably half that.

Heavy sour crudes seem to be twice to three times this number so last time I figured it out to refine a heavy sour crude seems to require about 30 dollars per barrel of NG with NG at about 10 and oil at about 120.

Basically on a btu basis the NG input to process the residuals is basically equal to that of the oil itself.

So say you take the NG price at $12 mcf *6 == $60 a boe. If the oil is 50% resid then you need half that i.e