Where can I find up-to-date rigorous peak oil projections?

Posted by Gail the Actuary on August 30, 2010 - 10:30am

This is a letter I received from a reader (with the name changed). Below the fold is an expanded version of my answer to him. I would be interested in what other people's thoughts are on this subject as well.

Hello,

My name is John Smith. I have been following the peak oil situation since about 2005. A few years back I thought I had a handle on what I could expect from peak oil. Then, the recession hit, and changed (delayed) everything.

My problem is, I have not seen an rigorous peak oil studies/projections that take recent events into account on peak oil projections going forward. As an expert on the subject, could you please point me to some literature that would be of help?

I do not know what the future holds, but it is clear to me that realities have changed, and with it, the timeline of peak oil.

Regards,

John

Dear John,

Curve fitting techniques including Hubbert Linearization, and forecasts based on amounts of reserves and dates of discovery, can be useful tools but, unfortunately, they provide only rough estimates. Now that we are so close to the peak oil date, the deficiencies of these techniques become more of a problem, because a difference of 5 or 10 years in peak date becomes more of an issue.

One thing that these techniques do not tell us is how much oil is really economic. In a way, this is equivalent to saying that these techniques do not tell us how much oil has a high enough Energy Return on Energy Invested (EROEI) that it really can be recovered and sold at a price that customers can afford. We are only now learning what this price might be. A rough estimate is that if the prices are above about $85 a barrel, they will send the economy into recession. It may be that in some places, enhanced oil recovery can be economically used, while in other places it is too expensive, and reserves should be adjusted accordingly.

Another problem with this type of technique is that these techniques were developed in a period when the world economy was growing rapidly, and it was reasonable to assume that the world economy would continue to grow rapidly. Thus, it seemed reasonable to assume that as much oil as could be produced, would be produced. But once oil production starts hitting economic limits, it sends the economy into a downward spiral. Instead of inadequate supply, what one gets is inadequate demand, because the value that the oil can produce is too low to provide consumers enough benefit that they can afford to buy high priced oil, plus all of the other goods they need to sustain their lifestyles. It is not clear that these techniques model inadequate demand as well.

It seems to me that what one really needs is models which consider both geological factors and economic factors, but at this point, I don't think we really have good models of this type. It is not just recession that is an issue, either. For example, if a country's tax rate on oil companies goes up, I would expect oil production to go down. It may be higher tax rates on oil companies that bring us down off the current peak oil plateau--not geological constraints.

It would probably also be helpful to adjust the models to reflect improvements in technology. If a better method is developed for extracting very heavy oil, for example, extraction of some such oil may become economic, when it has not been in the past.

Recent Forecasts

We published one recent post showing peak oil projections, but which did not look at economic issues. This was Steve Mohr's thesis. He used several techniques which give a range of peak oil dates from 2005 to 2019. Regarding OPEC Oil Production, in his thesis paper itself, he says, "OPEC oil production peaks broadly in line with literature peak dates which range from 2008 to 2042." All of these are very broad ranges.

Another recent estimate of peak oil dates is Forecasting World Crude Oil Production Using Multicyclic Hubbert Model by Ibrahim Sami Nashawi, Adel Malallah, and Mohammed Al-Bisharah of Kuwait University, published in March 2010. This model estimates a peak date of 2014. It was discussed a bit in Drumbeat. It also does not consider economic issues.

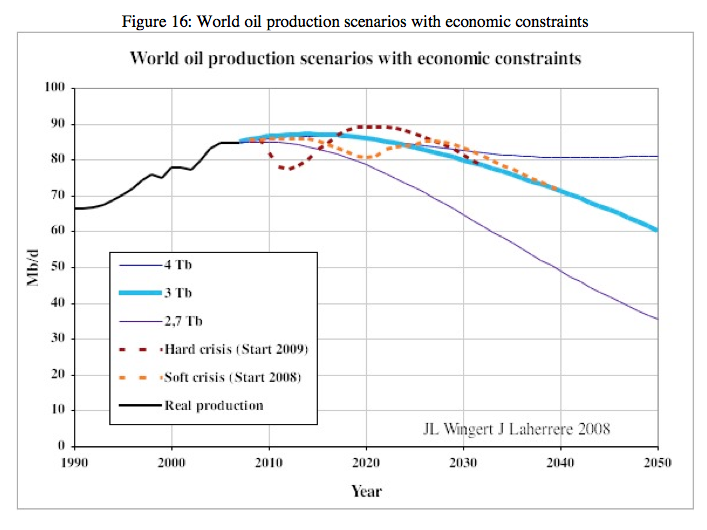

Jean LaHerrere and Jean Luc Wingert published an analysis in October 2008 called Forecast of liquids production assuming strong economic constraints. It develops a peak date range of 2012 to 2027. It concludes:

Since 2001 we in ASPO France have claimed that future oil production will be a bumpy plateau with chaotic oil price, but we did not plot any curve, only saying that the smooth peak model (below-ground constraint only) with the estimated ultimate could be disturbed by above-ground constraints. The strong financial crisis the world is now facing will of course have some impact on the world economical situation and oil consumption. Is the financial system going to collapse or not and how quickly is it going to recover? We do not try to answer these questions but imagined two crisis models. Reality will probably be none of the two but we can see that with these simple scenarios, the possible oil peak dates vary below 90 Mb/d from 2012 to 2027 with the same ultimate of 3 Tb. The tensions on oil production will be realised for some years, the risk would be to forget the necessary efforts that have to be made to increase our energy efficiency.

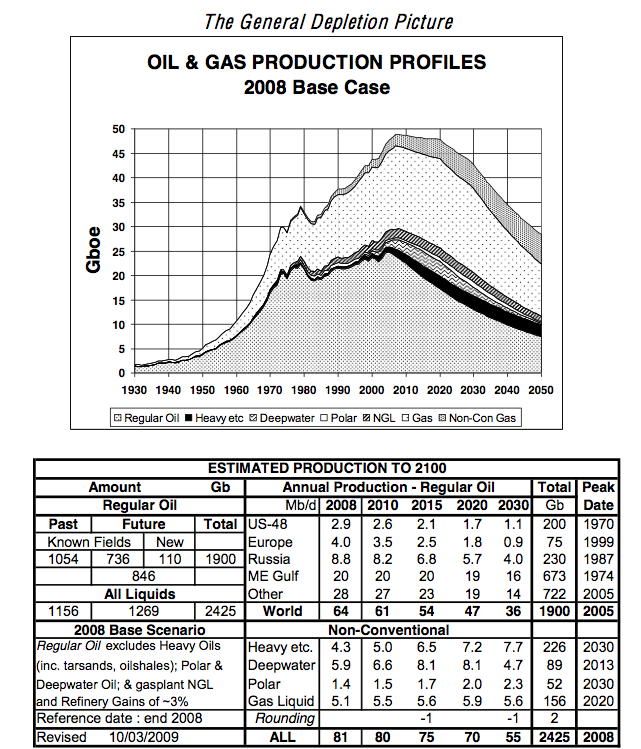

Colin Campbell used to publish forecasts of world oil production, but retired from this after ASPO Ireland's Newsletter 100 in April 2009. In the final newsletter, this forecast was shown:

Dr. Campbell's forecasts did not particularly take into account economic conditions, as far as I know. He expected oil production to decline after 2008.

There have also been a number of forecasts based on analyses of oil megaprojects, by Chris Skrebowski and by "ace" (Tony Eriksen) and by Sam Foucher. These studies are fairly different from the general modeling done by others, mentioned above, in that they look specifically at large known projects, and when they are expected to be online, and compare these to expected losses in oil production due to natural declines in oil production. They require keeping abreast of a large amount of detail data, and even then a considerable amount of judgment is required: If capacity of a given amount will be added, how much will really be produced, and for how long? How much impact will infill drilling and enhanced oil recovery have? The most recent projection of this type that we published was by "ace". It was published in November 2009, and showed oil production declining production after that date.

Information on Connection between Oil Production and Recession

If you want to read more about the connection between oil prices and recession, one possibility is Jeff Rubin's book, "Why Your World is about to get a Whole Lot Smaller." I have also written about the issue, for example, in this post and this post and this post.

We will continue to run posts forecasting future oil production, using modeling techniques, as they become available.

Thanks for asking.

Sincerely,

Gail Tverberg, Editor

The Oil Drum

Would Chindia's domestic needs of energy be insulated from an otherwise global recession or falldown, or do you think European and NA markets are still vital to their consumption rates? I would suspect that if the economy continues to be flat it will eventually spread to the remaining islands of pent up need. What is your opinion on this?

Thanks in advance..

Paul

In the short term, Chindia's domestic needs will be subject to global market forces. In the medium and long term, they will be insulated to a large degree as their economies adapt and internalize, thus driving domestic demand. In the long term, what ever slack the western world allows for in energy production Chindia will pick up with obvious exceptions for, say, natural gas which is not easily transported over long distances. Coal suffers from a similar problem but to a lesser degree than natural gas.

IMO, Buffet's acquisition of BNSF will seal his legacy as an investor. I'd be willing to bet that the U.S. begins exporting coal to China within a decade.

China's 10% economic growth rate since the reforms of the 70s doesn't suggest they will be insulated to me. They are already very dependent on international material inputs and due to peak in their own coal production in the next decade. They will not be able to scale up domestic demand fast enough to offset national (peak coal) and international (peak oil) energy constraints.

I have some questions too, about China being able to keep its growth up very long, independent of the rest of the world. I think Liebig's Law of the Minimum gets to be an issue, too. If electric power plants are set up for coal, and there is not enough coal available, this could cause a major problem. Or the problem could be water availability--a real issue for China right now.

If China sucks too many resources from their overseas market then they may damage their consumers (USA et al) affecting their own sales and growth.

NAOM

The Liebig's minimum for them and about everyone else might be livable climate. China has decommissioned over 1000 old coal plants over the last three years. These were very inefficient and dirty. But they also supplied a continuous stream of aerosols to the atmosphere that helped block out sun and kept from .5 to 4 degrees C of AGW from being manifest.

With these old plants being decommissioned, we are likely to see some of that delayed warming coming on strong in the next few years. And we're at the beginning of another active solar cycle.

But oceanic overturn could cool things down, too, so who knows. The really big tipping points are likely to be in the Arctic--loss of sea ice cover will have wild and largely unpredictable effects on most areas in the upper Northern Hemisphere; continued melting tundra and sea bottom clathrates will be releasing increasing amounts of CO2 and methane in one of many reinforcing feedbacks now underway.

We tend to think we are verging on hyperbole when we talk about PO threatening civilization. But that construct is very recent--only some very few thousands of years old. We are threatening living communities and planetary balances that are millions to hundred of millions of years old.

There is no "civilization," only varying degrees of Barbarism. If humanity exercised civility, there would be no wars, no racism, no exploitation, and the crises Global Warming and Peak Oil wouldn't exist. Humanity's inability to evolve into a civil whole at the same pace as its technological advances will be the cause of Humanity's collapse.

This is kind of going OT but you have to remember that humans are animals and that, as animals, we seek to propagate our own genetic material. We do this by acquiring more and more colorful feathers*. Thinking in these terms rationalizes many human actions and immediately quashes any idea of a collective utopia.

*just as a bird builds a better nest or a better positioned nest to attract a mate, we humans do what we can to build a bigger and/or better home to attract a mate. We acquire "feathers" such as a nice car, a nice hair cut, nice clothes, breast implants, porcelain veneers, etc. to further this end. You might find a hand full of academically inclined people that do not think this way but they are very much the minority.

No other animal has fouled its 'nest' (along with everyone else's) quite so thoroughly as our lovely species has.

At the global level, human behavior (particularly the behavior of global industrial society) has no good parallel in nature. (Perhaps, if you went back to the first oxygen producing micro-organisms that poisoned the atmosphere for most other species around at the time you'd have something close--but my paleo-biology is not what it could be, so I could be wrong here.)

With a nod to Totoneila, yeast do a pretty good job at fouling their nests:

Like wine? It's 14% alcohol because no matter how much sugar you start with, the poor yeasties kill themselves off with their EtOH waste when it hits 14%.

Like beer? Brewers start with less sugar than vintners, and the yeasties gobble it all up until it's gone (at about 5% EtOH) then croak 'cause there's no more food left.

So, given that humans probably aren't smarter than yeast, the next couple of decades should answer the question of wine or beer for the human species, IMHO.

Well, when WE put them in a contained, artificial environment, yes. They generally end up in some kind of equilibrium in nature.

The main point is that we have managed to foul everyone else's nest along with ours.

You are merely describing one facet of Barbarity. When the power wielded is compared to the capacity to control that power, humans are extremely primitive and have a long way to go to become civilized. Humans can talk a good game, but actions always speak louder than words.

If humanity were civilized, we would have a;ready implemented the Oil Depletion Protocol, thrown Capitalism under the bus and embarked upon intensive efforts to rollback Global Warming, which are just three of the very many major changes in human behaviors and sociocultural arrangements that would be in place.

Although China is suffering from some serious environmental problems including the worst rates of desertification in the world they can to some extent offset these as long as there is available energy eg importing food and water to constrained provinces if need be.

The same can be said for material inputs nessesary for the production of goods.

To keep the economy growing they have proposed a plan to move another 150 million or so from the countryside to the cities. So they will have adequate labour and slowly increase domestic demand.

So I agree with Gail that Liebig's law will kick in and adversly affect the Chinese economy because of energy constraints but its too much of a close run thing between coal and oil to say exactly which.

I think Rubin's book is called "Why Your World is about to get a Whole Lot Smaller". I can vouch for the fact that it's an excellent source, though.

The world is very close to producing the maximum amount of oil possible -- there was a temporary blip but the economic recession did not significantly change the timeline of peak oil, IMO. I would guess that world production of conventional crude is under 70 mbd by 2015.

Let's also keep Sam Foucher's running totals of predictions in mind for questions like these;

Thanks, Will!

Sam's post is really a summary of other peoples forecasts, of different types. The one you link to is from July 2009. I believe that summary is his most recent one of this type.

I was going to link to that if someone didn't do the deed. I don't know how to calculate the mean absolute scaled error like Sam did, but plugging in EIA numbers for the 5 month average for 2010 we get these diffs in the published forecasts for this year:

It's endlessly amusing that the population based forecast is more accurate than most of the human ones. Maybe we should just feed some petroleum variant of Moore's Law into the machine.

Also note that Rembrandt says AL capacity at the moment is around 90 mb/d now. That would make his own forecast one of the more accurate ones. If anyone wants to mess around with Sam's numbers here is my spreadsheet: Sam Foucher - 2009 Forecast Roundup (OpenOffice .ods file)

Great article, thanks.

(Btw: quixotic is right in both ways)

I'd like to add that there is an important source of peakoil projections you have not mentioned:

http://www.peakoil.net/publications/peer-reviewed-articles

Especially Kjell Aleklett's work is generally seen as authoritative in many fields. The link above provides usefull literature including some of his work.

That is a good point about estimates being made by Kjell Aleklett's group.

One thing I have noticed about some of these estimates is that rather than being what I would consider "best" estimates of when production will begin to decline, they are designed to put a "box" around when production will decline, using approaches that are on the optimistic side for what can really be produced. In this way, they tell the public that there is a problem ahead, without being accused of being unduly pessimistic. Thus, their estimates are in the range of what might be expected, with perhaps some bias toward optimism.

I've been preparing for Peak Oil for over 3 years now and made some short videos showing people what they could do to better prepare. I attached one of the videos here.

http://www.youtube.com/watch?v=hHmXhgBhtWk

MrEnergyCzar

memo to:john smith

from:elwood

re: rigorous peak oil projections

you will know it when you see it in the rearview mirror.

two methods, 1)past performance and 2)megaproject forecasts. the megaproject approach has a chronic lack of current reliable data and past performance is well.............viewable in the rearview mirror.

I think in many ways, what is important is the date the plateau in oil production started, which is about 2005. World oil production is no longer growing, and this is putting a downward pull on the world economy. Exactly when world oil production will start downward is perhaps not all that important, and is difficult to model. This is one reason that some of the folks who have spent time doing modeling of this type are no longer doing this modeling.

My guess is that the downward trend in oil production will be started by increased taxes on oil companies. Right now, governments around the world need more taxes, and governments often feel that oil and gas companies can easily have their taxes raised, without too much public outcry (especially compared to raising individual taxes). They expect that somehow, these higher taxes can be passed through to the public, through higher oil prices. But it is not clear this is really the case. Instead, if taxes on say, the output of stripper wells in the US, are raised, I expect less of this oil will be produced. Oil prices may rise briefly, but the primary effect of the change will be recessionary, rather than higher oil prices.

Increased taxes on the general population could also have an effect--causing recession in the parts of the world with higher taxes. This loss of demand may be made up elsewhere over time, though.

Another wild card is geopolitical risk, in places like Mexico and other oil exporting nations. Modeling doesn't really value this well.

Add to that, for those who are sensitive to NET energy available, the fact that decreasing EROI all the while is nibbling away at the energy flow into the economy. Our economic system is dependent on growth, which is only possible when exergy flows (meaning net energies of the right kind and potential) are increasing. Not only has gross production in oil leveled off, but the net has already been declining (at least as shown in models). This recession is no surprise since all economic activity requires exergy.

Question Everything

George

Net energy (including coal and gas) increased rapidly right up to 2008. The energy plateau has only just started! The economic fallout is only just beginning!

I would sincerely like to know how you figure that since accounting hasn't been explicitly done on net energy. What data are you looking at? Models based on EROI estimates suggest that net (from oil anyway) started decelerating as much as 30 years ago and probably peaked a decade ago. EROI of coal has been steadily declining with mountain top removal (strip mining) and of natural gas with non-conventional (horizontal drilling and fracking). So I suspect that the net from these sources is near the inflection point with peak net to follow within another twenty years.

As I said, all of this is based on models and our best estimates of EROI since we don't keep explicit data on net energy. Our only data is for gross extraction (barrels of oil) which tells us nothing about net unless we factor in the energy cost of obtaining energy.

I think that Christoph-r is assuming that through 2008, the large ramp up in coal production, particularly in China, plus smaller ramp-ups of natural gas production, is enough to offset the net energy decline of oil. I am not sure if that is true--it seems like it is in the range of the possible.

Thanks Gail. That was the assumption that I was making.

I have a further observation that I find particularly worrying. The energy crisis we have had so far has been an oil energy crisis. Although the cost of coal and natural gas increased, the increase was far less than for oil. If China requires large coal imports in the near future, the cost of coal imports (and as a result LNG imports, as they are to some degree interchangeable for electricity generation) will explode from a production cost driven price to a demand driven price. The resulting effect will be very large increases in the electricity price for all importing nations. I am still trying to work out the implications of this, but the result will not be very nice, as fully developed nations cannot function without a good supply of electricity. At any rate it will hit Europe and Japan much harder than the USA.

"At any rate it will hit Europe and Japan much harder than the USA."

Why? Coal producers in the United States are

going to sell to the highest paying market so

prices will go up.

Historically, only Eastern coal has been sold for export, I believe. Western coal has much lower energy per unit of volume. I am not sure there are enough railroads either, beyond what are needed for transporting Western coal of places where it is used. I believe there would have to be changes to the electricity generating plants as well, to adapt them to using the low-heat content Western coal. It would be possible over time, but it would take some effort, I would think.

Western coal is too far from the ports for it to effectively compete against Australian coal in the Asian market. There'll be some exports when they are seeking a specific kind of coal, but not much.

Agreed. The U.S. still has vast untapped reservers. We can dig that out of the ground, put it on a train, and ship it over to China when the time is right. As a kicker, there's a lot of coal we haven't bothered to mine because it is either of low energy density (lignite in west Texas) or it is too high in sulfur (much of the bituminous and anthracite coal).

This is one of the few ways I see the U.S. repaying its debt to China. Berkshire Hathaway is going to make a killing along the way.

At $50/ton delivered, and with a 33% effective tax rate, we would need to export ~60billion tons of coal. These are horribly back of the envelope but it shows the feasibility of such an idea. There are 80 billion tons in the powder river basin alone (assuming a market price of $60/ton according to the USGS).

I think people might be talking past each other here. As I understand it, your "energy produced" chart is not NET energy--that is, it does not figure in EROEI.

As we know, this is a devilishly tricky estimate to make, but shortonoil (over at Peak Oil Forums) and others who have tried tend to come up with what mobius said--peak in net available energy was a bit over ten years ago. Some point out that this is also when oil started it's exponential price rise.

As I recall, his estimation was that, as far as crude oil goes, we only have about 12% of left to extract from that source out of the total available energy that was there when oil first started being developed.

@ Gail,

But this is comparing apples and oranges. We don't know what the huge ramp up of coal (and smaller of gas) costs in energy expended so we don't know what the net of those are either. All we know for sure is that energy costs to get energy are going up for all fossil fuels.

And, I was largely referring to the United States re: impact of peak net on the economy. Clearly China has still been in growth mode (or so the GDP numbers suggest) so they must have an increasing net flow. I suspect, however, that it is already past the negative (deceleration) inflection point on its way to peaking in another decade or so. A lot will depend on how much energy they expend to get the coal (or oil or gas) they burn.

George

The oil companies always say they should not be taxed.

Retrospectively it seems clear that taxes on oil over the last thirty years would have discouraged production leading to more oil in the ground now, and less disruption currently.

Prospectively is always less clear, but it seems to me that oil 30 years from now to power combines or railroad locomotives might be a far better plan than burning it in SUVs now.

The simplest cause and effect relationship should be that depression makes peak oil come earlier, because existing fields continue to depleted, but investment in new and more expensive fields is delayed. This will also make the decline more gradual or bumpy, since more deferred prospects will be available to come on line later.

I wonder if recession leaves more oil in the ground than what some people have assumed is really available.

If it weren't for recession, oil prices would be higher, making it economic to extract oil that is higher-cost to extract. The lower price available cuts off the high-cost-to-extract oil (really, the low EROI oil).

In my view, the real question is how optimistic or pessimistic estimates of resources are, relative to what is truly economic. Those making estimates can point to practically any amount of oil that is theoretically in the ground--that is why CERA can make such high estimates. But if it is not possible to extract this oil at a price which consumers can really afford, it is really an illusion that it is available in the first place.

If it weren't for recessions, we would dream of extracting what is in fact very low EROI oil. Having recessions points out the futility of doing so.

This tread suggests chronic recession and thus a longer plateau.

In much of the Peak Oil modeling, there appears to be the underlying assumption that: oil reserves and the costs of production are well known, and oil which can be economically produced will be produced. It is not clear that either of these assumptions are correct.

Oil reserves and the details of formations which would determine cost of production are information that would be closely held by countries and by private organizations. The profitability of producting a given opportunity is not well known because of geological uncertainty, technological risk, and future market pricing risk.

Furthermore, it may be national policy or corporate strategy to produce a field at below its economically feasible rate in order to stretch revenues or to sell oil later for greater profit.

Lastly, countries may subsidize production which would normally be thought of as economically unprofitable in order to achieve "energy independence" and/or to produce a commodity that can be exported for foreign exchange needed to buy other critical goods.

I know of no one in the peak oil camp who says that oil reserves are well known. In fact, most, including myself, have argued that the exact opposite. And production costs are all over the map. It is assumed that deep sea oil, and especially sub-salt oil, will be very expensive to produce. I know of no one who has put a price per barrel on production costs however. Very expensive is the only phrase that anyone can seem to agree on.

Well, that is exactly what is happening right now. Every nation on earth except Kuwait, Saudi Arabia and the UAE is producing flat out. $75 oil has everyone pumping every barrel possible. Of course there is risk in everything. But if a company were not reasonably sure they could make a profit they will not drill the well.

That makes no sense whatsoever. It is the drilling and start up costs that are factors in deciding whether to develop a field or not. Once the field has been drilled and pipelines laid, the costs after that is only a few dollars per barrel. It is hard to produce a field below its economically feasible rate after it has already been developed. Some wells in Texas produce less than 10 barrels per day... and they make a profit.

And development costs falls under the previous risk estimate. "Are we reasonably certain that it will make a profit?" If the answer is yes it will be developed. If no it will not be developed.

Ron P.

In that case, there is no way to determine if/when peak oil will happen.

Venezuela, Iran, Myanmar, Iraq? I really doubt whether any of those are "producing flat out" except in the sense that they are producing as much as they can in the absence of new investment. Some other areas, such as ANWR, offshore CA, and South China Sea are not being developed as fast as economically possible.

I agree that once a project is implemented the marginal costs of continued operation are very low. This is why I focused on the decision making that goes into new projects and investments. These may be projects to further develop existing fields through advanced recovery techniques or projects to drill and develop new prospects. There are a whole variety of economic and non-economic reasons why new projects are not being implemented. The decision making is not up to private oil companies. Most of the world's reserves are controled by countries and state-controlled oil companies.

You have not been paying attention Merrill. We all say that picking the date of the peak is just a guess and that we will only know for sure by looking into the rear view mirror. Peak oil is when the flow of oil out of the ground peaks.

Yes, most definitely those nations are producing flat out. Myanmar? Myanmar produces less than 20,000 barrels of crude per day. Why would you mention them? Anyway producing flat out means you are producing every barrel you possibly can with the money you have. What they might be able to produce if they had enough money and if oil was $200 a barrel is another story. The fact they are producing flat out and their production is declining.

As far as OPEC nations producing flat out and those that are not, please see my TOD article HERE.

Of course there are. I have never denied that. I was speaking of projects that are being developed and have already been developed. Only three nations in the whole world do not have their taps fully opened. My above link covers that. That may change soon however. When peak oil becomes obvious and a panic among nations sets in, we will see hording on a grand scale. At least I believe we will.

Myanmar link: Total: Oil and Gas in Myanmar

Ron P.

Good points. Just to reiterate the obvious--the main point of Simmons' book was that we don't know (or didn't then) how much oil is below Saudi sands. Much of the discussion in the first few years on this forum was about what kinds of proxies were the best determinants of how much oil the Saudis had.

But not knowing precisely is not the same as not knowing anything.

Matt's main beef was to get accurate data.

However, as an investor, I am aware that the rules relating to the disclosure of reserves envourage gross understatement in most jurisdictions. For explorers, that is probably appropriate; but for some larger organisations the reserves can be understated up to (a factor of) 5-10 times.

For many OPEC countries including the Saudis, the disclosure of reserves is a state secret. It is even hard to determine what their surplus capacity really is.

Technology is also a game changer for timing of the peak. I don't just mean what is happening with multi-lateral horizontal drilling with multi-fracking. However what happened with that inovation in the Barnett Shale play, opened up the opportunity to change the supply of gas from many other plays and to the realistic exploitation of oil plays in places like the Bakken and even mature oil pools like the Cardium. Inovation in one area leads to inovation in others.

Of greater potential significance is the work being done in the Canadian oil sands patch - which in turn can be carried to the Orinoco or North Africa. OK there are a number of technological initiatives and this is very much work in progress, but will it extend the current supply plateau or not?

Then we have the exploration uncertainties....

Given the lack of precision on current true reserves and given the new technology being brought into play and given way in which new technology has the ability to change the proportion of a field that is recoverable, IMHO it is impossible to say when peak oil will occur.

The only things we know for certain are:

1. July 2008 seems to have been the peak in supply thus far, and

2. The geological environment is not making us any more oil for this century than is already laid down. Whether found or not.

I wonder how many agree with this?

kind regards

ei

China secures Myanmar energy route

The gas would seem quite useful for China's interior southern provinces. And an oil pipeline that bypasses the Malacca Strait is highly strategic.

Ouch!

Of course, we are already producing such oil--tar sands.

Natural gas is cheap, so it is possible to make a lower EROI work than if they fuel source were primarily oil, instead.

Also, I expect tar sands EROI has been improving, with technological advances. It is still not great, but some of it may be in the 5 -6 range, rather than 3 range. If the price drops below $70 barrel for long, I expect we will see most future developments put on hold.

Gail, could you possibly link this?

Oil sands companies don't really think in those terms. They tend to use steam-oil ratio (SOR), which is volume of steam injected (reduced to a cold water equivalent) to volume of oil produced. Typical SORs in the oil sands range from 2.2 (Cenovus Christina Lake) to 5.8 (Nexen Long Lake). see http://communities.canada.com/calgaryherald/blogs/pipeline/default.aspx and http://www.cenovus.com/operations/technology/sor.html

It's relatively easy to convert steam volumes to energy equivalents using the heat of vaporization of steam using widely available reference works. Feel free to do that yourself because it's boring and I'm retired and don't get paid to do it any more.

The companies are not really concerned about the actual energy inputs in gigagajoules versus outputs in gigajoules because the bottom line is the bottom line on the financial report, and it's in dollars. At this point in time, oil is expensive and natural gas is cheap, so they're not that concerned about energy costs.

The issue is that as technology improves, the amount of inputs required from outside goes down. For example, the heating temperature of the open pit method is not much lower than it used to be, and more efficient methods of mining are being used. With the open pit mining operation I saw at Syncrude, they claimed EROI was 6:1, but I expect that did not include the energy embedded in the equipment. The EROI would seem to include the entire process including upgrading, but not refining, since it was all done at that one location.

In the same post I note that I was told that the EROI for the SAGD operation was 6:1. When I inquired, I found out that that ratio only measured the natural gas inputs, and only took the product to the point where it was still bitumen, (which was then blended with upgraded oil from elsewhere). I know SAGD is quite a bit more expensive than open pit mining, so I would expect its EROI to be a fair amount lower than that of the open pit mining.

Dave Murphy looked at the EROI for the Toe To Heel Air Injection method of extraction, and came out with some quite high EROIs.

I know that the table Dave Murphy shows has an EROI of 2 to 4 listed, but I wonder what the date of the study was. (It is not shown.) The process has been gradually improved--so the expectation would be that the EROI would go up not down (at least for a while).

You may be missing the energy required to clean up all that wastewater. Of course, the plan could be to just leave the toxic lake to fester there for centuries. After all it is only Canada.

You're missing a couple of points yourself. The first one is that the oil sand companies recycle water, so most of what they use is produced salt water which is not fit for human or animal consumption. They just put it back into the process and keep cycling it over and over again.

The second is that they don't need to use tailings ponds at all. They could just centrifuge the tailings, put the dry tailings back into the mine, and recycle the water back into the steam generators. The only reason they use settling ponds is because they're cheap. If people keep whining about them, they'll eliminate them and go to a more expensive dry tailings process.

The government regulators don't care, because from their perspective a wet tailings process is the same as a dry tailings process. They work in terms of decades, and over the course of a few decades the tailings ponds dry up and are reclaimed.

No, I do not think I am missing much at all. Do you think folks are that foolish to think that new lake seen from outer space is filled with fresh water. That the polluted water therein does not leak through any liner that may or may not be there. That any volatiles that are in that polluted water do not wind up as air pollution. I sure the energy used to move those ¨tailings¨is in the net energy calculation. Please, sell it somewhere with less educated folk.

No, you are missing the point that they don't necessarily have to use tailings ponds at all. They only use them because they are the cheapest alternative. They are not the only alternative.

The envirobabblers like to point at them because they are highly visible. However they are not really necessary, and are not nearly as toxic as they imply - at least, they're no more toxic than the natural oil sands, which have always been somewhat toxic and have always leaked hazardous chemicals into the water. At some point they'll be reclaimed into agricultural land, which they were not originally.

If you want to see a tailings pond that is really toxic, have a look at the old Anaconda copper mine in Butte, Montana. The tailings pond contains a mixture of arsenic and sulfuric acid, sits just uphill of Butte's city water reservoir, is continuing to get bigger, and is in danger of overflowing into Butte's water supply. It's the biggest Superfund site in the US, but they don't know how to reclaim it. How many Americans know it even exists? Probably not you.

Your tax dollars at work keeping arsenic out of Butte's water supply, our tax dollars turning oil sands into new grazing land for buffalo. You worry about your problems and we'll worry about ours.

One might also question the notion of burning a relatively clean fossil fuel to produce a filthy one.

Also, are we talking about energy returned on an investment or energy returned for an energy investment?

Since 2008, the demand for oil has been more price-elastic and income-elastic than most people thought. However, we have been in a situation where supply is adequate, and taking the low hanging fruit of easy conservation measures reduces demand enough to bring prices down. As supply contracts, however, there has to be a point where the demand for oil gets a lot more inelastic and prices go way up, subect, as you say, to EROI. Oil is, after all, essential for food production and distribution, movement of other goods, and commuting to work.

In my area (NW Oregon) the economic bubble was driven by the building boom of houses no one could really afford, and as it turns out, that hardly anyone really wants-- second homes, McMansion-style oversize homes, rental projects of various sorts. Elsewhere, the boom times were driven by producing oil to physically power that housing bubble, and still elsewhere, the boom was driven by financial and media wizards providing the emotional underpinning to produce the "demand" for such stuff.

During the runup to PEAK OIL (which was apparently pretty accurately pegged at 2005 + a few years of "bumpy plateau" by various people on TOD) no one in the business of creating demand (which was, of course, what the media is all about) ever thought to ask whether we really needed all this stuff, and they made the further assumption that the the part of the world that was still mired in antediluvian "tribal" ways could be brought into the "market" and WalMartized with relative ease -- a few little dust-ups here and there, but essentially, everyone could be a lot happier buying houses and cars and riding lawnmowers on credit and the boom would go on forever supported by the new markets in Asia, Latin America, Middle East and even Africa.

Of course, there were naysayers -- but they were easily dismissed, and except for Alex Cockburn and Jim Kunstler and a few others, they have become tired and discouraged and hardly say anything any more. After all, who wants to be remembered as a Cassandra? Those who didn't descend into terminal depression went off to start organic farms and become part of intentional communities of one sort or another -- but without fanfare. I believe there is a lot more of that kind of activity than is generally recognized -- certainly it is ignored by the media.

I think the OilDrum is mostly spot-on. Most of the "predictions" have turned out to be accurate, and many people-- myself included -- have profited (an unfortunate word, we didn't necessarily profit in money terms) from that information.

I think the level of resistance to the hyperconsumption of the 1990 -2010 decades is growing, but not showing. No one wants to be a Cassandra, and no one wants to be thought of as a hypocritical prig, either. People are just retreating into a lower order of consumption -- though unfortunately, the penchant for "throwaway" plastic persists, and is proving hard to eradicate, even from the "sustainable" world.

I certainly have less knowledge than the authors of TheOilDrum about whether the "peak" oil/gas/condensate/liquids of the past decade is "real" or will be exceeded again in some distant future -- and they claim not to know -- but it seems unlikely. It is a lot of work to be a good consumer! I don't personally know anyone who longs for a return to the time when they could be commuting two hours each way to a boring job that provided lots of "money" so they could buy a 6500 sqft "home" with two mortgages, and make payments on a vacation home, a couple of cars and a boat and a plane and jet skis and snowmobiles and a giant TV and keep the kids in ballet lessons and music lessons and go to all their ball games and recitals and go out to eat at fancy restaurants every Friday and eat heated up gourmet pre-pack food all the rest of the time -- and sleep ?when, and have some kind of relationship with sig other ?when.

I look forward to a saner world than I have lived in during the last 20 years. I don't believe in the Mad Max scenarios, but I don't think it is going to be painless, either. There is a lot of suffering out there that the general American public resolutely "unsees" -- and by remaining glued to the corporate media, is prevented from seeing. But I don't believe that all those unfortunates will rise up and kill everyone, either.

Mostly, I think the OilDrum has been about the most consistently accurate recorder and mirror for our times that exists anywhere in the electronosphere, and I thank you all -- official and unofficial contributors -- very much. I also do not believe that "John Smith" is correct that "the recession changed everything." I think that many contributors to the OilDrum quite accurately predicted how that was going to play out -- and if anyone can guide us to a "soft landing", it will be people fortified with the knowledge they have obtained from the OilDrum.

A word of caution, however. Manic people never land "softly" -- but they can be sometimes be helped to avoid a total crash and burn. I would imagine the same could be said for collections of people, and maybe even empires -- though history would argue that there isn't much help for over-reaching empires.

Dear John,

When it is impossible to know just how much oil is still in the ground and how much it will cost to extract it, then every estimate carries a bit of speculation. And since no one knows for sure what the short term economic situation will be, then even more speculation is added to the mix. I say "short term" because I think there is little doubt as to how the long term economic situation will be.

Nevertheless there are some things we can say about the timing of peak oil that has a high degree of probability of being correct. The first is that cheap oil peaked in 2005. $75 dollar oil plateaued in 2005 and we have been sitting on that plateau for six years. The very fact that crude oil production has not increased in six years testifies to the fact that if more oil could be produced at that price, it would be produced.

We have learned that high oil prices has a dramatic effect on the economy. I believe that it is unlikely that oil prices will rise above $100, for any length of time, in the future. Hi oil prices drive down demand and cause the price to drop.

One more very important point. Lots of peak oil predictions buy into OPEC's enormous reserve claims. Any estimate that takes OPEC's claims as legitimate are simply wrong. A good example of such a prediction was made by Scientists from Kuwait University and Kuwait Oil Company. Kuwaiti researchers predict peak oil production in 2014. They pare OPEC reserve claims down slightly from about 1.2 trillion barrels to 909 billion barrels. Nevertheless the claim that OPEC contains 78% of remaining reserves is truly absurd.

But this prediction is a real eye opener. They are predicting the World to peak in 2014 yet OPEC, they predict, will not peak until 2026 at 53 million barrels per day. They peaked in 2008 at about 31 standard barrels per day, (not including condensate or NGLs), and are currently producing about 29.2 standard barrels per day. The idea that they will produce 22 million barrels per day above their 2008 peak is... well... wishful thinking at best.

Nevertheless they are predicting a 2014 peak. This really gives their estimate of non-OPEC production the short shift.

So what is an "up-to-date rigorous" prediction of peak oil. Actually there is no such thing because there is no up-to-date rigorous estimate of reserves or an up-to-date rigorous estimate of what the economy holds or how much of the remaining reserves can be produced at what cost. But what we do have are current production numbers. And the production numbers say we plateaued in 2005 and have remained on that plateau for six years. From this we can infer that we are at peak right now.

Ron P.

Essentially the timing of the peak is dependent on what lies are being told about reserves and production? The peak is not in doubt.

NAOM

How true. But it seems to me that the real question on everyone's mind is when does the public at large really begin to feel a fuel shortage problem? World oil production can decline at 3 MMBOPD per year but it won't be perceived as a serious problem if the world economy shrinks demand at the same rate or more. That is what happened since early 2008. Eventually, however, economic growth in China and elsewhere will push demand beyond production capacity. People will likely be surprised at how rapidly the situation deteriorates after that. A whole new psychology will take over throughout the world. It ain't likely to be pretty.

Bones,

Oil will be there, available for those willing to pay, for some decades from now. But people will slow down their gas consumption as prices grow. Prices of goods will grow because they use transportation, we will have less money to spend on transport. We will switch to vehicles using less energy, diesel, hybrids, electric, lighter and more efficient. We will reduce our weekend trips as we start feeling our personal fuel shortages, then we will move closer to our jobs.

This process has already begun, for some there already is a fuel shortage, for others there isn't. It depends on the money you have in your pocket. This is happening everywhere, in North America, Europe and China. NA citizens which will compete other people around the world for a more expensive oil. China's oil consumption will continue boosting, even though oil prices keep growing, pushing the prices up, and generating fuel shortages for many individuals everywhere. Those citizens who use more fuel will be less prepared for this situation. For this reason there will be more citizens feeling the shortages in NA than in the rest of the world.

But as all this grows up, full pockets will not feel any fuel shortages.

The capacity to adapt to the future situation depends on the expectations each one has in his life. The first step to reduce the impact of personal fuel shortages is to reduce expectations.

Peak oil will not be the end of the world, it will just be the end of many personal expectations. Just look behind how our grand-parets managed to live happy using much less energy than us.

Trabirio.

No, peak oil will not be the end of the world. I think we are at the peak right now and the world has not ended yet. You will not see really dramatic changes until we are well down the back slope of peak oil.

However how our grandparents lived is not, by any stretch of the imagination, an indication of how life will be like when fossil fuels have declined by over 50 percent. Our grandparents lived, depending on your age, at a time when the population of the world was less than one third the current population. And our grandparents lived in an agrarian world where, in most countries, the vast majority of people lived on farms.

Now one farmer produces enough food and fiber for 200 or more people. The rest must labor at other jobs to earn money to purchase what they need. If those people, or just half those people, were thrown out of work they could never go back "to how our grandparents lived". They would have no money, no land, no farm animals and no knowledge of farming even if they did.

Ron P.

People, of course, are being thrown out of work and not finding new jobs. And it's not going to get prettier.

Some are already turning to ag, even urban ag.

http://www.ci.minneapolis.mn.us/dhfs/homegrown-home.asp

No, it won't feed everybody. But as an urbanite, I'd rather see the unemployed cultivating land than robbing convenience stores (there was a triple murder at one one half block from where I live with my wife and 14 year old daughter a few months ago.) And it could serve an important role in urban food deserts where there are no fresh foods available anywhere across entire (usually poor/minority) neighborhoods.

And many recent immigrant and people driven from their US farms in the last few decades still DO know something about ag.

Trabirio:

Colin Campbell, a man I respect enormously, put it this way: it's not so much the peak that matters, it's the vision of the long decline that occurs after the peak.

I happen to agree with him. Right now, we are producing more oil than we ever have, in all of modern history - this explains the disconnect that is occurring, even though all of the technical numbers on finance and our economy seem to show the end of the world, for many people things are just continuing as usual.

This disconnect will ultimately end. The absolute key is that oil is a finite resource. It is impossible...no matter what level of consumption, no matter if consumption is not growing, to burn it in a sustainable manner. Which basically means that the entire edifice that the world is built around is not sustainable once we hit the downslope. And coal to liquid will only work until we hit peak coal! And nuclear? Until we hit peak uranium! And on and on.

This is not trivial. It means that whatever follows this, whatever lifestyle changes people make, whatever diminished expectations people have...they ultimately will have to fall farther. And farther, and farther.

And even if we did have a magical source of energy, that was everlasting, that could power industrial civilization forever...What would we do with it? Now trillions of dollars for bankers? Now quadruple Whoppers with triple cheese? Now mega mega churches-or mosques with 3000 foot minarets? Now Dodge Rams for everyone? Now 20 billion humans on earth? Now every nation with predator drones and hydrogen bombs?

Which basically points to the essential issue: despite the energy situation-which could not be bleaker-our inability to mature as a species is even worse. We have no idea what we are doing on, or to, this planet. And until we do, we are hopeless.

This shows a lack of imagination and, moreover, an entrenched and unreasonable pessimism, not just about the future, but the present. How about building healthy food co-ops? How about culture and art? How about bikeable cities with light rail for everyone? Every nation with courts and community centers and sufficient housing and birth control. It is just as easy to focus only on the good as only on the bad.

Maybe there is no infinite energy source, but if there were, I would like one.

"How about building healthy food co-ops? How about culture and art? How about bikeable cities with light rail for everyone? Every nation with courts and community centers and sufficient housing and birth control."

I have been involved in implementing most of those things in my neighborhood. So if what follows seems pessimistic to you, note that I am an activist pessimist '-)

Mostly we aren't doing these things, and I think it is most likely that we will continue to mostly not do these kinds of things.

Putting the previous posters point another way--Has our behavior with the nearly free, massive amounts of energy that have already been bestowed on us qualify us for another set of huge new sources of energy?

Maybe we should see how if we can act (collectively) in some remotely moral--or at least not in an almost completely immoral--way with much diminished quantities of energy before we are provided with another bonanza.

We need time to mature.

Unfortunately, the runaway global warming we have now triggered will not give us much time for this maturation process.

Define "peak". Is it when a 12-month rolling average stops climbing and levels out, year over year? Or, when a 12-month rolling average goes into a year over year decline?

I think you need something longer than a 12-month rolling average to have a clear visualization of peak. Five years might do it. Anything much shorter than that is essentially static.

That is why many say that you can only really see peak in the rather distant rear view mirror.

It only testifies to the fact that supply and demand are static at that price. If more oil were produced the price would go down. Since the price hasn't gone down, then either no oil can be produced at that price or someone is holding production back to maintain $75 oil.

Granted it is possible that "no more oil could be produced at that price", but this is an empirical question, not deducible from the fact that crude oil production has not increased. Demand (by definition) has not increased either.

There may be a fairly long plateau before the decline begins.

At the start of the plateau, new projects may have been started whenever the return on investment was equivalent to the ROI that investors could have gotten on other non-oil investments, taking into account adjustments of ROI for risk.

Due to the finiteness of the reserves, we may be transitioning to a world where new projects are started only when investors can earn the monopoly rate of return, i.e. the rate of return available to a monopolist who prices goods at a level where a further increase in price reduces the product of profit/unit times demand.

Of course, existing projects, with lower sunk-cost basis, would be even more profitable than new ones.

In other words, is "peak" the left shoulder or the right shoulder, or somewhere in between? Clearly the left shoulder is the demarcation point at which supply initially departs from established demand. This initial point sets a roughly constant deficit rate between established demand and the new constant supply rate. It is certainly a pain point in the evolving process. We have all experienced that pain in one way or another. Over some time some social and economic adjustments can be made to this change of business. We are seeing those adjustments manifesting themselves now. For the most part it isn't pretty.

The right shoulder is a pain point too, though much more significant I suspect. We'll all soon find out. It won't be a speculation for long. Here the supply rate starts and continues declining relative to both the original established demand and "new" adjusted demand. This transition and the subsequent social and economic repercussions must certainly be extraordinary compared to life on the plateau.

The two recently shut-down McDonalds I have seen are very pretty!

I think they are MUCH prettier now that they are shut down than when they were open for business last year and into the spring.

This is honest and real, this is what the world energy picture is. This is less garbage and waste (now only the buildings are waste products and no more paper and plastic issues forth from them.) This is eventually a future where we make our own food and talk to each other and walk. This is a future where CO2 emissions eventually go down (OK that will take a hundred years but....)

It is better now. It is pretty in that sense. The financial problems are "not pretty" I guess is the idea---most people would agree..but I want to see a wild meadow growing where those McDonalds used to be, that will be pretty.

Nice points.

You can hurry the process along a bit with some guerrilla gardening '-)

http://www.guerrillagardening.org/

As Nassim Taleb (in The Black Swan) and others have made clear, we cannot predict the future, whether for peak oil, the world economy, or demographic growth, to name only a few things. One needs only to look at past predictions to see how poor we really are at making them. If people were somehow held responsible for their predictions, which is usually not the case, then maybe they would make fewer of them.

Right now, for example, the U.N. projects that world population will reach around 9 billion by 2050 (compared to only 1.6 billion in 1900). Whether that happens or not depends in turn on what happens to energy production, including oil but also coal and natural gas.

It doesn't hurt to look at future scenarios, so long as we recognize that we don't know what will really happen. If it helps people prepare for a different future, that would be good. Peak oil will come, as will peak coal, peak natural gas, and even peak population, but putting dates on any of those peaks can only be an exercise. Future historians will tell stories about when those peaks arrived and what happened afterward.

In the short run predictions may be easier, especially for population. In 2010 the world's population will grow by about 80 million, a figure that seems not to bother most people, especially economists. In 2011 we'll add another 80 million, give or take a few. The U.S. just passed the 310 million mark and adds another person every 11 seconds, yet few seem concerned.

It should be apparent to anyone that more people will confound predictions of virtually anything related to economics, including peak oil. Stopping, then reversing, human population growth would achieve more to relieve future stresses generated by various limits to growth than any other single thing we could do, but most people are afraid to even talk about it. For decades human population growth has been viewed as untouchable and treated as something "natural," despite the fact that it is right now on a course that is totally unnatural and unsustainable. We always ask "how are we going to provide for millions more humans?" rather than "why in the world do we want or need more humans?" All discussions of our future should be shifted to the latter question. To paraphrase ecologist Garrett Hardin, we don't have a shortage of resources, we have a longage of people.

Very well said, glp.

I've given up asking loved ones and acquaintances if they honestly believe sustained growth is win-win, that there's no downside. I'll try again with your 80m extra mouths to feed (year on year) figure; it's a truly nasty stat.

Cheers, Matt B

Concerned Dad of three great kids

I believe in the bumpy plateau for up to 20 years

IF AND ONLY IF the world seriously invests in unconventional and heavy oil NOW.

Right now we need to bring 3 mbpd of new supply every year to tred water(make up for actual oil field depletion)---

this is a significant amount of oil(Alberta tar sands are 1 mbpd, US GOM is 1.6 mbpd).

If not production will fall at 1-2 mbpy, starting in ~5 years.

Right now we are getting new oil from the Caspian, Angola, Russia and Iraq but the world needs new supplies, possibly Brazil and West Africa.

God helps those who help themselves.

The Caspian has been a disappointment for years, Angola is near its peak according to most projections, Russia has virtually admitted it won't be able to increase production significantly. Brazil offshore is years away. West Africa I haven't seen much info. Iraq, well, that could be the game changer, but it looks like the realistic target is another 1.5 million barrels per day (i.e. 4 versus 2.5 currently).

I don't know if you are talking about total liquids or C+C. If the former that works out to be a decline rate of existing fields of 3.5 percent per year. If the latter then it works out to be a decline rate of about 4.2 percent per year. CERA estimates that existing fields have a decline rate of 4.5 percent per year. Your estimate of the decline rate is even lower than that of CERA!

The following link is mostly about giant fields but the decline rate, as stated, is the estimate for all existing world oil fields.

Giant oil field decline rates and their influence on world oil production

Hell, your estimate is about half what Schlumberger and others estimate. Anyway Table 10 of this study concludes that the average decline rate of all existing fields is 6.5 percent. They list CERA's estimate at 6.3 percent.

So actually we need about 5.5 million barrels of new production each year just to stay even.

ron P.

RP,

You are always the numero uno way-over-the-top gloomster.

5.5 mbpd?

That's more than total US production(the third largest oil producing country on earth) replaced every year.

Isn't 3 mbpd bad enough?

Do you think we should vote on it? ;-)

Ron P.

Alberta crude bitumen production is currently about 1.5 million barrels per day, and is steadily rising. It should be around 3 million bpd by 2020. This is great for Alberta, because Alberta's conventional oil fields are almost completely exhausted, and 70% of Alberta's oil production is now from the oil sands.

However, it is only a fraction of the new oil production the world needs to add every year to make up for field depletion. Globally, oil production has exceeded new discoveries every year for the last 25 years. I would look for a relatively steep decline beginning now if not sooner.

"However, it is only a fraction of the new oil production the world needs to add every year to make up for field depletion."

Yep, and if we burn all that and increasingly dirty coal, and the rest of the oil and NG, we will absolutely guarantee that we will leave the future a toasted planet.

http://scienceblogs.com/islandofdoubt/2010/01/james_hansen_says_goodbye_...

The effect of a rise in international prices denominated in dollars will depend on an economy's intensity of oil-base energy use, the ratio of imported to indigenous oil production, the rate of taxation or subsidy of imported oil, and the exchange rate of the currency versus the dollar.

For example, if the average price of fuel is $3 / gallon when crude is $2 /gallon, a 10% rise in crude will result in a 7 to 10% rise in fuel depending on whether downstream maintains absolute or percentage margins. However if the average price of fuel is $6 / gallon due to taxes, the same 10% rise in crude will result in only a 3.5% to 5% rise in the price of fuel.

Alternatively, a country which has a low amount of imported oil may chose to subsidize or preferentially tax oil products depending on whether they are going for primary production or for consumption. Thus, it may mute the impacts of an oil price rise on inflation in its economy.

What actually happens in a given economy depends on how adroitly the country manages its energy policy.

Exactly. We discuss 85 dollars as the recessionary pivot point, yet also refer to world oil production. 85 dollars is actually a US phenom, and differs for other countries depending on their energy situation. Possibly there is a bias to what the US can handle oil price wise, because its economy tends to strongly influence other countries economies. However, Chindia is still growing, in part because their energy base is cheap coal. Other countries as well do not rely on oil as an embedded cost in all products to the same degree like many developed countries. I know peak oil is having worldwide ramifications, but also wonder if the worst of the worse will occur in the US and Japan.

OPEC has said in its statements that it is sensitive to the global macroeconomic situation and that it will not raise its prices so fast that it either reduces short-term demand inordinately by causing a global depression or reduces long term demand by causing the widespread substitution of other energy sources for oil.

On the other hand, sensitivity to the overall global situation does not mean that OPEC will gear its pricing to the needs of the US. If the US can't keep up and is in chronic recession, well too bad.

OPEC can only maintain its pledge not to raise the price of crude oil too quickly while it is a swing producer. If global demand for crude oil intersects maximum global supply, OPEC will lose control and the price will again be governed by the free market (instead of the OPEC cartel which has had control for the last 1.5 years).

In the very short run, OPEC can't control price by producing more from existing wells. That was demonstrated by the $140 / barrel price runup.

The time frames of importance are those for implementing major new investment projects that maintain or increase production.

Quite. If China decided to price oil according to a basket of currencies, such as the Euro, $ and Renmimbi then the $85 metric becomes even more dubious (even without taking inflation into account). A global currency mapped to EROI or even gold in circulation would make more sense in that world.

Any fiat currency isn't necessarily a good measure of the value of a commodity such as conventional crude.

We live in interesting times.

Oil exporters decide what currency they will accept, importers pay what is demanded. Oil is priced by grade of oil, among other factors, not by any currency exchange rate.

Oil priced in any other currency would be the same basic price as the price in dollars. It is just very convent to price in dollars. If China wanted to pay in Euros or Yuan they could very easily do so. It would take less than half a second to convert either to dollars on the FOREX at a cost so low it is negligible. (About three basis points. A basis point is one percent of one percent or one cent per hundred dollars.)

Ron P.

I have not seen an rigorous peak oil studies/projections

There are no rigorous peak oil studies/projections, because peak oil is essentially a mirage. It exists separately for every price, (and even location) and of course, the price moves.

So, seeking a 'peak' is a good example of needing to 'ask a better question' : it is better to think of finite oil, and focus on the area under the curve.

Exactly when the peak occurs, varies around the world, and with price, and regulations.

Many peaks can already be found in the past.

What is going to matter MUCH more, is the shape of the tail.

It might also be useful to know who receives the benefit of the tail. We assume that we will all be able to buy what we want, but it is not clear that all of it will be available for international trade. Producers will keep quite a bit for their own use. It remains to be seen how trading partners will be chosen for the remainder. Maybe it will depend on who has food exports that that the oil exporters need.

Yes, That's exactly why the shape of the tail, will be so important.

Far more important than any academic discussion over when the peak was/is/might be.

There are a number of countries that both import and export oil, and not many have broad refining abilities.

There will be complex interactions between Oil Price, Oil Availability, and GDP,

and they will play-out very differently for different countries.

Every country will have a different weighting factor, or correlation effect, between Oil Price, Oil Availability, and GDP, and that too will vary over time, as Nations move to decouple themselves.

Remember "Peak Oil Update", from Sam Foucher? The link to the tagged posts is still at the top of the main page. The last one was in 2009. There was one in 2008. Before that there were several each year. We haven't had an analysis from Tony Erikson (ace) since early this year either.

It would be interesting to know why TOD has gotten away from this. It seems to be what 'John' is asking for.

Gail seems to have taken his question as a foil to make a point about economics which, aside from being debatable itself, isn't what 'John' is asking about.

The reason that there have not been more posts linked to is because Sam Foucher and Tony Eriksen and others have chosen not to write them. We have asked, but not much has happened.

I can only speculate as to why. One reason may be that when production is flat for years on end, modeling not be all that much fun.

I can only speculate as to why. One reason may be that when production is flat for years on end, modeling not be all that much fun.

Thats an interesting way to put it.

:>)

If I may be so bold, it looks like nobody on this thread has the slightest idea of any "rigorous peak oil projections" (the original question), but there are a lot of ideas out there ... no?

We have plainly entered uncharted territories, and the old models will continue to work "until they don't". Chaos, including economic, political and Black Swan events, will preclude anything that approaches reasonable, much less rigorous estimates.

Welcome to the future.

Not to be too redundant. . . but some of us round these parts think that key issue is, drumroll please, net oil exports.

Sam Foucher's most optimistic projection is that the (2005) top five net oil exporters--Saudi Arabia, Russia, Norway, Iran and the UAE--will have shipped about half of their post-2005 CNOE (Cumulative Net Oil Exports) by the end of 2013, a little more than three years from now.

And then, we have the "Chindia" factor. At their current rate of increase in net oil imports, by 2020, their combined net oil imports will be equivalent to 100% of projected net oil exports from the (2005) top five net oil exporters.

But no worries, we have Canada, Mexico & Venezuela, don't we? Their combined net oil exports fell from 5.0 mbpd in 2004 to about 3.8 mbpd in 2009 (EIA)

Added to the net factor is the ability of consumption to fund exports at a price that allows production at some given level. If consumers cannot afford expensive oil it will not be shipped.

As the cost to produce oil increases faster than the ability of consumers to afford it the outcome will be shortages at relatively low price levels.

On a dollar- for- dollar basis, peak oil took place in 1998. Since that time oil has relentlessly increased in price to the point where oil has become unaffordable to the commerce that relies on it. What people don't understand is that is not $150 oil that is unaffordable it is $50 oil that is unaffordable.

Our economic system is misnamed. It isn't 'Capitalism' it is 'Waste- ism'. Waste does not provide returns at all, only allows for metering of the flow in steps in the production cycle that precedes end use (the final waste).

What is happening in the world's economies is the effect of input costs exceeding returns on those same inputs. This phenomenon makes physical peak production rates both unmeasurable and irrelevant. Peak production rates are out of reach economically rather than physically. The work that is done with oil is insufficiently profitable to support prices high enough to drive maximum flow rates. Ironically, reaching maximum flow rates only serve to bring forward more quickly the period when the productivity of oil- driven work declines relative to the value of its input.

Well this guy has summarised 19 forecasting models, including his own. He puts the peak a few years away.

http://www.trendlines.ca/

Streeter

I think you can pretty safely throw out the top six or so of those models.

That would probably bring the peak back to about now.

Another point--only two projections have the peak later than 2040.

So all others have the peak within 30 years--a kind of near consensus.

The Hirsch report claimed that we will need at least 30 years to convert away from oil before peak if we want to avoid minor or major economic disruption.

So nearly everyone should be basically agreed that we should start planning for peak oil now (though some would have preferred 30 years ago).

As I recall, even Vaclav Smil agreed with this position--that PO may be decades away, but that's no reason to put off planning for it.

Mmmm lessee... WHAT???

The first thing I see is an arrow pointing out the "1st annual ASPO Peak Oil Call: 66 mbd in 1989".

What ASPO is this? According to the ASPO "About" page, ASPO was concieved in 2000. Anyone here know of another ASPO?

OK... looking a bit more... he divides the scenarios in three categories, I see... Tier1, Tier2, and Invalidated... let's have a look at the invalidated ones... Aleklett 2009? INVALIDATED??? OK, production of all liquids is 86 Mbd now, but TPotOA isn't talking about All Liquids, but Oil+NGLs with the barrels of NGLs recomputed to barrels of oil equivalents, and also not including biofuels. Very much NOT invalidated; this guy either hasn't read the paper or he's deliberately misrepresenting. If he hasn't read the paper, where did he get the graph?

Back to the Tier1 scenarios... there are one red and two brown lines (hard to tell which names they correspond to) going up at sixty degrees or so from the 2008 peak, according to those we should be above 90 Mbd by now. And these are NOT invalidated?

Seriously, I think it's best to ignore this guy. Don't give his site more hits by mentioning his name or linking to his site. It's disinformation.

What ASPO is this? According to the ASPO "About" page, ASPO was concieved in 2000. Anyone here know of another ASPO?

Freddy appears to be assigning Colins estimates to ASPO. You are aware of who founded ASPO? However, it is inaccurate to confuse the two, let Colins mistakes stand on their own.

As far as ignoring the guy, his information was recently cited by an ex-President of AAPG during a public presentation to show the sheer number of guesses which have come down over the years. He isn't being ignored if people at that level are aware of his work.

Freddys site is excellent in another way, and that is for historical perspective. Most peakers aren't aware of the years, decades or near centuries that the prediction of peak or its cousin, running out, have been going on. Once it becomes obvious that people have been proclaiming the end of oil since right around the beginning of oil, it allows an individual to put the current claims into proper perspective.

I linked to the ASPO page that gives a short history of the organization, so OBVIOUSLY, yes.

Oooh he has the attention of the Professionals eh? The Ones In the Know? Wow. Guess you're one of them too, eh? Should I feel intimidated, instead of just annoyed?

Anyway, I was sayin he should be ignored, not that he was.

I can't speak for most peakers, but if you read around on this site a bit, that becomes clear pretty quickly. See for example Sam Foucher's running totals of predictions, linked upthread.

He gleefully dismisses Aleklett as wrong because he "bet the farm on a 2008 peak", when firstly the '08 peak is still standing, and secondly Aleklett's fast scenario puts the peak in 2014.

That is misrepresentation. That is insincerity. It is not excellent.

Oooh he has the attention of the Professionals eh? The Ones In the Know? Wow. Guess you're one of them too, eh? Should I feel intimidated, instead of just annoyed?

Not knowing you, I don't have a clue how you should feel.I am always surprised to see web stuff referenced and when it was something I recognized I figured I should tell FreddyH that his stuff carries farther than I would have assumed.

He gleefully dismisses Aleklett as wrong because he "bet the farm on a 2008 peak", when firstly the '08 peak is still standing, and secondly Aleklett's fast scenario puts the peak in 2014.That is misrepresentation. That is insincerity. It is not excellent.

Certainly you are allowed to think the value of Freddys work isn't up to snuff. I have already mentioned why I think it has value, and it has nothing to do with how he chooses to poke The Swedish Peaker Gang.

average sh1t and shinola and what do you get ? sh1tola or applebutter ?

One interesting problem with predicting peak oil using published numbers consumption, production and reserves is that global peak has some fairly serious social and economic problems.

I'd argue that any peak oil prediction should include what happens to the data when the world peaks in its scenario.