Tech Talk - Going Back to the First Look at Saudi Arabian Oil Production

Posted by Heading Out on March 19, 2012 - 1:41pm

The United States Government has just asked the Kingdom of Saudi Arabia (KSA) to raise the levels of its oil production in summer 2012. Oil production is otherwise anticipated to be at some 9.8 mbd this summer, with fluctuations of around 200 kbd about that number. (There are rumors it has just hit 10 mbd.) It is reported that the KSA could raise production to 12.5 mbd if needed. Saudi Oil Minister Ali al-Naimi has now stated that the KSA is able to meet that commitment.

Since I started writing about peak oil back in 2005, the possible maximum sustainable production achievable from the Kingdom has been one of the recurring issues at The Oil Drum, and there have been a number of very perceptive analyses carried out by folk such as Euan Mearns, Stuart Staniford, and JoulesBurn that I do not intend to try and surpass. I will, however, try to summarize some of their conclusions as I work through a few posts that look at the overall production from the various fields that are found both on and offshore Saudi Arabia.

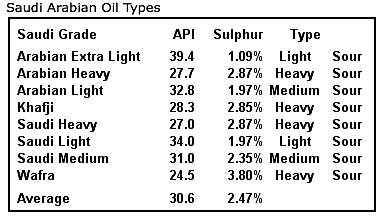

As an initial point, not all the oil that comes from the country is of the same quality, and this is often one of the initial factors that folk do not appreciate when they look, for example, at the two numbers I gave above, that which the KSA is producing, relative to that which it might be able to achieve. The problem arises with the heavier crudes that make up a part of the surplus, for which there is not a great market, as yet. So let me begin the review this week by simply taking an overall view of the country, the oilfields that comprise regions of major production, and what sort of oil KSA is producing.

Back in 2005, production from the different oil fields added up to 9.07 mbd, and at the time I had figures suggesting that the total broke down as follows:

Abqaiq 400 kbd;

Abu Sa'fah 200 kbd;

Berri 300 kbd;

Ghawar 4,500 kbd;

Hawtah 200 kbd;

Hout 300 kbd;

Khurais 300 kbd;

Marjan 270 kbd;

Qatif 800 kbd;

Safaniya 700 kbd;

Shaybah 600 kbd; and

Zuluf 500 kbd.This adds up, methinks, to 9.07 mbd.

JoulesBurn has since pointed out to me that my initial attributions were incorrect and that, in a paper given in 2006, Mendez et al had reported that the target for Hout was only 50 kbd, while that for Khafji was 300 kbd. I will explore those issues more in later posts on this region. A hat tip to JB for catching my error.

Not all these fields have oil of equivalent quality, and this is a point that often fails to be understood when there is a global shortage, and the KSA offers more crude to the market. If that crude is sufficiently sour (i.e. too much sulfur) and heavy (low API gravity) then it cannot be refined by some refineries that may be hurting the most. Thus the oil might not find a market, even though there is a shortage. What the KSA tries to do is to swap deliveries, but that does not always work as it might.

For those who have forgotten the API gravity classification in degrees, I explained it in an earlier post. Suffice it to say that the higher the number, as a general rule, the lighter the crude and the better the market. As the share produced from the historic fields changes, so the KSA has offered the heavier crudes to the market, but as I noted, even with the increase in global demand, those crudes have been less successful in finding a permanent market.)

Way back when the world was more innocent, there were four major fields that produced most of the oil from KSA:

Ghawar (the King), which started producing in 1951. Peak production was at 6.6 mbd. Current production is under 5 mbd. Water inflow percentages are increasing, and overall output is decreasing. It is divided into various regions, Ain Dar oil has an API gravity of 34, and 1.66% sulfur. Shedgum is at an API gravity of 34 and sulfur content of 1.75%. Uthmaniyah has an API of 33, and 1.91% sulfur. Hawiyah is at an API gravity of 32,and 2.13% sulfur, while Haradh oil has an API gravity of 32 and 2.15% sulfur. The levels of sulfur define how “sour” the crude is, and this must be recognized by the refineries, such as the Fujian Refinery in Quanzhou, China which is designed to refine 240 kbd of sour light Arabian crude. The oil from Ghawar flows to the Abqaiq processing plant, this can handle up to 7 mbd of light and extra-light crude., and cleans the crude before sending it on to refineries at Ras Tanura, Jubail, Yanbu and Bapco.

Abqaiq (The Queen) saw peak production in 1973 at 1 mbd, has now fallen to a level of around 200 kbd. It is a field that is “rested” from time to time in order to sustain an even displacement as the water flood progresses. The oil is at API 36.

Safaniya (2nd Queen) started producing at 50 kbd from 8 wells in 1957, peak production was at 1 mbd, and is now down to about 770,000bd. The field lies offshore, and is a producer of some of the heavier crudes, with an API gravity of 26, and a sulfur content of up to 2.96%. It has a current production capacity of 1.2 mbd, but because of the heavier nature of the oil has more trouble in finding a world market, and thus often much of this production is withheld. (In 2008, for example some 700 kbd was being withheld from the market.) The field is currently being further developed with a larger pipeline being installed to allow a higher flow rate from the field onshore. It is also intended that the gas that is now flared will be captured. The upgrade will also involve the installation of submersible pumps and an upgrade to the distribution network, and is scheduled for completion in late 2013, when the capacity will rise to 1.5 mbd.

Berri (the Great Lord) saw peak production at 788,000 bd in 1977 and more recently that fell to around 300,000 bd. This was the fourth of the original set of fields in Saudi Arabia that were responsible for 93% of Saudi production back in 1978. It is slowly watering out and has been occasionally left resting except when additional production is required. The oil has an API gravity of 38, with about 1% sulfur. The field has been reworked so that it now has a capacity of 1.15 mbd though some 300 kbd of this is considered part of the reserve production in case of need, rather than normal production.

Looking back seven years, the plans that the kingdom had back then for sustained and increasing production (they recognized that existing wells would decline and thus planned for their replacement) were clearly stated by Abd Allah Al-Saif:

Major projects that Saudi Aramco is undertaking to ensure meeting future demand:

The Abu Sa'fah and Qatif projects came on stream in 2004 adding 650,000 bpd.

300,000 bpd of Arabian Light will come on stream in the Haradh field in mid-2006.

500,000 bpd of Arabian Light will be added to capacity through the Khursaniyah development, planned for 2007.

2008 is the target date of approved expansion plans that would add 300,000 bpd of lighter crude at Shaybah and central Arabian fields.

A Khurais increment of 1.2 million bpd of Arabian Light will be commissioned in 2009.

"This is a very aggressive program that will require the mobilization of immense resources, such as rigs, material and manpower, but which we are confident to successfully execute, as we have done for the past 70 years," he said.

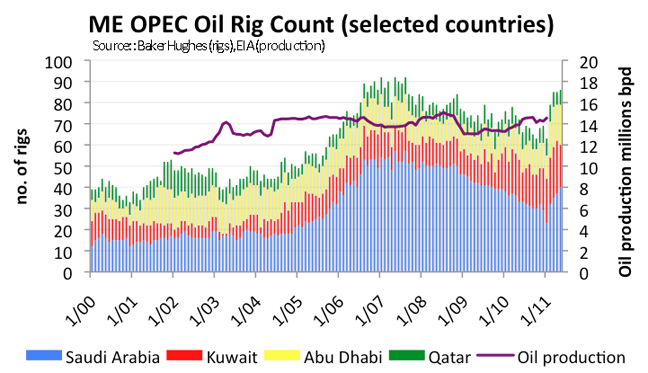

Concerns at the time over the ability of the kingdom to meet these plans focused not only on the quality of the mix, but were initially aimed on the number of drilling rigs that the KSA had available to drill the required number of wells. Back in 2005, the country did not have a whole lot of rigs at their disposal. This has since been highlighted by Euan Mearns:

Bear in mind that when we started posting, we were just coming to the end of the relatively flat section of the Saudi plot, and at the time were unable to see how they could continue operations with only 20 odd rigs. Well, with hindsight they could not, and as the plot suggests, they rapidly acquired all the spare rigs available at the time, and this allowed the increase in the number of wells that afforded new levels of overall production. Sam Foucher has also posted on the rig count, and his plot agrees more with my memory of the dramatic transition in rigs that the KSA employed back in the 2006-07 timeframe to move them from the placid conditions pre-2005 to the sudden realization that BAU would no longer work.

The point of the illustration is to indicate that circumstances do change operating conditions, and that folk do respond when they have to. Up, that is, to the limits that they are able to achieve. Some of those limits are imposed by the fact that you cannot suck beer from a conventional pint glass forever, as I discovered when in college, and it is in regard to those issues, as well as some more of the above, that the discussion will swing toward as the next few weeks unfold.

There have been many other posts on the subject in the Oil Drum over the years (if one includes Drumbeat there are more than 2,000). Here are but a very few:

JoulesBurn-

Abqaiq

Intro to Satellite sleuthing

Khurais me a river

Happenings in Harmaliyah

Ghawar Numerology

Stuart Staniford-

Satellite o’er the desert

Euan Mearns-

Saudi Production laid bare

I will add to this list as I move on and start to address some of the concerns that have been raised.

"When the Saudis have peaked, the world has peaked" - Matt Simmons

"For gods sake, leave it in the ground, our children needs it" - Saudi king

The big question is when Saudi Arabia will start to decline in production, no matter how many rigs the mount to every field.

How about this from King Abdullah of Saudi Arabia in 2007:

"The oil boom is over and will not return. All of us must get used to a different lifestyle."

From the introduction of chapter 5 in the book Bad Money.

The BP data base shows that annual Saudi total petroleum liquids production has been below their 2005 rate of 11.1 mbpd for five straight years, and I suspect that the 2011 data will show the same pattern. Meanwhile, as I have, on occasion, opined, what really counts is their net oil export number.

Following are annual Saudi net oil exports in dark blue (BP, Total Petroleum Liquids) from 2002 to 2011* versus annual Brent crude oil prices. Note that Saudi Arabia showed a huge increase in net exports from 2002 to 2005, as annual Brent crude oil prices doubled from $25 to $55, but then they have shown declining net oil exports, relative to their 2005 annual rate of 9.1 mbpd, as annual Brent crude oil prices doubled again, from $55 in 2005 to $111 in 2011.

*I estimate that their 2011 net exports were between 7.5 and 8.1 mbpd, versus the 2005 level of 9.1 mbpd; the graph shows a midpoint estimate of 7.8 mbpd.

But here is a key point that is virtually completely ignored, the total post-2005 supply of Cumulative Net Exports (CNE).

Indonesia Versus Saudi Arabia, a Tale of Two Founding Members of OPEC

It would appear that Indonesia's final production peak was in 1991, at 1.67 mbpd (Total Petroleum Liquids, BP). Note that their Consumption to Production Ratio (C/P) increased from 42% in 1991 to 52% in 1994. If we extrapolate this rate of increase, they would hit the 100% mark in 2003. The 100% C/P line denotes the boundary line between net exporter status, below 100%, and net importer status, above 100%.

The actual data for Indonesia show a C/P ratio of 94% in 2002 and 105% in 2003 (in 2010, they were at 132%).

The same BP data base shows that the Saudi C/P ratio increased from 18% in 2005 to (I estimate) between 28% and 29% in 2011. Using 28% and projecting the rate of increase in the C/P ratio in the same way that we did for Indonesia implies that Saudi Arabia would approach the 100% mark around 2028, which is consistent with Sam Foucher's modeling.

Incidentally, this projection implies that Saudi Arabia has already shipped about 46% of their post-2005 Cumulative Net Exports of oil (CNE), which suggests that remaining post-2005 CNE from Saudi Arabia could be as little as about 21 Gb. This differs "slightly" from the conventional wisdom regarding Saudi Arabia.

And here are Sam Foucher's projections for Saudi production, consumption and net exports. The projections were based on annual data through 2006. Actual data points for 2007, 2008, 2009 and 2010 are circled. The dashed lines represent 95% probability limits.

The situation in the US today is reminiscent of the time just before the French Revolution. At that time, the French monarchy and aristocracy had no problem with France's economy going downhill as long as they remained at the top. Hence, Marie Antoinette's famous reply "Let them eat cake" when told the people had no bread.

The gap between conventional wisdom and what our net export analysis shows is so vast, it is almost comical.

As Dr. Bartlett famously said, human beings have trouble with exponential functions, and in the following we are dealing with multiple exponential functions, so explaining this to the general population tends to be a bit challenging, but I'm afraid that the implications of the Global CNE and CANE (Cumulative Net Exports) estimates are quite sobering.

Incidentally, regarding what actions we can take, and what actions we can recommend, given what amounts to massive denial on a global scale about what is going on in energy markets I have begun to think that the chances of any actual policy changes are fairly poor, at least in the near term, and perhaps we should focus on things like encouraging a renewed emphasis on vocational and agricultural training.

First, a simple mathematical model:

"Export Land Model" (ELM)

"Export Land" is consuming 50% of production at peak. Production then Declines at 5%/year, Consumption Increases at 2.5%/year, and therefore Net Exports show an accelerating rate of decline

CNE = Post-peak Cumulative Net Exports = 1,382 mb

ELM, assuming a production peak in 2000:

http://i1095.photobucket.com/albums/i475/westexas/Slide1-17.jpg

Note that since these net export decline curves tend to show a "Shark Fin" pattern, one can do "Cowboy Integration" by calculating the area under a triangle, and get a pretty good approximation for post-peak CNE (Cumulative Net Exports) by multiplying 365 mb/year X 9 Years X 0.5, (less 365 mb), which is 1,260 mb, versus actual post-peak CNE of 1,382 mb. However, if we want to estimate high, we can just multiply the peak net export rate times the number of years to zero, times 0.5, resulting in an estimate of 1643 mb (or 1,600 mb, rounded off to nearest 100 mb), versus the actual value of 1,382 mb.

Also, if we extrapolate the 2000 to 2003 rate of increase in the C/P ratio for the ELM (50% to 64%), it suggests that ELM would approach a 100% C/P ratio in 8.5 years, when it actually took 9 years. The rate of increase in the C/P ratio was 8.2%/year from 2000 to 2003, so we just take the natural log of (100/50) divided by 0.082, which gives you 8.5 years. This suggests (post-peak) CNE of 1,600 mb, if we round up to 9 years (as shown above), and round to the nearest 100 mb.

Key Point: In some cases, we can extrapolate the initial rate of increase in the C/P ratio to determine approximately when the net exports might approach zero (as the C/P ratio approaches 100%), and thus we can integrate the area under what tends to be a triangular shaped area to get a reasonable ballpark estimate for CNE.

Also, a rough rule of thumb is that about one-half of post-peak CNE are shipped one-third of the way into a net export decline period, e.g., ELM, Egypt, UK, Indonesia:

http://i1095.photobucket.com/albums/i475/westexas/Slide1-8.jpg

Some Applications:

Saudi Arabia Post-2005 CNE Estimate

(as noted above)

I estimate that 2011 annual Saudi net exports (total petroleum liquids) will be 1.0 to 1.6 mbpd below their 2005 annual rate of 9.1 mbpd, as we are seeing a small change in the slope of the projected and ongoing net export decline. If we take a net export rate of 7.8 mbpd as a middle case estimate, then Saudi Arabia would approach zero net oil exports some time around 2028 (projecting the 2005 to 2011 estimated Consumption to Production ratios, total petroleum liquids, which increased from 18% in 2005 to an estimated 28% in 2011). The 2028 estimate is consistent with Sam Foucher's projections.

Using the same approach that we used for "Export Land," post-2005 Saudi CNE would approximately be: 3.3 Gb/year X 23 years X 0.5, which would be approximately 38 Gb. Post-2005 Saudi CNE are about 17.5 Gb through 2011, so based on this ballpark estimate, post-2005 Saudi CNE would already be about 46% depleted.

You can see how this estimate of about 21 billion barrels in remaining cumulative Saudi net oil exports differs "slightly" from conventional wisdom.

Global Net Export (GNE) Post-2005 CNE estimate

Our data table shows the C/P ratio for the top 33 net oil exporters in 2005 (GNE) increasing from 26.9% in 2005 to 31.1% in 2010, a 2.9%/year rate of increase. This suggests that GNE would approach zero in 45 years from 2005, or around 2050, suggesting post-2005 Global CNE of about 374 Gb, and it suggest that post-2005 Global CNE will be about 50% depleted around 2020.

CANE (Cumulative Available Net Exports)

The ratio of Chindia's combined net oil imports to GNE increased from 11.2% in 2005 to 17.6% in 2010. This suggests that ANE might approach zero in 24 years after 2005, or around 2029, suggesting post-2005 CANE of about 175 Gb, and it suggests that CANE would be about 50% depleted by the end of next year, 2013.

In other words, this mathematical exercise suggests that the total post-2005 cumulative supply of (net) exported oil available to importers other than China & India could be 50% depleted by the end of next year.

My analysis of the situation is this:

Since the media refuses to report in any meaningful way on Peak Oil, nothing can be done until the signs of Peak Oil become so great it no longer can be ignored.

Truly, an Orwellian situation.

"Since the media refuses to report in any meaningful way on Peak Oil, nothing can be done until the signs of Peak Oil become so great it no longer can be ignored."

I think the situation is worse than you suggest, because the powers that be will never admit that declining production of oil is mainly due to geological limitations. Just as the Republican candidates for president loudly denounce Peak Oil as a myth, politicians of all stripes will deny Peak Oil for perhaps twenty years to come. Politicians usually want to be re-elected, and successful politicians almost invariably promise voters that economic and social problems will be solved and that life will be better in the future, if and only if he or she is re-elected. Also, political candidates get large sums of money from oil companies which want to suppress the idea of Peak Oil.

The mainstream media use mainstream organizations (big oil companies, CERA, USGS, IEA, EIA) as the sources for their stories. Without exception, the mainstream organizations all say that there is not going to be an oil peak for at least the next twenty years. In other words, the mainstream media will ignore TOD because all the "reputable" organizations emphatically deny that that Peak Oil is about now.

To comprehend the ELM and related models in reference to declining Saudi net exports of oil one has to be both literate and numerate. IMO, few Americans are numerate, except for accountants and scientists and engineers. Instead, most Americans believe that Saudi Arabia has substantial excess capacity that can and will be used to prevent spikes in oil prices. They have been told this many times by the mainstream media. Equally important, the great majority want to believe this comforting story.

There are no limits to self-deception. Most people only listen to the information they want to hear and are deaf to dissenting voices. We don't need Big Brother and totalitarianism to block awareness of the Peak Oil story and numbers; all we need is is the perception that the mainstream media stories are true, along with with the psychological phenomenon of selective attention.

Professor Hamilton has a comment on the SPR to the rescue (which he does not think is a good idea.):

http://www.econbrowser.com/archives/2012/03/strategic_petro.html#comments

Strategic Petroleum Reserve to the rescue

My comments:

since i am a novice and learning much from all of you but especially WESTEXAS. have question for you wes,,,, in your research have you been able to model the effect of a possible growing tendency for producing nations to keep more in the ground for their future generations,,,, on cummulative net exports? i remember some one in saudi arabia saying something like that

if i had the interest of my children i would most assuredly do that?

is their any way to predict that?

From the point of view of a consumer in an oil importing country, in my opinion all that counts is the global supply of net oil exports. I've put it this way. Let's assume that you were just run down by an 18 wheeler. Does it matter to you whether or not the driver of the 18 wheeler aimed for you?

For 2006 to 2011 inclusive, the cumulative shortfall between what Saudi Arabia would have net exported at their 2005 rate of 9.1 mbpd and what they actually net exported was about 2.5 Gb (billion barrels). From the point of view of consumers in oil importing countries it doesn't matter a great deal whether or not the cumulative shortfall was mostly voluntary or mostly involuntary. The bottom line is that we have seen a sizable cumulative shortfall.

In my opinion, given the divergence between Saudi net export rates of change for 2002 to 2005, versus 2005 to 2011, the post-2005 Saudi decline was mostly involuntary.

"From the point of view of a consumer in an importing country, in my opinion all that counts is the global supply of net oil exports."

Your statement needs one caveat: all that counts is the global supply of net oil exports THAT REACH THE GLOBAL MARKETS.

So if China has production contracts with Venezuela that allow the oil to be sold to China as a first choice (though it may be at world market price), what good does the increase in production do for lowering price? Not much in my opinion. If world net exports were increasing this would not be an issue. But where world net exports are declining, the more oil bought by production agreement means less available for trade on world markets, where OECD will get its share. ELM will predict price to a degree, but it does not seem to account for oil that never reaches the markets, such as that which is exported by production agreements.

From what I have read here and on other energy blogs China and India have already locked up a lot of the future net oil exports. So the oil available to trade on world markets will decline much faster than ELM suggests.

As I noted up the thread, at the 2005 to 2010 rate of increase in Chindia's net imports as a percentage of Global Net Exports of oil (GNE), the Chindia region alone would consume 100% of GNE in about 19 years.

WT,

Why is India going to be on par with China in terms of Oil - why would India be the preferred recipient (and not the US)? I may seem ignorant about India, but wanted to hear it from you - after watching Slumdog Millionaire, it's kind of hard for me to put India on such a high dais.

India, as of 2010, was the nation with the 4th largest oil consumption. Two of the 4 (Japan and U.S.) have declining consumption at high prices. India has such low per capita consumption and so many people that tiny per capita increases net to large import demand. In other words, poor people in developing countries have higher utility for oil and can pay more for it in very small quantities. My sister buys 1.5 gallons of gasoline a week for her scooter in Taiwan. She can afford to pay a much higher price per gallon than someone filling a Suburban once a week.

That does make sense. Thanks. Brings to mind the picture of the family with eight people on a small motorcycle ...

The dominant trend that we are seeing is that developed oil importing countries like the US are gradually being priced out of the global export market, as global annual crude oil prices doubled from 2005 to 2011, and as the Chindia region consumed an increasing share of a declining volume of Global Net Exports of oil.

good point,,,, isnt the oil exchange some shadow market anyway

For years I have goaded "Environmentalists" to pay serious attention to Peak Oil and its real implications instead of spinning off into fantasies of "electric cars" and techno-utopian magic solutions to replace millions of years of stored Solar energy in fossil fuels. Lately I have noticed that some Progressives are beginning to wake up and more and more commenters on various Websites are explicitly mentioning Peak Oil as well as callers to Talk shows. For example,

after countless articles on Commondreams.org blaming speculators for oil and gasoline price rises, they finally actually included Richard Heinberg :

http://www.commondreams.org/view/2012/03/03-8

Also Counterpunch had the following article from Michael Klare:

http://www.counterpunch.org/2012/03/13/why-high-gas-prices-are-here-to-s...

Alexander Cockburn, who used to put out paeans to "abiotic oil" has stopped

promoting that fairy tale for some years now.

Reality is beginning to set in and some people are waking up.

Even the BAU-in-Chief, Pres Obama, has argued that we cannot drill our way out

of the oil price problem. Of course what Pres Obama is afraid to touch is

the US auto addiction which is the biggest cause of US wasteful consumption

of oil. We just spent billions bailing out the Auto companies, $7.5 billion on 'cash for clunkers' instead of "cash for Green Transit" and the Auto companies, thanks to an exemption allowing sub-prime auto loans, have a temporary respite.

But Reality will set in...

For another hopeful sign see the excellent rebuttal in the New York Times by a

"Y generation" about supposed "lazy stay at home tendencies" of their generation because less and less young people are driving or getting driver's licenses. The younger generation is acutely aware of Global Warming and beginning to realize peak resources issues as well. They would rather have iPhones than cars...

What would be a very interesting subject to pursue here is whether the Internet

telcommunications and IT can be sustainable past Peak Oil.

For example, can we develop peer-to-peer networks of local wireless routers

instead of telecomm centralized systems? Could shortwave provide a sustainable carrier of Internet traffic? IT systems are continuing to get more and more

energy efficient and an earlier article on TOD showed Moore's law unaffected so far by Peak Oil. Also recall Occupy Wall Street before being swept out of

Zuccoti Park, used bicycle generators to power their IT systems...

It would be nice to keep telecommunications and in particular the Internet going

past Peak Oil...

Did you post a comment to Heinberg's item CommonDreams (CD) republished? And according to one of the denialists, "gonzonews:" "TheOilDrum which is an oil speculation website." I once did a lot of argumentative commentary that directed CD readers to visit this site and become informed. It's intersting the numerous types of Trolls one encounters, certainly "matti" amd "gonzonews" on that thread which I already knew about. Quite frankly, after the rapid deterioration of the discussion thread, I ceased comenting and hadn't revisited that thread until your post.

The world cannot function with 7 billion people if it can no longer use motorized transport. Whether EV's ever ramp up to claim numbers approaching current ICE mobiles, as long as there is still one ICE powered car being built then we should be pushing as hard as possible to make it electric driven instead. And while we're at it, build out some solar panels and solar thermal with the remaining oil, then voila we have the beginnings of a renewable transportation infrastructure which will be desperately needed post-PO.

Sure beats burning the oil right now till it's all gone, creating nothing lasting except some CO2 which we don't want anyways.

I would have said:-

Since the media refuses to report in any meaningful way on Peak Oil, nothing can be done until the signs of Peak Oil become so great it no longer can be rectified.

NAOM

In a way, though, the stance of politicians, to officially ignore peak oil, is correct.

By the time things crumble, a fresh and more limited system will mean new sorts of politicians, or rather government officials (elite managers and controllers) who operate on new rules and new resource regimes. They will intimately understand the flows of energy and matter that they depend on.

Things are still functioning according to the old rules. Thus oil is assumed to be endless. Because it is assumed that humans would never choose a resource that wasn't permanent, we are not that stupid, right?

"Things are still functioning according to the old rules."

Yep, been goin' for about 7K years, and I think it highly unlikely to change. Indeed, "things" are in the process of getting worse. Here's Putin's plan for the utilization of Russia's hydrocarbon revenues, which is further added to here. I think he has just as good a chance at getting it to work as Bismark did.

WT.

I think Saudi is invaded long before they reach 100% consumption.

Lonnie

CW - "Saudi Arabia is not only the top foreign supplier to the United States". Actually not even close. Canada is the largest source of imported oil to the US (http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_epc0_im0_mbbl_m.htm) according to the latest stats. The KSA only sold 59% as much oil to us as the Canadians.

They might be able to up the pumping capacity. But in the oil patch, as in most other circumstances in life, there's no free lunch. Increasing lift rate, especally from water drive reservoirs, will typically increase the rate of decrease in the oil cut. It also tends to reduce ultimate recover as the increased water influx will strand more oil behind. Before long a well might have increased the total volume of fluid lifted but the increase in water cut reduces the net oil production. But I've seen more than one US company make that choice because they we're in need of a quick increase in cash flow. And without exception every one I've witnessed lost in the long run to reduced URR, increased operating expenses and also occasional premature abandonment of some of their wells.

from Bloomberg

so looking at the data points in your chart it appears liquids other than crude are becoming a more sigificant part of their domestic consumption mix. That crude consumption increase for 2011 amounts to 4%, do you happen to have the % total liquids Saudi consumption increase for 2010 to 2011?

No doubt the ELM shows big trouble ahead. Of course we all know that 8mbpd Saudi domestic consumption in 2040 is not going to happen so at some point that projected curve will start to level off but with a fast growing population and 50% of Saudi electrical generation currently coming from crude oil...the curve shown may not be steep enough for a few years to come.

WT and HO.

If you take alook at the Aramco annual report it makes some interesting reading. I am not sure if I agree with the statement that the Arab Heavy cannot find a ny buyers. There are ways of processing AH. Many years back Exxon regularly ran 5% ah in the crude charge. It was added to a light crude such as Brent and Forties and was processed without too much difficulty.

Running high levels of AH would need a specific refinery configuration. The new Reliance Jamnagar 2 refinery can run very heavy crude. The problem is with the price that the Saudis want for AH, and this is because they do NOT want to sell it. The discount on AH has been reduced such that it makes it unattractive to process. The Saudis claim that no-one wants it but it is really a price issue. Each month OPEC publishes it bulletin and in the report is the current indicative pricing before premiums or discounts. In the US the price is related to WTI, in Europe Brent, and in Asia the average of Dubai/Oman. The premium or discount can be found on Reuters.

The current heavy discount has been progressively reduced that it is now only around $5 in Europe making it unnactractive to process. Moreover the discount on AL is now a premium. That is not a mistake. The yield structure of AL is such that it is more profitable to run than Brent because it makes less naphtha and gasoline and more middle distillate, even with the much higher sulphur. So much for the light crude premium.

The reason why the Saudi do not want to sell the AH is that in the summer they are crude burning due to a shortage of gas. They are betting on some new gas fields solving that issue but in 2014 they will start SATORP, a 400 kbd heavy oil refinery and another is planned with Sinopec iN Yanbu about 2016. Most of the heavy oil comes from Safaniyah and Khafji. Khafji is in the neutral zone and the output is shared with Kuwait. When Manifa comes to full production this will also add to the heavy crude output.

To sum up . AH is not selling because it is being priced not to sell. That way the Saudis can burn it for power and water production and later on it will be refined in the country. It is a clever way of taking it off the market. It is all the in the Aramco Annual Report. You just have to do the maths.

I will try and post the links tomorrow as I am at the airport - again.

Makes sense to me. Mexico and Venezuela don't appear to have any problems selling their heavy oil.

Incidentally, I wonder how much of the reported surge in Saudi production is just the Saudis moving crude oil in storage from Saudi Arabia to overseas locations, in advance of a possible attack on Iran?

Mexico and Venezuela don't appear to have any problems selling their heavy oil.

That's because their oil production is falling, and the US Gulf Coast refineries are having to fall back on expensive Brent-priced light oil to replace it. They would prefer to run much cheaper Canadian heavy, which is a good substitute, but it can't reach the coast due to insufficient pipeline capacity.

The Carribean refineries which relied on Mexican and Venezuelan heavy are shutting down - including the huge one in the US Virgin Islands, 50% owned by the Venezuelan state-owned Petroleos de Venezuela S.A (PDVSA), and this latest closure of a Valero refinery in Aruba, off the coast of Venezuela.

Rocky - Did you catch this news: Valero has announced it's shutting down its big Aruba refinery. Not sure what they've been doing lately but at one time most of the products were shipped to the NE US.

Kinda makes you wonder if we are getting close to the downslope.

"Meanwhile, as I have, on occasion, opined, ELM ELM ELM!!!"

Thanks for the chuckle. :)

But we need it more right now. Let's pull it out, but use it differently. This will be an interesting test of humanity's ability to plan beyond the immediate. If we take a step back and look at the big picture, SA has (had) enough resources to not only power itself but also the whole world -- FOREVER. It could have taken a small portion of that oil and invested it into developing a solar energy infrastructure, of which it has almost unlimited potential.

But it seems it will follow the same road that all other short sighted societies follow -- burn the oil till there's nothing left, then we won't have enough left over to build solar panels.

Until there's an undeniable global energy crisis, the political motivation to change course from BAU won't be there. When we do hit crisis, then by definition the options we will have left to build out renewable infrastructure will no longer be there...

+1

I've given your point a lot of thought in the last year - I've thought of how we could buy ourselves centuries of salvaging our lessons learned from the embarrassment of riches oil has been - if only everyone could be made to believe. That is, if we could all literally park our cars and start walking or mass-transiting into a bold new future where food, comfort, and human need are what the remaining oil is to service.

Instead, the world will run it to the bare dribble and humankind will be plunged into a dark ages that will last thousands of years, I'm afraid.

Hopefully, as they begin to once again dig, the next humans won't find any of those dry storage casks (nuclear), open one to see what's inside ...

HO - This is far removed my little piece of the oil patch so maybe I'm missing something and will be enlightened by other TODsters. First, as you clearly point out all KSA oil doesn't have the same utility and market. But for sake of argument let’s assume it all has equal value. So the process: the KSA offers a certain volume of its oil at $X per bbl. Those who can justify the cost buy that oil. Assume the KSA increases the volume offered for sale by 2 million bbl/day. But at what price? If they offer it at the same price as they have been perhaps there will be some more sold. But that won't reduce the ultimate cost of the end products. Thus it would appear the request for increased KSA production assumes the potential buyers are those who cannot afford oil at the current price. IOW the only way this additional oil will be sold is if the KSA offers it at a lower price.

But if the goal of the US request and an affirmative response by the KSA is to lower the price of oil the KSA need not increase production by a single bbl. They can simply offer their oil for, let’s say, $90/bbl. The world would still be supplied with the oil it's currently utilizing, the price of refined products would presumably decline and the KSA would be preserving their declining reserves (whatever that volume actually is) by not putting more oil into the market place just to lower prices. And thus the global economy should improve which would logically increase the demand for more oil. Of course, the KSA hasn't put more oil on the market so the demand for products increases which would put upward pressure on prices. Unintended consequences?

Simply put we’re not asking the KSA to increase production but to reduce their income from their dominant source of revenue that keeps their country functioning. And we would expect them to do this why? But if they did wouldn’t it be logical for the KSA to reduce the price they sell oil for today then to increase the depletion rate of their finite resource to achieve the same goal?

In yesterdays drumbeat there was an article by yahoo news on "Iran sanctions seen spurring more Saudi oil sales to U.S."

So it sounds like SA is selling oil cheaper to the US than the rest of the world. The question is a) by how much and b) why? Is it due to difference in quality of oil, or for political reasons? Any other reasons?

Is it due to difference in quality of oil, or for political reasons?

Well those might be viewed as one and the same if you consider the quality of the oil that serves as fighter jet fuel.

The request for more Saudi production would seem to be aimed at staving off a new price spike more than anything else--the US is trying to find supply for Iran's most dependent customers. I don't know how successful that will be considering the quality of the crude that would have to make up a substantial share of any Saudi increase.

To my ear the volume of prelude to war undertone seems to be rising...it is a heck of a game of chicken, and quite a bit different than the cold war.

As if on cue today's NY Times piece reporting on this month's war game simulating an independent Israeli first strike on Iranian nuke facilities

I would expect to see a smiley face after such a suggestion because you must be joking. If Saudi offered their oil for $90 a barrel then it would be snatched up immediately like it was a fire sale. Then the price of the rest of the world's oil would immediately return to what the supply and demand required, about $125 a barrel.

Ron P.

Exactly Ron. The only way to reduce the global price of oil is to put so much oil in the market place that the exporters have to compete for the buyers by lowering prices. Be like 1986 all over again. Can't hardly wait for that day, eh? LOL. Of course it could happen for the same reason it did 25 years ago: a global recession so severe it destroys economies so badly much of demand disappears. All together now: Happy days will be here again!

The true disaster scenario is the kingdom has 3-5mpd shut in capacity and uses it.

the Saudis are being quite responsible in just holding it at 9-10 for as long as possible because the price will still force the issue... and it is.

Who still listens to what they say anymore?

"...Kingdom has 3-5 mbpd shut in capacity and uses it."

Not sure how this could be a scenario as far as production capacity goes. Besides, much of any additional production is likely to be heavy/sour oil. The main theme of the post is to document the limited market for additional oil they may produce.

Kingdom of Saudi Arabia could boost oil put on market for a short term by simply selling more from their storage tanks, which they probably have several extra million barrels (maybe 20 or 30?). But no data suggests they have more than 2.5 mbpd extra production capacity as they claim and more likely it is less than 2 mbpd if the extra oil is to be pumped long term (more than two months).

The recent recession has actually been much worse economically than the early 80's. The cause of reduced oil consumption prior to that time was chiefly fuel switching and efficiency. In the mid 80's OPEC gave up on reducing output to keep prices up, since consumption had fallen so far.

Ron/Rockman:

As we remember KSA has flooded the market in the past, so the topic is fair. The problem of the moment that is underlying the current discussion is more however what happens if some of the existing supply from elsewhere gets cut off (particularly Iranian oil). The KSA has promised that they can cope by upping production to compensate, but this gets into the whole issue of what the quality is of the additional supplies that they can make available. There are various scenarios, such as swapping heavy sour Saudi crude for some of the lighter stuff in national strategic reserves, but other than giving breathing room while the refineries get converted, I am not sure what else that buys us, since it takes more time than the market will likely allow for it to be arranged.

KSA has said (as I will note in a later post on where it might come from) that they see their peak as being 12 mbd, regardless of what would be nice to meet suppply balance estimates from all those models used by the EIA and IEA, and if they hold to that (and I can't see why they should not if it helps with extending production rates) then I suspect we will start hurting sooner than a lot of folk are willing to admit.

No one even implied it was not a fair topic HO. And they have increased production by about 1.5 mb/d since November of 2010. What I was implying is that was the extent of their "flooding of the market" this time. We know that their fields are declining by an accelerating rate but they have also brought Khurais on line since their cut in production in 2008.

The debate is what can they do if high oil prices start to wreck the economy, as I suspect they will very soon. If they do not increase their production to halt world economic disaster we must infer that they are at their limit. But we must wait and see.

Ron P.

Ron/Rockman:

As we remember KSA has flooded the market in the past, so the topic is fair. The problem of the moment that is underlying the current discussion is more however what happens if some of the existing supply from elsewhere gets cut off (particularly Iranian oil). The KSA has promised that they can cope by upping production to compensate, but this gets into the whole issue of what the quality is of the additional supplies that they can make available. There are various scenarios, such as swapping heavy sour Saudi crude for some of the lighter stuff in national strategic reserves, but other than giving breathing room while the refineries get converted, I am not sure what else that buys us, since it takes more time than the market will likely allow for it to be arranged.

KSA has said (as I will note in a later post on where it might come from) that they see their peak as being 12 mbd, regardless of what would be nice to meet supply balance estimates from all those models used by the EIA and IEA, and if they hold to that (and I can't see why they should not if it helps with extending production rates) then I suspect we will start hurting sooner than a lot of folk are willing to admit.

By supplying the world with the same amount of oil that it is currently utilizing, the same exact amount of physical work, and physical products made from that oil would occur. No energy is created by lowering the price. So the affect on real GDP, and real work done would not change. It's a zero sum game energy wise, no matter if the oil was given away. The same amount of energy input would cause the same amount of products, goods and services, and jobs output.

What baffles me is why they sell any oil now: If they had kept half of the 100,000,000,000 barrels they sold at $20/barrel and sold it today at $120 they would have made, ...um..., a lot more. Of course this would required knowing in that past that there was a finite resource that would pay more in the future.

I guess this is the marshmallow test - if you don't eat the marshmallow now I'll give you another in an hour.

So if the _________ don't sell now they make a whack more later; as long as the society does not rebel because of lack of services due to loss of revenue.

Sounds like it comes down to sound financial management, like we have in all free democratic nations.

(that was irony, by the way, from a Canadian who is enjoying the benefits of selling off our oil at 30% discount).

Bryan

You have to look at who rules in oil exporting countries:

In the UK we have expensive government who wanted al the tax revenue and balance of trade exports they could get. A strong pound from exports beefs up the finance industry, persuades foreigners to buy UK govt debt etc.

In Saudi, they have 1000s of Royal princes living on hand-outs, cheap fuel, medical care, low or no taxes etc.

Basically all the decision makers, need the money now. The Saudis have done the best job of 'hotelling' their resources [see an old Oildrum post on Hotelling by Stuart S.] versus others because they had way more capacity than the gov was desperate for - in the past. After 50 years of high pop growth, things have become less flexible and are soon coming to a head.

Your rig count chart above shows Saudi rig count in 2006 and 2007 hitting 270 rigs. But that's where the data ends. They apparently cut back quite dramatically after that.

Saudi Arabian Drilling Rig Count Rises

And the Bloomberg article referred to in the above:

Saudi Oil-Rig Use Soars as Obama Pressed on SPR: Energy Markets

Ron P.

You must be looking at a different chart than HO's. It appears SA's rig count ramped up to ~50 starting in '06 and stayed more or less flat until about '09. The data ends about 05-'11.

Edit: I see you must be looking at the one labeled Sam Fourcher. I am looking at Euan Mearns, which is much clearer and complete.

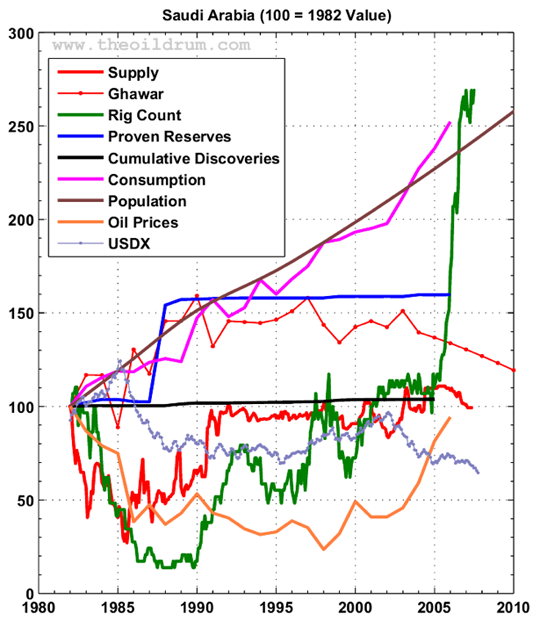

I am looking at this chart. The green line represents "Rig Count".

Various Saudi plots from Sam, though the critical one is the rig count change (Sam Foucher)

Ron P.

Yes, I see that - however, the chart doesnt include kitchen sink !

Note: 100 = 1982 Value

Yeah I see that now. For every rig they had in 1982 they then had, in 2006, 2.7 rigs.

HO,

Your list of SA Megaprojects shows 2.95 million bpd coming online between '04 and '09.

Wiki also shows 600 kbpd crude oil coming on in 2010 from Khurias expansion - Phase II. Wiki also shows 70 kbpd NGL, also from Khurias.

Altogether, Wiki shows 3.7 million bpd (including NGL)coming online from '04 through '10. Wiki shows Manifa - Phase I coming online in 2015. I beleive the plan, and part of the reason for the ramp up of rig count, is to accellerate Manifa, with a start-up in 2013.

Of course, there is that pesky problem of depletion. Sam Foucher noted that North Sea oil fields whose first full year of production was in 1999 or later--when total North Sea production hit about 6 mbpd (C+C, EIA)--had a production peak of about one mbpd in 2005. These new oil fields, whose first full year of production was in 1999 or later, served to slow the overall post-1999 North Sea decline rate to about 5%/year.

On the other hand, the conventional wisdom seems to be that Saudi oil fields don't deplete, so we shall see what happens.

bud:

I have been somewhat cynical about Manifa for about 7 years. When there is talk of increasing Saudi production, then Manifa and Safaniya are two of the immediate candidates (I will get more into this as this short series continues) but the problem reverts to who needs the oil and who can process what is available. The KSA has complained for years that when they put the types of oil that they can make available by increasing the volumes they have available, no-one wants to buy them. This is because it is heavy and sour, and with regard to Manifa, contaminated with vanadium.

The kingdom is building its own refineries to cope with this, but there are two being built and the schedules for delivery seem to fluctuate every few months, and will end with only about 1 mbd, IIRC of added capacity. Now they have been dickering with the Chinese and I will be exploring some of the new options that opens up for them in future posts.

Here is Saudi Production, January 2005 thru February 2012. As you can see they have been relatively steady for the last nine months. I think they are pumping every barrel they possibly can but that is just my opinion. The numbers are in thousands of barrels per day crude only. The data is from OPEC's Oil Market Report.

Ron P.

As you know, a couple of points: (1) Charles Mackay* has pointed out that there seems to be a bit of a disconnect between reported production numbers and actual oil deliveries from Saudi Arabia and (2) The key difference between now and 2005 is, as noted up the thread, that now the Saudis are consuming about 28% to 29% of their production, versus 18% in 2005.

We saw something quite similar in Indonesia. It appears that Indonesia's final (total petroleum liquids) production peak was in 1991 at 1.67 mbpd (BP). Their production was slightly lower, but basically flat, from 1992 to 1997. Here are the 1991 and 1997 production, consumption and net export data and C/P ratios for Indonesia (P - C = NE):

1991: 1.67 - 0.70 = 0.97 mbpd; C/P = 42%

1997: 1.56 - 1.04 = 0.52 mbpd; C/P = 67%

Production was only down by 7% in six years, but consumption had increased, as their C/P ratio increased from 42% to 67%, resulting in a net export decline of 46%. As noted up the thread, if we extrapolate the initial rate of increase in the C/P ratio, it suggests that Indonesia would approach zero net oil exports around 2002/2003, and they actually hit zero net oil exports in 2003.

Here are the total petroleum liquids data for Saudi Arabia for 2005 (BP) and my middle case estimate for 2011:

2005: 11.1 - 2.0 = 9.1 mbpd; C/P = 18%

2011 (Estimated): 10.8 - 3.0 = 7.8 mbpd; C/P = 28%

Production would only be down by about 3%, but consumption has increased, as their C/P ratio increased from 18% to about 28%, resulting in a net export decline of about 14%. As noted up the thread, if we extrapolate the initial rate of increase in the C/P ratio, it suggests that Saudi Arabia would approach zero net oil exports around 2028.

*3/5/12 Comment: http://www.theoildrum.com/node/9000#comment-877793

I wonder if Stuart Staniford's bet on 10.5 million bpd is still open ?

Sigh, after all these years of TOD and it's still just a guessing game. Wake me up when something concrete happens as regards peak oil (and I'm a believer).

A link to our "Gap" charts, showing where we would have been for various liquids measurements at the 2002 to 2005 rates of increase, versus the actual data:

http://www.theoildrum.com/node/8944#comment-874877

From 2004 to 2010, combined net oil exports from major net oil exporters in the Americas and the Caribbean fell at an average rate of 240,000 bpd per year.

From 2005 to 2010, Global Net Exports of oil (GNE) fell at an average rate 600,000 bpd per year.

And ANE (GNE less Chindia's net imports) fell at an average rate of 1.0 mbpd per year from 2005 to 2010. I estimate that this volumetric decline rate will accelerate to between 1.4 and 2.0 mbpd per year between 2010 and 2020.

As noted up the thread, at the 2005 to 2010 rate of increase in the Chindia region's net imports, as a percentage of GNE, the Chindia region alone would consume 100% of GNE in only 19 years.

Very interesting - there was a drop from ~9.70 mm bpd to 9.40 mm bpd in Sept/Oct last year - anyone think this might have been timed to coincide with SPR release last time out?

A not so subtle way of reminding US politicians that releasing even relatively meaningful chunks (60 mm bbls = ~8% of the total at the time) of the SPR can be negated very easily by reducing supply (by an even smaller amount).....

The drop was actually 30.666 million barrels or 4.22 percent.

Max 726,617,000 barrels on June 1st 2010

Now 695,951,000 barrels

Ron P.

Thanks Ron,

That the SPR draw was "only" 30.666 mm bbls makes my point even more succintly - the drop in Saudi production for those two months represents in the region of 67% of the volume released from the SPR...

So.... does anyone think this was the Saudis showing the US that they have the ability and desire to counter any negative price effects simply by choking down a few wells at the same time that oil is being released from the SPR?? Or was it just a coincidence of timing?

NFE - IMHO you don't need to attribute some hidden message in the KSA response if they did indeed sell less oil as a result of the SPR release. As I pointed out above the KSA posts the price they are selling their oil. Buyers either take the offer or not. If the KSA didn't lower their prices to compensate for the release then they are doing nothing more than carrying on biz as usual: offering oil for sale at a specific price. OTOH if you're a Gulf Coast refiner that normally buys KSA oil but the feds offer you similar oil for the same price why wouldn't they switch? The price they pay for the oil is the same yet they don't have to pay as much for transportation. It also gives them a little PR boost because they are "buying American". And as long as the release doesn't put a significant amount of extra product into the market then there's no downward pressure on pricing. Thus the refiner's profit margin might increase a tad since its net cost for the crude is a little lower. Say they cut transportation cost by just a $1/bbl. That makes them an extra $2 million by not paying a VLCC to haul that oil half way around the world.

Ironic if it plays out like that, eh? Fuel prices don't drop but the public thinks they're getting some help, the KSA preserves a little reserve base they can sell later at a higher price and, most importantly, they don't put downward pressure on crude prices for any of the producers including US Big Oil, the SPR buyers make a little better margin and the politicians/refiners get some positive PR. So virtually nothing changes despite all the hype by the MSM. One heck of an effective illusion IMHO. It would probably make David Copperfield jealous. LOL.

Rock,

Totally agree that SPR release appears to be an exercise in futility. I take on a board your valid comments that lower Saudi exports were more likely a result of fewer buyers taking the Saudi offer, which (I'd guess) would be linked to the SPR release....

So... no covert message from the Saudis to the US, just an overt message from the market instead! The market will compensate for released volumes of SPR oil when it can do so (eg take less oil from Saudi). Therefore, SPR releases only make sense when there is extreme demand/supply dislocation (eg prices are radically higher) because there is a bidding war going on due to severe supply disruptions (eg a Strait of Hormuz event). In this eventuality, I doubt SPR release would have much effect on prices, as extreme gasoline prices in the US would already be causing de facto rationing....

Just a reminder of my earlier post on Saudi consumption trends:

What's "our" oil doing in their economy?

Rather than trying to influence Saudi production paths, probably the most significant contribution Obama could make to jawboning global oil prices down is to talk the Japanese into turning their undamaged nukes back on.

http://www.ft.com/intl/cms/s/0/3eeb5dba-6d27-11e1-b6ff-00144feab49a.html...

730kbpd of direct burn crude in Japanese power plants to offset the shutdown of 52 nukes.

The current PM of Japan has been pushing to turn on more nukes, but nobody wants them anymore. The shine came right off when everyone figured out that this could happen again. Basically, local resistance is the main factor preventing the restarting of the nukes, not high level politics. While some things gradually get pushed through despite local resistance in Japan (Narita airport is one example), it takes a lot of time and effort. Japan's governments have been very fragile for a while lately, so I doubt they can muster that sort of pressure easily.

Basically, I wouldn't count on it happening easily. The Japanese also tend to get rigid under pressure, so you may get "agreements" that never turn into reality (I expect the new marine base that is supposed to be built in Okinawa not to appear anytime soon, despite agreements made under pressure from US administrations).

However unlikely, another event cutting power to a "shutdown" plant would still cause a similar situation to Fukushima. No meltdown, but with no electricity and no pumps the spent fuel still overheats and scatters radiation forcing evacuations. Might as well start producing electricity with it again, it's just a little more dangerous.

We have created something from a myth or fairytale, a machine without an OFF switch.

Obviously all the reactors should be relit immediately, except the one closest to my house....

Wow, there are some great comments. Talking about Saudi Arabia brings back fond memories of Matt Simmons, of listening to him on Financial Sense Newshour, of seeing him appear on CNBC, face flushed, talking about how oil is 15 cents a cup. Boy, do I miss Matt Simmons. Yeah right, a heart attack and accidental drowning, I believe that about as much as Ron Paul winning most of the straw polls but not a single primary. Simmons gave his life for our cause, RIP. I live in Oregon now, since I think it will survive the collapse better than other areas. If there are any fellow Oregonian peakists, perhaps we can meet up to chat about the situation sometime.

What do you think happened to MS ?

The distinct impression I got is that Simmons suffered from a lifetime of affluence, bad diet and inadequate exercise, leading to heart disease and possibly the early stages of dementia brought on by clogged arteries and small strokes. It was sad that his mental capacity declined so publicly in the last months, but his death seemed all too predictable if not entirely 'natural' in the organic sense.

From uptop:

Remember the OPEC price band?

http://www.independent.co.uk/news/business/news/opec-studying-plan-to-bo...

Of course, in this time period, early 2004, Saudi Arabia was then massively increasing their net oil exports. At the 2002 to 2005 rate of increase in their net oil exports, by 2010 they would have been at about 13 mbpd, versus the actual 2010 net export rate of 7.2 mbpd (BP, total petroleum liquids), and versus their 2005 net export rate of 9.1 mbpd.

Why is it that virtually everyone uses the term oil production to describe oil extraction?

Oil extraction rate is many orders of magnitude greater than oil production rate, and this twist of language does not help to shed our illusions.

Yair...

Yep, I agree Cycle, them darn dinosaurs sure takes a long time to melt.

Cheers.

I always find it somewhat ironic that conventional wisdom "solution" to our fossil fuel problems is to increase the rate of depletion of a finite fossil fuel resource base.

But...but..averaged over the last 100 or 200 million years, oil productin has been higher than oil extraxtion.

CE - Maybe because all the folks in the oil patch that actually get the grease outta the ground call it production. We don't use dem fancy terms like "extraction". Not for oil, NG or teeth. OTOH I get the feeling by oil "production" rate you're referring to the oil "generation" rate which is what we geonerds call the time it takes to turn organic matter into oil or NG.

ROCKMAN - Thanks for your historical explanation. I like the tooth analog. Seems accurate to say that you folks pull oil from the ground once it stops gushing, and the dentist doesn't produce teeth. Yes, IMHO, production is synonymous with generation.

CW - We trip over our own tongues in the oil patch from time to time. Just today I had to clear up some communications between my company and the La. state people. My clerk reported no "production' from a new well for last Dec. But the state saw the paper work from selling 75 bbls of oil from the well. We didn't "produce" the well (by common meaning to producion hands). But we perforated and tested it and then shut it in while we waited on production equipment. The 75 bbls was from the testing. But on the state computer any oil sales from any well shows up as "production". Just a matter of refiling the paper work but does show how we don't always communicate well amongst ourselves.

That's something that gets to me too because there isn't a single company in the world that "produces" petroleum -- sorry CAPP.ca (Canadian Association of Petroleum Producers - a misnomer if there ever was one).

The problem isn't that the oil engineers misunderstand "production", since obviously it's just the term they use while fully understanding that it's being extracted, it's that the public, and especially economists, misinterpret the term "production" too literally to mean just that -- that we are actually producing oil!!! Then they go and take this and plug it into their supply / demand charts and proclaim to the world that PO will not be a problem, that the free market will solve the problem because according to the supply / demand chart, lower supply and higher prices will motivate "producers" to produce more oil so that we revert the dynamic back to equilibrium ... FOREVER!

Well, I don't think the algae from 100 million years ago are paying attention to our supply / demand charts.

Now, now little Johnny. We all know oil comes from the factory next door to the one where the food comes from. Now sit back down and don't ask too many questions.

Desert

How does coal gasification fit into the picture of peak oil? I have zero background in petroleum but didn't Germany use gasification during WWII? I know quite a few experienced people post on TOD so any input is greatly appreciated.

apg - Your question pulls us into the area of terminology. Which is critical and unimportant at the same time IMHO. A matter of communicating ideas clearly. OTOH coal gasification, biofuels, gas to liquid, etc have nothing to do with peak oil...they aren't oil. OTOOH they have great implications re: peak motor fuel for instance. You don't have to go all the way back to WWII. In the 1970's Mobil Oil built a plant in New Zealand to convert NG into motor fuel. Turned out to not be profitable even though they were getting the NG almost free.

And this is where our friendly discussions on TOD can get confusing for some folks. Debates about how much oil is left to produce and at what rate get mingled in with alternate fuel/energy sources. And that leads to the difficulty of making predictions...especially about the future. LOL. Probably the worse confusion (with the public...not so much on TOD) is the many billions of bbls of oil some folks attribute to our western oil shales. First, there isn't oil in those shales but a solid hydrocarbon that could be converted to oil but as of yet no one has found an economical way to do so. And then those deposits sometimes get confused with actual oil production from different shale reservoirs.

The best advice I can offer is to strive to understand the specific meaning of the terms tossed around especially by the MSM and the politicians. Some are just ignorant. Some (Newt would be my poster child for such efforts) understand but are willing to intentionally confuse the public to support their agendas. It's not that difficult...just a little research and tossing out a question or two for clarification will get you there.

Thanks for the replies, I was wondering more along the lines of how much EROEI? I did just a little research and coal gasification-FT seems like the only real alternative when oil prices explode. After reading many articles and links to articles here I've gotten the same feeling that I had when house prices were exploding. The can might be kicked further down the road but how far? My analysis is very amateur but it seems to me that humans have always been in a pattern of increasing energy density. We discovered fire/wood, we then doubled our energy density from wood to coal, if my research was correct. We then doubled again from coal to oil. Now what? It seems like the only step up is fusion, so an increase seems like it is many years off. It seems almost inevitable that things will change drastically when you have no realistic increase in EROEI. I believe ominous foreboding is the phrase I'm looking for. I work for the Oregon ANG on fighter jets and I'm just now doing the math on the fuel that we burn each day flying and back of the envelope calculations I would say we burn 45000 gallons of JP-8. 18 jets carrying 17000 lbs of fuel divided by 6.7 lbs per gallon. Local FBO's must love it when our jets divert. I'm rambling so thanks again for the replies.

assume exploding prices will force a somewhat different energy use configuration than we have now, of course if the straits shut down there will be virtually no adaption time in the short run--almost can hear a big choke and sputter sound as the the tank runs dry.

Since you are in the business I have been curious: how much fly time (and range) does that 17,000 pounds of fuel allow, and about how many maintenance man hours and parts dollars per hour fly time?

Looks like our local fighter wing is getting shipped off for good, then our expensive little base (Eielson) will be left with only air guard tankers and a few yearly large scale combat excercises--lots of military reserve overland air space up here. Well I wasn't planning to sell my house anytime soon anyhow, property values will take a hit in a community this small. Good thing I'm mostly retired. Close to ten percent of my income in the last twenty years has come from working on that base.

I of course didn't mean to imply that our adapting to a new energy use configuration would be painless.

Our jets are up in the air for 45 mins. to an hour depending on how much dogfighting they do. Range I would have to look up and also maintenance costs I would have no meaningful answer on my own either. Eielson huh? I just applied for an avionics job there, I'm originally from Sitka so my families always begging me to move home. I had read about them moving a fighter wing from Eielson to Elmendorf wasn't sure if it was guard or active duty.

The fighter wing (364th) is active duty, the A-10s left quite a few years ago. The air-tanker fleet (168th Air Refueling Wing) that is staying on is guard. I believe the guard is also running the Clear Air Station phased array setup 70-80 mile south of town--I got to know that 100ft tall 'pyramid' well as it went up.

Fairbanks isn't Sitka,

MIDDLE TANANA VALLEY-

INCLUDING...FAIRBANKS...FORTWAINWRIGHT...EIELSON AFB...ESTER...

NORTH POLE...MOOSE CREEK...TWO RIVERS...FOX...CHATANIKA...CHENA

HOT SPRINGS...SOURDOUGH CAMP

359 AM AKDT FRI MAR 23 2012

.TODAY...PARTLY CLOUDY. HIGHS 10 TO 20 ABOVE. EAST WINDS AROUND

10 MPH.

.TONIGHT...INCREASING CLOUDS. SNOW LIKELY AFTER MIDNIGHT. SNOW

ACCUMULATION 1 TO 2 INCHES.LOWS ZERO TO 5 ABOVE. EAST WINDS AROUND

15 MPH.

.SATURDAY...CLOUDY WITH SCATTERED SNOW SHOWERS. HIGHS 15 TO 25.

LIGHT WINDS.

.SATURDAY NIGHT...MOSTLY CLOUDY WITH A CHANCE OF SNOW. LOWS

AROUND 5ABOVE. LIGHT WINDS.

.SUNDAY...MOSTLY CLOUDY. HIGHS 20 TO 25. LIGHT WINDS.

.SUNDAY NIGHT...MOSTLY CLOUDY. LOWS NEAR 5 ABOVE.

.MONDAY AND MONDAY NIGHT...PARTLY CLOUDY. HIGHS NEAR 25. LOWS

NEAR 5 ABOVE.

.TUESDAY THROUGH WEDNESDAY NIGHT...PARTLY CLOUDY. HIGHS NEAR 30.

LOWS 5 TO 10 ABOVE.

.THURSDAY...PARTLY SUNNY. HIGHS NEAR 25.

&&

TEMPERATURE / PRECIPITATION

FAIRBANKS 18 2 18 / 0 70 50

The 'long season' certainly can be. Getting out for a while at Halloween/Thanksgiving time shortens it up a lot. This is the fun time of winter, lots of daylight (last night still a glow of sunset in the far western sky after 10PM--that glow gets later as it moves north every night till it just quits getting dark altogether in May) and daytime temps are finally starting to rise. Rivers are frozen highways for sleds and trails are in great shape. The yearly 50k ski event tomorrow, a lot of it through Fort Wainwright (which borders Fairbanks).

There is a small refinery at North Pole which predominantly serves Eielson, not sure how moving the fighter wing works out for them. Koch Brothers own the larger North Pole refinery. Their biggest customer is the Anchorage airport air cargo hub, a couple one hundred car tanker trains haul jet fuel there daily peak season in good times. A bit expensive to operate refineries in the subarctic but they do have a fairly sweet arrangement with Alyeska (the Alaska Pipeline owner/operator) where they get to partially refine enough crude to keep their final product mix at 90% diesel/jet fuel or so and put the partially degraded crude they won't be using back into the pipeline (there is a charge to the refineries for the quality loss in crude they return). The refineries actually raise the temp of the all the oil in the line about ten degrees in the process so they are an important part to keeping TAPS flowing at the lower oil production levels. The fossil fuel web we have woven is highly interconnected, that is sure.

Coal gasification was, and is, an energy source in countries which had abundant coal but not natural gas/oil. Hence the historical use by Germany (and to a lesser extent Britain) and its continued use in places such as South Africa. Look up Sasol, the South African national energy company, which is a big player, and has a number of technological processes it uses (such as the proprietary Fischer-Tropsch) to produce synthetic liquids form a variety of gas sources.

o-t: Speaking of Sasol, did you catch my post about the rumor that they're planning to build a $12 billion gas to liquids plant in SW La?

Rockman: No, I missed that! I do some work with them on African assets but in the upstream oil/gas sector. I know they bought into Canadian assets via Talisman, and there was talk of using their GTL technology in that part of the world.