Peak Oil Update - January 2007: Production Forecasts and EIA Oil Production Numbers

Posted by Sam Foucher on January 15, 2007 - 11:00am

An update on the last production numbers from the EIA along with different oil production forecasts.

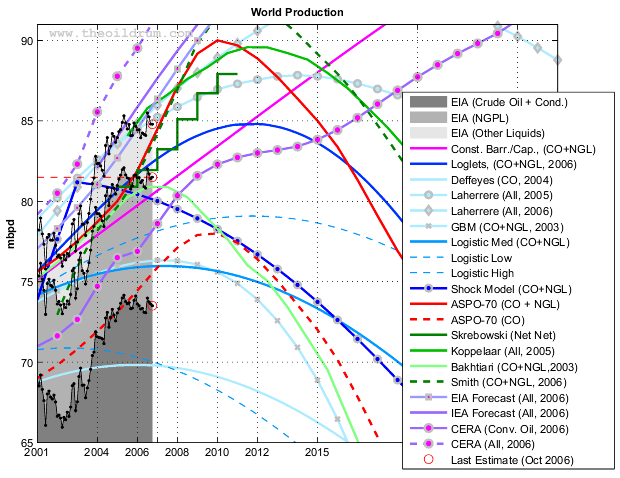

World oil production (EIA Monthly) and various forecasts (2001-2027). Click to Enlarge.

What's new:

- Michael Smith from the Energy Institute (World, CO+NGL, 2006)

- Michael Smith (Saudi Arabia, 2006)

A French version is also available on TOD:Canada here.

A pdf version of this article is available here.

- mbpd= Millions of barrels per day

- Gb= Billions of barrels (109)

- Tb= Trillions of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO= Crude Oil + lease condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (October)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy 2006 (Crude oil + NGL).

- EIA data (monthly and annual productions up to October 2006) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

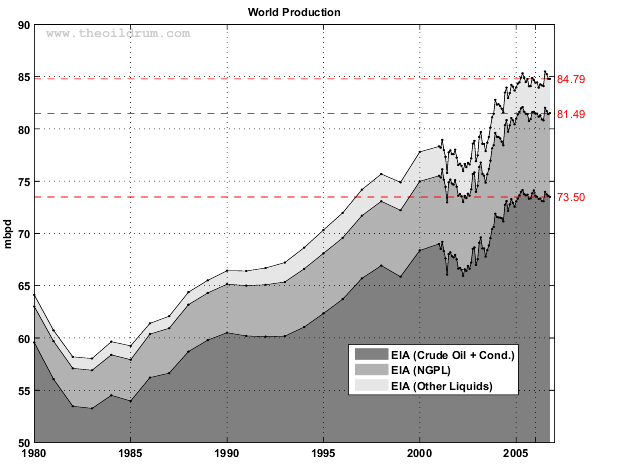

The All liquids peak is now July 2006 at 85.49 mbpd (previously May 2006 at 85.21 mbpd), the year to date average values in 2006 (10 months) are down from 2005 for all the categories except for the total liquids which now equals 2005 production. The peak date has changed for Crude Oil + Cond. and is now May 2005 at 74.15 mbpd (see Table I below).

Fig 1.- World production (EIA data). Click to Enlarge.

| Category | Oct 2006 | Oct 2005 | 12 MA1 | 2006 (10 Months) | 2005 (10 Months) | Share | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|

| All Liquids | 84.79 | 84.87 | 84.60 | 84.56 | 84.56 | 100.00% | 2006-07 | 85.49 |

| Crude Oil + NGL | 81.49 | 81.60 | 81.41 | 81.37 | 81.41 | 96.12% | 2005-05 | 82.08 |

| Other Liquids | 3.29 | 3.27 | 3.18 | 3.19 | 3.15 | 3.88% | 2006-08 | 3.54 |

| NGPL | 8.00 | 7.77 | 7.86 | 7.90 | 7.85 | 9.43% | 2005-02 | 8.05 |

| Crude Oil + Condensate | 73.50 | 73.83 | 73.55 | 73.47 | 73.57 | 86.68% | 2005-05 | 74.15 |

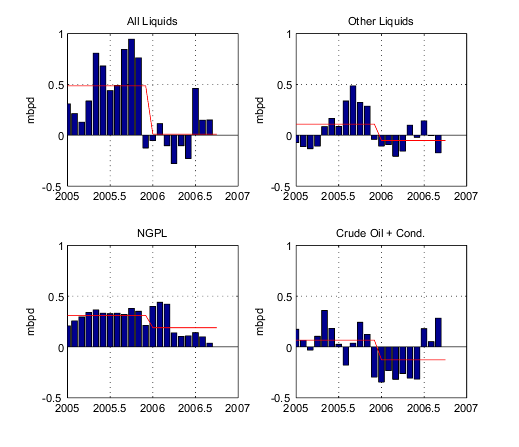

Revision Pattern

The cumulative change in production estimates are shown on Figure 2. The 2005 annual production for all liquids has been revised up by 0.5 mbpd since first estimate. NGPL estimates increased. CO+NGL production has been revised down for 2006 so far.

Fig 2.- Cumulative change in production numbers since first estimates are issued for each month. Click to Enlarge.

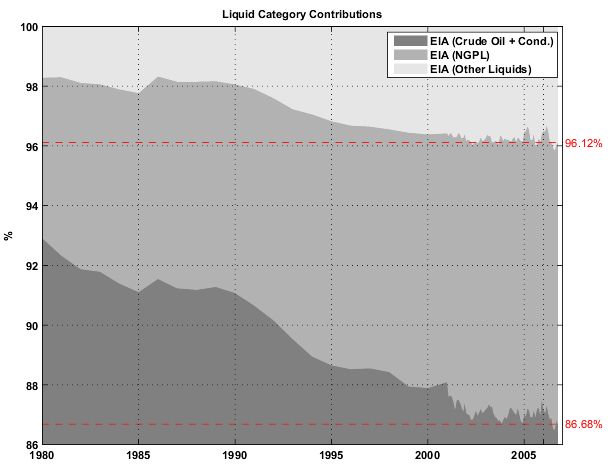

The share of CO is now only 86.68% of the total liquid production.

Fig 3.- Share of each liquid category to the total liquid production. Click to Enlarge.

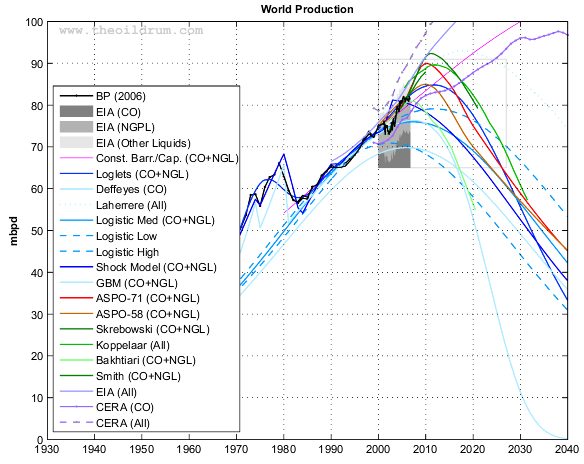

Fig 4.- World oil production (Crude oil + NGL) and various forecasts (1940-2050). The light gray box gives the particular area where the Figures below are zooming in. Click to Enlarge.

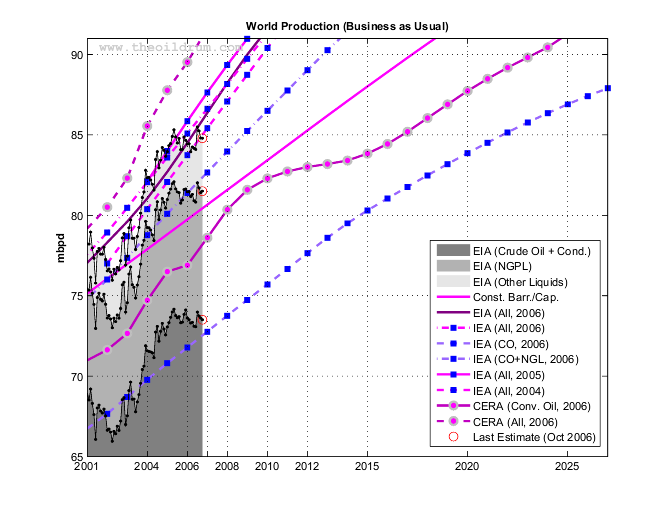

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2006 : forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004 : forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.4496 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 5.- Production forecasts assuming no visible peak. Click to Enlarge.

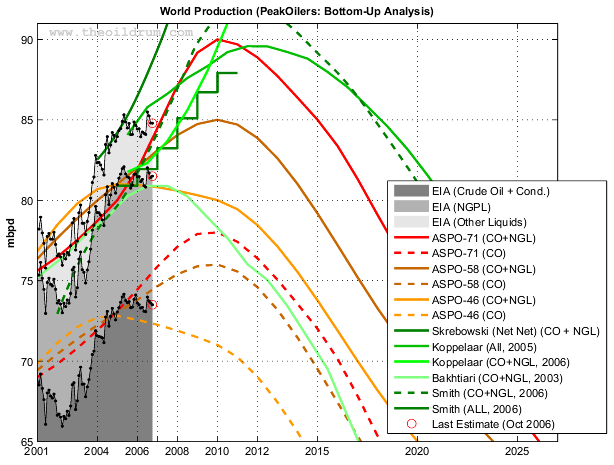

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

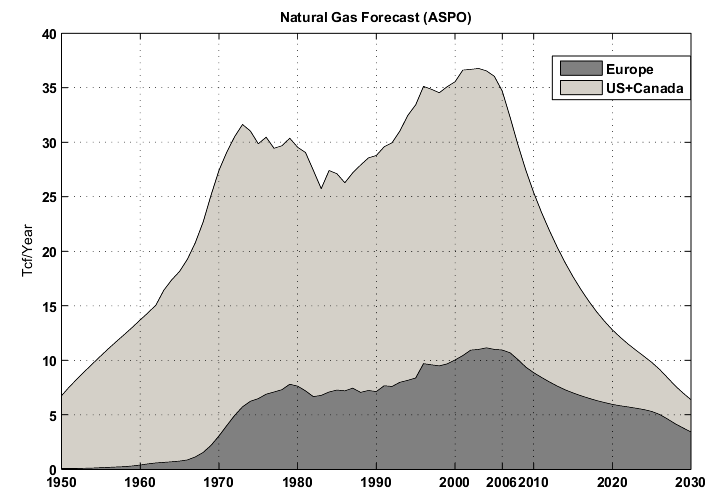

- The ASPO forecast from the last newsletter (#71): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively). There was no revision since August 2006.

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (Energy Institute) for CO+NGL, the data have been taken from this chart in this presentation (pdf).

Fig 6.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

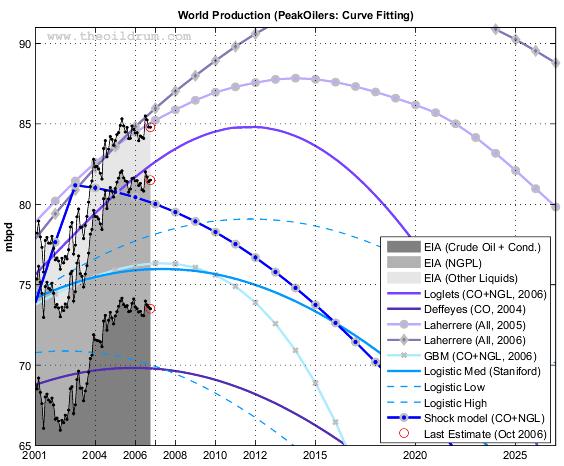

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006). World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions ; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here. The current estimate was done in 2005 based on BP's data.

Fig 7.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

Production Growth

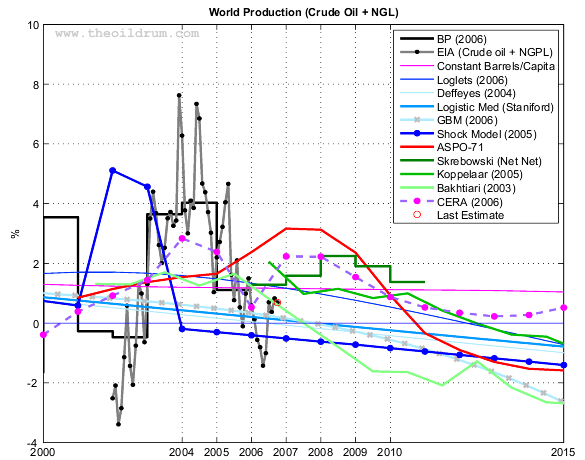

The chart below gives the year-on-year production growth (or decline) for each month. Growth has been weak (below 1%) most of the year but went back in positive territory since last July.

Fig 8.- Year-on-Year production growth. Click to Enlarge.

| Forecast | 2005 | 2006 | 2007 | 2010 | 2015 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|

| All Liquids | |||||||

| Observed (EIA) | 84.56 | 84.56 | NA | NA | NA | 2006-07 | 85.49 |

| Koppelaar (2005) | 84.06 | 85.78 | 86.61 | 89.21 | 87.98 | >2011 | >89.58 |

| EIA (IEO, 2006) | 82.70 | 84.50 | 86.37 | 91.60 | 98.30 | >2030 | >118.00 |

| IEA (WEO, 2006) | 83.60 | 85.10 | 86.62 | 91.30 | 99.30 | >2030 | >116.30 |

| IEA (WEO, 2005) | 84.00 | 85.85 | 87.64 | 92.50 | 99.11 | >2030 | >115.40 |

| IEA (WEO, 2004) | 82.06 | 83.74 | 85.41 | 90.40 | 98.69 | >2030 | >121.30 |

| CERA1 (2006) | 87.77 | 89.52 | 91.62 | 97.24 | 104.54 | >2035 | >130.00 |

| Lahèrrere (2006) | 83.59 | 84.82 | 85.96 | 88.93 | 92.27 | 2018 | 92.99 |

| Lahèrrere (2005) | 83.59 | 84.47 | 85.23 | 86.96 | 87.77 | 2014 | 87.84 |

| Smith (2006) | 85.19 | 87.77 | 90.88 | 98.94 | 98.56 | 2012-05 | 99.83 |

| Crude Oil + NGL | |||||||

| Observed (EIA) | 81.45 | 81.37 | NA | NA | NA | 2005-05 | 82.08 |

| IEA (WEO, 2006) | 80.10 | 81.38 | 82.67 | 86.50 | 92.50 | >2030 | >104.90 |

| ASPO-71 | 80.00 | 81.90 | 84.48 | 90.00 | 85.00 | 2010 | 90.00 |

| ASPO-58 | 81.00 | 82.03 | 83.10 | 85.00 | 79.18 | 2010 | 85.00 |

| ASPO-45 | 81.00 | 80.95 | 80.80 | 80.00 | 73.77 | 2005 | 81.00 |

| Koppelaar (2006) | 81.76 | 82.31 | 83.68 | 91.00 | NA | >2010 | >91.00 |

| Bakhtiari (2003) | 80.24 | 80.89 | 80.89 | 77.64 | 69.51 | 2006 | 80.89 |

| Skrebowski (2006) | 80.90 | 81.42 | 82.59 | 87.32 | NA | >2010 | >87.92 |

| Smith (2006) | 80.53 | 82.81 | 85.45 | 91.95 | 88.60 | 2011-02 | 92.31 |

| Staniford (High) | 77.45 | 77.92 | 78.31 | 79.01 | 78.51 | 2011-10 | 79.08 |

| Staniford (Med) | 75.81 | 75.94 | 75.97 | 75.52 | 73.00 | 2007-05 | 75.98 |

| Staniford (Low) | 70.46 | 70.13 | 69.71 | 67.92 | 63.40 | 2002-07 | 70.88 |

| Loglets | 81.12 | 82.14 | 83.02 | 84.65 | 83.26 | 2012-01 | 84.80 |

| GBM (2003) | 76.06 | 76.27 | 76.33 | 75.30 | 67.79 | 2007-05 | 76.34 |

| Shock Model (2006) | 80.76 | 80.43 | 80.01 | 78.27 | 73.74 | 2003 | 81.17 |

| Constant barrels/capita | 78.81 | 79.73 | 80.66 | 83.42 | 88.01 | 2050 | 110.64 |

| Crude Oil + Lease Condensate | |||||||

| Observed (EIA) | 73.65 | 73.47 | NA | NA | NA | 2005-05 | 74.15 |

| IEA (WEO, 2006) | 70.80 | 71.78 | 72.77 | 75.70 | 80.30 | >2030 | >89.10 |

| CERA1 (2006) | 76.49 | 76.89 | 78.60 | 82.29 | 83.83 | >2038 | >97.58 |

| ASPO-71 | 73.10 | 74.45 | 75.87 | 78.00 | 72.00 | 2010 | 78.00 |

| ASPO-58 | 73.00 | 73.80 | 74.65 | 76.00 | 69.50 | 2010 | 76.00 |

| ASPO-58 | 72.80 | 72.56 | 72.25 | 71.00 | 63.55 | 2005 | 72.80 |

| Deffeyes (2004) | 69.81 | 69.81 | 69.71 | 68.90 | 65.88 | 2005-12 | 69.82 |

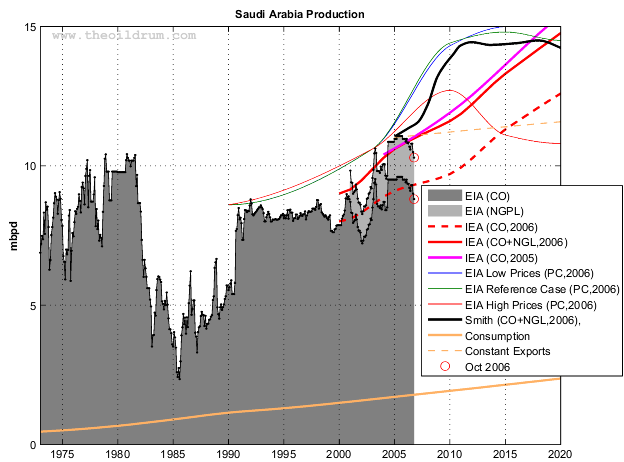

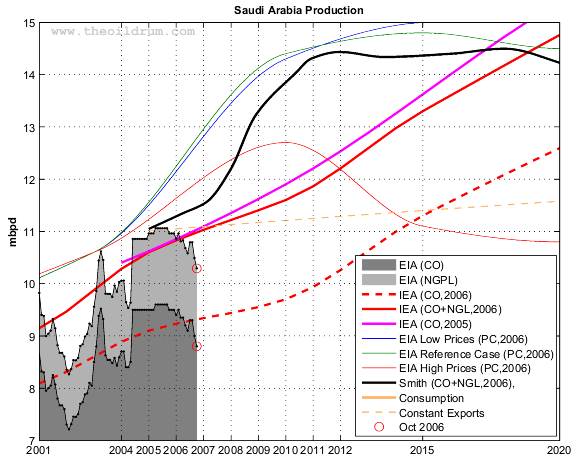

Saudi Arabia

The Figure 7 below gives Saudi Arabia production for crude oil and NGPL (data from the EIA: Monthly Energy Review for CO and the International Petroleum Monthly for NGPL).- IEA World Energy Outlook 2006 : forecasts for CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- EIA, International Energy Outlook 2006 : World Oil Production Capacity by Region and Country, Reference Case, High and low prices scenarios, 1990-2030 (Table E1, p. 155).

- Forecast by Michael Smith (Energy Institute) for CO+NGL, the data have been taken from this chart in this presentation (pdf).

I've added a simple domestic consumption forecast based on a population forecast by the UN and a constant number of barrels per capita at (see here for details). In order for exports to remain at their 2005 level and assuming the aforementioned consumption model, production needs to grow by (orange dotted line on the charts).

Fig 9.- Saudi Arabia oil production (EIA Monthly) and various forecasts (2001-2020). The EIA estimate is a productive capacity (PC). Click to Enlarge.

| Forecast | 2005 | 2006 | 2007 | 2010 | 2015 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|

| Crude oil + NGL | |||||||

| Observed (EIA) | 11.01 | 10.71 | NA | NA | NA | 2005-04 | 11.06 |

| IEA (WEO, 2006) | 10.60 | 10.83 | 11.03 | 11.60 | 13.30 | 2030 | 17.30 |

| IEA (WEO, 2005) | 10.62 | 10.85 | 11.09 | 11.90 | 13.62 | >2030 | >18.20 |

| EIA Low Prices (IEO, 2006) | 11.79 | 12.45 | 13.11 | 14.40 | 15.01 | >2030 | >18.60 |

| EIA Reference Case (IEO, 2006) | 11.87 | 12.57 | 13.27 | 14.46 | 14.79 | >2030 | >17.10 |

| EIA High Prices (IEO, 2006) | 11.41 | 11.82 | 12.19 | 12.65 | 11.06 | 2010-01 | 12.70 |

| Smith (2006) | 11.16 | 11.39 | 11.78 | 14.08 | 14.38 | 2018-01 | 14.50 |

| Crude Oil + Lease Condensate | |||||||

| Observed (EIA) | 9.55 | 9.23 | NA | NA | NA | 1980-11 | 10.41 |

| Consumption | |||||||

| Cont. Barrels/Capita | 1.71 | 1.75 | 1.79 | 1.92 | 2.14 | 2050 | 3.43 |

Next update in February.

Previous Update:

December 2006November 2006

October 2006

September 2006

Khebab@theoildrum.com

![[-]](/images/thread_collapse.gif)

Consider this a reminder to positively rate this articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us if you are so inclined. (email me at the eds box if you have questions about this).

Also, don't forget to submit this to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

I can assure you that the authors appreciate your efforts to get them more readers.

Khebab-very well done!

Figure 3 was very interesting -the total of all liquids that is actual crude oil has declined from 92% to 86% - most of this difference has been made up by natural gas plant liquids (which makes sense, seeing that we have ramped up Nat gas production since 1980). It would be interesting (though probably impossible) to take these numbers and look at the decline in net energy delivered to society - as presumably the 14% of total liquids that are now NOT crude oil or condensate, require more energy to create which is taken out of the total pie.

It will also be interesting to see the impact of NA gas cliff on the NGPL component - though the world as a whole may still get a good boost in this area.

Nice job (again)

But on a per capita basis it is surely declining. You know, Olduvai and all that Jazz…

Thanks Nate,

Re: as presumably the 14% of total liquids that are now NOT crude oil or condensate, require more energy to create which is taken out of the total pie.

Besides, it could be interesting to know how much diesel fuel has been used to produce ethanol which is counted in the "Other Liquids" category.

Re: It will also be interesting to see the impact of NA gas cliff on the NGPL component - though the world as a whole may still get a good boost in this area.

I agree, NGPL production is almost flat since February 2005 but seems to have increased a little bit lately.

Besides, it could be interesting to know how much diesel fuel has been used to produce ethanol which is counted in the "Other Liquids" category.

We discussed this some yesterday in another thread. The answer to this is 'not much'. The bulk of the energy input is derived from natural gas.

What else could have been done with the natural gas?

The number Austex came up with was 23% of the BTUs for a gallon of ethanol was from gas/diesel.

Unfortunatly he didn't save his work and only posted the results.

Last night after the fact I found this piece of analysis that I did not see the other day when I was trying to calculate the crude oil inputs. By far the most detailed and thorough piece of work that I've seen to this point. Many of the numbers are justified as well, which I did not see much of the other day. Check it out if you have time. It's few years old, but should still be fairly applicable to today's situation

http://www.ncga.com/ethanol/pdfs/energy_balance_report_final_R1.PDF

If you don't have time, in his conclusion (pg 55/56) it's stated that the makeup of btu's comes from 7.3% petroleum, 75.2% coal/natural gas, and 17.5% captured solar energy by the corn.

I'm thinking these percentages do not include transportation of feedstock and finished product which is why my conclusion came out with a higher percentage.

The link refers to the energy balance of corn ethanol. Until the recent foolish burst of subsidized ethanol production from the US, the single largest producer of ethanol was Brazil and it was done with 100% sugar cane.

Sources that I have frequently posted here cite energy balances of 8-10 from sugar cane-based ethanol rather than the 1.2-1.3 from corn.

So even if crude based inputs constitute 50% of the energy input into sugar cane based ethanol production, they woudn't be more than 5-6% of the BTUs in the final fuel.

So instead of double counting, in the case of sugar cane, it is more like + 5% counting. Biodiesel presumably comes somewhere in between.

I believe that the world could derive 5-10% of the BTU content in all liquid fuels from sugar cane without much damage to the environment (and ideally with improvement to health). This would be a significant offset to waning oil supplies and would have little actual oil content.

By the way, I think it makes sense to count and track both C & C figures as well as all (net) liquids, but for different purposes. C&C is the best measure of peak oil. All (net) liquids is the best measure for how mankind will cope with it.

'By the way, I think it makes sense to count and track both C & C figures as well as all (net) liquids, but for different purposes. C&C is the best measure of peak oil. All (net) liquids is the best measure for how mankind will cope with it.'

A succint and important point, well worth keeping in mind as the inevitable decline of crude production will lead to a number of different directions in how that reality is accepted, from starving those who can't pay for a tank of gas (based on the data that the corn required for one tank of vehicle fuel is equivalent to what one human requires for a year) to utopian visions of peaceful powerdown, or in the German expression, 'Frieden. Freude. Eierkuchen.' (a slightly nonsensical expression meaning 'Peace, Joy, and Pancakes' - or if you are from Berlin, then 'Peace Joy, and jelly filled Doughnuts' - sort of like 'happily ever after,' it tends to refer to something very desirable, but which will never really occur.)

Explain the basis of this belief, please. How much topsoil is lost annually to achieve this process? How much silting occurs annually to achieve this process? How much water table damage occurs annually to achieve this process? What level of salinization occurs annually? Under what population scenarios? Under what consumption scenarios?

Please provide the data for your conclusion, as I do not believe the statement you made.

Thank you.

I found that graph quite interesting as well. There has been a tendency for some to characterize the growth in 'All Liquids' as being much steeper and more recent than this graph displays. Although growing, All Liquids has obviously been a significant percentage for quite a while. I don't see the 'market forces' all the sudden kicking in here.

So far it looks like Bakhtiari gets the cigar for being the most accurate. His prediction, CO + NGL, made over three years ago, (3003) is now spot on. He predicted that the peak would be right now, well actually 2006, and so far it is.

Peak CO is still 2005 but it is so close we must say we are on the peak plateau. When we come off this plateau which way will we turn? Bakhtiari says it will turn down. That is my guess also.

Bakhtiari is an Iranian and knows more about Iran and the Middle East than anyone giving us reserve numbers today. Well, that is true in my opinion anyway. Others may to choose to believe the IEA or the EIA but one glance at the graphs above should instantly tell us how accurate we can expect their prediction may be. Only a Freddy Hutter would believe those absurd numbers.

Bakhtiari On Middle East Oil Reserves:

http://www.evworld.com/view.cfm?page=article&storyid=980

Ron Patterson

I forgot to add, Bakhtiari has the plateau lasting through 2007 and turning down in 2008. I think this is very significant. We cannot expect a sharp drop (or rise) anyway soon. As some nations peak, others are still increasing production, but only slightly. Russia, if not already peaked, is likely to peak in 2007. China is likely at peak. Of the major producers, other than Russia only Brazil, Angola and the Caspian area are yet to peak. Canada is a big question mark. I think they will likely increase production but so slowely it will have little or no effect on the peak date.

Ron Patterson

This is why I feel that the ongoing debate between WT and RR is irrelevant. Maybe there will be a new high in the next year or so or maybe there won't. But it will not be sustainable and will be overtaken relatively quickly by declines in other world producers. Let's wait and see, but it is really only a technical point IMHO.

As I noted down the thread, the midpoint between Deffeyes' most likely pick for the world peak and Robert's earliest pick for the world peak is about five months away--July 1, 2007.

This is why I feel that the ongoing debate between WT and RR is irrelevant.

You would be correct if what we were debating is the peak date. It is not, but those who believe it is see the debate as essentially nitpicking.

The debate, from my perspective, is about the quality of data you use to support your argument, and how well that data withstands scrutiny. I will leave it at that.

Except that WT model implies that the treadmill of depletion is speeding up as the giants peak and decline. This leads to a small cliff off the peak plateau as the decline rate of the giants have a large impact on production.

This mini cliff will have huge repercussions economically.

In later posts you mention that we have handled the peaking of various giants with increased production form other sources but the problem is the timing I don't think we can handle ghawar/canterell collapsing in the end 2007/2008 time frame along with worldwide depletion.

To me this post plateau dip is the important issue. WT implies a big drop you disagree. A 14% decline or better from both Ghawar and Canterell at the same time cannot be made up in the time span IMHO. And its this initial roll off peak which is the most critical.

"...I don't think we can handle ghawar/canterell collapsing in the end 2007/2008 time frame along with worldwide depletion."

Why not? Gas will become expensive and people will drive slower, less and buy smaller cars. That alone can reduce gas consumption by 10% in the US, if necessary. We are not looking at 20% annual decline but at a few percent initially and 5-10% later. As world oil consumption declines, a new equilibrium between price and utility function of oil will be found. Currently the utility of most of the oil we burn in the US is 0. We burn it to make us feel better about ourselves by driving a larger than necessary vehicle. I bet that the average consumer can replace one gallon of gas with one dose of Viagra and probably not notice the difference. Or, maybe, he will notice the difference. Viagra will actually give him the better erection the SUV ads promised.

At current prices, one dose of Viagra costs considerably more than a gallon of gasoline -- however you want to factor that into your argument...

Don't forget to calculate the utility of Viagra vs the utility of a gallon of gasoline. Viagra gives an old guy an erection, gasoline does the same for the young male.

Pfizer is applying to have Viagra sold over-the-counter. This should allow them to drop the price somewhat as they are anticipating huge sales increases (pun intended).

I was more thinking about the energy required to produce one dose of viagra. I bet it can be done for less than one tenth of a gallon worth of gas. Pharmaceutical chemists are welcome to give us an estimate of the net energy required to make sildenafil citrate.

The direct energy needed to make the actual tablet might be small, but when you include the entire energy utilization chain: employees, food, transport, r&d, packaging, etc, its probably in the several gallons per viagra tablet.

I wonder what the half-life of that stuff is.....

This makes no sense to me; if it took more than two gallons of gasoline to deliver a tablet of a drug, the drug would have to cost more than than two gallons of gas (and there are numerous other costs involved, plus a large profit). Since it doesn't, it can't be requiring that much gasoline to produce. Generic viagra (not legally available in the US, yet) costs a small fraction of what the branded product does, so we can be pretty sure that the energy is much less than that.

In Stuart's thread of Dec 8, the point was made that price increases in the last few years haven't reduced consumption significantly. In order for price to really affect consumption, first it has to be high enough to really hurt. Since 3.5% of our typical budget now is spent on motor vehicle fuel, and 15% of our vehicle expenses are fuel, it would require a pretty big jump. It needs to be combined with a recession, and there needs to be an expectation of continuing shortage. Political leadership is also a factor.

There may be 'stealth' effects over a period of time with higher gasoline prices that don't show up in immediate consumption figures. Families have to spend a continuously larger portion of their discretionary budget on gasoline and probably run up the credit card balances even more. And spending elsewhere will be cut down, all leading to greater chance of recession which would definitely cause a slowdown in gasoline consumption. You would get sort of a 'slingshot' effect with a buildup in the economy of pressure from the higher gasoline prices, resulting in no immediate drop in consumption, but the whole economic machine would eventually falter.

It's already been tabulated and hasn't changed since last month. $10/barrel increase or decrease in oil affects Real GDP 0.45% over 24 months.

All I can say is your not considering the impact on the third world and resulting political fallout.

A fairly sudden and continued increase in price caused by the elimination of any spare capacity will not be easy to deal with.

The effect of the WT model is that we will run into a situation that leaves us no spare capacity at best and at worst a real shortage of a few mbd compared to normal demand. The result is a price spike followed by nominally high and destructive oil prices along probably with the dawning understanding that peak oil is real.

Getting the masses to believe in addressing peak oil while we have time to mitigate is a good thing while even the chance of the world suddenly becoming peak oil aware because we are really post peak is not good.

Thats the big reason I believe in addressing peak oil earlier than later.

Mitigation needs to start today not when the world believes peak oil is imminent. Even the most optimistic analysis puts peak oil within 30 years

half this for safety and we would have 15 years to wean ourselves of oil.

Even with this its time to start working on moving away from a oil based society.

Its a chicken and egg problem if we start to seriously work on moving away from oil I think that we can and will get good numbers on remaining reserves.. And this will of course give us a clear picture on the time we have to transition. The reasoning is that the first step in mitigating peak oil will be to of course force all oil producers to become transparent.

If we don't then we won't get real numbers until peak is blatantly obvious.

I doubt that educational efforts to explain PO will have any lasting or even significant effect on consumer behaviour. As long as fuel is cheap - and right now fuel is still very cheap - most people will not abstain from buying oversized cars. I did point out in other posts that people I know and work with follow consumer patters with anti-correlation between income and vehicle mass/engine volume. The more educated they are, the more efficient cars they drive. But this is probably mostly motivated by the need of PhDs to send their kids to expensive schools (and thus moderate all their other expenses) rather than an insight into the workings of PO. There is considerably less moderation on the side of people with far more limited incomes who would actually profit more from conserving fuel and their income.

The driving factors in the US as well as in Europe (and I would assume Japan) towards higher fuel efficiency are fuel price and regulations, not insight and rational response to foreseable events. I don't see any serious efforts in the US to limit waste outside of a few state settings (like CA) but even those fall far short of efforts in Europe. I also don't expect a $/gallon tax hike on transportation fuels which is the least that would be required to save tens of billions of dollars which need to be invested in effective fuel economy measures. The US had a hard landing with vehicle economy in the 70s and it is waiting for another hard landing now. Just like then, there are plenty of automobile companies waiting to supply the burn victims with soothing economy models to reduce the pain. Just like then the US industry will implode on its own failings. I am sure they have greased enough politicians already to bail them out.

I agree, so far Bakhtiari's forecast has the best performance (in terms of number of predictive years and quality of the fit). Also, surprisingly, the old ASPO forecasts (ASPO-46 and 58) are quite good for CO.

I agree with this assessment. I had mentioned after Khebab's post a couple of months ago that Bakhtiari's curve looked the best fit. At the moment it looks like 2007 might be a "quiet" year for peak oil with low prices for much of the time dampening public and political concern. As long as KSA and OPEC can get away with saying that they are "voluntarily" limiting production to prop up prices, many people who don't want to accept the peak oil argument, won't.

As previously posted on TOD Europe, I think the real fun and games will come next year (maybe in the second half of the year), as we start to come off plateau, prices rise, economies struggle to cope and OPEC (maybe) can't get the output up to control them. Then watch financial markets, the $ and real estate prices tumble.

Hi Ron,

Bakhtiari’s model is quite apart from the other for it includes economic constraints resulting in an earlier peak. By 2003 the soon-coming cycle of deep-offshore production was still very unclear and I believe was hardly well incorporated in WOCAP, thus I think a new run with present data would probably give different results. Lets hope Bakhtiari does so, as he indicated some time ago.

Freddy is a very important member of this forum, that kind of comments not only fail to recognize that but also diminish the level of openness of the debate.

I agree Luis, but everytime Freddy replies to one of my posts his comments are far worse than anything I could possibly dream up.

The above degrading comments are typical of Freddy Hutter and I was still stinging from them this morning. And that is why I took off on Freddy. However if you could possibly persuade this very important member of this forum, to be a little more civil, then I would be very glad to do likewise.

Ron Patterson

Hey Ron, don’t try to justify something bad with another bad thing.

If you don’t like Freddy’s conduct, you shouldn’t repeat it on the first place. If every one did so this would be a very sad forum.

Freddy is well known for his excessiveness. Like everyone does with the Oil CEO / Hugo Chavez / James Bond character, why don’t you just ignore Freddy when he looses it?

We didn't just ignore him.

We banned him.

Thank you!

And you acted correctly BUT now he is back. Same as before but just a tad less offensive. Not much but a tad.

Isn't InfinitePossibilities just as bad? When are you banning him?

Huh? You're kidding, right? I haven't been around all that long but InfinitePossibilities seems to be one of the more rational and objective posters here. Unlike most, he seems to have at least a basic grasp of economics, something more peak oilers would do well to emulate.

My impression that the reason so many people have such a big problem with Hothgar and Infinite Possibilities, and not with I'm Skeptical, for example, is ideology.

We are shocked when a commenter insults someone we agree with, but cheer the same behavior when it is done against someone we don't.

Frankly, I do think some of the commenters whose only role here seems to be insults should be reprimanded privately first, then banned.

But we should encourage disagreement, avoid groupthink and not censor people by banning or insults. I do think a lot of people with differing viewpoints have been chased away by hostile commenters, many of whom don't ever contribute much intellectual product themselves.

I think some of my favorite commenters here are people I frequently disagree with and would sadly have to abandon TOD if it became a one sided choir.

It's my impression that ImSkeptical has an ideology similar to Hoth and IP.

I think the problem is not ideology, but social skills. If you're rude, people will take offense. Kevem is a doomer, but he's not popular here, either, because he's rude.

I think the problem is not ideology, but social skills

>> Or maybe both.

It's my impression that ImSkeptical has an ideology similar to Hoth and IP.

>> How about any poster whose posts are so predominantly insulting that we can't even tell what their ideology is, gets banned?

Freddy also referred to Kenneth Deffeyes and Matthew Simmons as "Scumbags."

There are a lot of terms I would use for people that describe Deffeyes and Simmons as "Scumbags," but "very important" is not one of them.

These gentlemen certainly have credentials and are well spoken. But IMHO, it is disgusting for them to use their notoriety and misinformation to imply a Peak that has not happened and is not going to happen in the near future. IEA has published new monthly, quarterly and annual Supply records for 2006.

There are media reports circulating that Simmons takes the subject further and infers immenent economic Depression on the short term. They may or may not be wrongly attributed but they are out there.

It also troubles me that both at times seem to use the narrow definition of C&C to allow them wiggle room to hype the MSM reporting at conferences etc that the globe has Peaked. It misrepresents the marketplace and causes confusion and cynicism.

They are both irresponsible and know better.

M King Hubbert got it wrong in the 1976 National Geographic. A 1995 Peak at 110-mbd. Colin Campbell is infamous for upward revisions. Todays Peak Oil awareness efforts do not need two idiots "crying wolf". And one has to question their motives and character.

With a little care and due diligence, the problems ahead surrrounding Peak Oil can be laid out w/o the ties to dieoff, fiat currency and economic collapse that abounds in Peakster promotions.

It is fortunate that MSM has degraded to tabloid style journalism of late and has been a willing partner in exposure of the apocalyptic scenarios. It may fool the consumer and gullible. But decision-makers, govt's and stakeholders will simply dismiss the topic and its apparent junk science...

With a little care and due diligence, the problems ahead surrrounding Peak Oil can be laid out w/o the ties to dieoff, fiat currency and economic collapse that abounds in Peakster promotions

I think it's unfortunate that people have gotten involved in the debate that are unobjective. People have been calling for the collapse of civilization since it began.

Logical people can see through these arguments and dismiss these people as idiots, and rightfully so. Unfortunately, the real issues regarding the possibility of peak liquids get dismissed by most people since the premise is currently connected to these idiots

Well, another who thinks Simmons and Deffeyes are itiots. Actually I don't think Simmons and Deffeyes are predicting the end of civilization as we know it.

That being said, is that the best you guys can do. That is, to call us guys who predict that the decline of fossil fuels will cause a subsequent decline in the population of humankind idiots? Is that idiocy?

One good argument is worth a thousand vile names. Instead of calling us vile names, please just answer our arguments instead! My argument can be found here: http://dieoff.org/page137.htm Either answer it or shut up! At least please treat those who disagree with you with a little respect instead of calling us idiots, scumbags or frauds.

Ron Patterson

Are you going on record and stating that Simmons and Deffeyes are predicting civilization collapse and and a mass dieoff? Please post the link as I have not seen them say this.

Or more likely, are you just attempting to twist my reply into implying that I'm referring to Simmons and Deffeyes?

Damn! Man read what I said. I said, (cut and pasted from my post):

But you say you have seen them say this. I have not! But I am predicting that but not based on anything Simmons or Deffeyes said or wrote. I am predicting that based on forty years of studying the overpopulation problem, reading about one hundred books on the problem, and a hundred or so other reasons. Three great references come to mind. "Overshoot" by Catton, "The Spirit in the Gene" by Morrison and "Energy and Human Evolution" by David Price: http://dieoff.org/page137.htm

You can read Price's essay in less than 20 minutes. If you are too lazy to do that then please don't bother me anymore with your unfounded faith.

Ron Patterson

Dude, whatever. I was NOT referring to these two guys as idiots, and you know it.

I'm done responding to you. Good night.

Why am I not surprised? At least I do read both sides of the problem. I have read Bjorn Lomborg's "The Skeptical Environmentalist". I have read Julian Simon's "The Ultimate Resource". I read web pages, much longer than Price's essay, daily who think peak oil and us doomers are all wet, every day. I read both sides of the argument. People who read only one side of the argument cannot possibly make a logical argument for their position. They cannot because they are totally ignorant of the real problem.

As I said it would take only about twenty minutes to read Price's essay. I can understand that you are not willing to read a whold book, though people who truly wish to understand both sides of an argument find that absolutely necessary. But to be so just damn lazy as not to read a 20 minute essay outlining the position opposite to yours is absoluely unbelievable. You MUST shut out from your mind any and all opposing positions. You will hear no opinion that contridicts your own.

Ron Patterson

Wow man. I posted that comment, read it, realized it was rude, and changed it. It must have been up for what, all of 30 seconds or so......... Do you hang around TOD all day hitting the refresh button on your browser every 15 seconds?

As far as the dieoff literature is concerned, I’ve read it already.

Will humans dieoff? Of course, they die everyday. There are millions starving in the world right now. It’s likely to get worse as peak forces the more fortunate to spend more of the available resources fending for themselves.

Will the human population collapse? If a catastrophic event occurs, quite possibly. I don’t they will because of peak oil. To think that people in industrialized nations will sit around waiting for death while doing nothing is naïve. Because of fear, greed, etc, they will evolve processes in order to sustain themselves.

Beyond these facts, I believe connecting the issue peak with dieoff and civilization collapse and presenting this to the masses is a foolish strategy that will have you labeled and dismissed quickly.

Now I really am moving on as I've got my TOD fix for the day

>Will the human population collapse? If a catastrophic event occurs, quite possibly. I don’t they will because of peak oil.

None of us believe that the day after Peak production that civilization will collapse over night. What we believe is that at some point, energy production will fall to the point where systems that are heavily dependant on fossil fuels will begin fail. This will lead to several changes:

1. Decline of Economic growth, later declining a global economy as businesses, goods are dependant on cheap fossil fuels are no longer sustainable. Whole industries fail, such as airlines, causing high unemployment. Higher energy prices means business must charge higher prices for goods and services which make them less affordable. Consumers cut back on the amount of goods and services they buy which results in higher employment. Higher unemployments leads to further consumption cuts, causing more job losses.

2. Declining food production as farmers are no longer able to afford or obtain fertializers and pesticides to maintain high production rates. Today farmers are already having difficult with the high costs of fertializers. Poor Populations that are already dependant on Western food production will stop recieving food as production rates fall resulting in massive starvation and die-offs. Global Food production has been on a steady decline since the late 1990s (the same time oil and gas prices began to rise). This trend will continue as oil and gas prices continue to rise.

3. The rise of disease cause by mal-nutrition. Much of the disease during the dark ages in Europe was related to declining food production caused by the little ice age. Disease will likely originate in the poorest regions and will spread to adjoining regions. Already we are faced with drug resistance superbugs, which will continue to evolve into more difficult to treat diseases. With the lack of money due to high energy costs and high unemployment, outbreaks will become difficult to control. Drug resistant diseases will eventually spread to Western cities which could result in wide spread death or long term illnesses that affect the population's long term health and moral.

4. Accelerated distruction of the environment as the high cost of fossil fuels leads to increase consumption of dirty fuels and consumption of bio-sources in a non-renewable fashion. e.g. people start burning wood, coal, and peat instead of oil and gas. Higher air and water pollution will lead to increase illness amoung the population. The environmental destruction will also later decrease the planet's carrying capacity to maintain large populations perhaps for many centuries.

5. Decreased geopolitical stability resulting in increased genocide and war. As populations are squeezed and pressed into a corner caused by shortages and declining economies, they will fight back, causing further distruction and death. We can see this is already on the rise this decade especially in Africa. This is more related to population overshoot but declining energy resources will almost certainly accelerate it.

6. Loss of energy as a tangible commodity. As the availability of oil and gas decline, its only natural for the nations that have remaining reserves to dramatically cut production in order to preserve them for future domestic consumption and trade. Within just the past few years we can see a dramatic rise in nationalization of oil and gas assets around the world in prepretion. Conservation of remaining reserves will likely cause dramatic loss of imports for many nations that are utterly dependant on oil and gas. Severe distruptions of imports will lead to very high employment and increased violence and drug use as the population is unable to make the physical and psycological adjustments. Local, State and Federal gov'ts will have difficult maintaining the infrastructure and delivering basic services when they are needed most. Disruptions in fuel to transport essential goods will lead to shortages causing further turmoil and social instability. Violence, Riots, murder will become the norm.

>Because of fear, greed, etc, they will evolve processes in order to sustain themselves.

These are the reasons why a die-off is likely to occur. Those with the will and the means, will do whatever it takes to maintain their lifestyles at the expensive of many others.

>I believe connecting the issue peak with dieoff and civilization collapse and presenting this to the masses is a foolish strategy that will have you labeled and dismissed quickly.

No doubt about that. Regardless of what the masses wish or want to believe, they will not change events. Perhaps if die-off was taken as a serious threat much of the problems could be addressed instead of a "every man and women for themself" strategy as you less than eliquently pointed out. Its always better to deal with your problems before the deal with you.

In my opinion this "die off" belief system would have far fewer converts if more people had at least a basic understanding of economics. At the very least, more people would realize how unlikely the above scenario really is.

I have seen zero evidence that the airline industry will fail post-peak. Individual airlines might fail, but then that happens regularly enough pre-peak. Airlines will keep flying because they will get their fuel from any of a) the tens of millions of bpd that will still be pumped out of the ground, b) bio liquids, c) coal to liquids, etc. The industry may contract somewhat in order to support higher ticket prices necessary to support more expensive fuel, but it will not fail.

The fertilizer / food argument is also a bit of a non-starter. It has been demonstrated that fertilizers can be created with no need for fossil fuels. It's true that food prices may go up--the poorest of the poor will be affected, mostly by requiring them to increase the percentage of their income spent on food. Other possible effects on the world's very poor include decreasing nutrition. Believing that billions of people will die of starvation is just nonsensical, however.

I just thought of this in regards to economics. If the economic system helps us in regards to finding new alternatives why hasn't the economic system found a cheaper and more abudnant energy source than oil to lauch growth to a higher rate?? Wouldn't economics be proactive in this instance??

Economics is about resource allocation. It can cause energy to allocated from less profitable to more profitable uses. It can cause scientific and engineering talent to work on energy-related research rather than something else. It can drive investment to produce more energy. But it can't magically create new sources of energy just because they would be nice to have. Clearly, more effort is now going into research into alternative energy sources than has gone into them in the past. We can see some results from those efforts. But there is no reason to think that there is a more-attractive alternative to oil waiting to be found in the near future. Economics can encourage the search, but it can't bury the treasure.

Why find something cheaper than something cheaper than water?

Oil is STILL increadibly cheap and will remain that way a long time after Peak, at least in relation to other sources. Higher resource rices will even help the world economy for a while (which they probably have since 2003). The question is one of degree - Oil will deplete quickly enough. Can the human endeavour "replace" the resource? This is the question that economics can never answer. Neither can Kunstler, for instance.

Maybe it is just me but I think the reason to find something other than oil is because there is a ton of money to make. Do you think people would not have a demand for something other than oil if it were cheaper?? I think that would be a pretty easy sell to most of the world which result in a fair amount of money for someone.

You are exactly right.

This is THE (did I say THE?) argument called "economics" (in a capitalistic world). If I can make money supplying something cheaper/better, I will. But the entire question here is CAN I?

DEMAND is not the problem. It would be bought, IF it were there.

SUPPLY is the issue here.

Have you found something cheaper than oil (even if oil is $200 or more) that you can sell and make a bitch of money doing it? If you had, you probably wouldn't be posting here, anyway, right?

Well, neither has anyone else. At least not on a scale which would effectively replace oil.

Rising prices will certainly create a shitload of economic activity which will tie down a large portion of our resouces to finding THE MAGIC REPLACEMENT to oil and natural gas. At first it will probably work. At first the "economists" will probably be right - start building the 28 THOUSAND nuclear reactors necessary to make the economists right!! But hurry up! Post Peak will probably be too late!

Well, I think you get the message.

Conservation, Wind, Solar, Hybrids, Nuclear, Geothermal, Biomass will all nibble at the corners of the problem. They will all BOOM BOOM BOOM. Til they don't boom any more, i.e. til the system collapses.

Have fun riding the wave! It's been fun up to the crest, now, hasn't it?? If you're even still reading this post..

Cheers, Dom

Right. If oil was trading at $200 per barrel, it would be unsustainable from a supply crunch side because then shale oil, coal liquefaction, and other synthetic oil infrastructure would be going up like mad.

If it was sustainable demand, it would put coal electricity out of business because all the coal would be swallowed up for synthetic fuel production. When the coal runs out, you can crack CO2 hout of limestone and H out of water in thermochemical methods fed by nuclear process heat, run over cobalt catalysts, and generate as much diesel fuel as you want.

Why not? We have nearly half that much in fossil infrastructure allready for similar capital costs and it will be replaced through standard depreciation anyways.

What, when the sun dies?

Right, why not build 28 THOUSAND Nuclear plants in the next 30 years?

That's 1000 FINISHED plants per year.

"What, when the sun dies?"

Actually, I was thinking a couple years before the sun dies

and even a couple years before the sun cooks the earth (scheduled in ca. 1.5 billion years).

This was the argument back 5-10 years ago, that oil only has to be SUSTAINABLY higher than $30 per barrel, and all the alternatives will kick in. Well, I would say that the price has risen a good while over $30, and the alternatives now need oil prices SUSTAINABLY over $80. Please continue watching the phenomenon that rising prices also induce rising necessary prices - over the next couple of years/decades, of course..

"the alternatives now need oil prices SUSTAINABLY over $80."

What makes you think that? Do you have a link or reference with that kind of breakeven point?

There are a lot of CTL projects starting up, which generally project breakeven points of less than $40. I saw one recently (unfortunately my link is broken): They said $4B and 4 years construction time for 96k/day. That gives a capital expenditure premium of $9.20 at 7% interest, or very roughly the cost of refining oil into fuel. That’s likely to have a very fast payback.

Most estimates are $6.5B and 5-7 years construction time for 80k/day, which gives a capital expenditure premium of $15-20/barrel, which is not bad given that it creates clean diesel with no further refining.

Wind is now the single largest source of new generation: wind is 47% of new generation planned for 2007 (adjusting for capacity factors). See http://www.nei.org/documents/Energy%20Markets%20Report.pdf page 8, keeping in mind that wind has a short planning horizon, so 2008 and beyond will rise a great deal - only 2007 is really useful for comparison purposes.

Wind electricity for EV's costs only about 2.5 cents per mile. The only barrier to electric vehicles is the battery. GM says that the batteries they're looking at now have the specs they need (Saft and A123systems) for an affordable EV, but there's still work needed to develop the battery packs, electronics, and do the testing (crash, environment, durability). Automotive development takes 3 years minimum to go from prototype to manufacturing for anything new (think Pinto gas tank - car execs certainly do), but these batteries are in use now for other things (power tools, especially).

Alternatives to oil cost less than $40 per barrel. The only barrier is the length of time to scale them up. That's why the date of peak oil is indeed important.

This is the classic fallacy that is committed over and over again on this site.

What you fail to understand, is that supply, demand, and price are all inextricably linked. The large increase in the price of oil over the last two years has served to reduce demand - a classic demand-side effect. If the price goes up further demand will further reduce.

Simultaneously, we are seeing an incredible boom in the production of non-conventional and alternative liquid fuel - a classic supply-side effect.

Consider also, we have a situation where it appears that less oil was being produced recently than was the case a year ago. "Signs that we have peaked" some people say. And yet, where's the predicted doom and gloom? Supply still equals demand. Market forces at work.

It would help Ener Ji, if you at least made some attempt at an argument. The word "economics" is no argument at all.

No one is really worried about whether we can fly coast to coast 20 or 30 years from now. We will have far greater problems to worry about. And is has not been demonstrated that fertilizers can be created without a need for fossil fuel. Sure we have horse manure but not enough to matter. The production and delivery of fertilizers requires massive amounts of fossil fuel. So does the planting, cultivation, harvesting, processing and delivery of all crops.

But methinks you are the one with a need to understand basic economics. Fossil fuel is not just the energy that produces everything we consume, but in many cases it is the feedstock as well. When fossil fuel starts to decline, there will be less energy and feedstock to produce these things. They will not be produced. The people who worked in these industries, producing, delivering and selling these things will be out of a job. This will mean less money to buy the things that still are produced, which will mean more layoffs. It will be a vicious circle causing a massive depression.

If you overlaid a graph of world population with a graph of the increasing use of fossil fuel, it would be hard to tell which is which. And it is just absurd to think the population will continue to climb, or even remain flat, when fossil fuel begins to decline in earnest.

You know, I read so many very short put-downs of the consequences of peak oil. But no one ever attempts to argue with Price. The reason is very simple. He puts all those very short and silly arguments to shame because his argument is scientific and air tight.

http://dieoff.org/page137.htm

Ron Patterson

Ron Patterson

Note that this graph is "Energy Use" vs. population, not "Fossil Fuel Use" vs. population.

And of course correlations in and of themselves don't prove much of anything anyway.

I have noted in my edited post that this is total energy.

Do you really think that the energy/population relationship is just one of correlation? The "Green Revolution" that kept us from hitting a Malthusian wall last century was primarily due to energy availability and cost (particularly Fossil Fuels), at least from my reading. That implies a direct cause and effect relationship that would have significant influence on the post-peak human ecology.

IIRC the main improvement was better forms of wheat.

dbl post

Exactly wilbert. And nobody expects total energy growth to stop when the pop'n peaks in 2050. All projections show growth as per capita income grows in asia and africa after 2050.

Do you have that in table form?

Yes. You can download it from http://www.paulchefurka.com/peakoil/Population_and_total_energy.xls

Goodness, where to even begin? I'm afraid I have limited time, so let's tackle something basic:

When oil peaks, fossil fuel use could keep right on increasing thanks to increased coal usage. There's also abundant forms of non-fossil fuel energy sources available (solar, wind, fission, etc.) so there is absolutely no reason to believe that there will be less energy available.

If we're trying to predict how people will react post-peak that's really all irrelevant, however. The really important things to keep in mind are the substitution effect, the Price Elasticity of Demand (PEoD), Price Elasticity of Supply (PEoS). A good understanding of excess profits and economies of scale / scope would also be quite helpful.

I have yet to see a "doomer" who has a good grasp on the above concepts. I believe that is because it is impossible to BE a doomer and understand the above concepts. An understanding of the above concepts will enable you to make some predictions about how people will react to peak oil when it hits us. Curling into a ball and dying will not be one of them. ;-)

I agree with you that almost no one "wants" to curl up into a ball and just die.

But what you want and what happens are often two different things.

Interesting analogy with the use of Fidel Castro, step back.

However, you really make my point for me. Fidel's does not have a market-based economy because it has a despot at the top who can allocate resources as he sees fit.

Luckily, most of the rest of the world operated (to varying degrees, admittedly) as a market economy. What that means in the simplest terms is that market forces work to allocate resources efficiently and to maintain stability.

"No one ever attempts to argue with Price. "

Well, they should, because his arguments fall down in a lot of places. Perhaps the most important is the following paragraph:

"Visionaries support the potential of wind, waves, tides, ocean thermal energy conversion, and geothermal sources. All of these might be able to furnish a portion of the energy in certain localities, but none can supply 75% of the world's energy needs. Solar thermal collection devices are only feasible where it is hot and sunny, and photovoltaics are too inefficient to supplant the cheap energy available from fossil fuels."

He provides no evidence for this, and he can't. Here's a counterargument:

http://gristmill.grist.org/story/2006/12/17/212637/60

"Again, there are renewables other than wind. But just as a limiting case, it is interesting that we could provide 95% of our power from wind -- reliably -- for between 5.6 and 8.6 cents per kWh. Note that existing hydroelectric could provide about 80% of the remaining 5 percent, with biofuels or natural gas-powered generators providing the remaining 1 percent. Alternatively, we could provide 5% of our electric needs with sustainable biofuels. (Whatever arguments we have about biofuels on a large scale, does anyone doubt we could produce enough sustainably to power 5% of our electricity needs?)"

A less important argument is that human population growth is exponential, and unending. This just isn't true - ask any professional demographer or population planning expert. Pop growth for the world as a whole now is roughly linear, and slowing pretty quickly. The UN's website is a good reference for this. Here's one discussion just for developing countries: http://www.un.org/esa/population/publications/WPP2004/WPP2004_Vol3_Final...

ballz.ababa.net/rocco23/anal-rape.htm

ballz.ababa.net/rocco23/animal-rape.htm

ballz.ababa.net/rocco23/anime-rape.htm

ballz.ababa.net/rocco23/asian-rape.htm

ballz.ababa.net/rocco23/ass-rape.htm

ballz.ababa.net/rocco23/black-rape.htm

ballz.ababa.net/rocco23/bondage-rape.htm

ballz.ababa.net/rocco23/boy-rape.htm

ballz.ababa.net/rocco23/brutal-rape.htm

ballz.ababa.net/rocco23/cartoon-rape.htm

ballz.ababa.net/rocco23/celebrity-rape.htm

ballz.ababa.net/rocco23/date-rape.htm

ballz.ababa.net/rocco23/duke-rape.htm

ballz.ababa.net/rocco23/erotica-rape.htm

ballz.ababa.net/rocco23/family-rape.htm

ballz.ababa.net/rocco23/fantasy-rape.htm

ballz.ababa.net/rocco23/forced-rape.htm

ballz.ababa.net/rocco23/free-rape-sites.htm

ballz.ababa.net/rocco23/free-rape.htm

ballz.ababa.net/rocco23/gang-rape.htm

ballz.ababa.net/rocco23/gangbang-rape.htm

ballz.ababa.net/rocco23/gay-rape.htm

ballz.ababa.net/rocco23/hardcore-rape.htm

ballz.ababa.net/rocco23/incest-rape.htm

ballz.ababa.net/rocco23/interracial-rape.htm

ballz.ababa.net/rocco23/japanese-rape.htm

ballz.ababa.net/rocco23/lesbian-rape.htm

ballz.ababa.net/rocco23/male-rape.htm

ballz.ababa.net/rocco23/nun-rape.htm

ballz.ababa.net/rocco23/porn-rape.htm

ballz.ababa.net/rocco23/prison-rape.htm

ballz.ababa.net/rocco23/rape-bondage.htm

ballz.ababa.net/rocco23/rape-cases.htm

ballz.ababa.net/rocco23/rape-club.htm

ballz.ababa.net/rocco23/rape-fantasies.htm

ballz.ababa.net/rocco23/rape-fantasies.htm

ballz.ababa.net/rocco23/rape-forum.htm

ballz.ababa.net/rocco23/rape-galleries.htm

ballz.ababa.net/rocco23/rape-hentai.htm

ballz.ababa.net/rocco23/rape-images.htm

ballz.ababa.net/rocco23/rape-incest.htm

ballz.ababa.net/rocco23/rape-index.htm

ballz.ababa.net/rocco23/rape-movie.htm

ballz.ababa.net/rocco23/rape-movies.htm

ballz.ababa.net/rocco23/rape-paysites.htm

ballz.ababa.net/rocco23/rape-pic.htm

ballz.ababa.net/rocco23/rape-pics.htm

ballz.ababa.net/rocco23/rape-pictures.htm

ballz.ababa.net/rocco23/rape-poems.htm

ballz.ababa.net/rocco23/rape-porn.htm

ballz.ababa.net/rocco23/rape-prevention.htm

ballz.ababa.net/rocco23/rape-scenes.htm

ballz.ababa.net/rocco23/rape-sex.htm

ballz.ababa.net/rocco23/rape-sites.htm

ballz.ababa.net/rocco23/rape-storys.htm

ballz.ababa.net/rocco23/rape-tgp.htm

ballz.ababa.net/rocco23/rape-thumbs.htm

ballz.ababa.net/rocco23/rape-trailers.htm

ballz.ababa.net/rocco23/rape-video.htm

ballz.ababa.net/rocco23/rape-videos.htm

ballz.ababa.net/rocco23/rape-vids.htm

ballz.ababa.net/rocco23/rape-xxx.htm

ballz.ababa.net/rocco23/rape.htm

ballz.ababa.net/rocco23/rp2.htm

ballz.ababa.net/rocco23/sleep-rape.htm

ballz.ababa.net/rocco23/top-100-rape.htm

ballz.ababa.net/rocco23/wife-rape.htm

ballz.ababa.net/rocco23/xxx-rape.htm

Ron, I am of the same mind-set, i.e. that it is important to read both sides in order to come to the right conclusion. I've found very little serious writing to answer PO claims. What is written in response to the PO movement does not directly address the most important claims of PO. I read Michael Lynch's stuff which is one of the better efforts I could find to debunk PO, though in my mind it failed. Anyway, I'm wondering if you could recommend any good sources for studying "the other side". Have you found anyone who has made a half-way decent attempt to address the issues raised by the PO movement?

Phineas, there lots of web sites that try to debunk peak oil but no whole books on the subject, that I can find anyway. Borg does mention the subject but says once oil gets above $40 shale oil will kick in and provide the world with all the oil it needs for the next 500 years. Understand that Borg's book and Simon's books, all attack the theory that the environment is in a damn mess. They all say everything is fine and getting better. They do not address the energy problem in particular.

All the web sites, and all the books for that matter, sing the same story. They all concentrate on reserves, adding all the oil sands and shale oil to the mix. They all simply think all that shale oil and oil sands oil is there for the simple taking. Just tap it and it comes gushing out, enough oil to last for one thousand years. And of course, they all buy into theos "vast Middle East reserves" argument.

Phineas, there are no valid arguments anywhere to be found against peak oil. It is a fact of geology, nothing more. The only debate is when. And it should be obvious to everyone that the "when" is somewhere between 2005 and 2012. My money is on 2005 but I would not be surprised to find that it may be 2007. No later than that however.

The true debate Phineas is what will be the consequences of peak oil and all the other environmental problems? And as far as I am concerned, that is the only debate.

I have been thrashing this straw for over forty years. Not peak oil mind you, but peak people and all the consequences of overpopulation. And there are many books telling us that there is no overpopulation problem or environmental problem. Borg's book "The Skeptical Environmentalist" is the one touted most often. I have read it and I think it is a joke.

But my advice to you, and anyone else for that matter, is don't concentrate on peak oil and try to figure out if that is a valid theory or not, that is a lead pipe cinch. Concentrate on the "Big Picture". Read "Overshoot" if you can find a copy and "The Spirit in the Gene" and the David Price essay, "Energy and Human Evolution." And if video clips is your forte there is no better place to start than here:

http://big-picture.tv/index.php?id=62&cat=&a=147 There are about fifty different video's here but Lester Brown's is by far the best. He points out it is the "synchronicity" of all these things coming together. You know, peak oil, peak water, and all those other environmental problems.

So that still leaves the question open, are there any good arguments everything will eventually turn out okay? No, there are no such arguments, not in books or on the web. It would be impossible because we have already passed the "okay" point. Everything is already a disaster and getting worse by the day.

Sorry I could not be of more help.

Ron Patterson

Thanks Ron. It's just still surprising to me that there is no sophisticated attack on PO. At least with the anti-GW people they jump on real (but misleading) data, quote bogus scientific studies and make some kind of attempt to refute the actual claims of environmentalists. If you don't look too hard, one could be impressed by their "scientific methods".

The original defence setup agin GW was to prevent hundreds of billions of dollars being spent to prevent something that was cyclical or an event that was unstoppable.

In the case of PO, the financial rewards have been immense to the oilco's and national oilco's. Russia has almost paid off its entire IMF debt.

The "fear of shortage" that caused some of the post 2003 price rise on top of the geopolitical "fear factor" has exponentially raised profits. Oil exec's admit the profit was obscene. With a $40 comfort zone, they were making a ton of money at $60 they have said.

The PO movement is good for profit. Any new migigation regulations pale in comparison to the Net. They luv u guyz!!!!

Phineas:

Wait a month, and you have on the market what might well be the first book-length attempt at refutation.

http://www.petro21.com/research/research.cfm?tab=content&id=301&client=n...

Thanks Asebius, I must have this one.

Ron Patterson

"The world’s oil future will be wholly at odds with Peak Oil’s ultra-pessimistic scenarios due to global upstream realities and industry fundamentals that will determine most-likely crude oil supply trajectories. Peak Oil’s dismal views contrast with commercial drivers to exploit large world resource endowment, consistent reserve growth, new oil field developments en route, and exploration dynamics that together will shape future crude oil supply growth."

Sorry, the book probably goes on the lines of CERA and is not concerned with a Post Peak world. It denies Peak Oil, if the recension is right.

From one of the comments:

"The Battle For Barrels lucidly shows that not all is known on potential oil reserves-in-ground, and Peak Oil is very wrong on its view that such reserves are now fully known and finite."

Of course - they are infinite. How wrong we are.

Hey, I cut and pasted your words into my post then you edited the post and changed your words. (Actually they were very confusing and I suspected you had made an error. You obviously caught that error and edited your post.) You can preview your post before you post and avoid this error in the future. No, I have not seen Deffeyes or Simmons say anything of the sort and I am not twisting your words. But you are doing a good job of that yourself.

Ron Patterson

Okay:

Dubious claim.

Dubious claim.

Dubious claim.

Dubious claim.

And that's all from one paragraph. Yes, I did read further -- through the whole document, you're not presenting an argument, you're just stating things you believe as if they're unassailable truth. As if, somehow, your personal faith can substitute for actual evidence.

Sorry, but the depth of your faith is not a compelling argument.

At the end of the story of the boy who cried wolf, the wolf really comes and it is the fault of the adults that the boy gets killed because they knew (or should have known) that the wolf was a real danger. There are at least two lessons to be learned from that story: don't cry wolf unless you see one and there are wolves, even if you don't see them.

Now, I agree that all this dieoff crap belongs into the mental institution and that is ultimately where some of these people will end up. However, that does not mean responsible politicians and citizens do not have an obligation to point out that there is a need for far more efficient energy policies. The need was there in the 1970s, 1980s, 1990s and it keeps getting more and more urgent. Among the wolf criers are probably some of those who are genuinely frustrated about not having been heard when it was time to mitigate the problem efficiently and cheaply.

I don't see anyone crying wolf here.

WT export land model is fairly sound.

The question here seems to be the exact date of peak oil.

1.) I don't see huge increases in oil supply in the near future thus demand and supply will continue to be at best balanced.

2.) Most models put peak around 2010-2015.

This is not a lot of time to mitigate.

I personally find the evidence for peak oil now that includes all factors fairly compelling and feel that any strong dip post peak could cause a lot of problems.

In general weaning our society off oil has so many pluses its hard to argue with doing it even if oil production was not peaking.

In any case we (the US) should have started aggressively mitigating oil use back in the 70 when the US peaked.

If we hand moved to renewable energy then we could have continued to have plentiful oil to use where it made sense for 100's of years if not thousands.

In short moving away from oil was the right thing to do in 1975 and is still the right thing today. I don't understand why people who have recently peak oil aware are so entranced by this straw man cry wolf argument.

And as far as the real date for peak oil the first step to mitigation would be to force data transparency so we can understand the problem at that point we can take action. The only thing the actual date of peak oil effects is the relevance of some mitigation plans nothing else.

I am confused here. Who are the two idiots, Simmons and Deffeyes or Hubbert and Campbell? From the sentence above it appears you are calling Hubbert and Campbell idiots but since Hubbert has been dead for many years and is not presently crying anything, then you must mean Simmons and Deffeyes.

Please clarify the matter. I sure want to know who are the true idiots here? Who's motives and character are you questioning?

But you are very clear on who is irresponsible and know better. No need to explain that point.

Ron Patterson

Glad to oblige. Idiots are those who attempt to promote Peak Oil (or Climate Change or fiscal restraint) with a dire sense of urgency by using baseless, exaggerated, alarmist consequences for non action ... often w/o including time lines that can be used to challenge their scenarios.

It does not include folks that have made an error in targets or holds that view.

I don't know why I'm replying but I feel compelled.

Shit happens Freddy ask anyone that was in a concentration camp in Nazi Germany or probably easier one of the Vietnamese boat people. Or even better on of the faceless Mexican immigrants we scorn.

I find your "American" attitude both repulsive and dangerous.

Now each any any of these dire scenarios has a certain probability of becoming reality everyone needs to decide using their own intellect how probable they are. A big part of why the world hates us is the attitude that America can never fail. But never assume things will always be rosy for Americans we have had hard times here in the past and we will again someday.

Anyone can figure out that China and India together growing at 10% plus will put a real squeeze on the "American Way" pretty soon now regardless of other issues. The world can't support 3 billion American lifestyles. Other issues such as Peak Oil global warming etc etc etc will only inflame the process.

Freddy might want to think about events unfolding in Mexico.

Thats a doomer scenario building if I ever saw one. The people are crying for BREAD (but in this case tortillas) since our corn is going thru the roof and beyond.

That is scary and Freddy doesn't get a clue.

Mike, please take 25 minutes and read the two recent links given to us by Ron Patterson and u will see quickly why there is no foundation for comments from Ron like this afternoon's:

"Everything is already a disaster and getting worse by the day."

He is one of the idiots that i described earlier that have no sense of time line for events to unfold; yet propagates impending doom with a sense of urgency.

I have been a proponent of resource conservation for several years; and i was one of the first north american members of Pollution Probe. Ron and Duncan and David Price can post a million pages at the die-off site but it won't make it happen. They have no background in economics nor technology nor futurism. All they have going for them is their vulnerability to the boomer based phenom of instant gratification. Their problem is psychological based. Their desire is to see the world implode in their lifetime. But wanting it won't make it happen quicker.

And that is what really pisses them off. The anticipation...

Pride and Duncan don't understand the Second Law of Thermodynamics and thus wrongly attribute it to population growth. Further their effort was based on per capita energy production crashing in y2k.

Pride wrote in 1995 and Duncan in 1989. Duncan forecast that per capita energy production was at PEAK (there's that word again!) and would be down 7% by y2k. Sorry sucker. Didn't happen. And so he has rewritten his essay as Ron posted yesterday. All the recognized projections show this ratio increasing to 2075.

Their population projections are similarly misguided. Pride's comparing human growth to reindeer is hilarious. So is his postulation that all nations and all regions would collapse simultaneously. While some regions and nation states have lost their self sufficiency due to globalization to reduce inflation and promote trade of their own goods, it would not take more than a generation for them to rebalance. The collapse scenario also wrongly assumes that their is an equal for all nations and peoples as cultures. This is wrong at both the high per capita income end as it is for the low end that don't have far to fall at present should they not be able to compete for energy resources.

I agree that Earth cannot support billions of people. But the crash in population won't come due to Peak Oil. or Energy prod'n per capita.

Pride's silly graph says human pop'n will grow 'til they can't eat. Wrong. All population scholars agree that earth will top out in 2050 due to natural fertility patterns. But why let peer reviewed studie ruin a good movie screenplay, eh?

The Earth has not seen plague or fammon for long times. They will come back. Aids and SARS are precursers to die-off scenarios that will befall us. But it won't be of the 80% variety that Ron, Pride and Duncan are selling as gloom merchants.

They have the story "almost right". But are out by about a few centuries as depletion of resources kicks in. And their visions of everyone living like mennonites in an agrarian society or in cabins in the usa mountains are similarly ridiculous.

One thing we have learned by reading the work of the futurists of the 20th century is that they all got the timing wrong. Almost Nothing happens as fast as predicted.

And idiots that come to TOD and tell us it's happening within a decade at the most (or two) and they're ready and they have their guns and rifles and nato-whatevers are just whacko's that need our pity and guidance ...

Finally i will say a word on mexico. For two decades the WTO has been attepting to get rid of usa/european style agri subsidies. Brazil has proved that their absence is workable. The WTO wants developing world farmerst to earn a better living by getting better commodity prices. All the peer reviewed studies say we have suplus capacity in agriculture and can do more with less. The whiners in mexico are just the start. But in the end they are only whiners and are not starving. Disposable income will absorb the planned adjustments.

Louis de Sousa wrote:

Freddy wrote:

Well Louis, it is nice to see that this very important member of this forum conducts himself in such a gentlemanly manner. His kind of comment, I am sure you recognize, does not diminish the level of openness of the debate.

How did Duncan get dragged into this debate? And what the hell do you know about David Price. Dr. Price will not see the world implode in his lifetime because he died in 1999.

http://www.mnforsustain.org/author_price_david.htm

And this other essay by price proves he knew his economics, even thoughhe was an anthropologist by trade.

http://www.mnforsustain.org/price_d_malthus_false_hopes.htm

Price, not pride you blooming idiot. (Sorry Louis but I just could not help myself.)

The essay that I posted yesterday, was written 1995 and never rewrote it, owing to the fact that he was dead. This just goes to prove Freddy, that you are not just an idiot but a liar as well.