In Defense of the Hubbert Linearization Method

Posted by Sam Foucher on June 24, 2007 - 10:30am

This a post by Jeffrey J. Brown (westexas)

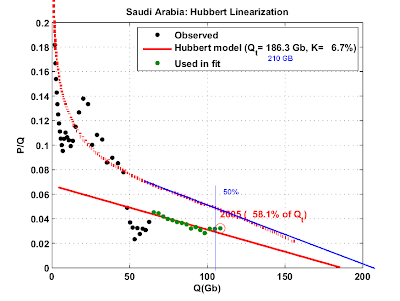

The Hubbert Linearization (HL) method (the Hubbert Linearization term was coined by Stuart Staniford, with The Oil Drum) is essentially based on the mathematical observation that a parabolic (bell shaped) curve can be plotted as a line, when we plot P/Q versus Q, where P = annual production and Q = cumulative production to date. The parabolic curve assumption is based on the premise that we tend to find the big fields first. In essence, "Peak Oil" is the story of the rise and fall of the big fields. The parabolic HL model suggests that the world and Saudi Arabia are both probably now in terminal decline. While the overall world decline may be quite gradual, the impact on world oil exports will probably be very severe. See the following article for more information on the HL method: Texas and US Lower 48 Oil Production as a Model for Saudi Arabia and the World.

Note that if the Ghawar Field in Saudi Arabia is in long term decline, which I believe that it is, it is my understanding that every single field that has ever produced one million barrels per day (mbpd) or more of crude oil (crude + condensate) is now in decline. Saudi Arabia has one field coming on line that might make one mbpd, although a lot of people have their doubts. The only real confirmed one mbpd and larger field on the horizon is Kashagan, which probably won't break the one mbpd mark until 2020 at the earliest.

As many people know, Kenneth Deffeyes predicted, using the HL method, a world crude oil peak between 2004 and 2008, most likely in 2005. (He observed that world production apparently peaked in 2000, but he never backed away from his mathematical model that the probable peak was between 2004 and 2008.)

In any case, in the above referenced Texas/Lower 48 article, we supported Deffeyes' work, and we added the Texas model. I observed that Texas peaked at a later stage of depletion than the Lower 48. Post-peak, Texas declined at a faster rate than the overall Lower 48. This was the basis of my warning a year ago that the world and Saudi Arabia were on the verge of a decline in crude oil production. It may be a coincidence, but relative to monthly peaks in 2005, world crude oil production is down more than one percent and Saudi crude oil production is down about 11% (EIA data, crude + condensate).

Note that the initial Lower 48 decline was quite gradual, less than 1% per year for the first two years. Also note that the world has the benefit of the non conventional tar sands production that was not a factor in the Lower 48.

A key piece of data in support of an involuntary decline for the world and Saudi Arabia is the price of oil. The average monthly Brent crude oil price in the 20 months prior to 5/05 was $38 per barrel. The average monthly Brent crude oil price after 5/05 has been about $62, within a range of $54 to $74. Again, we saw this pattern of higher oil prices and lower production in the Texas and the Lower 48 in the Seventies.

The Lower 48 peaked in 1970. Based only on production through 1970, the Lower 48 was right at the 50% of Qt mark in 1970 (Qt is a mathematical estimate of URR for a region).

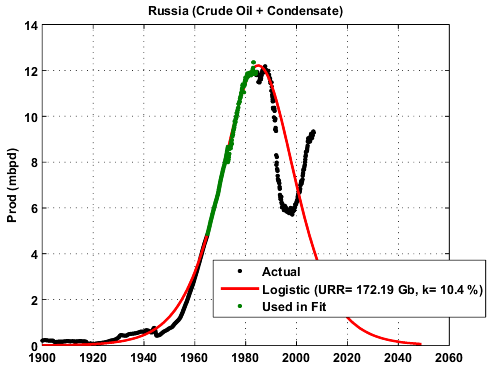

Russia peaked on a broad plateau centered on 1984. Based only on production through 1984 Russia was right at the 50% of Qt mark in 1984. Russia made from just above 11 mbpd to just below 11 mbpd for five years on both sides of 1984.

At my request, Khebab generated a post-1970 production profile for the Lower 48 and a post-1984 production profile for Russia, using only production data through 1970 for the Lower 48 and through 1984 for Russia to generate the models.

The post-1970 cumulative Lower 48 production, through 2004, was 99% of what the model predicted it would be, see Figure One, Hubbert Linearization technique applied to the Lower-48. Only the data between 1942 and 1970 (green points) are used to perform the fit (red curve).

The post-1984 cumulative Russian production, through 2004, was 95% of what the model predicted it would be. In other words, Russia was "underproduced" through 2004, see Figure Two, Hubbert Linearization technique applied to Russia. Only the data through 1984 (green points) are used to perform the fit (red curve).

In 2006, Russia "caught up" to where it should be. Now, as Russia has approached the 100% mark (100% of what it should have produced based on the HL model), its year over year increase in production has been slowing appreciably, and since October, 2006, the EIA has been showing basically flat production for Russia.

By the way, based on data through 1999 and 2005 respectively, both the North Sea and Mexico started declining right at their respective 50% of Qt marks.

Now, a lot of claims that the HL method is inaccurate are based on a misuse of the method. In most cases, we don't get an accurate Qt estimate until we get a P/Q intercept in the 5% to 10% range. For example, a lot of people use the UK as an example of where the HL method doesn't work, but this is based on wildly improbable early P/Q intercept of 30%.

A lot of the disbelief/denial about a World/Saudi peak is very similar to the reaction that we saw in the Lower 48/Texas in the Seventies. Probably 9 out of 10 Texas oilmen were shocked that Texas didn't show increasing production after the Texas RRC went to a 100% allowable in 1972.

But the bottom line is that we are using a fairly objective method that takes the two pieces data that we have the most confidence in, annual and cumulative production, to generate mathematical models. And many large producing regions--Texas; Lower 48; Total US; North Sea; Russia and most recently Mexico and the world--have shown production patterns that are consistent with the HL models.

The most common response I get to all of this is simply denial. The reserve situation "can't be that bad."

All I can tell you is what the mathematical models are telling me. In a nutshell, I think that the reserve situation is that bad, and I think that we are facing the near certainty of rapidly declining net export capacity worldwide.

While reasonable people can disagree on what the annual and monthly production data are telling us about our proximity to Peak Oil, in my opinion it is a virtual certainty that Peak Oil, from the point of view of importers, is here. This virtual certainty is due to the absolutely lethal combination of flat to declining crude oil production in exporting countries and the (sometimes rapidly) rising domestic consumption in exporting countries, resulting in sometimes catastrophic declines in oil exports. For example, based on EIA data, net total liquids exports by the UK dropped at an annual rate of 60% per year from 2000 to 2005.

In effect, in my opinion the very lifeblood of the world industrial economy is draining away in front of our very eyes. The only question is how fast the patient is bleeding to death.

Sorry to be the bearer of bad news, but you wuz warned.

Jeffrey Brown is an independent petroleum geologist in the Dallas, Texas area. His e-mail address is westexas@aol.com.

Nice work. I know I could probably go find it elsewhere, but I'd like to see the world C+C HL and annual prodcution charts in the grand finale

I believe that this is Ace's work:

http://i129.photobucket.com/albums/p237/1ace11/WorldCC2100.jpg

Note that, IMO, exported crude oil will decline much, much faster.

There is also an interactive modeling tool which can be downloaded from this site.

This tool graphically displays the changes you make the input parameters (total reserves, production rate, depletion rate, etc).

You can also create linearization charts from the current production graph and interactively slide the linearization data selection set along the data points to view how moving the data set effects the total calculated reserves quantity.

Hi Engineer,

Here is the latest update!

Updated World Crude Oil & Lease Condensate (C&C) Production Rate Forecast to 2100

The chart below is an updated forecast of C&C production rates. Actual production rates are used up to 2006. A bottom up forecast based on more than 300 projects/regions is used for the years 2007 to 2012.

The dark red line represents an estimate of true remaining reserves which is adjusted for the grossly overstated OPEC reserves. The green line is based on BP’s recently released reserves figures which includes OPEC’s grossly overstated reserves. The forecast from 2013 to 2100, for both the dark red and green lines, is an exponential fit based on remaining recoverable reserves, similar to the HL method.

Click to enlarge - This chart will be updated when EIA Apr 2007 data are released, before mid July 2007.

Your showing a fairly high decline rate not sure I believe it.

You have us down the magic 4mbpd that make peak oil painfully obvious by 2010. Other people are showing it later.

We do have quite a bit of production coming online that should push this out 2012 or so ?

The decline looks to steep to me for the next few years.

I've refusing to consider this decline rate coupled with exportland.

I also don't want to believe that decline rate. There is a lot of production coming on, but it's not enough. Recently, Aramco is only scheduling one more expansion of Shaybah so that Shaybah will reach plateau production of 0.75 MB/D instead of 1 MB/D. Aramco's Al Khafji project of 0.30 MB/D, in the Neutral Zone, is no longer on their project schedule. Aramco only has 0.5 MB/D from AFK coming on line late this year, 0.1 MB/D from Nuayyim late 2008 and 0.25 MB/D from Shaybah expansion also late 2008. It's just not enough new production to offset declines.

Many of Russia's projects have been delayed to come on line late next year. (It's tough to do work in the long cold Russian winter). Mexico/North Sea are showing very high decline rates.

People like Robelius show an optimistic peak oil date later in 2018 but this assumes that Ghawar has 150 Gb URR. Robelius does show worst case peak oil, including NGLs happening in 2008. Also note that the C&C excludes other liquids such as NGLs (8 MB/D) and ethanol/XTL. Bakhtiari/Deffeyes/Skrebowski/Campbell/Simmons/Savinar/Heinberg probably wouldn't disagree with the decline rate.

Here is the chart that the 2007-2012 bottom up forecast was based.

click to enlarge

If you believe that OPEC's reserves are overestimated by at least 400 billion barrels, the world's total URR is about 1,840 billion barrels and that the world has produced just over 1,000 billion barrels C&C to the end of 2006, then the world has produced over 54% of its total URR of C&C. This means that C&C will decline.

Are you taking into account the Canadian tar sands (already included in the EIA C+C data)?

The production is set to increase by 0.5 mbpd in 2007, check this post:

http://www.theoildrum.com/story/2006/10/20/142436/03

Hi Khebab,

Yes, I have taken into account Canadian tar sands, but I think that most forecasts are too optimistic.

Last year, I was optimistic about tar sands production but then I read your comprehensive story a few months ago when I was checking my forecast for tar sands. I also listened to David Hughes http://globalpublicmedia.com//interviews/823 who thought that tar sands production was limited to 2.5 mbd. The Hughes interview was done in 2006, prior to the possible cancellation of the MacKenzie Valley pipeline. His tar sands limit of 2.5 mbd may need to be revised downwards.

The Canadian Association of Petroleum Producers (CAPP) just released their June 2007 forecast http://www.capp.ca/raw.asp?x=1&e=PDF&dt=NTV&dn=123361

Table 7.2, page 32 of CAPP’s forecast (moderate growth case) shows the following tar sands production numbers, mbd (actuals to 2006)

2004, 0.99

2005, 0.99

2006, 1.13

2007, 1.28

2008, 1.49

2009, 1.69

2010, 1.84

2011, 2.03

2012, 2.27

My annual average tar sands forecast numbers, included in the charts above, are lower.

2007, 1.27

2008, 1.36

2009, 1.45

2010, 1.55

2011, 1.65

2012, 1.70

These numbers show an annual growth rate of 7% until 2012, when a ceiling of 1.70 mbd is assumed, which is similar to your logistic curve and the CAPP 2005 (constrained case) from your chart below.

I cannot justify using a higher growth rate than 7%/yr for tar sands production because tar sands uses huge amounts of natural gas, water, infrastructure and produces lots of carbon dioxide/other pollutants. Environmental constraints may also become stronger. Woodland Cree First Nation is challenging Shells Oil Sands expansion from 12,500 bopd to 100,000 bopd.

http://www.marketwire.com/2.0/release.do?id=745361

Tar sands could also be starting to produce acid rain which is derived from sulphur and nitrogen oxides.

http://pubs.acs.org/subscribe/journals/esthag-w/2006/aug/science/jp_acid...

It also appears that a huge source of natural gas is at risk, the $US16b MacKenzie Valley pipeline. However, the Canadian taxpayers might subsidise this pipeline so that tar sands oil can be exported to the US.

http://blog.foreignpolicy.com/node/5110

The $US25b Alaska natural gas pipeline may also be at risk.

http://www.canada.com/nationalpost/financialpost/story.html?id=397fb965-...

Delays in either or both of these pipelines could force gas prices up considerably, making tar sands oil more expensive to produce which could adversely impact the economic viability of new projects.

Even with increasing tar sands production, according to EIA production data, Canada’s total C&C production decreased slightly from the last quarter of 2006, 2.643 mbd to the first quarter of 2007 at 2.636 mbd. This probably means that Canada’s conventional C&C production is declining at 7%/yr to offset the tar sands increase of 7%/yr.

Memmel,

Ace has spent huge amounts of time in the existing data, something I have never seen you do. If this is Ace's forecast, then I believe that, based upon his assumptions, this is a valid forecast. He always includes all the mega-projects known to be coming online in the future. But generally he has posted the "near term" graphs that focus on now to about 2012. Rarely has he posted this larger graph.

Also, Ace is very close to Bakhtiari, who predicts 55 mbd by 2020. Ace's prediction shows just under 50 mbd by 2020 or 55 mbd by 2020 if you believe OPEC's reserve numbers.

You've talked the talk but the scenario in front of us is worse than most on this website are willing to admit, Far, far worse. Take your economic collapse scenario and expand it and speed it up at the same time. Then you might be closer to the truth. Data like Ace's is why we need to move, as an entire civilization, right now, on this issue. We're almost out of time. And this is the killer of techno-BBs such as those hoped for by some here. If the global economy collapses too fast you are not going to have solar PV producers still producing, nor high tech wind, nor anything else. Add in the global shortfall in grain production for 7 of the last 8 years and we're closing in on several nasty problems at the same time. People who can't eat cannot even be conscripted into slave labor.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I've come close to doing some modeling on my own but I have nothing to add of any value over whats been presented. So I'm not sure where or how I could contribute modeling. I've got lots of ideas I'd like to model but it would be a full time job and in general requires data we don't have. The crux of the problem is to do anything beyond whats been done on the modeling front requires data thats not in our possession.

Take my irrational markets and shortages model all you get is almost immediate system collapse so I'm not sure what to model. My other keen area of interest bunker fuel has most of the data behind a paywall and given the data the model looks complex to me. I've looked for free databases of historical price records and even emailed bunkerworld but no reponse.

The model he presented was the most aggressive I've seen so

maybe I was a bit rude in asking but yes I wanted to understand why/how he got it. I'm sorry if it came off rude.

My ant antenna's went up and got burned off by the implications of the graph.

Now with that said we are completely dependent on total liquids and the EROI of these total liquids to keep this house of cards from collapsing early. Outside of NGL's the EROI of the rest is suspect and NGL's probably are offset by the declining quality of the crude. So even if you throw in all liquids your back to Aces curve. BTW this is why I'm not all that interested in all liquids from a EROI perspective with the decreasing quality of crude thrown in they are pretty much neutral or 1:1 on EROI and can be discounted at best say 3:1 and thats probably pushing it.

Given the way I handle none C&C sources Ace's graph caused me to sh%@t my pants which can have the effect of causing a posting to be a bit rude if done before the trip to the bathroom.

Sorry.

I didn't see it as rude at all! More like complete shock. :)

But this is the problem that Ace, WT, Khebab and others keep talking about - decline looks horrid and while the economy can muddle through a few years of tightening its belt, you cannot tighten your belt forever.

By the way, if you've been reading Ace's plots ever since he started, you would see the all liquids peak creeping forward from early 2009 now into 2008. It's moving towards us and we are moving towards it. If it happens in 2008, things could get ugly fast. Also, Ace is predicting noticeable shortages somewhere in the world as early as this fall which probably will create price spikes. So if we get the $80 or $85 per barrel oil in the fall, don't be lulled into thinking the worst is over if it falls again. Volatility is the buzzword of a resource constricted market.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Yes I figured out that this latest plot has shortages starting this fall not just tight prices. We can only hope that KSA is holding back a little bit at least and will up production once oil crosses 100 a barrel. Also we effectively have a economic crisis scheduled for the late fall early winter. With Aces work this event becomes almost 100% certain. This should cause demand too back off some. So the first shock wave esp if KSA has any excess capacity will give us a small Indian summer.

So regardless of when the first shock from peak oil hits I see a bit of a breather before the next one. I'm guessing it will take three shocks before things start to crumble.

So using Aces work we have a shock sometime this fall.

If we have a hard winter a shock then if not we squeeze by.

This puts a much large shock next summer as we don't have a summer driving season but widespread shortages or very high prices. The fall of 2008 should be another breather period.

2009 is toast.

Now if Ace is too aggressive we get a weaker signal this fall

which is a unexpected price run up when prices should be falling I think a lot of people consider this very likely.

Late summer of 2008 would be shortages etc.

So Aces work moves everything up by 6-8 months. And if we sneak by without a hurricane this year I doubt we make it next year and certainly not for the three year initial crisis period 2007-2008-2009. We are going to have one sometime and in general the chances of a major above ground event making a bad situation horrible is close to 100%.

To some extent a strong hurricane this year causing major problems would be a good thing since it would give use a overly strong initial shock.

Personally the basic problem I have is the recent insanity of the housing market still has not blown off and its really hard to make a prudent buying decision in most markets.

And since you can figure even if prices reverted to the mean quickly the value of property will be very low for a looong time so your only buying it for a personal garden but your locked in forever in effect since you effectively cannot sell.

But waiting till land/houses is dirt cheap is pretty dangerous because it may be difficult to execute a move at that time and of course any fiat money based savings could get wiped out in the interim.

So I need to see a serious crash in prices in the RE market but things still stable enough and the currencies not trashed so I can make a move. Its going to be very very tight. I have a plan B but Ace is mucking up my A plan.

There it is.

There's the answer to the "They've predicted the end of oil 'X' times in the past and they were always wrong" talking point.

Just playing devil's advocate, but won't the cornucopians and deniers immediately come back to westexas' point with another talking point along the lines of:

"Well, there's plenty of oil out there, we just haven't discovered or developed those fields yet!"

First, thanks for pushing back. I think it's healthy and good for the discussion. It might even be helpful to put together a "Cornicopian rebuttal FAQ" -- with an emphasis on Factual data to rebut these kinds of "Faith-Based talking points.

For the "plenty of oil argument" I can think of a handful of replies for different occasions: (Some are just for fun)

1) Serious / Factual:

2) Serious / Business:

(*I need a technical reference for that, I believe I read it in a Roscoe Bartlett special orders speech, but the FAQ would need to have bulletproof, referenced facts.)

3) Flippant / disdainful / Political

4) Flippant / disdainful

5) Disdainful / Serious

6) Disdainful / joking

7) Disdainful / Jim Kunstler

(Edited for spelling. Too much coffee)

There are unbelievably large amounts of fossil fuels in the world ... peak oil is about flows of oil ... we can't get it to flow out of the ground at the rates required to meet our exponential expectations of increase in demand.

IMO anybody that responds to peak oil by talking about the amount of oil in the world, either undiscovered or discovered, doesn't understand the problem.

Xeroid.

Good point. My response to that is "Reserves are not the issue. The issue is how fast you can get it out of the ground. There is an unstated assumption that if oil is "there" that there is no difficulty in getting out of the ground, processed at the well head for water and other impurities, transported halfway round the world, then refined and delivered to you. There are a lot of difficulties, lately with refining, but mostly in getting it out of the ground. We can discuss those difficulties if you want."

At this point the eyes have normally glazed over and they think I am a nutter (probably I am) and they walk away. Most people just do not care. Even educated, aware people, do not care. They do not have the entire matrix of information required to understand the information in their heads. Most people are not aware, they are more concerned with the personal habits of Brad Pitt and Paris Hilton, or football. These are the folks who also whine about "gougers" and being ripped off etc.

Humanity will trip over the edge wondering what dress x or y actress is wearing to the Oscars. Nobody cares.

Your comment reminds me of an excellent movie... starring Brad Pitt! Fight Club is described by a fan like this:

"the story is nothing short of incredible, a pure shock-value social commentary on the state of the world at the end of the century"

Discovery rates are a good approach.

8) We can use past discovery to predict how much is left. As discovery each year drops, it points to a maximum:

In "Beyond Oil" Deffeyes models "hits" on new oil fields. His model projects that we have found 94% of all oil and that roughly 100 bbl remain unlocated (this was in 2005). (which is why a "big" field like 7 billion barrels is news and we don't find any 70 billion barrel fields).

9) We can play a "what if" game. What if there were 4 trillion barrels. Then we would expect to be finding X bbls of oil per year in new fields now. We are not.

Colin Campbell co-authored an analysis (which I cannot find right off hand) where he showed how much discovery we would have to be having to find the extra 1 trillion and 2 trillion barrels of oil predicted by the USGS. As you can imagine, to find another 2 trillion, we would need a second discovery peak as huge as the one in the 1960's. And to find another 1 trillion, the peak would have to be half the size. Nothing like that is happening.

10) Serious/Business

If there is so much more oil to discover, why are the oil companies trying to get into tiny slivers of protected Federal Land? Why not just drill the vast world wide reserves? (because the protected areas are the only undrilled areas remaining).

11) Serious/Business

If there is so much more oil to discover, why are the oil companies developing fields in countries that are undergoing civil war (Nigeria) instead of developing the 2 trillion barrels of oil elsewhere.

The next cornicopian response will be that we will just squeeze more oil from the current fields.

12) Serious/Business

If we could get more oil from the current fields with advancing technology, then why is the US lower 48 in decline? Why is the most technologically advanced country int he world, home the the most sophisticated oil companies, unable to halt the decline in oil production?

(Here we could use a few more items that explain how oil becomes locked in the rock once the water or gas flood replaces a percentage of the oil. And some references on how water and gas flooding have been used extensively since the 60's. "Twilight in the Desert" is one source.)

The next step is dealing with low EROI alternates. And then other energy sources substituting for oil.

Jon Freise

Analyze Not Fantasize -D. Meadows

Hi Joe,

Thanks for the detailed reply, you certainly came up with a wide array of counters to the common talking points out there.

I feel like the (Western) world has lived through some great years and now we are entering a period of consequences.

Personally I am very frustrated that people at all points of the political spectrum are so completely in love with their cheap oil lifestyles to formulate a constructive response to the end of cheap, easy oil.

The problem is that production curves look very similar to discovery curves and the global discovery curve peaked back around 1964, I believe. It may be a year off either way but it was roughly then. The discovery curve since then looks like a descending meteorite, absolutely plummeting downward.

So we are left with one of the following options:

1. All the geologists in the world are in cahoots to hold back oil to drive up the price. OR

2. All the geologists in the world are incompetent and can't find what their granddaddy could clearly find. OR

3. There's not much oil left for today's geologists to find.

My response to geologists who insist there is more oil is to directly ask them - where? I ask them if they have looked at the discovery curve over the last 100 years and almost always they say no. Like most employees in most businesses they are concerned about today and tomorrow and don't have much time for yesterday. Yet in the data from yesterday are important clues about today and tomorrow.

So while you are playing devil's advocate, please explain the discovery curve:

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Hi Greyzone, this is not about oil, but my own lack of HTML skills. How do you embed an image in TOD. I have tried, but not yet managed this.

Eyeballing that particular discovery curve it would give a URR probably around 2000 bbls. I suppose that the geologists would explain away the clear decline by saying that the actual URR is 3500 bbls (such as what USGS predicts). But then we should ask, where is the discovery curve that supports the higher value?

Well here is one from Shell Oil:

(for SAILDOG, note how to imbed a pic

<img src="http://www.peakoil.nl/wp-content/uploads/2006/09/po-shell6.jpg" /> )

Well, this discovery curve shows approximately 3500 bbls, which is 75% higher than the other discovery curve. It would be interesting to do a year-by-year analysis of this curve against the one you posted to see how the discovery values are boosted. Shell either puts in reserve growth or place fairly aggressive predictions on the discovery values (possible instead of provable or probable?)

Or better reserves are known to be 3500 bbls so the discovery curve must match. A bit simpler explanation without a in depth analysis. The prediction discovery is asymmetric. However if you assume that Antarctica can and will be fully exploited you probably do have 3500 barrels. Does anyone know if some people are excluding Antarctica and some are including it. You would have to think their has to be some pretty big oil fields in Antarctica.

Funny the USGS included it with Africa.

http://www.usgs.gov/newsroom/article.asp?ID=636

And they have a lower figure.

I'd have to guess that estimates for the Arctic and Antarctic would be the wild card ?

Antarctica is protected by international treaty. Whether any geologists include it or not is anyones' guess. However that continent was in a tropical spot during the Carboniferous period. If anything, it'll have coal, though pretty inaccessible. Wouldn't add that into the coal reserves. As far as oil, one could try the obvious and use Google.

If oil is there, the treaty becomes an above-ground sticking point and drilling becomes a pain as ice under great pressure flows and will cause the drilling pipe to get stuck. READ: heated piping. The EROEI might not be worth it even for a large field. The treaty does not allow for divvying up the Antarctic into "colonies" though military and research bases are allowed. And of course, a spill would make quite a mess. A similar treaty protects the moon from national ownership.

I wonder if any seismic exploration has occured on the sly and kept secret regardless of the results. A scientific base looking for fault lines doing the exploring on the sly seismically could find possible formations. Fun conspiracy theory: Suppose the USA bases did find a Ghawar size field. We'd keep it quiet until we break the treaty and being the only superpower (while fuel lasts!) go in uncontested. The Antarctic is really the last unexplored (as far as we know) oil patch. But since it's covered in ice, all bets are off.

Petrol prices high enough yet? Just wait!

AKAIK, nothing has been discovered at the poles yet, so how can it appear on the chart if these have to be probable or provable?

Thats what made me wonder if its a case of we don't know whats been discovered at the poles.

You would have to guess that both regions still have some large reserves discovered or undiscovered or as I'm wondering discovered but generally unreported. Considering extraction costs political issues etc etc and more important the fact that we are a long way from even attempting to exploit these fields I don't think they are important to oil use with our current economy. But you have to figure their must be significant reserves somewhere in the arctic regions that have not been officially acknowledged.

I don't see why a nuclear sub could not be used to do a bit of prospecting.

http://www.cnn.com/TECH/science/9807/01/arctic.yoto/

Its not a large stretch to go from this to actually do a bit of oil exploration.

And this

http://www.sciencedaily.com/releases/1998/01/980129074316.htm

But not a single hit from google for seismic studies with a nuclear submarine. I can't think I'm the first person to think about doing this.

Perhaps the difference is (at least partly) explained by a difference in what is being measured on the left axis of the two graphs. One is barrels (bbl) and the other is barrels of oil equivalent (boe).

Good call, I will update with that information.

It's a reasonably safe bet that the GCA (Guneshli-Chirag-Azeri) complex in Azerbaijan will exceed 1MMb/d next year, and probably for a few years thereafter. All the major facilities are now installed, and the final platform (on Deepwater Guneshli) will come onstream, using pre-drill wells, within a few months. GCA produces into one export pipeline, but you could argue that it is three different fields. Then again, look how finely Ghawar gets sliced on this very website, sometimes.

PDF Alert - GOTO page 3. Hey, Khebab - linearize this...

http://www.bp.com/liveassets/bp_internet/globalbp/STAGING/global_assets/...

Not that this will do anything noticeable to overall global decline; just making the observation. I certainly don't see a million coming from anywhere else, anytime soon - maybe never.

Post hoc ergo propter hoc

Or, just because "B" follows "A," it doesn't mean that "B" is related to "A."

Having said that. . .

Building on Hubbert/Deffeyes work (now known as HL) and on Matt Simmons' work on increasing consumption in oil exporting countries (and Khebab’s excellent technical work), last year I warned of three upcoming events: (1) A decline in Saudi crude oil production (based on comparisons to Texas); (2) A decline in net exports worldwide and (3) A decline in Russian crude oil production.

As I said up the way, it may be a coincidence (i.e., the Saudi decline may have been voluntary), but we have evidence of support for Events #1 and #2. The remaining question is Russia, where the EIA has been showing basically flat production since October, 2006.

The key point to remember about Russia is that is is a very old producing province, about 20 years past its peak production level and as Russia has gotten closer to "catching up" to the HL model prediction for post-1984 cumulative production, its rate of increase in production has been slowing--and for the six months its rate of increase has basically been zero, based on EIA data.

Very recently, we have seen some remarkable comments coming out of Russia, from suggestions that Russia may “choose” not to increase its oil production to calls from the newspaper Pravda to “Step up its efforts for alternative energy solutions.”

Link to Pravda Editorial: Russia to reform national economy to get rid of oil dependence http://english.pravda.ru/russia/economics/93835-0/

Nina Krushchev (apparently no fan of Putin), granddaughter of Nikita Kruschev, had an interesting declarative statement in a recent column in the Guardian:

In any case, because of the HL based analysis, last year I also strongly recommended the ELP Program: http://graphoilogy.blogspot.com/2007/04/elp-plan-economize-localize-prod...

A question I have asked in regard to my ELP recommendations is the following: Does anyone now wish that they had bought, on January 1, 2006, a $50,000 SUV and a $500,000 suburban McMansion, all with 100% financing?

A question that you need to ask yourself is the following: Given all of the above, what are the chances that events are going to continue to unfold as the HL based models suggest they will?

Almost certainly yes, as envy is an extremely strong social force. But they're probably not reading anything around here...

I had a nice talk with the Russian oil analyst at Aton Securities earlier this year. He had a good story:

The export taxes on oil are very high in Russia, and domestic prices are relatively low, so the oil producers' "netback" on their production isn't very high. In effect, either the Russian people (via low prices) or the government (via high taxes) benefits from the oil. This worked for a while because the workover methods they were using on old fields to up their output were cheap and easy, and thus production costs were low. However, that bonanza has been about tapped out, and the next cycle of development has high capital costs. At today's low netbacks for Russian crude, these high capital costs are not justifiable, so Russian crude producers (Lukoil, Surgut, Rosneft, etc.) are not expected to undergo large capex programs, and crude production is likely to decline accordingly.

This could be remedied by raising local prices and lowering export taxes, and it is likely that some step towards that direction will eventually be taken. However, the Russian government is well aware of the resource situation, and they may deem it attractive to limit the pace of development, so that a greater resource base is available in the out-decades.

Good work WT. I think most of us here agree with your ELP plan even if we dont vocalize it as much. The problem is convincing the 99% outside the peak circle who refuse to believe the truth.

Based on your assessment of russian production how much do you expect exports to decline year on year from 2007 to 2008?

Khebab and I are working (that is Khebab is doing the hard work) on projections for future production and exports by at least the top five net exporters (that accounted for half of world net exports in 2006). The HL based projections will not be a pretty picture.

In any case, for the top five, if you assume a 5% decline in production (the top four showed about a 4.4% decline from 2005 to 2006), and a 5% rate of increase in consumption (which is below their 2005 to 2006 increase), net exports by the top five would initially decline at about 10% per year. Note that in later years, the decline rate, based on the Export Land Model, tends to increase. Based on the 5%/5% assumptions, net exports by the top five would be at about zero in 14 years.

Can their exports (in a practical sense not theoretical) ever go to zero? I mean the reason that their economy is booming is because of huge export revenues right? wouldnt a point where exports are so compromised that any amount of price increase does not negate the loss of export revenue start to compromise their GDP's and hence their domestic usage?

Your thoughts?

I have postulated two phases in Export Land.

In Phase One, revenue from export sales continues to increase, even as exports decline, because of higher oil prices.

In Phase Two, revenue from export sales declines, even as oil prices increase, because higher oil prices can't offset lower export volumes.

The problem arises when exporting countries try to limit local demand, so that oil and petroleum products can be exported, e.g., look at what is going on in Nigeria.

As a practical matter, there won't be a big difference (between restrained domestic consumption and no controls on domestic consumption) in exported volumes once an exporter's exports fall by 75% or so.

It's kind of analogous to the HL method. As we get more data, the plot asymptotically approaches the horizontal line (P = zero), without ever quite getting there in most areas. But the production rate is so low that P is effectively zero.

Gotta run for now. Be back later. I have to go do my part to flatten the Lower 48 HL curve, by picking some drillsite locations.

I've pretty much got my economic model done for considering the economic effect of HL/Export Land. I still don't see how to plugin numbers to get estimates.

First and foremost we assume the market is in denial well past when its obvious we have peaked this means the market will be ineffective in pricing oil to include the risk of export land.

It will only react to export land conditions.

This condition of a broken market implies that it will incorrectly allocate resources which of course means shortages will develop so assuming the market is misguided naturally results in shortages from mis allocation of resources. This is a common theme when a resource is over exploited if its renewable or simple exploitation of a non-renewable resource where the expectation is supply is far larger than reality. Humans are by nature bullish so our markets always fall into boom bust cycles its practically intrinsic.

Thats the economic side of the equation. So the primary effect is shortages this leads to the second half and why peak oil is so ugly. What happens when the supply of a resource becomes strained is events that where previously uncorrelated because ample supply acted is a sort of buffer become correlated. In the markets this is known as systematic risk. Even without outright shortages the whole system becomes more and more susceptible to systematic risk as supply and demand drain reserves until outright shortages develop.

The systematic risk or correlation is not obvious but you can see that a shortage in one part of the world prompting panic buying can lead to a shortage somewhere else and another run of panic buying. The how of the correlation or chain of events that cause seemingly unrelated events to actually be correlated is complex.

A simple picture is a spray of hot coals landing on a sheet of paper each burns a hole and if the paper is big enough and the size of the coals small enough and better you can get a fresh sheet the events remain uncorrelated. But in the case of coals landing on paper if two land close together by chance then you can get exponential growth in the burning region they share a common variable in this case proximity.

So for the sheet of paper to go from having small holes burned in it to bursting into flames and completely disintegration we actually have a good idea of the variables that cause correlation its the size of the coals the rate the coals are falling on the sheet and how often two different coals land close enough to share the flame front.

In the case of oil these variables are not as easy to determine but its easy to create any number of correlated positive feedback loops when supply is short to show that shortages and low supplies result in correlation between previously independent events.

Its easy to see from the paper example how a lot of small events can suddenly turn into a big event as the correlation causes coalescence with bigger and nastier feedback loops.

And you can see how hard it is to actually see this coming since its effectively random which the exact chain of events

actually causes the paper to burst into flames.

Back to the model you can however watch for more and more correlation and although its impossible to time you know that past a certain threshold which from other models I set at about a 5% difference between supply and potential demand the chance for a coalescence of correlated events becomes almost 100%. Next of course this model has everything falling apart so fast you really don't have time for the market to respond and try and restabilize the situation.

Forget about trying to find alternatives as punishing shortages cause the economy to grind to a halt.

A major hurricane in the gulf or and attack on Iran will be enough to send our world economy to the bottom. But even if this does not happen the aggregate of correlated small events will eventually result in cascading failure.

The timescale is easy since WT's models shows exports dropping by about 50% within 5 years this economic model of correlated shortages with exponential feedback everywhere has to execute in less than two years once it goes critical.

The minimum is based on simple timescales for the moving of oil and the fact that reserves will not all be at zero in the beginning this gives a lower bound of about 8 months from the beginning of cascading failure until the system cannot recover. I think barring a large event this is to low and its weighted to the high end.

Next of course when does this model start I gave 5% split between potential demand and supply but this is hard to gauge. Going to Exportland agian we can see that two years into Exportland we are well within this 5% region regardless of how demand has adjusted to supply. So two years past when export land begins in earnest is about the most your going to get and then your less then two year before meltdown.

Taking a conservative approach and assuming ExportLand started this year we end right where my predictions keep ending which is we are toast by 2010. So the end of the oil age can be predicted comfortably to be 2010 to 2011 at the latest. So enjoy the next 2 1/2 years.

Wow. Really important post, memmel, thank you. I guess so as not to engage in ego-stroking I should offer some quibble,so...when you say"this model has everything falling apart so fast you really don't have time for the market to respond and try and restabilize the situation." have you given weight to SPR, Plunge-Protection Team, trading suspensions, circuit-breakers,etc? Gov't does have some options in arresting a slide, I mean if, for example the military were to suspend fuel purchases temporarily that would release an enormous amount of pressure on demand. Even a voluntary odd/even rationing system would relieve some demand pressure and buy us SOME time. Not that we would use it to fashion a coherent societal response, but I don't see gov't and Wall St as being impotent, either.

odd even wont do shit.

people will just buy twice as much.

it's simple.

anyways, the best way would be to tax the shit out of gasoline right now. tax it under "global warming prevention", don't let the people know it's because the oil is running down, increase taxes every year (note that increasing taxes have an exponential effect on demand and size of a market) so you can actually get away with lower tax increases year on year and look like you are doing something.

in the mid term (10-15 years) the tax will shift everyone away from gasoline powered vehicles. In the long term it will hopefully prevent ACC (anthrpomorphic(sp) climate change) by moving humans to renewable means.

simply put people, this is it, we either make it or break it through this chokepoint. How things are going it is unlikely humans will get off the planet, so we are screwed, more screwed than ever before. Simply because we have wasted our natural endowment of resources.

Now humanity will never go to other planets, and will likely die in a gamma ray strike, a meteor, GW, or an iceage.

Physical limits cannot be surpassed by physical creatures.

"Physical limits cannot be surpassed by physical creatures."

You hit it, that's the problem right there.

Don't you know Gilgamesh, we aren't physical creatures? No, no, we are much much more special than that. We are so special, nothing, in the end, can bring us down. Ah the provincial nature of humanity, gotta love it...

to fully address what you have written

the SPR will be gone before last imported barrel from OPEC.

The military will not have fuel either

Even if the fuel is suspended(Ignoring the overnight destruction of the economy), petrol will still have a use. The real market has always existed in some form throughout the ages. Bartering goods for goods, services for goods, money is just the abstraction layer.

What this means is that if there is a demand, the market will try and satisfy that demand regardless of what the gov does. i make no guesses at which price this demand may be, but it will be there.

Actually I agree but it won't be used by soccer moms in SUV's to pick up the kids at school.

To expand on the first response. In general and maybe the Russia is a good example the status quo will be protected until it can't. When it can't the situation will change. So the powers that be esp in the US will vigorously protect the status quo as long as they can until they can't.

Considering the current state of our fiat currencies or better faith based currencies we don't have a lot of room left to protect the status quo. And the big problem all the powers that be face is simple loss of faith in authority once this happens you either get a new set of masters that at least make promises that thing will be better or the current ones usurp more and more power and effectively crush any outward effects of this loss of faith.

The key is context and to directly answer this post. Sure we use gasoline but it won't be for a soccer mom to pick up the kids at school in a big SUV.

The solution is brutal and obvious the biggest problem as export land progresses is the overconsumption by the middle classes of all countries. I've stated before that usage numbers for the poor countries are heavily distorted since most of the gasoline is used by people that have purchasing power on parity with people in the wealthiest nations. So the top 10% of the population of a poor country use 90% of the resources effectively mirroring the usage patterns in the US. The statistical averaging of the large population of very poor people with the smaller "western" population distorts the real situation.

So to focus the problem is this class of people world wide that are basically equivalent in their purchasing power the only way out is for this whole class to develop a way to start shedding a big percentage of competitors annually.

This has to happen since demand cannot exceed supply its a natural force and no monetary games can fix this so at best these games can buy the richest time to reposition to take advantage of the changing climate but as far any sort of real effect I doubt it.

A lot of people on the board live at least a middle class lifestyle walk out and look around you at least 50% of the people you see in your neighborhood will probably be begging for food to eat within the next ten years. It may even be you. Nothing can stop this from happening since the natural move is to follow the same usage patterns as the third world with the top 10% using 90% of the resources. Thus the only solution is for most of the middle class to cease to exist as a group. Not to his has the side effect of dramatically dropping the need for a wide range of resources outside of food which can't drop all that much so the only sticky commodities are food and water. Shelter might be a issue or more importantly shelter that allows access to jobs.

Think about it during the depression exactly this happened people that stumbled or simply had bad luck plunged into deep poverty while for those that managed to continue employment it was not a bad time.

So you see the core problem is we have a group of people that have fairly equivalent purchasing power world wide that do not support changing their lifestyle one bit. This group will simply engage in a Mexican standoff until one party blinks or fails. This scenario simply repeats. Nothing can stop this. Initially it will generally take out those that have made the worst financial decisions and cannot actually afford the lifestyles the live. This will in turn cause others to fail effectively randomly as consumption drops and

various companies downsize. So the second wave can easily take out a lot of people that are conservative esp those close to retirement. Wave three gets tough because your down to those who can hold out the longest. Actually at this point consumption might be down enough that a sort of Indian summer is possible before we continue the relentless march downward.

To sum it up we practically have to have and event that removes at least 1% of demand in the next year or so nothing can stop it. And all I'm outlining is a common depression scenario nothing special. The underlying cause is interesting assuming our recent financial games don't take us down before peak oil gets going in earnest.

Don't forget their are a lot of events coming together competing to be the one that takes out. Peak oil may well have to wait its turn.

Financial is the top contender.

GW is the 800 pound Gorilla and we don't know for sure when it will cause serious problems.

Water/Food/Fisheries are all right on the brink.

War is increasingly a issue.

So their is a really good chance we won't make it to a peak oil caused meltdown its a tight race. But Peak Oil puts a fairly absolute bounds on how long we can continue business as usual and its certainly less then ten years and if the models are right less than 5. I think we have until late this fall before we can easily see that things are obviously not normal.

Now if the damned housing bubble would just crash faster so at least we have and option of sane prices for a place you can grow a decent garden.

I am not sure that I go with the melt down theory. Much depends on how the markets react; and how governments react.

Peak Oil can be defined as a growing gap between the amount of oil supplied at a given price and the amount demanded at that price. Within that definition Peak Oil already exists for all those people who cannot afford oil (products) above (say) $35. Many poorer countries, Senegal, Guinea and Zimbabwe among them import much less oil than they used to. For these folks the age of oil is already over.

This process will continue and Westerners will buy smaller cars and drive less for some while, even as supply commences to decline. Even though production has been flat, the silence is deafening from TPTB and the MSM. Maybe the world will come to accept this situation. It has already lived with it for nearly 3 years. Maybe declining supplies and higher prices will be accomodated by the markets. Conservation can go a very long way. Not everybody "needs" to have lunch in Venice if they live in London. There is a lot that can be done.

Some countries (notably the US and Australia) will struggle because they have poor public transport. Europe will be better off in some respects. etc etc.

The catastrophic scenario might not happen. I hope it doesn't.

First a lot of the demand destruction in the poorer countries is probably a myth since the oil usage distribution is the same as at the world level with the top 10% of the population using 90% of the oil in these countries. These people have purchasing power on par with the wealthier nations. Once you exclude them the physical amount of oil products used by the poorest is very small so even if they are demand destructed your not going to "reclaim" a lot of oil to use for SUV's. Squeezing the third world for oil will thus not work for long.

Collapse is based on a market that is not pricing the situation correctly and shortages. This is a bubble type market but in this case the bubble is caused by the market optimistically creating a low price for a commodity until its physically in short supply. Considering the status of the US's gasoline supply I'd say we can see this happening now.

All bubble markets eventually collapse in the case of oil since its a underpricing problem the collapse means huge spikes in prices and shortages.

The shortages which I've mentioned several times are the killer not price. The example is a 1969 VW beetle without gasoline is worth just as much as a 2007 Mercedes SLwhatever. They are just big hunks of steel. Shortages remove the purchasing power option from everyone.

Thus in the shortage scenario instead of everyone reducing consumption by 1% you simply go a week with no gasoline.

This balances supply and demand. Reactive pricing at a much higher price point then before the shortage helps keep some demand destroyed but its not a primary agent.

As long as we have purchasing parity and a delusional market

the only outcome I can see to balance supply and demand is physical shortages. And these wreak havoc on a economy. Unless prices increase substantially and people also have a viable path to reducing their oil usage significantly we will have shortages.

As far as to why the market is in denial the basic reason is if your customer prints the money that he pays you with you have a problem. The current situation is a symptom of a world awash in petrodollars and borrowing forward like mad to keep running. I think worldwide it would take 100 years to pay off the debt thats on the books right now. I'd have to guess the economy will falter when we are 1000 years in debt. Obviously most of this debt will be defaulted. But you can see that commodity prices which don't live in a vacuum are heavily affected by the economic conditions. This borrowed money is also flowing in and out of markets including the commodities markets looking for yield. So at the moment the money flows control all the markets fundamentals have little effect.

G,

2 things:

1/ It's too late for a high US gasoline tax, you would drive too many people and businesses into bankruptcy.

2/ The military will have fuel long after everyone else runs out. The US army, for example, has its own private storage tank, under the Iraq desert.

bankruptcy sounds a fuck-load better than death.

i'll take a pound of wallop as a cure anyday over a meandering death from starvation.

the us military will fragment as soon as there is trouble. they (upper ranks) likely understand the significance of peak oil and the impossibility of maintaining any semblance of order or control over such a vast land area.

and how will the USarmy get the oil from Iraq to the USA where it is quelling riots?

Its all guesswork or pure speculation. I think its clear you probably don't want to be living in downtown LA. I'd stay away from large populations in deserts in particular and large cities in general and try to be near areas that grow significant quantities of food vs the population. And of course start practicing ELP. Other than that we really don't know how thing will turn out.

The US has a large coal supply and could build Nuclear power plants very fast with a crash program. And of course wind could be scaled out fairly quickly. So a lot of good things could happen. I know I'm calling a lot of coal fired plants good but if we had to build them to have enough energy to convert our economy it can be argued to be better then just falling apart. PV also.

The EU has similar options and is in better shape.

Outside of the near certainty of trouble in the biggest cities and potential food shortages esp in ones that are barely sustainable with oil anything else is pure speculation or envisioning a possibility.

We know we must change and we know that a few places are probably not a good place to be other than that we know nothing about how this is going to play out much past peak.

This uncertainty coupled with models to point to far worse conditions as possible makes ELP'ing a pretty good idea.

The UK just became a net importer. They still export some, but they import more. It must be something to do with grades needed by refineries.

I am not sure if this answers your question, but it amounts to the same thing. Instead of supplying themselvs and the world, the UK now is becoming dependent on other countries. The US of course went through this process (painfully) in the early 1970's.

While I more or less agree with everything you have been saying on Hubbert Linearization, I have had a problem for a long time with your export model. I agree that most big producing areas tend to underprice their oil for domestic consumption and it is obvious that such a policy means a continuous shift from exports to domestic consumption in those countries. But I disagree with your next leap that such a policy will mean less consumption for world importers than what the commonly used forecasts for imports are saying. Unless you disagree with the commonly used world consumption numbers of 2% per year, what does it matter if some countries consume more or less. By just using a certain number of countries, the big producing countries, you arrive only at a partial picture and you cannot then generalize from this picture.

You would make the same mistake, for example, if you just take the consumption changes of the G8 countries and then extrapolate this number to the level of changes in world consumption. In other words, what matters is still only world production and world consumption if we discuss Peak Oil.

In purely economic terms, there are producers and consumers, and political boundaries shouldn't matter. The oil should go to the highest bidders inclusive of the higher transportation costs to remote importers.

However, back in the real world, borders do matter. For example, look at what is happening in Nigeria, where they are trying to maximize exports, without meeting local demand.

Also, look at what happened from 2005 to 2006, for the top five net exporters (EIA, total liquids):

Production: -1.3%

Consumption: +5.5%

Net Exports: -3.3%

Why will this trend not continue?

Furthermore, we have the "positive feedback loop," where torrents of cash flow from exported oil increases domestic consumption in exporting countries, e.g. 50%/year rate of increase in foreign car sales in Russia.

Understand that the wealth of people that own and drive cars is about the same worldwide with and advantage going to those in exporting nations. The averaging of this wealthy class with large populations of poor in some countries gives a very distorted view of the demand for oil. The reality is that the very poorest use very little oil so removing their demand has little effect the remaining users are fairly equal and the bidding war will quickly move into this car owning class and this means political issue will of course become a big factor as this fairly elite class pressures their government to maintain their way of life.

We often talk about the next stage as a bidding war amongst the western nations but its a bidding war for gasoline by all car owners the vast majority happen to be in the west.

This is important because it means demand will be very inelastic even with significant price increases. This leads to my shortage model.

While I am in no way disagreeing with any of your points, there is a wild card in that there are rather large areas of the planet which are obviously unexploited. To use a national characterization as a basis can be misleading.

As an example, during WW2 the construction of the Alaska highway caused TPTB to put in an oil facility at Norman Wells in the North West Territory on the Mackenzie River. There is a natural oilseep there which made the exploration rather easy. A pipeline was constructed to Whitehorse, Yukon as I recall, which appears to still be running. Google Norman Wells, and disregard the evangelist of the same name, or whatever he is. One site has a nice aerial view.

My point is that the Western Sedimentary Basin doesn't stop at the Alberta border. It appears to be potentially productive all the way to Prudhoe Bay. There is no pipeline, railway or decent highway, so at the moment it is all stranded. Geological studies of Ellesmere Island and so on were carried out in the sixties. Quite how much is up there is not public knowledge but by extrapolation it could be rather large.

In defense of HL, there is no way that it would be a great mitigating factor, but if we embarked on a major exploitation, its HL curve would start today rather than lumping it in with the rest of the Canadian curve. In other words, if it were a separate country we would treat it as statistically starting now rather than whenever you want to start Canada, say 1948.

If you want to use Hubbert on a field by field basis it works pretty much as advertised, but trying to lump it into national generalizations is an oversimplification. The chances of another couple of SA megafields sitting up there is perhaps remote, but I don't know. Not a lot of holes to go by. There could just as easily be just as much or more oil between Hay River and Alaska as in Alberta. Prudhoe Bay could go all the way to Baffin Island.

It isn't cheap and it isn't fun up there, but neither is the North Slope. How much is potentially off the south coast of Australia? Central Africa? The Siberian coast? So far, all the oil in Africa has been from the coast, largely because going inland was pretty risky politically and out of gunboat range. These sorts of remote and nasty areas that are currently unexploited could mitigate the world downslope for quite some time. It won't affect the peak situation, but will provide a lot more downside breathing space than the doomers seem to assume.

The socioeconomic transition from high usage to low will be a good trick given that the economics system is an evolved rather than a designed one which has eveolved around a growth model up to now. Debt service becomes rather problematic in a shrinking economy and inflating them away becomes our only current solution. Maybe they'll inflate away your payments on that Hummer and McMansion anyway. A free useless car and house courtesy of the Fed!

What if Iraq has more oil than SA did? The situation having been that potential oil supply gluts made exploitation of somewhat higher cost oil risky, most installations were close to the coast, and inland areas were left for later. Now it's later and there is a mix of really cheap and really expensive oil out there. There's still another round in the chamber with CO2 as the recoil and who gets the dubious distinction of burning it still in the balance. But it's Sunday and the sun is shining.

When Hubbert did his original work in 1956, he noted that a one-third increase in estimated Lower 48 recoverable reserves postponed the predicted peak by five years.

The question is when, not if, an exponential rate of increase in energy consumption runs up against physical limits.

The problem that we, as importers, are facing, is that net export capacity is a dependent function that is dependent on two independent variables, (exponentially declining) production and (exponentially increasing) consumption.

Our problem is we have not one, but two exponential functions working against net exports. This is what produced the 60% annual decline rate in net exports from the UK.

To further compound the problem, here in the US, our demand for imports is growing because of exponentially declining production and exponentially increasing consumption: http://www.theoildrum.com/uploads/28/Data_4weeks.png (Khebab's work)

As I have said, every time I run through these scenarios, I get more--and not less--concerned.

I don't get the "Exponentially declining production" bit...the HL curve is often simplified as parabolic (i.e. polynominal, not exponential), but of course it's actually closer to a normal distribution curve, which eventually flattens out again and is asymptotic to zero.

I accept that consumption in developing oil-producing nations is likely to be exponential, but probably not all that dramatically so. Do you actually have any data showing this trend?

Do we have any data for large fields (and groups of large fields) that have gone far enough down the production curve to know what the tails look like?

What would be expected is that production will decline until EROI of the field drops toward 1, then the field will be shut down.

But it does not matter a huge amount. We don't get into the tails until the final 10% of the oil. By then production is so much lower, society will be very different.

Jon Freise

Analyze Not Fantasize -D. Meadows

None of model are valid much past peak. At best 15% of peak production. I doubt they will work much past a 5% decline.

The underlying assumptions are simply not valid past this point.

If you press one of the global warming modelers I suspect they will also admit their models don't hold much past significant melting in the Arctic since its almost impossible to successfully predict through adding a new ocean to the planet.

The models may be accurate but we cannot have faith in them.

All the peak oil models suffer the same problem since oil extraction and usage is a economic/life style choice and concentrated in the middle class of the wealthy countries the actual production after about a 5% depletion has a lot more to do with the economic health of this group than anything else. If they can continue to maintain their consumption patterns and lifestyle then we probably stay close to the current models. This is the weakest business as usual part of these models but inherent through out is that things stay like they are with prices effectively steadily increasing. The chances of this happening esp when you consider the current financial climate are slim to none.

My guess is we will see shortages and major price spikes followed by economic downturns then a bit of recovery rinse and repeat. At each downturn you will shed a certain percentage of the population which will find that it can at best earn survival money. If you take ExportLand and just apply the percentages pretty much directly you have about 10% of the worlds population that used a decent amount of oil becoming minimal participants in the oil economy. Its of course not a flat percentage and it won't be a simple increase. But each year a pretty big hunk of the worlds population is going to have to effectively opt out of the world economy and it won't just be in the poorest of nations. You would expect this to cause above ground factors that won't favor oil production and consumption at anywhere near current levels.

But I hasten to add its impossible to believe any model we have much past peak they will all be invalid fairly quickly I doubt we can correct them quickly enough to actually maintain any predictive value in effect things will change faster than we can get enough data to even make a prediction and correct replace models. I'm not optimistic but I do recognize that we don't really know except that we can be pretty sure the next five years will not be pleasant.

As and aside simply having business loosen their rules for workers and moving to extensive carpooling could easily buy us a lot of time. Also subsidizing moving into the cities. We could even after we wait too late still act in a way that we can convert our society.

At least in America I'd be surprised to see people do such acts since in a lot of cases it would mean actually setting next to a stranger this is intolerable in the US.

Yes.

As soon as i get them up to my photosomething account I will post them.

Here is the plot.

Didn't wanna make a legend in R so...

Black is the Lower48

red is Texas

grey is Brent

blue is Alaska

The USA has the longest records as well as some of the most detailed.

The plot is a modification of typical Q/P y axis by Q x axis plot.

It is

Q/P y axis

RelativeQ*Age of oilfield/region x axis

Using the relative Q (convert each data points Q by dividing by the max Q observed) all of the data becomes scaled very nicely (between 0 and 1) meaning different sized oilfields can be compared easily.

the (relative Q) * (age of the region) gives a good idea of how different fields stack up even when they are differently aged.

Here is the same graph as above with some interesting lines drawn on it.

Notice how the p/q ratio drops like a rock after a specific point. This is when the field no longer produces any amount of consequence(ie watered out).

plz comment.

Would you happen to know the well types used in these various fields. Did technical improvements increase URR or simply shift the production curve ?

Most people that believe in peak oil also argue that most of the technical advance generally allow faster extraction. Certainly that have allowed production of difficult to extract oil that generally of low quality although we successfully extracted this oil for example the California tar a long time ago. So even in these cases its not clear that recent technical advances did anything but increase the extraction rate in many cases of course this had to happen to make the project viable.

The technology will save us argument is actually the hardest one to refute IMHO. I'll give you that advanced methods allow us to extract oil from old fields but the production rates in these cases are low enough that your not talking about and approach that makes a huge difference in the big picture.

Do you have the well type and production logs for these fields ?

I argue that the US with decades to apply any advanced method it deems has been unable to substantially increase its production rate and depending on how you do the accounting has not made any change in its URR. Thus the chances of technological advancements actually making a big difference are old.

I'll take a looky for the well types, i have production logs as reported by respective agencies.

i'll send you a mail if i find it in a non-timely manner.

Cool In my opinion the technical argument is the one that has the biggest chance of at least delaying the effects of peak oil maybe by several years. We actually don't know right now if technical innovation will give us a bit more of a plateau then what HL is predicting. Since we know that horizontal drilling and other advanced methods seem to allow us to keep the production rate high at least at the expense of greater declines later if not higher URR we have a chance that they have indeed managed to delay the decline rates to lower values than predicted by peak oil.

Of course since these methods have been in use for a while the steeper declines of "older" fields probably offsets any gains so your back to square one. But you can always hope.

I'm praying we get a really nice price shock soon and economic slow down before we run this thing into the wall.

I might be one of the few people who ever prayed for a recession but we need one ASAP.

One more thing do you have the dates when wells where drilled and completed ?

In the case that I'm asserting that the logistic model is actually a valid physical model showing that the wells are created in a logistic manner leading to logistic production rates would be really cool.

Please email if you have this data set and send it to WHT also I think he seems to be interested in this and having data of well completions with production logs ? :) would be cool.

If we want to do any sort of real modeling we have to have this data.

Just for my own benefit, I did some basic calculations based on what existing data I could find. For SA, which currently produces ~9.5mbd and uses domestically 2mbd, if we assume that the 9.5 can just hold flat for 10 years, and domestic consumption increases 5% year over year, then by 2017, we're down to 6.5mbd exported. While significant, even if that pattern was extrapolated across all major oil producing countries with rapidly growing economies, I would see it as a "pretty bad, but not catastrophic" rate of decline. True, after that it has the potentially to get much worse, but I suspect the world economy will already be a very different place by then, with pretty significant demand destruction going on.

Really the only thing that I see producing a completely unmanageable rate of decline in available oil for importing is North-Sea or Cantarell-like production rate declines.

Our problem is that many exporters, especially the top three net exporters, based on HL, are way, way past the 50% depleted mark, which I think will result in catastrophic net export declines.

The paper that Khebab and I are working on will attempt to quantify the estimated net export decline, at least for the top five. It will not be a pretty picture.

This is why I am increasingly tending towards the "Amish" option: to adopt a non-electric/no fossil fuel lifestyle. Before that I thought in terms of "green' solutions like high mpg cars, etc., but sooner or later even these adaptions will be too expensive. I figure we have, at best, 4 or 5 years before Olduvai Gorge.

Might as well prepare for it now, rather then fight the inevitable.

Flavius Aetius

Regarding consumption, the top five (half of net exports worldwide) have shown an accelerating rate of increase in consumption since 2000. From 2005 to 2006, their consumption increased at a 5.5% annual rate.

The key point is that net exports decline because of declining production and (sometimes) rapidly increasing consumption, which resulted in the 60% annual decline rate in UK net exports.

The 60% annual decline rate in UK net exports (a figure I haven't seen any raw data for, but I'm assuming is valid) is presumably because the high rates of production decline (due to the agressive way in which the North Sea fields were exploited) quickly lead to a situation where total oil production was very close to domestic consumption (which has barely increased over the same period).

The 60% was a once-off (and final) drop of course - from now on the UK will be a net importer, barring any substantial new finds.

I'm not sure how this is relevant to the situation of major oil-producing countries with developing economies that are now supplying the world market. Almost all of them are producing far more oil than they consume internally, and it would require at least 20 years at 5% growth in domestic consumption for most of them to end up with zero net exports. Sustaining 5% growth for 20 years is no mean feat, I might add - especially with unstable/authoritarian political regimes. But I would certainly accept that in 20-30 years time there will be extremely little oil left on the world market. The part I don't get is why exports are expected to decline at the sort of rates I've seen you post before (26%?).

In round numbers, for 2006 the top five (half of net exports worldwide in 2006) had the following numbers (Total Liquids, EIA):

Production: 30 mbpd

Consumption: 7.5 mbpd

Net Exports: 22.5 mbpd

You can actually use the Rule of 72 here (or just round off to 70) for the top five:

At a 5% year decline rate (pretty close to what the top four showed from 2004 to 2005), production would be at 15 mbpd in 14 years.

At a 5% per year increase in consumption (less than the 2005 to 2006 rate of increase), their consumption would be 15 mbpd in 14 years.

Basically peak exports (in 2005) to zero exports in 15 years. The UK went from peak exports to zero in about six years.

Note that based on HL, Saudi Arabia is 60% plus depleted, Russia (at least mature basins) is 85% plus depleted, and Norway is 70% plus depleted.