DrumBeat: November 30, 2006

Posted by threadbot on November 30, 2006 - 9:30am

Costly fuel cools Americans' love for cars

HOUSTON - High gasoline prices not only slowed fuel demand growth and cut sales of gas-guzzling vehicles in 2005, they also prompted Americans to drive less for the first time in 25 years, a consulting group said in a report Thursday.The drop in driving was small -- the average American drove 13,657 miles per year in 2005, down from 13,711 miles in 2004 -- but it is more evidence that the market works and prices help control consumption, Boston-based Cambridge Energy Research Associates said.

"Price matters," CERA Chairman Daniel Yergin said.

You can't conduct an orchestra with an invisible hand: The problem with carbon taxes

Historically, large-scale infrastructure changes take place only via hands-on government involvement -- involvement that not only subsidizes technology but helps shape its deployment. This can consist of public works, or grants of land and rights of way that help shape where infrastructure is placed. You can find examples in List 1 at the bottom of this post, ranging from canals and railroads to the internet.

Tom Whipple - The Peak Oil Crisis: The View from Capitol Hill

While up on Capitol Hill discussing the prospects for the peak oil message in the new Congress, I was brought up short by a question from a hill staffer. "Can’t you guys sharpen the time frame when oil production is going to peak?"“Telling us that all sorts of bad things are going happen sometime in the next five or ten years really is not that useful. Here, in the Congress we constantly hear about so many crises about to befall us— Iraq, budget and trade deficits, global warming, avian flu, Medicare, social security, housing bubble, terrorism, and immigration, to name a few — that trying to put peak oil threat in its proper perspective is difficult.”

Energy expert urges conservation

The days of dancing in oil around exploding derricks is over, and it’s past due time to think about conserving crude consumption, said Scott Waterman. Waterman, who works as the State Energy Programs Manager for Alaska Housing Finance Corporation, is looking to find ways to build more energy-efficient homes as he speaks around the state, taking on a number of education programs.

Canadian Energy's "Exit Stage Right" Plan

With prices approaching $1,500 per barrel, what would ever make investors like Charles Morgan want to sell their stake in the oil industry?Well, Morgan had noticed that the price of recovering the oil was increasing every year, and foresaw even further rises in the cost of his operations.

The world knew that oil wouldn't last forever, and people like Morgan thought that at the current rate of production the source would soon run dry. Fortunately for him, he recognized this trend and was able to get out of the industry at peak prices, generating a healthy profit for himself.

Peak Oil to Peak Gas Is a Short Ride

Could an 'African Kuwait' Be in the Making?

The discovery of oil in the small West African island nation of Sao Tome and Principe could help turn one of the poorest countries in the world into a sort of "African Kuwait."

South Africa Poised to Embark On Nuclear Route for Power

Opportunity knocks for biofuels industry

Oil prices have eased in recent weeks on the international markets, but the same cannot be said for agricultural commodities.World stocks of cereals are at their lowest level for more than 20 years, and supply and demand is expected to tighten over the next 12 months.

India is desperately looking for long-term gas supply contracts with gas-rich nations in Central Asia, Africa and the Middle East to meet the acute fuel shortage that has hit its power plants, which operate at half their capacity.

Brazil May Not Meet Domestic Ethanol Demand

Brazil, the world's biggest ethanol producer, may struggle to make enough of the fuel in the crop season ending March to meet domestic use because higher prices elsewhere are encouraging exports, C. Czarnikow Sugar Ltd. said.

Russian FM warns West against discussing energy security without Moscow

MOSCOW: Russia's foreign minister on Wednesday warned the West against discussing ways to reduce energy dependence on Russia, saying that would not help energy security.

Iraq's oil industry in grip of despair

The present state of Iraq's collapsing oil sector, its economic lifeline, is bleak and its future looks far worse, despairing officials say.Another damaging oil attack this week, the prospect of British troops handing over the oil city of Basra and virtual civil war have all but crushed hope for Iraqi officials battling to keep exports flowing to world markets.

"One thing is sure. The worst is yet to come," an Iraqi oil industry source said by telephone from Baghdad.

Think tank says Alberta should reap more oil royalties

Biofuel Markets Hinge on Biomass Progress

The fast-expanding biofuels market could falter without significant progress in making fuel from biomass like plant stalks and wood chips, according to a report issued Wednesday.

WRC's 2006 Hurricane Prediction Verifies Again This Year

Stocking Stuffer for a Green Christmas: The $40 Carbon Credit Gift Pack

Naughty little boys and girls get a lump of coal in their Christmas stockings; green little boys and girls get...carbon credits to take coal gases out of the atmosphere and fight global warming.

California tries to terminate greenhouse gases

Arnold's risky power play: The Golden State's small businesses worry that a new energy mandate will dim their prospects.

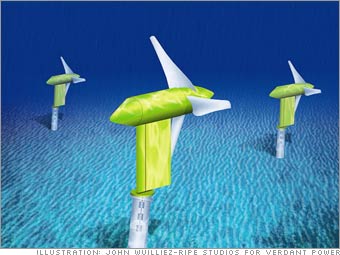

The next little thing: New innovations coming from small businesses. Two of the items are energy-related: ways to tap the power of the tides.

Global energy demand set to rise: McKinsey

HOUSTON: World energy demand will rise by 2.2% a year through 2020, outpacing the 1.6% growth of the past 10 years, according to a McKinsey & Co report...."Under all scenarios, you see future energy growth being stronger in the next 15 years than in the past despite some pretty significant attempts to increase efficiency,’’ said Diana Farrell, director of the McKinsey Global Institute, which spent a year studying energy demand worldwide among sectors including residential and industrial.

GM working on electric version of SUV: Automaker also plans biofueled Hummer within three years, CEO says

Auto industry should speed fuel economy fixes

While plug-in hybrids and hydrogen fuel cells are likely one day to help cut U.S. gasoline consumption, major fuel savings can be achieved now if automakers put existing technologies to work under one hood.

It's Electric!: The Tesla Roadster — a hotshot sports car that runs on batteries

Angola to ask for OPEC membership

While officials in high ranking positions and most brokerages seem to be sanguine about the prospects of north american natural gas supplies, one voice of reason has come from a surprising source. Raymond James.

http://www.raymondjamesecm.com/industry_1300_main.asp?indid=71

Click on above link and then on Energy Stat of the week. Direct link does not work.

Raymond James paints a picture that is even worse than that depicted here.

Specifically it hits on Branett Shale gas production. This was surprise to me as Raymond James says "First Year Decline rates are about 65%!!!" Mind you this is supposed to be the average.

There is table out there which shows decline rates in some cases exceeding 70%!!.

Raymond James analysts believe rig counts will rise 12% in 2007 utilizing every existing rig and still gas production will be down about 2% in USA.Although RJ points out some scary stats the "down 2% production " is actually based on very conservative numbers i.e. overall decline rates of 2004, mobilizing of every possible rig and very little rig migration.

The supply demand in our friendly neighbour is no better. Barring last week's canadian NG storage data, there were 21 weeks of decreased injection/higher withdrawal compared to 2005. Canadian storage is now 10% below last year.

One nasty winter and things could get pretty bad.

This also ties into the India natural gas shortages story Leanan posted above. They passed-up some opportunities to get some LNG long-term contracts at what they considered "inflated" prices -- now they are paying dearly for that. The future U.S. natural gas supply will also depend on LNG to make up future shortfalls. There's no time like the present to start lining up that supply. Thinking ahead is the only way to go here. We Americans are not noted for our long range planning abilities, however. See Iraq.

Ron Patterson

Last year it was -49 and the 5 year average was -40.

-32 looks like about normal to me...maybe even better than normal.

http://americanoilman.homestead.com/GasStorage.html

Rick

Highly reminiscent of the offer to Nixon by the Shah of Iran in 1969 for a 10 year contract for crude at $1/bbl. Nixon declined figuring that oil had to go down in price from its obviously too high $1/bbl.

So, mature tight shale wells are a good long term source of NG. Better than most others.

Alan

Its a perfect example of the kind of prospects that we will see developed in the post-peak era-expensive, and not productive at commercial rates with old prices Operators are buying pipeline right ofway in people's backyards, using the common carrier statutes to condemn what they can't buy. Its so crazy its almost funny.

The article link is http://www.reghardware.co.uk/2006/11/30/pc_cooling_app/

And since this is not Slashdot or groklaw, no comments about anyone's choice of operating system.

just make sure you install the power management drivers in windows(cool 'n' quiet for amd cpu's(amd64 and newer) powernow(for older k7's with power management) intel's i think is called speedstep). then go to your control pannel -> power management -> and from the drop down menu choose 'minimal power management'.

in linux it's simpler.

suto root 'su'

go to

/usr/src/linux(symlink to the current kernel tree)

type

make menuconfigthen go to the following.

Power Management OptionsACPI --->

and then select the following (x = * for built in)

[x]ac-adaptor

[x]fan

[x]button

[x]video

[x]processor

[x]thermal zone

if your also on a laptop also select 'battery, ac adapter, and dock'.

then go to

power management options

cpu frequency scaling--->

before selecting the following.

[x] Cpu Frequency scaling

[x] Default cpufreq governer (userspace) -->

[x] 'Performance' Governor

[x] 'Powersave' Governor

[x] 'Conservative' Governor (choose this instead of 'On-demand because it's a smoother transition between states)

under this is the list of cpu drivers for frequency scaling.

choose the following for amd64 based cpu's

[x] Amd Opteron/Athlon64 PowerNow!

or for intel's cpu's

[x] Intel Enhanced SpeedStep

there are other drivers there depending on the arch and whether the system your running is a 32bit or 64bit system.

from then all you have to do is install your favorite cpu freq manager and then tell it what state you want as default(most likely conservative) and forget it :)

for those of you who are wondering why i called the linux method easier, you do not need to go searching for the driver on a cd or on the web before installing it's already in the kernel.

Personally, I use openSUSE, and power management is pretty simple from its 'Control Center,' though real tweaking is always done in the conf files - it is just that SUSE has always had the very unfortunate habit of rewriting them anywasy after the tweaking - YAST is a very mixed blessing.

One of the things that makes this application a bit more interesting is the social aspect - most 'marketing' hinges on higher consumption, while this makes conservation the goal.

Of course, making sure that the PC, monitor, and peripherals are truly shutdown to no electric use is a hardware problem. I use a powerstrip with an off switch. The draw of turned off equipment is easily 20W and higher.

i have tried to explain it to other people to use a power strip to really shut everything off.. though they stop doing it as soon as they find out that when they do that and turn the power back on and find they have to wait 20 seconds to a minute before they are able to turn on their lcd screens they ignore me..

Recall back in the August 31 thread, you provided TODers with an exceptional Bloomberg article on peak oil. The article mentioned that a GAO report on the issue was going to be released in November of this year. Was that report ever released, or did I somehow miss it? Can anyone elaborate on this?

The GAO is supposed to have a report out in early 2007, yes. No one has missed it yet. I think they've been working on it for about a year since it was asked for by Congress or at least some members of Congress. the Congressional Research Service of the Library of Congress does the research for it. I've been watching for it but I'm sure it's not going to be out until after the first of the year 2007.

Tom Whipple - "The Peak Oil Crisis: The View from Capitol Hill"

This gets you by during good times, but throw some major crises in the mix people are totally unprepared (i.e., response in New Orleans). If this does not change, we will continue to put band-aids on larger and larger cuts until the 1,000th cut becomes too much.

I'll also add that those who think they will move to the boondocks like me either as a family or a group need to recognize how long it takes to adapt psychologically, develop the necessary skills and to actually build the necessary physical plant. Based upon 30 years of country experience, my best case is 7 years from the time the decision is made to move.

Second, the goal from the Hirsch perspective is actually to satisfy a high growth in demand:

I interpret the Hirsch "wedge graphs" that way, as attempts to maintain energy growth.

I think people often present Hirsch as if "since we aren't doing the 10-20 years thing, we will crash" ... actually a closer reading of the original would be "since we aren't doing the 10-20 years thing, we probably won't grow energy as much as many people would like.

IMO that leaves us with a good opportunity for conservation to meet alt-energy half way. See also: Can Energy Efficiency Be as Sexy as Solar?

As an example, "more efficient cars" make a small impact in the Hirsch model because the model expects overall demand to grow (presumably because overall VMT will grow faster than small car share). That only works with low gas prices and production meeting ever-higher demand.

The key thing is that failure to meet that production-utopia opens doors to all sorts of questions, but it certainly does not prove any unstated proposition about what the world will look like when a HIGH energy growth curve is not maintained.

Here's the reuters article.

http://us.rd.yahoo.com/finance/external/reuters/SIG=11vg30000/*http://yahoo.reuters.com/financeQuote CompanyNewsArticle.jhtml?duid=mtfh65881_2006-11-30_14-04-12_l30750555_newsml

But if the parliament is being told, perhaps the info will leak? Or we might get an idea of what the MPs were told by what they say about Kuwait's efforts to increase/maintain production.

We will not announce it (the reserves)

publicly because we are not obliged to

Don't stick your nose in Kuwait's business where it doesn't belong! Take that, you snooping Oil Drummers!

"now go away or I shall taunt you a second time"

:)

-PoP

Bravo!

The Kuwait North development project with the involvement of BP, XOM and CVX may also be construed as the Iraq South project. Saddam attacked Kuwait supposedly because the Kuwaitis were siphoning oil from Iraq via horizontals.

The US departs Iraq and instead plants itself in friendly Kuwait and gets the oil from Iraq, anyway.

I wonder if that is technically possible. Anyone with technical knowledge of the area?

Good technical solutions to population control involving contraception exist but are impossible to implement without coercion and cultural changes. I do not think effective coercion will ever be used. Cultural change leading to negative population growth is happening, but not fast enough in most parts of the world.

So far as the USA is concerned, most, if not all of the population increase is from illegal immigrants and their children. I also do not think the problem of the flow of massive illegal immigration will be solved. Implementing of existing laws regarding the hiring of illegal workers, and changing laws involving secure identification and anchor babies seems unlikely to happen.

Just put me in the doomer group. I see no hope for future generations. I like the quote that Anyia ended a post From "SaturnV":

"In fact the application of more and more technofixes like the ones envisaged in this article, and elsewhere, to support increasing production and consumption will not only hasten the inevitable end of the energy sources and other resources that make them possible, but also ensure that the effects of collapse will be even greater than if it occurred today, because more people, infrastructure, and GDP will by then need to be supported when the bottom gives way."

That said, there are statistics that show correlations between education and healthcare availability with a reduced birthrate in populations. Whatever else might have been affecting the numbers there, it is enough for me to recognize that if we insist on our communities, societies and policies to be set up to provide both of these things, we have the best leverage to involve ALL the people around us to help discover and implement the solutions. If we do start to see a decline, we will also see a severe shortage in available labor. This is already a concern in North America, where the Boomers will be out of the workforce soon, without a sufficient supply of genexers, genWHYBothers, etc to fill those ranks.

There are many means to attack population growth without major coercion.

Throw ten billion dollars at my post and the barely-above-replacement fertility rate in the US goes down significantly. Possibly enough to match the immigration rate.

In Australia, you can get a 3 year implantable hormonal contraceptive called Implanon, with miniscule failure rates. For 20 bucks. 3 if you're on their national healthcare system. In the US (following FDA approval a few months back), an Organon spokesman said it's "likely to cost less than $1000."

Combined KSA and Russian Production/Consumption/Net Exports (Total Liquids):

- 19.64 mbpd/4.24/15.4

- 20.6/4.8/15.8

Production increased 4.9%Consumption increased 13.2%

Exports increased 2.6%

For 2006, let's assume KSA down 4%, Russia up 2%, combined consumption up by 13%.

Combined KSA/Russian Projection for 2006:

Production: 20.35 mbpd

Consumption: 5.5

Net Exports: 14.85 (a 6% decline, close to one mbpd)

IMO, KSA is in a long term decline, and I predict that Russia is about to start a long term decline. Consider the compound effects of a long term decline in production with a rapid increase in domestic consumption.

Meanwhle, back in the States

I also briefly compared the first 11 months of total US petroleum imports in 2006 to the same period in 2000. In round numbers our total petroleum imports went up from about 3.2 Gb to about 4.2 Gb, a long term growth rate of 4% to 5% per year.

Note that we have required ever greater petroleum imports every year, as our consumption has gone up and as our domestic consumption has fallen.

How did you arrive at that assumption? Are you taking existing year-to-date 2006 data and extrapolating it for the entire year? Please post your sources and methods.

For KSA, I was picking a midpoint between the current (presumably crude + condensate) production of less than 9 mbpd (8.9?) and last year's production of about 9.6. Note that the EIA is using total liquids for exports.

Relative to 12/05, I think that Russia has been lower for five out of the eights months of 2006, but most numbers I have heard put production up from about 2% to 2.5% over last year. Even the Russians are admitting to lower exports as consumption skyrockets (car sales up 11% year over year for example).

I need to try to track down total liquids production by country for 2006. For the final 2006 projection, I plan to use the best average year to date total liquids numbers I can find.

The general principle that I derive from your export-land-model is that, as a resource becomes more scarce, its distribution in the marketplace becomes skewed by how much control the producing countries have on the given resource.

I wonder if the ELM would hold true in very poor countries, say Nigeria, where there is no favorable treatment of the local population, hence little increase in domestic consumption. In Venezuela where gasoline is heavily subsidized, I would expect the model to manifest itself in the extreme. Would this be the case?

The principle is that, as a general (but as you point out not absolute) rule, net exports tend to be what is left over after domestic consumption is met. As you pointed out, in exporting countries that have subsidized energy costs, this is akin to pouring gasoline on a fire.

The really interesting period we are entering is this positive feedback loop, where rapidly surging oil prices increase the domestic demand in many exporting countries, even as their production begins to stagnate or decline.

Note that, as a general rule, exporting countries can export domestic production less domestic consumption (I estimate that this spread is falling at about 6% to 7% per year from the top three exporters).

Importing countries want to import domestic consumption less domestic production. Over the past several years, this spread has been increasing at about 4% to 5% per year in the US.

As these two trends--falling exports and increasing import demand--collide, the result is higher (much, much higher IMO) oil prices.

Note that in January, if I had proposed a 13% year over year increase in consumption for KSA and Russia, I suspect that I would have been banned from TOD as a dangerous lunatic.

Resolved: Evidence supporting a peak in world oil production is that world net oil export capacity, as predicted by Jeffrey Brown, is declining.

That limits the debate, so we don't spend a lot of time arguing whether HL for Saudi is correct, etc. That is not the issue I am concerned with. I am concerned that the export model is wrong, and critics will use rising imports in the future to discredit Peak Oil. So I want him to explain his model, and then argue his case.

Production cuts from October to November amounted to 745 million barrels per day according to the EIA.

Ron Patterson

OPEC met and made the decision mid-October. They had been talking seriously about it for at least two weeks prior to that.

The cuts were officially to have gone into effect on Nov. 1st. You yourself have stated we wouldn't know until the historical numbers come out at the beginning of February.

Well, I don't remember saying that but perhaps I did. I was simply wrong. The cuts have been confirmed by petroconsultants as well as by buyers.

Of course 745 million barrels per day is just over half the official announced cuts. So I don't see what the problem is. Let us remember that this is not a new thing with OPEC. They have cut production several times in the past and successfully so. Why would anyone think that no member would comply this time?

And of course the oil market will, after about a six weeks delay or so, confirm the cuts. There will simply be less oil on the market.

Ron Patterson

Here is the OPEC press release announcing the cuts:

OPEC Press Release, October 19-20, 2006

Part of the recent price runup seems to be a reversal of the skepticism that OPEC would actually go through with the cuts. I read yesterday that traders are accepting that a good chunk of the announced cuts have indeed occurred.

Ron Patterson

Caspian oil field to produce 25% more.

I wonder what other revisions will occur in the future at other upcoming projects...

-C.

Regards,

-C.

Costs are rising, projects are being delayed, but those good ol' decline rates just keep rollin' along...

Note that the combined net exports from the top three were basically flat in 2005 (18.5 mbpd) compared to 18.31 mbpd in 2004, and as I warned, they are now down versus 2005, while oil prices traded in a range that was 50% to 100% higher than the previous (nominal) record. Also note that the growth in consumption in Saudi Arabia and Russia was vastly higher than I would have guessed. I was using a 20% increase in consumption over a five year period, while the KSA/Russian increase in one year was 13.2%.

http://www.theoildrum.com/story/2006/1/27/14471/5832

Posted on Friday January 27, 2006 at 2:47 PM EST

Guest Post by Westexas

Hubbert Linearization Analysis of the Top Three Net Oil Exporters

It is not clear to me why you aren't interested in debating what I proposed we debate: Whether your import/export hypothesis is evidence of a peak in oil production. That is the challenge I put forth, which you accepted. I have no doubts that once oil production peaks, there will be an export crisis. But what you have been repeatedly suggesting is that falling imports, as predicted by you, support the fact that oil production has peaked. It is this claim that I dispute, and this claim that I wish to debate.

Again, here is my proposed resolution:

Resolved: Evidence supporting a peak in world oil production is that world net oil export capacity, as predicted by Jeffrey Brown, is declining.

Once again I ask: Is this, or is this not what you have suggested? And if it is, do you wish to debate this point?

I have made three central points (all primarily based on Khebab's HL analysis):

(1) We are facing a permanent net export oil crisis: http://www.theoildrum.com/story/2006/1/27/14471/5832

(January, 2006)

(2) Deffeyes is probably right that world crude + condensate production peaked in 2005 (primarily using the Lower 48 as a model for the world): http://www.energybulletin.net/13575.html

(March, 2006)

(3) Saudi Arabia, in 2006, is probably at the start of a permanent long term decline in production (using Texas as a model for KSA): http://www.energybulletin.net/16459.html

(May, 2006)

I would be happy to debate any one of these three points, or any combination of two them, or all three of them.

I could be wrong, but I don't think that I have ever asserted that #1, in and of itself, supports #2.

I would point out that:

(1) Net exports by the top three net oil exporters are down;

(2) World crude + condensate production is down;

(3) Saudi oil production is down.

Robert, if claim #1 is true, that is arguably another manifestation of your "peak lite," which I understand gives rise to peak oil symptoms without requiring an actual production peak. In the "export land" model, all that is required for peak lite is domestic consumption rising faster (in absolute terms) than production.

Yesterday, in this post, you made a claim that imports were down, as you predicted, that the math seemed obvious, etc. You warned "I think that the only option left to us is a triage operation of sorts, with large parts of suburbia being abandoned."

You have made these claims before. Now, my contention is the import situation is readily explainable without implying that we have peaked. In my opinion you have used ad hoc reasoning to explain the import data, and I believe you have completely ignored data that did not fit your model.

It is that point that I challenged you to debate. I wish to debate the import data, and what they mean. Again, I ask you if you believe that the import data suggest that we have peaked? You have used (selected) import results to suggest that we have peaked. Will you debate that point?

There is no doubt in my mind that once peak occurs, there will be an export crisis. But exports can fall without peak having occurred. That is my contention - that the export data we have seen this year is a very poor argument in favor of Peak Oil. What you are saying is "If A, then B." But I agree with that. But then you are saying "We see B, and this supports A." I say that B, in this case, does not support A. Furthermore, I say that we aren't even seeing B; that the appearance of B is because you have cherry-picked and ignored certain data.

If you do not believe that your falling export hypothesis is evidence of Peak Oil (which I believe you have claimed outright, but you have certainly implied this) or you do not wish to debate this issue, then let me know. I have offered a couple of resolutions:

Resolved: The import/export model proposed by Jeffrey Brown provides compelling evidence that world oil production has peaked.

or

Resolved: Evidence supporting a peak in world oil production is that world net oil export capacity, as predicted by Jeffrey Brown, is declining.

I believe you have made these claims, and I am willing to debate either of them. What I am not willing to debate is that if oil production peaks, we will see falling exports/much higher prices. Frankly, I think that is pretty obvious.

I believe that world oil exports are falling, and I believe that they are falling because of a combination of two factors: involuntary reductions in production and rising consumption in most exporting countries.

I have authored or co-authored 10 articles on the Energy Bulletin plus the January, 2006 post on TOD. Again, I may be wrong, but I don't remember ever arguing that lower exports--per se--mean that we have peaked. So, you are asking me to debate a position that I don't think that I ever took, but I would invite you to peruse all eleven of these documents to see if you can find a specific example.

As I outlined above, I have repeatedly outlined the quantitative case for three central warnings/predictions using multiple graphs and thousands of words.

The three specific things that I predicted and/or warned about are all--so far--coming true.

OK, lighten up guys...we want you two to remain friends.

OK, I don't want to quibble all day about what we are going to debate. I think this statement will suffice. Will you debate this resolution:

Resolved: World oil exports are falling because of a combination of involuntary reductions in production and rising consumption in most exporting countries.

Again, I may be wrong, but I don't remember ever arguing that lower exports--per se--mean that we have peaked.

What you have argued, many times in fact, is that we are seeing falling exports, and this supports Deffeyes claim that we have peaked. In other words, "B supports that A has occurred." After all, what was the point of saying yesterday "look, imports are falling, batten down the hatches"? What I am saying is that import data doesn't support that view; that the data are easily explained from other factors. This is the particular point I wanted to debate (and "falling exports supports peak oil today" is the position that I believe you have staked out), but the resolution above shall suffice.

So, is that wording acceptable?

Resolved: World oil exports are falling because of a combination of involuntary reductions in production and/or rising consumption in most of the top (one mbpd and larger) exporting countries.

So, I accept that resolution. If you prefer, you can send the essay to PG so I don't get a sneak peak. I have no problem with leaving the essays open to comments if you are in agreement.

I know we promised not to butt in, but may I suggest you change "Resolved" to "Hypothesis". I don't ever think WT has stated that he thinks what he is purposing is 100% for sure. It's a working hypothesis.

That's just the way debate proposals are typically framed. I understand that what he has is a hypothesis. What I want to do is discuss whether the observed import data support his hypothesis.

In ordinary words: because they have peaked? Isn't that exactly what RR is saying you are saying, but you are saying that you are not saying that?

Or words to that effect...

confused bystander {:/

Yes, there is a bit of tapdancing going on, in my opinion. But I am willing to work with his suggested resolution. I think we can get to the heart of the point I want to make, although I think there will be some rabbit trails involved.

I think that there is a problem here. If we are going to split hairs on PO (2-5 yrs +/-) then after it becomes "rearview mirror" clear we will have wasted that much more time and money (similiar to Bushco's Iraq). Each week, month, or quarter, brings out a new minor point to get the next pissing match started.

What I don't get....Everyone seems to agree that there are few, if any, good options to replace liquid transport fuels - and the economic complications are bigger yet.

There is alot of money involved here. Keeping us hopelessly "addicted" to the last barrel is very important to producing nations. I call into question postings with personal attacks - it makes me suspect. I think that WT has been the most vocal in a public way (TV, etc.) and is foremost in thier crosshairs. Why not (also) trash the Hirsch report, Khebab's excellent work (among others), The CEO of Shell Oil, National Geographic, along with numerous articles that lend support to PO.

Paying someone to trash WT would be "pocket change" to the players involved. I would be naive (IMO) to think that they wouldn't. I think there is something going on...WT must have stepped on someone's flying carpet.

I think some of you are seriously confused about my position. First, it is not his model I object to. I think the model is logical. It is that he is using current export data to sound the alarm. I don't think the evidence is with him on this, and if you want to put your money against me in that debate, I would be glad to take it from you.

What you don't seem to understand is that nobody is going to take PO seriously if we throw evidence out there that is easy to poke holes in. If someone says "Look out, imports are down, we are in serious trouble" I think they seriously undermine credibility, because I don't think the evidence supports this view. It was that which I offered to debate. This is not about pinning an exact date on the peak. It is about making sure the evidence we use is good enough that we will be taken seriously.

But if it makes you feel better to believe that there is a conspiracy out to get Jeffrey, there really isn't much I can do about people's delusions.

Perhaps I should also clarify. When I read about all the revisions to production numbers going back in some cases a few years then you have to wonder about their current pertinence. However, there will eventualy be a tipping point somewhere and WT thinks it is now. I think this data problem is why HL as a prediction tool looks about as good as anyone has ever come up with (is there another one?). The longer wave - like a long wheel based car- smoother ride, fewer bumps.

My other point is that there looks to be a swelling ammount of articles such as the CEO of Shell in the Oregonian, National Geographic, etc. about the looming crisis. This makes me think that if WT grabs a number set that doesn't have a long enough history to justify it's use to you and others that the perponderance of other evidence makes me wonder why is it so important to pick it apart(such as the Rig Count vrs production blog at the top).

I think this is a very serious problem we are facing. People will fall all over the range of belief to contempt in PO. The economic implications are stagering IMO, and I can easily see that there will be some people who will try and denounce anyone who rocks the boat and WT is a boat rocker. If you think I suffer delusions about people out to attack WT then I wonder why you find it so implausable that it couldn't happen.

The last point I'm trying to make is that this is a longer term(longer wave form) issue. I think so many people lock onto a week, month or what ever period that you want that debunks PO and grind that number into the dust or hold it up as proof that there isn't a problem. Meanwhile we are taking a slow but never ending march to the enivitable.

The items(trends) below I think speak louder than anything either you or WT could possibly say to the other about anything in the short term of the last year.

1)Discoveries vrs. Production/Consumption last 10 yrs or so.

2)Rig count vrs. Production (look at todays blog.)

IMO the writing is on the wall if we want to look.

I'm in no way an oil person(botany/nursery production) and you are very welcome to dismiss anything that I have to offer. I believe the crisis is set to unfold - when is a more minor issue IMO.

Unfortunatly I believe that there is no way you are going to steer public perception with or without accurate short term number trends. The change is too fundemental for people to consider for more than a couple of nano seconds. They don't want to hear that technology won't save them. They do not want to work in a hot dusty field. They don't want to be cold, hungry and poorer. They don't want to hear this is thier childrens future. IMO it will take a crisis and then it may not be clear what caused it.

I wish you all the best and I look forward to your debate.

Whether it will futher PO awareness and needed mitigation I have serious reservations. IMO you would be better off in joining forces with WT and getting the word out.

D

Well, I am ultimately on his side. I just think we need to police ourselves, and I don't think the export data this year support the point he has been trying to make. My belief is that by debating this, it will help tighten up and strengthen his argument. I can tell you if he threw that out to the scientific community (the export claims) they would eat him alive. You have to have a tight model if you want people to listen.

In three months, after the EIA year end data has come in in early March, I will have a debate of my own. I will try to show, with the data, that we are post peak. I am currently building my case and it looks rock solid.

To quote Matt Simmons, "Data trumps theories every time."

Ron Patterson

We have seen Peak Oil. All that is left to deny it are ProJECtionz and lint picking.

To bad the Geopolitical Blizzard is "arriving early" (according to Mahmoud Ahmadinejad) and will obscure the view from the complacent Ivory Towers.

Speaking of which...Kansas City is in the middle of a frickin blizzard right now...and it's a bone-chilling 18 degrees F. Not three days ago, we were pushing 75 degrees.

The same has started in my neck of the woods... time to get to work on that superinsulation, passive solar, radiant floors coupled with High Mass storage for solar heating...

Run, rabbit run.

Dig that hole, forget the sun,

And when at last the work is done

Don't sit down it's time to dig another one...

The promise of carbon taxes is the hope that they will cause a utility, for example, to conclude that it does not make economic sense to pursue a new coal fired plant that does not sequester co2. Therfore, they will choose sequestration or some other approach like natural gas or wind.

If the carbon tax did not elicit that decision, then many of us would want to raise the tax until it did.

But, if the result is the same, why wait for the carbon tax to be passed, implemented, and responded to. That approach will take years. In the mean time, dozens of new coal fired plants might be under construction or completed.

The clearly egregious and harmful technologies need to be prohibited now. Utilities like TXU of Texas need to be told to take those coal plants off the table now. After all, they are rushing through these plants so they will be well under way before congress or others come down with the carbon tax hammer.

He wants a timetable for the Cataclysm.

I think you have to clearly illustrate the effects that CO2 will have on Duck Hunting (typo was 'Dick Hunting'.. I think I have to put the tinfoil up again)

If Scalia and the rest of SCOTUS want a timetable--forcibly parachute them into Darfur, Zimbabwe, or some other ravaged African country--I think once they overcome their societal jetlag: they will reset their GW + PO timetable clocks appropriately. =)

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Economy stronger than first thought in third quarter.

Not only was the economy stronger then expected last quarter, but growth is expected to continue at a moderate pace through 2007. I wonder if its possible for the Feds to be that wrong. After all, aren't we supposed to see 0.0% growth in the 4th quarter?

And just for 2 seconds of gloating, I predicted that the GDP would be revised up around half a percent here

"My 8-ball is telling me that Q3 GDP will be adjusted up 'around' half a percent, and the housing 'crash' will turn out to be a 'dud' for the PO community yet again."

Goto the link because he has many hyperlinks in the text.

Expect Fourth Quarter U.S. GDP Growth to Be 0%

http://www.rgemonitor.com/blog/roubini

Also take a look at the #7 reason in this article.

Eight Market Spins About Housing by Perma-Bull Spin-Doctors...And the Reality of the Coming Ugliest Housing Bust Ever....

http://www.rgemonitor.com/blog/roubini/143257

Posting a giant article about it just paying lip service to a now dead horse :P

""As you know, a substantial correction is going on in the housing market," Bernanke said, using stronger language than he had in recent months, when he described the real estate cool-down as "orderly." The process is one of the "major drags causing the economy to slow," he said." -- Ben Bernanke discussing the housing slump.

Walmart sales drop for the first time in a decade.

Now, on top of all this, the stock market is nowhere hear its 2001 high point when you factor in inflation. You can even ask the Federal Reserve Bank of Minneapolis questions about inflation and they have a web page that will cheerfully calculate what a dollar value then would be now or vice-versa. So the roughly 11,700 Dow high in 2001 won't even be matched til the Dow hits about 13,300 (or higher depending on how many years it takes to get there).

Finally the government is fooling you, Hothgor. Each year the underlying methodology of gathering statistical information changes in important but significant ways. John Williams has been tracking the shadow statistics that remove these changes so you can compare year to year data realistically. He's been doing it for decades and his most important data is via subscription only but he does release some general information to the public. You might want to familiarize yourself with what he is saying and has said. He's been right far more often than any other economic source I can recall. For instance, did you know that in recent years the government has been weighting the inflation chart with a factor they call "hedonics" (as in hedonism). That is to say, that washing machine you bought did not cost you 20% more really because some of that increased cost was the "pleasure" of using its shiny new electronic controls instead of noisy old dials. (That's a sampling of how absurd the manipulation of government stats has become.) So the real inflation number is reduced because, perhaps, you are filling your car with that "newer, better" reformulated gasoline and it gives you "pleasure" despite costing more. We're way off in 1984 country now where Newspeak is the norm and you are totally brainwashed into accepting it.

Thanks Hothgor, Got the affirmation I wanted from your response. Williams and ShadowStatistics.com is bunk right?

Good luck with your worldview... What ever your mission is to spread it.

My last reply post to you sir.

Good day.

http://www.marketwatch.com/news/story/feds-big-inflation-worry-gets/story.aspx?guid=%7B662FC525%2D23 EA%2D4B73%2D97CC%2DF8CF11E912B8%7D&siteId

While everyone seems to have labeled you as a troll, I advise you to sit back and grab a beer because this is going to get ROUGHT next year. Hothgor who really cares about numbers that are fake? You and I can both look around us and make our own judgements especially when you talk to those around the country. Tell me who is making SO much more money today than a year ago today? I know of only a few and that's because they have a nice union contract with again, BOGUS, cola #'s, but at least it's something. I have been told in no uncertain terms that I better not expect anything. Thats fine since I'm looking to leave anyway once the ink sets on that degree.

Let me add one last thing. I don't know where to find the backup info, but I recall a rather telling fact about economists and their ability to predict recessions. In 2001 prior to the 9/11 attacks only 2 of like 60 economists surveyed believed we would have a recession in the coming two quarters. It turned out years later when ALL The data was in that at the time OF the survey, we were already in a recession. Two people had an idea and these are the "smart" ones. Now go buy a box of salt, you need it. :)

I didn't realize 25 years on TOD was in fact only 18 months in the real world.

"The dollar has tumbled about 2.5 percent against the euro in the five sessions through Tuesday. Although the greenback came back a bit Wednesday, the dollar's near its weakest against the Euro since March 2005. The dollar also fared badly against the British pound, though it's done slightly better against the lowly Japanese yen."

Now I highly doubt that the Dollar could only decline that much vs the Euro, but still be down to a 25 year low vs all other currencies worldwide. But perhaps your referring to something else?

They also go on to talk about how currencies have on averaged followed a 6 to 7 year cycle of major fluctuations up and down.

"Currencies typically have a six- to seven-year cycle of adjustments, said Quincy Krosby, chief investment strategist at Hartford Financial. "If you look at February 2002 as the strongest point in the cycle, I do think [the dollar] will ease a bit more. But that's also just part of the adjustment process that began [almost seven years ago] and is continuing.""

Yes, I'm trembling at the thought. The Dollar clearly is headed towards rock bottom, and were all doomed just like you said! <chortle>

And as for why the Greenback didn't rebound yesterday on the GDP report:

"Perhaps the dollar's muted rebound against the Euro Wednesday can be traced to the news that new home sales fell a larger-than-expected 3.2 percent in October, quelling hopes that the worst of the real estate slump was over."

The housing market is continuing to cool, though there is little in the way of economic indicators that consumer spending is being so adversely affected that we are going to enter into a recession in 2007, much less headed for 0.0% economic growth in the 4th quarter.

And for future reference, I commented on the Wal-Mart problem earlier here. And just for reference:

"The problem with wal-mart is two fold:

1. Their target client group feels significant pressure from high energy/food costs. That is, the higher these costs get, the less this group buys in terms of disposable goods and services. The first businesses that will experience the squeeze in profits are those that primarily cater to the low income group. But this can not be used as an indication of the economy as a whole: 95% of the gross income earned annually in the US isn't used in these areas. You need to watch where the money goes, not what the poor do.

2. Prices can only come down so much. There gets to be a point to where no matter what volume you purchase a good or service, the price will simply not decrease by any significant amount. I know this sounds wrong when compared to the 'economies of scale' theory, but that only applies to rational goods, and as many of you noted, can not continue forever in a non-flat earth. Wal-Marts success has been based on continually decreasing prices for 'bargain hunters'. When you can no longer do so, your growth hits a wall."

And what do you know, Wal-Mart has suddenly hit a brick wall in profits. But lets at least be honest about their sales decline: It was a pathetic 0.1% drop for the month of November. DOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOMED!!!

"The USD is now at 14 year lows against the Sterling and EUR/USD is only 4 cents away from an all time high."

http://news.efxnow.com/en/commentary/index.html

I bet the Euro makes the 4 cents necessary for an all time high.

Exactly what pleasure do you get from posting on this website? If you don't see the serious economic problems looming for the US and the world, you really need to take your blinders off.

My guess is he really can't afford to "see the serious economic problems looming for the US and the world", ie cognitive dissonance

But as to why he posts here, you got me.

BTW, I have 0 credit card debt, and I worked my way through college. I'm what you could call a penny pusher :P

Glad to hear about the debt free situation. Sounds like you are well on your way to ELP.

BTW

Instead of my (incorrect) guessing, Why are you here?

His post about using charcoal as a source of power production and for agriculture needs was very impressive :)

There are too many technical hurdles that must be overcome. They are doable, but nobody is actually doing any of that doing.

If you could point to massive investment in battery tech, infrastructure, alternative fuels, conservation etc etc I would feel a lot better.

While things like the Tesla EV and super capacitor batteries are promising they are a long way from showing up in my driveway and even longer from showing up in the driveways of India and China.

Don't even get me started on the social engineering it would take. Even you admitted that getting Americans to take drastic changes (space heaters, closing off unused parts of the Mc mansion etc) are wishful thinking. Next we have to convince the Chinese and Indians they can't have a middle class lifestyle too. Good luck with that.

Where do you see hope?

Certainly there are some dark spots in the future: wars with oil producing nations, massive new coal plants, Americas love affair with the gas guzzlers, ethanol, but the picture overall is no longer as dark as it has been in the past.

Full EV are more than 3-4 years away (where did you get that info). More likely 10-15 years away from widespread adoption.

Solar is growing at an exponential rate because the install base is ridiculously small. It has very big scaling problems.

Wind Power is half of all planned power increases, that is true and a bright spot. But increases in electricity production are a tiny fraction of the installed base. And as with solar, you can't rely on it for baseline generation.

Thorium nuclear power? Give me a break. I have a lot of hope for nukes, but that's a generation or two away.

And this is our best hope? All these BB's are dependent on cheap oil. It will only take a very small shortfall in oil production to cripple the world economy. Ask anyone who lived through the 70's oil shocks what that was like. And that was only a short fall of a few percent and lasted only months.

That actually is the scariest thing. Its not that the US couldn't massively ramp up wind/solar power. It not that industry can't develop better batteries to power EVs.

The scary thing is nothing is being done.

If peak was 20 years out we would have a good shot at mitigating the worst of the problem. But with peak 5 years out (or worse, 1 year ago) and next to no investment now, what hope is there in these techs?

I believe we have a lot of potential BB's too. I have to say we're just painted way into the corner because it takes a lot of BB's to do what just a couple Bullets would do, however.

I try not to make sweeping 'predictions' about where things will go with energy or climate, but I do think that our margins-for-error and cushions are increasingly scant, so it wouldn't take much of a bump to put us in a very bad spot. (ie, slimming grain stocks, household savings vs debt, local preparedness and community involvement for emergency mgmt, aging grid, reactors, highways, air fleet.. etc) So your 'not expecting disastrous catastrophes' is where I see it differently. I don't say they definitely WILL happen, just that there are now clearly several massed at the borders, and we are poorly prepared for, and in denial of most of them. Leaving aside climate and energy for a second, this War on Terror has been so poorly concieved and conducted that it has both increased the world's vulnerability to desperate Fundamentalist groups (and bringing the Iraqi insurgents or Al Quaeda into the black with black-market oil and Afghani poppies) , and at the same time weakened the US in economic, diplomatic, military and energy fronts.

The BB's are great.. I just don't know how well they work against Tidal waves, literal or metaphoric.

We have somehow managed to plug along for a few 1000's years thus far, I highly doubt that will change in the future.

The human race has survived for quite a few thousand years, and I doubt anybody thinks we won't survive for quite a few more. However, human history is full of rises and catastrophic falls of civilizations, death, disease, fanime, etc., etc. In fact, every single civilization has declined or collapsed, every single one.

The fact that we have easily survived and generally prospered over the last century, during the greatest expansion in energy usage ever, means absolutely nothing when compared to the scale of history. What in humanity has changed so drastically that you would think that we are no longer subject to setbacks? I would argue that modern society is much more subject to potential setbacks when compared to ancient rome, the aztecs, etc. Our overpopulated, overused world and our interconnected, extremely dependent civilization is (IMO)in a very fragile situation, and we are in grave danger.

You can't look at the last century and think that is how things are supposed to progress forever. I am sure that the yeast would think (if they could think) that their exponential growth in the petri dish is the only way life could exist, and that it would go on forever.

We citizens of TOD might get lucky and have things muddle along for the next 50 years. We also might have an economic collapse next week and you will be picking through landfills in a year (if you are alive). What I do know is, short of the discovery of an unlimited, clean energy source, and invention of interplanetary migration, our civilization is doomed. History shows that without continual expansion, collapse is inevitable.

Here is an article I think you would like. It's not new, and I probably discovered it on this site when it was originally published. I was cleaning up my bookmarks and just reread the article.

The Story of Wheat

Apropos of nothing except being in Europe on business/pleasure:

I have seen the future and it looks a lot like Holland. New, GINORMOUS wind turbines; solar panels atop the sound barriers along the highway powering the roadway lights; small cars that go just as fast (seemingly faster!) than SUVs in the States while using a lot less gasoline (don't feel as safe however); smaller, more compact houses; hot water at home that is heated as needed, no constantly-filled hotwater tank; a bicycle culture; multiple streetcar, rail and bus public transportation options...

And gasoline at around $7 a gallon!

And a fully-functioning first world economy/culture!

And beautiful women everywhere! (Including my Dutch wife).

Maybe there is hope after all if we all follow this model? (Not necessarily the wife part, although I'd recommend it).

You never know - if the government gets desperate enough for tax revenues.... Anything could happen.

Garth

The Dutch are not sending billions (or the equivalent for their economy) of dollars to Israel

The Dutch are not the Hessian mercenaries of the word, as the US troops are.

The Dutch are not funding an enormous military

The Dutch I believe have a sort of "social welfare" state of the type that works well with genetically related populations, certain things like housing and education and job training and medical care are fairly much guranted.

Among the Dutch, lot of things like drug problems and teenage pregnancy are treated as medical rather than as crimes.

Hence they do not have a huge prison-industrial complex.

They probably have fairly strict anti-usury laws.

This is the way the US was heading until the international capitalists realized it would be much more profitable to them to import vast numbers of other tribes from other nations, remove usury laws, make more and more things illegal and punishable by unpayable (for the lower class) fines or prison time, then have prisoners work for 10 cents and hour, subsidize oil and the auto industry and form society to make Americans as dependent on oil as heroin addicts to junk, and so on.

We need to create our own little Hollands throughout the U.S. but more than likely this will only occur by necessity, not forethought.

- the Dutch have a famously egalitarian society (biologists think this may also be why they have become the world's tallest society-- whereas a generation ago Americans were taller, even adjusting for ethnicity, the Dutch are now taller).

The world, by contrast, is getting less equal (within countries) not more.

- the Dutch have the multicultural problem in spades: the recent murders of a right wing gay politician (only in NL could you have the leader of a right wing party be a public and flamboyant homosexual), and of a film maker making an anti-Islamic film, have underlined the problems between the rapidly growing Islamic minority and the rest of the society

- along with Bangladesh and some Pacific Islans, the Netherlands is the first country to go as the sea level rises

There is much to admire about Netherlands:- on the economic front, the combination of a high level of social security with job market flexibility and low unemployment;

- on the social front the functioning, high quality, welfare state;

- on the libertarian front the relatively relaxed attitude towards the human tendency towards drug experimentation (note: Netherlands is not actually a place where drugs are legalised, that is a myth-- the penalties for dealing in illegal drugs are quite severe)

However I don't think the Netherlands is the model for the future in a world where displacement and inequality are likely to be the rule, rather than the exception.They get it.

Russia's RTS Climbs to Record on Oil; Lukoil, Gazprom Advance

http://www.bloomberg.com/apps/news?pid=20601085&sid=ac6_SRnUImaE&refer=europe

Saudi production (permanently IMO), down

The Saudi stock market collapse coincided with the first of the many "voluntary" cuts in production this year--the one where they announced that they couldn't even find buyers for their light, sweet oil, which resulted in my announcement that Texas has "voluntarily" cut production because we too could not find buyers for all of our oil, even our light, sweet oil.

Those that wish not to see it will later shake their heads in dismay and think, "How could we have let this all happen?"

My 2007 prediction is that the big news worldwide will be the confirmed simultaneous declines in Saudi and Russian oil production.

BTW, I plugged in a continued 13.2%/year increase in KSA/Russian oil consumption and assumed a 5% combined decline rate (highly conservative IMO). KSA/Russia's combined net exports would drop by close to 60% (by 9 mbpd) in five years.

Remember that the average Saudi family has something like six or seven kids.

It is correct that KSA has a large and growing population and this population is dependent on the state for employment. KSA and other ME countries are moving from raw material exports to intermediate product exports. Instead of shipping NG they will ship polystyrene pellets or whatever. So more of a product's value chain will in future be located within the Kingdom. This will enhance earnings and job growth within KSA.

If more of the raw product is being directed to intermediate product mfg within KSA then there will be less available for export. As the growing KSA middle class seeks to emulate western consumption patterns (houses, cars, swimming pools, suburbs built on reclaimed islands, etc, etc) there will be less raw product available for export.

This is not simply a KSA strategy. In the past few years there has been a trend for energy intensive plant to be relocated from USA to be closer to source of energy supply in ME. US firms have moved plant to China to benefit from lower labour costs and they appear to be moving plant to ME to ensure access to needed energy supplies. Historically, this has been a standard pattern in development with nations seeking to avoid raw materials exports and instead seeking to move up the product value chain toward the export of finished goods.

This transition to finished goods export strikes me as central to WT ELM and I am slightly puzzled at RR's position. But I am looking forward to the debate to clarify both positions.

Cheers!

Simple. The export data this year are not evidence that a peak in oil production has occurred. In fact, at times this year the data contradict what one would expect if a peak had occurred. There are other logical explanations for export data, which I will delve into.

I was somewhat confused over your objection to WT's ELM. From your comment above you appear to be objecting to a tight couple between ELM and Peak Oil and any claim that current export data is supportive of PO within the current timeframe.

I do not see the precise date of PO as being very relevant. If Hirsch is correct then we encounter problems if PO is anytime in the next 20 years. If PO is 35 years out we will still have problems if we wait 29 years before commencing mitigation.

Saw another recent post from you today with regards to US capital being withdrawn from local plant and being moved overseas. This relocation of capital would be supportive of the ELM as plant operation would divert some portion of domestic supply and reduce the amount available for export. This consumption, together with increased consumption due to improved lifestyle of population, should have the result of bringing PO impacts forward in time irrespective of Geologic Peak (GP).

Not to put words in your mouth, but am I correct that there are two issues here?

Sorry to butt into your prospective debate, but I was a little confused over the terms of reference and perhaps Jeffery was as well.

Cheers!

Correct. I have no issue with 1, as I agree that this will take place when production peaks. But, the issue is 2. I think it is being used to promote the idea that oil has peaked, and I don't think it supports that at all. My concern is that using weak evidence to support a viewpoint really exposes us all to criticism, and will cause Peak Oil claims not to be taken seriously.

My point is different. Assuming that KSA and other major oil producers are subsiding domestic consumption, i.e. allowing domestic consumption to occur at below-market prices, then there is an opportunity cost to allowing such domestic consumption to occur versus selling the product on the open market; that is, they will be leaving money on the table. Indeed, some smuggling will doubtless occur to recapture some of this opportunity cost. But at a minimum, the leaderships in the major oil producing countries will be acutely aware of the money they are losing by subsidizing domestic consumption. (The subsidies can take the form of cheap gasoline, royalty payments to citizens, or low or no taxes.)

Some subsidies may be necessary, in the view of the leaderships, to avoid social unrest and to try to stay in power. Perhaps the best long-run strategy would be to gradually remove the subsidies as their economies strengthen and diversify.

They see the writing on the wall and they want to capitalize as much as possible before the wolves come knocking at their door. And when the pack arrives, they will have some big ass guns waiting to scare the wolves away.

Me. I loaded up on my company's stock several weeks ago, when oil prices were falling and the stock was hovering near a 52 week low. That investment, currently a substantial part of my portfolio, is up 16% from my purchase price.

Is an employee of one of the major oil companies (Exxon Mobil perhaps?) who also owns substantial stock in that company more likely to take a position favorable to his employer and stock portfolio or a position unfavorable to his employer and stock portfolio?

If you think that is being unfair, then ask yourself this: would you have the slightest chance of being on a jury in a court case involving a lawsuit against a major oil company? Of course you wouldn't. Why? Everyone would agree that it would be an obvious conflict of interest.

It's been my experience that engineers (like myself) tend to have trouble believing they could possibly have a conflict of interest. Engineers are highly analytical and objective by nature. As a result they feel that just because they are employeed by Company XYZ, they have no conflict at all in commenting on issues directly affecting Company XYZ. But somehow, their analyses almost always conforms to what is good for Company XYZ, often without their even realizing how they coopted their own thinking.

I have not read all of your many posts, but from the posts of yours that I have read, I don't recall a single a thing you have said that was strongly critical of Big Oil. This may just be a coincidence. Or it may not.

How about if I just dismiss it? Period.

Honestly, I have a long track record, in the public domain, of what I am all about and what I support. If some anonymous poster called Joule wants to question my motives or objectivity, then that's his/her problem.

If you have an issue with a position I have taken, then let's rumble. As I have said before, even if I am the Crown Prince of Saudi Arabia, you still have to address the factual basis of my arguments. Focusing your arguments on who I am is in fact an ad hominen argument. Try to address the positions, OK? Going for the ad homs every time suggests to me that you are unable to rebut my position. It seems to me that you don't have anything substantive to say, and are intent on wasting my time.

I am not rebutting your 'positions' because I generally agree with most of them, particularly as they relate to the downside of ethanol from corn. Nor am I saying that your positions are necessarily wrong or dishonest because you work for Big Oil and own stock in Big Oil.

But what I AM saying is that there is a good reason why your or I hold a particular position, regardless of how rigorously and effectively we might defend that position. And that has to do with one's biases.

A person who has worked for Big Oil for a long time will natural have pro-Big Oil biases. Those biases will often dictate what positions he intends to adopt. I know because I've been there. Once upon a time I was in the corporate environmental department of a large chemical company, which at the time was grappling with a whole bunch of regulatory issues. Well guess what: my 'position' at the time very much conformed to what the Chemical Manufacturers Association position was. Now that I have long been away from the chemical industry, I realize that in many regards they were wrong and the environmentalists were right.

So, if you are going to presume the role of self-appointed authority on all things oil, you should at least admit to yourself that you have biases and be honest as to what those biases are. If you were with GreenPeace and took an extremely greeny environmenal radical position, I would likely be busting your chops in the same way. (I'm an equal-oppurtunity pain-in-the-ass in that regard.)

And no, what you cannot seem to get through your head is that it is not WHO you are (one Robert Rapier), but rather WHAT you are (Big Oil employee and Big Oil stockholder) that raises some issues regarding point of view, etc.

And if you didn't want to waste your precious time, you wouldn't have responded, but I know that you love to argue and consider yourself an excellent debater.

Peace.

Well, Hubbert, Deffeyes and Campbell all worked for big oil, does that mean that their argument is invalid? Does that mean they have, or had, a pro Big oil bias? Does that mean that their arguments must be taken with a grain of salt? And I worked five years for ARAMCO, does that mean that my arguments have a pro-Bib Oil bias?

Rellly Joule, simply because someone works for an oil company does not mean that they cannot be objective in their arguments. If that is the only thing you can come up with to refute an argument, that they work for an oil company, then you have no argument at all.

It would behoove you to try to be a little more objective yourself.

Ron Patterson

I should also point out that people like Deffeyes largely became highly vocal and publically visible AFTER they were no longer in the employ of Big Oil. It's a good thing, because if they had expressed many of their opinions earlier, they surely would not have been thus employed for very long. (Didn't Hubbert get into some hot water when he first came out with his theory?)

Yes, we could all be a little more objective - I freely admit that I've got many biases myself - but I think if one doesn't recognize one's own biases, then one is deluding onself.

Not everyone thinks that the oil industry is the benign force that some Big OIl employees who post here would like us to believe.

While maybe during the early 1950s it was once true that 'What's good for General Motors is good for America', I think today one cannot assume that what's good for Exxon Mobil is good for America. It is probably getting less so with each passing year.

But you miss the entire point. All you are saying to Robert is that his argument must be flawed because he works for an oil company. Well, that may be but just saying as much is no argument at all. You must point out any flaws in his argument in order to have any credability yourself. If all you can say is you work for an oil company, then as I said before, you have no argument whatsoever. You are just wasting bandwidth.

It is likely that everyone has biases and very good reasons for them. But searching for their biases is a useless endevour. You job, if you choose to accept it Joule, is to find the flaws in the argument, not search for any biases a man or woman may have. A man once wrote: If you cannot answer a man's argument, all is not lost. You can still call him vile names. Joule has a new verson of that. If you cannot answer a man's argument all is not lost. You can still accuse him of being biased.

Ron Patterson

But on the other hand, if say the Oil Minister of Saudi Arabia says he can produce 12 million bpd for the next 10 years and that we shouldn't worry about future supplies, it IS legitimate to question the credibility of that statement solely on the basis of who is making the statement.

And no, I am not saying that Robert's arguments are flawed; and no it is not my job to find flaws in his arguments. I am merely saying that the motivation for the arguments and the way they are framed can be strongly influenced by one's allegiances. There is nothing inherently wrong with this, but it at least should be acknowledged.

And how, pray tell, am I calling anybody 'vile names'?

My one objection to Robert's stance is that his rebuttal to any argument for a peak in oil production right now is that he knows he can access additional supplies without difficulty, and sees no signs of any impending shortage. Whilst this may be true on a local basis, I'm not sure how any oil company employee, no matter how high his position, is able to extend this to an assessment of worldwide supply capacity. Then again, he's in the industry, and I'm not.

I have always found RR's arguments and critique to be based on a stance of persuasive argument and an appreciation of the scientific method, and for that reason I rate him is one of this site's most valuable contributors.

I rate the work of Westexas equally as highly, but in this case I feel Robert has sound grounds for concern. WT's export model makes complete sense to me, but any scientist when presented with a set of facts which support his hypothesis would also ask whether there are other explanations which may lead to the same results. I don't think WT has done this, or at least if he has, he has not articulated his dismissal of those alternative explanations to us.

I for one am thankful that we have two such strong contributors to this site, and I think it says much for both of them that they have conducted their difference of opinion in such a courteous manner.

This is true. I never discuss things that impact upon my company. Well, I have been critical of tar sands development, and my company is involved in that. But Joule has never been interested in substantive debate with me. It's like I have told people before: Some people will hate you because of the business you are in. They will hate you, but they will keep filling up an driving their cars. They depend on your product, but they still hate you. It doesn't matter what you say or do. So just learn to live with it.

My one objection to Robert's stance is that his rebuttal to any argument for a peak in oil production right now is that he knows he can access additional supplies without difficulty, and sees no signs of any impending shortage.

Well, that's not the sum total of it. I also know about all of the projects/fields we are bringing online, and I know where we have production that is not running at capacity. But I can't discuss those things, which is why I don't debate the timing of the peak. I say that I don't believe it is now. I will not try to debate and convince you that it is in 5 years if I have to resort to data that I can't talk about. However, if you assert that peak is now, and use selected import data as part of your evidence, I think I am on solid ground challenging that with publicly accessible data.

April 7, 2006

June 6, 2006

Because of your admitted lack of expertise on depletion, I have a hard time understanding how you could rule out a peak in any particular near-term time frame. I suppose you could be reasonably confident of your prediction if you knew of several million barrels per day of imminent new production capacity, enough to overcome any reasonable decline rate of existing fields in production. However, any imminent capacity increases that large would most likely be public knowledge and would be reflected in the oil price. As it is, the oil price has more or less held up and the futures market is in contango out to September 2008.

Also, in the same June 6 post, you made a prediction:

What did happen? Did we set additional production records? Freddy Hutter says yes. Westexas says no.

I look forward to your debate with westexas.

We did not set additional production records, because demand did not stay strong. Prices fell. Margins eroded.

As far as the depletion aspect goes, we would first have to deplete and consume the excess capacity that is setting around. And then, we would have to deplete in addition to that the projects and fields in the works (short-term). In my opinion, that level of depletion is unlikely in the short-term.

Incidentally, since I am moving into upstream production on Feb. 1, I will know much more about depletion and African and North Sea fields. Of course I won't be able to share that information, but I think it will enable me to be a bit more informed when depletion discussions take place.

I disagree because peak world oil is a messy concept some parts of the world are already experiencing peak oil now for example in the third world countries as subsidies are reduced.

In fact Indonesia and Mexico both oil exporting nations will probably be the first countries to crash from peak oil followed by Britain. These national peaks are a harbinger of whats to come because no one can make up the lost production. In the big picture West Texas is right on the money with the export land model. The remaining oil exporters will spend as much oil revenue as possible to try and diversify there economies and in doing this they will increase domestic oil usage. The problem is they will increasingly be in a position of trying to sell products with no buyers. And of course oil prices will be all over the place as demand destruction makes the markets volatile.

Basically peak oil is a financial problem as oil prices rise you are no longer able to maintain your standard of living either via economic collapse or inability to pay the price.

This is the demand destruction side of peak oil. Certainly other economic factors are at play now and will probably hide the peak for a number of years. But peak oil will ensure that oil prices remain high and worse ensure that the global economy will never recover from the coming slump.

This slosh of demand destruction and roller coaster prices are expected at the peak. Shortages which you seem to consider peak happen well after the peak when oil supply hits inelastic demand in large parts of the world. It will be years before we see real shortages in first world countries.