The Record Falls - January 2008 is the New World Record for Crude Oil (plus Condensate) Production

Posted by nate hagens on April 11, 2008 - 9:44am

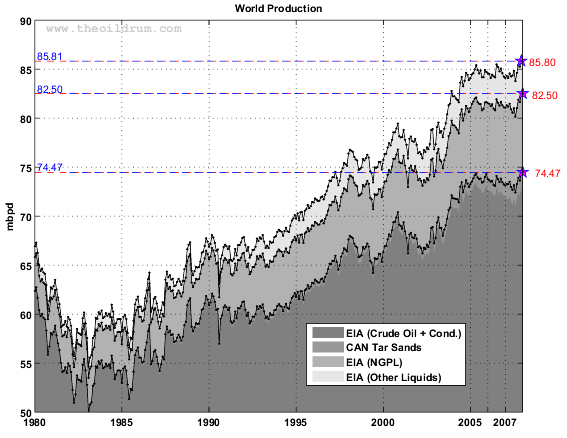

The EIA’s newest International Petroleum Monthly shows World C+C production for January was 74,466,000 barrels per day, eclipsing the heretofore peak of May 2005 by 168,000 barrels per day. (thanks to Ron Patterson for the heads up and to Khebab for the quick graphics).

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

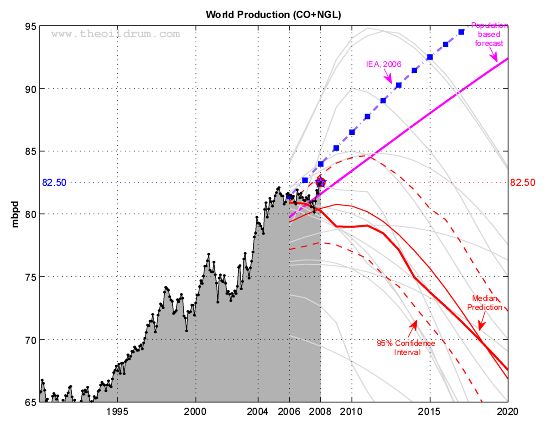

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 13 models that are predicting a peak before 2020 (Bakhtiari, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45], Robelius Low/High, HSM). 95% of the predictions sees a production peak between 2008 and 2010 at 77.5 - 85.0 mbpd (The 95% confidence interval is computed using a bootstrap technique). Click to Enlarge.

Peak oil a hoax? Deffeyes dephazed? Robert Vindicated? Bumpy plateau continues? Oil prices gonna drop like a stone? Totally meaningless datapoint? Pass the Kool-Aid? Discuss.

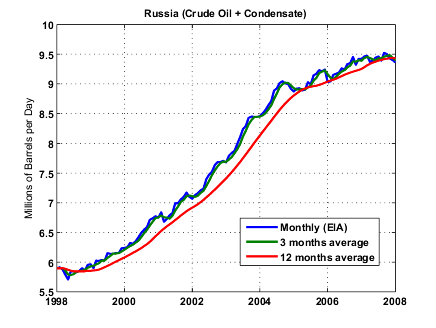

[Update by Khebab]: Despite the good news above, Russia's production plateau is looking more and more like a peak now:

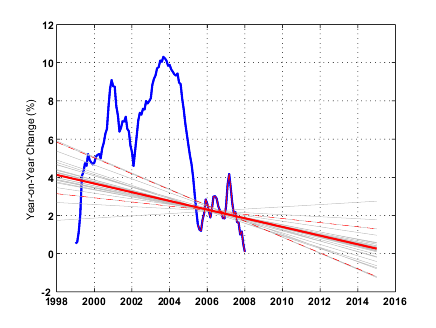

The year-on-year monthly production growth is near zero and reached its lowest point since 1998:

Whew, with oil worries out of the way, it's onto the next problem:

http://news.bbc.co.uk/2/hi/business/7342161.stm

Nonetheless, I doubt anyone here thinks they'll drop like a stone. With the falling dollar, and major producers like Russia becoming stagnant. Only if that new Saudi field (Kuri-whatever) comes on line and gushes oil like Old Faithful will oil prices drop any reasonable amount.

And with declines, only for a short time.

I followed up on several of the mega projects from the wikipedia oil megaprojects list for 2008 put together by

1. Samuel Foucher

2. Stuart Staniford

3. Tony Eriksen

4. Publicus 21:07, 10 December 2007 (UTC)

5. Phil Hart (talk) 06:10, 21 December 2007 (UTC)

http://nextbigfuture.com/2008/04/oil-mega-project-status-saudi-russia.html

Saudi Arabia announced on Thursday, April 10 that they will start adding 500,000 bpd to its total capacity when the Khursaniyah field comes on stream this month [april 2008]. Abdulaziz al-Judaimi, vice president of new business development at Saudi Aramco said, "The Khursaniyah field will start producing within a month [apil 2008] at 300,000 bpd and will eventually add 500,000 bpd to the country's production capacity."

Azerbaijan, and the two petrobras projects appear on track for mid-year.

Horizon (CNRL) for oilsands will be going at 110,000 bpd in Q3 it appears. Suncor Firebag looks to be later in 2008. Suncor overall will probably have an average for the whole year up 25,000-55,000bpd (because Firebag will be a few months late but by year end 350,000 bpd probably up from 240,000 last year)

My link also has an update on the oilsands from presentations made in Jan and Feb of this year.

OIL Projects 100,000 barrels of oil per day or larger, Big to smaller

Country Project Name Company Peak Yr Peak amt bopd

Saudi Arabia AFK Aramco 2009 500,000 [Abu Hadriya;Fadhili;Khursaniyah]

Russia Vankorskoye TNK-BP Rosneft 2017 420,000 bopd towards the end of 2008

Mexico Amatitlan PEMEX 2029 393,000

Saudi Arabia Hawiyah Aramco 2009 318,000 (NGL)

Azerbaijan ACG Phs III BP 260,000 [Q208]

USA Thunder Horse BP 250,000 End of 2008

Canada Cold Lake CNRL 2018 240,000

Nigeria Agbami Chevron 2010 230,000 [first oil Q308, ramped up Q309]

Nigeria Akpo Total 180,000 [Probably early 2009]

Brazil Marlim SM2 P-51 Petrobras 180,000 P-51 On track for mid-2008

Brazil Marlim Leste P-53 Petrobras 180,000 P-53 also on track second half 2008

Russia YK Lukoil 2009 150,000 [ramping up 2008-2009]

Kazakhstan Dunga Maersk 150,000

Canada Firebag; Steepbank Suncor 2010 140,000

Qatar Ras Laffan QP 140,000

Canada Horizon CNRL 135,000

Iran Azadegan P1 NIOC 2012 125,000

Norway Alvheim; Marathon 2009 120,000

Nigeria EA expand Shell 115,000

Iran Darkhovin P2 NIOC 2008 110,000

Brazil ML(FPSO C d Niteroi) Petrobras 100,000

Angola B15 Kizomba C (Mondo) ExxonMobil 100,000

Angola B15 KizC(Saxi;Batuque) ExxonMobil 100,000

And yet the Saudis also announced that their production would not be increasing, and the following news report, citing a Saudi source, shows that their production has fallen back to 9.0 mbpd, from 9.2 mbpd in January. Of course, as always, it's "voluntary."

http://www.gulf-daily-news.com/Story.asp?Article=214240&Sn=BUSI&IssueID=...

It's impressive that so many projects are coming on line in the next two years. But at even a conservative 4.5% decline rate ala Yergin, we need to add approx 8 million bbl/day of liquids through 2009. The above megaprojects list only accounts for about 4 million bbl/day in two years time.

One has to wonder if the Saudis have hit serious decline in Ghawar and are scrambling to add capacity to make up for shortfalls. Of course it's all speculation since their oil data is mostly secret. But if Ghawar were humming and they were adding all this capacity, then would they really keep flat in the face of $112 oil and risk of high prices destroying demand? History says no.

Perhaps a validation of Simmons.

The complete list of megaprojects at the wikipedia [oil megaprojects] is for over 13 million barrels per day added.

Plus there is all of the small 200-25000 barrel per day small wells. Like several hundred in the Bakken to offset the 4.5% decline. Ten of thousands of small rigs.

So it looks like 8-16 million barrels per day to be added net of the decline.

Dream on. . . you lost me at Bakken.

I'm still waiting for an answer regarding the following question:

Note that Saudi Arabia and the world, in 2005, were at the about the same stages of depletion at which Texas and the North Sea respectively peaked in 1972 and 1999 (based on HL).

If the Ghawar complex is in decline, it would appear that every single oil field in the world that has ever produced one mbpd or more of crude oil is in decline.

I'm not arguing that we can't make money finding smaller fields, but I doubt that we can reverse the long term decline, especially given the super giant situation.

In calculating this 8-16 mbd did you account for the fact that many of those megaprojects will not reach the stated peak flows during 2008/2009?

Thanks for calling my attention to the megaprojects list.

http://en.wikipedia.org/wiki/Oil_Megaprojects

If the depletion rate holds at Yergin's 4.5 percent, and if all these projects are on time and reach their production goals you have a net addition of about 5,000,000 bbl/day by end of 2009 through the megaprojects. Do you think small wells will account for 3-11 million barrels per day? Seems like a pretty huge stretch to me.

Taking a closer look at the megaprojects list, though, causes one to feel a little more cautious about making overly optimistic predictions:

1. Saudi Arabia, alone, is slated to add 2.7 million bbl/day in the 2008-2009 period. With Saudi stating it will not increase production and that the market is well supplied, one has to wonder if any of this 'new oil' will see the market as a production gain. Saudi Arabia's secrecy in the oil reserves area also does not inspire confidence.

2. Iraq is slated to add 900,000 bbl/day in the period. Given the current trouble in the country and geopolitical instability resulting in production being shut in, it is possible that Iraq may not deliver.

3. Nigeria is slated to add 610,000 bbl/day. As the country has a history of instability and shut in capacity, I don't know if any added capacity is likely to reach market in a consistent fashion.

4. In all 7.5 million bbl/day of new capacity is supposed to be produced inside of OPEC. As the cartel is acting more effectively as a cartel it may be possible that these barrels won't reach markets for reasons of political self interest.

5. Canadian additions in the megaprojects summary during 2008-2009 are supposed to reach 735,000 bbl/day. Canada is just now beginning to feel the bite of plummeting natural gas supplies. Since Canada relies on synthetic oil/tar sands for new supply gains and such production is slated to involve 10+ percent of the nation's current natural gas supply future reductions in that supply may well have a negative impact on Canada's ability to increase production.

6. Russian additions in the megaprojects summary during the 2008-2009 period are supposed to reach 1.1 million bbl/day. Taking a closer look, Russian production 2007-2008 is flat or declining so one wonders if the 1.1 million bbl/day addition is a realistic figure. Furthermore, it is possible Russia could curtail new projects in favor of higher priced oil. Its strong arm tactics regarding gas supply do not inspire confidence in its commitment to add supply to world markets and place downward pressure on prices. Most analysis supports a price increase bias on the part of the Russians.

Of course it's possible that many of these projects will also experience delays or fail to produce expected amounts of crude. Regardless, given the above list, at least 6.1 million bbl/day of the megaprojects list confront serious geopolitical and other production risk factors. Furthermore, if enhanced recovery is biting as deep into the reserves as some on this site are projecting, the depletion rate may well be beyond Yergin's optimistic 4.5 percent.

In any case, I don't think this new oil is a sure thing by any stretch and a net gain in oil production of 8-16 million bbl/day by end of 2009 seems to be in the realm of a hallucination. I think any gains, if there are real gains, will be fought for tooth and nail and that we will struggle to break 90 million bbl/day in any case. Both above and below ground factors make this a really tough sell.

Good luck with your predictions! I hope you don't have any money riding on it :)

Cheers

Rob

Um, guys? Have you seen the latest IEA OMR?

http://omrpublic.iea.org/

"Global oil supply fell by 100 kb/d in March to 87.3 mb/d, led by lower supplies last month from OPEC, the North Sea and non-OPEC Africa."

This has got to be monumental. The world is scrambling to produce every liquid an engine or generator can burn. Prices are as high or higher than they ever were. Demand is still pushing forward. And the IEA reports a supply backslide?

As for megaprojects -- show me the oil.

Canada has new natural gas discoveries in BC.

http://nextbigfuture.com/2008/04/some-natural-gas-and-oil-plays.html

The Horn River Basin, very little was known about the play until Feb 28, 2008, when Houston-based EOG Resources Inc. said it might have reserves of six trillion cubic feet - the same as Mackenzie Delta, Northwest Territories, and a figure that would increase Canada’s total proved reserves by roughly 10 per cent.

EnCana Corp. of Calgary - which claims the initial discovery of Horn River’s potential - and partner Apache Corp. of Houston may also have 6 trillion cubic feet of gas, Apache said in early February.

Montney natural gas is potentially one of the largest economically viable resource plays in North America, says a report by Raymond James Ltd.

Estimates for gas content in the sandstones, siltstones and shale sequences of the Triassic-aged Montney formation in northeastern British Columbia put the resource size at about 50 trillion cubic feet (tcf) over an area of about 680 square miles (73 billion cubic feet per section). This estimate is near the bottom end of the range of the B.C. government estimates of 30 tcf for the Upper Montney and 50 tcf in the Lower Montney in B.C. alone. the report says.

==

I will adjust my predictions (not speculating quite as much on the smaller production).

2006, 2007 were flat oil production years so roughly 3.5-4 million b/d of megaprojects has gone to offsetting decline. So 3 to 3.5 million b/d is the projected excess from 2008, 2009. So it would be 6-7 million barrels per day to be added net of any decline for the end of 2009 and into 2010 as those new additions scale up. If the increase in large projects also indicates more small projects then say 0.5-1.5 million b/d each year from that increase.

So if we are at 87.3 million b/d Jan 2008.

Then my prediction is a little over 90 million b/d at the end of 2008 (not the full 3.5-5 million b/d increase because of lag in scaling)

For the end of 2009, over 94 million b/d and for the end of 2010, over 97 million b/d.

So, to be clear, you are predicting that world total liquids will (on average) increase by between 300,000 and 400,000 b/d every month from now until the end of 2010?

Hmm, you know I have been posting about oil stuff for quite awhile but I don't recall ever intentionally using the word "play" to describe a prospective reservoir. I always knew what it meant, but it seemed to insider talk for my tastes. So when I see it used, I immediately think about the possibility that AdvancedNano reads too many press briefings or worse, is some sort of shill.

A similar thing occurs when I read about an earthquake. If people read only newspapers, everyone would go around calling it a "temblor". Now I look it up and find it is just Spanish for "earthquake". So these journalists go around and use the word Temblor because they probably secretly want to impress somebody. Or they happen to be a Mexican seismographer.

Play (n): Oil industry jargon for a prospective reservoir. Used by investors to hype something.

I did cut and paste a some of the sentences from the press release on the natural gas discovery. So what. I gathered information (which happened to be company reports and press releases) on over a dozen of the biggest oil projects. It seems likely that if an oil project is going to start producing or is producing this year then the company working on it would have a pretty good sense of it was going to happen. If a company says that they are going to start up a project this month, I would tend to believe them since there is little uncertainty. If they are promising for the next year or later then a lot more can go wrong.

So I added information and research to this oildrum discussion. My website http://nexbigfuture.com you can see that I have almost 2100 articles (43 of which are about oil). You and other here whenever they see any information from a company or from someone who has a position that is positive on any industry or company have a knee jerk reaction ... shill. Which is an assertion without facts.

You parse one or two words in one of serveral 1000 word posts.

Why don't you try to find some information about why particular projects will not happen if you believe your case (as one of the other commenters Robert Marsdon did). Bring some information and research to your position.

Yes my prediction is an average of 225,000 b/d increase in 2008

avg 333,000 b/d increase in 2009

and avg 250,000 b/d increase in 2010.

Overall avg 277,000 b/d from now to the end of 2010.

You are looking at Jan 2008. I indicated that the 300,000 bpd is adding in April so the increase will show when May, 2008 figures are reported in 4 months.

Reported in the Wall Street Journal 14 April 2008:

"...Ukrainian President Viktor Yushchenko said on Tuesday that he had agreed to let Libya grow wheat on 247,000 acres of land in the Ukraine. In exchange, Libya promised to include the former Soviet republic in construction and gas deals.

Brazil recently invited Egypt's minister of commerce to discuss a possible trade deal which would have a strong agriculture component. China also cut its first free-trade deal with a rich country, picking New Zealand, a major food exporter, and is talking about a pact with Australia, another big agricultural producer..."

In the words of a very wise man, "I'll believe that when me sh!t turns purple, and smells like rainbow sherbert!"

Seriously though, I do hope there is one more bump over the next year at least, it's a longshot but every bit counts and the longer we have before the slide, the more (still slim) chance there is that world leaders will choose to confront the problem head on (in ways that don't involve bombs and guns).

Another bump up in production may no help PO arguements (when trying to convince lay people) but it still means more time, and that can't be a bad thing.

The time to act was over 30 years ago. A little bit more time at this point will do nothing to wake up the dead, those who believe that salvation is just around the next corner, the next wilderness area, or off the next shoreline.

I disagree. To my mind, the sooner we cut back on oil consumption, the less precipitous the slide down the backslope of the curve will be. It's unrealistic to think that by allowing more time, consumers & their so-called "leaders" will wake up & make important lifestyle choices. History doesn't support this view. The sooner fossil fuel consumption is curtailed the less oxidized carbon will be in the atmosphere & surface ocean. The more reduced carbon that remains in the ground the better chance ecosystems & the species that comprise them have of adapting, rather than crashing & going extinct.

Word.

But effectively curtailing it requires one essential resource, among many others... time. We need time to build wind turbines and solar panels and even geothermal plants.

We need time to build vehicles that can run on compressed air, or batteries. We need time to build more electrified rail systems. We need time. If the United States takes the initiative and makes the choice to conserve at all costs and begin implementing these strategies, it isn't going to significantly curb world demand, it will just make it easier for China and India to consume more of the oil, and demand will stay relatively flat.

One the other hand, dragging out the plateau gives us more time to get these manufacturing processes implemented with the supply of energy currently available. It doesn't necesarrily take government intervention to start these steps. It takes the action of an influential company to see the coming crisis and begin making the investment in its own infrastructure so that it can become the dominant energy supplier in a few years time.

It is true, however, that using up all of the surplus production to maintain the plateau or even bump it up now with certainly make the slide on the other end alot steeper.

We need more time that is well-spent. IF we end up at the current status quo for another decade, and nothing or little is done, then it will have made no difference. There are efforts afoot, but they are quite small and disorganized. For example, the new Nanosolar (Google) solar panel plant is expected to produce 400MW of panels per year. Assuming it does that, and we had 100 of those plants fully producing today, in ten years we would only produce 40% of our needed electric capacity by then. I've since lost my calculations on that, but I don't even think I calculated that the US averages less than 180 sunny days per year. But if only a few plants are built in the next decade, it will make no difference at all.

Don't forget CSP!

Arclite,

Thanks for your comments! CSP looks like a great technology and I think it will play a big part in our future. I didn't leave it out on purpose, thats an oversight on my part. I think PV panels still have alot of potential in less sunny (less arid) regions because unlike CSP, they can function pretty well with scattered sunlight (i.e. sunlight that has passed through clouds).

I think that you're right that it won't make a very big dent in our current energy landscape. This wikipedia image sums it up pretty well. The sustainables (everything hydro and lower on that chart, though some argument for biomass could be made) represent about 5% of our current energy usage. Say we put in an amazing effort and double the amound of renewables we use. It would then make up only ~9.5% of the energy grid.

But now suppose that the FFs, nuclear, and biomass are taken completly out of the picture. Suddenly, insead of a 5% increase in overall energy supply, we'd have doubled what we would have had if we did nothing.

So yes, compared to our huge, wasteful supply of energy that we now have, alternatives don't look like they do much. But an increase in those alternatives now could make a world of difference later when they are the only thing we've got.

The point I want to stress is that we didn't start nearly soon enough to avert the kind of shortages we're now in for with PO. But better late than never. Anything we can build or change now that will help us post PO should be done with the utmost urgency.

In reference to the wikipedia image listed above, if a similar graph were made of transportation modes in 1900, automobiles would make up a fraction of a percent of overall transportation and airplanes would not even be on the graph. Present usage is not a good indicator of future usage.

Electricity could be made to take on a greater load in supplying energy needs -- domestic, transportation and industrial -- however, electricity is an ephemeral quality and is most efficiently used as it is produced, with production matching load over a large distribution area.

Solar, as a replacement energy technology is problematic, not because of cost or production shortfalls, but because of its intermittency, as mentioned above.

Wind, however, could become the heavy lifter of the future, especially in North America which is blessed with high average windspeeds in the thinly populated center of the continent. At 300 feet up, the wind blows night and day year-round on the Great Plains. North Dakota, alone, could supply half the electricity need of the U.S.

The biggest problem, by far, for wind power development is availability of collector powerlines to gather the energy from the turbines and feed them into the national grid. Powerlines are the electrical homologue to oil refineries: they are absolutely essential but are low in profit making potential and no one wants to build them or have them cross their property. In Minnesota, there is now a theoretical 600 year waiting list to authorize wind farms planned but unable to access existing feeder powerlines.

For windpower to make a break-out, super-regional planning authority is required that would survey and preplan future wind turbine and powerline siting to allow for efficient phased-in development. Federal funding of collector powerlines, as is done now for highways, would provide a huge boost to wind. The resource is there, but without the powerlines it can't be accessed.

The Stanford study on wide-area windpower generation http://news-service.stanford.edu/news/2007/december5/windfarm-120507.html has shown that wind can be a stable, predictable base-load electrical energy source. With wide-area interconnected wind farms, energy storage is unnecessary if production capacity is greater than demand and excess turbines are feathered when not needed. Building more turbines is cheaper and more efficient than trying to store electrical energy.

Windpower could replace all coal, nuclear and about 2/3 of petroleum use. HVAC can be all-electric. (Our permanent home in northern Minnesota and the farm in North Dakota are heated by off-peak electric power.) Linear transportation (rail, light rail, trolley and bus) can be fed off mains electric. Personal isotropic transportation (automobiles) can be stored electric -- not easily or cheaply, but doable.

Industrial isotropic transportation -- farm, construction, sea shipping, trucking -- will continue to need high power density portable fuels. Stored electrical power density is too low to be useful in these situations. For example, a standard field tractor or combine on the Northern Plains would require about 3,000 Kwh of stored energy for a day's work. To put this into perspective, a Tesla electric roadster has a 57 Kwh battery pack weighing 1,000 pounds and costing $20,000. The cost, which would scale up to $1,000,000 for our electric tractor, is less serious than the weight, which would be over 50,000 pounds. For a semi-tractor rig, that weight penalty would be an even greater impediment. This is why biofuel energy development will continue to be necessary.

I cerftainly agree that wind power seems to be the most practical.

As to your EV and electric tractor comments, there may be another option. The main problem I see with EV for normal cars is really all of the gasoline cars on the road now. They can't be easily converted to electric and it will take years and years to replace that infrastructure. Your weight problem with the tractor is also a good point.

A possible (carbon nuetral) solution would be to take H2O and split it (electrolysis) in to H2 + O2 and then use the H2 and CO2 from any source, carbon capture, extraction from air, etc, and use a Sabatier Process to generate methane as auto fuel.

Automobile could then be converted to run on methane, which would be a much easier task than converting the transportation infrastructure over to electric vehicles. This could also be dne much faster if needed.

And of course the problem with this is that it requires a huge amount of power. You have to put in alot of effort to make that methane fuel, but that's just the reality today, isn't it? This methane would serve as an energy carrier, and it wouldn't make sense to use it for electricity generation because you need electricicty to make it in the first place (except in areas that don't have many other energy sources, like the SouthEast US, if it's deemed unfeasible to use transmission lines).

Like I said, the main advantage here is that it would be relatively easy to convert lots of cars over to methane fuel (compared to other options). But you have to build up those wind farms on the plains to get that process going.

This is a good example of loose use of that old "we" word. Unless "we" are one of the very large oil exporters, it will not be "we" who make the initial decisions as to who gets to even bid on ever-diminishing exports. This "above ground factor" is the refuge of fools, demagogues and CERA, but it is absolutely true nonetheless and accounts for a large part of current market prices.

The first decisions are going to be whether exporters can allow foreigners to outbid their own citizens for indigenous hydrobcarbon supplies. The decisions are not as straightforward as they may seem at first blush. Mexico is the best current case in point: Is it two thirds of the government budget or Fx earnings directly from Pemex. Also, Chavoco (a new and quite naughty name for PDVSA) has annlounced that they may not be willing to sell to certain customers at certain times, even if those customers are properly configured to refine and market their output.

You must mean "we" that is weaning itself off hydrocarbons without starving to death or going after the neighbours and their pets. Less and less likely as the box of options gets smaller. Indeed, a world without political leadership on this set of issues is an earthly paradise for fools, demagogues, CERA and especially the profiteers of the Iron Triangle. Maybe Oil Drum could present an Iron Triangle Award to the biggest dinosaur af the year.

Damn, I hadn't thought about the pets.

I'm not sure I want to learn much more about what our brave new world is going look like. There is a subtle transition from being prepared to just being depressed.

I wouldn't count on oil dropping like a stone. The IEA said:

Should be interesting to see what Deffeyes has to say about this. I know, he's actually using a curve fit, not individual data points, but he's been giving the May 2005 as the specific time of peak oil, and he can't do that any more.

EIA haven't shown themselves to be extremely accurate with their initial numbers-it is so close that May 2005 might still be the peak.

I agree, and it may yet be several months or even next year before we know whether this peak month "stands." Included in this month's IPM are two revisions to 2006. When I load my spreadsheet, I can look to see whether the values have increased or decreased.

Using the smoothing technique that Stuart Staniford uses the "peak month" was December 2005 with the shoulder of months on either side being very flat.

Of course, one month does not tell the tale AND if we see month after month of climbing C+C production values each month (more or less) a new record, we will know that the two-and-half years between May 2005 and January 2008 was merely "the pause that refreshes."

Leanan was talkin IEA forecats, BrianT EIA forecasts. These two agencies have disagreed before.

Current opinion from IEA:

- some lowering of oil demand growth for 2008 due to US lead recession: - 0.5 Mbpd from their previous forecast

- regardless, projected demand for 2008 @ 87.2Mpd, up 1.3Mpd from 2007

- supply rising slower than forecast

- so, demand from Asia's growing economies remains strong

- sees that margins remain tight, geopolitical risks notable, prices driven up partly by tight refinery margins

- no supply/demand related big price drops expected

- current price may reflect increasing costs and thus be justified, or then not (really, that's what they in effect are saying)

- on a related note: OPEC anticipates a higher demand increase for 2008 @ c. 2.1 Mbpd

EIA standing

- clear speculative premium in current prices, real demand driven price even down to c. $90/barrel.

- expected average of $100/barrel for 2008

- demand increase 1.2Mbpd for 2008, bulk coming from non-OECD

- expects possible delays in new non-OPEC supply

- US gasoline price will peak at $3.60 during summer, down from there

- tight supply/demand situation driving up oil price (trend)

- speculation driving up price volatility

- upside/downside risks remain for oil price and make it hard to predict accurately

So, currently they are mostly in agreement, but not always. As for price projections going forward, on that EIA has been increasingly off the mark during the last years, but seem to have corrected somewhat late last year and early this year.

Refs:

http://www.guardian.co.uk/feedarticle?id=7454433

http://online.wsj.com/article/SB120792207645407921.html?mod=googlenews_wsj

http://omrpublic.iea.org/currentissues/full.pdf

http://www.cattlenetwork.com/content.asp?contentid=211559

http://blogs.wsj.com/environmentalcapital/2008/04/09/running-with-the-bu...

http://ap.google.com/article/ALeqM5jkPHIIfviqYN5x89eQb16MYtMNdgD8VTNLK00

First, when they say that "demand is lower",

the only correct interpretation is that "growth in demand is

lower."

Second, heating oil is at it's lowest inventory point since

1993. H/T CNBC.

Third, can the IEA really get w/in 178 000 on a 74 000 000

number?

740 000 is 1%. 178 000 is slightly more than .02%.

Rigid scientific experiments would kill to get an accuracy

rate like that.

178,000 is 0.2% not 0.02%. Its fifth part of percent, not fifyth, but you are right, even with this 0.2% its one part in 500, not think they are that accurate especially when some oil producing areas are under war (nigeria, iraq etc).

Hello TODers,

If I may add a bit more to the accuracy debate: How many more wells providing C+C have been added from 2005 to now? I have no idea--100,000? 200,000? 300,000 if we count all the old horsehead pumpjacks restarted to extract oil-stained brine? The larger the database, the harder it is to get the truly accurate and time-dependent numbers for summation; this new C+C high is mathematically-bound to be less accurate than the 2005 data. Thus, IMO, this recent single measurement basically means the 2005 record still stands if one mentally adds error bars to this latest number.

I think it would be interesting for the reporting orgs to detail how much the reporting accuracy has gone down, or else what expensive data-collection steps they have taken to keep the accuracy level the same. My feeble two cents.

Of course, if C+C goes higher in each report for the next year or two, and net exports goes higher too, then I would agree that the 2005 number was premature. But TODer Ace's report [bottom of yesterday's DB] seems to indicate otherwise, plus the excellent statistical work done by Khebab, then detailed by WT.

EDIT: plus a big kudo to Darwinian and any other hard-working, much-admired data-freaks I overlooked at all the other TOD regional chapters.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thank you for the correction.

I practice close math. ;}

And i humbly think I understand Pakistan better now.

Leanan,

Wouldn't Peak depend on how, or why, the oil outflow is being produced? the figures from 2005 only produce one month over 85 gazoolian barrels yet the next two years which produce visibly less than that year each have 3 months higher than 85. While the previous four months including Jan 2008 have figures over 85, the pressure from the faltering economy could be responsible, much like someone jumping on a garden hose, a temporary spurt. Is the present increase sustainable?

The plateau is bumpy at fine scale. May '05 wasn't THE peak, & this January may not be either. Over time, the bumps smooth out. Doesn't change the fact that we're peaking out & the downslope impends. The impression that production can be cranked up to meet demand just promotes business as usual. The longer the slide is delayed, the steeper the downslope is going to be.

And along similar lines, what does the 'peak number' really signify other than a source of great debate? Taking into account random error, measurement error, human error, etc.. I'm skeptical that these 'peak' values are even different numbers. As a data analyst in the pharmaceutical industry, I'm continually amazed at the variability observed even in tightly controlled quality control labs. Gathering consistent and reliable data is extremely difficult.

I agree with you. I've stated this here before, but my wife is a data analyst for a natural gas field service company. The data loggers connected to wellhead & pipeline meters transmit data directly to the computer (there are no "meter readers" anymore Leanan). In any given month, between 20 & 30% of the meters (or data loggers or transmitters) are malfunctioning. The job of the analysts is to report the malfunctioning meters to service techs, and to "guesstimate" the amount of gas flowthru for which they have faulty or no data. They do this by averaging flowthru for the meter over previous months, or by substituting data from a similar meter that's currently working. How accurate this "made up" data is is anyone's guess. I agree with you that this new "peak" blip in global crude production is likely well within the margin of measurement error.

Especially as demand increases in FF producing countries and they reduce exports for domestic use.

Another bump on the plateau — meaningless.

Indeed just another bump...a bit of spare capacity in saudi arabia, blowing gas caps in north sea and the help of Angola. And during that time, Russia passed from a daily production of about 1333/1335 th tons (february/march) to 1323 in a few weeks. See http://www.riatec.ru/en/shownews.php?id=37182&sha=1&sfa=1&RiatecSess=1d7... for daily production figures. Which means about 1 percent in a month... Is Russia about to loose same production as Saudi arabia did in 2006? Time will tell but if yes, the bump of this winter was the real peak...

That's right. We're waiting for a trend not an isolated data point.

Yeah people, that's right. 'We're waiting for a trend, not an isolated data point' - unless of course the isolated data point in question could have been (and was) interpreted as 'Peak in 2005', in which case it was OK to scream 'Head for the hills!'

Now that's been contradicted, it's time to start questioning the evidence. 'Measurement errors', is it ... which, mysteriously, only apply now but didn't apply in 2005. Funny, eh.

Oh wait, I guess I must be in Peak Oil denial or something.

You people would be funny if you weren't turning into prime evidence of the thing you always complain about - the intractable stupidity of the human race. (oh, that and having kids, especially if the parent in question is black or yellow or something).

They did question it in May 2005. That's what happens when figures are new and recent.

But almost three years later, they're more sure the figures are right.

So in March 2011 you can come back and see if they're still questioning the figures of April 2008 :)

No wonder prices are so low. :<)

I just gave a presentation this week to the league of women's voters which included a slide on peak oil. Talked about 2005 as maybe the peak. What will happen when they find out about this?

It might make sense to place more emphasis on peak per capita than total peak. Anyway, no one on this site fails to qualify that we won't really know the peak until it is way beyond the rear view mirror.

Talked about 2005 as maybe the peak. What will happen when they find out about this?

Nothing if you gave them enough info and they have brains. Suggestion: don't say we peaked in 2005, say "the current peak." Then show them a graph of the production and how flat it is and explain the bumpy plateau. Then show them all the oil coming on-line this and next year while also showing them the dearth of new oil after 2012 or so.

Cheers

I didn't say it was necessarily the final peak; I told them that there is controversy with others saying the peak could be as much as a decade or more away. I did,however,say, it might be the peak but time would only tell. But people don't always retain all the subtleties. So this, like Bakken, could create problems for those who are trying to educate people about peak oil.

Well, the question looms: Are we smarter than yeast? Before I read Diamond's Guns, Germs and Steel I had already theorized humanity must logically be getting more stupid. We are interrupting natural selection, right? Everyone survives, so there is no winnowing of those with low intelligence, poor insight, lacking common sense, etc. We may "know" more, that is, have more data to hand, overall we must be getting dumber.

Perhaps we are dumbing ourselves into extinction.

Unintended consequences.

Cheers

Great book indeed you cited, very important if you want to understand the history of civilization. But I disagree with your point that intelligence is just a matter of gene selection. What it counts now that we are civilized is the intelligence of the whole community and not only that of the single individual. Collective intelligence is more a matter of "meme" selection, i.e. the spread of successful ideas and concepts. And I feel that this blog has succeeded in creating very lively and useful memes.

Aceroni,

First, I didn't say intelligence is only genetic. There is a lot of anecdotal evidence of lowered intelligence. TV viewing rates, drop-out rates, voting rates, who gets voted into office, how easily the populace is duped into accepting/participating in horrific events, etc. Diamond's example of friends who retained such detailed knowledge of their environment is a great example of how we even fail to test intelligence in a meaningful way. How stupid is it, for example, to test intelligence only by what is learned in school?

Meme? You are equating meme with intelligence?

Given the above, one can define a meme as data or behavior far better than as intelligence. Cultural actions/beliefs, etc. are not examples of intelligence, though they may be expressions of it, to a degree.

This is simple logic: if all persons are allowed to survive, then those poorly adapted are surviving and procreating. The average and the mean must fall if we assume intelligence is a positively selected trait, i.e. generally leads to a greater chance of survival.

Cheers

Our brain has not changed that much from when the first homo sapiens has appeared. A nuclear scientist and an hunter-gatherer living in the amazon forest are sharing basically the same cognitive capacities. So which of the two is more intelligent?

I am pretty sure that a nuclear scientist put in the amazon forest has pretty low chance of survive but the chances of an hunter-gatherer to design a power plant are even lower, he probably doesn't even have the word for it.

If you measure the intelligence with QI tests the nuclear scientist would score probably 100 points more than the poor guy, which wouldn't even understand what he has to do. But QI tests measure only how good you are in doing QI tests. I agree that scholastic systems are putting less selective pressure in the individuals, that are moving much faster through high school and university, but there is also a much larger number of PhDs out there now than ever before.

Anyway measuring the capability of a single individual is a pretty worthless exercise. No single individual, not even the more knowledgeable, would ever be able to produce from first principle (just raw materials) anything more than a stick with a stone attached to it. What we are looking at is the capabilities of the entire civilization that individuals are forming. The current global civilization is able to create fusion reactors and space carriers, and this is because we have accumulated and selected memes from when we started talking to each other.

As the first definition you are posting is saying, a meme is also an idea and a concept. It's true that beliefs are strong memes, but even "Peak oil" is a meme, or quantum mechanics. And internet is helping propagation and selection of ideas at a much faster pace. Look for example at the global scientific output compared to 10 years ago.

In fact, this belief give me hope for the downward slope. Because if you compare the pre- and post-oil societies the difference in accumulated knowledge is huge and therefore the capability of solving problems at the global scale. If oil has done anything this is to allow us to produce knowledge and infrastructures that we can reuse to, for example, produce renewable energy based power plants.

This I doubt very much, but I wasn't comparing us to spear throwing people. A pretty high percentage of people died early even just decades ago, let alone hundreds of years.

You've offered nothing to refute the proposition except to say that the amount and kind of knowledge we have has changed. You don't need a high level of intelligence along the general population for that.

May god save us from yet another fad... memes... crikey...

Cheers

So would you provide evidence for selective pressure to your definition of intelligence (which is?) in the last centuries? Most of the people died anyway for infections or malnutrition, and neither bacteria nor famines are looking to much at the cognitive capabilities. The spread of human genes in civilized countries is mostly governed by the simple fact of reaching the mating age. Don't tell me that at roman times the smartest where mating more than the normal peasants.

Anyway, I am just telling you .. it doesn't matter. Single individual's intelligence is not affecting too much the collective intelligence of the population. But you can't get this point.

P.S> Franz is not me, I am not a troll.

We spent about 99% of our evolutionary history as hunter-gatherers. Our brains were our primary tool for survival. The smartest survived. Our brains had to change dramatically from when we first became non-arboreal upright walking animals until the end of our hunter-gathering days. But it has likely changed very little since then.

In times of plenty natural selection loses much of its grip. Today, when almost everyone survives to reproductive age, the most prolific reproducers will be the ones whose offspring will be dominate the population. And those prolific reproducers are not likely to be the smartest members of the population. Therefore, as long as this situation continues, the average intelligence of the population will decline.

Anyway, this very short YouTube video explains it all.

http://www.youtube.com/watch?v=upyewL0oaWA&e/

Ron Patterson

I *can't* get the point? Arrogant a bit, are we? More like, I think you are wrong. That is, we disagree. Your high level of "accomplishment" can be argued to be rather stupid in the face of overshoot/depletion, no? Further, it can also be argued to be nothing more than building incrementally on what came before.

No. My contention is based in logic. It is neither provable nor unprovable, in any case. You can philosophize about it all you wish, but the logic makes sense to me. If it doesn't to you, so be it.

However, just for shits and giggles: war. One could argue the least able (intlligent) are in the lowest ranks and the most likely to die. Accidents: The least able (intelligent) are most likely to be doing the dangerous manual labor, thus most likely to die. Etc., etc. So, the dumb are dying. Yay! Except that population is increasing far faster than people are dying, so, relative to the past, more of us dummies are escaping Death and his bony grip.

Anecdotal: Dumbya remains president; large numbers of Americans still think Saddam had something to do with 9/11; after many hundreds of years and all this development, the 1/5/20/80 ratio still applies to wealth and income distribution; television, etc. I mean, how dumb do you have to be?

On a more serious note, it is a fact that watching TV has negative effects on cognitive development. The average American, for example, watches something like 4 hours a day. Back in the day, kids played and/or worked, both of which increased intelligence.

Ron's post does a good job of covering the more "sientific" aspect, but again, please note this is not an issue that one can prove. Accept the logic or don't. Your choice.

Personally, I believe we are collectively no smarter than yeast. Relatively, we are dumber than yeast: we have brains (they don't), yet we are doing no better in terms of overshooting our environment.

Hmmm....

Cheers

P.S. Who said you were a troll? (<-- See! No smarter than yeast! He-he... joking...)

I was going to contradict you, until I realized your own post provided prime and irrefutable evidence of the thing you are complaining about. Bravo, Maestro!

Look! We have a troll! You already got your ass handed to you above. Do yourself a favor and don't go looking for more kicks in the ass.

That's a 0.23% increase over May 2005 - you need to take out the redundant million BTW. How precise are the numbers being quoted? How do they actually gather this data?

Given the (even after adjusting for the USD), the prices of oil, you would expect to see more than that as an increase (given that demand ought to have increased 7-8% over from May 2005 to April 2008).

I would say that supply is struggling to keep up with demand and is vert sticky at this point.

Srivathsa

Some things I recall from reading Oildrum for awhile--EIA data seems to always be revised, so these figures are at best preliminary; "production" from SA tank farms may be capable of causing this "increase"; Robert Rapier may be correct that we're experiencing "peak-lite", where consumption/demand is exceeding supply/production, even though supply may be still increasing--hence the high prices...

I find visual materials a better aid to understanding, so to put this in perspective I went back to Khebab's December 2007 update. The current EIA figure is indeed a small blip on a plateau that has been ongoing since May 2005. The shape of this now-three-year plateau is plainly different than any pattern exhibited in the 1985-2005 runup of production.

Furthermore, the current EIA figure is still far below the APSO-58 projection for conventional oil (and even farther below APSO-76). Oil production is going to have to increase a lot more to reach APSO's projected 2010 peak. So far, APSO-46 and APSO-58 seem to constitute the most accurate upper and lower bounds of near term forecasts.

Chart:

http://www.theoildrum.com/files/PU200712_Fig5.png

Correction

My math was a little off when I figured the amount that production was up from May of 2005. The amount was actually 168,000 bp/d rather than 178,000 bp/d. I did the data by pencil instead of on my spreadsheet. I should have known better. Sorry about that.

Ron patterson

I don't think it is important to look at the average production for each month but to look at it for each year.

2004 72,512

2005 73,807

2006 73,539

2007 73,223(11 months)

If we could average over 73,807 for the year that would be a little more significant.

http://www.simmonsco-intl.com/files/NYC%20SCI%20Investor%20Lunch.pdf

The average production is now in for 2007, it is 73,274 kb/d.

But all this matters little. The fact that non-OPEC is down one million barrels per day since May o 05 and is clearly on a downward trend, that is important. As far as non-OPEC yearly averages go, they are down over 300,000 barrels per day from 2005.

It's all up to OPEC. Angola, since May 05, has been the one big gainer in OPEC, up 822 kb/d with the UAE second at up 307 kb/d and Iraq third, up 250 kb/d.

The non-OPEC trend is clearly down. Will OPEC trend continue up to offset the non-OPEC downward trend? That is the question

Ron Patterson

As I recall, Angola recently joined OPEC and this is partly why the comparison between OPEC/non-OPEC has changed, with non-OPEC declining-Angola changed teams!

Insofar as I know, we don't have monthly data for the Lower 48 but we do have annual data, and (using the world data through December, 2007) the annual world decline rate in 2007, relative to 2005, was -0.3%/year, versus the initial two year decline rate of -0.8%/year for the Lower 48 (C+C in both cases).

The initial Lower 48 data, and year over year decline rate:

1970: 9.408 mbpd

1971: 9.245 (-1.7%/year)

1972: 9.243 (-0.02%/year)

1973: 9.010 (-2.6%/year)*

1974: 8.581 (-4.9%/year)

1975: 8.183 (-4.7%/year)

*Note that worldwide, in January, 2008, we would be at about the same point as January, 1973, in the Lower 48.

And regarding the monthly data, as Khebab has previously noted, the EIA revisions tend to be downward with time.

More importantly, I estimate that the top five net export decline rate accelerated in 2007, relative to the 2006 net export decline rate. With the latest data from Russia, and with Saudi Arabia saying that they will not increase production (whether they can increase production is the question), I don't see the situation changing. So, at present the top five net oil exporters are on track to approach zero net oil exports in about 23 years.

This decline in exports (due to domestic consumption) was given some attention at the EIA Conference as well as a note that this sort of taking oil of the world market for internal consumption is a driver that is being missed in some quarters (not here, of course, because we are pretty much able to think at multiple levels simultaneously. We can even walk and chew gum at the same time).

So, really folks, this shouldn't be cause for peeps to go out and buy that new Suburban.

Naw, just a Tahoe Hybird.

(ducking)

In all seriousness, it is a pretty impressive feat to get such a beast to get 21 MPG.

Total US monthly data is available at

the EIA.

Further, you could derive lower 48 production from this EIA web page by taking total production and subtracting out the part of PADD 5 that is Alaska as well as US offshore. The data is all there if you wish to make the adjustments just for lower 48. Note that the data for any of those series is available as a monthly spreadsheet from 1920 to 2007 (and in a few cases to 2008).

I have put two charts within the post, just hit refresh.

What is not clear from your World Production chart (fig 1), given that from 2007 the Canadian tar sands production is no longer broken out, is the ratio of tar sand production to tradition oil production....

What I am thinking about is all the EROEI posts lately... certainly as far as EROEI is concerned tar sands are a different beast than traditional C&C.

Is there anyway to break out the tar sands production again? And, if that could be done, might it not be clearer what the "peak" dates truly mean?

I have corrected the chart, It's clear that the Canadian tar sands are contributing a little bit to this new record. The production was around 800 kbpd in January 2005 and is now around 1,500 kbpd end of 2007. If you remove this contribution (~0.7 mbpd) the corrected maximum would be still in May 2005. Anyway, if Russia goes into a decline, the tar sands contribution will be wiped off in a few months.

Well there ya go. As I wrote about 2 years ago, the changing definition of 'what is oil' will confuse people and lull public into complacency at the same time the internals deteriorate. So for CRUDE OIL, May 2005 still is the peak. Ceteris paribus, I am sure more energy and other resources went into Jan 08 world oil production than went into May 2005 world oil production. In addition to higher dollar costs 4 years later, we have higher costs in terms of natural gas, iron ore, water, oil, and environmental inputs.

"...more energy and other resources went into Jan 08 world oil production than went into May 2005 world oil production."

What, Nate, you sayin' EROEI matters!?! :-)

If Crude and Condensate is a smaller percentage of the total, the total BTUs produced is quite possibly lower in Jan 08 than in May 2005, because the non-crude tends to have fewer BTUs per barrel. When you combine that with spending more BTUs to produce the "liquids", we are definitely behind.

I'm saying net energy matters. Immensely. EROEI is the primary accounting metric for net energy, and is fraught with problems. But its the best we have, for now. I doubt the EIA will complicate things to that level, but its CLEAR that NGPL and ethanol and some other liquids have different BTU contents, and are able to do less work that straight crude oil, so that SHOULD matter. Im sure they would agree - they just don't 'complicate' it unnecessarily because it's never mattered before. Lets petition them to start reporting in net (not net energy) but the net in BTU terms. One way to do it is to start EIA SHADOW statistics on TOD and report them in graphical form each time an EIA report comes out. I don't have the technical skills to do so, but several of my fellows here do...

Absolutely, getting EIA to report in BTU's, rather than in "any ol' goo will do" terms would help clarify the picture, and be a meaningful first step in the direction of full bore consideration of net, rather than gross, energy.

Well I was about to make this point, but you beat me to it Nate. I thought it would be the first comment in the list, Ha silly me, I must say though I have been confused by this new "Oils is Oils" reporting strategy, Kudo's to big Oil, I'm confounded, ;? I expect SLW mbp to fall, and Shudder in horror when Brent$ rises, but I am still at a loss as to where these condensates finally end up, I can see it now, Damn, My Mustang just wont run on this High Octane Premium Condensate.

Nate and Khebab --

I think you guys have nailed it. My basic additions to your statements which, to many here, are likely to be seen as no-brainers:

1. The 2005 bend/peak/plateau saw ever after diminishing returns in EROEI for all oil. The easy, high energy, oil peaked.

2. After 2005 we saw a greater influx of lower EROEI fuels which, along with contraction in world exports, added cost to all interchangeable oil products. I think non-conventional oil and ethanol are obvious constituents of these low EROEI liquids. But I think you need to add in previously uneconomic oil that came back online after the drastic increases in prices as well as weird, semiconventional oil like the stuff coming out of Bakken right now.

3. This greater influx of lower EROEI fuel may well push the total liquids 'peak' up or extend the plateau. In my opinion, it's really not possible to exactly predict how many months or years this trend may continue. That said, prices will have to stay high and continue to climb to keep new resources open until we have significant enough demand destruction to make a serious dent and allow for some relaxation in price -- albeit never to past lows (IMO the current demand destruction bottom isn't much lower than $80 per barrel).

4. The cliff/downslope will likely come as net EROEI for oil/liquids approaches 1:1 and economies are placed under enough strain to see serious demand destruction. In this case, demand destruction would be enough to result in a net decline in world oil demand. Sure there's massive amounts of oil locked in the ground. But how much of it can be extracted at a measurable net energy gain? Once the net liquids EROEIs reach a certain tightness (6:1, 4:1, 2:1, 1.5:1??) then I think we'll start to see a measurable and consistent drop-off in production. I guess this would be the famed 'rear view mirror effect.' In any case high cost energy at least, in part, reflects lower EROEI energy.

Caveats:

a. Net oil exports per West Texas seem likely to contract regardless as net gains in liquids are likely to be marginal considering the depletion rate.

b. OPEC has a firm control over price as any small decrease in OPEC exports has serious impact (historical data from early 2007 bears this out).

c. It is possible that we have just seen a post 2005 bump in net supply even though follow on plateau/marginal decline may still materialize in the 'rear view mirror.'

d. My past critiques of EROEI analysis were due to bias in the data reported and not in the validity of the underlying logic. It is perfectly reasonable to want high energy content energy sources and the natural preference would be for greater EROEI. But once these basic assumptions are accepted, everything else seems to fly out the window as sample/issue bias comes into play. People who dislike ICEs will negatively skew EROEI numbers. Conversely, those supporting electric vehicles may well exaggerate their efficiency numbers. In this kind of environment, it's tough to separate truth from fiction without a much broader and less biased system of peer review.

e. I think EROEI will be in most visible decline in liquid fuels throughout the coming decade. I also think we'll have a much better idea how resilient or frail economies based on renewable sources are as time passes. In any case, since we have few alternatives to fossil fuels other than renewables and nuclear I think a rapid transition to these alternate sources is advisable. Some net energy gain is better than none at all and even if we have to increase our efficiency and do without certain luxuries it's far better than having to do without everything and live in a state of starvation and anarchy.

So this means that May 2005 was the all time Peak for world wide Conventional Oil Production ?

Alan

What Canadian tar sands numbers are you using? Someone in a Drumbeat mentioned that tar sands production was down in 2008 relative to 2007. Do you have any numbers on this? Do you have any hard data showing tar sands production is up in 2008?

I used data from the EUB up to December 2007 but I don't have the link handy right now, I'll post it later.

I'll check on the site for the 2008 numbers.

Ok, I've found the source (National Energy board):

http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/sttstc/crdlndptrlmprdct/stmtdprd...

you will need to add the entries named AB NON-UPGRADED BITUMEN and AB UPGRADED BITUMEN and multiply by 6.2929 in order to get a production in barrels per day.

It seems that it has been revised downward significantly for the Non-upgraded bitumen figures but I don't know why, my numbers where more optimistic by 150 kbpd:

for 2007 (kbpd):

1107 1187 1257 1133 1064 1056 1158 1329 1243 1215 1200 1217

for 2008 (projections):

1220 1114 1259 1203 1210 1221 1255 1294 1323 1406 1426 1451

data for 2008 are only forecasts.

You will notice in my post below (little table shown) that Canadian production is not doing well in January 2008. The lower tar sands numbers would seem more likely than high ones.

Thanks!

To an outsider, when they hear statements about "oil production" and so forth there is much confusion, and many people do not realize that "all liquids" includes even water (if counting Orimulsion and not adjusting for water mixture.)

To me, when I hear "oil" I interpret that to mean the liquid that comes out of oil wells, not some other hydrocarbon produced through the acrobatics of chemical engineering.

Here is a primer on whats included in the EIA oil numbers, also linked above. Tar sands are part of C+C, but Orinoco emulsion is part of 'other liquids'. We really ought to challenge the EIA to report this data in ways that are more meaningful. To ask them to do 'net energy' reporting would be too much. But they at least could handicap the increasing amounts of NGPL and ethanol by the much lower BTU content. A barrel isn't a barrel in its impact on society after all.

If Tar Sands is taken out of Crude and Condensate, then we lose the Canada total (unless we can get EIA to give us an all liquids total for Canada, including the Tar Sands + Biofuels). At least we can get the total data pretty easily this way.

It's the same old problem of comparing energy apples and oranges. Things can not be compared if they are different. Peak Oil is about conventional oil production. If non conventional oil is added in, it is an invalid comparison and illogical.

Hubbert was talking about conventional oil and the historical data is for conventional oil as far as I know since unconventional oil is relatively recent. It is invalid reasoning to base Peak Oil on conventional oil data and then at some late date throw in non-conventional sources and say there is a new peak in oil production. It is comparing energy apples and oranges and a big no no.

The valid approach is to keep separate data for non conventional oil from tar sands and such and also ethanol for example. Then do a Hubbert type of analysis for those types of liquid energy just as one might do for coal for example. Things that are significantly different can not be compared. It is a logic error to do so and invalidates the result. Logic rules, not numbers. Logic tells numbers what to do. Do not let numbers dictate logic.

Significantly different things can not be compared or mixed. If it is done, for whatever reason, the result is nonsense. This is an important concept. It appears that even government agencies have a difficult time grasping it. Or maybe they do understand and make the mistake on purpose to confuse the sheeple and obfuscate what is really going on.

X - We agree!!

(note, ethanol not mentioned in your post)

Nate, are you sure about this? Orimulsion, which is no longer produced, was part of "Other Liquids" but I believe heavy oil produced from the Orinoco Bitumen is considered crude oil just like oil from the oil sands.

Ron Patterson

I was sure about Orimulsion because of my links in my post from 2 years ago. Not sure about heavy oil - presumably that is in C+C. When did Orimulsion stop being produced?

It was phased out in late 2006. They could get much more money for the goo by converting it into crude oil than using it as boiler fue.

Venezuela to phase out production of Orimulsion boiler fuel

Ron Patterson

IOW, compared to 2006 (when I wrote that post), in 2008 ALL Venezuala production is now in C+C, whereas in 2006 and before, some fraction was in 'other liquids'.

What had confused me is that EIA, in their definitions, still list Orimulsion. I guess they leave it in there for historical reasons.

No doubt Robert is vindicated. I think time after time Robert has been proven to be the best predictor on this site.

http://www.youtube.com/watch?v=YwEMxYggoKQ

Now I know I am in trouble-I am starting to find you funny. I can't figure out if you are posting from a frat room or from a Junior High classroom, but your comments are getting funnier.

My guess is junior high classroom.

Laughter is the best medicine. Hey if I can give you a laugh no matter how it comes, then cool. :) Alright peeps, gotta take off for a bit, have to head to Europe for work. Peace out.

At least when the predictions pertain to oil production..

(Of course, he is only one on staff that works (worked) for an oil company...)

R^2 is the Alan Combs of TOD. He's the token sane person they add for balance.

Robert is not "vindicated" yet by a long shot. As the discussion right above your comment demonstrates, the crude peak remains May 2005 once you remove the synthetic stuff from Canada's tar sands which is in no way, shape, or form "crude" oil.

All liquids is rising because of tar sands, ethanol, biodiesel, etc. The problem with many of these is the environmental atrocities committed to create them.

It is interesting to note that most of this gain came from OPEC. Though non-OPEC nations, since May of 05, Azerbaijan and Russia were up 506,000 bp/d and 459,000 bpd respectively, non-OPEC as a whole was actually down 997,000 bpd since that date. The largest gainer was Angola, up 822,000 bp/d since May of 05.

According to most reports out of Russia, they have peaked, at least for the short term. January Russian production was down 161,000 bp/d from their latest peak in September of 07.

Ron Patterson

Russia and China look liked a lot they are peaking.

Chirs Skrebowski was forecasting a peak for China in 2007 I think. More oil imports for China?

China March imports up 15% from last year according to Drumbeat item

Just a little caution on short-term Russian declines. I seem to remember that they have some production difficulties in winter months, and if this has been a more than recently normal hard winter then this may have effected some of the numbers, even y-o-y.

I wrote: non-OPEC as a whole was actually down 997,000 bpd since that date. The largest gainer was Angola, up 822,000 bp/d since May of 05.

Sorry, I did those figures before I updated all my spreadsheet. Non-OPEC is actually down 470,000 bp/d since May of 05. The EIA updated all OPEC data all the way back to 1997. It had something to do with Ecuador. I have got to slow down and make all changes before I post them. My error, sorry.

Ron Patterson

If the new drilling techniques being used in the Bakken shale formation work on other formations,it would push Peak Oil back indefinately. The U.S. has 3X current Mideast oil reserves locked up in shale.

"Oil companies began sharing technology about two years ago on how to recover the oil. The technology involves drilling vertically to about 10,000 feet, then "kicking out" for as many feet horizontally, while fracturing the rock to release the oil trapped in microscopic pores in the area known as the "middle" Bakken."

http://www.cctv.com/english/20080411/105608.shtml

HaHaHaHa!!

Oh, you're serious...

Well first, one needs to distinguish the (probably less than) $4 GB of Bakken oil trapped in shale from the vast "oil shale" where one has to dig it out and barbecue it before it becomes something usable. Oh, never mind.

HaHaHaHa!!

You didn't read the link I provided JoulesBurn. They aren't digging up the shale in Bakken. New drilling techniques allow them to tap it. If the same can be done for other shale deposits,it will delay Peak Oil quite some time,true or false?

Well, you didn't read my post.

Your link (Dateline Beijing?) has the same story reported yesterday. Your 3X Mideast assumption includes what, per chance?

False - Bakken is not an oil shale, it is an oil deposit in ordinary shale rocks (that have very low porosity). Since the oil is still a liquid, it is possible (using a lot of money and energy) to get at it through drilling.

The Colorado 'oil shale's are solid form of hydrocarbons, which require an order of magnitude more energy and money to mine and convert into liquid fuels. There is no liquid fuel in those deposits.

Think of the Colorado deposits like the Canadian tar sands; Bakken is a really crappy (and possibly fairly large) oil field.

"The Colorado 'oil shale's are solid form of hydrocarbons, which require an order of magnitude more energy and money to mine and convert into liquid fuels. There is no liquid fuel in those deposits."

Thanks for the info Hindmost. Still,it doesn't mean Colorado shale won't be tapped eventually. These drilling techniques to get at the Bakken deposits weren't available 3 years ago. People can be damn creative when the price is right.

I disagree. IMO wind energy (and others) will always be more worthwhile than shale, especially since that will continue to develop as the energy squeeze tightens.

The horizontal drilling part has been around a while, I think what may help more is the slickwater frac job. By changing the composition of the fluid to make it thinner and more slippery they are able to drive the proppant further back into the frac.

The oil shales will most likely be tapped in the same manner as our other major solid fossil fuel deposits: mining.

Despite the name they really compete more with coal than with crude oil.

Hindmost. What a wonderfully clear and concise explanation.

False. It's all about flow rates.

As I have previously noted, in 1956 Hubbert found that a one third increase in estimated Lower 48 URR from 150 Gb to 200 Gb delayed the projected peak by all of five years.

If we round off the upper end Bakken estimate to 5 Gb, and assume that it was pretty much fully developed in 1970, it would have therefore delayed the Lower 48 peak by about six months.

And you need to consider that these are very expensive wells, relative to fairly modest production rates, after the initial peak production period, and we will need a lot of them at the same time that we are facing personnel and equipment bottlenecks.

Also, we need to keep in the mind the difference between Kerogen deposits, e.g., the Green River Formation, and thermally mature oil reservoirs, e.g., the Bakken Formation.

Any way you slice it, maintaining an infinite rate of increase in our consumption of a finite resource base tends to be difficult to achieve--at least outside the special world that people like Peter Huber live in.

By all means, let us exhaust what little capital is available to maintain our God given need to infinitely increase our consumption. Let us not consider whether or not the required billions to explore and drill Bakken, not to mention futile attempts to bake oil out of shale in Colorado, might be better utilized in conservation, efficiency, and in further attempts to make renewables like wind and solar more competitive. For, indeed, if oil were not infinite, God would not have given us the ability to drill and bake in the first place. It is not a cruel God; it is merciful and has blessed us with infinite abundance ( except for that brief little blip where we thought we had peak production in the U.S.).

FALSE.

Bakken Not Giving It Up

It appears there's a lot of oil down there. It also appears not much is ever going to come out. They're looking at getting out about 1% of OIP.

Cheers

Expensive is right; the initial - or older - figures for wells I'd seen were ca. $2 million; latest batch of news articles have prices more like $6. Last year when we were wholly in the dark about what could be pulled out of the Bakken it seemed like tens of thousands of wells could do some real good if the URR were high enough. Nope!

I'm constantly seeing the conflation between Bakken oil (API as high as 42 - good stuff) and shale, too. Also the odd bit of tinfoil liner on baseball caps. OF COURSE the low figure is a conspiracy to hamper domestic production! Just like Gull Island!

Wonder why Price was so far off, though - his low figure was 271 bbls.

I dunno much about Bakken production but I keep checking the mailbox - they brought in a 1,200bbl/day well on my family's land in North Dakota and the royalty check is due ...

Right now, Bakken flow rates are around 100,000 bbl/day. They are hopeful for 250,000 bbl/day in a few years. Not quite so earth shattering is it? As everyone is saying, it looks like a really crappy formation with a lot of mumbo-jumbo needed to coax the oil out.

Imagine how much (useful!) plastic we could make from that?

Let use it to make plastic instead of burning it. Oh wait, that's not our decision. My bad.

That's about $49,000,000 a year. What are typical royalties? If you get a dollar per barrel, that's about 438k a year. Ten cents a barrel would eliminate the need for a job for one family.

Let us know what it's like in Beverly Hills, Jed.

Lucky bastards...

:)

Cheers

To the mineral rights holders somewhere between one quarter [one quarter would be for a a hot prospect in a hot area -- more of those in the late seventies] to one eighth [the old standard now much less common in TX or OK except for on old leases held by production].

Most of what I have seen lately are three sixteenth leases sometimes with some small additional overrides attached.

If SCT and his family have the whole unit, they could indeed be headed for the "Hills of Beverly" if so inclined. Personally, I'd wait to see what happens after initial flush production, but one tenth that rate with no expenses would be a very tidy sum.

Do these contracts pay off of market price? At 1/8 that would be nearly half a million/mo.

Lordy be...

There are a lot of newly rich in the area of that basin, if so.

Cheers

Probably close to "market" if you are defining market as the NYMEX WTI headline number as market. In ND or MT there may also be severance taxes payable to the state -- OK takes about seven percent -- otherwise the mineral rights owners take their cut right off the top.

The gathering company gets a cut [somewhere around two dollars off WTI in central OK -- adjusted for gravity and sulfur if out of specifications].

ND or MT oil probably sells at a discount, but if the discount gets too large I suspect the producers will make other arrangements. I was told that Elm Coulee, MT Bakken oil is great stuff, light at 42 degrees and sweet. There should not be a problem [longer term at least] for finding a receptive market for this oil. Just conjecture, but shorter term a local glut due to availability of pipelines may result in a bigger discount.

I read the report last week and remember a figure of 3.65 billion barrels recoverable. From memory the consumption in the US is 20.5 million barrels/day. So dividing 3,650 million by 20.5 gives 178 days or about 6 months, if my memory, maths and calculator are correct. I wouldn't call 6 months "indefinate".

I have recently seen lots of share tippers pushing this, usually mentioning the huge quantities 500 billions but never the recoverables of 3.65!! not a surprise really.

Do you understand permeability? Porosity? Flow rates? No? Then you're just repeating BS from someone trying to hype a bad stock play. The oil companies have known there is oil in the Bakken formation for a long time. But the physics of the rock won't let it come out at anything other than a tiny trickle.

Horizontal drilling, which is what you describe, is decades old. It's not some new super secret magical tech that will make the Bakken produce anything approaching useful amounts of oil.

The US uses 21 MILLION barrels of oil per day. The Bakken may add a few tens of thousands of barrels per day to our production. Do you understand what that means?

Horizontal drilling has been recently improved with Stacked fracturing (multi-stage fracturing).

http://nextbigfuture.com/2008/02/multi-stage-fracturing-of-horizontal_29...

This is what is making the Bakken economically viable and increasing flow rates.

Each of the new wells is producing about 200-2000 barrels of oil per day.

The success ratio for the wells is high.

Flowrates declining to an average of 60% of initial flow.

At 400-1000 wells per year (USA and Canada) this could be quite significant into the hundreds of thousands of barrels over 2-3 years. It will take 5 years for pipelines and refinery expansions to be put in place.

10 years at 1 million b/d for the 3.65 billion (US only) avg estimate with todays technology. The Canadian also seems to be multi-billion barrel.

US and Canada combined seems like Bakken without improved tech could go to 1.5 to 2 million b/d in about 5-7 years and last at that rate for another 8 years.

Going beyond the 3.65 billion US figure. It seems that the remaining oil should be easier to go after than straight shale formations. There is a massive multi-trillion motivation to get to better technology to get at that oil. Between 1995 and 2008 the technology and price improved to allow 25 times more oil to be accessed economically.

You are using all of the most optimistic numbers possible and still all you get is 2 mbpd MAX from Bakken for a few years. Whoop-dee-doo. On the global scale that doesn't amount to squat, given BRIC increasing consumption.

However, I don't see that 2mbpd happening because drilling costs rise as rapidly as price, as the rest of the industry is discovering. You can't assume a $150 per barrel price gives sufficient incentive if the costs rise proportionately, can you?

And there is still a problem in proving those flow rates will scale. That's one reason the majors have been very leery of Bakken.