Peak Oil Update - August 2008: Production Forecasts and EIA Oil Production Numbers

Posted by Sam Foucher on September 13, 2008 - 8:00pm

An update on the latest production numbers from the EIA along with graphs/charts of different oil production forecasts.

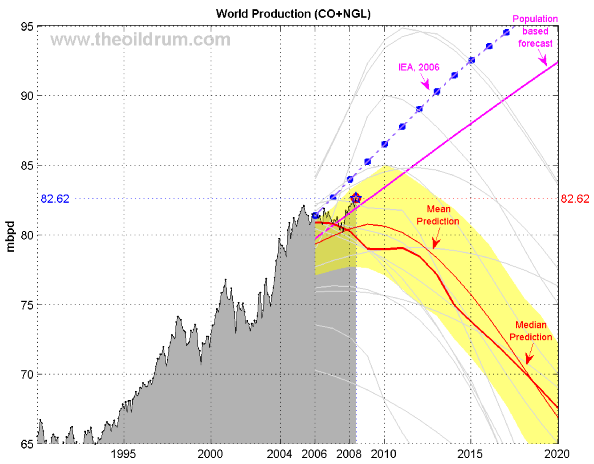

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 14 models that are predicting a peak before 2020 (Bakhtiari, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45], Robelius Low/High, HSM). 95% of the predictions sees a production peak between 2008 and 2010 at 77.5 - 85.0 mbpd (The 95% forecast variability area in yellow is computed using a bootstrap technique). Click to Enlarge.

Notations:

- mbpd= Million of barrels per day

- Gb= Billion of barrels (109)

- Tb= Trillion of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO= Crude Oil + lease condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (May)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy 2006 (Crude oil + NGL).

- EIA data (monthly and annual productions up to May 2008) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

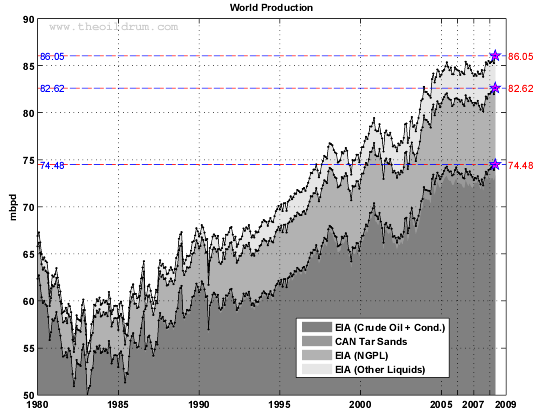

The all liquid peak is now May 2008 at 86.05 mbpd, the year to date average production value in 2008 (5 months) is up from 2007 for all the categories. The peak date for Crude Oil + Cond. is also May 2008 at 74.48 mbpd (see Table I below).

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

| Category | AUG 2008 | AUG 2007 | AUG 2006 | 12 MA1 | 2008 (5 Months) | 2007 (5 Months) | 2006 (5 Months) | Share | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|---|---|

| All Liquids | 86.05 | 84.11 | 84.18 | 85.03 | 85.49 | 84.07 | 84.30 | 100.00% | 2008-05 | 86.05 |

| Crude Oil + NGL | 82.62 | 80.73 | 80.87 | 81.54 | 82.22 | 80.96 | 81.24 | 96.02% | 2008-05 | 82.62 |

| Other Liquids | 3.42 | 3.37 | 3.30 | 3.49 | 3.27 | 3.12 | 3.06 | 3.98% | 2007-06 | 3.81 |

| NGPL | 8.14 | 7.96 | 7.78 | 7.99 | 8.05 | 7.97 | 7.77 | 9.46% | 2008-05 | 8.14 |

| Crude Oil + Condensate | 74.48 | 72.77 | 73.09 | 73.54 | 74.17 | 72.98 | 73.47 | 86.56% | 2008-05 | 74.48 |

| Canadian Tar Sands | 1.10 | 1.09 | 1.02 | 1.19 | 1.16 | 1.15 | 1.06 | 1.28% | 2007-08 | 1.35 |

Table I -

Production

estimate

(in millions of barrels per day (mbpd)) up to May 2008 taken from

the EIA website (International

Petroleum Monthly). 1Average

on the last 12 months. Canadian tar sands production numbers are from

the NEB and includes updagraded and

non-upgraded bitumen.

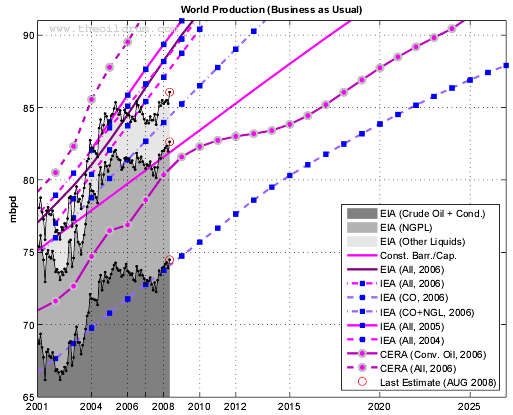

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2006 : forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004 : forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.4496 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 4.- Production forecasts assuming no visible peak. Click to Enlarge.

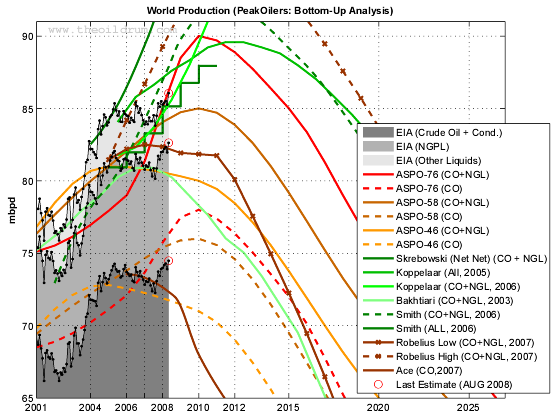

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

- The ASPO forecast from April newsletter (#76): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively).

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (was at the Energy Institute, now works for EnergyFiles) for CO+NGL, the data have been taken from this chart in this presentation (The Future for Global Oil Supply (1641Kb), November 2006.).

- PhD thesis of Frederik Robelius (2007): Giant Oil Fields - The Highway to Oil: Giant Oil Fields and their Importance for Future Oil Production. The forecasts (low and high) are derived from this chart.

- Forecast by TOD's contributor Ace, details can be found in this post.

Fig 5.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

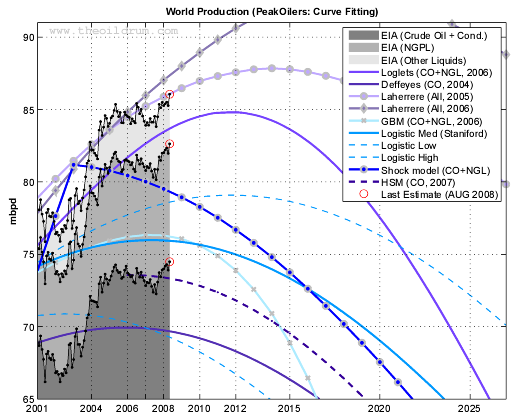

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006). World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions ; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here as well as a review on TOD. The current estimate was done in 2005 based on BP's data (CO+NGL).

- The Hybrid Shock Model is a variant of the shock model described here. The forecast is based on EIA data (up to 2006) for crude oil + condensate, the ASPO backdated disovery curve and assumes no reserve growth and declining new discoveries.

Fig 6.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

| Forecast | Date | 2006 | 2007 | 2008 | 2010 | 2015 | Diff2 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|---|

| All Liquids | |||||||||

| Observed (All Liquids) | 84.54 | 84.44 | 85.49 | NA | NA | 2008-05 | 86.05 | ||

| IEA (WEO) | 2004 | 83.74 | 85.41 | 87.08 | 90.40 | 98.69 | -2.34 | 2030 | 121.30 |

| IEA (WEO) | 2005 | 85.85 | 87.64 | 89.35 | 92.50 | 99.11 | -4.61 | 2030 | 115.40 |

| Koppelaar | 2005 | 85.78 | 86.61 | 87.60 | 89.21 | 87.98 | -2.86 | 2011 | 89.58 |

| Lahèrrere | 2005 | 84.47 | 85.23 | 85.87 | 86.96 | 87.77 | -1.12 | 2014 | 87.84 |

| EIA (IEO) | 2006 | 84.50 | 86.37 | 88.23 | 91.60 | 98.30 | -3.48 | 2030 | 118.00 |

| IEA (WEO) | 2006 | 85.10 | 86.62 | 88.17 | 91.30 | 99.30 | -3.42 | 2030 | 116.30 |

| CERA1 | 2006 | 89.52 | 91.62 | 93.75 | 97.24 | 104.54 | -9.01 | 2035 | 130.00 |

| Lahèrrere | 2006 | 84.82 | 85.96 | 87.02 | 88.93 | 92.27 | -2.27 | 2018 | 92.99 |

| Smith | 2006 | 87.77 | 90.88 | 94.38 | 98.94 | 98.56 | -9.63 | 2012-05 | 99.83 |

| Crude Oil + NGL | |||||||||

| Observed (EIA) | 81.28 | 81.01 | 82.22 | NA | NA | 2008-05 | 82.62 | ||

| GBM | 2003 | 76.27 | 76.33 | 76.20 | 75.30 | 67.79 | 5.16 | 2007-05 | 76.34 |

| Bakhtiari | 2003 | 80.89 | 80.89 | 80.24 | 77.64 | 69.51 | 1.12 | 2006 | 80.89 |

| ASPO-46 | 2004 | 80.95 | 80.80 | 80.59 | 80.00 | 73.77 | 0.78 | 2005 | 81.00 |

| ASPO-58 | 2005 | 82.03 | 83.10 | 84.05 | 85.00 | 79.18 | -2.69 | 2010 | 85.00 |

| Staniford (High) | 2005 | 77.92 | 78.31 | 78.63 | 79.01 | 78.51 | 2.74 | 2011-10 | 79.08 |

| Staniford (Med) | 2005 | 75.94 | 75.97 | 75.91 | 75.52 | 73.00 | 5.45 | 2007-05 | 75.98 |

| Staniford (Low) | 2005 | 70.13 | 69.71 | 69.20 | 67.92 | 63.40 | 12.17 | 2002-07 | 70.88 |

| IEA (WEO) | 2006 | 81.38 | 82.67 | 83.96 | 86.50 | 92.50 | -2.60 | 2030 | 104.90 |

| Koppelaar | 2006 | 82.31 | 83.68 | 85.60 | 91.00 | NA | -4.23 | 2010 | 91.00 |

| Skrebowski | 2006 | 81.45 | 82.62 | 84.20 | 87.35 | NA | -2.84 | 2010 | 87.95 |

| Smith | 2006 | 82.81 | 85.45 | 88.27 | 91.95 | 88.60 | -6.90 | 2011-02 | 92.31 |

| Loglets | 2006 | 82.14 | 83.02 | 83.74 | 84.65 | 83.26 | -2.38 | 2012-01 | 84.80 |

| ASPO-76 | 2006 | 79.00 | 81.35 | 85.06 | 90.00 | 85.00 | -3.70 | 2010 | 90.00 |

| Robelius Low | 2006 | 82.19 | 82.50 | 82.35 | 81.84 | 72.26 | -0.98 | 2007 | 82.50 |

| Robelius High | 2006 | 84.19 | 86.67 | 89.27 | 93.40 | 92.40 | -7.90 | 2012 | 94.54 |

| Shock Model | 2006 | 80.43 | 80.01 | 79.51 | 78.27 | 73.74 | 1.86 | 2003 | 81.17 |

| EWG | 2007 | 81.00 | 80.45 | 79.78 | 78.06 | 69.21 | 1.58 | 2005 | 81.41 |

| Crude Oil + Lease Condensate | |||||||||

| Observed (EIA) | 73.48 | 73.05 | 74.17 | NA | NA | 2008-05 | 74.48 | ||

| ASPO-46 | 2004 | 72.56 | 72.25 | 71.89 | 71.00 | 63.55 | 1.49 | 2005 | 72.80 |

| Deffeyes | 2004 | 69.92 | 69.83 | 69.64 | 69.01 | 65.98 | 3.73 | 2005-12 | 69.94 |

| ASPO-58 | 2005 | 73.80 | 74.65 | 75.39 | 76.00 | 69.50 | -2.02 | 2010 | 76.00 |

| IEA (WEO) | 2006 | 71.78 | 72.77 | 73.76 | 75.70 | 80.30 | -0.38 | 2030 | 89.10 |

| CERA1 | 2006 | 76.89 | 78.60 | 80.35 | 82.29 | 83.83 | -6.97 | 2038 | 97.58 |

| ASPO-76 | 2006 | 72.10 | 73.66 | 75.74 | 78.00 | 72.00 | -2.36 | 2010 | 78.00 |

| HSM | 2007 | 73.56 | 73.53 | 73.40 | 72.82 | 69.53 | -0.02 | 2006 | 73.56 |

| Ace | 2007 | 73.48 | 73.03 | 72.18 | 66.96 | 58.47 | 1.20 | 2006-01 | 73.55 |

Previous Update:

December 2007OilWatch last issue:

This is one of the most well put together reports I've seen yet. I really like the way you lay out the graphs and the data. I haven't gone through it with a fine toothed comb yet, but I wanted to commend your efforts.

Chris Martenson has done a great job of illustrating the value of various oil sources various oil sources. I highly recommend you watch his entire presentation.

Totally invalid apples and oranges comparisons again. Things that are different can not be compared, added, subtracted, multiplied or divided. If they are the result is silly nonsense.

Grain return on grain invested is a similar commodity related invalid concept. Also metal return on metal invested. Energy, grain and metal are groups of commodities which exist only in the abstract.

Corn can not be compared to soybeans. They are different. Each has a different price, use and characteristics. Iron can not be compared to gold for the same reasons. And wind can not be compared to oil or ethanol for the same reasons. They have different prices, unique characteristics and unique utilities.

Try buying grain, metal or energy. It can not be done. Only specific individual forms of energy, grain or metal can be traded in the real world. Energy in the abstract may be valid in a mathematical/physics sense but in exists only in its forms in the real world.

These forms are different. Energy out/energy in as invalid and useless as grain out/grain in or metal out/metal in.

Just because something can be measured and quantified does not mean that it can be compared validly. Logic rules numbers. When logic says the numbers are invalid, it makes no difference if they add up; they are wrong.

Why wasn't fossil fuel electricity included in these invalid comparisons?

Was it because it would make ethanol and hydrogen look good?

Logically, comparison is always possible. But your point that some comparisons give more insight than others is well taken.

Also, I see some value in some of the comparisons you say make no sense.

Methanol, Biodiesel, Tar sands, oil shale, corn ethanol all produce similar products. Lump together in right proportions (Biodiesel and ethanol) and you got three groups (Biodiesel and ethanol), (Tar sands), (Oil shale) that produce similar products although the byproducts are very different.

A short while ago oil was used to produce electricity so oil where used instead of sun and wind.

This is a misguided critique of Chris Martenson's comparisons. The point CM was making was about how much energy a society has left over to spare on discretionary uses. It really doesnt matter so much whether that energy be apple-energy or pear-energy if there's almost none anyway. And CM rightly points out that the solar and wind that are nicely up top cannot be poured into your tank anyway. (Not sure he mentions the scaling up problem but then it's a crash course.)

>>...solar and wind ... cannot be poured into your tank anyway<<

While solar and wind can not be poured into a gas tank, solar can be used to offset electricity demand through solar collectors for home heating and hot water. The resulting savings in electricity can be used to power an electric vehicle (EV). All this without increasing the need for more utility generators.

A typical sedan will go approximately 3 to 4 miles on a kilowatt hour of electricity. If 90% of us commute less than 30 miles, then we are talking about 10 KWhr which should be easy enough to save through home solar installations.

A while back, I roughly calculated that if the output from a PV array were fed directly into an EV, The payback at 15% efficiency was about 8 years. This is without any government subsidy. The trick is to be able to directly refuel your EV from solar.

After Gustav gets through with the Gulf infrastructure, and gasoline prices climb, EVs operating at 2 to 3 cents a mile will be looking good. The good news is that a number of conversion shops are starting to spring up and a number of new and old car companies have EV and Plug in Hybrid EVs (PHEV) on the way.

Conversion shops are started where someone asks their mechanic if they would convert a car or truck to all electric. Amp Mobile Conversions (http://www.ampmobileconversions.com/) was started this way. In other cases a person picks up a copy of "Convert It" by Micheal Brown and Sheri Prange and does it themselves. When successful, the person is sometimes asked to do one for a neighbor.

Companies such as IBM and Cisco are putting in electrical outlets in their parking lots for free for employees who drive EVs. If you drive an EV, ask your employer if you can plug in or if they would install an electrical outlet for you.

Nanosolar is now concentrating on 2-10MW systems, which are low cost.

The installation of one of these systems, which many factories and offices have enough roof space for, would allow their workers cars to be recharged at considerably less cost than home systems - both because maintenance and operation are cheaper at this scale, and because the charging could take place during the day when the car is at work.

In hot areas it has even been found that people are prepared to pay enough for shaded parking that it can pay for a solar covering to the car park!

Nissan, Renault, Mitsubishi and lately Toyota have announced plans for mass production of EV's.

The first ones are due in 2009.

Luxury Electric claim that their car can be charged in 10minutes for a 140mile run from a normal power outlet,although how the heck they put that much power through a normal outlet is not clear.

http://www.transport20.com/electric-vehicle/luxury-electric-to-drive-a-l...

Luxury Electric to drive a long-range electric car across the U.S.A. » Transport 2.0

You can't logically ignore the capital costs of solar and wind. Both are around $3/watt and work only 20% of time so you need $15/watt. You lose atleast 20% energy during the most efficient storage (batteries) so the cost is $18.75/watt. Then add the maintenance cost which would be atleast 12.5% of the capital cost, so the total cost is %21/watt. Then add the cost of the battery which would be atleast 12.5% of the cost above. This takes the total cost to about $24/watt.

This system work for 30 years before total replacement and produce:

30 years x 365 days/year x 86400 second/day = 947 MJ energy

Each one dollar in gdp consumes 10 MJ energy (divide world/country/province gdp by world/country/province energy consumption) so each watt capacity above contributes $94.7 over a period of 30 years.

This is a ROI of less than 400% in 30 years or a linear 13.16%/year or an exponential 5%/year. Thats ROI in overall GDP of country. Given that each barrel of oil contributes about $600 in gdp and maximum per barrel oil price in history is $150 which is 25% of its contribution in gdp we can assume that the owner of solar cells or wind mill will only get at maximum 3.25% linear ROI per year.

I got one reply wiped as the site went down, but briefly, there is plenty of power available at least in the States to run EV's or hybrid's without extending the grid or solar, according to a recent study 84% of cars could be hybrid before the grid would need improving.

On the specifics of solar as suggested, thin film from First Solar costed around $1.29 watt in 2007 - figures are not available for Nanosolar.

PV maintenance costs are also low - and the configuration suggested is optimised for this.

The power also would not need transmitting or stepping down, as it is produced exactly where it is needed, saving cost, and although intermittency means it is only available 20% of the time, that is exactly when it is wanted.

The batteries are also paid for in the price of the car, or by a battery hire system which works out a lot cheaper than petrol.

Your calculations also take no account of the far greater efficiency of running an electric car rather than an ICC car, so you need a fraction of the power - only around 1kwh for 3-4 miles.

Finally, you appear to take no account of the inefficiencies of power generation with fossil fuels, which is 40% if you are lucky, and so counteracts around half of your losses for the 20% efficiency of solar due to intermittency.

But all that lot falls very short of an answer to that opening phrase. There's a huge investment in things with gasoline/diesel etc tanks, not just millions of cars but also other rather pricey vehicles and machines. And then there's the supply infrastructure to be added. All that lot amounts to a daunting investment even for a thriving economy let alone one which is in substantial recession. Most of those empty tanks are not going to find electric replacements, my bet. And hence as I stated, C Martenson's point is valid.

I would not see at smooth transition to an all-electric fleer of vehicles in a use pattern similar to todays' either.

But the good news is that this is because we have made a mess of the financial environment, and fatally delayed transiting from fossil fuels.

This means that most will probably be using electric bikes and scooters rather than being able to afford a car, but delivery vehicles, emergency vehicles and taxis should be perfectly capable of being run.

This is a much brighter future than one where that is not the case, and has the additional advantage that the power requirements of this use are even lower than for EV cars, so the grid will need less power and we have more time to build alternative generating capacity.

Is it just me, or are things seeming a little more urgent lately?

A great example of how limited our predictions for the future can be. Perhaps it has been mentioned before on TOD but I, like many others I'm betting, had typically thought of EVs being recharged at home because the recharging cycle could be scheduled for off peak generation. Recharging during working hours has its problems in stressing the electric grid and peak generation capacity.

Solar generated electric has a long way to go with regards to cost per watt. (I think that is the measure:) Home solar is still a niche market and more of a good faith effort to move solar forward than to save money. By taking advantage of the commercial scale of solar installation and integrating it into the company's workplace as either a cost free benefit (perhaps the IRS would be willing to not tax the value of that benefit:) or a low cost benefit that helps to subsidize the installation costs is a win win situation. Not to mention a huge shot in the arm for the solar industry.

Let's take it one step further and consider the problem of compressed natural gas replacing a significant portion of gasoline usage. That problem being distribution of refueling facilities. Let's put in natural gas fueling facilities on company parking lots. Again, you have the advantage of scale (if the number of work vehicles is large enough). It will be a balancing act between the number of pumps vs the number of vehicles and how many need to fuel up each day. Still, think of the huge number of gas stations throughout the country that don't have the customer volume to add natural gas. Medium to large companies can help considerably in achieving the critical mass of fueling stations for natural gas to take off.

The thought of using canopies as a dual system to reduce heat buildup in cars and as a platform for solar panels solves the not insignificant problem of protecting the users of a charging station from being electrocuted during a rain storm. You also solve the square footage limitation on company building rooftops to install solar panels on.

I don't want to imply this is a done deal. I'm saying there are a significant number of ways to think a bit outside the box and some will be home runs. Leaving many of us to slap our heads and say "why didn't I think of that!"

Hmm, parking garages?

In London they have been trialling a system with public points for recharging, and there have been no reports of fried drivers that I have heard of!

Correct design appears to be able to deal with that one.

As for the cost of solar power, if you are recharging cars at work you have the not-inconsiderable advantage of having the power right where you want if, right when you want it.

In Berlin the system they are putting in there will be able to accept current back from the cars, so that sophisticated charging/discharging systems can use some of the vast storage capacity that would be available to balance out very short term fluctuations in the grid.

A lot of he synergies seem to be very hopeful.

Fossil fueled anything isn't sustainable, and that most definitely includes ethanol ... and ethanol produced using ethanol as an energy input is totally impractical ... and on Earth hydrogen is not a fuel but a battery, so it will never look good as a fuel.

Do you even understand where the word Fossil comes from?

Hint, it doesn't come from any step in Ethanol production.

Not advocating nothing here, just making sure idiocies don't spread out too much.

Err ... Mr 'Troll' .... just to make sure idiocies don't spread out too much ... I think you will find that the agricultural equipment, road transport, agrichemicals, fertilizer, natural gas etc used in the manufacture of ethanol from corn are ALL fossil fueled and manufactured and mined using fossil fuels, and ethanol from oil refineries definitely comes from fossil fuel!

Do you understand how crops are grown, ethanol is made or liquid fuels containing 'net energy' are obtained ... from your comments, I think not?

Oh ... and if you think that 'net exports' of crude + concentrate (the stuff that fuels most of the world's transport and the stuff that 'Peak oil' is about, not 'all liquids') haven't peaked you are TOTALLY wrong.

That's not completely true. A fair bit of mining machinery(draglines, pumps, crushers, conveyors, slurry pipelines...) used in mineral fertilizer production, rail roads(not so much in the US), grain elevators etc. commonly use electrical power. Much of grid power is derived from fission and hydro; that which is derived from coal can quite easily be replaced with fission without any technological breakthroughs or inventions(ask France or Sweden).

I think you will find that the mining machinery, pumps, crushers, conveyors, slurry pipes, hydro dams, nuclear reactors, rail roads, grain elevators and even windmills all use FF somewhere in their manufacture, or the workers do in their vehicles, even if the electricity comes from nuclear (which, in most countries, it doesn't).

At present fossil fuel is ubiquitous and I think you will find, if you ask the French, that during construction and decommissioning of nuclear power stations a lot of fossil fuel is used.

I think you'll find that nearly all energy sources use nearly all other energy sources somewhere in their production. The amounts involved in the case of nuclear and hydro are trivial; see for instance vattenfall's EPD data for their nuclear plants.

Hydro is indeed quite low. But not nuclear. Denholm has investigated the literature and found various flaws in lifecycle analysis. These were corrected and nuclear was found to require between 0.1 and 0.3 kWh thermal for every kWh electrical output. That is definately not trivial. But doable.

Eh, life is not sustainable for inevitably you die.

Sustainability is a red herring.

You use what you got.

When it runs out you find something else.

If you want to build intricate, delicate societies predicated on sustainable supply of anything, you got heap big problems in your basic model.

You are all looking for the perfect world where nothing challenges your comfort and desires.

"You are all looking for the perfect world where nothing challenges your comfort and desires".

Not me. A simpler world would suffice... Do we really need ALL those gadgets, the ability to fly anywhere anytime, fast food, huge investment portfolio... ?

Nah. Good friends, loving family, food on the plate. That'll do.

Regards, Matt B

All the EROEI hysteria is non-sensical, so your comment isn't even a red herring. With a red herring, people notice there is a problem. Not so here on TOD, where Olduvai and "Relocalization" is the dogmatic truth, and EROEI, Jevon's Paradox, Demand Destruction "attrition" (or whatever), and other things like that are mantras that are part of the ritual of gathering in here and spewing pessimistic excel scenarios while uttering frantically the expressions "oh, OMFSM, we are so fukd'up! We're so gonna die!"

Appeals to emotion, excluded middles, dead wrong economical analyses, etc., etc.

And a vote system to easily herd the sheep to automatically "censor" questioning comments without actual censoring.

Spewing pessimistic excel scenarios? lol.

And yet you feel the need to attack what's going on here on this forum? Hey, at least we can type and (presumably) find the United States on a globe. It gets much worse...

Curiously, I think most of the posters here are far too optimistic...

I see a massive systematic extermination being carried out on a global scale against the entire species. Everyone's bodies are infected with a hundred different industrial chemicals, swarming with genetically modified bacteria, and being bombarded by ungodly amounts of electromagnetic radiation. But of course it's all just a random set of coincidences and unintended consequences. There's no malice in this! Like I said, I think most of the posters here are far too optimistic...

There's a word for you: paranoia times infinity.

I know you are, but what am I? (a schoolyard taunt or a Shakespearean Zen koan?)

Dear Luisdias,

If you would like to express an opinion that's listened to, try not to start it with insults. Not only is it impolite, it tends to put off the folks who would normally be interested in what you have to say. That’s because when you start with insults, folks will tend to write you off as a person who just yells but doesn't have anything concrete to contribute. I find quite a wide range of opinions expressed here and calling them names just won't fly with folks who are using mathematical models as the basis of their work. If you can point out a flaw, then do so.

And just to restate it here in simple terms, there are three basic issues that this Blog seems to concentrate on (Mind you, I'm just a reader):

1) When will world oil production peak?

2) How steep will the roll of be? (The minimum forecast is 2 % to 4% per year)

3) What will we do when it happens? Or stated another way,

Will natural market forces handle the situation or do we need to act together?

That’s it. And as a result they are called Pessimists, Malthusians, Crisaholics, Doomtards and quite a variety of other names I won’t bother to repeat. And for some reason, these three questions create enormous emotional reactions folks like you who (I’m guessing) feel that the market will always handle any situation. And that’s despite the fact that there are many historical examples where it did not: The Great Chicago Fire, The 1917 Flue Pandemic, Wall Street Crash & the Great Depression, WW1, Pearl Harbor & WW2, Korea. The Cold war, AIDS, False SEC filing & Enron’s collapse, 9/11, Katrina and other natural disasters, etc.

As far as EROEI, historical data shows that in until the last few decades, oil companies only had to spend 100:1 to 30:1 of the oil they got out of the ground to produce more, all processing and infrastructure included. Unfortunately, industry wide, EROEI is now heading for 4:1 or 25% of the total (Heavy sour crude, Oil shale, tar sands, outer continental shelf oil, etc.) and production costs have skyrocketed from $1 to $15/bbl to as much as $90/bbl or more & oil's price has risen over $100/bbl 20 years before the optomistic organizations said it would (EIA, IEA, CERA, etc.) That’s an enormous change and, according to folks like you (I'm guessing again), peak oil is still decades away.

How will this affect our industrial society, which is used to only spending 1% to 3% on production and $15 to $30/bbl? You can rail that its nothing to worry about, but if you were a business manager and your production cost increased by a factor of 7 while output fell by 22%, your boss would absolutely expect you to run the numbers to see what both the short and long term effects were.

That’s all the folks here are doing. If you can prove them wrong, they would be thrilled. So try an analytical approach rather than personal attacks, and you will find many willing listeners.

NOTE: CERA and IEA, EIA and other optimistic organizations have stated that the minimum roll off in world oil production will be around 2%. For each 1% roll off, the U.S. energy lost is equivalent to building 16 1GW nuclear power plants each year (7.6 Gbbl x 1% = 76 million bbls/year. 1 GW NPP = 4.5 MMbbl/year). This would consume all of the NPP’s that Senator McCain has proposed to build over 20 yeas in just three, and require 3x as much money annually as Senator Obama has proposed, hence the condern.

I was attacking the blog and making a claim that this is hysterical nonsense. It's nothing personal whatsoever. My problem with this is that there is allegedly millions of readers of this site, and it gets me off by knowing that crazy doomster rationales are being promoted to scare people to death. It's been a while since I've seen this site behaving level-handed and "rationally". Economists are called shills and blow-jobbers, but then the editors feel the need to fill the gap in the economic analysis, resulting not in extensive and comprehensive studies (professionals), but with school yard junk science theories about demand destruction (which wouldn't pass on the very first year) and the likes.

I am no economist, but it is easy even for me to attest that the authors know nothing more of economics than lay people do. And yet, they don't refrain from calling the collapse of the economy! Are you kidding me?

I wouldn't have the time to do anything more. And so you know, I've been probably a much, much longer reader and poster than you are (I don't really care, so I won't check it) and I do know the "issues" quite well. I fully disagree with your "minimum forecast of 2% to 4% per year", it goes against all the main peak oil theory, which predicts an almost bell-shaped production curve of petroleum, but it is one of those maintained mantras in this blog, without any backup whatsoever of evidence. And anytime they predict stuff, things happen exactly the contrary. So why do people still take seriously this kind of rethorics?

Those guys are people who object that there are pretty available solutions right now to the issues at hand, and that by a mix of government leadership and market entrepreneurship, things are doable. By a doomtard, I take people that only look at the bad things of the universe, while ignoring the good news, and still think they are the best positioned to make a good analysis. I love how TOD makes its monthly oil report with the worst message graph they can find in the report. If it is the production which is telling the bad news, go ahead and put it in the first page. If it is the oil stock, then be it so. This is subliminal, and is permanent. Doomsters are people that tell you that in no way oil will top 2005 production, and when you present 2008 numbers, they tell you, "but that was the market, not geology, and that was so low, there's no way we're gonna make it". It's stupid.

It won't of course, that's the excluded middle fallacy of I was referring. Because I'm attacking an hysterical position, people take me as if I am with another hysterical contrarian position. I'm arguing against hysterisms.

You are wrong. In general, there will be some moderate problems, but not much to worry about, and I'll prove it with maths. It will be devastating for all the business managers of Exxon, Chevron et al, but that's life. There's nothing in life which is permanent, and it won't mean the end of the world by a lightyear.

The math analysis is simple. In EROEI, and equating efficiency to mpg (I'm simplifying the issue to better understanding), we had E=100 when we had mpg = 25. If we want to keep society running with E=4, all other things being equal, we would need mpg = 37. And you are telling me that not only this is unfeasible, that it will destroy the economy. This is crackpot science, doomtard thinking. You can get out of it, if you start thinking by yourself.

I don't care about those. As far as I am concerned, they are as horribly hysterical, as Simmons is. A clear example on how extremes touch themselves.

Hmmm ... I've tried thinking for myself, but I can't answer these questions perhaps you can explain (or anybody else, please), especially bearing in mind that all other things will NOT be equal, ie. the number of barrels being produced for net export is already declining?

EROEI is not instead of peak oil, it is AS WELL AS peak oil, each declining barrel will contain less energy ... a double whammy.

How are you going to make all the world's hundreds of millions of cars that currently do 25 mpg do 37 mpg or much more, increasing year on year?

... and why chose E=4? ... when will/did E=4, and when it did/does =4 how much affordable oil will there be to import - your math only answers a part of the question?

.... how many mpg do you need when E=1?

... when will E=1?

... how many mpg will you need when net exports =0 ?

... how many mpg will you need when net exports=0 and E=1, and when will that happen?

It is wrong to pull rank; just because you have been at TOD longer than someone else does not make your argument stronger. Also, if hysterical people on this forum upset you so much, you could just leave...

>> I am no economist, but it is easy even for me to attest that the authors know nothing more of economics than lay people do. And yet, they don't refrain from calling the collapse of the economy! Are you kidding me?

Weren't economists saying $100/barrel oil would kill the economy? How does the global economy look to you lately? If oil/energy became more expensive than it is now, what would happen?

Even if we estimate $5 billion per gigawatt the 16 GW per year would only cost $80 billion per year to build - or half the cost of the Iraq war. In other words, we could afford to build massive numbers of nukes.

Suppose we lose 6% of available oil per year. That would work out to $480 billion worth of nukes built per year. We could still afford that as well. The US economy is north of $13 trillion per year. So a half trillion is affordable.

Our bigger problem would be the equipment and training needed to scale up such a rapid rate of nuclear power plant construction. But we have other ways to meet a 6% decline in oil production such as build wind farms, build up lots of PV, build small hybrid cars, move closer to work, insulate houses, etc.

Money is not the problem. Manufacturing capacity is the problem. But that's a solvable problem. We can buy time to solve that problem by adopting other measures to use energy more efficiently and to get energy from other sources to soften the blow of declining oil production.

FuturePundit, you are correct in citing the problem of re-tooling our workforce. Since I joined this forum, I have furthered my fledgling career, and learned quite a bit about the power industry from the inside out. Pertaining to the current (well, future) situation my thoughts are as follows:

We DO have a liquids problem comming down the pipe. I live in a small apartment. My apartment uses roughly 1 MWhr per month during the peak summer months. The car I drive uses roughly 3 MWhr per month, reguardless of the season. If liquids run out, or become too scarce to rely on, transportation will switch to electricity. (All of you reading who are ready to jump on me about hybrids and just increasing effeciency, calm down; I'm talking LONG term, like 20 years here). So lets be nice, and assume I purchase a new vehicle, and due to various circumstances it is 3 TIMES more effecient (getting somewhere around 70mpg) than my current car. The grid still has to double. This is a problem, good thing there are electrical engineers!

Doubling the grid presents manifold challenges. The current swing seems to be toward DER and microgrids, though the IEEE has only finalized 2 of the 6 standards they are drafting on those... I would suggest TOD readers brush up on great technologies like micro-turbines, the logistics of DER, absorption chillers, and perhaps supercapacitors.

The problem still comes down to the logistics for generation. Even if one assumes NIMBY issues go away and people allow construction of transmission lines (which we desperately need, see New York Blackout, 2003), we still need to generate power to transmit.

In California they have been planning a certain wind project for 10 years. It is supposed to be the largest wind farm in the United States, with 300 MW of installed capacity. Anybody in the wind game knows that translates to about 100 MW of continuous capacity. Cool. Except, it has already taken 10 years and final plans have not even been issued. It also will cost over 1 Billion dollars. Let me summarize; 100 MW of generation capacity, for 1 Billion dollars, with 10 years of design, and quite likely another 10 years of construction. The United States has a generation capacity around 1 TW.

Quite honestly I don't think peak oil will result in the destruction of the United States economy. I think it will result in the creation of another Gates, Rockerfeller, or Carnagie.

Giddaye Luis,

I'm one of the few Joes-in-the-street that stumbled across all this around a year ago (curse that film, "A Crude Awakening"!!). Quite simply, the notion that fossil fuels are a finite resource had never occurred to me until then. And as I've discovered, very few in my immediate circle of family, friends and colleagues had thought about it either.

So I've been asking basic questions here - I'm a little lazy on the reading front - all the while crossing my fingers and grumbling that the Big Boys (and Girls) have plenty of time to sort things out. The replies were for the most part polite - dare I say, patient! - but always helpful.

The thing that clinched it for me was the exponential growth thing (thanks Rethin and Sea Dragon), the possible doubling of energy consumption over so many years, which I'm sure you're aware of. That China, India and the like must at some point stop growing!

However, my personal frustration remains... "Sustainable Growth" seems like such an oxymoron; when will MSM realise this? Will I ever be able to talk about it with the immediate circle?

Regards, Matt B

Concerned Dad of three great kids - 9, 11 and 13 - who are shown none of this sort of stuff in school. Indeed, the wife teaches years 9 to 11 math/science; again, what's available to eventually replace the 85mbpd current consumption in the future is NEVER discussed. BAU forever, hey?

Good night, Matt.

I am a father as well, and I am as you are, concerned about the future. There are millions of problems and issues at hand right now that are creeping in, as you probably know. Global Warming can be a serious issue, famine, poverty, globalization can create a fascist tendency, etc., etc. And of course, peak oil is an issue.

What I can't stand is this fake scientology of theories all piled which in turn create ideologies that are no where near the reality of things. The exponential growth paradox is one of such myths, for these people first state that growth is what mankind automatically does (and our economy, etc.), and stagnation is against our nature. Then, they hype the numbers and tell you that not only stagnation is inevitable, but that it is creepily near us. Add those two and boom! We have total collapse of civilization. QED.

Well, not so fast. Neither of those two premises are that easy to prove, and they are, in my view, terribly wrong.

There is also a simplistic notion that all the goodies of mankind are due to energy, that somehow, e=$, and because we are due to a correction on e, then we will collapse because we can't do with less of $. It's bollocks.

It goes on and on.

Hey again Luis,

I'm actually all in favour of people making do with less (apart from a fairly decent home cinema, I myself am very much the minimalist). Indeed, I quite fancy the thought of solar-powered golf carts and putt-putting around. And for most of the past year, I'd have more or less sided with you.

However, now that I have my head around the notion that crude oil is finite and realising that the vast majority of Joes and Janes like me haven't a clue; that global consumption is growing; that crude is getting harder and harder to find/extract/refine; that there's no alternative on the horizon that delivers anywhere near the energy return; and that, most importantly, MSM isn't discussing these issues, I must conclude that at some point, pressing on with current practices must come under serious question.

As such, change of some sort must be inevitable. Certainly I agree with you that total collapse seems quite extreme. Rather a slow fade (to a better, friendlier, more balanced world? Hey, I can remain a little optimistic!) seems far more realistic - Mad Max will remain a movie.

Whether the fade has started, is still a decade or two down the track, beats me. But certainly there's not the energy for BAU indefinately.

What still worries me today is that MSM, with seemingly plenty of indicators, very rarely discusses PO, growth and other such matters. And as a result, little is being done to prepare for a future without abundant and affordable energy. Like GW, shouldn't Joe Public at least be made aware that a serious problem "may" be just around the corner?

Regards, Matt

All energy production requires some input energy. Once you obtain EROEI for each energy source, then they can all be compared. It's an "apples to apples" comparison.

If there are some externalities, costs not incorporated into the calculation, then point that out.

How can we get this presentation onto the Senior High School curriculum?

Seriously.

I am skeptical of the high EROEIs claimed for wind and solar. If their EROEIs were really that high I would expect them to cost a lot less. Wind has substantial needs for steel and concrete to make foundations and towers. Plus, wind requires a lot more long distance electric power lines to take the power from where the wind is to where the people are.

Solar looks set to go way down in EROEI due to advances by companies such as First Solar and perhaps Nanosolar. But PV still costs too much for such a favorable EROEI today - at least for most PV makers.

I agree. I seem to recall a graph from a scandinavian institute that stated that the best return on investment was insulation. Solar and wind were way down the line.

Wind's EROEI is high for one simple reason: energy is not expended to bring the air through the turbine blades. That missing energy input really adds up over a 25- to 30-year period.

The same is true for solar electricity and solar hot water. The sunshine gets to the panel under its own power, as it were.

Another attractive aspect of a commercial wind turbine is the amount of energy it yields per land area dedicated to power production. Though flowing air is a very diffuse energy source, a wind turbine's power production zone (the swept area) is gigantic relative to its surface land requirements (turbine base, transformer, access roads). This explains why wind energy is the only renewable energy resource that can scale up to utility systems.

--MV--

Great source of information here, page bookmarked. :-) Thanks.

On a sidenote: my projections seem to fare well for the time being. Slightly optimiscit but not by much. For 2008 I projected:

C&C: 74.67 mbpd

C&C + NGPL: 83.25 mbpd

All Liquids: 86.59 mbpd

I think I'll be pretty close by the end of the year, as recent numbers show some increase over the first 5 months of 2008.

For the record, my predictions for 2015 are:

C&C: 60.0 mbpd

C&C + NGPL: 68.6 mbpd

All Liquids: 72.7 mbpd

I'm not going to post my graphs again. :-) Thank you one more time.

Eastender,

When are you going to post your price forecast?

I think your forecast for this year is an average price of $120/barrel.

Am I right?

Yes, I had USD 120 for 2008 and USD 180 for 2009. The model is under review at the moment, I have a few problems with my elasticity assumptions. (Price elasticity of demand being a variable, not a constant.)

As soon as I get some decent results I'll post them.

I went to look at your graphs on the "Wikipedia Megaproject Update (August 2008)" http://www.theoildrum.com/node/4419#comment-397209 by Khebab. The Graphs are now broken links.

Could you fix that?

Cheers, Dom

Unfotunately, those links I cannot fix now. What I can and will do is an upgrade and a post with all the important graphs and equations, along with my price projections.

In a few days I think.

Thanks. I think we are all looking forward to it. I hope Leanan gives you permission to do a guest post.

I'd like to see some math whiz present a NET ENERGY comparison between the peak's two slopes. The net energy on the downside might be MUCH lower. But how much lower?

One could take this to mean that instead of "half the oil is still left", only a third of the oil is still left, practically speaking.

You mean the upslope versus the downslope?

I mean that as we go over the peak, it'll take more and more energy to extract the remaining oil, so that in a practical sense, we don't really have that second trillion barrels.

This might be quantified, even if only speculatively. Propose some average return on energy and apply a little basic calculus (which I myself no longer remember. )

Oh, so you are referring to EROEI, which is actually a response to BillJames comment above.

That is fairly standard math, no calculus needed

So the last term becomes a factor that you can lop off the right-side of the curve with. That is if E stays relatively constant and if renewables don't figure heavily into the mix. Therefore if E=2.0, then you only get 1/2 of the production you would expect from looking at the left-side of the curve, which may have had an E of 10 perhaps.

Calculus would likely come into play if you wanted to ramp E down slowly as we get farther into the future. This is not too hard to do, but we would need a good model for how E varies over time.

Thanks, WebHubbleTelescope.

From those numbers, it looks to me as though we can't count having much gasoline and deisel left for our motor vehicles. We'll use a whole lot of it just extracting the remaining oil. The second trillion barrels won't feel at all like the first.

The shape of the curve depends on the price.

In order for demand to to fall the oil must be more expensive as a % of income than today - real world data? ... this is what we see, prices up >1000% in just 9 years!

In order to meet the CERA projection of demand growth of ~22% to ~104 mbpd by 2015, the cost of a barrel of oil as a % of income will have to be much less than today - hence people like CERA say the price is going to fall, in order to meet that volume the real price MUST fall.

Since Income = net earnings + new debt , and since both earnings and new debt are declining in real terms CERA is proposing massive oil price deflation - good news, party on, we are saved, a US $ is going to buy much more house and much more energy in the future. Real world data? ... massively opposite of what CERA thinks.

Who do you want to believe, CERA or your lieing eyes?

Don't forget - and this is a scary thought - ALL the predictions should be low, compared to the actual. The price of oil has sky-rocketed recently, so there's been huge incentives for oil producers to produce at the maximum possible rate for the last year. This increase in production (solely from market forces, not geology) pushes the production curve higher for the length of the favourable market conditions. And, just how much extra oil did this massive incentive to over-produce get us? 1% perhaps... Scary...

I agree.

If doubling the price of crude oil produces such a feeble supply response, there there must indeed be a serious problem somewhere.

What further price increase would be required to generate the optimistic future production scenarios?

It is possible that what is happening is that the time delay to get new product on line is longer than the response time expected. We read repeatedly about the lack of pipe, the lack of drill rigs, the lack of experienced engineers, etc. Also it is probably true that the oil companies were fearful of investing, expecting a market correction (recession?) as the banking/real estate bubble has imploded.

We are now seeing new peaks being reached while the North Sea and Cantarell are collapsing. That certainly means that the increase in drilling that we have been watching is starting to pay off.

I suspect that in the next few months we will see if cornucopian market worshippers will be right one more time. I doubt it for the long run but it may happen...A lot of people are betting on it or oil prices would be $500 today. Wouldn't they?

Your entire line of reasoning is invalid. Market forces pushing production curves higher? Oh my, what a surprise! I thought it should be the geology forcing companies to produce more!

And about that 1% "scary" increase... it happened in a time frame where according to most of TOD's predictions we should see a 1% "The shit is hitting the fan" drop. Well, but according to you, the fact that market forces did the opposite isn't a red herring to these crackpot predictions, but a red herring to the market forces themselves!

Oh boy, is this place going down in flames.

Then leave. Its that simple.

Naa, I like bashing stupid ideas too much.

Your "bashing" reads more like comedy to me. And bashing is an ad hominum tactic that is ineffective and thus a waste of everyone's time. Eventually, your "tactic" will get you banned from commenting. Is that what you desire?

Luisdias,

I have read through your posts today and I am unsure if I understand your position. Minus the hyperbole, you seem to be saying that Peak Oil either is not going to happen, or that it will be a "non-event" easily mitigated by existing technology. Could you clarify your position for me?

I am not interested in what you disbelieve, but what you believe.

Thanks

Great thought. Let's see what production increases will be like in one or two years if these prices stay in the range they are in now. If this price doesn't do it nothing will.

http://oilenergystockvideos.blogspot.com

Excellent summary, Khebab!

Total liquids supply remains on a peak plateau. Price is expected to show continued volatility over the next year before resuming its long term uptrend in late 2009.

Supply, Demand and Price to 2012 - click to enlarge

The largest part of total liquids is crude and condensate which also remains on a peak plateau. As it is almost September, the red line in the chart below now represents September, rather than August.

Crude and Condensate to 2012 - click to enlarge

Crude and condensate production is forecast to come off its peak production plateau at the end of 2008. For comparison, the green line represents the decline if Colin Campbell's remaining reserves figures are used. Colin Campbell has revised his world total liquids forecast to peak in 2008 at 85.3 mbd, including processing gains but excluding biofuels, which agrees with the chart below.

http://www.aspo-ireland.org/index.cfm?page=viewNewsletterArticle&id=49

Crude and Condensate to 2100 - click to enlarge

Awareness of peak oil continues to grow and energy security will soon become a more important issue than climate change.

UK minister says energy comes before climate: report, August 28, 2008

http://www.reuters.com/article/environmentNews/idUSLS51543420080828

Ace, thanks for the updated graphs.

One nitpick: on your Crude and Condensate to 2012 graph that the projected demand curve continues to increase over time with increasing distance from the supply curve doesn't seem supportable.

My sense is that the demand curve will follow the supply curve down with perhaps a just a bit of distance between the two. We're already seeing a worldwide economic slowdown (in part due to oil and notwithstanding the recent U.S. data).

Have you given thought to changing the projected demand in that way?

(Of course this is notional demand since in reality they must equal each other.)

The discussion in the following thread should answer your question.

"How can supply and demand diverge?"

http://www.theoildrum.com/node/4419/397187

It did, thanks.

Ace,

thanks for the weblink. But I think the future demand development, whose steady growth was taken for a long time, needs much more research. I might for example imagine that the potential oil price of 250 USD per barrel will be traded with a considerable decrease in consumption. Just like what is happening now with US transportation. Until now economists used fairly constant rates of price elasticity and only distinguished between short and long term values. But things are probably more complex and include sort of "tipping points" at certain price levels - just like in climate science.

Imagine for example that at a certain oil price level flying becomes more expensive than going by train (this is probably happening now), so - depending on the connection etc - people increasingly shift from plains to trains. Altogether there is not a distinct tipping point but rather a "shifting area", as each sort of activities, industries etc is more or less sensitive to price shifts.

It would be interesting to model this behaviour - with the recent shifts there should be probably plenty of data to calibrate the model.

Oh, now peak oil is in 2008? You guys keep changing goalposts as fast as NASCAR pilots race! I wonder what you will say in 2009, or 2010...

Well, at least you post these nice images here on TOD for everyone to see and archive. Next year, or even 2010, I'll enjoy making an animated .gif out of those nice charts.

And net energy returns decline in advance of geologic peak--

And net exports decline in advance of geologic peak--

And oil "nationalism" and hoarding arrives in advance of geologic peak--

And supply outstrips demand in advance of geologic peak (peak lite)--

And prices rise meteorically in advance of geologic peak--

And net world population increases 250,000 per day--

All this coupled with the hideous, many-headed-Hydra of credit "crunches," and mortgage "messes," and economic deflation, and climate change, conspires to make your petty obsession with the exact date of geologic peak a quaint academic exercise.

One day, in the midst of poverty, and war, and depression, and climatic catastrophe, someone will say, "Oh, by the way--oil finally peaked," and we will just shrug.

You forgot the last "And" points.

And people started car-pooling

And companies started to use electric vans

And cars eventually stopped using oil

And at last someone will wake up one day and think, "wait, wasn't there a funny site that claimed that the end of oil was gonna be the end of civilization? Jeez, what a joke!"

Weird, I don't seem to recall posting or commenting on any of that stuff here. TOD is essentially the only place one can have objective scientific discussions of oil depletion on the net. It's your problem if you lack the skill to filter it.

That's a hell of a filter you got there, Web. It's filtering 80% of TOD nowadays. Could I borrow it?

Not hard, you pick out stories you want to read, and then follow up any discussions that start. You keep on discussing it until the comments close. I recently had one discussion here on TOD that went on for quite awhile, and when the comments were forced to close, the discussion spilled over to my own blog. The upshot of that particular discussion was that we collectively came up with a modelling breakthrough, and (if you care) it will probably be posted on TOD by Khebab within the next few days.

You know Luis, you are a real pain in the ass!

By comparison with your ranting and raving TOD is a paragon of reason and common sense.

Luisdias - can you spell out the basis for your belief that these social behavioral (carpooling), technological (electric vans, non-oil-based cars) and economic (implicitly) changes will come about? You may well be right, I'm just trying (here and generally) to understand the basis for people's optimism about these things in the face of what seem to be pretty overwhelming negative trends. You're not just discounting the future, you seem to have some basis for believing that change will happen.

The problem with Luis is not that he is putting forward heretic viewpoints or challenging the tod orthodoxies but that he is doing such an abysmal job of doing so. Evidence and sound reasoning are almost totally absent. He does us all a service here by reminding us rational realists that there are billions of others who will never be able to see the writing on the wall until it comes crashing down on them -- bringing about the very thing they were so resolute in denying.

Hey...you got a better model or prediction? You got all the data and revisions to come. Lets see it then. We'll be here waiting.

Ye - someone talks trash but cannot back it up with anything other then ridicule.

My suggestion - ignore. Its a waste of electrons.

And that is what luisdias has earned for himself through his petty behavior--everlasting ignore. Good job luis.

If someone tells you that according to the Mayan calendar, the world is going to end in 2012, you say "that's fucking ridiculous". If someone answers you asking, "okay, then whats your pick", you politely say "I don't know". It won't stop being ridiculous, though.

You keep right on posting, Luis, I find your discussion points refreshing and non-threatening. You could lose the obsenities and some of your rhetoric is over the top. I agree that EROEI is a limited tool (the defintion for EI is nebulous to me) though I strongly disagree that it is not a useful tool keeping in mind it is not the grand unification theory.

The elephant in the China shop on this thread though, which, to my mind, you could barely refrain yourself from braying nyah, nyah, nyah is that the date for PO is pushed back. This is the single most important piece of information in this excellent analysis. You had courage to mention it here on the Oil Drum and I think you got like a negative 20 at least - not that you were very diplomatic. But this is the Oil Drum and the fact that the PO date has moved back you would think would be the center of open, unbiased discussion. Incidently and I honestly suspect by coincidence per some glitch I am finding all ratings of comments on this whole analysis disabled?!

For myself, I will say I put the consequences of PO somewhere between a hemmerhoid and an appendicitis. The hemmerhoid is self-explanatory, the appendicitis is a condition which is treatable but which will kill you if ignored. I tend at this point towards the appendicitis end and really at this point we have already gone far beyond the simple pain in the ass model.

Despite your well pointed ripostes, you have been following this issue for sometime, have there recently been protests and riots in numerous countries and continents over oil scarcity? While it is hard to define effects clearly, has corn-to-ethanol production decreased global food supplies and if so has PO directly or indirectly already caused an increase in global hunger? Are there already declining exports? Again, while maybe needing Dumbledore's Pensieve, has scarcity of oil played a large, possibly direct part in recent wars costing the lives of thousands or millions?

I find this last point particularly troublesome as regards the recent attack on Ossetia by Georgia with its US/Israeli weaponry. Was this conflict influenced by/primarily caused by scarce oil supplies? I don't know. But then again there was no real danger of WW III. Its not like we had American military advisors in Georgia at the time, its not like Russia has ever been double crossed by Western nations and found itself fighting for its survivial on the streets of Moscow. Meanwhile we hear nothing here in the States about oil, Eurasian pipelines or destroyed cities but something about liptstick, change and some baby named Casey. So I value TOD and its open discussion of a very serious topic.

Keep posting.

Yeah, I agree. TOD is a great resource and discussion forum, but my observation is that it is not tolerant of people with a different point view. Unfortunately, some people (eg Dave Cohen a few months ago) are undiplomatic to the point of being rude in the way they argue their point. Luis hasn't come anywhere near that line. Luis, keep posting. However, I don't think the big news this year has been oil SUPPLY. The big news has been DEMAND destruction in the US, and the big question is whether this will occur in the developing countries in 2009.

Conventional oil sources have peaked. The rest will follow like a set of dominos.

It's kind of like you were living in the mid 1800's and monitoring the passenger pigeon population. You noted it declining toward zero and then someone took over and started including the count of Carolina parakeets in the population. Passenger pigeons went first and then the Carolina parakeets followed.

And the idiots kept their heads in the sand because they were clueless and couldn't understand their own gullibility.

Again I think the the evidence that the peak has moved back has made this thread a bit sensitive.

I would ask Luis to comment though, as he wishes to avoid the propagation of idiocies, that there are possibly millions of readers obtaining bad information, and as he is concerned that imprecision makes for useless apples and oranges comparisons with EROEI, what he means when he stated upstream

These terms are neither further defined nor even commented on in that previous write-up. Solving it algebraically, well it looks like nonsense. Perhaps I am missing something obvious? However there seems to be no basis in common knowledge to allow for modification of these terms, especially as undefined as they are. At first glance it does look like some simple typo or rank, reckless nonsense. Perhaps some friction coefficient or somesuch.

Luis???

Don't rack your brain over it. First point, it is basically a statement of conservation wrapped in "numbers". Second, Luis would like nothing better than for you to waste your time figuring out the algebra.

I can only guess he is referring to the EROEI chart which he roundly criticized as not valid and then used this concept he doesn't believe in as the basis for a more general and sweeping prognostication as to what will prevent societal disruption. Don't know.

I really do enjoy hearing well-reasoned counterpoint to the more depressing potentialities of PO, just hoping to try and draw Luis out a bit, guess not.

See Pitt below. Luis's math was off.

I think so; what you quoted seemed fairly straightforward.

Suppose there are 100 units of energy. When getting those 100 units used up one of them (E=100), there were 99 left. 99 units x 25 miles/unit = 2475 miles. By contrast, if getting those 100 units uses up 25 of them (E=4), there will be only 75 left, so getting the same number of miles will require 2475 miles / 75 units = 33 miles/unit.

In other words, the difference to society between EROEI 99 and EROEI 3 is not necessarily as large as the difference between those two numbers would suggest. (FWIW, plugging in an EROEI of 2:1 - 67 units of usable energy per 100 - gives the 37mpg from the original quote.)

You are a better man than I.

I almost got pulled into the trap of trying to figure his math out. If he would have said 2:1 right off the bat, you could work it out in your head, but with the 4:1, you have to wonder what he was trying to say ...

Supply is not a single data point, it's the entire curve; how much the oil the world's oil producers would like to sell at each given price from zero to infinity $/bbl. The same is true for demand. Single points on these curve are referred to as quantity supplied and quantity demanded for the given price and this appears to be what you are plotting.

If the quantity demanded is higher than the quantity supplied you get shortages, but this is never a permanent state unless there is rationing. The reason is that suppliers are always eager to make a profit and when they notice that inventories are running low and shortages start to form they increase the price to reduce the quantity demanded and increase their profits; they'd be stupid not to.

Now, that may well be relatively painless(substitution or reduced waste...) or it might be painful(having to car pool, having to set the thermostat lower in winter, losing your job...) but the quantity demanded and quantity supplied will stay in unison. All but the most abundant of resources are actually scarce; they only seem abundant because markets are so good at making sure shortages don't develop by adjusting the price. What the forecast should show is quantity demanded tracking the quantity supplied and the price adjusting to keep them in sync, unless your model includes some kind of rationing mechanism.

Great work as usual!

Question about EIA IEO data.

1) Why is the EIA IEO 2006 used in the graph? Currently the data is from IEO 2006, but the links point to latest IEO page, which is currently IEO 2008. I think the 2008 numbers that came out in July 2008 differ from the 2006 numbers in meaningful manner, although they are still clearly BAU numbers. The differences are (EIA def of total liquids, reference case):

- 2006: 84.5 -> 84.2

- 2010: 91.6 -> 89.2

- 2015: 98.3 -> 95.7

- 2020: 104.1 -> 101.3

Additionally some minor link checking:

2) The link for the second graph titled 'World Production' is not working. It's referring now to an image that does not exist at that location. I'm assuming it's supposed to point to this larger version of the same image.

3) ASPO's newsletters in English are available for #58 (October 2005) and #46 (October 2004)

4) Bakhtiari's pages seem to be gone now from SFU. The WOCAP model paper Peak Oil : The End of the Modeling Phase is at Scribd, where it can be viewed and downloaded (requires registering for the latter).

5) Data for "Michael Smith (Energy Institute)" is probably Michael R. Smith (Energyfiles Ltd). The current link for the presentation is not working. His latest model can be found in the July 2008 presentation Volumes & Peak: A passing phase or quite the reverse on slides 29 and 32 respectively.

Again, many thanks for this update. This compilation is invaluable and all the work that has gone into compiling it is much appreciated.

I do commend the effort to quantify the EROEI ratio. I’ve tried to do the same with a single oil well drilling model and eventually became lost in the amortization process.

But I would like to offer an insight which you may be able to use. With respect to hydrocarbon drilling/production efforts EROEI has never been nor ever will be a direct determining factor. Indirectly, of course, it will always be there in the background. A current example: the unconventional natural gas play. It is not driven by an attractive EROEI. It is driven solely by NG prices. I’ll just make up a number: EROEI is 3.0. Not very impressive and nothing to brag about. But as long as NG prices stay high enough to deliver 25%+ return on investments 100’s of thousands of these wells will be drilled. Conversely, if the gains were 50 to one and NG prices fell to $2/mcf none of these wells would ever be drilled. Of course, there isn’t a complete disconnect between ERORI, drilling/completion costs and NG prices. But even if one were to master the complexity of developing a reasonable EROEI for such resource development the question would be to what end. That value wouldn’t be very applicable, IMO, to predicting future trends.

We may well see short periods when the EROEI of any product is less then one but the product will be generated because the dollar gain is there. I’ve completed a number of wells that would never recover their total investment. At the decision point of making a completion the only factor is the cost of the completion and not the monies spent to get to that point. Those monies are considered “sunk costs” and don’t play a part in this final phase. I suspect that if one were to use total energy expended to drill and complete, a number of these projects were net energy losers. But the decision to complete such a well was still the correct choice. A distasteful example would be a starving man eating his hand in order to survive. It does gain him some time but truly not a sustainable solution.

Again, this isn’t an argument against EROEI. It does have the potential to show the long term folly of unsustainable efforts. But, at the same time, I don’t see it becoming a factor in the decision making process at least in the case of resource development. After 33 years as a petroleum geologist and reviewing hundreds of drilling projects no one has ever expressed the slightest interest in any factor other than $ in and $ out. In fact, the amount of bbls and mcf’s is seldom a focus. It’s net present value and ROI. While we may rightfully ridicule such efforts they will, none the less, proceed on this basis.

Hi ROCKMAN

This sort of echoes my own thoughts, that ability to make a profit will drive investment in energy procurement. The only caveat would be that relevent EROEI will be an invisible hand behind the costs. By relevent I mean those energy inputs that attract a cost - manual labour, energy that has to be paid for, equipment etc. Not 'free' energy such as solar or wind. In some ways chasing endless trails of energy input is not neccesary - just look at the $ ROI!

There was a very good post on here some time ago showing how energy procurement will consume an increasingly greater share of gdp (best way to think about it without getting into all that messing about with inflation) with less and less left over for discretionary items. The end result is that more and more people, capital and time is spent procuring energy. Presumably this will procede hand-in-hand with a reduction in overall energy usage.

tw

Rockman,

Your point is well taken that EROEI is not considered in these decisions, nor are they likely to be, as worship of the almighty dollar is unlikely to change any time soon. However, this is much to our collective detriment, of course. Simply put, at your hypothetical 50:1 society would have 49 units leftover to cook/heat/dry/process/generate with, but the dollars (in your example) would lead us not to do it. Whereas in the 3:1 example, which the dollars say to do, society will only have 2 units for c/h/d/p/g. Ultimately, dollars are meaningless, and EROEI means all. That we collectively don't get this is a disaster.

All true clifman. What tends to make the situation even more unbalanced is the nature of the decline curve of the unconventional NG plays that are beginning to dominate domestic drilling. As I mentioned, it's the NPV (net present value) that drives these plays. NPV calculations take into account the time factor in a well’s productive life. The very high initial flow rates with the following steep decline rates generate a great NPV. I spend $1 today to earn $1.30 NPV. Works every time. But most of the players in these trends are public companies. While the market loves to see the good profits they demand to see growth in the reserve volume base. As a public company drills these wells their base grows rapidly but it will also drop rapidly due to the decline rate. This will not be tolerated by Wall Street. Thus these companies will be forced to drill even more such wells to make up for the decline. And that's not a problem because the NPV says it’s profitable. But I can also promise you that if NG prices drop for a bit and the NPV says you're now making just $1 (and maybe even a little less) for each $1 you spend, the drilling will still go on at an accelerated clip. So now, you’re not making much profit and EROEI is crappy but the wells must continue to be drilled.

This isn't a hypothetical. Back in the late 70's a Texas oil company (UPRC) effectively committed corporate suicide by drilling over 600 PROFITABLE oil wells. Same profile: high initial rate with steep decline. The stock shot straight up but then they ran out of locations to drill. Reserve base nosed dived and the stock went into the toilet. And every CEO and president of every public oil company out there knows this very story quit well. I've worked on projects where the company knew for certain they would loose money but went ahead so they could meet Wall Street's expectations....at least for those next few quarters.

Rockman I've been trying to make this point over in the Hurricane thread.

The reason its over there is if we do see signficant damage in the gulf then we probably have seen peak NG production in the US.

The only reason recovered from Katrina is that it hit fairly early on in the development cycle of unconventional plays.

If I'm right we will effectively never recover from Hurricane damage in the gulf going forward.

Hi RM

The example you give is not really a criticism of using profitability rather than EROEI, more a case of bad business planning. But I agree it does sound like madness. It would be a bit like TESCO building a supermarket during the Glastonbury festival. Or a bank creating as much credit as it could, to a host of people that were never likely to pay the money back, just for a temporary boost to profits.

tw

Thanks for double checking my links. The web is not a very stable environment over the course of one year, I should probably archive the references on TOD server.

1) I wanted to track how forecasts are performing over time, If I always use the updated version there is obviously less challenge in predicting future supply on a shorter timeline. The IEA link always point to the last version of the IEO report, I didn't find a specific link for the 2006 version.

2) corrected.

3) the ASPO links are a mess, they moved many times in the past.

4) Since the passing of Bakhtiari, I think his website is no longer online. I may have a copy somewhere.

5) You're right, I changed the link.

Thanks. It makes sense to use one forecast and not update.

Still, it would be an interesting exercise to see where the peaking estimates have been converging in the past 10 years or so. ASPO/Campbell estimates have moved slightly more into future, but not by much. I'm not sure if EIA/IEA even have public peak dates in their models, as both seem to be almost demand weighted models and not real production models.